Global C2 Chlorinated Solvents Market

Market Size in USD Billion

CAGR :

%

USD

2.37 Billion

USD

3.58 Billion

2024

2032

USD

2.37 Billion

USD

3.58 Billion

2024

2032

| 2025 –2032 | |

| USD 2.37 Billion | |

| USD 3.58 Billion | |

|

|

|

|

C2 Chlorinated Solvents Market Size

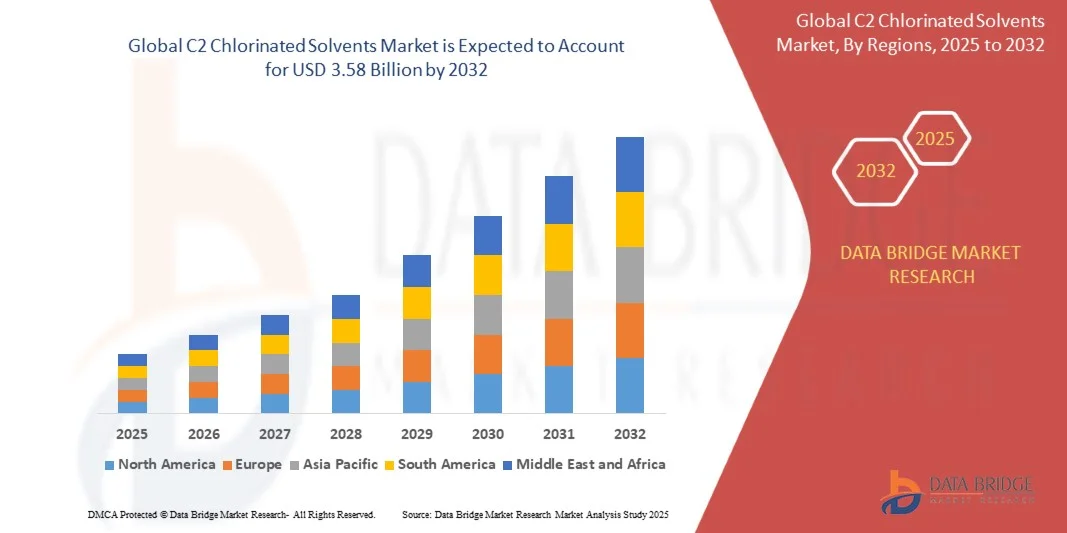

- The global C2 chlorinated solvents market size was valued at USD 2.37 billion in 2024 and is expected to reach USD 3.58 billion by 2032, at a CAGR of 5.3% during the forecast period

- The market growth is largely fueled by the increasing demand for high-purity solvents across industrial applications such as metal cleaning, chemical synthesis, pharmaceuticals, and electronics manufacturing. Growing industrialization, expansion of manufacturing hubs, and rising adoption of specialty chemical processes are driving the widespread use of C2 chlorinated solvents

- Furthermore, stringent regulatory requirements for product quality, efficiency, and environmental compliance are encouraging manufacturers to adopt reliable and high-performance C2 chlorinated solvents. These converging factors are accelerating the adoption of these solvents across multiple industries, thereby significantly boosting market growth

C2 Chlorinated Solvents Market Analysis

- C2 chlorinated solvents are a class of chemical compounds widely used as intermediates, degreasing agents, and cleaning solvents in industries such as metal processing, pharmaceuticals, electronics, and textiles. They offer high solvency, stability, and compatibility with advanced industrial processes, making them indispensable for precision applications

- The escalating demand for C2 chlorinated solvents is primarily driven by rapid industrialization, expansion of pharmaceutical and electronics manufacturing, increasing chemical synthesis activities, and rising awareness of solvent efficiency and sustainability. Manufacturers are increasingly focusing on high-purity and environmentally compliant solvents to meet evolving industrial requirements

- North America dominated the C2 chlorinated solvents market in 2024, due to extensive industrial applications in metal cleaning, chemical synthesis, and pharmaceuticals

