Global Building Automation Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

2.27 Billion

2024

2032

USD

1.14 Billion

USD

2.27 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.27 Billion | |

|

|

|

|

Building Automation Market Size

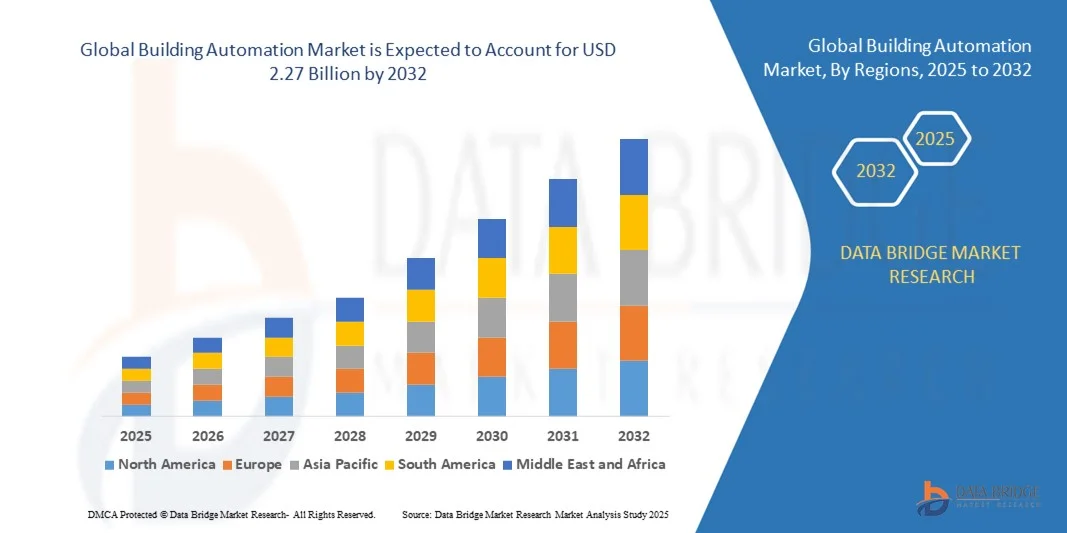

- The global building automation market size was valued at USD 1.14 billion in 2024 and is expected to reach USD 2.27 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of smart building solutions and technological advancements in IoT, AI, and cloud-based systems, leading to enhanced digitalization and operational efficiency in both commercial and residential buildings

- Furthermore, rising demand for energy-efficient, secure, and integrated building management solutions is encouraging property owners and enterprises to implement automation systems that optimize HVAC, lighting, security, and fire protection. These converging factors are driving rapid adoption of building automation solutions, significantly boosting the market’s expansion

Building Automation Market Analysis

- Building automation systems (BAS) are integrated solutions that allow centralized monitoring and control of various building functions, including HVAC, lighting, security, fire protection, and energy management. These systems enhance operational efficiency, reduce energy consumption, and provide improved comfort and safety for occupants in residential, commercial, and industrial spaces

- The escalating demand for BAS is primarily driven by increasing urbanization, rising construction of smart buildings, growing focus on sustainability, and the adoption of IoT-enabled and cloud-connected technologies. Concerns over energy costs, operational efficiency, and regulatory compliance are further accelerating market growth and encouraging the deployment of intelligent building management systems

- North America dominated the building automation market with a share of 35.5% in 2024, due to stringent energy efficiency regulations and high adoption in commercial construction

- Asia-Pacific is expected to be the fastest growing region in the building automation market during the forecast period due to increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- Wired technology segment dominated the market with a market share of 63.40% in 2024, due to its reliability, stability, and low susceptibility to interference, making it ideal for large commercial and industrial buildings with critical automation requirements. Wired systems offer consistent performance for HVAC, lighting, and security controls, ensuring seamless integration with existing building infrastructure and long-term operational efficiency

Report Scope and Building Automation Market Segmentation

|

Attributes |

Building Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Building Automation Market Trends

Rising Adoption of IoT and AI-Powered Building Automation

- The building automation market is witnessing strong growth with the rising adoption of IoT devices and AI-powered solutions that enhance efficiency, sustainability, and occupant comfort. Intelligent sensors and automated control systems are increasingly being used to centrally manage HVAC, lighting, security, and energy consumption

