Global Building Integrated Photovoltaics Market

Market Size in USD Billion

CAGR :

%

USD

28.38 Billion

USD

98.64 Billion

2024

2032

USD

28.38 Billion

USD

98.64 Billion

2024

2032

| 2025 –2032 | |

| USD 28.38 Billion | |

| USD 98.64 Billion | |

|

|

|

|

Global Building Integrated Photovoltaics Market Size

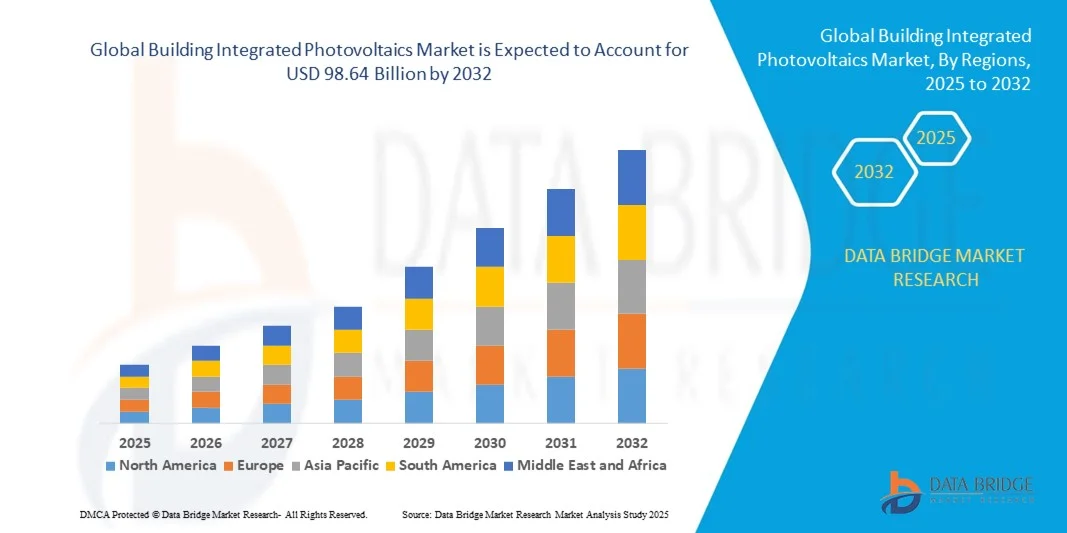

- The global building integrated photovoltaics market size was valued at USD 28.38 billion in 2024 and is expected to reach USD 98.64 billion by 2032, at a CAGR of 16.85% during the forecast period

- The market growth is primarily driven by the rising emphasis on sustainable construction practices, coupled with stringent energy efficiency regulations across residential, commercial, and industrial sectors

- Additionally, advancements in solar technology, along with increasing demand for aesthetically integrated renewable energy solutions, are positioning BIPV systems as a preferred choice for green buildings, thereby fueling rapid industry expansion

Global Building Integrated Photovoltaics Market Analysis

- Building Integrated Photovoltaics (BIPV), which incorporate solar energy generation directly into building components like facades, roofs, and windows, are becoming essential elements in modern sustainable architecture due to their dual functionality, aesthetic appeal, and ability to reduce energy costs and carbon emissions

- The surging demand for BIPV systems is largely driven by increasing global awareness of climate change, government incentives for renewable energy adoption, and a shift toward zero-energy buildings in both residential and commercial sectors

- Europe dominated the BIPV market with the largest revenue share of 42.6% in 2024, attributed to stringent energy efficiency regulations, early adoption of green building technologies, and supportive government policies promoting solar integration, with countries like Germany, France, and the Netherlands leading in BIPV installations

- Asia-Pacific is expected to be the fastest growing region in the BIPV market during the forecast period, fueled by rapid urban development, growing investments in renewable infrastructure, and supportive policies in countries like China, Japan, and India

- The roofs segment dominated the Building Integrated Photovoltaics market with a market share of 48.9% in 2024, owing to its widespread use in both residential and commercial buildings, ease of installation, and high energy generation potential compared to other building surfaces

Report Scope and Global Building Integrated Photovoltaics Market Segmentation

|

Attributes |

Building Integrated Photovoltaics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Building Integrated Photovoltaics Market Trends

Enhanced Efficiency Through AI and Smart Home Integration

- A major and rapidly evolving trend in the global Building Integrated Photovoltaics (BIPV) market is the growing integration of artificial intelligence (AI) and smart home ecosystems, which is significantly enhancing energy efficiency, system performance monitoring, and user interaction. AI-driven BIPV systems are transforming buildings into intelligent energy hubs that optimize solar energy generation and consumption in real-time.

