Global Bullet Round Bottles Market

Market Size in USD Billion

CAGR :

%

USD

1.72 Billion

USD

2.71 Billion

2024

2032

USD

1.72 Billion

USD

2.71 Billion

2024

2032

| 2025 –2032 | |

| USD 1.72 Billion | |

| USD 2.71 Billion | |

|

|

|

|

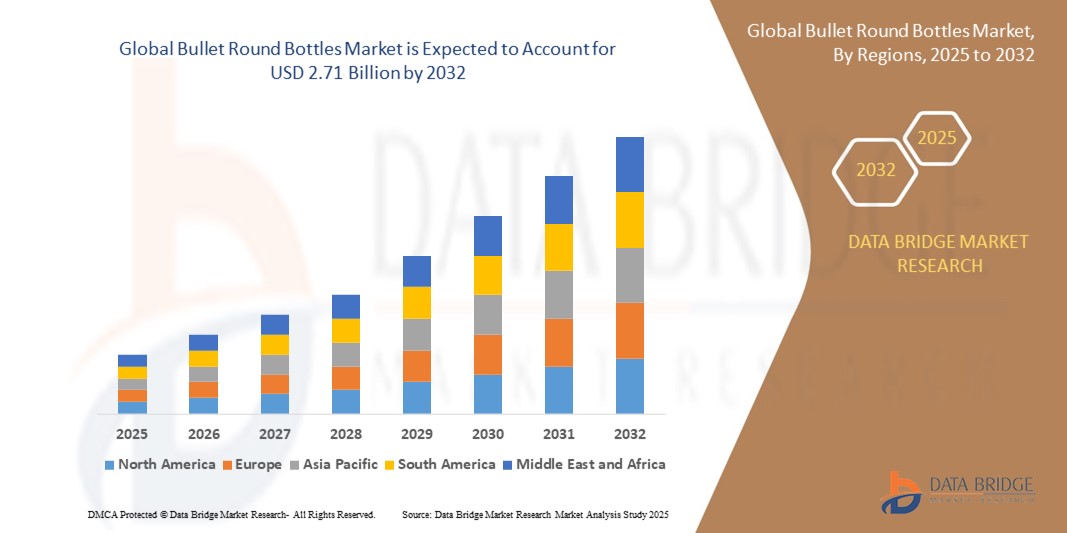

What is the Global Bullet Round Bottles Market Size and Growth Rate?

- The global bullet round bottles market size was valued at USD 1.72 billion in 2024 and is expected to reach USD 2.71 billion by 2032, at a CAGR of 5.80% during the forecast period

- Growth is fueled by increasing demand in personal care, pharmaceutical, and food & beverage industries, driven by the product’s durability, design appeal, and compatibility with various closure systems

- Rising consumer preference for lightweight, recyclable packaging, and the shift toward premium branding further accelerates market expansion

What are the Major Takeaways of Bullet Round Bottles Market?

- Surging usage in the personal care sector particularly in packaging shampoos, lotions, and sprays propels demand. For instance, Unilever, L'Oréal, and Procter & Gamble are increasingly shifting to bullet round designs to enhance brand visibility and user experience

- The market benefits from the growing trend of sustainable packaging with many manufacturers opting for rPET and bio-based polymers, aligning with global green initiatives

- In addition, innovations in custom molding and tamper-evident closures enhance functionality and consumer trust, boosting the adoption of bullet round bottles across sectors

- North America dominated the bullet round bottles market with the largest revenue share of 32.87% in 2024, fueled by demand in personal care, pharmaceuticals, and food sectors, along with a strong culture of recyclable and convenient packaging

- Asia-Pacific is projected to grow at the fastest CAGR of 6.45% from 2025 to 2032, driven by urbanization, expanding FMCG sectors, and growing health and wellness awareness in China, India, and Southeast Asia

- The PET segment dominated the market with the largest revenue share of 41.6% in 2024, owing to its excellent clarity, lightweight nature, and high recyclability

Report Scope and Bullet Round Bottles Market Segmentation

|

Attributes |

Bullet Round Bottles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bullet Round Bottles Market?

