Global Building And Construction Tapes Market

Market Size in USD Billion

CAGR :

%

USD

5.65 Billion

USD

8.25 Billion

2024

2032

USD

5.65 Billion

USD

8.25 Billion

2024

2032

| 2025 –2032 | |

| USD 5.65 Billion | |

| USD 8.25 Billion | |

|

|

|

|

Building and Construction Tapes Market Size

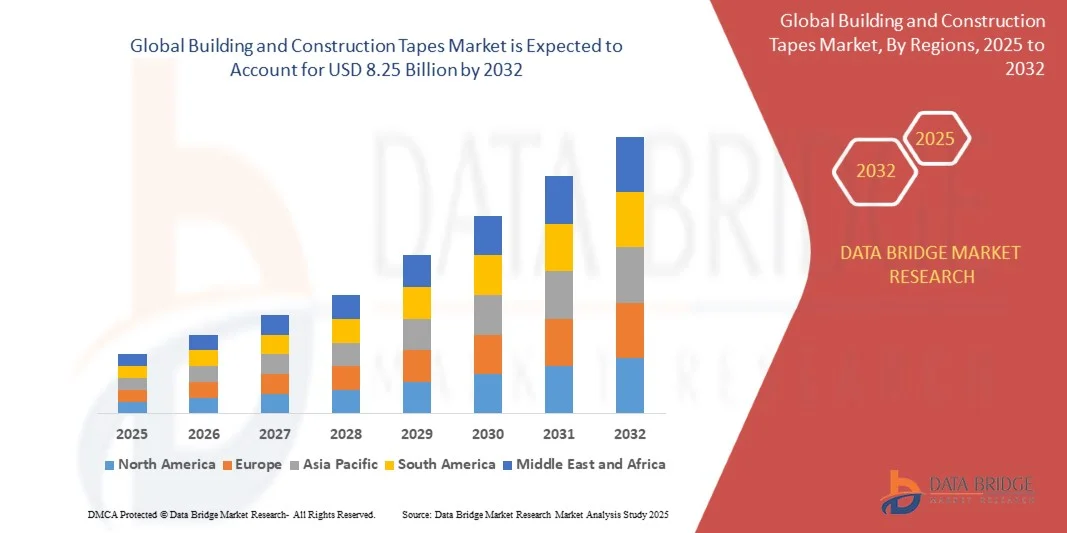

- The global building and construction tapes market size was valued at USD 5.65 billion in 2024 and is expected to reach USD 8.25 billion by 2032, at a CAGR of 4.85% during the forecast period

- The market growth is largely fueled by the rising demand for energy-efficient and sustainable construction materials, driving the adoption of high-performance adhesive solutions across residential, commercial, and industrial projects. The growing shift toward eco-friendly and solvent-free products, coupled with advancements in adhesive technology, is enhancing the functionality and durability of building and construction tapes in various structural applications

- Furthermore, the increasing use of these tapes for sealing, bonding, insulation, and moisture protection in modern buildings is strengthening their market presence across the construction sector. The integration of durable, weather-resistant materials capable of withstanding extreme conditions is positioning building and construction tapes as a preferred alternative to conventional fasteners and sealants, thereby propelling market growth

Building and Construction Tapes Market Analysis

- Building and construction tapes, designed for applications such as bonding, insulation, sealing, and protection, play a crucial role in improving structural integrity, energy efficiency, and longevity in construction projects. Their versatility across flooring, roofing, HVAC, and window systems makes them essential components in modern building practices focused on sustainability and performance

- The escalating demand for high-strength, easy-to-apply adhesive solutions is primarily driven by rapid urbanization, infrastructure expansion, and the growing emphasis on green building standards. As construction practices evolve toward lighter, more efficient materials, the use of advanced adhesive tapes continues to accelerate, supporting innovation and long-term durability across the global construction landscape

- Europe dominated the building and construction tapes market with a share of 30.5% in 2024, due to the growing emphasis on energy-efficient buildings, stringent environmental regulations, and the increasing use of high-performance adhesive materials in construction

