Global Buyer Oriented Business To Business E Commerce Market

Market Size in USD Billion

CAGR :

%

USD

13.39 Billion

USD

42.13 Billion

2025

2033

USD

13.39 Billion

USD

42.13 Billion

2025

2033

| 2026 –2033 | |

| USD 13.39 Billion | |

| USD 42.13 Billion | |

|

|

|

|

Buyer Oriented Business-to-Business E-Commerce Market Size

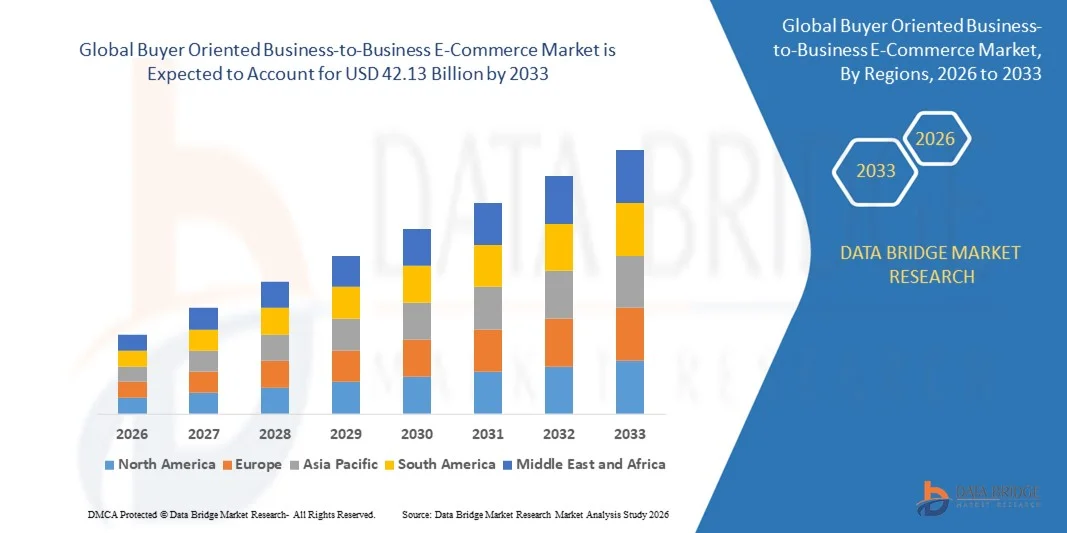

- The global buyer oriented business-to-business e-commerce market size was valued at USD 13.39 billion in 2025 and is expected to reach USD 42.13 billion by 2033, at a CAGR of 15.40% during the forecast period

- The market growth is largely fuelled by the increasing shift of enterprises toward digital procurement platforms that streamline purchasing, enhance transparency, and reduce operational costs

- Rising adoption of automated purchasing systems such as AI-driven recommendation engines and cloud-based procurement tools is further supporting market expansion

Buyer Oriented Business-to-Business E-Commerce Market Analysis

- The buyer oriented business-to-business e-commerce market is witnessing robust growth as companies increasingly prioritize digital procurement ecosystems that offer efficiency, flexibility, and improved supplier management

- The integration of advanced technologies such as AI, machine learning, and analytics is transforming purchasing operations, enabling enterprises to optimize sourcing decisions and enhance overall procurement effectiveness

- North America dominated the buyer oriented business-to-business e-commerce market with the largest revenue share of 38.50% in 2025, driven by the rapid adoption of digital procurement platforms, high internet penetration, and the presence of technologically advanced enterprises

- Asia-Pacific region is expected to witness the highest growth rate in the global buyer oriented business-to-business e-commerce market, driven by rapid urbanization, expanding manufacturing and industrial sectors, government initiatives promoting digitalization, and increased adoption of cloud-based and AI-enabled procurement solutions across enterprises

- The Net Banking segment held the largest market revenue share in 2025, driven by its convenience, secure transaction capabilities, and widespread adoption among enterprises for bulk payments. Net banking allows seamless integration with corporate accounts, enabling faster processing of high-value transactions and better cash flow management

Report Scope and Buyer Oriented Business-to-Business E-Commerce Market Segmentation

|

Attributes |

Buyer Oriented Business-to-Business E-Commerce Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Alibaba Group Holding Limited (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Buyer Oriented Business-to-Business E-Commerce Market Trends