“Adoption of Recyclable and Lightweight Bullet Round Bottles”

- A significant trend in the bullet round bottles market is the shift toward recyclable, lightweight, and eco-friendly packaging solutions, fueled by growing environmental awareness and stringent plastic waste regulations across global markets

- Manufacturers are focusing on design innovation to reduce material usage while maintaining durability, particularly for the personal care, beverage, and pharmaceutical sectors, where convenience and sustainability intersect

- For instance, Amcor Plc launched a new lightweight PET bullet round bottle line in 2023 that reduces plastic use by 30% without compromising performance, aligning with its pledge for fully recyclable packaging by 2025

- The demand for rPET (recycled PET) and biodegradable polymers is rising, especially in Europe and North America, where government-led recycling targets and consumer eco-consciousness are reshaping procurement practices

- Companies are also integrating monomaterial designs and digital watermarking technologies to enhance sortability in recycling streams, aiming to close the loop in the circular economy

- This trend is expected to accelerate innovation in sustainable bottle manufacturing, making eco-designed bullet round bottles a strategic differentiator in competitive consumer markets

What are the Key Drivers of Bullet Round Bottles Market?

- The market is driven by rising demand across food & beverages, pharmaceuticals, and cosmetics industries, where bullet round bottles offer high durability, leak resistance, and shelf appeal

- For instance, in April 2024, Berry Global introduced an antimicrobial bullet round bottle line for personal care packaging, enhancing product hygiene and extending shelf life in high-touch environments

- Growth in e-commerce is fueling demand for durable and protective packaging, making bullet round bottles ideal for liquid and semi-liquid product delivery, especially in direct-to-consumer channels

- In addition, the health and wellness boom has led to increased consumption of liquid supplements, plant-based beverages, and organic cosmetics segments that favor compact, squeezable bullet round bottles for portability and ease of use

- Rising investments in customizable and digitally printed bottles are also boosting brand differentiation in saturated markets, enhancing consumer engagement and shelf visibility

- These factors collectively ensure a steady market expansion, positioning bullet round bottles as a versatile and indispensable packaging format across various consumer sectors

Which Factor is challenging the Growth of the Bullet Round Bottles Market?

- One of the main challenges is the environmental impact of plastic waste, as traditional bullet round bottles made from virgin polymers contribute to landfill overflow and marine pollution

- For instance, regulations in the European Union now mandate a minimum percentage of recycled plastic content in packaging, pushing brands to rethink material sourcing and end-of-life strategies

- Inadequate recycling infrastructure in emerging markets and lack of consumer awareness further limit the circularity potential of plastic bottles, restricting widespread adoption of sustainable formats

- In addition, price volatility of raw materials such as PET and PE, exacerbated by global supply chain disruptions, impacts production costs and squeezes margins, especially for small-to-mid-size manufacturers

- There are also design constraints related to lightweighting, where structural integrity may be compromised if not properly engineered, increasing the risk of leakage or damage during transportation

- Overcoming these challenges requires investment in recycling ecosystems, regulatory compliance, and material innovation, enabling manufacturers to meet both sustainability goals and performance expectations

How is the Bullet Round Bottles Market Segmented?

The market is segmented on the basis of material, capacity, and application.

• By Material

On the basis of material, the bullet round bottles market is segmented into PE (Polyethylene), PET (Polyethylene Terephthalate), and PP (Polypropylene). The PET segment dominated the market with the largest revenue share of 41.6% in 2024, owing to its excellent clarity, lightweight nature, and high recyclability. PET Bullet Round Bottles are widely used in the food & beverage and personal care industries, offering durability and product safety.

The PE segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in pharmaceutical and agrochemical packaging. Its strong resistance to chemicals and low-temperature flexibility makes it ideal for sensitive formulations.

• By Capacity

On the basis of capacity, the bullet round bottles market is segmented into Up to 4 Oz, 4 to 8 Oz, 8 to 12 Oz, 12 to 16 Oz, and More than 16 Oz. The 8 to 12 Oz segment held the largest market revenue share in 2024, primarily due to its versatility in retail packaging and optimal balance between portability and volume. These bottles are commonly used in personal care, beverages, and household products.

The More than 16 Oz segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its growing usage in bulk packaging for pharmaceutical and cleaning agents, especially in commercial and industrial environments.

• By Application

On the basis of application, the bullet round bottles market is segmented into Food & Beverages, Pharmaceutical, Personal Care & Cosmetics, Agrochemicals, Consumer Goods, and Others. The Personal Care & Cosmetics segment dominated the market in 2024, capturing the largest share of 33.2%, driven by increasing demand for premium, user-friendly packaging for skincare, haircare, and hygiene products.