- Asia-Pacific is expected to be the fastest growing region in the building and construction tapes market during the forecast period due to rapid urbanization, industrial expansion, and government investments in infrastructure development

- Double sided tapes segment dominated the market with a market share of 41.8% in 2024, due to their superior bonding strength and versatility across diverse construction applications. These tapes are extensively used for joining, mounting, and laminating surfaces such as glass, metal, and wood, reducing the need for mechanical fasteners. Their ability to offer clean finishes and high adhesion on both smooth and irregular surfaces further supports their dominance in both residential and commercial construction activities

Report Scope and Building and Construction Tapes Market Segmentation

|

Attributes |

Building and Construction Tapes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Building and Construction Tapes Market Trends

“Rising Use of Eco-Friendly, High-Performance Tapes in Sustainable Construction”

- The global building and construction tapes market is experiencing significant transformation driven by the rising demand for eco-friendly and high-performance adhesive solutions that support sustainable construction practices. These specialized tapes are increasingly used for bonding, sealing, and insulating in modern green buildings that prioritize energy efficiency and environmental compliance

- For instance, 3M Company and Saint-Gobain S.A. have launched sustainable building tapes manufactured from solvent-free adhesives and recyclable backing materials. These innovations reflect how leading producers are aligning their product development strategies with global sustainability goals and regulatory demands for low-VOC building materials

- The transition toward high-performance acrylic and silicone-based adhesives is enabling improved longevity and structural integrity in demanding construction environments. These advanced tapes can withstand temperature variations, UV exposure, and moisture, ensuring durability across applications such as façade insulation, roofing, and window sealing

- The growing emphasis on energy-efficient construction materials is supporting the use of vapor control, insulation, and weatherproof tapes that minimize air leakage and improve thermal retention in residential and commercial buildings. Such features align with green building certification frameworks such as LEED and BREEAM

- Rising adoption of prefabricated and modular construction methods is accelerating demand for tapes that offer both speed and consistency of installation. Their ease of application, combined with enhanced bonding capacity, supports high productivity and reduces the need for mechanical fasteners or solvents

- As sustainability becomes integral to global construction practices, eco-friendly and high-performance tapes are emerging as essential components in building envelopes. Their balance of strength, versatility, and environmental responsibility highlights their growing importance in the future of modern construction technology

Building and Construction Tapes Market Dynamics

Driver

“Growing Demand for Durable and Versatile Bonding and Sealing Solutions”

- The increasing focus on structural reliability, thermal efficiency, and design flexibility is driving the use of durable bonding and sealing tapes across construction projects. These tapes provide a combination of mechanical strength, aesthetic integrity, and ease of installation, making them suitable for a wide range of applications from insulation to roofing and interior finishing

- For instance, Tesa SE and Avery Dennison Corporation have developed advanced pressure-sensitive tapes designed to deliver strong adhesion on materials such as concrete, wood, glass, and metal. These products demonstrate how manufacturers are addressing the growing need for versatile bonding solutions capable of adapting to varying substrate conditions

- The ability of construction tapes to provide immediate adhesion and sustained sealing under extreme conditions makes them critical in enhancing energy performance and weather protection. Their use in HVAC systems, window installations, and panel assemblies helps prevent air infiltration and water leakage, improving building efficiency

- The increasing adoption of lightweight and composite building materials has reinforced the demand for tapes that can deliver reliable structural stability without additional hardware. This shift supports construction speed while reducing total building weight and labor costs

- As urbanization and infrastructure development accelerate, the need for durable bonding systems with enhanced longevity and flexibility continues to grow. This ongoing evolution toward multifunctional adhesive products ensures steady demand for construction tapes in global building markets

Restraint/Challenge

“Fluctuating Raw Material Prices”

- The volatility in raw material costs, particularly for adhesives, polymers, and synthetic resins, poses a major challenge to the building and construction tapes market. Price fluctuations in feedstocks such as acrylic, rubber, and polyethylene directly impact production expenses and profit margins for manufacturers

