Global Building Acoustics Market

Market Size in USD Billion

CAGR :

%

USD

14.66 Billion

USD

22.00 Billion

2025

2033

USD

14.66 Billion

USD

22.00 Billion

2025

2033

| 2026 –2033 | |

| USD 14.66 Billion | |

| USD 22.00 Billion | |

|

|

|

|

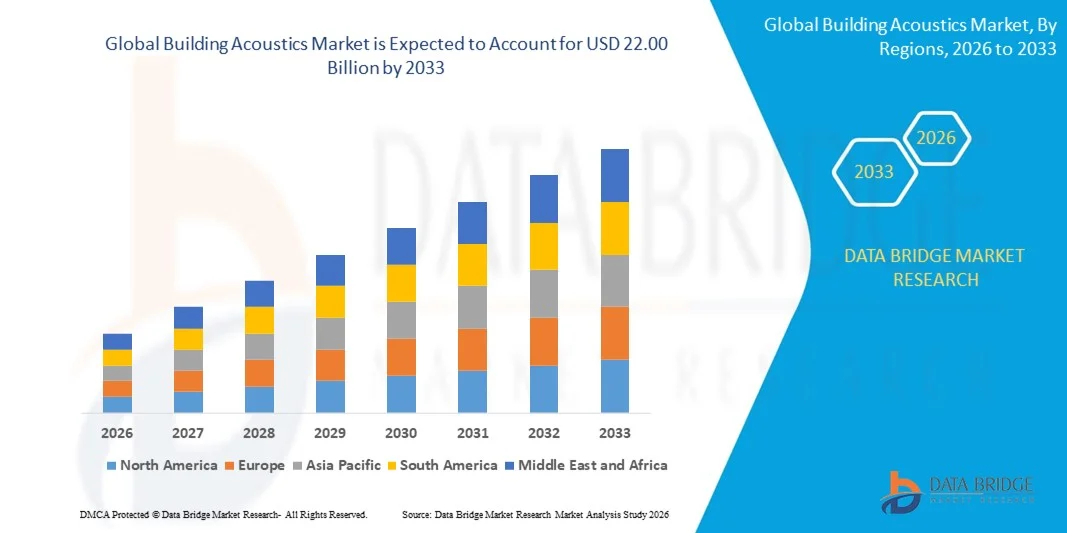

What is the Global Building Acoustics Market Size and Growth Rate?

- The global building acoustics market size was valued at USD 14.66 billion in 2025 and is expected to reach USD 22.00 billion by 2033, at a CAGR of5.20% during the forecast period

- Growth is driven by increasing adoption of advanced acoustic assessment and noise-mitigation solutions across industrial, automotive, commercial, and residential sectors. Stricter noise regulations, rising occupational safety requirements, and environmental compliance initiatives are key factors supporting demand

- Additional drivers include rapid urbanization, infrastructure expansion, environmental awareness, and investments in smart building technologies, which are fueling adoption of acoustic monitoring, modeling, and control systems globally

What are the Major Takeaways of Building Acoustics Market?

- Increasing focus on regulatory compliance, workplace safety, and environmental noise reduction is boosting demand for building acoustics solutions across industries and public infrastructure projects

- Expansion of urban infrastructure, construction of smart cities, and growing awareness about noise pollution’s health impacts are accelerating adoption of acoustic assessment and mitigation tools

- Technological innovations — such as high-resolution acoustic cameras, microphone arrays, AI-powered analytics, IoT-enabled monitoring systems, and cloud-integrated platforms — are improving accuracy, usability, and scalability, thereby supporting sustained market growth

- Asia-Pacific dominated the Building Acoustics market with a 42.3% revenue share in 2025, driven by rapid industrialization, expansion of electronics, automotive, and construction sectors, and increasing government focus on environmental noise control across China, India, Japan, and South Korea

- North America is projected to register the fastest CAGR of 9.7% from 2026 to 2033, led by the U.S. and Canada. Adoption of AI-powered acoustic cameras, IoT-enabled monitoring systems, and industrial noise assessment solutions is driving market growth across manufacturing, transportation, and urban planning sectors

- The Glass Wool segment dominated the market with a 38.7% revenue share in 2025, driven by its excellent thermal and acoustic insulation properties, high fire resistance, lightweight structure, and ease of installation

Report Scope and Building Acoustics Market Segmentation

|

Attributes |

Building Acoustics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Building Acoustics Market?

