Global Bronchoscopes Market

Market Size in USD Billion

CAGR :

%

USD

3.65 Billion

USD

7.06 Billion

2024

2032

USD

3.65 Billion

USD

7.06 Billion

2024

2032

| 2025 –2032 | |

| USD 3.65 Billion | |

| USD 7.06 Billion | |

|

|

|

|

Bronchoscopes Market Size

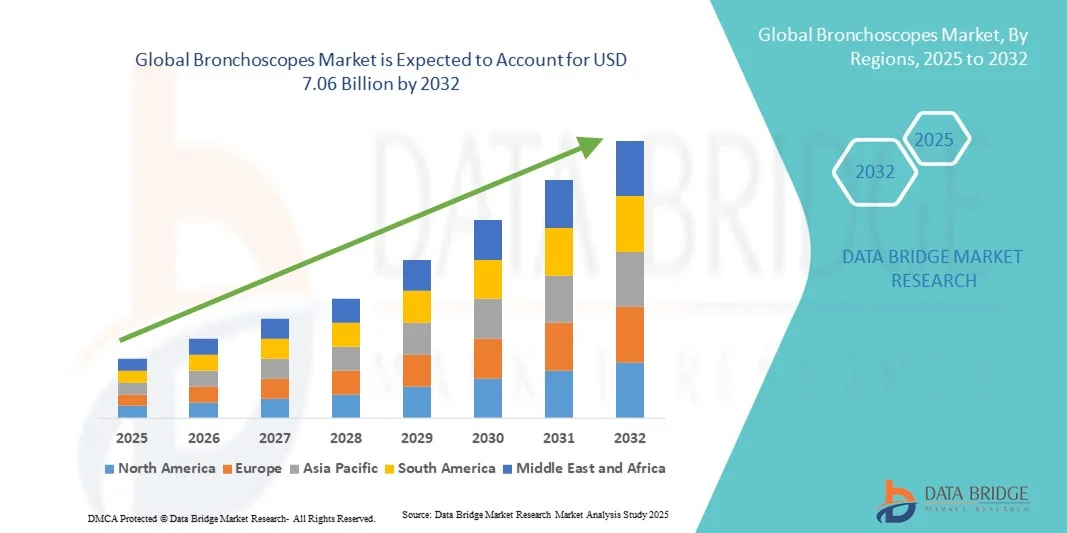

- The global bronchoscopes market size was valued at USD 3.65 billion in 2024 and is expected to reach USD 7.06 billion by 2032, at a CAGR of 8.60% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory diseases, rising demand for minimally invasive diagnostic and therapeutic procedures, and the growing adoption of advanced medical imaging technologies in healthcare facilities

- Furthermore, technological advancements in bronchoscope design, including high-definition imaging, flexible scopes, and disposable devices, along with the expansion of healthcare infrastructure and rising awareness among clinicians, are accelerating the uptake of bronchoscope solutions, thereby significantly boosting the industry's growth

Bronchoscopes Market Analysis

- Bronchoscopes, offering minimally invasive diagnostic and therapeutic access to the lungs and airways, are increasingly vital components of modern healthcare systems in both hospital and clinical settings due to their enhanced visualization capabilities, real-time imaging, and integration with advanced endoscopic platforms

- The escalating demand for bronchoscopes is primarily fueled by the rising prevalence of respiratory diseases, increasing geriatric population, growing adoption of minimally invasive procedures, and technological advancements in flexible and disposable bronchoscopes

- North America dominated the bronchoscopes market with the largest revenue share of 40.69% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key medical device manufacturers. The U.S. experienced substantial growth in bronchoscope installations, particularly in hospitals and specialized respiratory care centers, driven by innovations such as high-definition imaging, AI-assisted navigation, and single-use devices

- Asia-Pacific is expected to be the fastest-growing region in the bronchoscopes market during the forecast period, with a CAGR of 10.32%, due to increasing healthcare spending, rising awareness of respiratory health, expansion of hospital infrastructure, and a growing patient population in countries such as China, India, and Japan

- The flexible bronchoscopes segment dominated the largest market revenue share of 57.1% in 2024, driven by their versatility, minimally invasive design, and high-definition imaging capabilities

Report Scope and Bronchoscopes Market Segmentation

|

Attributes |

Bronchoscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bronchoscopes Market Trends

Enhanced Convenience Through Advanced Imaging and Automation

- A significant and accelerating trend in the global bronchoscopes market is the integration of advanced imaging technologies, automation, and AI-assisted diagnostic platforms. This fusion is significantly enhancing procedural accuracy, workflow efficiency, and patient safety in both clinical and surgical settings

