Global Budesonide Inhaler Market

Market Size in USD Billion

CAGR :

%

USD

7.12 Billion

USD

11.17 Billion

2025

2033

USD

7.12 Billion

USD

11.17 Billion

2025

2033

| 2026 –2033 | |

| USD 7.12 Billion | |

| USD 11.17 Billion | |

|

|

|

|

Budesonide Inhaler Market Size

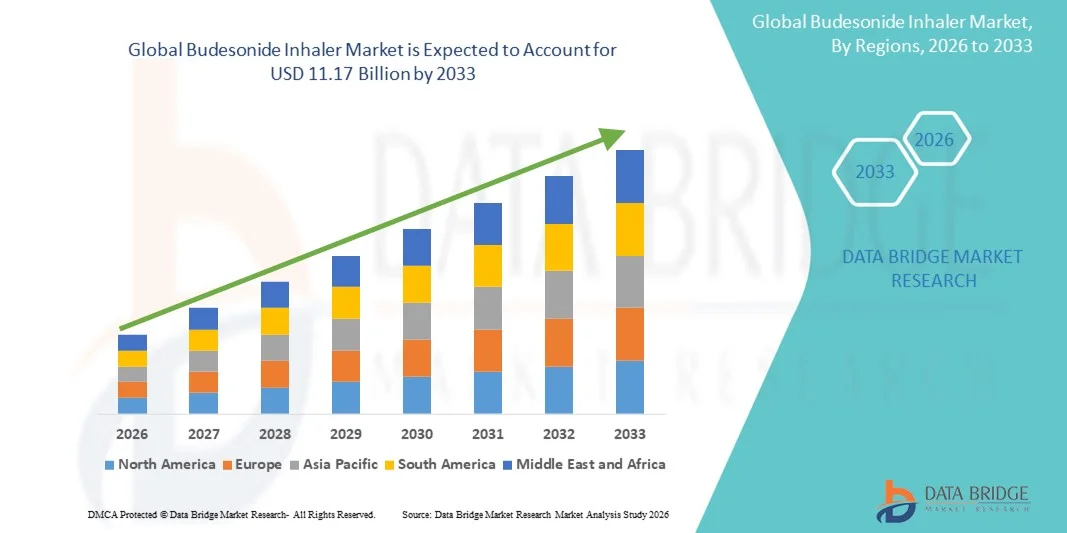

- The global budesonide inhaler market size was valued at USD 7.12 billion in 2025 and is expected to reach USD 11.17 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by increasing prevalence of respiratory disorders, rising patient awareness about asthma and chronic obstructive pulmonary disease (COPD), and technological advancements in inhaler devices, leading to more effective and convenient drug delivery in both homecare and hospital settings

- Furthermore, growing demand for user-friendly, portable, and efficient inhalation therapies is driving the adoption of Budesonide Inhaler solutions, thereby significantly boosting the industry's growth

Budesonide Inhaler Market Analysis

- Budesonide Inhalers, widely used for the management of asthma and chronic obstructive pulmonary disease (COPD), are increasingly recognized for their effectiveness in delivering corticosteroid therapy directly to the lungs, improving patient outcomes and reducing systemic side effects

- The escalating demand for budesonide inhalers is primarily fueled by the rising prevalence of respiratory disorders, increasing patient awareness about proper inhalation therapy, and the growing adoption of advanced inhaler devices that offer ease of use, portability, and dose precision

- North America dominated the budesonide inhaler market with the largest revenue share of 40% in 2025, supported by well-established healthcare infrastructure, high prevalence of respiratory disorders, and a strong presence of key pharmaceutical manufacturers, with the U.S. contributing the majority share due to widespread access to prescription inhalers and robust patient education initiatives

- Asia-Pacific is expected to be the fastest-growing region in the budesonide inhaler market during the forecast period, registering a CAGR driven by increasing urbanization, rising incidence of asthma and COPD, improving healthcare access, and growing awareness of respiratory health in countries such as China, India, and Japan

- The inhalants segment dominated the largest market revenue share of 62.5% in 2025, owing to their convenience, portability, and widespread use in outpatient and home settings

Report Scope and Budesonide Inhaler Market Segmentation

|

Attributes |

Budesonide Inhaler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Budesonide Inhaler Market Trends

