Global Cable Assembly Market

Market Size in USD Billion

CAGR :

%

USD

178.90 Billion

USD

265.22 Billion

2024

2032

USD

178.90 Billion

USD

265.22 Billion

2024

2032

| 2025 –2032 | |

| USD 178.90 Billion | |

| USD 265.22 Billion | |

|

|

|

|

Cable Assembly Market Size

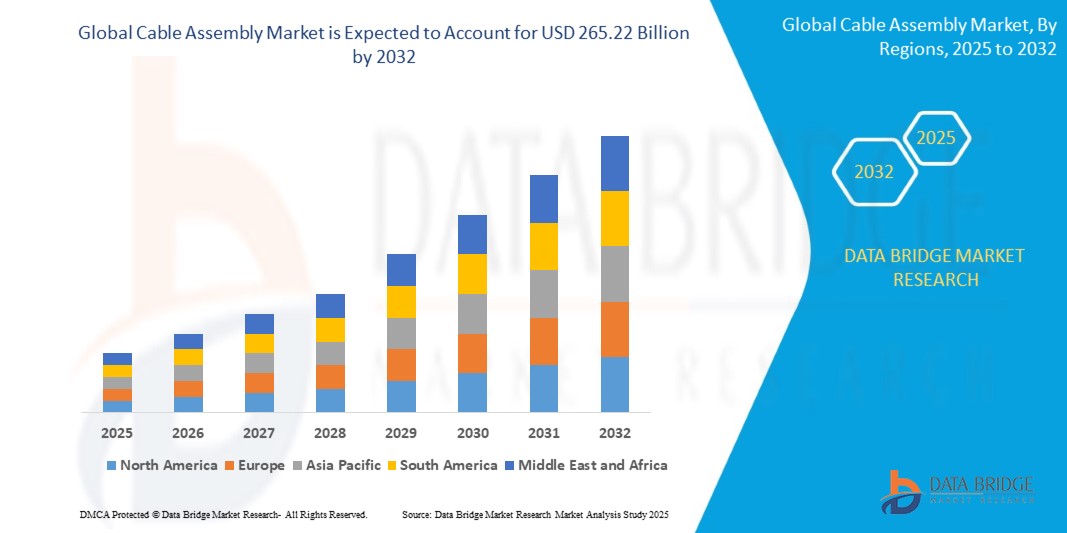

- The Global Cable Assembly Market Size was valued at USD 178.90 Billion in 2024 and is expected to reach USD 265.22 Billion by 2032, at a CAGR of 5.8% during the forecast period

- The Global Cable Assembly Market's growth is driven by the rising demand for high-speed data, fueled by 5G expansion, automotive electrification, industrial automation, and consumer electronics.

Cable Assembly Market Analysis

- The Global Cable Assembly Market is experiencing rapid expansion as industries across telecommunications, automotive, industrial automation, healthcare, aerospace & defense, and consumer electronics prioritize high-speed data transmission, reliable connectivity, and operational efficiency. The increasing adoption of advanced technologies like 5G, IoT, AI, and the growing trend towards miniaturization and modularization of electronic devices has made cable assemblies critical components for diverse applications.

- A primary driver of market growth is the advancement of technology and material sciences. Innovations in fiber optics, high-speed copper cables, and specialized connectors are enabling faster data rates, reduced electromagnetic interference, and enhanced durability. As these solutions become more efficient and capable of handling complex system demands, adoption is accelerating across diverse end-user segments.

- The growing demand for electrification and digitalization across industries is reshaping the landscape. In the automotive sector, the surge in electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates robust, high-voltage, and lightweight cable assemblies for battery connections, sensors, and infotainment. Telecommunications is heavily driven by 5G network rollouts and the expansion of data centers, demanding high-bandwidth fiber optic and copper cable assemblies. Industrial automation and robotics rely on specialized cable assemblies for precision control and data communication in harsh environments. Healthcare providers are increasingly leveraging high-performance cable assemblies for advanced medical devices, imaging systems, and patient monitoring.

- Military and defense organizations are also adopting ruggedized and high-reliability cable assemblies for avionics, communication systems, and critical equipment in challenging conditions. The integration of smart sensors and IoT connectivity is enabling real-time feedback and data analytics capabilities, thereby improving both performance and safety across various applications.