- Asia-Pacific is expected to be the fastest growing region in the C2 chlorinated solvents market during the forecast period due to rapid industrialization, increasing electronics, pharmaceutical, and textile production, and rising adoption of chemical synthesis processes in countries such as China, Japan, and India

- Industrial grade segment dominated the market with a market share of 52.6% in 2024, due to its extensive use in large-scale manufacturing, cleaning, and chemical synthesis applications. Industrial grade solvents offer cost-effective solutions and sufficient purity for routine applications in metal processing, coatings, and degreasing, making them the backbone of C2 chlorinated solvent consumption globally

Report Scope and C2 Chlorinated Solvents Market Segmentation

|

Attributes |

C2 Chlorinated Solvents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

C2 Chlorinated Solvents Market Trends

Rising Use of High-Purity C2 Chlorinated Solvents in Industrial Applications

- The market for C2 chlorinated solvents is expanding rapidly driven by increasing demand for high-purity solvents in critical industrial applications such as aerospace, automotive, electronics, and pharmaceuticals. These solvents are highly valued for their efficient cleaning, degreasing, and chemical synthesis properties, supporting advanced manufacturing processes

- For instance, 3M and Solvay have invested in refining solvent formulations to produce high-purity C2 chlorinated solvents that meet stringent quality standards required in aerospace component cleaning and pharmaceutical production. Similarly, Dow offers specialized grades tailored for electronics manufacturing and precision metal degreasing

- Technological advancements in production processes are enabling manufacturers to reduce impurities and improve solvent stability, which enhances performance and regulatory compliance. This focus on product quality is helping companies address increasingly sophisticated industry requirements while minimizing environmental and health impacts

- Regions such as Asia Pacific are witnessing accelerated industrial growth, especially in China and India, which contributes to rising demand for C2 chlorinated solvents. Expansion of automotive production, construction materials, and textile industries further drives the solvent requirements in these fast-developing markets

- Research into greener chemistries and automation in solvent handling processes is gaining traction, with manufacturers exploring sustainable formulations that reduce emissions and waste. These initiatives are increasing solvent efficiency and safety, aligning with global trends toward environmental stewardship and operational excellence

- The convergence of high-purity solvent demand, industrial growth, and sustainability innovation is poised to sustain strong market momentum. This trend underscores the strategic importance of advanced C2 chlorinated solvent products as essential components in modern industrial ecosystems

C2 Chlorinated Solvents Market Dynamics

Driver

Growing Demand from Various Industries

- Strong growth in end-use sectors such as automotive, electronics, pharmaceuticals, and textiles is a critical driver for the C2 chlorinated solvents market. These solvents are integral for applications requiring precise cleaning, degreasing, chemical formulation, and manufacturing process enhancements

- For instance, automotive manufacturers are increasing use of trichloroethylene and perchloroethylene in component cleaning and aerosol propellants, driven by production scale and quality requirements. The electronics industry relies on these solvents for circuit board cleaning and semiconductor manufacturing, where consistency and purity are vital

- Increasing pharmaceutical production globally demands high-grade solvents for drug formulation and active ingredient extraction, scope which is expanding rapidly in emerging economies. Textile treatment and fabric finishing industries are adopting chlorinated solvents for effective stain removal and processing efficiency

- Expansion of chemical synthesis and intermediate production further fuels the solvent requirement in specialty chemicals and agrochemical sectors. This broad industrial uptake creates a diversified demand base that stabilizes market growth against sector-specific fluctuations

- The correlation between industrial output expansion and solvent demand highlights a positive feedback cycle driving continuous C2 chlorinated solvent market growth. This dynamic ensures long-term market resilience and opportunities for innovation-driven differentiation

Restraint/Challenge

Strict Environmental Regulations on Solvent Production

- The C2 chlorinated solvents market faces considerable restraints from increasingly stringent environmental regulations targeting volatile organic compounds (VOCs) and hazardous emissions associated with solvent production and use. Regulatory frameworks impose limits on permissible levels of chlorinated solvent discharge and mandate safer handling practices

