Global Busway Market

Market Size in USD Million

CAGR :

%

USD

9,653.18 Million

USD

14,731.02 Million

2024

2032

USD

9,653.18 Million

USD

14,731.02 Million

2024

2032

| 2025 –2032 | |

| USD 9,653.18 Million | |

| USD 14,731.02 Million | |

|

|

|

|

Busway Market Size

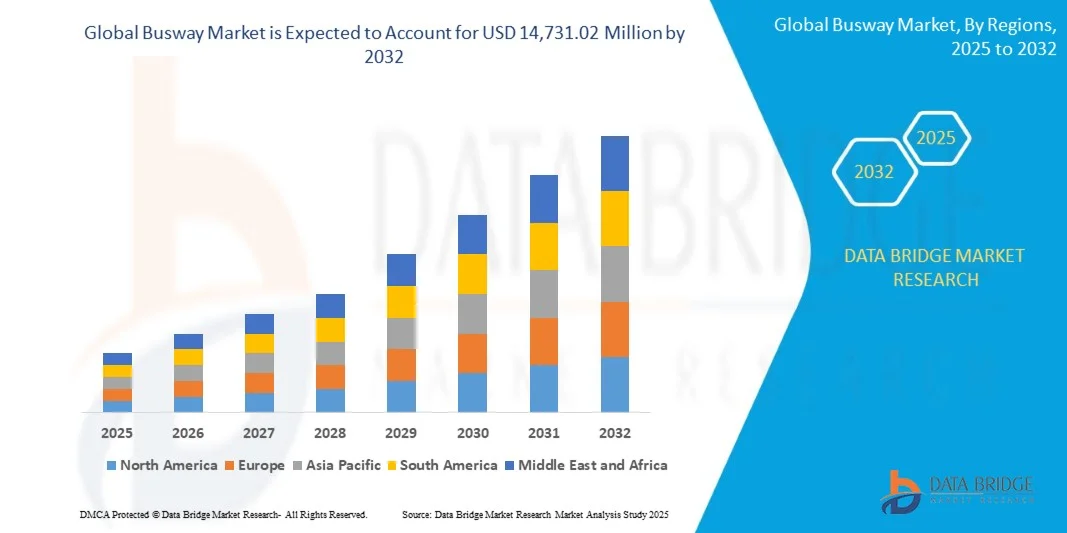

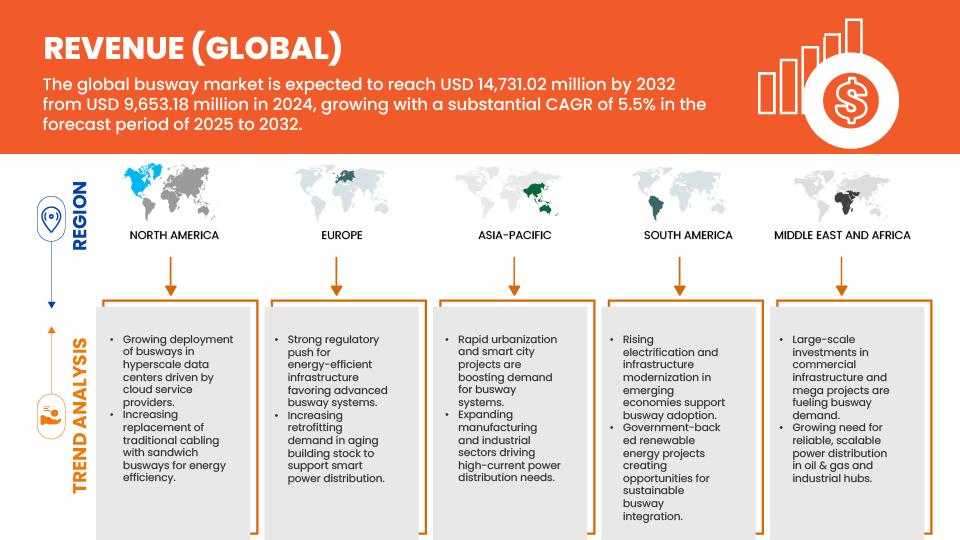

- The Global Busway Market was valued at USD 9,653.18 Million in 2024 and is expected to reach USD 14,731.02 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.5%, primarily driven by increasing demand for energy-efficient distribution systems.

- This growth is driven by factors such as the integration of electrical systems in industrial automation further support market expansion.