- For instance, Siemens has expanded its Desigo CC building management platform with IoT and AI capabilities that help optimize energy use and predict maintenance needs. This demonstrates how market leaders are deploying data-driven solutions to create smart, adaptive building environments for commercial and residential applications

- IoT integration in building automation enables real-time monitoring and system interoperability across multiple building functions. By connecting devices through centralized platforms, building operators gain actionable insights that support better decision-making and streamlined operations

- The use of AI algorithms supports predictive analytics, enabling systems to automatically adjust ventilation, lighting, and temperature based on occupancy patterns. This reduces energy waste while ensuring personalized occupant comfort, which enhances user satisfaction and lowers operational costs

- Smart building automation is also becoming a critical enabler for green certifications such as LEED and BREEAM. By integrating AI-powered monitoring, companies improve their compliance with energy efficiency goals, making building automation an attractive investment for developers and enterprises alike

- The growing reliance on IoT and AI in building automation is redefining the way buildings are managed, leading toward digital, sustainable infrastructures. This trend is expected to accelerate, creating smarter, more resilient, and cost-efficient building ecosystems globally

Building Automation Market Dynamics

Driver

Demand for Integrated, Energy-Efficient Building Management

- The demand for integrated, energy-efficient building management is a key driver in the building automation market. Organizations seek solutions that lower operating costs, reduce energy consumption, and improve sustainability performance while maintaining occupant comfort and safety

- For instance, Honeywell has launched advanced building automation systems that combine HVAC, energy management, and fire safety under one integrated platform. This showcases how companies are addressing the growing demand for centralized, energy-efficient building control solutions across multiple industries

- Modern buildings increasingly require unified solutions that can manage diverse systems from lighting and heating to security and energy distribution. Integrated platforms streamline these operations, reduce redundancy, and ensure cost efficiency, making them highly attractive for both new construction and retrofit projects

- Global emphasis on energy savings and carbon reduction goals is consolidating building automation adoption. Enterprises across sectors such as healthcare, education, and commercial real estate view automation as essential to complying with climate targets and reducing rising utility expenses

- The focus on sustainability, integrated control, and operational optimization ensures that energy-efficient building management will remain a central driver as smart cities expand and infrastructure investments grow globally

Restraint/Challenge

High Upfront Costs and Retrofit Complexity

- A major challenge in the building automation market lies in the high upfront investment costs and complexity of retrofitting older buildings with advanced automation solutions. Initial capital requirements for sensors, software, and integration often act as barriers for cost-sensitive stakeholders

- For instance, retrofitting legacy buildings with automation systems provided by companies such as Schneider Electric requires integrating new IoT-enabled devices with outdated infrastructure. This process increases project complexity, requiring specialized expertise and higher installation costs for end-users

- The retrofitting challenge is intensified by compatibility issues when integrating new automation technologies with existing HVAC or lighting systems. This technical complexity can extend project timelines, increase costs, and discourage adoption among smaller building owners

- In price-sensitive regions, the perception of high upfront costs overshadows the long-term energy savings and operational efficiency benefits. Many organizations postpone or limit their investment in comprehensive building automation due to the delayed return on investment

- To overcome these barriers, vendors are introducing scalable solutions, performance-based financing models, and modular upgrades that can gradually modernize building infrastructure. Addressing these cost and integration challenges will be critical to expanding the adoption of smart building automation globally

Building Automation Market Scope

The market is segmented on the basis of product, vertical, communication technology, and offering.

- By Product

On the basis of product, the building automation market is segmented into HVAC controls, facility management systems, security and access controls, fire protection systems, building energy management software, BAS services, and others. The HVAC controls segment dominated the largest market revenue share in 2024, driven by the critical role of heating, ventilation, and air conditioning in maintaining comfort, energy efficiency, and indoor air quality across commercial and residential buildings. The segment benefits from increasing adoption of smart thermostats, sensors, and automated climate control systems, which allow centralized monitoring and optimization of energy consumption. Demand is further fueled by government regulations promoting energy-efficient buildings and rising awareness among property owners regarding operational cost savings.

The building energy management software segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the increasing need for real-time energy monitoring, predictive maintenance, and data-driven decision-making. Organizations are adopting software solutions to reduce operational costs, enhance sustainability, and integrate renewable energy sources into building systems. The growing trend toward digital twins, IoT-enabled devices, and cloud-based analytics also supports the expansion of this segment, as businesses seek scalable solutions for smarter building operations.