- For instance, companies such as Nitto Denko Corporation and Scapa Group plc have reported significant cost pressures due to rising crude oil prices, which influence the pricing of adhesive formulations and substrate materials. This volatility complicates forecasting and pricing stability across supply contracts

- The dependency on petrochemical-derived components also exposes manufacturers to unpredictable supply disruptions, particularly during geopolitical or transportation crises. These fluctuations can affect production schedules and hinder delivery timelines for large infrastructure projects

- Variations in global demand for packaging and automotive adhesives further create competitive resource allocation issues among producers, limiting availability of specific resin grades for construction applications. Such constraints occasionally lead to increased procurement costs and reduced supply flexibility

- Mitigating these challenges will require companies to adopt supply diversification, raw material recycling, and bio-based adhesive innovations. Strategic partnerships with material suppliers and investment in research for renewable alternatives will be essential to stabilize pricing and ensure long-term market resilience for construction tapes worldwide

Building and Construction Tapes Market Scope

The market is segmented on the basis of product, backing material type, application, function, end use, and distribution channel.

• By Product

On the basis of product, the building and construction tapes market is segmented into double-sided tapes, masking tapes, duct tapes, and other tapes. The double-sided tapes segment dominated the market with the largest revenue share of 41.8% in 2024, driven by their superior bonding strength and versatility across diverse construction applications. These tapes are extensively used for joining, mounting, and laminating surfaces such as glass, metal, and wood, reducing the need for mechanical fasteners. Their ability to offer clean finishes and high adhesion on both smooth and irregular surfaces further supports their dominance in both residential and commercial construction activities.

The masking tapes segment is projected to witness the fastest growth rate from 2025 to 2032 due to the expanding use in painting, surface protection, and finishing applications. Masking tapes are valued for their easy removability without leaving residue and their compatibility with various substrates. The growing demand for aesthetically appealing finishes in modern construction and renovation projects has increased the adoption of masking tapes, especially in interior wall and ceiling applications.

• By Backing Material Type

On the basis of backing material type, the market is segmented into polyvinyl chloride (PVC), polypropylene (PP), polyethylene terephthalate (PET), polyethylene (PE), foil, paper, and foam. The PVC segment held the largest revenue share in 2024 owing to its superior flexibility, moisture resistance, and durability under varying environmental conditions. PVC-backed tapes are widely used in sealing, insulation, and surface protection, making them essential for both indoor and outdoor applications. Their robustness against chemicals and UV exposure makes them ideal for long-term performance in building projects.

The polypropylene (PP) segment is expected to witness the fastest growth rate from 2025 to 2032 due to its lightweight structure, cost efficiency, and recyclability. PP-backed tapes offer excellent tensile strength and are preferred in applications where high adhesion and easy handling are required. The increasing focus on sustainable materials in the construction industry further boosts the adoption of PP tapes as an eco-friendly alternative.

• By Application

Based on application, the market is segmented into flooring, walls & ceilings, windows, doors, roofing, building envelope, electrical, HVAC, and plumbing. The flooring segment dominated the market in 2024 due to the widespread use of tapes for bonding, sealing, and securing materials such as vinyl, carpet, and wood panels. Flooring tapes enhance installation efficiency and provide long-lasting adhesion, ensuring durability under heavy foot traffic. Their ability to resist moisture and temperature changes makes them indispensable in both residential and commercial projects.

The building envelope segment is anticipated to record the fastest growth rate from 2025 to 2032 as energy-efficient construction practices gain traction. Tapes used in building envelopes offer superior air and moisture sealing, contributing to thermal insulation and overall energy performance. Growing emphasis on green building standards and regulatory requirements for energy conservation drives the demand for high-performance sealing tapes in this segment.

• By Function

On the basis of function, the market is categorized into bonding, barrier protection, insulation, glazing, soundproofing, and cable management. The bonding segment dominated the market in 2024 owing to its critical role in replacing mechanical fasteners and enabling seamless surface adhesion. These tapes simplify assembly processes, reduce weight, and prevent surface damage, enhancing construction efficiency. Their adaptability across multiple substrates such as glass, aluminum, and composites sustains their widespread usage.

