Global Business Intelligence Bi Vendors Market

Market Size in USD Billion

CAGR :

%

USD

9.72 Billion

USD

75.93 Billion

2024

2032

USD

9.72 Billion

USD

75.93 Billion

2024

2032

| 2025 –2032 | |

| USD 9.72 Billion | |

| USD 75.93 Billion | |

|

|

|

|

Business Intelligence (BI) Vendors Market Size

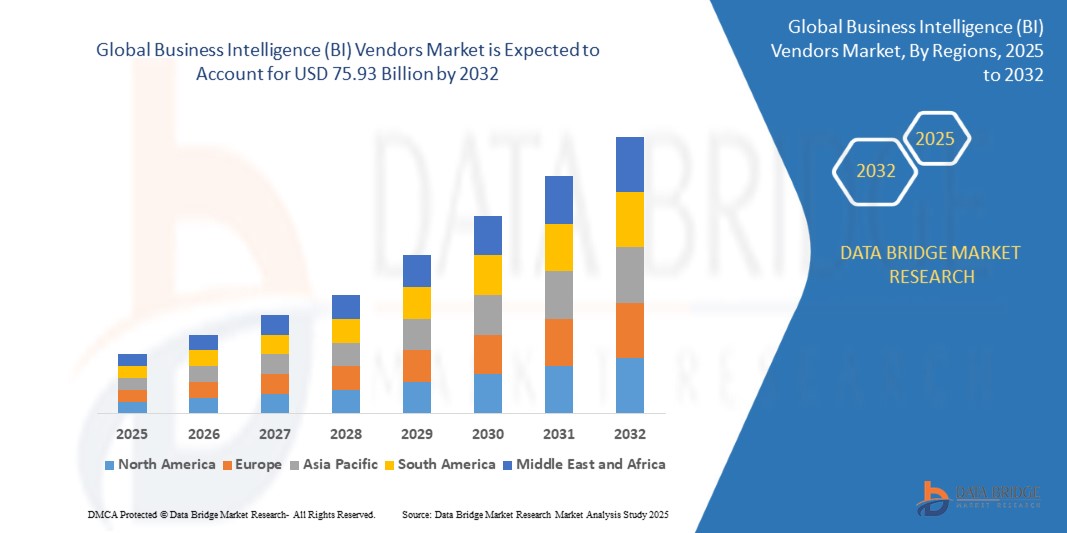

- The global business intelligence (BI) vendors market size was valued at USD 9.72 billion in 2024 and is expected to reach USD 75.93 billion by 2032, at a CAGR of 29.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of data-driven decision-making and technological advancements in analytics, enabling organizations to gain actionable insights from large volumes of data across industries

- Furthermore, the rising demand for real-time reporting, predictive analytics, and self-service BI tools is driving enterprises to implement comprehensive BI solutions. These converging factors are accelerating the adoption of BI platforms, thereby significantly boosting market growth

Business Intelligence (BI) Vendors Market Analysis

- Business intelligence vendors provide software and services that enable organizations to collect, integrate, analyze, and visualize data for informed decision-making. BI platforms support functions such as finance, operations, marketing, and human resources, offering dashboards, reporting, and predictive analytics capabilities

- The escalating demand for BI solutions is primarily fueled by the growing need for operational efficiency, improved performance tracking, data governance, and enhanced strategic planning. Enterprises are increasingly leveraging cloud, mobile, and AI-driven analytics platforms to transform raw data into actionable business insights

- North America dominated the business intelligence (BI) vendors market with a share of 38.5% in 2024, due to early adoption of advanced analytics tools, growing reliance on data-driven decision-making, and widespread deployment of BI solutions across enterprises

- Asia-Pacific is expected to be the fastest growing region in the business intelligence (BI) vendors market during the forecast period due to id digital transformation, increasing IT infrastructure investments, and rising demand for data-driven decision-making in emerging economies such as China, India, and Japan

- Structured data segment dominated the market with a market share of 52.5% in 2024, due to its high accuracy, ease of storage, and compatibility with traditional BI tools. Enterprises rely heavily on structured data from relational databases, ERP systems, and transactional records for core business analytics. Its predictable format allows for efficient querying, reporting, and performance monitoring, enabling organizations to make informed decisions quickly. Structured data also supports financial analysis, operational tracking, and KPI management, ensuring reliability across critical business functions. In addition, its integration with existing software systems and dashboards enhances real-time insights and decision-making capabilities for organizations of all sizes

Report Scope and Business Intelligence (BI) Vendors Market Segmentation

|

Attributes |

Business Intelligence (BI) Vendors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Business Intelligence (BI) Vendors Market Trends