- For instance, Olympus EVIS EXERA III bronchoscopes integrate high-definition imaging and automated workflow systems, allowing physicians to navigate airways more precisely and perform diagnostic procedures with greater efficiency. Similarly, Pentax Medical’s Broncho-Videoscopes offer advanced optical features and automated recording functions, enhancing procedure documentation and clinical decision-making

- AI-assisted image analysis in bronchoscopes enables functions such as detecting anomalies, suggesting biopsy locations, and providing predictive insights on potential complications. For example, some high-end bronchoscopes utilize AI to improve lesion detection and classify airway abnormalities over time, supporting more informed clinical decisions. Furthermore, automation capabilities streamline procedure setup, reduce manual handling, and facilitate easier navigation of complex airway structures

- The seamless integration of bronchoscopes with hospital information systems and electronic medical records (EMR) enables centralized management of procedural data. Through a single platform, clinicians can control imaging, capture results, and monitor patient outcomes, creating a unified and efficient diagnostic and therapeutic workflow

- This trend toward more intelligent, automated, and interconnected bronchoscopic systems is fundamentally reshaping clinical expectations for minimally invasive respiratory diagnostics. Consequently, companies such as Boston Scientific and Fujifilm Medical are developing AI-enabled bronchoscopes with features such as automated lesion detection, real-time imaging enhancements, and workflow optimization tools

- The demand for bronchoscopes that offer advanced imaging, automation, and AI-assisted functionality is growing rapidly across hospitals, specialized clinics, and research centers, as healthcare providers increasingly prioritize precision, safety, and procedural efficiency

Bronchoscopes Market Dynamics

Driver

Growing Need Due to Rising Respiratory Diseases and Demand for Minimally Invasive Diagnostics

- The increasing prevalence of respiratory diseases, including lung cancer, COPD, and chronic bronchitis, coupled with the rising preference for minimally invasive diagnostic procedures, is a major driver for the heightened demand for bronchoscopes

- For instance, in March 2023, Boston Scientific launched the EXALT Model B Single-Use Bronchoscope, designed to improve procedural efficiency and patient safety by reducing infection risks associated with reusable devices. Such innovations are expected to drive the bronchoscopes market growth in the forecast period

- As clinicians seek more accurate and less invasive diagnostic tools, bronchoscopes offer high-resolution imaging, flexible maneuverability, and compatibility with therapeutic procedures such as biopsies and stent placement

- Furthermore, the growing adoption of automated and AI-assisted bronchoscopic systems in hospitals and specialized centers is accelerating the integration of advanced diagnostic solutions into routine respiratory care

- The convenience of single-use bronchoscopes, high-definition imaging, and integration with EMR systems are key factors propelling adoption across both public and private healthcare institutions. The trend toward outpatient and ambulatory procedures also contributes to market growth

Restraint/Challenge

High Equipment Costs and Limited Skilled Personnel

- High initial costs of advanced bronchoscopes, coupled with the need for trained personnel, pose significant challenges to broader market penetration. Hospitals and clinics in developing regions may find it difficult to invest in high-end automated or AI-assisted bronchoscopes due to budget constraints

- For instance, the cost of disposable bronchoscopes and high-resolution imaging systems can be a barrier for smaller hospitals or clinics

- Addressing these challenges through training programs, cost-effective device development, and flexible procurement models is crucial for expanding adoption. Companies such as Fujifilm and Olympus offer both reusable and single-use systems to accommodate varying hospital budgets

- While prices are gradually decreasing and single-use bronchoscopes reduce maintenance costs, the perceived premium for advanced imaging, AI-assisted features, and automated workflow systems can still hinder adoption, particularly in resource-limited settings

- Overcoming these challenges through enhanced clinician training, partnerships with healthcare institutions, and continued innovation in affordable bronchoscopic solutions will be vital for sustained market growth

Bronchoscopes Market Scope

The market is segmented on the basis of type, usage, application, and end user.

