Global Building Thermal Insulation Materials Market

Market Size in USD Billion

CAGR :

%

USD

26.14 Billion

USD

39.80 Billion

2024

2032

USD

26.14 Billion

USD

39.80 Billion

2024

2032

| 2025 –2032 | |

| USD 26.14 Billion | |

| USD 39.80 Billion | |

|

|

|

|

Building Thermal Insulation Materials Market Size

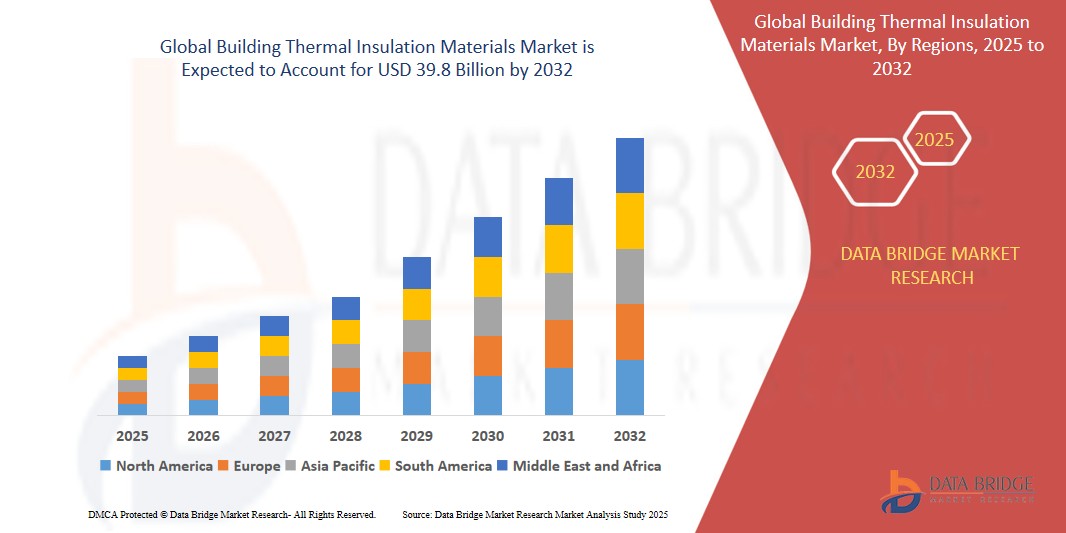

- The Global Building Thermal Insulation Materials Market size was valued at USD 26.14 Billion in 2024 and is expected to reach USD 39.8 Billion by 2032, at a CAGR of 6.1% during the forecast period

- The Building Thermal Insulation Materials Market is experiencing consistent growth, driven by increasing demand for energy-efficient construction solutions across residential, commercial, and industrial sectors. These materials play a vital role in reducing heat transfer, enhancing energy savings, and improving occupant comfort in buildings, aligning with global energy conservation goals

- Additionally, the growing emphasis on sustainable construction practices and stringent building codes aimed at reducing carbon emissions are propelling market expansion. Rising urbanization, infrastructure development in emerging economies, and advancements in eco-friendly and high-performance insulation technologies are expected to further support market growth. Innovations in materials such as aerogels, vacuum insulation panels, and bio-based insulations are fostering new opportunities and improving thermal performance across applications

Building Thermal Insulation Materials Market Analysis

- Building thermal insulation materials are increasingly adopted across residential, commercial, and industrial sectors due to their effectiveness in reducing energy consumption, enhancing indoor comfort, and complying with stringent energy efficiency regulations. These materials contribute significantly to sustainable construction by minimizing heat transfer and lowering HVAC-related energy demands

- The rising global emphasis on green building certifications, carbon neutrality, and environmentally responsible construction is accelerating the demand for advanced insulation materials, including mineral wool, polyurethane foam, expanded polystyrene (EPS), and eco-friendly bio-based alternatives. Builders and developers are prioritizing solutions that offer thermal performance, fire resistance, and moisture control

- North America dominates the Building Thermal Insulation Materials Market with the largest revenue share of 38.01% in 2024, driven by established regulatory standards such as LEED and the International Energy Conservation Code (IECC), along with significant investments in energy-efficient retrofitting projects across the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, growth in residential construction, and government initiatives promoting energy-efficient infrastructure in countries such as China, India, South Korea, and Southeast Asian nations