Integration of AI and Machine Learning in BI Platforms

- The integration of artificial intelligence (AI) and machine learning (ML) within BI platforms is transforming how organizations analyze and interpret data. These technologies offer real-time analytics, predictive modeling, and prescriptive insights, empowering businesses to make faster and more informed decisions across complex datasets

- For instance, Microsoft has enhanced its Power BI platform with embedded AI features such as natural language queries and automated ML models, enabling business users to generate insights without requiring advanced technical knowledge. Similarly, Tableau’s integration of Einstein Discovery (Salesforce AI) allows more accurate predictions and recommendations

- AI-driven automation is reshaping the BI landscape by reducing manual reporting and enabling self-service analytics. This is particularly relevant for organizations with limited data science resources, as embedded ML tools within BI solutions enable everyday business users to access sophisticated analytical capabilities

- The adoption of conversational analytics is a growing trend where BI platforms incorporate natural language processing (NLP). This allows business executives to interact directly with data through questions typed or spoken in plain language, significantly improving adoption rates across non-technical teams

- In addition, the trend of augmented analytics is fueling demand as BI vendors embed AI-driven data preparation, smarter visualization recommendations, and anomaly detection tools directly into dashboards. This helps organizations uncover deeper business insights with minimal human intervention

- The growing linkage between AI-enabled BI tools and Internet of Things (IoT) ecosystems is enhancing real-time monitoring capabilities. BI platforms are integrating edge analytics to process data from connected devices instantly, benefiting industries such as manufacturing, healthcare, and logistics that prioritize operational agility

Business Intelligence (BI) Vendors Market Dynamics

Driver

Complex Event Processing Techniques

- The growing adoption of complex event processing (CEP) techniques is fueling the BI market as enterprises seek to analyze large volumes of data from multiple sources in real-time. CEP enables organizations to identify patterns, detect anomalies, and make proactive decisions with speed and accuracy

- For instance, IBM’s BI solutions incorporate advanced event stream processing technologies that empower organizations to manage large-scale data influx from financial markets, cybersecurity systems, and IoT devices. This integration has allowed enterprises to carry out predictive risk management and instant fraud detection

- The requirement for real-time decision-making in industries such as banking, telecom, and retail is reinforcing demand for CEP-enabled BI platforms. These industries must respond immediately to fast-changing data, and BI vendors integrating such capabilities are gaining significant market traction

- In addition, the incorporation of CEP with predictive analytics is enabling businesses to proactively manage customer behavior, optimize inventory, and streamline operational processes. This is enhancing efficiency and adding measurable business value across different verticals

- The rising complexity of business environments and the emergence of multichannel data streams further drive companies to adopt BI vendors that support CEP architectures. These advanced platforms provide better scalability, agility, and future-proofing for competitive enterprises

Restraint/Challenge

High Levels of Resistance

- One of the primary challenges in BI adoption is the high level of resistance that persists at various organizational levels. Employees often hesitate to embrace new BI tools due to fears of redundancy, lack of technical knowledge, or resistance to altering established workflows

- For instance, despite the proven benefits of BI platforms such as Qlik Sense or SAP BusinessObjects, studies reveal that many enterprises face challenges in gaining widespread user acceptance as employees prefer traditional reporting formats and resist change to new AI-driven interfaces

- The lack of effective training programs contributes to this resistance as organizations underestimate the time and investment needed to foster BI adoption across diverse teams. Without proper knowledge transfer, even advanced BI platforms remain underutilized and fail to deliver potential ROI

- In addition, cultural resistance rooted in data silos and internal politics slows down BI implementation. Many teams prefer to maintain departmental autonomy and show reluctance to share insights across the organization, hampering the effectiveness of centralized BI adoption

- Unclear communication of BI’s benefits from leadership further intensifies this resistance. When employees fail to perceive immediate value or easy usability, resistance grows stronger, resulting in low adoption rates and slower overall digital transformation progress

Business Intelligence (BI) Vendors Market Scope

The market is segmented on the basis of component, data type, function, technology, deployment model, organization size, application, and industry vertical.

• By Component

On the basis of component, the BI vendors market is segmented into platform, software, solution, and services. The software segment dominated the market with the largest revenue share in 2024, driven by the rising need for advanced analytics tools, interactive dashboards, and reporting capabilities that support informed decision-making. Enterprises are increasingly adopting BI software to monitor KPIs, track performance metrics, and enable real-time insights across multiple departments. The availability of self-service analytics further boosts adoption, allowing non-technical users to access actionable insights. BI software also integrates seamlessly with other enterprise applications, enhancing operational efficiency and overall productivity.