- Despite strong momentum, the market faces challenges. These include fluctuating raw material prices (especially copper and plastics), the increasing complexity of designing miniaturized and customized cable assemblies (leading to higher production costs and longer lead times), and the prevalence of counterfeit products which can impact performance and safety. Furthermore, supply chain disruptions and the lack of standardized performance metrics in certain niche areas can slow down adoption.

- Nevertheless, the outlook remains highly promising. Growing investments in digital infrastructure, increased funding for advanced manufacturing, and government initiatives promoting smart cities and renewable energy are expected to create significant opportunities. As technological capabilities and affordability improve, the Cable Assembly market is poised for sustained growth in the coming years

Report Scope and Cable Assembly Market Segmentation

|

Attributes |

Cable Assembly Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cable Assembly Market Trends

Integration of Smart Technologies

- The integration of smart technologies in cable assemblies marks a significant evolution in the role these components play across various industries. Traditionally used for basic signal and power transmission, cable assemblies are now becoming active enablers of intelligent systems by supporting the seamless transfer of data between embedded sensors, control units, and cloud-based platforms. This shift is essential in smart wearable devices, where responsiveness, adaptability, and real-time feedback are crucial.

- One of the most prominent applications of smart cable assemblies is in wearable exosuits. These devices rely on real-time motion data and biometric inputs to provide adaptive assistance to users in healthcare, industrial, or military contexts. Cable assemblies are engineered to carry data from sensors embedded in textiles, joints, or modules connecting components that interpret user movements and trigger support actions. The result is a more fluid, responsive user experience that enhances mobility, reduces fatigue, and improves safety.

- Machine learning is playing an increasingly important role in how cable assemblies function within these systems. By transmitting large volumes of user data to processing units or cloud services, the assemblies help facilitate the development of predictive models. These models can anticipate user needs such as increased support during physically strenuous tasks and adjust the operation of the wearable device accordingly. This predictive support is especially beneficial in rehabilitation or industrial applications where user conditions change dynamically.

- Sensor fusion is another key advancement supported by smart cable assemblies. By connecting multiple types of sensors (e.g., motion, pressure, temperature, EMG), cable assemblies help consolidate and transmit synchronized data streams. This enables more accurate decision-making and faster system response times. In exoskeletons, for example, this capability ensures that the support provided is not only real-time but also highly precise and tailored to the user’s physical condition.

- Furthermore, the rise of IoT-enabled ecosystems has elevated the importance of cable assemblies that can integrate with cloud and edge computing platforms. These smart assemblies facilitate continuous performance monitoring, remote diagnostics, and software updates, making wearable devices more maintainable and scalable. In decentralized healthcare settings, for instance, patients using wearable rehabilitation tools at home can still be monitored and guided by clinicians through cloud-connected platforms enabled by these assemblies.

Cable Assembly Market Dynamics

Driver

Growing Demand for High-Speed Data Transmission

- One of the most significant drivers of growth in the global cable assembly market is the surging demand for high-speed data transmission. With the digital transformation of virtually every sector ranging from telecommunications and cloud computing to industrial automation and healthcare the need for fast, reliable, and high-capacity data transfer has never been more critical.

- The rollout of 5G networks, for instance, is a major catalyst. 5G enables ultra-low latency, massive machine-type communication, and enhanced mobile broadband all of which require cable assemblies that can handle higher frequencies and greater bandwidth. As a result, manufacturers are increasingly developing high-performance coaxial, fiber optic, and high-speed copper cable assemblies to meet the technical demands of 5G infrastructure, base stations, and backhaul systems.

- In the data center industry, where the volume of data generated and processed is growing exponentially, there is a continuous push for faster internal data flow and external connectivity. This is driving demand for high-density and low-loss cable assemblies that support standards like USB 4.0, HDMI 2.1, PCIe 5.0, and 100G/400G Ethernet. Cable assemblies in this space must maintain signal integrity, electromagnetic compatibility (EMC), and thermal stability over longer distances and under high workloads.

- Cloud computing, artificial intelligence (AI), and big data analytics are further fueling this trend. These technologies require the transmission of large datasets in real time, often over multiple interfaces and platforms. High-speed cable assemblies serve as critical connectors between servers, storage devices, and networking equipment, ensuring that data flows smoothly with minimal interference or data loss.

- In consumer electronics, the demand for faster data transmission is evident in the development of high-definition displays, gaming consoles, and virtual reality (VR) systems. These devices require cable assemblies that can transfer large volumes of data rapidly while maintaining synchronization and quality, especially for video and audio content.