Busway Market Analysis

- The Busway Market is experiencing robust global growth, increasing demand for energy-efficient distribution systems, rising construction of commercial and industrial facilities, and the push for modernization of aging power infrastructure. The shift towards smart buildings, adoption of renewable energy sources, and the integration of electrical systems in industrial automation further support market expansion. However, market expansion is challenged by high initial costs, complex retrofitting in legacy systems, and compliance with regional electrical codes and standards such as IEC, NEC, and UL.

- Emerging trends include the development of smart busway systems integrated with sensors and IoT for real-time monitoring, demand-driven energy distribution, and predictive maintenance. The global market continues to witness investment in R&D, product innovations, and strategic collaborations aimed at enhancing system reliability, safety, and scalability.

- Asia-Pacific dominated the Global Busway Market with the market share of 40.88% in 2024, due to by growing demand for enhanced material properties, cost-efficiency, and increasing adoption in various industrial applications

- North America is the fastest growing region for Global Busway market with a CAGR of 6.3% during the forecast period, fueled by growing demand for enhanced material properties, cost-efficiency, and increasing adoption in various industrial applications

- The Product segment dominated the market with a 79.18% market share in 2024, driven by growing demand for enhanced material properties, cost-efficiency, and increasing adoption in various industrial applications.

Report Scope and Busway Market Segmentation

|

Attributes |

Busway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Busway Market Trends

“Rising deployment of busways in data centers and cloud facilities”

- One prominent trend in the Global Busway Market is the data centers and hyperscale cloud facilities has brought new attention to the reliability and flexibility of power distribution infrastructure.

- The shift has been further encouraged by cloud giants Such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, whose global expansion strategies involve building and upgrading hundreds of high-density facilities.

- For instance, in May 2025, Renyun (Hunan) Busbar Co., Ltd. recently hosted a valued customer at its headquarters, marking another milestone in the company’s commitment to building strong, long-term partnerships. The visit included a guided tour of Renyun’s state-of-the-art manufacturing facilities, where the customer observed advanced production processes, rigorous quality testing, and innovative product designs. In-depth discussions focused on ongoing projects, performance feedback, and opportunities for future cooperation. The event highlighted the mutual benefits of close collaboration, reinforcing Renyun’s dedication to delivering high-quality solutions and fostering customer success in both domestic and international markets.

- Data centers, where uptime is non-negotiable, busways are being integrated to provide streamlined and reconfigurable power delivery, allowing operators to scale infrastructure without extended downtime. Their plug-and-play nature has been valued for enabling quick rack power connections and supporting dynamic load shifts—needs that have become common in both hyperscale and edge computing scenarios.

- The World Bank’s energy development programs further highlight how electrification is being linked with sustainable industrial growth in emerging economies. In smart industrial zones and government-led infrastructure corridors, busways are being considered as part of low-voltage distribution strategies—particularly where speed, flexibility, and long-term safety are required.

Busway Market Dynamics

Driver

“Increasing electrification in developing countries”

- One of the key trends propelling the Global Busway Market is the growing push for electrification in developing countries is reshaping how energy infrastructure is designed, built, and maintained

- The ongoing wave of industrial modernization, including smart manufacturing, renewable energy projects, and urban development initiatives, is driving consistent demand for Busway in equipment fabrication, structural components, and fluid handling systems.

- For instance, in April 2024 as described by Reuters, cities in Latin America such as Bogota, Santiago, and São Paulo have been transitioning toward electric buses, backed by local public‐private initiatives Such as Drive Electric and ZEBRA. Electrification infrastructure has thus been deployed in dense urban corridors, reflecting the growing preference for scalable, safe distribution systems in developing city contexts.

- As electrification efforts continue to expand across developing regions, a shift toward modular, efficient, and scalable power distribution has been clearly observed. Busway systems have been increasingly favored in these settings not only for their ease of installation and safety, but also for their ability to adapt to evolving infrastructure needs in fast-growing urban and industrial environments.

- A report by the United Nations’ Sustainable Energy for All (SEforALL) initiative echoes this direction, noting that modern electrification efforts are no longer limited to grid expansion alone. Instead, integrated power distribution solutions, including busways, are being deployed in utility-scale, microgrid, and off-grid systems to support both reliability and efficiency as access improves.

Opportunity

“Smart Infrastructure & Digital Integration”

- Smart Infrastructure and Digital Integration is emerging as a pivotal driver of growth in the global busway market. As cities and industries increasingly adopt smart technologies to improve energy efficiency, safety, and operational transparency, there is a growing demand for intelligent power distribution systems.

