Global Bunk Trailers Market

Market Size in USD Million

CAGR :

%

USD

880.32 Million

USD

1,280.94 Million

2024

2032

USD

880.32 Million

USD

1,280.94 Million

2024

2032

| 2025 –2032 | |

| USD 880.32 Million | |

| USD 1,280.94 Million | |

|

|

|

|

Bunk Trailers Market Size

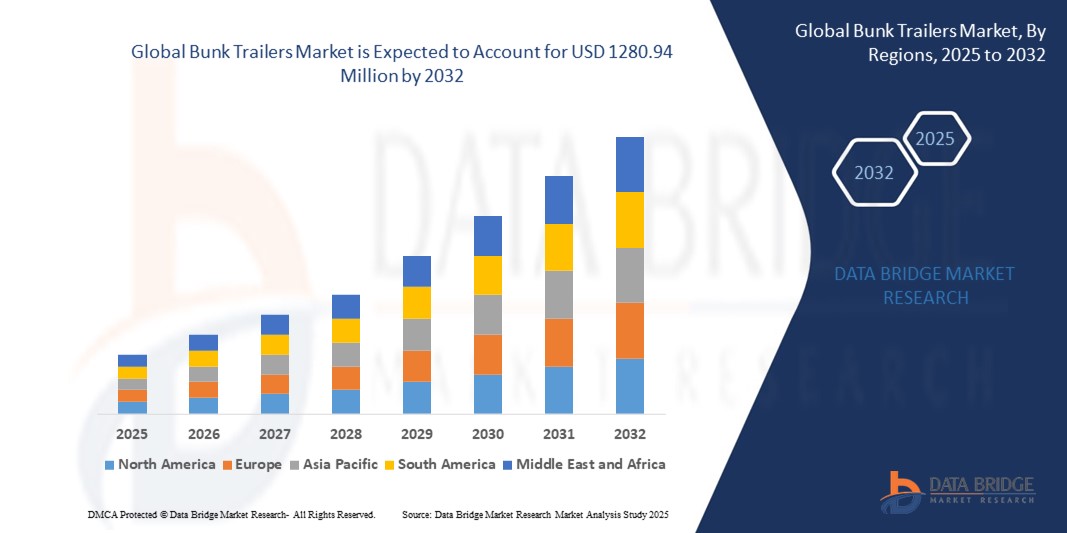

- The global bunk trailers market size was valued at USD 880.32 million in 2024 and is expected to reach USD 1280.94 million by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the rising demand for efficient bulk transportation solutions across agriculture, construction, and manufacturing industries, along with the modernization of logistics fleets to improve operational efficiency

- Furthermore, increasing adoption of lightweight, fuel-efficient trailer designs and the integration of advanced safety features are establishing bunk trailers as a preferred choice for high-capacity, reliable freight movement. These factors are accelerating the replacement of aging fleets and driving significant market expansion

Bunk Trailers Market Analysis

- Bunk trailers are specialized transport units designed for carrying bulk goods, livestock, and other heavy or specialized cargo, offering high load capacity, durability, and operational stability. They are widely used in agriculture, construction, industrial logistics, and cross-border freight operations

- The growing demand for bunk trailers is primarily driven by expanding global trade volumes, infrastructure development, and the need for cost-effective, long-distance transport solutions. Rising focus on fuel efficiency, compliance with safety regulations, and the adoption of advanced materials are further supporting market growth

- North America dominated the bunk trailers market in 2024, due to the region’s extensive transportation network, high industrial output, and significant demand from agriculture, construction, and manufacturing sectors

- Asia-Pacific is expected to be the fastest growing region in the bunk trailers market during the forecast period due to infrastructure expansion, industrial development, and agricultural trade growth in countries such as China, India, and Australia

- Dry bunk trailers segment dominated the market with a market share of 55.6% in 2024, due to its versatility in transporting a wide range of goods including packaged products, machinery, and bulk materials. These trailers are widely used in both domestic and cross-border trade due to their enclosed structure that offers protection from weather and theft. Industries such as retail, manufacturing, and agriculture rely heavily on dry bunk trailers for consistent supply chain operations. Their compatibility with various cargo handling systems and ease of customization for specialized needs further boosts demand in this segment

Report Scope and Bunk Trailers Market Segmentation

|

Attributes |

Bunk Trailers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Bunk Trailers Market Trend

Growing Adoption of Lightweight and Fuel-Efficient Trailer Designs

- Increasing focus on developing bunk trailers using lightweight materials such as aluminum and galvanized steel enhances fuel efficiency and lowers overall towing costs, appealing to freight and recreational users aiming to optimize operational expenses

- For instance, Utility Trailer Manufacturing Company launched a new lightweight bunk trailer model featuring advanced materials and aerodynamic designs to reduce drag and boost fuel efficiency, targeting commercial logistics and transportation sectors

- Rising demand for corrosion-resistant trailers designed for longevity in both freshwater and saltwater environments supports growth in marine and recreational applications. Aluminum trailers lead the market with over 50% share due to their rust resistance and lighter weight improving handling and reducing fuel consumption