- Moreover, industries adopting edge computing and industrial IoT (IIoT) applications are also contributing to this demand. These systems require high-speed connectivity for processing data close to the source, such as in manufacturing environments, smart cities, and autonomous systems. Cable assemblies used in these settings must not only be fast but also robust, flexible, and resistant to harsh conditions.

Restraint/Challenge

High Customization Costs and Complex Manufacturing Processes

- One of the significant challenges restraining the growth of the global cable assembly market is the high cost and complexity associated with customization and manufacturing. As industries demand more application-specific, miniaturized, and high-performance cable assemblies, manufacturers face mounting pressure to deliver tailored solutions within tight deadlines and cost constraints.

- Custom cable assemblies especially those used in sectors like aerospace, medical devices, military, and automotive electronics often require precise specifications regarding size, shape, shielding, connectors, and environmental resistance. Meeting these specifications involves advanced design tools, specialized materials, and highly skilled labor, which increases production costs and lead times.

- Moreover, the lack of standardization across industries adds to the challenge. Each sector and sometimes each client demands unique cable configurations, certifications (such as RoHS, UL, ISO), and testing protocols. This makes mass production difficult and limits economies of scale, particularly for small and mid-sized manufacturers.

- The manual-intensive nature of cable assembly also remains a bottleneck. Despite increasing automation in many industries, much of the cable assembly process still involves hand soldering, crimping, and inspection, which are labor-intensive and prone to human error. As a result, maintaining consistent quality control and reliability becomes more difficult, especially for high-volume or complex orders.

- Additionally, supply chain disruptions especially shortages of raw materials like copper, plastic insulation, and specialized connectors can severely impact production timelines and costs. These disruptions have become more common due to global events such as the COVID-19 pandemic and geopolitical tensions, exposing the industry's vulnerability.

- In summary, the high degree of customization, labor-intensive processes, and material and certification requirements pose a substantial challenge to scalability and cost-efficiency in the cable assembly market. Addressing these issues through standardization, automation, and supply chain resilience will be critical for sustained market growth.

Cable Assembly Market Scope

The market is segmented on the basis of Cable Type, Application, Shielding, Assembly Type.

- By Cable Type

The global cable assembly market, when segmented by cable type, includes copper cable assemblies, fiber optic cable assemblies, RF cable assemblies, molded cable assemblies, and discrete cable assemblies each serving distinct applications. Copper cable assemblies dominate the market due to their affordability, flexibility, and widespread use in consumer electronics, automotive, and industrial systems. Fiber optic cable assemblies are gaining traction in high-speed, long-distance data transmission applications such as telecommunications, data centers, and healthcare due to their high bandwidth and low signal loss. RF cable assemblies are essential for high-frequency signal transmission in aerospace, military, and wireless communication systems. Molded cable assemblies offer enhanced durability and environmental resistance, making them ideal for rugged industrial, medical, and automotive applications. Discrete cable assemblies, comprising individually terminated wires, are used in internal machinery wiring and home appliances, offering cost-effective and flexible solutions for low-complexity electrical connections. This diverse cable type segmentation enables the market to cater to a wide array of performance and environmental requirements across sectors.

- By Application

The global cable assembly market serves a broad range of industries, with key application segments including automotive and transportation, IT and telecommunication, industrial, aerospace and defense, and healthcare. In the automotive and transportation sector, cable assemblies are essential for advanced driver-assistance systems (ADAS), infotainment, electric vehicle (EV) power systems, and overall vehicle wiring, supporting the growing trend toward smart and electric mobility. The IT and telecommunication segment relies heavily on high-speed cable assemblies for data centers, networking infrastructure, 5G deployment, and server interconnects, driven by escalating global data demand. In industrial applications, cable assemblies are vital for automation, robotics, machinery interconnection, and process control systems, especially with the rise of Industry 4.0 and smart manufacturing. The aerospace and defense sector requires highly durable, lightweight, and EMI-resistant cable assemblies for mission-critical systems, avionics, satellites, and communication networks under extreme conditions. Meanwhile, the healthcare industry uses specialized cable assemblies in diagnostic imaging, surgical tools, patient monitoring, and wearable medical devices, where biocompatibility, precision, and reliability are paramount. This diverse application landscape reflects the cable assembly market’s critical role in enabling connectivity, power, and performance across modern technologies and infrastructure.