- Busways, traditionally used for reliable and compact power transmission, are now being enhanced with digital capabilities such as IoT-based sensors, real-time monitoring, and integration with building automation systems (BAS). These features enable predictive maintenance, remote diagnostics, and precise energy management, aligning perfectly with the goals of smart infrastructure.

- For instance, in July 2025, According to Saudi Shopper, An event in Riyadh, Saudi Arabia, showcased a modular busway system from Vertiv, a global leader in critical digital infrastructure. The event highlighted the system's design for "flexible and high-efficiency power delivery in data centre and industrial environments." This demonstrates how busways are being developed and marketed as a key component of modern, high-density digital infrastructure.

- Furthermore, busway systems support modular, plug-and-play configurations, making them ideal for dynamic environments such as commercial buildings, data centers, and smart factories. Their compatibility with renewable energy systems and smart grids—where flexible, bidirectional power flow is essential—further strengthens their role in next-generation infrastructure.

- The alignment of Busway with global green initiatives is not only opening new end-use verticals but also fostering collaborative innovations between steelmakers and clean-tech industries. This integration is expected to expand Busway's relevance in the global transition toward net-zero emissions, boosting long-term market growth.

Restraint/Challenge

“High initial installation and material costs compared to conventional cabling”

- The Busway Market is significantly impacted by the higher installation costs and premium material pricing have been perceived as initial deterrents when compared to traditional cable-based systems. While long-term operational efficiency, reduced downtime, and easier maintenance are commonly cited advantages of busways, these benefits have frequently been overlooked in budget-constrained environments where capital expenditure is closely scrutinized.

- A lack of universally accepted performance benchmarks, cost-to-benefit metrics, and lifecycle-based return models has made it difficult for engineers and planners to conduct accurate cost comparisons with conventional cabling. As a result, long-term economic advantages of busways have often remained underrepresented during procurement discussions.

- For instance, in June 2025, a cost analysis report titled "Busway vs Cable Tray: Power Distribution Cost Analysis" highlights that the initial installation costs of busways are higher due to the need for specialized components and installation precision, compared to traditional cable trays and conduits. It further notes that these costs can be justified when long-term operational flexibility, modularity, and easier reconfiguration are prioritized

- The long-term performance benefits and reduced maintenance associated with busway systems, adoption in many regions has been slowed by the high initial capital outlay required for installation and materials. These upfront costs have often been viewed as barriers, particularly in price-sensitive sectors or retrofit projects. Without standardized ROI benchmarks or consistent cost-justification frameworks, stakeholders have been hesitant to transition from conventional cabling.

- Decision-makers in such industries have generally prioritized immediate uptime and cost containment over long-term infrastructural agility. As a result, innovations Such as intelligent busway monitoring, plug-in configurations, and integrated fault-detection have seen limited uptake in these sectors, despite their advantages.