- Emergence of modular and adjustable bunk trailer designs enables compatibility with a broad range of boat hulls and cargo types, improving versatility and user convenience which is especially beneficial for small to medium-sized boats and rental fleets

- Increasing adoption of electric-assist braking systems and IoT-enabled safety features is transforming bunk trailers into more technologically advanced, reliable, and user-friendly transport solutions. Smart monitoring and predictive maintenance enhance operational efficiency and reduce downtime

- Government regulations promoting emissions reduction and sustainability encourage manufacturers to prioritize eco-friendly designs and recyclable materials in trailer production, aligning with stricter compliance standards especially in North America and Europe

Bunk Trailers Market Dynamics

Driver

Increasing Demand for Efficient Freight Transportation

- The ongoing need for cost-effective, reliable freight transport is driving growth in bunk trailers, as they provide a simple, durable platform for moving a variety of goods including boats, agricultural products, and general cargo

- For instance, Wabash National Corporation introduced refrigerated bunk trailer systems tailored for cold chain logistics, improving temperature control and monitoring during transport of perishable goods, expanding bunk trailer applications beyond traditional uses

- Expansion of e-commerce, industrial output, and marine leisure activities requires trailer solutions that support high volume freight with reduced fuel consumption and maintenance costs, creating sustained demand across multiple sectors

- Increasing infrastructure investments, particularly in North America and Europe, create opportunities for advanced bunk trailers to help meet growing supply chain and logistics demands, supported by robust highway networks and transportation ecosystems

- Rising adoption of lightweight trailer designs contributes to meeting sustainability targets by reducing carbon footprints and operational expenses in freight transportation. Integration with telematics and fleet management tools further drives market growth

Restraint/Challenge

High Initial Investment and Maintenance Costs

- Relatively high capital expenditure for acquiring advanced bunk trailers equipped with lightweight materials, technology features, and modular designs limits adoption among price-sensitive buyers and SMEs

- For instance, small logistics operators and independent boat owners may find upfront costs prohibitive despite long-term fuel savings and reduced maintenance costs of aluminum or technologically enhanced bunk trailers

- Maintenance of specialized components such as corrosion-resistant coatings, electronic braking systems, or IoT monitoring devices adds complexity and increases total cost of ownership

- Fluctuations in raw material prices (such as aluminum and steel) coupled with supply chain disruptions increase production costs and retail prices for bunk trailers, challenging affordability for many buyers

- Financial and regulatory hurdles in some regions restrict access to affordable financing or subsidies needed for upgrading to newer, more efficient trailer models, while repair part availability and skilled labor shortages can extend downtime and operational risks

Bunk Trailers Market Scope

The market is segmented on the basis of material and type.

- By Material

On the basis of material, the bunk trailers market is segmented into steel, aluminum, and composite. The steel segment dominated the largest market revenue share in 2024, primarily due to its exceptional strength, high load-bearing capacity, and durability in demanding transport conditions. Steel bunk trailers are favored for heavy-duty applications such as transporting construction materials, agricultural goods, and industrial equipment. Their relatively lower manufacturing cost compared to aluminum and composite trailers makes them more accessible, particularly in cost-sensitive markets. In addition, advancements in anti-corrosion coatings and galvanization processes have extended the service life of steel trailers, reinforcing their dominance in both domestic and international freight operations.

The aluminum segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by the rising demand for lightweight trailers that improve fuel efficiency and reduce carbon emissions. Aluminum bunk trailers are increasingly preferred in regions with stringent environmental regulations and for long-haul transportation where weight savings translate into cost benefits. Their resistance to rust and lower maintenance needs make them ideal for transporting perishable goods or operating in coastal and humid climates. The growing adoption of aluminum in the logistics and agricultural sectors is also supported by innovations in high-strength alloys that maintain durability while minimizing weight.

- By Type

On the basis of type, the bunk trailers market is segmented into dry bunk trailers, livestock bunk trailers, and others. The dry bunk trailers segment accounted for the largest market revenue share of 55.6% in 2024, driven by its versatility in transporting a wide range of goods including packaged products, machinery, and bulk materials. These trailers are widely used in both domestic and cross-border trade due to their enclosed structure that offers protection from weather and theft. Industries such as retail, manufacturing, and agriculture rely heavily on dry bunk trailers for consistent supply chain operations. Their compatibility with various cargo handling systems and ease of customization for specialized needs further boosts demand in this segment.

The livestock bunk trailers segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by increasing global demand for safe and efficient animal transportation solutions. These trailers are designed with features such as proper ventilation, anti-slip flooring, and secure compartmentalization to ensure animal welfare during transit. Rising meat consumption, expansion of commercial livestock farms, and growth in live animal exports are driving adoption worldwide. In addition, evolving animal transport regulations in regions such as North America and Europe are prompting farmers and logistics providers to invest in modern livestock bunk trailers with advanced safety features.