- By Type

On the basis of type, the Bronchoscopes market is segmented into rigid bronchoscopes and flexible bronchoscopes. The flexible bronchoscopes segment dominated the largest market revenue share of 57.1% in 2024, driven by their versatility, minimally invasive design, and high-definition imaging capabilities. Flexible bronchoscopes allow clinicians to navigate complex airway structures with precision and reduce patient discomfort. Their integration with AI-assisted navigation systems and advanced imaging platforms enhances diagnostic accuracy. Hospitals and specialized clinics prefer flexible bronchoscopes for both diagnostic and therapeutic procedures. The segment benefits from ongoing technological advancements, including ultra-thin scopes and enhanced light sources. Demand is further fueled by increasing prevalence of respiratory diseases such as COPD, asthma, and lung cancer. Rising awareness about minimally invasive procedures also supports growth. High adoption in North America and Europe is backed by advanced healthcare infrastructure. Flexible bronchoscopes also facilitate outpatient procedures, reducing hospitalization costs. Compatibility with multiple accessories and tools strengthens their usage in various interventions. Cost-effectiveness over the long term and improved patient outcomes further drive adoption. The segment remains preferred for both routine and complex procedures in hospitals worldwide.

The rigid bronchoscopes segment is expected to witness the fastest CAGR of 9.54% from 2025 to 2032, fueled by increasing demand for high-precision procedures. Rigid bronchoscopes provide stability and are widely used in surgical and interventional settings where controlled access is critical. They offer superior durability and ease of sterilization, supporting repeated use in hospital environments. Adoption is rising in North America, Europe, and Asia-Pacific for specialized bronchial interventions. The segment also benefits from increasing training and awareness among medical professionals. Hospitals performing therapeutic procedures, such as tumor resection or stent placement, rely on rigid bronchoscopes. Their high optical quality ensures accurate visualization during complex procedures. The segment growth is supported by favorable reimbursement policies in developed countries. Rising geriatric population and increasing prevalence of airway diseases contribute to demand. Manufacturers are introducing ergonomic designs and better imaging technologies. Technological integration with surgical navigation systems further accelerates adoption. The need for precision in treatment procedures ensures steady growth over the forecast period.

- By Usage

On the basis of usage, the Bronchoscopes market is segmented into reusable and disposable bronchoscopes. The disposable bronchoscopes segment dominated the largest market revenue share of 49% in 2024, driven by infection control advantages, convenience, and reduced sterilization requirements. Single-use bronchoscopes minimize the risk of cross-contamination, making them highly preferred in outpatient procedures and critical care settings. Growing awareness about hospital-acquired infections in North America and Europe is a key driver. Disposable bronchoscopes also reduce equipment maintenance costs and turnaround time between procedures. They are widely adopted in emerging economies where sterilization infrastructure is limited. The segment is supported by technological advances in lightweight, portable designs. Hospitals and ambulatory centers are increasingly incorporating disposable options for high-volume procedures. The cost-effectiveness in high-infection-risk environments boosts adoption. Increasing demand for minimally invasive procedures further drives the segment. Manufacturers are expanding product lines to improve imaging quality and maneuverability. Clinical studies demonstrating safety and reliability encourage greater acceptance among healthcare providers. The convenience of ready-to-use devices supports continued dominance of this segment.

The reusable bronchoscopes segment is expected to witness the fastest CAGR of 9.63% from 2025 to 2032, driven by durability, cost-efficiency over multiple uses, and wide adoption in hospital settings. Reusable scopes are preferred in high-volume hospitals where repeated procedures justify initial investment. They offer superior imaging quality and integration with advanced therapeutic tools. The segment benefits from increasing respiratory disease burden, especially in aging populations. Hospitals in North America, Europe, and parts of Asia-Pacific are upgrading reusable bronchoscopes with high-definition cameras and AI-assisted navigation. Reusable scopes are compatible with multiple accessories, enabling flexibility for both diagnostic and interventional procedures. Technological innovations in sterilization and scope durability further accelerate adoption. Training programs and awareness campaigns support their clinical use. Hospitals benefit from reduced long-term costs and improved patient outcomes. Strong presence of leading manufacturers ensures availability and support. The segment is increasingly preferred for complex and precision-guided interventions. Favorable healthcare policies and insurance coverage also stimulate market growth.

- By Application

On the basis of application, the Bronchoscopes market is segmented into bronchial diagnosis and bronchial treatment. The bronchial diagnosis segment accounted for the largest market revenue share of 38.7% in 2024, driven by the rising prevalence of respiratory disorders, such as lung cancer, COPD, and asthma. Diagnostic bronchoscopes are extensively used for early disease detection, biopsy collection, and airway visualization. Hospitals and clinics prioritize diagnosis for improving treatment outcomes. High-definition imaging, AI-assisted navigation, and 3D imaging tools enhance diagnostic accuracy. Increasing awareness about early intervention and preventive healthcare supports adoption. The segment benefits from expanding hospital infrastructure, especially in developed regions. Rising prevalence of chronic respiratory diseases in aging populations drives demand. Manufacturers are developing scopes with advanced imaging and enhanced maneuverability. Integration with electronic medical records (EMR) streamlines workflow in hospitals. Cost-effectiveness and procedural efficiency reinforce segment dominance. Regulatory approvals and safety standards further increase adoption. Technological innovations ensure broader use in both routine and specialized diagnostics.