The insulation segment is forecasted to witness the fastest growth from 2025 to 2032 as the demand for thermal and acoustic comfort in buildings increases. Insulation tapes provide excellent sealing and temperature resistance, ensuring improved energy efficiency and reduced sound transmission. Rising focus on sustainable construction and green certifications fuels the adoption of insulation tapes across new building and renovation projects.

• By End Use

Based on end use, the market is segmented into residential, commercial, and industrial. The residential segment dominated the market in 2024 due to increasing urbanization, home renovation activities, and demand for aesthetic finishing materials. Tapes are widely used in flooring, windows, and roofing installations to enhance bonding strength and long-term performance. Their ease of application and cost efficiency make them a preferred choice for homeowners and contractors.

The commercial segment is projected to exhibit the fastest growth rate from 2025 to 2032 with rising construction of office complexes, retail spaces, and hospitality infrastructure. High-performance tapes offering durability, fire resistance, and weatherproof sealing are gaining prominence in large-scale commercial projects. The expansion of modern architectural designs and focus on sustainable building practices further accelerate demand in this segment.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and third-party. The direct segment accounted for the largest market share in 2024 due to the preference of large construction firms and industrial buyers for bulk procurement and consistent product quality. Direct distribution enables manufacturers to maintain long-term relationships with contractors, ensuring efficient supply chains and timely deliveries for large-scale projects.

The third-party segment is expected to record the fastest growth from 2025 to 2032, driven by the expanding presence of online platforms and distributors offering a wide range of products. E-commerce and retail channels provide easy access to various tape types and brands, particularly benefiting small-scale contractors and DIY consumers. The convenience of price comparison and doorstep delivery further boosts sales through this segment.

Building and Construction Tapes Market Regional Analysis

- Europe dominated the building and construction tapes market with the largest revenue share of 30.5% in 2024, driven by the growing emphasis on energy-efficient buildings, stringent environmental regulations, and the increasing use of high-performance adhesive materials in construction

- The region’s focus on sustainable construction practices and eco-friendly materials has significantly boosted the demand for advanced tape solutions for insulation, sealing, and bonding applications

- Furthermore, the strong presence of global construction tape manufacturers and the rapid adoption of green building certifications reinforce Europe’s market leadership

U.K. Building and Construction Tapes Market Insight

The U.K. building and construction tapes market captured a significant share within Europe in 2024, supported by rising infrastructure renovation projects and stringent building energy efficiency standards. The country’s growing shift towards sustainable materials and smart construction technologies is driving the use of high-performance tapes for insulation and sealing. Moreover, the expansion of residential construction and government initiatives promoting eco-friendly housing are strengthening market growth in the U.K.

Germany Building and Construction Tapes Market Insight

The Germany building and construction tapes market held the largest revenue share in 2024, attributed to its advanced construction industry, strict environmental norms, and innovation-driven approach. German manufacturers emphasize the development of recyclable and solvent-free adhesive tapes for thermal insulation, soundproofing, and bonding applications. The country’s continuous investment in energy-efficient infrastructure and preference for premium-quality construction materials are key factors supporting market expansion.

North America Building and Construction Tapes Market Insight

The North America building and construction tapes market accounted for a notable share in 2024, primarily fueled by high construction spending and modernization of commercial and residential buildings. The region’s growing awareness of energy conservation and the increasing use of adhesive tapes for roofing, HVAC, and electrical applications are driving market demand. The strong presence of major tape producers and the adoption of advanced adhesive technologies further support market growth across the U.S. and Canada.

U.S. Building and Construction Tapes Market Insight

The U.S. building and construction tapes market represented the dominant share in North America in 2024, propelled by a surge in infrastructure upgrades and a rising preference for flexible bonding solutions. The growing focus on sustainable construction materials, coupled with the integration of high-strength adhesive tapes in flooring and roofing systems, is accelerating market adoption. In addition, the U.S. continues to lead in technological innovations, ensuring superior product durability and performance in varied climatic conditions.