- Among material types, mineral wool holds a significant market share of 44.6% in 2024 due to its excellent thermal and acoustic insulation properties, non-combustibility, and wide applicability in both new construction and renovation. However, demand for bio-based and recyclable insulation materials is rising rapidly, reflecting the construction industry's shift toward sustainable and circular economy practices

Report Scope and Building Thermal Insulation Materials Market Segmentation

|

Attributes |

Building Thermal Insulation Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Building Thermal Insulation Materials Market Trends

“Technological Advancements and Sustainable Innovation in Thermal Insulation Solutions”

- A prominent and growing trend in the Global Building Thermal Insulation Materials Market is the integration of advanced material science and sustainable innovation to improve thermal efficiency, reduce environmental impact, and comply with increasingly stringent energy efficiency standards across the construction sector

- Leading companies such as Saint-Gobain, Owens Corning, and BASF are investing in the development of next-generation insulation materials, including aerogels, vacuum insulation panels, and phase-change materials, which offer superior performance in thinner profiles and support net-zero energy building goals

- The industry is witnessing a shift toward eco-friendly, recyclable, and bio-based insulation materials such as hemp, cellulose, and sheep wool that reduce embodied carbon, support circular economy principles, and align with global green building initiatives

- Digitalization in construction—such as Building Information Modeling (BIM)—is enhancing the planning, installation, and lifecycle management of insulation materials, ensuring optimal integration and performance across a structure’s envelope

- There is rising demand for multifunctional insulation systems that combine thermal resistance with properties such as fire retardancy, acoustic insulation, and moisture control, particularly in high-performance building applications and passive house designs

- This trend toward technologically advanced, sustainable, and multifunctional insulation solutions is reshaping the market landscape. Companies focusing on R&D, green innovation, and regulatory compliance are poised to capitalize on emerging opportunities in both new construction and retrofitting markets

Building Thermal Insulation Materials Market Dynamics

Driver

“Rising Demand for Energy Efficiency, Sustainable Construction, and Advanced Insulation Technologies”

- The increasing global focus on reducing energy consumption, minimizing carbon emissions, and enhancing building performance is a primary driver propelling the Building Thermal Insulation Materials Market. Thermal insulation plays a critical role in achieving these objectives by improving energy efficiency and lowering heating and cooling demands across residential, commercial, and industrial buildings

- For instance, in February 2025, Kingspan Group launched a new range of ultra-thin vacuum insulation panels designed for space-constrained urban housing projects, offering superior R-values and aligning with the growing demand for compact, high-performance insulation solutions in modern architecture

- Growing regulatory mandates and building codes—such as the International Energy Conservation Code (IECC), European Energy Performance of Buildings Directive (EPBD), and China’s Green Building Evaluation Standards—are compelling developers to integrate high-quality insulation materials into both new constructions and retrofit projects

- Advancements in insulation technologies, including nanotechnology-based insulants, reflective thermal barriers, and phase-change materials, are enabling improved thermal regulation, fire resistance, and durability, while also supporting long-term sustainability goals

- The increasing need for resilient and climate-adaptive building envelopes, especially in regions facing extreme temperatures and rapid urbanization, is driving the adoption of innovative insulation systems tailored to diverse environmental conditions

- This convergence of energy efficiency imperatives, environmental regulations, and technological innovation is accelerating the global growth of the Building Thermal Insulation Materials Market, with Asia-Pacific, Latin America, and the Middle East emerging as high-potential regions due to infrastructure development, supportive policy frameworks, and rising awareness of green building practices

Restraint/Challenge

“High Installation Costs and Regulatory Barriers Hindering Market Adoption”

- The high initial capital investment required for the installation and integration of advanced thermal insulation systems remains a major restraint in the Building Thermal Insulation Materials Market. Materials such as vacuum insulation panels, aerogels, and phase-change insulants, while offering superior performance, are significantly more expensive than conventional alternatives like fiberglass and EPS, limiting their uptake in cost-sensitive projects

- For example, implementing high-performance insulation in large-scale commercial or industrial buildings often involves complex retrofitting procedures, structural adjustments, and specialized labor, increasing overall project costs and deterring widespread adoption, particularly in developing economies