The Pharmaceutical segment is projected to witness the fastest CAGR during 2025 to 2032, owing to rising health awareness and the need for precise, leak-proof packaging for liquid formulations such as syrups and nutraceuticals.

Which Region Holds the Largest Share of the Bullet Round Bottles Market?

- North America dominated the bullet round bottles market with the largest revenue share of 32.87% in 2024, fueled by demand in personal care, pharmaceuticals, and food sectors, along with a strong culture of recyclable and convenient packaging

- The region benefits from a mature retail infrastructure, brand-driven cosmetics market, and high penetration of ready-to-drink beverages, where bullet round bottles are widely used

- Rising environmental regulations and consumer preference for sustainable packaging are further accelerating the market

U.S. Bullet Round Bottles Market Insight

The U.S. market held the largest share in North America in 2024 due to rising use of bullet round bottles in pharma-grade syrups, supplements, and personal care products. Increasing demand for travel-sized packaging and growing trends toward customizable bottles with flip-top caps is driving innovation. Strong presence of packaging manufacturers and private-label brands reinforces the market’s dominance.

Europe Bullet Round Bottles Market Insight

The Europe market is projected to grow steadily due to growing demand for cosmetic-grade packaging, eco-friendly plastics, and bottle designs with extended shelf appeal. Bullet round bottles are gaining traction in natural skincare, organic food packaging, and clinical healthcare products. The EU’s focus on reducing single-use plastic is encouraging the use of recyclable PET and PP materials.

U.K. Bullet Round Bottles Market Insight

The U.K. market is set to expand with growing demand for compact, aesthetic packaging in personal care and cosmetic products. Brands are using bullet round bottles with custom labeling and matte finishes to differentiate products. With the rise of sustainable beauty brands and e-commerce, lightweight and tamper-evident bottles are in high demand.

Germany Bullet Round Bottles Market Insight

The Germany market is thriving due to innovations in smart, refillable bottle systems and recyclable polymers. Bullet round bottles are increasingly used for pharma liquids, dietary supplements, and haircare products. Demand is supported by Germany’s leadership in packaging automation and its push toward a circular economy, encouraging biopolymer bottle adoption.

Which Region is the Fastest Growing in the Bullet Round Bottles Market?

Asia-Pacific is projected to grow at the fastest CAGR of 6.45% from 2025 to 2032, driven by urbanization, expanding FMCG sectors, and growing health and wellness awareness in China, India, and Southeast Asia. Rising demand for affordable, multi-use packaging in developing countries and the shift to local manufacturing are propelling growth.

Japan Bullet Round Bottles Market Insight

The Japan market is growing steadily due to high demand for compact, hygienic packaging in pharmaceuticals, travel cosmetics, and food supplements. Consumers prefer minimalist, functional designs, and manufacturers are investing in bio-based PET and PP bottles. Japan’s strict packaging laws support consistent product quality and innovation.

China Bullet Round Bottles Market Insight

China held the largest share in Asia-Pacific in 2024, led by strong demand in personal care, pharma, and food packaging. Local manufacturers offer cost-effective and customizable bullet bottles, supporting rapid market penetration. Government incentives for plastic recycling and domestic brand growth are enhancing bullet bottle adoption across the region.

Which are the Top Companies in Bullet Round Bottles Market?

The bullet round bottles industry is primarily led by well-established companies, including:

- Berry Global (U.S.)

- Amcor Plc (Switzerland)

- Silgan Holdings (U.S.)

- Gerresheimer AG (Germany)

- ALPLA Group (Austria)

- Cospack America Corporation (U.S.)

- Comar LLC (U.S.)

- Pretium Packaging (U.S.)

- Plastipak Packaging (U.S.)

- O.Berk Company (U.S.)

- MJS Packaging (U.S.)

- Kaufman Container (U.S.)

- Richards Packaging (Canada)

- Zhejiang B.I. Industrial Co., Ltd. (China)

- Ningbo Hengxing Packaging Material Co., Ltd. (China)

- Alpha Packaging (U.S.)

- TricorBraun (U.S.)

- RPC Group (U.K.)

- Takemoto Packaging Inc. (Japan)

- Pont Packaging (Netherlands)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bullet Round Bottles Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bullet Round Bottles Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bullet Round Bottles Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.