- By Shielding

The global cable assembly market is segmented by shielding into shielded and unshielded cable assemblies, each catering to specific performance and environmental needs. Shielded cable assemblies are designed with protective layers such as foil or braided shielding to minimize electromagnetic interference (EMI) and radio frequency interference (RFI), making them essential in high-noise environments like industrial automation, aerospace, medical equipment, and telecommunications. These cables ensure data integrity and signal clarity in mission-critical applications. On the other hand, unshielded cable assemblies are lighter, more flexible, and cost-effective, suitable for low-interference environments such as office electronics, basic consumer devices, and internal wiring systems. While shielded cables offer higher performance under demanding conditions, unshielded cables remain popular in less complex, space-constrained, or budget-sensitive applications, offering a balanced scope across industries.

- By Assembly Type

The global cable assembly market, based on assembly type, is segmented into custom-assembled and pre-assembled cable assemblies, each catering to different industry needs and production models. Custom-assembled cable assemblies are tailored to specific customer requirements in terms of length, connectors, shielding, and environmental protection. They are widely used in specialized applications such as aerospace, medical devices, industrial automation, and defense systems, where performance, precision, and compatibility are critical. These assemblies offer flexibility and exact fit but generally involve higher costs and longer production lead times. In contrast, pre-assembled cable assemblies are standardized and mass-produced for ready-to-install use in applications like consumer electronics, automotive wiring harnesses, and telecom infrastructure. They offer the advantages of reduced manufacturing time, cost-efficiency, and consistent quality. The growing demand for rapid deployment and plug-and-play solutions is driving adoption of pre-assembled cables, while the need for customized, high-performance solutions continues to sustain demand for custom assemblies across high-tech sectors.

Cable Assembly Market Regional Analysis

- North America is a key market for cable assemblies, driven by strong demand in aerospace & defense, medical technology, telecommunications, and data center infrastructure. The United States leads the region, benefiting from advanced R&D capabilities and early adoption of cutting-edge technologies like AI, 5G, and IoT. The region places a high emphasis on custom cable assemblies for mission-critical applications, especially in sectors requiring high reliability and compliance with strict safety standards. Additionally, increasing investment in electric vehicles and smart manufacturing is contributing to market growth across the region.

- Europe represents a mature yet evolving market for cable assemblies, with strong demand rooted in its well-established automotive, aerospace, and industrial automation sectors. Countries like Germany, the UK, and France are at the forefront of innovation, especially in electric mobility and renewable energy integration, which require sophisticated wiring solutions. Europe’s stringent regulatory environment also drives demand for high-quality, compliant cable assemblies in medical, transportation, and defense applications. The ongoing shift toward Industry 4.0 and smart infrastructure further supports market expansion across the region.

- Asia-Pacific holds the largest share in the global cable assembly market, driven by its strong electronics manufacturing ecosystem, expanding industrial base, and rapid infrastructure development. Countries such as China, Japan, South Korea, and India are major contributors, with China leading as a global hub for cable assembly production due to its low manufacturing costs and high-volume output. The region is also witnessing rapid growth in automotive, consumer electronics, telecommunication (especially 5G), and industrial automation, which fuels consistent demand for high-performance cable assemblies. Government initiatives supporting smart cities and electric vehicles (EVs) further boost the market in this region.

- Latin America is an emerging market for cable assemblies, with growing opportunities in telecommunications, automotive, and energy sectors, particularly in countries like Brazil and Mexico. The expansion of 4G/5G networks, increasing electrification in transportation, and the growth of smart grids and industrial automation are gradually fueling demand. However, the market faces challenges such as limited local manufacturing capabilities, economic instability, and dependence on imports, which can hinder faster growth. Nevertheless, foreign investment and infrastructure development are expected to drive long-term progress.

- The Middle East & Africa region is witnessing steady growth in the cable assembly market, mainly driven by infrastructure development, oil & gas projects, and rising telecom investments in countries like UAE, Saudi Arabia, and South Africa. As the region increasingly embraces digital transformation, smart city projects, and renewable energy initiatives, the demand for reliable and durable cable assemblies is on the rise. While the current market size is smaller compared to other regions, growing industrialization and government-driven technology initiatives are expected to create future opportunities for expansion.

United States

The U.S. leads the cable assembly market in North America due to strong demand from the automotive, aerospace, defense, and data communication sectors. The presence of major manufacturers and the push toward high-speed data and electric vehicle (EV) infrastructure contribute significantly to market growth.