- Stringent regulatory and certification requirements related to fire safety, thermal performance, and environmental impact—such as ASTM, ISO, and EN standards—necessitate thorough testing, quality assurance, and product documentation. This can slow down time-to-market and increase compliance costs for manufacturers, particularly small and medium enterprises

- The lack of harmonized global building codes and insulation standards poses an additional challenge for multinational companies, as navigating diverse regulatory landscapes across countries complicates product standardization, logistics, and scalability

- Volatility in raw material prices—such as petrochemical derivatives for polyurethane foams or mineral resources for stone wool—adds financial uncertainty and impacts pricing strategies, especially amid global supply chain disruptions, inflationary trends, and geopolitical instability

- In some emerging markets, a limited awareness of the long-term cost savings and environmental benefits of thermal insulation, combined with a shortage of skilled installers and limited enforcement of energy codes, continues to restrict market penetration

- Overcoming these restraints will require broader policy support, increased public-private investment in sustainable construction technologies, cost-reduction strategies through economies of scale, and educational initiatives to promote best practices in energy-efficient building design.

Building Thermal Insulation Materials Market Scope

- By Material Type

On the basis of material type, the Building Thermal Insulation Materials Market is segmented into Stone Wool, Glass Wool, Plastic Foam, and Others

The Plastic Foam segment dominates the market with the largest revenue share of 28.4% in 2024, owing to its widespread use in residential, commercial, and industrial construction for energy-efficient thermal insulation. This material type—encompassing expanded polystyrene (EPS), extruded polystyrene (XPS), and polyurethane foam—is highly favored for its low thermal conductivity, lightweight structure, and moisture resistance. These properties make plastic foams ideal for a variety of applications including walls, roofs, and floors, particularly in regions with extreme temperature variations

- By Building Type

On the basis of building type, the Building Thermal Insulation Materials Market is segmented into Residential Building and Non-Residential Building.

The Residential Building segment dominates the market with the largest revenue share of 28.4% in 2024, driven by the rising demand for energy-efficient housing and increasing implementation of building codes mandating thermal insulation in new constructions. This segment benefits from rapid urbanization, growing awareness of energy savings among homeowners, and government incentives promoting sustainable residential development. Insulation materials are extensively used in walls, roofs, and floors of homes to reduce heating and cooling costs, enhance indoor comfort, and lower carbon footprints

- By Application

On the basis of application, the Building Thermal Insulation Materials Market is segmented into Roof Insulation, Wall Insulation, Floor Insulation

The Wall Insulation segment dominates the market with the largest revenue share of 28.4% in 2024, owing to its critical role in reducing heat transfer, enhancing building energy efficiency, and ensuring thermal comfort in both residential and commercial structures. Wall insulation materials are widely used in external and internal wall assemblies to minimize energy loss through conduction and convection, especially in regions with extreme climatic conditions

- By Material Type

On the basis of temperature range, the Building Thermal Insulation Materials Market is segmented into (-160°C to -50°C), (-49°C to 0°C), (-1°C to 100°C), and (101°C to 650°C).

The (-1°C to 100°C) segment dominates the market with the largest revenue share of 28.4% in 2024, owing to its broad applicability in standard building insulation scenarios including residential, commercial, and light industrial constructions. This temperature range encompasses typical indoor and ambient outdoor conditions, making it ideal for commonly used insulation applications such as wall cavities, attics, and underfloor installations

Building Thermal Insulation Materials Market Regional Analysis

- North America dominates the Building Thermal Insulation Materials Market with the largest revenue share of 39.01% in 2024, driven by strong demand across construction, industrial, and commercial sectors. The region benefits from advanced building codes, increasing focus on energy efficiency, and growing investments in sustainable construction materials. High awareness of green building practices and regulatory incentives supporting energy conservation further bolster market growth

- Leading manufacturers in North America are innovating with eco-friendly and high-performance insulation solutions such as stone wool, plastic foam, and glass wool, aimed at reducing carbon footprints and enhancing building energy ratings. The trend toward retrofitting older buildings to meet stricter thermal performance standards also contributes to market expansion

U.S. Building Thermal Insulation Materials Market Insight

The U.S. Building Thermal Insulation Materials Market captured the largest revenue share of 81% in North America in 2024, propelled by stringent federal and state energy codes, rising construction activities, and incentives for sustainable building materials. The adoption of high-efficiency insulation in both new residential and commercial projects is accelerating, supported by growing public and private sector investments in green infrastructure