- For instance, compliance with the Montreal and Kyoto Protocols and regional EU regulations compels market leaders such as Dow and INEOS to reformulate products or transition to less harmful alternatives to avoid penalties. These regulations increase operational costs and restrict the use of some high-performance solvents in key markets

- Monitoring and enforcing emission controls require investments in pollution control technology and adherence to best environmental practices, which can weigh heavily on smaller producers. Restrictions on solvent usage in specific applications are also driving substitution toward greener solvents, impacting traditional solvent demand

- The complexity and cost of regulatory compliance pose barriers to entry and scalability, limiting geographic expansion and slowing product development timelines. Furthermore, evolving regulatory landscapes require ongoing adaptation, increasing uncertainty for market participants

- In conclusion, while regulatory pressures aim to mitigate environmental impacts, they represent a significant challenge for C2 chlorinated solvent producers. Success in this market depends on innovation in sustainable formulations and proactive compliance strategies to balance growth with environmental responsibility

C2 Chlorinated Solvents Market Scope

The market is segmented on the basis of application, grade, derivatives, and technology.

• By Application

On the basis of application, the C2 chlorinated solvents market is segmented into metal cleaning, chemical synthesis, pharmaceuticals, textile processing, and electronics. The metal cleaning segment dominated the largest market revenue share in 2024, driven by the high demand for degreasing and surface treatment in automotive, aerospace, and heavy machinery industries. Metal cleaning applications benefit from the excellent solvency and non-flammable characteristics of certain C2 chlorinated solvents, which allow efficient removal of oils, greases, and waxes. Furthermore, regulatory compliance and the need for high-performance cleaning in precision metal parts contribute to the continued preference for these solvents.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing use of C2 chlorinated solvents in drug formulation, extraction, and intermediate synthesis. Their ability to dissolve a wide range of organic compounds and compatibility with advanced chemical processes makes them essential in pharmaceutical manufacturing. Rising global demand for high-purity drugs and the expansion of pharmaceutical R&D activities are further boosting the adoption of C2 chlorinated solvents in this sector.

• By Grade

On the basis of grade, the market is segmented into industrial grade, pharmaceutical grade, and electronics grade. The industrial grade segment held the largest market revenue share of 52.6% in 2024, owing to its extensive use in large-scale manufacturing, cleaning, and chemical synthesis applications. Industrial grade solvents offer cost-effective solutions and sufficient purity for routine applications in metal processing, coatings, and degreasing, making them the backbone of C2 chlorinated solvent consumption globally.

The pharmaceutical grade segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by strict purity requirements in drug manufacturing and laboratory processes. This grade is essential for ensuring product safety, efficacy, and compliance with regulatory standards. Growth in contract manufacturing organizations (CMOs) and expansion of pharmaceutical production in emerging markets further propel the demand for high-purity pharmaceutical-grade C2 chlorinated solvents.

• By Derivatives

On the basis of derivatives, the C2 chlorinated solvents market is segmented into 1,2-dichloroethane, trichloroethylene, and perchloroethylene. The 1,2-dichloroethane segment dominated the largest market revenue share in 2024, driven by its widespread use as an intermediate in the production of vinyl chloride monomer (VCM) and polyvinyl chloride (PVC). Its high solvent power and versatility in chemical synthesis make it a key derivative across multiple industrial applications, including coatings and adhesives.

The trichloroethylene segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in degreasing, electronics cleaning, and specialty chemical synthesis. Trichloroethylene is preferred for precision cleaning and environmentally controlled applications due to its effectiveness and stability, with growth accelerated by expanding electronics manufacturing and increasing automation in industrial cleaning processes.