Rising Adoption of Advanced Inhalation Therapies

- • A significant and accelerating trend in the global budesonide inhaler market is the increasing adoption of advanced inhalation therapies that combine improved drug delivery mechanisms with patient-friendly designs. These innovations are enhancing therapeutic outcomes for respiratory conditions while providing greater ease of use for patients

- For instance, newer formulations of Budesonide inhalers feature breath-actuated devices and dry powder inhalers that reduce the risk of improper dosing, improving adherence and treatment efficiency. These devices are particularly suitable for patients with chronic respiratory conditions such as asthma or chronic obstructive pulmonary disease (COPD)

- The trend is further supported by the development of combination therapies, where Budesonide is paired with long-acting bronchodilators, enabling simultaneous management of inflammation and airway constriction in a single inhaler

- Enhanced portability, compact design, and user-friendly dose counters are also driving patient preference, allowing easier integration into daily routines, particularly for children and elderly patients

- Pharmaceutical companies are increasingly investing in device innovation, including advanced metering and low-resistance inhalers, to differentiate products and improve patient compliance

- Healthcare providers are actively recommending these advanced inhalers for improved clinical outcomes, especially in regions with high asthma prevalence

- The global trend is also fueled by awareness campaigns emphasizing the importance of adherence to inhaled corticosteroid therapy and the role of proper inhalation technique

- Patient-centric approaches, such as training apps and educational materials provided alongside inhalers, are contributing to higher acceptance and sustained use

- Regulatory bodies in Europe and North America are encouraging development of inhalers with improved safety, efficacy, and environmental sustainability, further accelerating market adoption

- Overall, the trend towards user-friendly, highly efficient Budesonide inhalers is reshaping expectations in respiratory care, creating a competitive environment for innovative products

- This trend is expected to continue as pharmaceutical companies focus on combining clinical efficacy with patient convenience, supporting growth across both emerging and developed markets

Budesonide Inhaler Market Dynamics

Driver

Rising Prevalence of Respiratory Diseases and Increased Awareness

- The growing prevalence of asthma, COPD, and other chronic respiratory disorders is a key driver of Budesonide inhaler adoption worldwide. Rising air pollution levels and changing lifestyles are exacerbating respiratory conditions, increasing the need for preventive and maintenance therapies

- Increasing awareness among patients and healthcare providers about the benefits of inhaled corticosteroids in controlling inflammation and reducing exacerbations further fuels demand

- For instance, the WHO estimated that over 300 million people globally suffer from asthma, emphasizing the potential patient pool for Budesonide inhalers

- The availability of affordable generics and combination therapies is also contributing to market growth, as more patients can access effective treatments

- Governments and healthcare organizations are promoting early diagnosis and regular treatment regimens, thereby increasing prescription rates for inhaled corticosteroids

- Insurance coverage and reimbursement policies in developed countries are further enabling patient access to Budesonide inhalers

- Pharmaceutical companies are expanding distribution networks and launching patient support programs to improve adherence, especially in chronic conditions

- Technological innovations, such as low-resistance inhalers and dose counters, increase patient confidence and treatment compliance

- The adoption of home-based respiratory care models and telemedicine services during COVID-19 and beyond has also accelerated demand for portable and easy-to-use inhalers

- Overall, the convergence of disease prevalence, awareness, and supportive healthcare infrastructure is driving robust growth in the Budesonide inhaler market globally

Restraint/Challenge

Side Effects, Inhaler Technique Issues, and High Costs

- Despite widespread adoption, the Budesonide inhaler market faces challenges related to side effects such as oral thrush, dysphonia, and systemic corticosteroid exposure, which may limit patient compliance

- Incorrect inhaler technique remains a significant barrier to effective therapy, with studies showing that a substantial proportion of patients fail to use inhalers correctly, resulting in suboptimal drug delivery

- For instance, a 2022 study in the Journal of Aerosol Medicine highlighted that nearly 50% of patients exhibited improper inhaler technique, reducing therapeutic effectiveness

- High costs of advanced inhaler devices and combination therapies can restrict access, particularly in low- and middle-income countries

- Availability of multiple inhaler types with varying usage requirements may confuse patients and caregivers, necessitating additional training

- Some patients may be hesitant to switch from familiar devices to newer technologies due to perceived complexity or fear of side effects

- Insurance limitations and inconsistent reimbursement policies in certain regions further restrain market growth

- Addressing these challenges requires patient education, device training programs, and cost-effective solutions that maintain clinical efficacy while improving usability

Budesonide Inhaler Market Scope

The market is segmented on the basis of type, dosage, strength, end-users, and distribution channel.