Increasing Adoption of Smart, Digital, and Eco-Friendly Acoustic Solutions

- The Building Acoustics market is witnessing robust growth due to rising adoption of high-precision, digital, and sustainable acoustic monitoring technologies that enhance regulatory compliance and support environmentally conscious urban planning

- Manufacturers are introducing advanced hardware and software platforms capable of detecting, visualizing, and analyzing complex noise sources in industrial, transportation, and urban settings

- Growing demand for real-time, AI-powered noise mapping for airports, highways, industrial facilities, and smart city infrastructure is accelerating technological investments

- Instance: Companies such as Brüel & Kjær (Denmark), 3M (U.S.), Cirrus Research (U.K.), Norsonic (Norway), and RION (Japan) launched portable acoustic cameras, multi-microphone arrays, and cloud-enabled noise analytics platforms in 2024–2025

- Integration of IoT, AI analytics, and cloud platforms is transforming noise monitoring practices globally

- As industries and municipalities prioritize accuracy, sustainability, and compliance, Building Acoustics solutions are evolving toward high-performance, digital-first, and eco-conscious technologies

What are the Key Drivers of Building Acoustics Market?

- Growing focus on environmental noise control, occupational safety, and urban planning is driving adoption of advanced acoustic assessment solutions worldwide

- Instance: In 2025, Brüel & Kjær, Cirrus Research, Norsonic, 3M, and RION expanded their portfolios with AI-enabled acoustic cameras, portable sensor networks, and cloud-integrated analysis platforms

- Rapid industrialization, urban expansion, and infrastructure development increase demand for accurate noise measurement in highways, railways, airports, and manufacturing facilities

- Technological innovations such as 3D sound visualization, multi-microphone arrays, IoT connectivity, and cloud-based analytics improve precision, usability, and scalability

- Regulatory mandates, environmental noise limits, and sustainability initiatives further accelerate adoption across construction, transportation, and environmental monitoring sectors

- Continuous R&D, partnerships, and software-hardware integration are expected to drive long-term growth of the global Building Acoustics market

Which Factor is Challenging the Growth of the Building Acoustics Market?

- High costs of advanced acoustic cameras, AI-enabled platforms, and multi-sensor networks limit adoption among small enterprises and municipalities

- Instance: During 2024–2025, fluctuations in electronic component costs, regulatory updates, and skilled labor shortages affected deployment of advanced noise monitoring solutions worldwide

- Complexity in implementing multi-sensor arrays, cloud analytics, and AI modeling increases the need for specialized expertise and training

- Limited awareness and technical know-how in emerging regions slows uptake of high-precision acoustic monitoring systems

- Competition from low-cost analog meters, legacy systems, and regional manufacturers exerts pricing and differentiation pressures

- Companies are addressing these challenges through cost-effective, scalable, cloud-integrated solutions, training initiatives, and automated noise analysis tools, enabling broader adoption of high-performance Building Acoustics technologies globally

How is the Building Acoustics Market Segmented?

The market is segmented on the basis of material and end use.

- By Material

On the basis of material, the building acoustics market is segmented into Glass Wool, Stone Wool, Acoustic Fabrics, Acoustic Insulators, Fabric Absorbers, Fabric Dampeners, Fabric Diffusors, Fabric Noise Barriers, Fabric Ceilings, Foamed Plastic, Fabric Soundproofing Materials, and Fabric Wall Materials. The Glass Wool segment dominated the market with a 38.7% revenue share in 2025, driven by its excellent thermal and acoustic insulation properties, high fire resistance, lightweight structure, and ease of installation. Glass wool is widely used in walls, ceilings, HVAC systems, and industrial applications due to its cost-effectiveness, durability, and versatility across commercial and residential projects.

The Fabric Soundproofing Materials segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing adoption in premium residential interiors, recording studios, corporate offices, and urban apartments. Growing awareness of noise pollution, enhanced aesthetic integration, and preference for lightweight, flexible soundproofing solutions are fueling segment expansion globally.

- By End Use

On the basis of end-use, the building acoustics market is segmented into Residential and Commercial sectors. The Commercial segment dominated the market with a 54.3% revenue share in 2025, driven by rising investments in office complexes, hotels, hospitals, airports, and educational institutions where high-performance acoustic materials are essential for comfort, privacy, and regulatory compliance. Commercial buildings increasingly integrate advanced acoustic panels, ceilings, and wall treatments to meet stringent sound absorption and noise control standards.

The Residential segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by the growing trend of home studios, urban apartments, and smart homes adopting effective soundproofing and noise-reduction solutions. Rising consumer awareness of health, well-being, and work-from-home requirements is driving demand for modern, aesthetically pleasing, and easy-to-install residential acoustic products.

Which Region Holds the Largest Share of the Building Acoustics Market?