- By Vertical

On the basis of vertical, the building automation market is segmented into residential, enterprise, industrial, hospitality, retail, and others. The enterprise segment dominated the largest market revenue share in 2024, driven by the high adoption of automation systems in corporate offices, commercial complexes, and smart campuses. Enterprises prioritize centralized control of lighting, HVAC, and security systems to improve energy efficiency, reduce operational costs, and enhance employee comfort and productivity. Integration of IoT devices, AI-powered analytics, and smart building dashboards further accelerates adoption in this vertical.

The hospitality segment is expected to witness the fastest growth from 2025 to 2032, supported by increasing demand for personalized guest experiences, energy-efficient operations, and seamless property management solutions. Hotels, resorts, and convention centers are deploying automation for room controls, access management, and predictive maintenance, driven by the rising focus on sustainability and smart infrastructure. Technological advancements such as mobile-based room control and AI-assisted energy optimization are contributing to faster adoption.

- By Communication Technology

On the basis of communication technology, the building automation market is segmented into wired technology and wireless technology. The wired technology segment dominated the largest market revenue share of 63.40% in 2024, driven by its reliability, stability, and low susceptibility to interference, making it ideal for large commercial and industrial buildings with critical automation requirements. Wired systems offer consistent performance for HVAC, lighting, and security controls, ensuring seamless integration with existing building infrastructure and long-term operational efficiency.

The wireless technology segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by flexibility in installation, scalability, and cost-effectiveness. Wireless solutions allow retrofitting of older buildings without extensive cabling, and their integration with IoT-enabled devices and cloud platforms supports remote monitoring and smart control. Increasing demand for mobile-based control, sensor networks, and smart lighting solutions further drives adoption in residential and commercial verticals.

- By Offering

On the basis of offering, the building automation market is segmented into integration and services. The integration segment dominated the largest market revenue share in 2024, driven by the need for seamless connectivity across multiple building systems, including HVAC, security, lighting, and fire protection. Integrated solutions enhance operational efficiency, reduce energy consumption, and provide centralized monitoring and control, making them highly valuable for large-scale commercial and enterprise buildings. System integrators play a key role in delivering tailored solutions that align with specific building requirements.

The services segment is expected to witness the fastest growth from 2025 to 2032, propelled by rising demand for maintenance, upgrades, consulting, and remote monitoring services. Service offerings enable continuous optimization of building systems, predictive maintenance to reduce downtime, and support for energy compliance and sustainability goals. The shift toward managed services and subscription-based models, especially in commercial and industrial buildings, accelerates adoption in this segment.

Building Automation Market Regional Analysis

- North America dominated the building automation market with the largest revenue share of 35.5% in 2024, driven by stringent energy efficiency regulations and high adoption in commercial construction

- The region's advanced infrastructure, widespread adoption of smart technologies, and proactive regulatory frameworks focused on energy efficiency and sustainability have established it as the most advanced and innovation-driven region in the sector

- The presence of major market players has accelerated innovation and deployment of AI-powered building solutions. In addition, government-led initiatives such as smart city projects, coupled with energy efficiency mandates at federal and state levels, are reinforcing the transition toward intelligent infrastructure

U.S. Building Automation Market Insight

The U.S. building automation market captured the largest revenue share in North America in 2024, fueled by the rapid adoption of smart building solutions and energy-efficient technologies. Organizations and homeowners are increasingly prioritizing centralized control and predictive maintenance systems. The growing trend of smart campuses, IoT-based monitoring, and integration with connected devices further drives the market. Moreover, robust demand for energy management software, AI-enabled automation, and building analytics solutions is significantly contributing to market expansion.

Europe Building Automation System Market Insight

Europe's Building Automation System market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by stringent security regulations and the escalating need for enhanced security in homes and offices. The increase in urbanization, coupled with the demand for connected devices, is fostering the adoption of BAS. European consumers are also drawn to the convenience and energy efficiency these devices offer. The region is experiencing significant growth across residential, commercial, and multi-family housing applications, with BAS being incorporated into both new constructions and renovation projects.

U.K. Building Automation Market Insight

The U.K. building automation market is anticipated to grow at a noteworthy CAGR, driven by rising awareness of energy efficiency and home automation trends. Concerns regarding operational costs, sustainability, and security are encouraging adoption in both commercial and residential sectors. The U.K.’s growing e-commerce and technology-driven infrastructure further stimulates market growth.