The bronchial treatment segment is expected to witness the fastest CAGR of 10.1% from 2025 to 2032, fueled by growing adoption of minimally invasive therapeutic interventions. Treatment bronchoscopes are used in tumor resection, airway stenting, and removal of foreign bodies. Hospitals and surgical centers are increasingly relying on therapeutic bronchoscopy for reduced recovery times and improved outcomes. Technological advancements such as high-definition imaging and robotic-assisted bronchoscopy enhance precision. Rising patient preference for less invasive procedures accelerates growth. Integration with AI and navigation platforms supports accurate interventions. Increasing prevalence of lung cancer and other respiratory disorders drives segment adoption. Manufacturers focus on ergonomic designs for improved operator control. The segment benefits from expanding hospital infrastructure and specialized clinics. Improved reimbursement policies and training programs enhance market penetration. Use in outpatient and ambulatory surgical centers further fuels growth. Ongoing research in therapeutic applications ensures continuous innovation and adoption.

- By End User

On the basis of end user, the Bronchoscopes market is segmented into hospitals, clinics, ambulatory surgical centers (ASCs), and others. The hospitals segment held the largest market revenue share of 58.2% in 2024, driven by the availability of advanced infrastructure, skilled professionals, and high patient preference for hospital-based treatments. Hospitals conduct both diagnostic and therapeutic procedures, requiring high-quality bronchoscopes. Integration with electronic health records, imaging systems, and AI-assisted platforms strengthens workflow efficiency. Rising prevalence of respiratory diseases, especially in aging populations, fuels adoption. Hospital investments in minimally invasive technologies support market growth. Regulatory standards ensure safe and effective use, further increasing adoption. Technological advancements in imaging, navigation, and ergonomics enhance outcomes. Multi-specialty hospitals adopt bronchoscopes for diverse procedures. The segment benefits from strong government and private funding. Hospitals remain primary end users due to capacity, expertise, and procedural volume. Continuous innovation in bronchoscopes supports increasing hospital demand.

The ambulatory surgical centers segment is expected to witness the fastest CAGR of 9.36% from 2025 to 2032, due to growing preference for outpatient procedures, reduced costs, and convenience. ASCs are adopting portable and disposable bronchoscopes for minimally invasive interventions. Rising patient awareness and preference for same-day procedures drive market growth. Technological integration allows ASCs to perform diagnostic and therapeutic procedures efficiently. Increasing prevalence of respiratory conditions and expanding healthcare infrastructure support adoption. Training and awareness among ASC staff accelerate usage. ASCs benefit from lower overhead costs compared to hospitals. Reimbursement policies favor outpatient procedures. Portable bronchoscopes reduce setup and sterilization times. Growing adoption in developed and emerging regions strengthens the segment. Manufacturers are designing products specifically for outpatient centers. Technological advancements ensure quality and safety. The segment sees steady growth driven by convenience and operational efficiency.

Bronchoscopes Market Regional Analysis

- North America dominated the bronchoscopes market with the largest revenue share of 40.69% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key medical device manufacturers

- The market experienced substantial growth in bronchoscope installations, particularly in hospitals and specialized respiratory care centers, driven by innovations such as high-definition imaging, AI-assisted navigation, and single-use devices

- The region’s growth is further supported by well-established reimbursement policies, increasing adoption of minimally invasive diagnostic procedures, and the presence of major players such as Olympus, Boston Scientific, and Fujifilm. High healthcare standards and the focus on improving procedural efficiency have solidified North America’s leadership in the global bronchoscope market

U.S. Bronchoscopes Market Insight

The U.S. bronchoscopes market captured the largest revenue share within North America in 2024, fueled by the adoption of advanced imaging systems, AI-assisted bronchoscopy platforms, and growing demand for single-use devices in hospitals and specialized clinics. Increasing prevalence of respiratory diseases, investments in hospital infrastructure, and integration of bronchoscopic systems with electronic medical records (EMR) further propel market expansion. In addition, ongoing research and development in minimally invasive respiratory diagnostics and training initiatives for healthcare professionals are strengthening the market’s growth trajectory.