Global Busway Market Scope

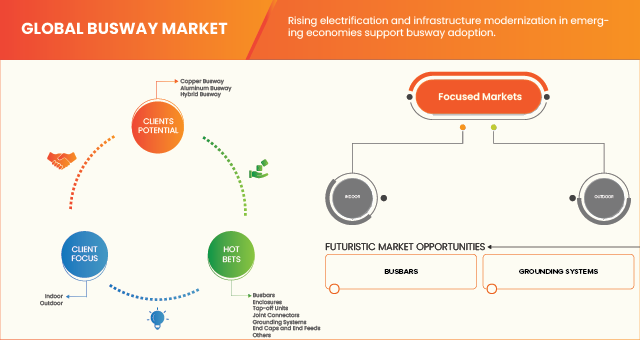

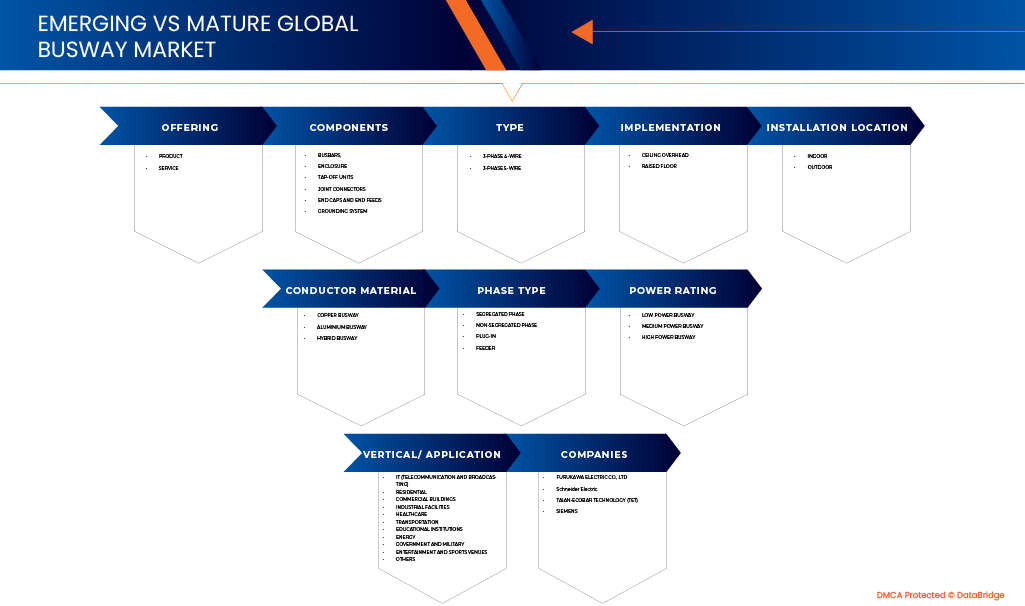

The market is segmented on the basis of offering, components, type, implementation, installation location, conductor material, phase type, power rating, application.

- Offering

On the basis of Offering, the market is segmented into product and service. In 2025, the Product segment is expected to dominate the market with a share of 79.24% and is projected to grow with the highest CAGR of 5.6% during the forecast period. This dominance is driven by the rising demand for reliable, energy-efficient, and low-maintenance power distribution solutions, particularly in industrial and commercial environments where continuous operation is essential. Products like busways offer superior performance over traditional systems, driving their rapid adoption and consistent market growth.

- Components

On the basis of Components, the market is segmented into busbars, enclosure, tap-off units, joint connectors, end caps and end feeds, and grounding system. In 2025, the Busbars segment is expected to dominate with a market share of 42.14% and is projected to grow with the highest CAGR of 6.4%. Busbars play a critical role in efficient current conduction, scalability, and reducing power loss, especially in high-load applications. Their compact design, high conductivity, and durability make them indispensable in both new and retrofitted electrical systems, driving their rapid adoption and consistent market growth.

- Type

On the basis of Type, the market is segmented into 3-phase 4-wire and 3-phase 5-wire. In 2025, the 3-Phase 4-Wire segment is expected to dominate the market with a share of 59.80% and is projected to grow with the highest CAGR of 5.9%. This type is widely preferred for its cost-effectiveness, ease of implementation, and compatibility with diverse industrial and commercial systems. Its efficient distribution capability for both balanced and unbalanced loads makes it a standard choice, driving its rapid adoption and consistent market growth.

- Implementation

On the basis of Implementation, the market is segmented into ceiling overhead and raised floor. In 2025, the Ceiling Overhead segment is expected to dominate with a share of 59.80% and is projected to grow with the highest CAGR of 5.9%. Overhead installation offers several advantages, including reduced floor space usage, improved safety, and simplified system accessibility for maintenance. These factors are increasingly important in space-constrained or high-traffic facilities, driving their rapid adoption and consistent market growth.

- Installation Location

On the basis of Installation Location, the market is segmented into indoor and outdoor. In 2025, the Indoor segment is expected to dominate the market with a share of 79.65% and is projected to grow with the highest CAGR of 5.7%. This dominance is attributed to the increasing demand for compact, safe, and efficient power distribution systems in modern infrastructures such as commercial buildings, residential complexes, and industrial plants. Indoor systems reduce exposure to environmental hazards, driving their rapid adoption and consistent market growth.

- Conductor Material

On the basis of Conductor Material, the market is segmented into copper busway, aluminium busway, and hybrid busway. In 2025, the Copper Busway segment is expected to dominate with a market share of 56.85%, while the Aluminum Busway segment is projected to grow with the highest CAGR of 5.7% by 2032. Copper remains dominant due to its excellent conductivity, reliability, and fire resistance, particularly in critical applications. However, aluminum is gaining traction for its lightweight structure and cost-effectiveness, especially in commercial and manufacturing setups, driving their rapid adoption and consistent market growth.

