Global Calcium Silicate Market

Market Size in USD Million

CAGR :

%

USD

295.50 Million

USD

433.28 Million

2024

2032

USD

295.50 Million

USD

433.28 Million

2024

2032

| 2025 –2032 | |

| USD 295.50 Million | |

| USD 433.28 Million | |

|

|

|

|

Calcium Silicate Market Size

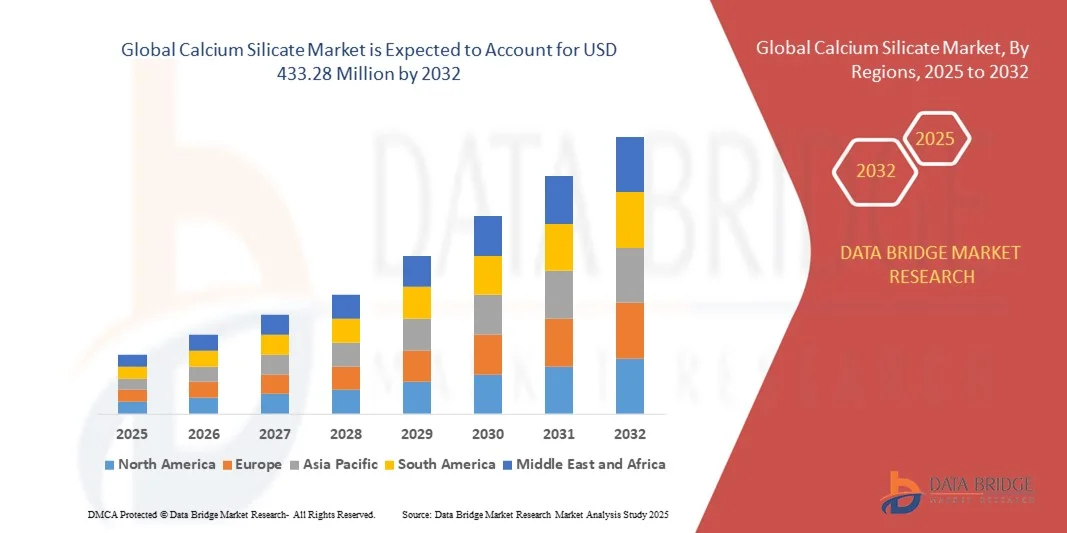

- The global calcium silicate market size was valued at USD 295.50 million in 2024 and is expected to reach USD 433.28 million by 2032, at a CAGR of 4.9% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance insulation materials in construction, industrial, and fireproofing applications

- Rising adoption of energy-efficient and sustainable building materials is accelerating the use of calcium silicate in residential and commercial projects

Calcium Silicate Market Analysis

- The growing need for thermal and fire-resistant insulation solutions is driving the demand for calcium silicate, especially in power plants, refineries, and industrial facilities

- Manufacturers are increasingly focusing on product innovation to improve compressive strength, durability, and moisture resistance, making calcium silicate a preferred material in insulation and construction applications

- North America dominated the calcium silicate market with the largest revenue share in 2024, driven by the increasing adoption of energy-efficient and fire-resistant insulation solutions across industrial, construction, and power generation sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global calcium silicate market, driven by increasing construction activities, rising demand for energy-efficient materials, and growing industrialization across countries such as China, Japan, and India

- The Medium Density segment held the largest market revenue share in 2024 driven by its balanced combination of mechanical strength, thermal insulation properties, and cost-effectiveness, making it suitable for industrial and construction applications

Report Scope and Calcium Silicate Market Segmentation

|

Attributes |

Calcium Silicate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Calcium Silicate Market Trends

Increasing Adoption of High-Performance Insulation Materials

- The growing use of calcium silicate in thermal and fire-resistant insulation is transforming the construction and industrial sectors by providing energy-efficient, durable, and fireproof solutions. Its lightweight and high-strength properties allow for easy installation, improved safety in industrial plants and buildings, and reduced operational downtime during maintenance

- Rising demand for sustainable and energy-saving building materials is accelerating the adoption of calcium silicate in residential, commercial, and industrial applications, particularly where long-term performance, minimal maintenance, and regulatory compliance are critical. This trend is further supported by governments promoting green building initiatives