Germany Building Automation Market Insight

The Germany building automation market is expected to expand at a considerable CAGR, fueled by technological innovation, strong infrastructure, and sustainability initiatives. Businesses and homeowners are increasingly adopting integrated building systems to reduce energy consumption, enhance security, and improve operational efficiency. Integration with IoT devices and smart building management systems is becoming prevalent in both new and existing constructions.

Asia-Pacific Building Automation System Market Insight

The Asia-Pacific Building Automation System market is poised to grow at the fastest CAGR from 2025 to 2030, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards smart homes, supported by government initiatives promoting digitalization, is driving the adoption of BAS. Furthermore, as APAC emerges as a manufacturing hub for BAS components and systems, the affordability and accessibility of BAS are expanding to a wider consumer base.

Japan Building Automation System Market Insight

Japan's Building Automation System market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant emphasis on security, and the adoption of BAS is driven by the increasing number of smart homes and connected buildings. The integration of BAS with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is likely to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors.

China Building Automation System Market Insight

China's Building Automation System market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for smart home devices, and BAS is becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable BAS options, alongside strong domestic manufacturers, are key factors propelling the market in China.

Building Automation Market Share

The building automation industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Schneider Electric (France)

- Johnson & Johnson Private Limited (India)

- Honeywell International Inc. (U.S.)

- ABB (Switzerland)

- Carel Industries S.p.A. (Italy)

- Carrier (U.S.)

- Crestron Electronics, Inc. (U.S.)

- Larsen & Toubro Limited (India)

- Raytheon Technologies Corporation (U.S.)

- Robert Bosch GmbH (Germany)

- Legrand (France)

- Hubbell (U.S.)

- Ingersoll Rand (U.S.)

- Lutron Electronics Co., Inc (U.S.)

- BuildingIQ (U.K.)

- Google Nest (U.S.)

- KMC Controls (U.S.)

- General Electric Company (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Cisco Systems Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Lennox International (U.S.)

- Rheem Manufacturing Company (U.S.)

Latest Developments in Global Building Automation Market

- In March 2023, Siemens launched the Connect Box specifically for small to medium-sized buildings. This IoT-driven solution is designed to comprehensively monitor building energy efficiency and enhance indoor air quality through real-time data analytics. The launch strengthens Siemens’ presence in the SMB segment by enabling building owners and facility managers to optimize energy usage, reduce operational costs, and meet sustainability goals. It also addresses the increasing market demand for smart, connected building solutions that offer actionable insights without requiring large-scale infrastructure investment

- In July 2022, the SAUTER Group expanded its actuator product portfolio, introducing IoT-capable actuators for HVAC systems that support autonomous or semi-autonomous operation. These devices, featuring cloud connectivity, allow for seamless integration into existing building automation networks and provide flexibility across diverse applications. This development positions SAUTER as a leader in intelligent building control, responding to rising industry demand for energy-efficient, automated systems that improve operational performance and reduce human intervention in facility management

- In October 2020, Johnson Controls introduced the OpenBlue digital technology service suite in the Asia Pacific region to remotely monitor HVAC, fire protection, and security systems. This platform leverages IoT and cloud technologies to provide real-time analytics, predictive maintenance, and enhanced operational control. The launch bolstered Johnson Controls’ market leadership in APAC by enabling customers to reduce downtime, improve energy efficiency, and integrate multiple building systems under a unified, intelligent management framework, meeting the rising demand for smart and sustainable building solutions in the region

- In January 2022, Daikin Applied unveiled Siteline Building Controls, a cloud-based platform designed to monitor and control integrated HVAC systems and connected electronic devices. By enabling centralized, real-time management of multiple systems, this solution enhances operational efficiency, predictive maintenance, and energy optimization. The launch significantly boosts Daikin’s competitive positioning in the digital building automation market, catering to both commercial and large-scale residential projects where centralized control and cloud-based intelligence are becoming essential

- In January 2022, Bosch Building Technologies formed strategic agreements with Hoerburger AG, a German building automation specialist, to broaden its product and services portfolio. This collaboration allows Bosch to penetrate new market segments, expand its European footprint, and provide comprehensive, integrated solutions for both residential and commercial buildings. The move strengthens Bosch’s market presence by offering scalable, technology-driven building automation solutions that align with increasing demand for sustainable, energy-efficient, and connected infrastructures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.