- Phase Type

On the basis of Phase Type, the market is segmented into segregated phase, non-segregated phase, plug-in, and feeder. In 2025, the Non-Segregated Phase segment is expected to dominate the market with a share of 50.57% and is projected to grow with the highest CAGR of 5.8%. This type is favored for its compact design, simplified structure, and lower installation costs, making it suitable for standard industrial and commercial operations. Its affordability and performance make it an attractive choice, driving its rapid adoption and consistent market growth.

- By Power Rating

On the basis of Power Rating, the market is segmented into low power busway, medium power busway, and high-power busway. In 2025, the Medium Power Busway segment is expected to dominate the market with a share of 52.19% and is projected to grow with the highest CAGR of 5.8%. Its ability to balance cost, performance, and scalability makes it suitable for a wide range of environments—from commercial complexes to light industrial facilities—driving its rapid adoption and consistent market growth.

- By Application

On the basis of Application, the market is segmented into industrial facilities, commercial buildings, IT (telecommunication and broadcasting), energy, healthcare, transportation, residential, government and military, education institutes, entertainment and sports venues, and others. In 2025, the Industrial Facilities segment is expected to dominate with a market share of 28.53% and is projected to grow with the highest CAGR of 6.1%. The rising demand for high-capacity, reliable, and efficient power distribution systems in industries such as manufacturing, automotive, and processing is accelerating the use of advanced busway systems, driving their rapid adoption and consistent market growth.

Busway Market Regional Analysis

- Asia-Pacific dominated the global busway market with the market share of 40.88% in 2024, due to by growing demand for enhanced material properties, cost-efficiency, and increasing adoption in various industrial applications

- North America is the fastest growing region for Global Busway market with a CAGR of 6.3% during the forecast period, fueled by growing demand for enhanced material properties, cost-efficiency, and increasing adoption in various industrial applications

- In developed regions such as North America and Europe, the busway market is mature and characterized by early adoption of intelligent and digitalized power distribution technologies. These markets benefit from stringent energy regulations and the need to upgrade aging electrical infrastructure. In contrast, emerging markets across Asia-Pacific, Latin America, the Middle East, and Africa are experiencing rapid industrialization and urbanization, which is driving demand for flexible and high-capacity power delivery systems. Global trends such as smart cities, data center expansion, electric vehicle infrastructure, and renewable energy integration are further fueling the demand for busway solutions worldwide. As a result, the global busway market is expected to witness steady growth, supported by innovation, regulatory backing, and the need for resilient, future-ready power systems.

Europe Busway Market Insight

The Europe busway market is expected to grow at a CAGR of 5.4% from 2025 to 2032, primarily driven by demand for enhanced material properties, cost-efficiency, and growing adoption of modular busway systems across industries like automotive, data centers, and manufacturing.

U.K. Busway Market Insight

The U.K. busway market is projected to register a Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period from 2025 to 2032. This growth is primarily driven by the country’s rapid industrialization, which continues to increase the demand for efficient and scalable power distribution solutions within factories and production units.

Germany Busway Market Insight

The Germany busway market is anticipated to grow at a CAGR of 6.0% between 2025 and 2032, positioning the country as one of the fastest-growing markets in Europe. This robust growth can be attributed to accelerating urbanization and increasing investments in infrastructure modernization, including upgrades to existing buildings, factories, and transportation systems.

North America Busway Market Insight

The North America busway market is expected to register the CAGR of 6.3% from 2025 to 2032, driven by growing demand for lightweight, durable materials across industries and increasing focus on recyclable and sustainable busway

U.S. Busway Market Insight

The U.S. busway market remains the largest contributor to market growth, driven by rapid deployment in data centers, healthcare, and commercial real estate. U.S. is the expected to be the fastest growing with CAGR 6.5% from 2025 to 2032, owing to smart plug-in busways integrated with IoT-based monitoring systems.

Canada Busway Market Insight

The Canada busway market is projected to register a compound annual growth rate (CAGR) of 6.0% from 2025 to 2032 in the North America. This growth is primarily driven by the rapid pace of industrialization, particularly in provinces with strong manufacturing and energy sectors such as Ontario, Alberta, and Quebec. Additionally, the launch of large-scale infrastructure modernization projects, including smart buildings, transportation networks, and green energy initiatives, is increasing demand for efficient, scalable, and low-maintenance power distribution systems like busways. The strong manufacturing base, coupled with Canada's growing commitment to sustainability and energy efficiency, is further accelerating the adoption of advanced busway systems across various end-use industries, including commercial, industrial, and institutional facilities

Asia-Pacific Busway Market Insights

The Asia-Pacific busway market is expected to register the CAGR of 5.1% from 2025 to 2032, driven by rapid industrialization, urban infrastructure development, and increased government investment in clean energy and smart cities.