- For instance, Tesla’s Solar Roof system, when paired with the Tesla Powerwall and integrated via the Tesla app, allows homeowners to monitor energy generation, usage, and storage. The system leverages AI to predict energy needs based on past usage patterns, weather forecasts, and grid conditions, optimizing the energy flow for maximum efficiency.

- AI-enhanced BIPV solutions are also capable of real-time fault detection, predictive maintenance, and performance analytics. Companies like Trina Solar are incorporating AI algorithms into their smart energy platforms to identify inefficiencies and automatically adjust photovoltaic output or energy routing, ensuring consistent and optimized building energy performance.

- Smart integration with home automation platforms enables users to control and monitor BIPV systems alongside other smart devices. For instance, BIPV panels linked with building management systems can adjust indoor climate settings based on solar input, daylight harvesting, and occupant behavior, creating a more responsive and sustainable living or working environment.

- This convergence of BIPV, AI, and IoT is redefining the concept of building energy management. Companies like Heliatek are innovating with lightweight, flexible solar films that can be seamlessly integrated into building materials and connected with AI-powered energy monitoring systems for both aesthetic and functional benefits.

- The increasing demand for intelligent, connected, and energy-efficient building solutions is accelerating the adoption of AI-enabled BIPV systems across residential, commercial, and industrial sectors, as property owners prioritize smart energy solutions that align with sustainability goals and modern lifestyle expectations.

Global Building Integrated Photovoltaics Market Dynamics

Driver

Growing Need Due to Sustainability Mandates and Green Building Adoption

- The increasing global emphasis on sustainable development, energy efficiency, and carbon footprint reduction is a major driver for the rising demand for Building Integrated Photovoltaics (BIPV) systems across residential, commercial, and industrial construction

- For instance, in February 2024, Trina Solar announced the launch of its next-generation aesthetic BIPV panels designed for commercial rooftops in Europe, aimed at meeting stricter EU carbon neutrality targets. Such innovations are accelerating adoption among developers seeking LEED and BREEAM certifications

- Governments worldwide are implementing supportive regulations and incentives—such as feed-in tariffs, tax credits, and building codes mandating renewable integration—pushing architects and developers to include BIPV in new construction and renovation projects

- Moreover, the growing popularity of net-zero energy buildings (NZEBs) is elevating the role of BIPV systems as essential components, allowing buildings to generate on-site clean energy while maintaining architectural integrity and visual appeal

- With the increasing demand for smart cities and intelligent infrastructure, BIPV systems are also being integrated with energy management and storage solutions, allowing users to monitor, store, and optimize energy usage through connected platforms. This trend is especially evident in urban centers where building surface area must be maximized for both function and sustainability

- As property owners, governments, and corporations aim to meet ESG (Environmental, Social, and Governance) goals, BIPV is emerging as a strategic solution that combines aesthetics, sustainability, and long-term cost efficiency. The shift toward energy-positive buildings is expected to further drive demand across both new construction and retrofit projects

Restraint/Challenge

High Initial Costs and Structural Integration Challenges

- One of the primary challenges hindering widespread adoption of BIPV systems is the relatively high initial cost compared to traditional photovoltaic panels or conventional building materials. This cost includes specialized materials, custom designs, and integration into architectural structures, which can deter budget-conscious developers or homeowners

- For instance, premium BIPV façade glass or solar shingles often require customized engineering and professional installation, making them less accessible for smaller projects or cost-sensitive markets

- Additionally, retrofitting BIPV into existing buildings poses significant challenges related to structural compatibility, aesthetics, and electrical integration. Unlike traditional solar panels, BIPV must conform to strict design and load-bearing standards of the building envelope

- Technical complexities, such as ensuring weatherproofing, thermal insulation, and compliance with building codes, add to installation time and cost. These factors can limit adoption, particularly in regions lacking skilled labor or regulatory clarity on BIPV installations

- While advancements in manufacturing and economies of scale are gradually reducing costs, the industry still faces the perception of BIPV as a high-end or niche solution.

- Overcoming these challenges will require collaborative efforts from manufacturers, architects, and policymakers—focusing on modular, scalable BIPV products, clearer guidelines for integration, and increased financial incentives to make these systems more viable for the mass market

Global Building Integrated Photovoltaics Market Scope

The market is segmented on the basis of product, application, sales channel, and technology.

