Global Burner Management System Market

Market Size in USD Billion

CAGR :

%

USD

5.85 Billion

USD

9.46 Billion

2024

2032

USD

5.85 Billion

USD

9.46 Billion

2024

2032

| 2025 –2032 | |

| USD 5.85 Billion | |

| USD 9.46 Billion | |

|

|

|

|

Burner Management System Market Size

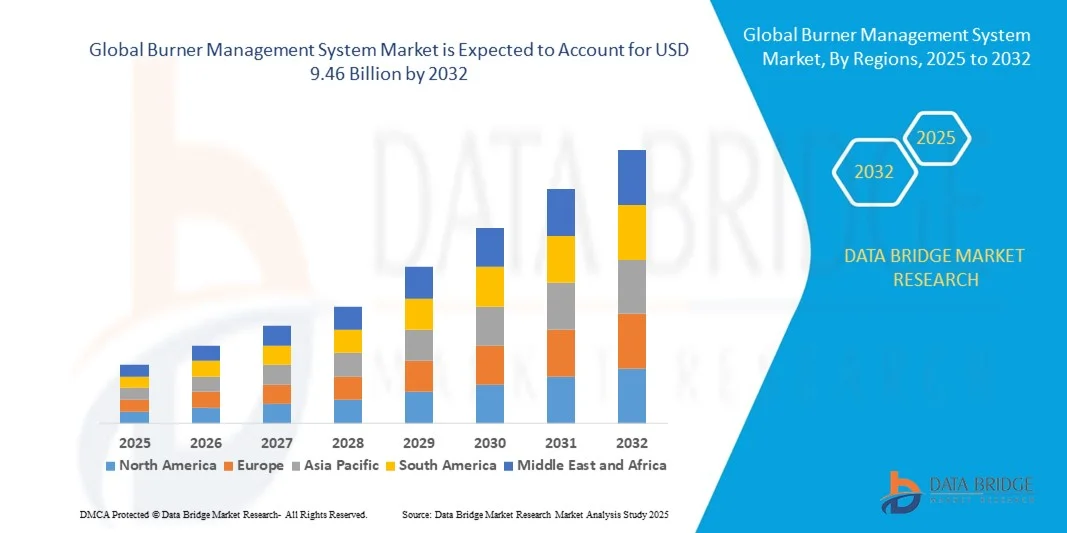

- The global burner management system market size was valued at USD 5.85 billion in 2024 and is expected to reach USD 9.46 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the increasing adoption of industrial automation and the need for enhanced safety and operational efficiency in combustion processes

- Rising regulatory compliance requirements for emission control and workplace safety are driving the implementation of advanced burner management systems across power plants, chemical, and oil & gas industries

Burner Management System Market Analysis

- The market is witnessing significant demand for automated safety systems that prevent hazardous incidents and ensure smooth operations in industrial facilities

- Technological advancements such as digital control panels, remote monitoring, and integration with plant management systems are enhancing system reliability and reducing downtime

- North America dominated the burner management system market with the largest revenue share of 35.42% in 2024, driven by stringent industrial safety regulations and the growing emphasis on operational efficiency across oil & gas, power, and chemical sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global burner management system market, driven by rapid industrialization, government initiatives promoting industrial safety, and increasing demand for energy-efficient and automated combustion systems. Countries such as China, Japan, and South Korea are leading the adoption of advanced BMS technologies, expanding the market across multiple sectors

- The hardware segment held the largest market revenue share in 2024, driven by the deployment of sensors, controllers, and actuators that ensure safe and efficient burner operation. Hardware solutions often offer high durability, reliability, and compliance with industrial safety standards, making them the preferred choice for large-scale industrial facilities

Report Scope and Burner Management System Market Segmentation

|

Attributes |

Burner Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Burner Management System Market Trends

Increasing Adoption of Advanced Combustion Control Systems

- The rising adoption of automated burner management systems (BMS) is transforming industrial combustion operations by enabling precise monitoring and control of fuel usage. The real-time data and automation improve operational safety, reduce downtime, and optimize energy efficiency, lowering overall operational costs

- The high demand for advanced safety and compliance solutions in remote and high-risk industrial environments is accelerating the deployment of BMS. These systems are particularly effective in power plants, refineries, and chemical facilities where manual monitoring is challenging, supporting timely interventions

- The affordability and modular design of modern BMS units are making them attractive for both new installations and retrofits, allowing consistent regulatory compliance and operational efficiency. Companies benefit from reduced risk of accidents and improved fuel management without excessive investment or technical hurdles

- For instance, in 2023, several petrochemical plants in the Middle East reported a significant reduction in operational downtime after implementing integrated BMS solutions, enhancing safety compliance and energy efficiency while lowering maintenance costs

- While automated BMS systems are driving operational safety and efficiency, their impact depends on continuous innovation, skilled personnel training, and integration with other industrial control systems. Manufacturers must focus on scalable, adaptable solutions to fully leverage market demand