Europe Bronchoscopes Market Insight

The Europe bronchoscopes market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of respiratory diseases, adoption of minimally invasive procedures, and rising healthcare investments. Well-established healthcare systems, coupled with advanced hospital infrastructure and emphasis on patient safety, are fostering bronchoscope adoption. The region is witnessing significant growth across hospitals, specialized respiratory centers, and research institutions, with high-definition and single-use bronchoscopes increasingly integrated into clinical workflows.

U.K. Bronchoscopes Market Insight

The U.K. bronchoscopes market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising awareness of respiratory health and a focus on minimally invasive diagnostic procedures. Increasing investments in hospital modernization, high prevalence of chronic respiratory diseases, and emphasis on early diagnosis are driving adoption. In addition, the U.K.’s well-developed healthcare system and strong clinical research infrastructure further stimulate market growth.

Germany Bronchoscopes Market Insight

The Germany bronchoscopes market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing healthcare expenditure, advanced hospital infrastructure, and rising awareness of respiratory diagnostics. Germany’s focus on innovation, sustainability, and adoption of high-definition and AI-assisted bronchoscopy systems is encouraging the integration of advanced diagnostic technologies in hospitals and specialized care centers.

Asia-Pacific Bronchoscopes Market Insight

The Asia-Pacific bronchoscopes market is expected to grow at the fastest CAGR of 10.32% during the forecast period, driven by increasing healthcare spending, rising awareness of respiratory health, expansion of hospital infrastructure, and a growing patient population in countries such as China, India, and Japan. The region is witnessing enhanced adoption of single-use bronchoscopes, high-definition imaging systems, and AI-assisted diagnostic platforms, supported by government initiatives and rising demand for minimally invasive procedures.

Japan Bronchoscopes Market Insight

The Japan bronchoscopes market is gaining momentum due to the country’s advanced healthcare system, increasing prevalence of respiratory diseases, and emphasis on early diagnosis. Adoption of high-definition and AI-assisted bronchoscopy systems, coupled with expansion of hospital infrastructure and integration of bronchoscopic devices with EMR systems, is fueling growth. In addition, Japan’s aging population drives demand for safer, minimally invasive respiratory procedures in both clinical and outpatient settings.

China Bronchoscopes Market Insight

The China bronchoscopes market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rising patient population, expanding healthcare infrastructure, and increasing healthcare expenditure. Strong adoption of advanced bronchoscopy technologies such as single-use devices, AI-assisted imaging, and high-definition diagnostic platforms is supporting market growth. Government initiatives to improve respiratory health and the presence of domestic and international bronchoscope manufacturers are key factors propelling the market in China.

Bronchoscopes Market Share

The Bronchoscopes industry is primarily led by well-established companies, including:

• Olympus Corporation (Japan)

• Karl Storz SE & Co. KG (Germany)

• Fujifilm Holdings Corporation (Japan)

• Ambu A/S (Denmark)

• Boston Scientific Corporation (U.S.)

• Cook Medical (U.S.)

• Medtronic (Ireland)

• PENTAX Medical (Japan)

• Teleflex Incorporated (U.S.)

• Richard Wolf GmbH (Germany)

• HOYA Corporation (Japan)

• EFER Endoscopy (France)

• SCHÖLLY Fiberoptic GmbH (Germany)

• LABORIE Medical Technologies (Canada)

• CONMED Corporation (U.S.)

Latest Developments in Global Bronchoscopes Market

- In August 2021, Boston Scientific Corporation received U.S. FDA 510(k) clearance for the EXALT Model B Single-Use Bronchoscope, designed for use in bedside procedures within the intensive care unit (ICU) and operating room. This advancement is expected to drive the market's growth over the forecast period

- In September 2025, Olympus launched the BF-UCP190F, a new EBUS bronchoscope featuring a thin design, strong upward angulation, and enhanced maneuverability. With a 5.9mm outer diameter, it offers extended reach and improved access to deeper lung regions, enhancing diagnostic precision in segmental and sub-segmental bronchial areas

- In October 2025, a study presented at the annual congress of the European Respiratory Society revealed that a robotic-assisted bronchoscope (RAB) can reach very small tumors growing in hard-to-reach parts of the lung, potentially improving outcomes for patients with lung cancer

- In July 2025, Kaneka Corporation launched the SUKEDACHI balloon catheter, the world’s first designed for use in the “Balloon Dilatation for Bronchoscope Delivery (BDBD)” method. This innovative approach allows the bronchoscope to reach lesions deep in the lungs for biopsy, aiding in lung cancer diagnosis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.