- Asia-Pacific dominated the building acoustics market with a 42.3% revenue share in 2025, driven by rapid industrialization, expansion of electronics, automotive, and construction sectors, and increasing government focus on environmental noise control across China, India, Japan, and South Korea. Rising adoption of high-precision, digital, and eco-friendly noise mapping solutions makes the region a key hub for Building Acoustics technologies

- Leading manufacturers in Asia-Pacific are focusing on AI-powered acoustic cameras, IoT-integrated monitoring systems, and cloud-enabled noise analytics platforms, strengthening regional technological leadership. Investments in smart cities, industrial automation, and sustainable urban planning are expanding long-term opportunities

- Strong industrial infrastructure, growing R&D capabilities, and supportive government regulations reinforce Asia-Pacific’s dominant position in the Building Acoustics market

China Building Acoustics Market Insight

China is the largest contributor in Asia-Pacific, supported by its vast industrial base, electronics manufacturing, automotive production, and ongoing adoption of digital noise mapping systems. Expansion in smart city projects and eco-friendly manufacturing drives demand for advanced Building Acoustics solutions.

Japan Building Acoustics Market Insight

Japan exhibits steady growth due to rising adoption of noise control technologies in automotive, construction, and industrial sectors. Investment in R&D, smart factories, and sustainable practices continues to support market expansion.

India Building Acoustics Market Insight

India is emerging as a key growth market, fueled by rapid industrialization, expansion in automotive and electronics manufacturing, and regulatory emphasis on environmental noise monitoring. Adoption of digital and sensor-based noise mapping systems is accelerating.

South Korea Building Acoustics Market Insight

South Korea contributes meaningfully due to increasing smart manufacturing initiatives, automotive NVH testing, and electronics production. Focus on precision noise measurement and sustainable industrial practices further boosts demand.

North America Building Acoustics Market

North America is projected to register the fastest CAGR of 9.7% from 2026 to 2033, led by the U.S. and Canada. Adoption of AI-powered acoustic cameras, IoT-enabled monitoring systems, and industrial noise assessment solutions is driving market growth across manufacturing, transportation, and urban planning sectors.

U.S. Building Acoustics Market Insight

The U.S. is the largest contributor in North America, supported by smart city projects, aerospace and automotive NVH testing, and advanced industrial noise assessment initiatives. High R&D capabilities and tech-driven enterprise presence ensure strong market penetration.

Canada Building Acoustics Market Insight

Canada contributes significantly to regional growth due to adoption of precision noise measurement technologies, government-backed noise regulation initiatives, and investments in renewable energy and industrial noise mitigation solutions.

Which are the Top Companies in Building Acoustics Market?

The building acoustics industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Publishers Representatives Limited (U.K.)

- Beijing New Building Material (Group) Co., Ltd. (China)

- AWI Licensing LLC and AFI Licensing LLC (U.S.)

- Saint-Gobain (France)

- Knauf Insulation (Germany)

- Jiangsu Burgeree New Technology Materials Co., LTD (China)

- USG BORAL (Australia)

- Guangdong Liyin Acoustics Technology Co., Ltd. (China)

- Jiaxing Shengyuan Imp & Exp Co., Ltd. (China)

- Hebei Borunde Building Materials Co., Ltd. (China)

- G&S Acoustics (U.K.)

- Abstracta AB (Sweden)

- Vicoustic (Portugal)

- Sound Seal (U.S.)

- TOPAKUSTIK (Germany)

- Kirei (U.S.)

- BASF SE (Germany)

- DuPont (U.S.)

What are the Recent Developments in Global Building Acoustics Market?

- In June 2023, Archroma and COLOURizd entered into a strategic partnership aimed at enabling more eco-friendly production of sustainable textiles by combining advanced dyeing technologies with reduced environmental impact, strengthening their joint commitment toward high-performance and sustainable fabric solutions

- In February 2023, Archroma completed the acquisition of the Textile Effects business from Huntsman Corporation, integrating it into a newly formed division called Archroma Textile Effects, thereby enhancing the company’s global portfolio and strengthening its leadership in textile chemical innovation

- In January 2022, Atul Ltd. introduced its NOVATIC Classic Dark Green Pdr VAT dyes and NOVATIC Classic Dark Navy Pdr VAT dyes for institutional clothing, leisure wear, and furniture applications, marking an expansion of its specialized dye portfolio to meet growing market needs

- In March 2021, Ralph Lauren unveiled its Color-On-Demand platform, an advanced cotton dyeing solution designed to recycle and reuse dyeing process water, establishing it as the first scalable zero-wastewater cotton dyeing system and reinforcing the company’s sustainability leadership

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Building Acoustics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Building Acoustics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Building Acoustics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.