Burner Management System Market Dynamics

Driver

Increasing Focus on Industrial Safety and Operational Efficiency

- Stringent industrial safety regulations and growing awareness about process hazards are prompting companies to prioritize burner management systems as critical safety infrastructure. Compliance with OSHA, NFPA, and other standards accelerates BMS adoption across sectors such as oil & gas, power, and chemicals. Companies are also increasingly integrating BMS with predictive maintenance tools to minimize accidents and improve operational reliability

- Companies are increasingly aware of the financial and operational risks associated with unsafe combustion operations, including equipment damage, production downtime, and potential regulatory penalties. This awareness has led to widespread deployment of automated BMS, even in small and medium-sized plants. The use of advanced monitoring and control systems also reduces human errors and improves safety metrics

- Government initiatives and private programs promoting energy efficiency and industrial automation are further supporting market growth. Incentives for adopting safety-compliant and energy-optimized systems encourage investment in advanced BMS technologies. These initiatives also foster adoption of smart burner solutions, which help optimize fuel consumption and reduce carbon emissions

- For instance, in 2022, several European industrial facilities upgraded their burner systems with automated control solutions to comply with revised NFPA standards, boosting demand for integrated BMS and analytics-enabled monitoring systems. This upgrade also enabled real-time alerts, minimizing operational disruptions and ensuring safer industrial processes

- While safety regulations and operational efficiency drive market growth, there remains a need to improve interoperability with legacy systems and enhance predictive maintenance capabilities for sustained adoption. Companies are focusing on AI-enabled diagnostics and remote monitoring to maximize BMS effectiveness and long-term ROI

Restraint/Challenge

High Capital Costs and Integration Complexity in Industrial Environments

- The high investment required for advanced BMS, including sensors, control units, and software, limits adoption in small-scale plants and in regions with constrained capital budgets. Cost remains a primary barrier to market expansion. In addition, ongoing maintenance and system upgrades add to the total cost of ownership, discouraging some potential buyers

- Many industrial facilities lack trained personnel capable of installing, configuring, and maintaining complex BMS solutions. The absence of technical expertise and supporting infrastructure reduces timely adoption and operational effectiveness. Staff training programs and hiring specialized engineers are often required, further increasing operational challenges

- Integrating modern BMS with existing industrial control systems, such as SCADA and DCS, can be complex, requiring specialized engineering and additional network upgrades. This increases deployment timelines and operational costs. Compatibility issues with older equipment may necessitate retrofitting, which can be both time-consuming and expensive

- For instance, in 2023, several chemical plants in Sub-Saharan Africa reported delays in BMS implementation due to high costs, lack of trained personnel, and challenges in retrofitting older combustion systems, highlighting market barriers. These delays also impacted operational efficiency and compliance with safety regulations, affecting production schedules

- While BMS technology continues to advance, addressing cost, technical, and integration challenges remains critical. Stakeholders must focus on modular solutions, user-friendly interfaces, and workforce training to unlock long-term growth potential. In addition, collaboration with system integrators and offering scalable solutions can accelerate adoption across diverse industrial setups

Burner Management System Market Scope

The market is segmented on the basis of component, fuel type, application, and end use.

- By Component

On the basis of component, the burner management system market is segmented into hardware and software. The hardware segment held the largest market revenue share in 2024, driven by the deployment of sensors, controllers, and actuators that ensure safe and efficient burner operation. Hardware solutions often offer high durability, reliability, and compliance with industrial safety standards, making them the preferred choice for large-scale industrial facilities.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of automation, predictive maintenance, and real-time monitoring platforms. Software-enabled BMS allows operators to remotely control burners, analyze operational data, and integrate safety alerts, enhancing efficiency and reducing the risk of accidents.

- By Fuel Type

On the basis of fuel type, the market is segmented into oil, gas, and electricity. The gas segment dominated the market in 2024 due to its widespread use in industrial boilers and furnaces, offering cleaner combustion and easier integration with automated systems. Gas-fired BMS solutions are also popular for their ability to optimize fuel efficiency and minimize emissions.

The oil segment is expected to grow steadily from 2025 to 2032, driven by its continued use in power generation and heavy industrial processes. Oil-based systems benefit from robust safety controls and precise monitoring, which are critical in high-temperature operations.

- By Application

On the basis of application, the market is segmented into boilers, furnaces, kilns, and ovens. The boiler segment held the largest revenue share in 2024 due to the high prevalence of boilers across power plants and process industries. BMS solutions for boilers ensure safe ignition, flame monitoring, and shutdown mechanisms, minimizing downtime and hazards.

The furnace segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising industrialization and the need for energy-efficient, automated combustion control in metal, chemical, and manufacturing industries.

- By End Use

On the basis of end use, the market is segmented into oil and gas, power, chemicals, mining, metal and mineral (MMM), refining, water, specialty chemicals, pharmaceutical, food and beverages, glass, ceramics, alternate fuel, building, automotive, and printing and publishing. The oil and gas sector held the largest market share in 2024 due to stringent safety requirements and high operational risks, necessitating robust BMS deployment.