- By Type

On the basis of type, the Budesonide Inhaler market is segmented into nebulizer and inhalants. The inhalants segment dominated the largest market revenue share of 62.5% in 2025, owing to their convenience, portability, and widespread use in outpatient and home settings. Inhalants are preferred for daily maintenance therapy and are compatible with combination treatments for asthma and COPD. The ease of self-administration, compact design, and low risk of dosing errors make inhalants the primary choice for both adult and pediatric patients. Physicians often recommend inhalants due to their rapid onset of action and suitability for chronic care. Market leadership is further reinforced by higher awareness, reimbursement support in developed countries, and widespread availability through pharmacies. Educational programs and patient training initiatives also encourage adherence to inhalant therapy. The growing trend of home-based respiratory care and telemedicine has expanded inhalant adoption globally. Inhalants also benefit from continuous innovation in drug formulation and device design, ensuring consistent therapeutic outcomes. Overall, the inhalant segment maintains dominance due to convenience, accessibility, and clinical efficacy.

The nebulizer segment is expected to witness the fastest CAGR of 15.8% from 2026 to 2033, driven by increasing adoption in pediatric and geriatric populations requiring precise dosing and in-home treatment setups. Nebulizers are particularly favored for acute exacerbations and for patients unable to use handheld inhalers effectively. Technological advancements, such as portable and battery-operated nebulizers, improve usability and patient compliance. The rise of home healthcare and outpatient respiratory care services, especially in emerging markets, supports rapid growth. Nebulizers also provide flexibility in combination therapy delivery and allow for higher-dose administration. Increased awareness among caregivers and healthcare providers regarding the benefits of nebulized Budesonide contributes to adoption. Moreover, insurance reimbursement for home treatment programs enhances accessibility. Market expansion is further fueled by patient education programs and clinical recommendations. Continuous device innovation ensures enhanced portability, reduced treatment time, and lower drug wastage, bolstering segment growth.

- By Dosage

On the basis of dosage, the Budesonide Inhaler market is segmented into dry powder, spray, suspension, aerosols, and others. The dry powder segment dominated with a revenue share of 47.3% in 2025, driven by convenience, precise dosing, and compatibility with portable inhaler devices. Dry powder inhalers are preferred for chronic treatment regimens due to their ease of use and patient adherence. They provide consistent therapeutic outcomes, especially in outpatient and home care settings. Manufacturers are investing in improved dry powder formulations for enhanced lung deposition and reduced throat irritation. Widespread clinical recommendation, patient-friendly design, and robust supply chains support dominance. Dry powder inhalers are widely used in developed markets due to regulatory approvals and insurance coverage. Continuous research into particle engineering and moisture-resistant designs further strengthens market share. Patient education and training materials ensure proper use, increasing treatment effectiveness. High awareness of long-term management of asthma and COPD encourages sustained adoption.

The aerosols segment is anticipated to witness the fastest CAGR of 14.5% from 2026 to 2033, fueled by technological advancements in propellant systems and metered-dose inhalers. Aerosols provide rapid drug delivery, making them ideal for acute exacerbations. The compact design, portability, and ease of administration contribute to growing patient preference. Growing home healthcare adoption and emergency care applications further support segment growth. Aerosols are increasingly recommended in pediatric and geriatric populations where ease of use is critical. Online pharmacies and retail expansions increase accessibility, especially in emerging regions. Manufacturers are investing in environmentally friendly propellants, enhancing market appeal. Clinical trials supporting efficacy and safety bolster confidence among healthcare providers. Expansion in combination therapies incorporating corticosteroids and bronchodilators also fuels growth.

- By Strength

On the basis of strength, the market is segmented into 0.25 mg, 0.5 mg, and 1.0 mg. The 0.5 mg segment dominated the market with a market share of 51.2% in 2025, preferred for maintenance therapy in both adults and children. This dosage provides effective symptom control while minimizing side effects, leading to higher prescription rates. Physicians favor 0.5 mg for its balance between efficacy and safety. Widespread clinical adoption, inclusion in treatment guidelines, and patient compliance contribute to market dominance. Pharmaceutical companies prioritize manufacturing and distribution of this dosage due to higher demand. Educational initiatives and awareness campaigns support patient adherence and correct usage. The 0.5 mg dose is compatible with both inhalants and nebulizers, providing flexibility in treatment administration. Hospitals and clinics stock this dosage as the standard, reinforcing its market share. Market growth is further supported by rising prevalence of asthma and COPD globally.