Rise of Digital Procurement Platforms and Automated Purchasing

- The growing shift toward digital procurement platforms is transforming the B2B e-commerce landscape by enabling real-time, streamlined purchasing and improved supply chain efficiency. These platforms allow buyers to manage orders, track shipments, and make informed purchasing decisions instantly, reducing operational delays and errors. In addition, they provide better visibility into spend analytics, helping enterprises identify cost-saving opportunities and negotiate favorable supplier contracts. The centralized control offered by these systems also enhances compliance and audit readiness across the organization

- The high demand for automated purchasing in large enterprises is accelerating the adoption of AI-driven recommendation engines, cloud-based procurement tools, and integrated supplier management systems. These solutions are particularly effective where multiple vendors and large transaction volumes are involved, helping reduce procurement cycle times. They also improve supplier collaboration, track supplier performance metrics, and support predictive ordering to avoid stockouts or overstock situations. The automation of repetitive tasks frees up procurement teams to focus on strategic sourcing initiatives and value-added activities

- The affordability, scalability, and ease of integration of modern B2B e-commerce platforms are making them attractive for routine enterprise procurement, leading to improved cost management and operational efficiency. Companies benefit from centralized systems that simplify supplier interactions and reduce manual intervention. Integration with ERP and finance systems ensures seamless data flow, allowing for faster invoice processing, enhanced payment accuracy, and improved cash flow management. Moreover, modular platform designs allow businesses to scale functionalities as their procurement needs grow

- For instance, in 2024, several manufacturing conglomerates in Europe reported a significant reduction in procurement lead times and administrative costs after implementing AI-powered B2B e-commerce platforms. These systems allowed for automated purchase approvals, vendor tracking, and analytics-driven decision-making. Companies also observed higher supplier satisfaction and better contract compliance due to consistent monitoring and reporting capabilities. The platforms facilitated smoother cross-border transactions, supporting global supply chain efficiency

- While digital B2B procurement is accelerating efficiency and supporting strategic sourcing, its impact depends on continued technological innovation, user training, and system interoperability. Platform providers must focus on localized solutions and flexible deployment strategies to fully capitalize on this growing demand. Continuous platform updates and AI enhancements are essential to meet evolving enterprise needs, while dedicated training programs ensure employees can maximize system capabilities for better procurement outcomes

Buyer Oriented Business-to-Business E-Commerce Market Dynamics

Driver

Increasing Adoption of Digital Procurement Solutions and Enterprise Automation

- The rising need for operational efficiency, cost reduction, and supplier visibility is driving strong adoption of buyer oriented B2B e-commerce platforms. Enterprises are leveraging automated tools to optimize sourcing, reduce errors, and improve supplier performance. These platforms also enhance procurement planning through predictive analytics and AI-driven recommendations, allowing companies to anticipate demand and streamline inventory management. Integration with supplier portals improves communication, contract compliance, and dispute resolution

- Companies are increasingly aware of the financial risks associated with inefficient procurement, including delayed deliveries, inflated costs, and compliance issues. This awareness is encouraging the widespread use of digital platforms for both small and large enterprises. Digital procurement systems also facilitate better risk management by monitoring supplier performance, flagging potential disruptions, and enabling contingency planning. With improved data transparency, companies can enforce consistent procurement policies and strengthen internal controls

- Government initiatives and industry standards are strengthening the demand for transparent, traceable, and secure digital procurement systems. Supportive frameworks related to data security and compliance are encouraging businesses to shift from manual to digital purchasing methods. Platforms that comply with international standards such as ISO and GDPR gain higher adoption due to trust and reliability. In addition, governments and industry associations often provide incentives for enterprises adopting automated procurement solutions, further boosting market growth

- For instance, in 2023, several European and North American enterprises implemented AI-powered B2B procurement platforms, resulting in faster order processing, improved supplier management, and measurable cost savings. Enhanced reporting capabilities allowed companies to identify inefficiencies and implement corrective measures quickly. The platforms also supported collaborative supplier negotiations and improved long-term supplier relationships through performance dashboards and analytics

- While enterprise awareness and institutional support are driving market growth, there is still a need to enhance digital literacy, ensure platform affordability, and integrate AI and analytics into routine procurement processes to maintain long-term adoption. Continuous investment in employee training, platform optimization, and cybersecurity measures is critical. Providers must also offer scalable and flexible solutions that can adapt to changing market conditions and enterprise requirements

Restraint/Challenge

High Cost of Advanced Digital Platforms and Limited Access for SMEs

- The high investment required for advanced B2B e-commerce platforms, including AI-powered procurement systems, makes them less accessible for small and mid-sized enterprises. High setup and subscription costs remain major barriers to widespread adoption. In addition, ongoing maintenance, customization, and licensing fees add to the total cost of ownership, deterring SMEs from transitioning from traditional procurement methods. Many smaller enterprises continue to rely on manual processes due to budget constraints