The platform segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for comprehensive analytics ecosystems. BI platforms consolidate multiple tools, including reporting, data visualization, and AI-driven insights, under a single environment. They enable organizations to centralize data management, improve collaboration, and deploy enterprise-wide solutions efficiently. Integrated platforms also facilitate seamless data sharing, faster decision-making, and advanced predictive analytics, making them attractive to organizations aiming to modernize their business intelligence capabilities.

• By Data Type

On the basis of data type, the BI vendors market is segmented into structured data, unstructured data, and semi-structured data. The structured data segment held the largest revenue share of 52.5% in 2024, driven by its high accuracy, ease of storage, and compatibility with traditional BI tools. Enterprises rely heavily on structured data from relational databases, ERP systems, and transactional records for core business analytics. Its predictable format allows for efficient querying, reporting, and performance monitoring, enabling organizations to make informed decisions quickly. Structured data also supports financial analysis, operational tracking, and KPI management, ensuring reliability across critical business functions. In addition, its integration with existing software systems and dashboards enhances real-time insights and decision-making capabilities for organizations of all sizes.

The unstructured data segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the exponential increase in social media content, emails, documents, and multimedia data. AI and machine learning-enabled BI tools are increasingly applied to analyze unstructured data for customer sentiment, market trends, and predictive insights. By extracting actionable information from unstructured sources, businesses gain deeper understanding of customer behavior, competitive positioning, and emerging opportunities. This capability allows enterprises to make more informed, data-driven strategic decisions.

• By Function

On the basis of function, the BI vendors market is segmented into human resource, finance, operations, and sales and marketing. The finance segment dominated the largest market revenue share in 2024 due to its critical role in financial planning, performance evaluation, and compliance reporting. BI tools enable finance teams to monitor revenue trends, optimize budgets, detect anomalies, and forecast financial outcomes accurately. They also help identify cost-saving opportunities and improve decision-making efficiency. Enterprises heavily rely on finance analytics to reduce risks, maintain regulatory compliance, and align financial strategy with organizational goals.

The sales and marketing segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing emphasis on customer-centric strategies and revenue optimization. BI solutions provide insights into customer behavior, preferences, and buying patterns, enabling personalized marketing and targeted campaigns. Companies also leverage these insights to track sales performance, optimize resource allocation, and improve customer engagement. As businesses aim to enhance revenue generation and market share, adoption of BI in sales and marketing functions continues to accelerate.

• By Technology

On the basis of technology, the BI vendors market is segmented into mobile, cloud, social, and others. The cloud segment dominated the market with the largest revenue share in 2024 due to its scalability, lower deployment costs, and ability to provide remote access to analytics dashboards. Cloud BI enables organizations to integrate multiple data sources, facilitate collaboration across departments, and deliver real-time insights. It also supports seamless updates, flexible storage options, and advanced security features, making it ideal for both SMEs and large enterprises. The flexibility of cloud solutions accelerates adoption across geographically dispersed teams.

The mobile segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for on-the-go analytics and decision-making. Mobile BI solutions allow executives and managers to access dashboards, monitor KPIs, and receive alerts anytime, anywhere. This mobility improves responsiveness, operational efficiency, and timely decision-making. Organizations increasingly use mobile BI for remote workforce management, field operations, and instant data-driven insights, making it a critical growth area for BI vendors.

• By Deployment Model

On the basis of deployment model, the BI vendors market is segmented into cloud, on-demand, and on-premises. The on-premises segment held the largest revenue share in 2024 due to the need for high data security, regulatory compliance, and complete control over enterprise data. Large organizations particularly prefer on-premises deployment to customize BI solutions according to internal processes, maintain data privacy, and support complex analytics workflows. On-premises BI also ensures minimal dependence on third-party service providers and offers stability for mission-critical operations.

The cloud deployment model is expected to witness the fastest growth rate from 2025 to 2032, driven by adoption of SaaS-based BI solutions among SMEs and multinational enterprises. Cloud BI reduces upfront investment, simplifies deployment, and provides automatic software updates. It allows organizations to scale analytics capabilities easily, access global datasets, and implement collaborative data-driven strategies efficiently. The flexibility and cost-effectiveness of cloud deployment make it highly appealing for businesses aiming to modernize analytics infrastructure rapidly.

• By Organization Size

On the basis of organization size, the BI vendors market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. Large enterprises dominated the market with the largest revenue share in 2024, owing to extensive operations, complex data requirements, and higher budgets for implementing comprehensive BI solutions. These organizations use BI for enterprise-wide visibility, operational efficiency, predictive analytics, and strategic planning. Large-scale adoption ensures seamless decision-making across multiple departments, enhancing competitiveness and profitability.