The 1.0 mg segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by increasing adoption in severe asthma and COPD cases requiring higher corticosteroid delivery. Patients in acute or exacerbation-prone stages benefit from higher doses for symptom management. Rising use in hospital-based care, emergency treatment, and clinical settings supports segment growth. Advanced inhaler devices allow for precise delivery of 1.0 mg doses with minimal wastage. Awareness campaigns and updated clinical protocols recommending higher doses in certain cases further propel growth. Accessibility improvements via retail and online pharmacy channels also enhance adoption. Technological improvements in aerosol and dry powder systems increase patient safety and ease of use.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospital segment dominated with a revenue share of 65.3% in 2025, due to the need for continuous monitoring, severe case management, and integration into critical care protocols. Hospitals remain the primary sites for both adult and pediatric respiratory care. High-volume procurement, trained staff, and clinical guidance reinforce segment leadership. The availability of multiple delivery devices and dosage forms for inpatient use further strengthens dominance. Hospitals benefit from long-term contracts with manufacturers and structured supply chains. Widespread adoption in tertiary care and specialized respiratory departments maintains the market share.

The clinic segment is expected to witness the fastest CAGR of 16.7% from 2026 to 2033, driven by the growing adoption of outpatient respiratory therapy and home healthcare programs. Specialty clinics are increasingly integrating portable inhaler devices for emergency management and routine monitoring. Growth is supported by rising awareness among patients and caregivers, as well as technology-enabled education and monitoring programs. Increased availability of inhalers in small clinics and telemedicine support enhances access. Emerging markets are seeing growth in clinic-based respiratory care, driving adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated with a market share of 59.1% in 2025, as hospitals procure Budesonide inhalers in bulk for inpatient, emergency, and critical care applications. Hospitals benefit from centralized procurement systems that ensure compliance with safety and regulatory standards while reducing operational inefficiencies. High consumption volumes, particularly in intensive care units (ICUs) and neonatal care, further reinforce segment leadership. Hospitals maintain long-term contracts with manufacturers, ensuring a steady supply of inhalers. The presence of trained healthcare staff and established clinical protocols allows proper administration and monitoring of inhaler therapy. The integration of inhalers into hospital pharmacy inventory systems ensures timely availability for patients. In addition, the rising prevalence of respiratory diseases among hospitalized patients drives sustained demand. Awareness programs and hospital-led patient education initiatives contribute to adherence and effective use. Overall, hospital pharmacies remain the primary and most reliable distribution channel for Budesonide inhalers due to their high-volume utilization, clinical support, and structured procurement processes.

The online pharmacy segment is expected to witness the fastest CAGR of 18.2% from 2026 to 2033, fueled by the growing adoption of digital healthcare platforms, e-commerce penetration, and increasing homecare delivery models. Online pharmacies provide convenient doorstep delivery, especially for patients in remote or underserved regions, reducing the need for physical visits to pharmacies. The segment is witnessing growth due to patient preference for home-based care, repeat orders, and subscription models. Expanding internet access and smartphone penetration in emerging markets enhance accessibility and trust in online medical purchases. E-pharmacies also offer wider product availability, including multiple inhaler brands, dosages, and device types, which is not always possible in retail settings. Telemedicine integrations allow doctors to prescribe inhalers directly to online platforms, simplifying the process for patients. Growing awareness of chronic respiratory diseases and the importance of continuous therapy supports this trend. In addition, online pharmacies often provide competitive pricing, promotions, and convenient payment options, further driving adoption. Emerging collaborations between pharmaceutical companies and online platforms reinforce distribution efficiency. Improved logistics, real-time tracking, and cold-chain compliance for sensitive medications strengthen consumer confidence. The segment’s scalability and adaptability to changing patient behaviors make it the fastest-growing distribution channel globally.