• By Technology

On the basis of technology, the market is segmented into chlorination and dehydrochlorination. The chlorination segment held the largest market revenue share in 2024, driven by its established role in the commercial production of C2 chlorinated solvents. Chlorination technology enables efficient synthesis of high-purity solvents at industrial scales and is widely adopted for both derivatives production and metal cleaning applications.

The dehydrochlorination segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by increasing focus on producing specialty C2 solvents with lower environmental impact and enhanced purity. This technology is gaining traction in pharmaceutical and electronics applications due to its ability to minimize by-products and improve solvent performance, with rising regulatory pressure on green and sustainable chemical production further driving adoption.

C2 Chlorinated Solvents Market Regional Analysis

- North America dominated the C2 chlorinated solvents market with the largest revenue share in 2024, driven by extensive industrial applications in metal cleaning, chemical synthesis, and pharmaceuticals

- The region’s established chemical manufacturing infrastructure and stringent quality standards for industrial processes support the widespread adoption of high-purity C2 chlorinated solvents

- Growing demand from aerospace, automotive, and electronics industries, coupled with ongoing R&D activities in specialty chemicals, further strengthens market growth

U.S. C2 Chlorinated Solvents Market Insight

The U.S. C2 chlorinated solvents market captured the largest revenue share in North America in 2024, propelled by the country’s advanced chemical, pharmaceutical, and electronics sectors. The demand is fueled by high industrial output, strict regulatory standards for safety and solvent purity, and increasing applications in precision metal cleaning, chemical synthesis, and pharmaceutical manufacturing. Rising investments in specialty chemicals, coupled with adoption of innovative solvent technologies and environmentally conscious processes, further contribute to market growth. In addition, the presence of leading global chemical manufacturers and robust R&D infrastructure supports continuous innovation and expansion of the solvent market in the U.S.

Europe C2 Chlorinated Solvents Market Insight

Europe is experiencing steady growth, driven by rising demand for C2 chlorinated solvents in chemical synthesis, pharmaceuticals, electronics, and textile processing. Stringent environmental, safety, and quality regulations encourage the use of high-purity, sustainable solvents across industries. The region’s focus on industrial automation and the integration of advanced chemical processes enhances consumption, while growing investments in pharmaceuticals and specialty chemicals provide additional momentum. European manufacturers are increasingly adopting modern production technologies to meet the demand for eco-friendly and high-performance solvents, contributing to the market’s stable growth.

U.K. C2 Chlorinated Solvents Market Insight

The U.K. market is expected to expand at a notable CAGR during the forecast period, driven by growth in pharmaceutical, electronics, and chemical manufacturing sectors. High demand for industrial and pharmaceutical-grade solvents is fueled by stringent regulatory compliance, environmental standards, and quality requirements in chemical synthesis and precision cleaning applications. In addition, increasing awareness of solvent efficiency, product safety, and sustainable industrial practices is encouraging wider adoption of C2 chlorinated solvents. The U.K.’s strong focus on innovation, coupled with growing R&D in specialty chemicals, further supports market development.

Germany C2 Chlorinated Solvents Market Insight

Germany exhibits significant growth potential in the C2 chlorinated solvents market, owing to its well-developed chemical and pharmaceutical industries. The country’s focus on sustainable chemical processes, technological innovation, and high-quality production standards drives the adoption of both industrial and specialty-grade solvents. High demand from the electronics, automotive, and aerospace sectors, combined with the country’s emphasis on eco-friendly manufacturing practices, promotes the utilization of C2 chlorinated solvents in precision cleaning, chemical synthesis, and pharmaceutical applications. Integration of advanced solvent technologies in automated industrial processes further contributes to market expansion.

Asia-Pacific C2 Chlorinated Solvents Market Insight

Asia-Pacific is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rapid industrialization, increasing electronics, pharmaceutical, and textile production, and rising adoption of chemical synthesis processes in countries such as China, Japan, and India. The region benefits from expanding manufacturing hubs, low production costs, and growing investments in specialty chemical production. Rising demand for high-purity solvents, driven by industrial automation, advanced manufacturing technologies, and increasing R&D activities, is accelerating market growth. In addition, government initiatives promoting industrial development and digitalization support the adoption of C2 chlorinated solvents across multiple industrial sectors.