Europe Building Thermal Insulation Materials Market Insight

The Europe Building Thermal Insulation Materials Market is projected to grow steadily over the forecast period, supported by rigorous energy efficiency regulations and the EU Green Deal’s push for net-zero carbon buildings. The region’s strong emphasis on sustainability, recycling, and circular economy principles is driving demand for recyclable and eco-friendly insulation materials. Countries such as Germany, the U.K., and France lead with initiatives promoting low-carbon construction technologies

U.K. Building Thermal Insulation Materials Market Insight

The U.K. Building Thermal Insulation Materials Market is expected to register a notable CAGR, fueled by government-led green building programs, expanding urban development, and growing retrofitting activities targeting energy conservation. The country’s leadership in sustainable architecture and innovations in insulation technology are supporting this growth trajectory

Germany Building Thermal Insulation Materials Market Insight

Germany’s market is set to expand significantly, backed by its engineering excellence and commitment to environmental standards. The demand for advanced thermal insulation solutions is rising in both industrial and residential sectors, with a focus on materials offering superior fire resistance and long-term durability, such as stone wool and glass wool

Asia-Pacific Building Thermal Insulation Materials Market Insight

The Asia-Pacific Building Thermal Insulation Materials Market is poised to register the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, industrial growth, and government initiatives promoting energy-efficient buildings. Countries including China, India, Japan, and South Korea are increasingly adopting innovative insulation materials to meet growing demands from residential, commercial, and infrastructure projects

Japan Building Thermal Insulation Materials Market Insight

Japan’s market is gaining momentum due to strong consumer interest in energy conservation, rising construction of green buildings, and technological advancements in insulation materials suited for seismic and climate considerations. Innovation in lightweight, high-performance insulation products supports growth in both new construction and renovation sectors

China Building Thermal Insulation Materials Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by aggressive government policies targeting carbon neutrality, expanding urban infrastructure, and rising consumer awareness about energy efficiency. Substantial investments in green building technologies and collaborations with global insulation material manufacturers are accelerating market penetration

Building Thermal Insulation Materials Market Share

The smart lock industry is primarily led by well-established companies, including:

- Saint-Gobain S.A. (France)

- BASF SE (Germany)

- Owens Corning (U.S.)

- Kingspan Group plc (Ireland)

- Rockwool International A/S (Denmark)

- Johns Manville Corporation (U.S.)

- Knauf Insulation (Germany)

- Recticel Group (Belgium)

- Huntsman Corporation (U.S.)

- GAF Materials Corporation (U.S.)

- URSA Insulation S.A. (Spain)

- Atlas Roofing Corporation (U.S.)

- Cellofoam North America Inc. (U.S.)

- Beijing New Building Material Group Co., Ltd. (China)

- Fletcher Building Limited (New Zealand)

- Paroc Group Oy (Finland)

Latest Developments in Global Building Thermal Insulation Materials Market

- In April 2025, Owens Corning launched a new line of eco-friendly stone wool insulation products featuring enhanced thermal performance and improved fire resistance. These materials are designed to support stringent energy codes and green building certifications in residential and commercial projects globally

- In March 2025, Kingspan Group introduced advanced vacuum insulated panels (VIPs) with ultra-thin profiles for retrofit applications, offering superior insulation performance while minimizing space requirements. The new panels are tailored for urban renovation projects where space is limited

- In February 2025, Saint-Gobain expanded its production capacity for glass wool insulation at its European manufacturing facilities to meet rising demand driven by stricter European Union energy efficiency regulations. The expansion includes investment in automation and sustainable manufacturing processes

- In January 2025, Dow Inc. unveiled a new range of bio-based plastic foam insulation materials that combine high R-values with improved environmental profiles. These products target the growing market for sustainable construction materials and are compatible with both residential and non-residential building applications

- In January 2025, Rockwool International partnered with a leading green building certification body to develop innovative stone wool insulation solutions optimized for net-zero energy buildings. The collaboration focuses on maximizing energy savings while ensuring recyclability and minimal environmental impact.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Building Thermal Insulation Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Building Thermal Insulation Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Building Thermal Insulation Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.