Budesonide Inhaler Market Regional Analysis

- North America dominated the budesonide inhaler market with the largest revenue share of 40% in 2025

- Supported by well-established healthcare infrastructure, high prevalence of respiratory disorders, and a strong presence of key pharmaceutical manufacturers

- The market contributed the majority share due to widespread access to prescription inhalers, robust patient education initiatives, and high adoption of advanced respiratory therapies

U.S. Budesonide Inhaler Market Insight

The U.S. budesonide inhaler market captured the largest revenue share of 78% in 2025 within North America, driven by the increasing incidence of asthma and COPD, growing patient awareness, and adoption of advanced inhaler devices. The presence of leading pharmaceutical companies and continuous innovation in inhalation technology further propels the market growth.

Europe Budesonide Inhaler Market Insight

The Europe budesonide inhaler market is projected to expand at a significant CAGR during the forecast period, driven by rising prevalence of respiratory diseases, increasing healthcare expenditure, and growing demand for effective inhalation therapies. Improved access to healthcare services and well-established distribution channels further support market expansion.

U.K. Budesonide Inhaler Market Insight

The U.K. budesonide inhaler market is expected to grow steadily, fueled by high awareness of respiratory health, increasing incidence of asthma and COPD, and strong presence of pharmaceutical companies producing innovative inhalation devices. Government initiatives for respiratory care and accessibility to prescription medications are also contributing to growth.

Germany Budesonide Inhaler Market Insight

The Germany budesonide inhaler market is anticipated to expand at a considerable CAGR, supported by increasing patient awareness, advanced healthcare infrastructure, and adoption of next-generation inhaler technologies. The country’s emphasis on chronic disease management and research in respiratory therapies further boosts market growth.

Asia-Pacific Budesonide Inhaler Market Insight

The Asia-Pacific budesonide inhaler market is expected to grow at the fastest CAGR of 11.5% during the forecast period, driven by increasing urbanization, rising prevalence of respiratory disorders, improving healthcare access, and growing awareness of respiratory health in countries such as China, India, and Japan. Expanding healthcare infrastructure and government initiatives to manage chronic respiratory diseases further support adoption.

Japan Budesonide Inhaler Market Insight

The Japan budesonide inhaler market is witnessing steady growth due to increasing prevalence of asthma and COPD, an aging population, and high healthcare spending. The availability of advanced inhalation devices and patient education programs on respiratory health are contributing to market expansion.

China Budesonide Inhaler Market Insight

The China budesonide inhaler market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising asthma and COPD cases, expanding middle-class population, improving healthcare infrastructure, and high patient awareness. The strong presence of domestic and international pharmaceutical manufacturers producing inhalation therapies further drives the market growth.

Budesonide Inhaler Market Share

The Budesonide Inhaler industry is primarily led by well-established companies, including:

• Sun Pharmaceutical Industries Ltd. (India)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Chiesi Farmaceutici S.p.A. (Italy)

• Hikma Pharmaceuticals PLC (U.K.)

• Cipla Limited (India)

• Sandoz International GmbH (Switzerland)

• Merck & Co., Inc. (U.S.)

• Novartis AG (Switzerland)

• Boehringer Ingelheim (Germany)

• Shanghai Pharmaceuticals Holding Co., Ltd. (China)

• Cipla Respiratory (India)

• Zuventus Healthcare Ltd. (India)

• AbbVie Inc. (U.S.)

• Haleon plc (U.K.)

Latest Developments in Global Budesonide Inhaler Market

- In July 2023, Viatris and Kindeva announced the launch of Breyna (budesonide + formoterol) Inhalation Aerosol, the first FDA-approved generic version of AstraZeneca’s Symbicort, making this combination more affordable for asthma and COPD patients

- In February 2022, Iconovo successfully completed a comparative clinical study between its ICOres budesonide/formoterol Dry Powder Inhaler and Symbicort Turbuhaler, supporting its development as a potential generic alternative

- In January 2023, a novel fixed-dose combination metered-dose inhaler (MDI) of budesonide and albuterol (rescue + anti-inflammatory) was filed for regulatory approval, targeting both bronchoconstriction relief and exacerbation prevention

- In May 2025, AstraZeneca revealed that its triple‑combination inhaler Breztri Aerosphere (budesonide/glycopyrronium/formoterol) met all primary endpoints in late-stage asthma trials, suggesting a potential shift in the standard-of-care for uncontrolled asthma

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.