Japan C2 Chlorinated Solvents Market Insight

Japan’s market growth is driven by the advanced electronics, chemical, and pharmaceutical sectors, where high-purity solvents are essential for precision cleaning and chemical synthesis applications. The country’s emphasis on technological innovation, quality control, and operational efficiency supports the growing adoption of C2 chlorinated solvents. Rising demand for specialty-grade solvents in R&D-intensive industries, coupled with integration into automated and eco-friendly processes, further accelerates market expansion. Japan’s aging population also increases the focus on streamlined and safe chemical processes, reinforcing demand in both industrial and pharmaceutical applications.

China C2 Chlorinated Solvents Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, expansion of chemical and pharmaceutical manufacturing, and increasing demand for electronics-grade solvents. The country’s industrial growth, coupled with government initiatives promoting smart manufacturing and high-quality chemical production, has significantly boosted solvent consumption. In addition, the presence of domestic manufacturers offering cost-effective solutions and investments in specialty chemical R&D further strengthen market adoption. Rising urbanization, growth of the middle class, and increasing demand for precision metal cleaning and chemical synthesis applications are key factors propelling market expansion in China.

C2 Chlorinated Solvents Market Share

The C2 chlorinated solvents industry is primarily led by well-established companies, including:

- BASF (Germany)

- Wacker Chemie AG (Germany)

- Solvay (Belgium)

- JSR Corporation (Japan)

- Occidental Chemical Corporation (U.S.)

- Formosa Plastics Corporation (U.S.)

- Tosoh Corporation (Japan)

- Chevron Phillips Chemical (U.S.)

- Dow Chemical Company (U.S.)

- INEOS (U.K.)

- SABIC (Saudi Arabia)

- Eastman Chemical Company (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- PCC Group (Poland)

- LG Chem (South Korea)

Latest Developments in C2 Chlorinated Solvents Market

- In July 2025, Westlake Chemical Corporation implemented a price increase for trichloroethylene, effective July 28, 2025. This adjustment reflects the company's response to rising production costs and market demand. The price hike is expected to impact industries reliant on trichloroethylene, such as metal cleaning and chemical synthesis, potentially leading to increased operational costs for manufacturers. Conversely, this move may benefit Westlake by enhancing profitability and reinforcing its position in the chlorinated solvents market

- In July 2025, Dow Chemical Company confirmed the permanent closure of three upstream sites in Europe, including an ethylene steam-cracker in Böhlen, a chlor-alkali and vinyl chain in Schkopau, and a siloxane unit in Barry. The wind-down is scheduled to commence in mid-2026 and conclude by late 2027. This strategic decision is anticipated to affect the supply chain of chlorinated solvents in the European market, potentially leading to supply constraints and price fluctuations. Dow's move reflects a shift in its operational focus and may influence market dynamics in the region

- In April 2025, Occidental Petroleum announced a $3 billion investment to modernize Sonatrach's gas production and export infrastructure in Algeria. The initiative focuses on expanding LNG capacity and advancing carbon capture and storage technologies. While this development pertains to the energy sector, the emphasis on carbon capture aligns with environmental sustainability goals, which may indirectly influence the chemical industry's approach to solvent production and usage, including C2 chlorinated solvents

- In November 2024, 3M and BASF Coatings announced a partnership to develop sustainable collision repair practices. The collaboration aims to introduce standard operating procedures and training content by early 2025. While the primary focus is on the automotive sector, the emphasis on sustainability may influence the adoption of eco-friendly solvents, including chlorinated variants, in industrial applications. This partnership underscores the growing trend towards environmental responsibility in manufacturing processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global C2 Chlorinated Solvents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global C2 Chlorinated Solvents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global C2 Chlorinated Solvents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.