- In many regions, limited technical expertise and insufficient digital infrastructure hinder the adoption of complex e-commerce solutions. Companies often face challenges in integrating these platforms with legacy systems, reducing operational effectiveness. Lack of trained IT personnel and limited access to reliable internet or cloud services further slows adoption, particularly in developing economies. Companies may also struggle with data migration, system downtime, and compatibility issues during implementation

- Market penetration is also restricted by uneven internet access, cybersecurity concerns, and inconsistent availability of skilled IT support. These limitations often force enterprises to rely on traditional procurement methods, resulting in inefficiencies. Security breaches, data privacy concerns, and compliance risks can also discourage adoption, especially among SMEs with limited IT budgets. These challenges necessitate robust support frameworks and affordable, secure solutions to expand reach

- For instance, in 2023, surveys across Southeast Asia revealed that over 65% of SMEs were unable to implement automated B2B e-commerce platforms due to high costs and lack of technical resources. Many reported delays in digital transformation initiatives, missed procurement efficiencies, and continued reliance on manual order processing. The lack of local support and training programs further compounded adoption barriers

- While digital procurement technologies continue to advance, solving cost, access, and technical challenges is essential. Platform providers must focus on scalable, user-friendly, and affordable solutions to expand adoption and unlock long-term market potential. Continuous innovation, modular platform design, and regional support networks can help overcome these barriers and promote wider adoption among enterprises of all sizes

Buyer Oriented Business-to-Business E-Commerce Market Scope

The market is segmented on the basis of payment method, platform type, application, and end users.

- By Payment Method

On the basis of payment method, the buyer oriented business-to-business e-commerce market is segmented into Net Banking, Credit Card, Debit Card, e-Wallet, and Others. The Net Banking segment held the largest market revenue share in 2025, driven by its convenience, secure transaction capabilities, and widespread adoption among enterprises for bulk payments. Net banking allows seamless integration with corporate accounts, enabling faster processing of high-value transactions and better cash flow management.

The Credit Card segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ease of use, instant payment processing, and ability to support automated reconciliation in procurement systems. Credit card payments are particularly popular among enterprises for smaller, frequent purchases, providing flexibility and improved tracking of operational expenses.

- By Platform Type

On the basis of platform type, the market is segmented into Cloud and On-Premise. Cloud-based B2B e-commerce platforms held the largest share in 2025, owing to their scalability, lower upfront costs, and ease of integration with existing enterprise systems. Cloud platforms also enable remote access, real-time updates, and centralized data management, making them ideal for large organizations with distributed operations.

On-Premise solutions are expected to witness substantial growth during the forecast period, driven by enterprises requiring greater control over data security, customization, and compliance with internal IT policies. On-premise platforms are particularly favored by regulated industries such as healthcare, automotive, and industrial sectors.

- By Application

On the basis of application, the market is segmented into Home and Kitchen, Consumer Electronics, Industrial and Science, Healthcare, Clothing, Beauty and Personal Care, Sports Apparels, Books and Stationary, Automotive, and Others. The Industrial and Science segment held the largest revenue share in 2025, driven by high-volume procurement needs, complex supply chains, and the adoption of digital procurement platforms to optimize sourcing efficiency.

The Healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, owing to increasing automation of medical supplies procurement, regulatory compliance requirements, and the adoption of cloud-based platforms to streamline purchasing processes.

- By End Users

On the basis of end users, the market is segmented into Small and Medium Enterprise and Large Enterprise. The Large Enterprise segment held the largest market share in 2025, fueled by extensive procurement needs, higher digital adoption, and investments in AI-enabled procurement platforms for cost optimization and supplier management.

The Small and Medium Enterprise segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing awareness of digital procurement benefits, affordability of cloud-based platforms, and the growing need to streamline supply chain and procurement operations for competitive advantage.