Bunk Trailers Market Regional Analysis

- North America dominated the bunk trailers market with the largest revenue share in 2024, driven by the region’s extensive transportation network, high industrial output, and significant demand from agriculture, construction, and manufacturing sectors

- Industries in the region prioritize the durability, high load capacity, and operational efficiency offered by steel and aluminum bunk trailers, making them integral to bulk goods and livestock transportation

- This strong adoption is further supported by stringent safety regulations, established logistics infrastructure, and the increasing replacement of older fleets with modern, fuel-efficient trailers designed to reduce operational costs

U.S. Bunk Trailers Market Insight

The U.S. bunk trailers market captured the largest revenue share in 2024 within North America, fueled by the country’s large-scale farming operations, livestock transportation needs, and construction industry demands. The trend toward lightweight aluminum trailers to improve fuel efficiency, combined with the shift to corrosion-resistant materials for extended service life, is accelerating adoption. Modernization of fleets to meet evolving safety and environmental standards is also contributing to market expansion.

Europe Bunk Trailers Market Insight

The Europe bunk trailers market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising agricultural exports, growth in cross-border trade, and adherence to strict EU safety and transportation standards. Demand is strong for advanced trailer designs that ensure secure and efficient transportation of livestock and perishable goods. The modernization of fleets across key exporting nations is further strengthening the market outlook.

U.K. Bunk Trailers Market Insight

The U.K. bunk trailers market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong demand from the livestock sector and a focus on animal welfare compliance. Lightweight aluminum trailers are gaining traction for their fuel-saving benefits, while custom-designed solutions for specific agricultural and industrial uses are also driving market uptake.

Germany Bunk Trailers Market Insight

The Germany bunk trailers market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s robust manufacturing sector, agricultural output, and strict quality standards. The market is witnessing a preference for corrosion-resistant trailers and advanced safety features to reduce downtime and maintenance costs.

Asia-Pacific Bunk Trailers Market Insight

The Asia-Pacific bunk trailers market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by infrastructure expansion, industrial development, and agricultural trade growth in countries such as China, India, and Australia. Regional manufacturers offering cost-effective, customizable solutions are further increasing market accessibility.

Japan Bunk Trailers Market Insight

The Japan bunk trailers market is gaining momentum due to the country’s high-quality agricultural exports and demand for specialized transportation solutions. The adoption of lightweight, durable trailers is increasing, particularly in long-distance transport operations.

China Bunk Trailers Market Insight

The China bunk trailers market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by its vast agricultural base, expanding livestock sector, and strong domestic manufacturing capabilities. Competitive pricing, large-scale production, and rapid modernization of logistics fleets are key drivers of growth.

Bunk Trailers Market Share

The bunk trailers industry is primarily led by well-established companies, including:

- Utility Trailer Manufacturing Company, LLC (U.S.)

- Wabash National Corporation (U.S.)

- Great Dane (U.S.)

- HYUNDAI TRANSLEAD (U.S.)

- Vanguard National Trailer Corp. (U.S.)

- STI HOLDINGS, INC (U.S.)

- East Manufacturing Corporation (U.S.)

- MANAC INC. (Canada)

- MAC Trailer (U.S.)

Latest Developments in Global Bunk Trailers Market

- In 2024, Daimler AG ramped up its investment in electric bunk trailer technology, aiming to address the growing demand for sustainable and low-emission transport solutions. This strategic move comes as governments worldwide impose stricter emissions regulations and logistics providers seek to reduce fuel dependency. Electric bunk trailers are expected to cut operational costs, improve efficiency, and position fleet operators competitively in eco-conscious markets, thereby accelerating the adoption of green technologies within the bunk trailers industry

- In 2024, Volvo Group and Great Dane Trailers formed a strategic partnership to integrate advanced smart technology systems into bunk trailer designs. The collaboration focuses on embedding telematics, predictive maintenance tools, and safety monitoring systems to enhance fleet management efficiency. This development responds to the increasing market need for connected, data-driven transport solutions, enabling operators to optimize routes, reduce downtime, and improve overall asset utilization in an increasingly competitive logistics environment

- In November 2023, Utility Trailer Manufacturing Company unveiled its latest lightweight bunk trailer model engineered to enhance both fuel efficiency and load capacity. By incorporating advanced materials and aerodynamic design features, the company has addressed growing industry demand for cost-effective and environmentally friendly transportation solutions. This innovation is expected to accelerate the shift toward lighter, high-performance trailers in the bunk trailers market, enabling fleet operators to reduce operating costs while meeting tightening emissions regulations

- In September 2023, Wabash National Corporation launched a new refrigerated bunk trailer system equipped with advanced temperature control and real-time monitoring capabilities. Designed to meet the stringent standards of the cold chain logistics sector, this solution ensures optimal conditions for transporting perishable goods. The introduction of such specialized, high-precision trailers is set to strengthen the market for bunk trailers in temperature-sensitive industries, driving adoption among logistics providers seeking to improve reliability and compliance in food, pharmaceutical, and other cold chain applications

- In 2023, Wabash National Corporation expanded its market reach and manufacturing capabilities by acquiring key assets from Trailmobile. This acquisition strengthens Wabash’s production capacity and broadens its product offerings, allowing it to cater to diverse transportation sectors, from bulk goods to specialized cargo. By consolidating resources, the company is positioned to meet rising global demand for high-quality bunk trailers while enhancing customization capabilities to meet regional and sector-specific needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.