Asia-Pacific Building and Construction Tapes Market Insight

The Asia-Pacific building and construction tapes market is projected to grow at the fastest CAGR from 2025 to 2032, supported by rapid urbanization, industrial expansion, and government investments in infrastructure development. The growing demand for affordable housing, energy-efficient materials, and moisture-resistant sealing solutions is driving regional growth. Countries such as China, Japan, and India are witnessing a sharp rise in construction tape usage for both new construction and renovation activities.

China Building and Construction Tapes Market Insight

The China building and construction tapes market accounted for the largest share within Asia-Pacific in 2024, bolstered by the rapid pace of urban development and strong domestic manufacturing capabilities. Increasing focus on sustainable infrastructure and the rising need for high-performance adhesive materials for windows, doors, and building envelopes are fueling demand. The country’s leadership in cost-efficient production and growing adoption of eco-friendly materials position China as a key growth hub in the region.

Building and Construction Tapes Market Share

The building and construction tapes industry is primarily led by well-established companies, including:

- tesa Tapes (India) Private Limited (India)

- 3M (U.S.)

- Avery Dennison Corporation (U.S.)

- Saint-Gobain (France)

- Berry Global Inc. (U.S.)

- LINTEC Corporation (Japan)

- Godson Tapes Pvt. Limited (India)

- Scapa Group plc (U.K.)

- Shurtape Technologies, LLC (U.S.)

- Nitto Denko Corporation (Japan)

- Maxell Holdings, Ltd. (Japan)

- DuPont (U.S.)

- BowTape Co., Ltd. (South Korea)

- Trustin Tape Pvt. Ltd. (India)

- Irplast S.p.A. (Italy)

- Lohmann GmbH & Co. KG (Germany)

- Bostik (France)

- ECHOtape (U.S.)

- kisscuttape.com (U.S.)

- MBK Tape Solutions (U.S.)

Latest Developments in Global Building and Construction Tapes Market

- In June 2024, 3M Company introduced its next-generation VHB Structural Glazing Tape series designed specifically for façade and window bonding applications in the building and construction sector. This development strengthens 3M’s product portfolio with enhanced bonding strength, weather resistance, and sustainability performance. The introduction of this advanced tape technology is expected to boost the adoption of high-performance adhesive solutions in energy-efficient building designs, reducing the reliance on mechanical fasteners and improving structural integrity across modern construction projects

- In November 2023, tesa SE expanded its production facility in Haiphong, Vietnam, to meet the rising global demand for construction and industrial adhesive tapes. The new manufacturing capacity enables tesa to shorten delivery times, improve regional supply chain efficiency, and cater to the growing construction activity in Asia-Pacific. This strategic expansion enhances tesa’s competitive position and supports the company’s sustainability goals by integrating eco-efficient manufacturing processes

- In August 2023, Avery Dennison Corporation announced a new line of high-performing adhesive tape for the building and construction industry. The Cold Tough adhesive tape range is engineered for seaming and joining metal building assemblies used in harsh environments. Its versatility across roofs, external walls, ducting systems, and doors enhances durability and energy efficiency, strengthening Avery Dennison’s presence in industrial and structural applications

- In March 2023, Rotunda Capital Partners completed the acquisition of Bron Tapes, a leading distributor and converter of pressure-sensitive tapes and adhesives. This acquisition supports Rotunda’s strategy to expand its footprint in specialty tape distribution and converting services. It also enhances Bron Tapes’ operational capacity, product availability, and customer reach, positioning the company for accelerated growth in the construction adhesives segment

- In December 2022, Shurtape Technologies, LLC finalized the acquisition of Pro Tapes & Specialties, Inc., a tape producer and converter serving multiple industrial applications. The move was aimed at improving Shurtape’s manufacturing capabilities and expanding its product range for the construction sector. By integrating Pro Tapes’ advanced converting technologies and industry expertise, Shurtape strengthened its market presence and improved responsiveness to the growing demand for customized adhesive solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Building And Construction Tapes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Building And Construction Tapes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Building And Construction Tapes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.