China Busway Market Insight

The China busway market is expected to register a compound annual growth rate (CAGR) of 5.1% from 2025 to 2032 in the Asia-Pacific busway market. This growth is primarily driven by the increasing demand for advanced material properties, such as higher thermal conductivity, improved insulation, and greater durability in power distribution systems. As China continues to expand its manufacturing base and modernize its industrial infrastructure, there is a strong shift toward more efficient, scalable, and reliable electrical distribution systems — with busways emerging as a preferred choice over traditional cabling solutions.

India Busway Market Insight

The India busway market is anticipated to record the fastest growth in the busway market in the Asia-Pacific region, with a projected CAGR of 5.9% from 2025 to 2032. This robust growth is being fueled by multiple transformative trends, including rapid urbanization, infrastructure modernization, and increased investments in smart cities and industrial corridors. As India’s urban population grows, there is a surging need for efficient and space-saving power distribution solutions across commercial buildings, residential complexes, airports, metros, and hospitals — areas where busways offer superior flexibility and energy efficiency.

Busway Market Share

The busway industry is primarily led by well-established companies, including

- Furukawa Electric Co., Ltd. (Japan)

- Schneider Electric SE (France)

- TAIAN‑ECOBAR TECHNOLOGY CO., LTD. (Taiwan)

- Siemens AG (Germany)

- LS Electric (South Korea)

- Eaton Corporation plc (Ireland)

- ABB Ltd. (Switzerland)

- Dingsheng Group Co., Ltd. (China)

- RITTAL GmbH & Co. KG (Germany)

- Vertiv Holdings Co. (U.S.)

- Powell Industries (U.S.)

- Elsewedy Electric (Egypt)

- Lapp Connecto Oy (Finland)

- LEGRAND SA (France)

- Tai Sin Electric Limited (Hong Kong)

- Panduit Corp (U.S.)

- ANORD MARDIX (U.K.)

- Busway Electric India Private Limited (India)

- Furutec Electrical Sdn. Bhd. (Malaysia)

- Delta Electronics, Inc. (Taiwan)

- Zhenjiang Sunshine Electric Group Co., Ltd. (China)

- Power Plug Busduct Sdn. Bhd. (Malaysia)

- Chatsworth Products (U.S.)

- Renyun (China)

- Ohory Electric Busway (China)

- 2Melectricgroup (Egypt)

- Bahra Cables Company (India)

- Wetown (China)

- EAE Inc. (Turkey)

- Megabarre Group, Ltd. (Brazil)

- Elcom International (India)

Latest Developments in Global Busway Market

- In 2025, Schneider Electric in its Busway Systems Overview, the company recommends sandwich busway designs for demanding applications such as manufacturing plants, high-rise towers, and data centers due to their thermal performance, fire resistance, and space efficiency.

- In 2025, Siemens has further noted that its SENTRON sandwich busway systems are being applied in critical facilities such as data centers and automotive manufacturing units, where operational continuity and high electrical loads are essential. The compact structure and high fault tolerance of sandwich busways were highlighted as key reasons for adoption in these high-density layouts.

- In July 2025, According to Saudi Shopper, An event in Riyadh, Saudi Arabia, showcased a modular busway system from Vertiv, a global leader in critical digital infrastructure. The event highlighted the system's design for "flexible and high-efficiency power delivery in data centre and industrial environments." This demonstrates how busways are being developed and marketed as a key component of modern, high-density digital infrastructure

- In June 2025, Singapore’s Keppel Corporation entered into a USD 1.5 billion partnership with the Asian Infrastructure Investment Bank (AIIB) to fund sustainable infrastructure projects across the Asia Pacific region—targeting renewable energy and power transmission/distribution systems for energy-intensive facilities like data centers. These scalable electrification frameworks mirror the principles behind modular busway deployment.

- In January 2025, the U.S. federal government boosted grid modernization efforts by mobilizing approximately USD 8 billion in federal funding to support over 100 transmission projects aimed at addressing growing demand from data centers and renewables. The emphasis on efficient, resilient power delivery underlines the demand for modular, scalable systems such as busways.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Busway Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Busway Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Busway Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.