Germany

Germany anchors the European market with robust demand from its world-class automotive and industrial automation sectors. The country’s emphasis on high-quality engineering, coupled with innovation in sensor cables, fiber optics, and EV-related assemblies, sustains strong demand.

China

China dominates the Asia-Pacific cable assembly market, driven by mass electronics manufacturing, expanding automotive production, and aggressive 5G and renewable energy deployment. The country benefits from a large, cost-effective manufacturing base and ongoing investment in smart infrastructure.

India

India is a fast-growing market, fueled by Make-in-India initiatives, rapid industrialization, and expansion in telecom and automotive sectors. Demand is further bolstered by infrastructure development, increased localization of assembly operations, and the growth of electric mobility.

South Korea

South Korea’s market thrives on its leadership in consumer electronics, automotive technology, and high-speed data solutions. The adoption of miniaturized, high-performance cable assemblies in 5G, IoT devices, and electric vehicles is driving innovation and market expansion.

Cable Assembly Market Share

The Global Cable Assembly industry is primarily led by well-established companies, including:

- TE Connectivity (Schaffhausen, Switzerland)

- Amphenol Corporation (Wallingford, Connecticut, USA)

- Molex LLC (Lisle, Illinois, USA)

- Prysmian Group (Milan, Italy)

- Nexans (Paris, France)

- Leoni AG (Nuremberg, Germany)

- Belden Inc. (St. Louis, Missouri, USA)

- Aptiv Plc (Dublin, Ireland)

- Sumitomo Electric Industries, Ltd. (Osaka, Japan)

- Yazaki Corporation (Tokyo, Japan)

- Furukawa Electric Co., Ltd. (Tokyo, Japan)

- Hirose Electric Co., Ltd. (Tokyo, Japan)

- JST Manufacturing Co., Ltd. (Osaka, Japan)

- Carlisle Interconnect Technologies (CIT) (St. Augustine, Florida, USA)

- W. L. Gore & Associates, Inc. (Newark, Delaware, USA)

- Samtec Inc. (New Albany, Indiana, USA)

- Fischer Connectors SA (Saint-Prex, Switzerland)

- Qualtek Electronics (Mentor, Ohio, USA)

- Cinch Connectivity Solutions (Waseca, Minnesota, USA)

- HUBER+SUHNER (Herisau, Switzerland)

- Phoenix Contact (Blomberg, Germany)

- Zetwerk (Bengaluru, India)

Latest Developments in Global Cable Assembly Market

- In January 2025, Prysmian Group announced plans for a dual listing in New York and future U.S.-based acquisitions, following its $4 billion purchase of Encore Wire, to strengthen its presence in the telecom and data center cable assembly segment.

- In January 2025, A research team introduced an AI-based robotic wire harness assembly system, enhancing automation in cable mating processes for industrial and automotive applications, significantly reducing human intervention and increasing precision.

- In April 2024, Cinch Connectivity Solutions launched the Fibreco high-density MIL-SPEC MT38999 connector series, engineered for extreme environments in military, offshore, and mining operations, improving the performance and reliability of cable assemblies.

- In March 2024, Technical Cable Applications (TCA) entered into strategic manufacturing partnerships in Guadalajara, Mexico, aiming to improve supply chain efficiency and reduce costs for custom cable assemblies across North and Latin America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CABLE ASSEMBLY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CABLE ASSEMBLY MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CABLE ASSEMBLY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 TECHNOLOGICAL TRENDS