The power is expected to witness the fastest growth rate from 2025 to 2032, driven by increased adoption of automation, industrial safety standards, and energy optimization initiatives across manufacturing and process facilities.

Burner Management System Market Regional Analysis

- North America dominated the burner management system market with the largest revenue share of 35.42% in 2024, driven by stringent industrial safety regulations and the growing emphasis on operational efficiency across oil & gas, power, and chemical sectors

- Companies in the region highly value advanced safety features, real-time monitoring, and integration capabilities offered by modern BMS solutions, which help prevent accidents, reduce downtime, and optimize fuel consumption

- This widespread adoption is further supported by robust industrial infrastructure, high capital availability, and government incentives for energy-efficient and safety-compliant systems, establishing BMS as a critical solution for industrial operations

U.S. Burner Management System Market Insight

The U.S. burner management system market captured the largest revenue share in 2024 within North America, fueled by stringent safety regulations, increasing industrial automation, and the need for energy optimization. Industrial operators are prioritizing the integration of BMS with SCADA and DCS systems for improved process control and predictive maintenance. The growing demand for oil & gas, power, and chemical production efficiency, combined with government support for safety compliance, is significantly contributing to market growth.

Europe Burner Management System Market Insight

The Europe burner management system market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict compliance with safety standards such as NFPA and IEC, and the increasing focus on energy-efficient operations. Industrial sectors, including chemicals, power, and manufacturing, are increasingly deploying BMS for enhanced process safety and fuel optimization. The region is witnessing notable growth in retrofitting legacy plants with automated control solutions, supported by industrial modernization initiatives.

U.K. Burner Management System Market Insight

The U.K. burner management system market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent safety regulations, high awareness of process hazards, and the adoption of industrial automation. Both oil & gas and power sectors are investing in integrated BMS solutions to minimize operational risks, reduce downtime, and enhance compliance. The country’s focus on sustainable energy and industrial efficiency continues to support the expansion of BMS technologies.

Germany Burner Management System Market Insight

The Germany burner management system market is expected to witness the fastest growth rate from 2025 to 2032, fueled by advanced industrial infrastructure, a strong emphasis on safety, and the adoption of energy-efficient solutions. German industries are increasingly implementing automated BMS to comply with local and EU-wide safety regulations while optimizing fuel consumption. The integration of predictive maintenance and analytics-enabled monitoring is gaining traction, supporting overall market growth.

Asia-Pacific Burner Management System Market Insight

The Asia-Pacific burner management system market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, rising energy demand, and increased awareness of industrial safety in countries such as China, India, and Japan. The region's focus on industrial modernization, combined with government incentives for energy efficiency and process safety, is promoting widespread adoption of BMS. In addition, the emergence of local manufacturers is improving accessibility and affordability of advanced systems.

Japan Burner Management System Market Insight

The Japan burner management system market is expected to witness the fastest growth rate from 2025 to 2032 due to high industrial safety standards, technological adoption, and the need for operational efficiency. Industries such as power, chemicals, and oil & gas are increasingly integrating BMS with IoT-enabled monitoring and predictive analytics to enhance safety and reduce downtime. Japan’s aging industrial workforce is also encouraging automation solutions such as BMS to ensure consistent and secure operations.

China Burner Management System Market Insight

The China burner management system market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s expanding industrial base, focus on safety compliance, and energy efficiency initiatives. The oil & gas, power, and chemical sectors are driving demand for automated BMS solutions to improve operational control, reduce fuel waste, and meet environmental regulations. Strong government support, local manufacturing capabilities, and cost-effective solutions are key factors propelling market growth in China.

Burner Management System Market Share

The Burner Management System industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- ACL Manufacturing Inc. (U.S.)

- Cimarron Energy, INC. (U.S.)

- Combustex Corp. (U.S.)

- Emerson Electric Co. (U.S.)

- Forney Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- TUNDRA PROCESS SOLUTIONS (U.S.)

- Zeeco, Inc. (U.S.)

- Babcock & Wilcox Enterprises, Inc. (U.S.)

- Born Inc. (U.S.)

- Doosan Babcock (U.K.)

- Pilz GmbH & Co. KG (Germany)

Latest Developments in Global Burner Management System Market

- In April 2024, Emerson Electric Co launched the ASCO Series 148/149, an advanced motorized actuator and shutoff valve, aimed at enhancing the safety and reliability of industrial combustion systems. The system delivers shutoff in under a second, ensuring critical protection for fuel burners under extreme conditions. This innovation improves operational efficiency, helps industries comply with stringent safety standards, and meets the growing demand for sophisticated burner management solutions across multiple sectors

- In February 2022, Babcock & Wilcox Enterprises, Inc. acquired Fossil Power Systems (FPS) to expand its capabilities in combustion and emissions control technologies. This acquisition strengthens Babcock & Wilcox’s strategic position in the burner management system market, enabling the company to offer more comprehensive solutions and capitalize on the increasing industrial focus on safety, efficiency, and regulatory compliance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Burner Management System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Burner Management System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Burner Management System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.