- By Product

On the basis of product, the global building integrated photovoltaics market is segmented into roofs, wall integrated solutions, glass, façade, and others. The roof segment dominated the market with the largest market revenue share of 48.9% in 2024, driven by the ease of integration into both new construction and retrofitting projects, as well as the high solar exposure and energy generation efficiency of rooftops. Roof-integrated BIPV systems are commonly used in residential and commercial buildings, combining the functionality of traditional roofing with clean energy generation.

The glass segment is expected to witness the fastest CAGR from 2025 to 2032, due to rising demand for transparent or semi-transparent photovoltaic solutions in modern architecture. Glass-integrated BIPV provides both energy generation and natural lighting, making it ideal for curtain walls, skylights, and building facades in contemporary commercial and institutional buildings prioritizing energy efficiency and aesthetics.

- By Application

Based on application, the global building integrated photovoltaics market is segmented into industrial buildings, commercial buildings, and residential buildings. The commercial buildings segment dominated the market in 2024 with the largest revenue share, owing to strong adoption in offices, retail centers, and public infrastructure projects targeting carbon neutrality and energy cost reductions. The availability of large surface areas and financial capabilities for upfront investment make commercial buildings ideal for BIPV integration.

The residential segment is projected to witness the fastest growth from 2025 to 2032, fueled by increasing awareness of sustainable living, declining costs of BIPV systems, and supportive government incentives. Homeowners are increasingly opting for solar-integrated roofs and facades that offer both energy savings and architectural appeal, especially in regions with high solar potential and net metering benefits.

- By Technology

On the basis of technology, the global building integrated photovoltaics is segmented into crystalline silicon and thin film technologies. The crystalline silicon segment held the largest market share in 2024, driven by its high conversion efficiency, proven reliability, and widespread availability. Crystalline silicon BIPV solutions are preferred in both roof and wall applications for projects prioritizing maximum energy output and longevity.

The thin film technologies segment is expected to register the fastest CAGR during the forecast period, owing to their flexibility, lightweight properties, and aesthetic integration into modern building surfaces such as glass facades and curved structures. Thin film BIPV is increasingly adopted in urban and architectural designs where appearance and seamless integration are essential.

- By Sales Channel

Based on the sales channel, the global building integrated photovoltaics market is segmented into direct sales and indirect sales. The direct sales segment dominated the market in 2024 with the highest revenue share, due to its strong presence in large-scale commercial and government projects where manufacturers or EPC (Engineering, Procurement, and Construction) companies directly manage installations. This channel ensures better customization, performance guarantees, and direct customer support.

The indirect sales segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the rise of distribution networks, online sales platforms, and increased engagement of local installers and integrators. This growth is especially prominent in the residential sector, where consumers prefer purchasing through third-party retailers or solar solution providers offering end-to-end services.

Global Building Integrated Photovoltaics Market Regional Analysis

- Europe dominated the global building integrated photovoltaics market with the largest revenue share of 42.6% in 2024, driven by stringent energy efficiency regulations, strong government support for renewable energy integration, and a growing commitment to sustainable building practices across the region

- Consumers and developers in Europe prioritize architectural solutions that combine aesthetic appeal with environmental responsibility, making BIPV an attractive option for both new construction and renovation projects in residential, commercial, and public infrastructure

- This strong market presence is further reinforced by progressive energy policies like the EU Green Deal, national solar mandates, and generous incentives such as feed-in tariffs and tax credits. The region’s advanced construction sector, emphasis on zero-energy buildings, and collaboration between governments and technology providers continue to drive the rapid deployment of BIPV systems across key markets such as Germany, France, the Netherlands, and the Nordic countries.

U.K. Global Building Integrated Photovoltaics Market Insight

The U.K. BIPV Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by growing government support for renewable energy adoption and carbon-neutral construction goals. The Future Homes Standard and updated building codes are encouraging developers to explore integrated solar technologies. BIPV adoption is increasing across residential and commercial buildings, particularly in urban centers prioritizing sustainable architecture. Additionally, the U.K.'s focus on energy efficiency, combined with rising electricity prices, is prompting homeowners and businesses to consider BIPV as a viable long-term investment.

Germany Global Building Integrated Photovoltaics Market Insight

The Germany BIPV Market is expected to expand at a considerable CAGR, supported by the country’s leadership in solar energy, advanced construction standards, and strong environmental regulations. Germany’s Energiewende (energy transition) policy framework promotes widespread solar adoption, with BIPV gaining traction in public, commercial, and residential projects. Builders and architects are increasingly integrating photovoltaic materials into building envelopes to meet energy performance requirements. Moreover, Germany’s technical expertise and focus on aesthetics and efficiency make it a key innovator in BIPV product development and deployment.