SMEs are anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing digitalization and availability of affordable BI solutions. Cloud-based and subscription-oriented BI models allow SMEs to adopt advanced analytics without heavy upfront infrastructure investment. These solutions enable SMEs to optimize operations, make data-driven decisions, and enhance competitiveness in increasingly dynamic markets.

• By Application

On the basis of application, the BI vendors market is segmented into CRM analytic application, financial performance and strategy management, production planning analytic operations, predictive asset maintenance, fraud detection and security management, supply chain optimization/operations, network management and optimization, workforce management, sales and marketing management, operations management, and others. The financial performance and strategy management segment dominated the largest market revenue share in 2024, driven by the critical need for strategic decision-making, budgeting, and forecasting. BI tools help executives assess organizational performance, identify risks, and optimize financial outcomes.

The sales and marketing management segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising emphasis on customer analytics and campaign optimization. BI solutions provide actionable insights into customer behavior, market trends, and campaign performance. This enables personalized marketing, improved customer engagement, and optimized allocation of resources. Companies increasingly rely on sales and marketing analytics to boost revenue and gain competitive advantages, driving rapid adoption in this segment.

• By Industry Vertical

On the basis of industry vertical, the BI vendors market is segmented into BFSI, telecommunications and IT, retail and consumer goods, healthcare and life sciences, manufacturing, government and defense, public services, energy and utilities, transportation and logistics, tourism and hospitality, media and entertainment, and others. The BFSI segment dominated the largest revenue share in 2024, driven by the need for risk management, regulatory compliance, fraud detection, and data-driven decision-making. BI solutions enable banks and insurance companies to enhance operational efficiency, improve customer insights, and make informed financial decisions.

The retail and consumer goods segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of BI solutions to analyze consumer preferences, optimize inventory, and improve supply chain operations. Retailers leverage predictive analytics and real-time insights to drive sales, personalize customer experiences, and maintain competitiveness in a dynamic market. BI adoption helps retailers optimize marketing strategies, manage stock levels, and respond quickly to changing consumer behavior.

Business Intelligence (BI) Vendors Market Regional Analysis

- North America dominated the business intelligence (BI) vendors market with the largest revenue share of 38.5% in 2024, driven by early adoption of advanced analytics tools, growing reliance on data-driven decision-making, and widespread deployment of BI solutions across enterprises

- Organizations in the region prioritize real-time insights, predictive analytics, and integration with existing enterprise systems to improve operational efficiency and strategic planning

- The strong presence of leading BI vendors, high IT spending, and a technologically savvy workforce further support market growth, establishing North America as the most mature and lucrative region for BI adoption

U.S. BI Vendors Market Insight

The U.S. BI vendors market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of cloud and mobile BI solutions and increasing demand for advanced analytics capabilities. Enterprises are investing heavily in tools that enable data visualization, self-service analytics, and AI-driven insights to support real-time decision-making. The growing focus on digital transformation, coupled with strong IT infrastructure and high awareness of data-driven strategies, is accelerating the uptake of BI solutions across industries.

Europe BI Vendors Market Insight

The Europe BI vendors market is projected to expand at a significant CAGR throughout the forecast period, primarily driven by increasing digitalization initiatives, regulatory compliance requirements, and demand for efficient analytics solutions across enterprises. Adoption is being fueled by the integration of BI tools in finance, operations, and sales functions, as well as the region’s strong emphasis on data governance. Organizations across the UK, Germany, and France are investing in BI to enhance decision-making, improve operational efficiency, and maintain competitiveness in a technology-driven business environment.

U.K. BI Vendors Market Insight

The U.K. BI vendors market is anticipated to grow at a notable CAGR during the forecast period, driven by increasing demand for analytics-driven business strategies and digital transformation initiatives. The adoption of BI solutions is particularly strong in financial services, retail, and telecommunications sectors, where organizations seek to optimize performance, gain actionable insights, and improve customer engagement. In addition, strong IT infrastructure and cloud adoption are expected to sustain growth in this region.

Germany BI Vendors Market Insight

The Germany BI vendors market is expected to expand at a considerable CAGR, fueled by growing awareness of data-driven decision-making and the need for advanced analytics in manufacturing, automotive, and industrial sectors. German enterprises prioritize BI for operational efficiency, predictive analytics, and process optimization. The market growth is further supported by Germany’s focus on Industry 4.0, digitalization, and adoption of cloud-based analytics platforms, which enhance enterprise-wide data management and insights.