5.2 REGULATORY LANDSCAPE

5.3 PORTERS FIVE FORCES ANALYSIS

5.4 PESTLE ANALYSIS

5.5 COMPANY COMPARATIVE ANALYSIS

6 GLOBAL CABLE ASSEMBLY MARKET, BY TYPE

6.1 OVERVIEW

6.2 RECTANGULAR

6.3 COAXIAL

6.3.1 HARD LINE

6.3.2 RADIATING

6.3.3 RG-6

6.3.4 TRIAXIAL

6.3.5 TWIN AXIAL

6.3.6 SEMI RIGID

6.3.7 RIGID LINE

6.4 MODULAR

6.5 FFC/FPC

6.6 TELEPHONE

6.7 RIBBON CABLE ASSEMBLIES

6.8 POWER

6.9 DATA/SIGNAL

6.1 OTHERS

7 GLOBAL CABLE ASSEMBLY MARKET, BY CABLE TYPE

7.1 OVERVIEW

7.2 COPPER CABLE ASSEMBLIES

7.3 FIBER OPTIC CABLE ASSEMBILES

7.4 ALUMINUM CABLE ASSEMBLIES

8 GLOBAL CABLE ASSEMBLY MARKET, BY CABLE LENGTH

8.1 OVERVIEW

8.2 SHORT CABLE ASSEMBLIES

8.3 MEDIUM CABLE ASSEMBLIES

8.4 LONG CABLE ASSEMBLIES

9 GLOBAL CABLE ASSEMBLY MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 SEMI-FLEXIBLE TYPE

9.3 FLEXIBLE

9.4 OTHERS

10 GLOBAL CABLE ASSEMBLY MARKET, BY VOLTAGE

10.1 OVERVIEW

10.2 LOW VOLTAGE CABLE ASSEMBLIES

10.3 MEDIUM VOLTAGE CABLE ASSEMBLIES

10.4 HIGH VOLTAGE CABLE ASSEMBLIES

11 GLOBAL CABLE ASSEMBLY MARKET, BY CONNECTOR

11.1 OVERVIEW

11.2 STANDARD CONNECTORS

11.2.1 USB (UNIVERSAL SERIAL BUS)

11.2.2 HDMI (HIGH-DEFINITION MULTIMEDIA INTERFACE)

11.2.3 RJ45

11.2.4 RCA

11.2.5 3.5MM

11.2.6 OTHERS

11.3 CIRCULAR CONNECTORS

11.4 RECTANGULAR CONNECTORS

11.4.1 D-SUB

11.4.2 IDC (INSULATION DISPLACEMENT CONNECTORS)

11.4.3 PCB

11.4.4 OTHERS

11.5 FIBER OPTIC CONNECTORS

11.5.1 LC (LUCENT CONNECTOR)

11.5.2 SC (SUBSCRIBER CONNECTOR)

11.5.3 ST (STRAIGHT TIP)

11.5.4 MTP/MPO

11.6 POWER

11.6.1 MOLEX

11.6.2 ANDERSON POWERPOLE

11.6.3 IEC

11.7 RF CONNECTORS

11.7.1 SMA (SUBMINIATURE VERSION A)

11.7.2 BNC (BAYONET NEILL–CONCELMAN)

11.7.3 TNC (THREADED NEILL–CONCELMAN)

11.7.4 N-TYPE

11.8 OTHERS

12 GLOBAL CABLE ASSEMBLY MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 ORIGINAL EQUIPMENT MANUFACTURER (OEMS)

12.3 MAINTENANCE, REPIR AND OPERATIONS (MRO) PROVIDERES

12.4 DISTRIBUTORS AND RESELLERS

13 GLOBAL CABLE ASSEMBLY MARKET, BY INDUSTRY

13.1 OVERVIEW

13.2 IT & TELECOMMUNICATIONS

13.2.1 RECTANGULAR

13.2.2 COAXIAL

13.2.3 MODULAR

13.2.4 FFC/FPC

13.2.5 TELEPHONE

13.2.6 RIBBON CABLE ASSEMBLIES

13.2.7 POWER

13.2.8 DATA/SIGNAL

13.2.9 OTHERS

13.3 INDUSTRIAL

13.3.1 RECTANGULAR

13.3.2 COAXIAL

13.3.3 MODULAR

13.3.4 FFC/FPC

13.3.5 TELEPHONE

13.3.6 RIBBON CABLE ASSEMBLIES

13.3.7 POWER

13.3.8 DATA/SIGNAL

13.3.9 OTHERS

13.4 AUTOMOTIVE

13.4.1 RECTANGULAR

13.4.2 COAXIAL

13.4.3 MODULAR

13.4.4 FFC/FPC

13.4.5 TELEPHONE

13.4.6 RIBBON CABLE ASSEMBLIES

13.4.7 POWER

13.4.8 DATA/SIGNAL

13.4.9 OTHERS

13.5 CONSUMER ELECTRONICS

13.5.1 RECTANGULAR

13.5.2 COAXIAL

13.5.3 MODULAR

13.5.4 FFC/FPC

13.5.5 TELEPHONE

13.5.6 RIBBON CABLE ASSEMBLIES

13.5.7 POWER

13.5.8 DATA/SIGNAL

13.5.9 OTHERS

13.6 AEROSPACE AND DEFENSE

13.6.1 RECTANGULAR

13.6.2 COAXIAL

13.6.3 MODULAR

13.6.4 FFC/FPC

13.6.5 TELEPHONE

13.6.6 RIBBON CABLE ASSEMBLIES

13.6.7 POWER

13.6.8 DATA/SIGNAL

13.6.9 OTHERS

13.7 ENERGY AND UTILITIES

13.7.1 RECTANGULAR

13.7.2 COAXIAL

13.7.3 MODULAR

13.7.4 FFC/FPC

13.7.5 TELEPHONE

13.7.6 RIBBON CABLE ASSEMBLIES

13.7.7 POWER

13.7.8 DATA/SIGNAL

13.7.9 OTHERS

13.8 HEALTHCARE

13.8.1 RECTANGULAR

13.8.2 COAXIAL

13.8.3 MODULAR

13.8.4 FFC/FPC

13.8.5 TELEPHONE

13.8.6 RIBBON CABLE ASSEMBLIES

13.8.7 POWER

13.8.8 DATA/SIGNAL

13.8.9 OTHERS

13.9 OTHERS

14 GLOBAL CABLE ASSEMBLY MARKET, BY REGION

14.1 GLOBAL CABLE ASSEMBLY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 FRANCE

14.3.3 U.K.

14.3.4 ITALY