Asia-Pacific Global Building Integrated Photovoltaics Market Insight

The Asia-Pacific BIPV Market is poised to register the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, government initiatives promoting solar integration, and growing construction activity in countries such as China, Japan, India, and South Korea. Increasing demand for energy-efficient buildings and supportive regulations—like mandatory rooftop solar in some regions—are propelling the use of BIPV across both residential and commercial sectors. As the region continues to invest in smart city projects and green infrastructure, the affordability and scalability of BIPV solutions are becoming increasingly attractive to developers.

Japan Global Building Integrated Photovoltaics Market Insight

The Japan BIPV Market is gaining strong momentum, backed by the country’s emphasis on innovation, limited land availability, and strong policies promoting building-level renewable energy. As urban density increases, BIPV systems offer an efficient means to incorporate solar generation without occupying additional land space. Japan’s adoption is further boosted by high energy prices, a well-established construction sector, and a preference for aesthetically integrated technologies. Modern BIPV products are being incorporated into new buildings and renovations, especially in urban residential complexes and high-rise commercial developments.

China Global Building Integrated Photovoltaics Market Insight

The China BIPV Market held the largest revenue share in the Asia-Pacific region in 2024, driven by strong government support for solar adoption, robust manufacturing capabilities, and large-scale urban development. As part of China’s goals to peak carbon emissions by 2030 and achieve carbon neutrality by 2060, BIPV has become a strategic solution in urban planning and green building policies. Domestic giants like Trina Solar and JA Solar are heavily investing in BIPV technologies, making products more accessible and affordable. The market is expanding rapidly across commercial, industrial, and residential buildings, with special focus on high-rise developments and government-led smart city projects.

Global Building Integrated Photovoltaics Market Share

Building Integrated Photovoltaics Market Leaders Operating in the Market Are:

- Merck KGaA (Germany)

- Trina Solar (China)

- CertainTeed, LLC. (U.S.)

- Tesla (U.S.)

- JA Solar (China)

- Canadian Solar (Canada)

- Changzhou Almaden Co. Ltd (China)

- Waaree Energies Ltd. (India)

- Hanergy Thin Film Power Group (China)

- Kyocera Corp. (Japan)

- Heliatek GmbH (Germany)

- Onyx Solar Group LLC. (U.S.))

- MetSolar (U.S.))

- The Solaria Corporation (U.S.)

- Suntegra (USA)

What are the Recent Developments in Global Building Integrated Photovoltaics Market?

- In April 2025, GoodWe’s BIPV division (GoodWe PVBM) unveiled three new flagship products at the Sydney Build Expo: the Luxa Series Solar Pergola, the Vela Series Solar Carport (with variants like Vela Plus and Vela Pro), and modular BIPV systems with IP67 waterproof panels. These solutions are aimed at blending energy generation with aesthetics for residential and small business applications, while reducing installation cost and complexity.

- In June 2025, AESOLAR showcased its new BIPV modules under its sub-brand Invitaic at SNEC 2025 in Shanghai. These customisable modules allow variations in glass thickness and materials, targeting façades to industrial rooftops. The launch underlines AESOLAR’s push into versatile BIPV offerings adapted to diverse regional and architectural needs.

- In July 2025, Japanese firms PXP Inc. and Tokyo Gas Co initiated pilot projects to deploy film-type chalcopyrite solar cells on low load-bearing industrial roofs, as well as perovskite solar windows installed in the Telecom Center Building in Tokyo. These projects illustrate a focus on lightweight, flexible BIPV solutions suitable for buildings with structural constraints, and integration of perovskite technologies in glass/windows.

- In January 2025, Swiss startup Climacy introduced the CLI400M10, a semi-transparent glass-glass BIPV panel for roofs and façades with ~17.25% efficiency and ~20% transparency. This strikes a balance between natural lighting and electricity generation, making it well suited for atriums, industrial halls, and façade applications.

- In mid‑2025, India made policy & regulatory strides: the inclusion of BIPV in its rooftop solar incentive scheme (PM Surya Ghar: Muft Bijli Yojana) aiming for 10 million installations by 2027, and publication of BIPV design guidelines for architects, installers, and construction firms via a collaboration between CSTEP, the School of Planning and Architecture (New Delhi), and India’s Ministry of New and Renewable Energy. This points to growing institutional support and policy framework strengthening for BIPV adoption in India.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Building Integrated Photovoltaics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Building Integrated Photovoltaics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Building Integrated Photovoltaics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.