Asia-Pacific BI Vendors Market Insight

The Asia-Pacific BI vendors market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid digital transformation, increasing IT infrastructure investments, and rising demand for data-driven decision-making in emerging economies such as China, India, and Japan. Governments and businesses are actively promoting analytics adoption, and SMEs are increasingly investing in affordable cloud-based BI solutions. The region’s expanding enterprise base and growing awareness of BI benefits contribute to accelerated market penetration.

Japan BI Vendors Market Insight

The Japan BI vendors market is gaining traction due to the country’s focus on technological innovation, digital transformation, and process optimization across industries. Enterprises are adopting BI solutions to improve operational efficiency, enable predictive analytics, and integrate data across multiple business functions. The growing demand for real-time insights and AI-powered analytics tools is further boosting adoption in both manufacturing and service sectors.

China BI Vendors Market Insight

The China BI vendors market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid digitalization, adoption of cloud and mobile analytics, and the rising importance of data-driven strategies among businesses. Enterprises in China are increasingly deploying BI for sales, marketing, supply chain optimization, and financial performance management. Government initiatives supporting smart cities and digital transformation, coupled with strong domestic and international BI vendors, are key factors propelling market growth.

Business Intelligence (BI) Vendors Market Share

The business intelligence (BI) vendors industry is primarily led by well-established companies, including:

- SAP SE (Germany)

- IBM (U.S.)

- Oracle (U.S.)

- Cisco Systems, Inc. (U.S.)

- Microsoft (U.S.)

- TABLEAU SOFTWARE, LLC, (U.S.)

- QlikTech International AB, (U.S.)

- fish, Inc. product. (U.S.)

- Mode Analytics, Inc. (U.S.)

- Looker (U.S.)

- Infor. (U.S.)

- ConnectWise. (U.S.)

- Hitachi Vantara LLC (U.S.)

- Sisense Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- MICROSTRATEGY INCORPORATED (U.S.)

- Cloud Software Group, Inc. (U.S.)

- Pegasystems Inc. (U.S.)

- Verizon (U.S.)

- RACKSPACE TECHNOLOGY (U.S.)

- AT&T Intellectual Property. (U.S.)

- Juniper Networks, Inc. (U.S.)

Latest Developments in Global Business Intelligence (BI) Vendors Market

- In June 2023, ThoughtSpot acquired Mode Analytics to expand its footprint in India and double its customer base. This acquisition strengthens ThoughtSpot’s AI-driven analytics offerings by integrating Mode Analytics’ BI capabilities, allowing enterprises to gain deeper insights and more sophisticated data visualization. The move enhances ThoughtSpot’s competitiveness in the rapidly growing Indian BI market, accelerates adoption of modern analytics solutions, and supports organizations in leveraging AI-powered decision-making across diverse industry verticals

- In May 2023, Qlik acquired Talend to enhance its data integration and management capabilities for modern enterprises. The acquisition enables organizations to transform, trust, access, and analyze data more efficiently, facilitating real-time, actionable insights. This expansion positions Qlik as a comprehensive BI solutions provider, strengthening its market share and encouraging enterprises to adopt integrated analytics platforms to support strategic decision-making, operational efficiency, and improved business performance

- In January 2023, Microsoft integrated Power BI with Microsoft Teams, introducing rich broadcast cards, updates for legacy Power BI tabs in Channels 2.0, and feedback-driven enhancements. The integration allows users to access analytics directly within collaboration platforms, improving real-time decision-making and streamlining workflows. This development drives greater adoption of Power BI by enhancing user engagement, enabling data-driven discussions, and reinforcing Microsoft’s leading position in the enterprise BI market

- In December 2022, Tableau launched the upgraded Tableau 2022.4, featuring automated insights tools such as Data Change Radar, Data Guide, and Explain the Viz. These enhancements simplify the creation, analysis, and communication of data stories, allowing business users and analysts to uncover actionable insights more efficiently. The upgrade strengthens Tableau’s market position by enabling faster decision-making, enhancing user productivity, and promoting broader adoption of advanced analytics solutions across enterprise functions

- In November 2022, Qlik launched a new cloud-based data integration platform combining cataloging and data preparation in a single environment. The platform enables real-time analytics, a unified data fabric, and seamless integration of multiple data sources, providing enterprises with a comprehensive view of their operations. This launch positions Qlik as a leader in cloud BI solutions, facilitates adoption of integrated, data-driven decision-making tools, and enhances operational efficiency across industries by enabling timely and accurate insights

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.