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 TURKEY

14.3.8 BELGIUM

14.3.9 NETHERLANDS

14.3.10 NORWAY

14.3.11 FINLAND

14.3.12 SWITZERLAND

14.3.13 DENMARK

14.3.14 SWEDEN

14.3.15 POLAND

14.3.16 REST OF EUROPE

14.4 ASIA PACIFIC

14.4.1 JAPAN

14.4.2 CHINA

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 AUSTRALIA

14.4.6 SINGAPORE

14.4.7 THAILAND

14.4.8 MALAYSIA

14.4.9 INDONESIA

14.4.10 PHILIPPINES

14.4.11 TAIWAN

14.4.12 VIETNAM

14.4.13 REST OF ASIA PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 EGYPT

14.6.3 SAUDI ARABIA

14.6.4 U.A.E

14.6.5 ISRAEL

14.6.6 OMAN

14.6.7 BAHRAIN

14.6.8 KUWAIT

14.6.9 QATAR

14.6.10 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL CABLE ASSEMBLY MARKET,COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL CABLE ASSEMBLY MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL CABLE ASSEMBLY MARKET, COMPANY PROFILE

17.1 TE CONNECTIVITY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 AMPHENOL CORPORATION

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MOLEX

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 3M

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 LAPP GROUP

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ELAND CABLES

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 FLUX CONNECTIVITY INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 CONEXTIVITY GROUP SA

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 COMMSCOPE, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 ROSENBERGER HOCHFREQUENZTECHNIK GMBH & CO. KG.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 SAMTEC

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 HARTING TECHNOLOGY GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 SMITHS INTERCONNECT GROUP LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 CARLISLE INTERCONNECT TECHNOLOGIES

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 W. L. GORE & ASSOCIATES, INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 PRYSMIAN GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 NEXANS

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 PANDUIT CORP.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 J.S.T. MFG. CO.,LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 INFINITE ELECTRONICS INTERNATIONAL, INC

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 EPEC, LLC

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

17.22 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 GEOGRAPHIC PRESENCE

17.22.4 PRODUCT PORTFOLIO

17.22.5 RECENT DEVELOPMENTS

17.23 YAZAKI CORPORATION

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 GEOGRAPHIC PRESENCE

17.23.4 PRODUCT PORTFOLIO

17.23.5 RECENT DEVELOPMENTS

17.24 APTIV

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 GEOGRAPHIC PRESENCE

17.24.4 PRODUCT PORTFOLIO

17.24.5 RECENT DEVELOPMENTS

17.25 CORNING INCORPORATED

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 GEOGRAPHIC PRESENCE

17.25.4 PRODUCT PORTFOLIO

17.25.5 RECENT DEVELOPMENTS

17.26 NKT A/S

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 GEOGRAPHIC PRESENCE

17.26.4 PRODUCT PORTFOLIO

17.26.5 RECENT DEVELOPMENTS

17.27 ZTT

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 GEOGRAPHIC PRESENCE

17.27.4 PRODUCT PORTFOLIO

17.27.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Cable Assembly Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cable Assembly Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cable Assembly Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.