Buyer Oriented Business-to-Business E-Commerce Market Regional Analysis

- North America dominated the buyer oriented business-to-business e-commerce market with the largest revenue share of 38.50% in 2025, driven by the rapid adoption of digital procurement platforms, high internet penetration, and the presence of technologically advanced enterprises

- Businesses in the region highly value the efficiency, transparency, and cost-saving benefits offered by B2B e-commerce platforms, including real-time order tracking, automated approvals, and integrated supplier management systems

- This widespread adoption is further supported by strong digital infrastructure, a high concentration of large enterprises, and increasing demand for cloud-based procurement solutions, establishing digital B2B platforms as a preferred choice for enterprise purchasing

U.S. Buyer Oriented Business-to-Business E-Commerce Market Insight

The U.S. B2B e-commerce market captured the largest revenue share in 2025 within North America, fueled by the swift adoption of AI-enabled procurement systems and the growing trend of enterprise automation. Companies are increasingly prioritizing digital procurement to optimize supply chains, reduce operational costs, and enhance supplier collaboration. The rising integration of cloud-based platforms with ERP and finance systems further strengthens the market, enabling faster processing, improved cash flow management, and analytics-driven purchasing decisions.

Europe Buyer Oriented Business-to-Business E-Commerce Market Insight

The Europe B2B e-commerce market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent corporate governance standards, regulatory compliance requirements, and growing digital adoption across enterprises. Increasing industrialization, the rise of SMEs, and the push for streamlined procurement processes are fostering the adoption of digital platforms. European companies are also attracted to the transparency, efficiency, and data analytics capabilities offered by cloud-based procurement solutions.

U.K. Buyer Oriented Business-to-Business E-Commerce Market Insight

The U.K. B2B e-commerce market is expected to witness significant growth from 2026 to 2033, driven by the increasing shift toward automated purchasing and the growing demand for efficient supplier management solutions. Businesses are adopting digital procurement systems to improve order processing, reduce administrative costs, and ensure compliance with industry standards. The U.K.’s robust IT infrastructure, advanced e-commerce ecosystem, and focus on enterprise efficiency are expected to continue propelling market growth.

Germany Buyer Oriented Business-to-Business E-Commerce Market Insight

The Germany B2B e-commerce market is expected to witness substantial growth from 2026 to 2033, fueled by rising adoption of AI-driven procurement solutions, industrial automation, and the need for operational efficiency. Germany’s emphasis on innovation, digital transformation, and compliance with strict corporate regulations is promoting the implementation of cloud and on-premise platforms. Enterprises are increasingly leveraging advanced analytics and automated purchasing to enhance supplier collaboration and cost optimization.

Asia-Pacific Buyer Oriented Business-to-Business E-Commerce Market Insight

The Asia-Pacific B2B e-commerce market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, urbanization, and technological advancements in countries such as China, Japan, and India. The region’s growing inclination toward digital procurement, supported by government initiatives promoting enterprise digitization, is driving adoption. Increasing affordability of cloud-based platforms and rising awareness of efficiency and cost benefits are expanding access to SMEs and large enterprises alike.

Japan Buyer Oriented Business-to-Business E-Commerce Market Insight

The Japan B2B e-commerce market is expected to witness significant growth from 2026 to 2033 due to the country’s high-tech culture, focus on operational efficiency, and rising adoption of AI and cloud-based procurement systems. Japanese enterprises are increasingly prioritizing streamlined sourcing, real-time analytics, and supplier integration to improve decision-making. In addition, the adoption of digital platforms is supported by government initiatives promoting smart industry practices and enterprise automation.

China Buyer Oriented Business-to-Business E-Commerce Market Insight

The China B2B e-commerce market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expanding manufacturing sector, rapid industrialization, and high adoption of digital procurement solutions. China stands as one of the largest markets for enterprise e-commerce, with platforms being increasingly adopted across industrial, healthcare, consumer electronics, and retail sectors. The rise of smart cities, robust domestic software providers, and affordable cloud-based procurement platforms are key factors propelling the market in China.

Buyer Oriented Business-to-Business E-Commerce Market Share

The Buyer Oriented Business-to-Business E-Commerce industry is primarily led by well-established companies, including:

• Alibaba Group Holding Limited (China)

• Amazon Seller Services Private Limited (U.S.)

• Sana Commerce (Netherlands)

• B2W - Digital Company (Brazil)

• China-Asean Free Trade Wang (China)

• DIYTrade (China)

• eBay Inc. (U.S.)

• EC21 Inc. (South Korea)

• eWorldTrade (U.S.)

• Flipkart Internet Private Limited (India)

• IndiaMart InterMesh Ltd (India)

• BigCommerce Pty. Ltd. (Australia)

• Kompass (France)

• Magento (U.S.)

• Mercateo (Germany)

• Newegg International Inc. (U.S.)

• Brandloom (U.S.)

• iBrand Strategy Services LLP (India)

• PayPal Holdings, Inc. (U.S.)

• W. W. Grainger, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.