Global Business Travel Accident Insurance Market

Market Size in USD Million

CAGR :

%

USD

3.97 Million

USD

5.45 Million

2022

2030

USD

3.97 Million

USD

5.45 Million

2022

2030

| 2023 –2030 | |

| USD 3.97 Million | |

| USD 5.45 Million | |

|

|

|

|

Business Travel Accident Insurance Market Analysis and Size

Business travel accident insurance have become of high use across numerous businesses and corporations to decline the potential liability when their personnel travel. Business travel accident insurance majorly covers accidental death and dismemberment, along with medical benefits such as sickness. These policies may even be extended to include coverage for employees working on-site.

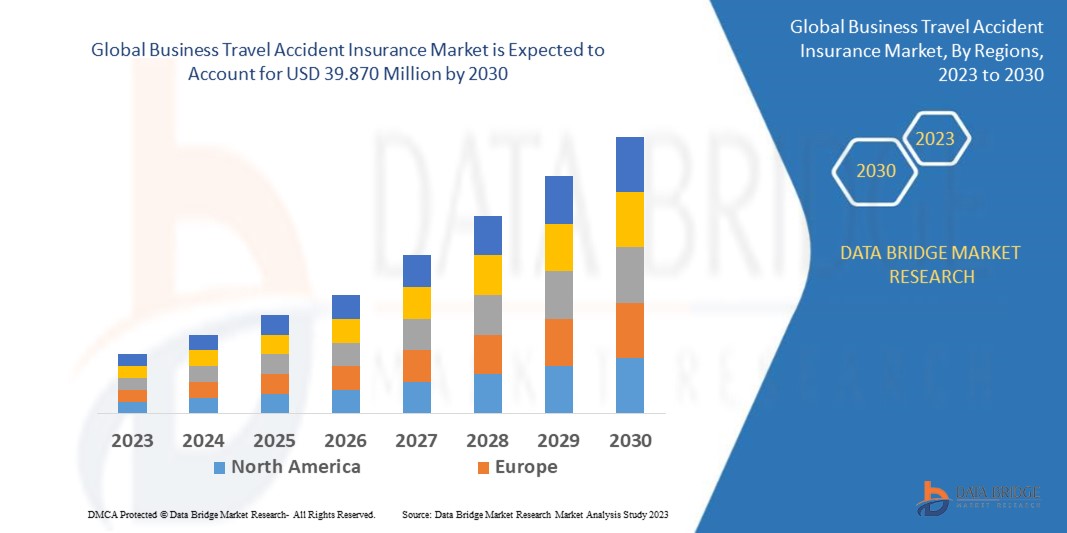

Data Bridge Market Research analyses that the global business travel accident insurance market which was USD 3.970 million in 2022, is expected to reach USD 39.870 million by 2030, and is expected to undergo a CAGR of 9.90% during the forecast period 2023-2030. This indicates the market value. “Annual Multi-Trip Coverage” accounts for the largest type segment in the respective market owing to the increase in prevalence of unforeseen diseases. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Business Travel Accident Insurance Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Single Trip Coverage, Annual Multi-Trip Coverage, Others), Distribution Channel (Insurance Company, Insurance Broker, Banks, Insurance Aggregators, Others), End User (Corporations, Government and International Travelers, Employees) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Assicurazioni Generali S.P.A. (Italy), MetLife Services and Solutions Inc. (India), Nationwide Mutual Insurance Company (U.S.), AWP Australia Pty Ltd. (Australia), AXA (France), American International Group, Inc. (U.S.), Chubb (Switzerland), Tokio Marine Holdings, Inc. (Japan), Woodward Markwell Insurance Brokers (U.K.), The Hartford (U.S.), Tata AIG General Insurance Company Limited (India), and Starr International Company Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Business travel accident insurance have become of high use across numerous businesses and corporations to decline the potential liability when their personnel travel. Business Travel Accident Insurance majorly covers accidental death and dismemberment, along with medical benefits such as sickness. These policies may even be extended to include coverage for employees working on-site.

Global Business Travel Accident Insurance Dynamics

Drivers

- Unexpected Emergency Medical Evacuation

The rise in the demand for business travel accident (BTA) insurance as it offers security and safety during unexpected emergency medical evacuation for employees acts as one of the major factors driving the global business travel accident insurance market. This covers companies against financial uncertainties that may arise from unfortunate instances such as accidents, baggage, flight cancellation, injuries and loss of baggage.

- Global Economic Growth

The rise in the economic growth along with transformation of trade practices accelerate the market growth. The increase in popularity of price comparison applications and websites and trend of multi-trip policies have positive impact on the market.

Opportunities

- Adoption of Digital Tools

Furthermore, adoption of digital tools, such as artificial intelligence (AI), and application program interface (API) extend profitable opportunities to the market players in the forecast period of 2023-2030. Also, increase in spending of business on different types of insurance will further expand the market.

Restraints/Challenges

- High Cost

On the other hand, high cost associated with the quality business travel accident insurance is expected to obstruct market growth. Also, lack of awareness among business owners toward travel insurance policy is projected to challenge the global business travel accident insurance market in the forecast period of 2023-2030.

This global business travel accident insurance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on global business travel accident insurance market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In June 2022, Hexagon, a multibillion dollar market leader in sensor, software, and digital reality solutions, is supporting start-ups to boost productivity and ESG. Hexagon Manufacturing Intelligence Division awarded SmartParts and RIIICO recognition. The manufacturing sector's efficiency and sustainability will rise thanks to the open innovation platform's assistance in scaling startups and expanding connectivity with top-tier businesses

- In June 2022, Construct Helix was introduced by Bentley Acceleration Initiatives, the company's internal incubator for strategic investments. Bentley Systems is a provider of infrastructure engineering software. By offering SaaS solutions that will enable a connected data environment, it is specifically designed to digitalize the flow of construction project workflows

Global Business Travel Accident Insurance Scope

The global business travel accident insurance market is segmented on the basis of type, distribution channel and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Single Trip Coverage

- Annual Multi-Trip Coverage

- Others

Distribution Channel

- Insurance Company

- Insurance Broker

- Banks

- Insurance Aggregators

- Others

End User

- Corporations

- Government

- International Travelers

- Employees

Global Business Travel Accident Insurance Market Regional Analysis/Insights

The global business travel accident insurance market is segmented on the basis of type, distribution channel and end user as referenced above.

The countries covered in the global business travel accident insurance market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe dominates the global business travel accident insurance market due to the rise in expansion of businesses and large market share of the UK and Germany.

Asia-Pacific (APAC) is expected to witness significant growth during the forecast period of 2023-2030 because of the surge in investments and increase in travel in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Business Travel Accident Insurance Market Share Analysis

The global business travel accident insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to business travel insurance market.

Some of the major players operating in global business travel accident insurance market are

- Assicurazioni Generali S.P.A. (Italy)

- MetLife Services and Solutions Inc. (India)

- Nationwide Mutual Insurance Company (U.S.)

- AWP Australia Pty Ltd. (Australia)

- AXA (France)

- American International Group, Inc. (U.S.)

- Chubb (Switzerland)

- Tokio Marine Holdings, Inc. (Japan)

- Woodward Markwell Insurance Brokers (U.K.)

- The Hartford (U.S.)

- Tata AIG General Insurance Company Limited (India)

- Starr International Company Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.