- The ease of integration with other insulation systems and compatibility with modern construction practices is making calcium silicate a preferred choice for manufacturers and contractors seeking efficiency, cost savings, and compliance with international fire and thermal standards

- For instance, in 2023, several power plants and industrial facilities in Europe reported improved energy efficiency, fire protection, and reduced operational costs after implementing advanced calcium silicate insulation systems, which also contributed to extended equipment life and safety improvements

- While calcium silicate is enhancing insulation performance and operational efficiency, its effectiveness depends on continued innovation, cost optimization, and adherence to international safety standards. Manufacturers must focus on developing tailored, high-performance solutions to meet diverse industry requirements

Calcium Silicate Market Dynamics

Driver

Rising Demand for Thermal and Fire-Resistant Insulation Solutions

- The increasing need for high-performance insulation in industrial, power generation, and construction sectors is driving the demand for calcium silicate, ensuring enhanced safety, energy efficiency, and reduced maintenance costs. Adoption is particularly strong in high-temperature and hazardous environments

- Manufacturers are increasingly aware of the benefits of calcium silicate, including high compressive strength, moisture resistance, fire retardancy, and dimensional stability, which encourages its regular use across multiple industrial, commercial, and residential applications

- Supportive regulations and standards for energy-efficient and fire-safe buildings are promoting the use of advanced calcium silicate insulation. This is coupled with government incentives for green and sustainable construction, encouraging manufacturers to adopt innovative materials

- For instance, in 2022, several industrial facilities in North America incorporated calcium silicate insulation to meet stringent fire and thermal efficiency standards, enhancing operational safety, reducing energy consumption, and lowering environmental impact

- While industrial growth and regulatory frameworks are driving market expansion, there remains a need to develop cost-effective, scalable, and application-specific solutions to ensure long-term adoption and market penetration, particularly in emerging economies

Restraint/Challenge

High Cost of Calcium Silicate Products and Technical Installation Requirements

- The relatively high cost of premium calcium silicate products limits adoption among small-scale manufacturers and in cost-sensitive construction projects. This restricts widespread use in developing regions where alternative, lower-cost insulation materials are preferred

- In addition, technical expertise is required for proper installation and handling of calcium silicate insulation, creating barriers for smaller enterprises, inexperienced contractors, and regions with limited skilled labor, which can result in suboptimal insulation performance

- Supply chain constraints, scarcity of high-quality raw materials, and logistical challenges can affect consistent production and timely delivery, delaying project implementation and increasing operational costs for contractors and end users

- For instance, in 2023, several construction projects in Southeast Asia faced delays due to difficulty in sourcing high-performance calcium silicate insulation, impacting energy efficiency, fire compliance, and overall safety standards in completed structures

- While product formulations continue to advance, addressing cost, technical installation, and supply challenges is critical. Market players must focus on developing user-friendly, cost-efficient, and scalable solutions, supported by training programs and technical assistance to unlock long-term growth potential

Calcium Silicate Market Scope

The market is segmented on the basis of product type, quality, application, and end-use industry

- By Product Type

On the basis of product type, the calcium silicate market is segmented into Low Density, Medium Density, and High Density. The Medium Density segment held the largest market revenue share in 2024 driven by its balanced combination of mechanical strength, thermal insulation properties, and cost-effectiveness, making it suitable for industrial and construction applications.

The High Density segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior compressive strength, fire resistance, and durability, making it ideal for high-performance insulation, fireproofing, and structural applications. High Density calcium silicate is particularly preferred in industrial plants and power generation facilities where safety and longevity are critical.

- By Quality

On the basis of quality, the market is segmented into 2N, 3N, 4N, and 5N. The 3N segment held the largest market revenue share in 2024 driven by its optimal purity and performance for construction and insulation applications.

The 5N segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high purity and enhanced properties, making it ideal for specialized applications in pharmaceuticals, electronics, and advanced industrial sectors.

- By Application

On the basis of application, the market is segmented into Building Materials, Insulation, Fire Protection, Cement, Paints & Coatings, Sealant, Food Additive, Ceramics, and Others. The Insulation segment held the largest market revenue share in 2024 driven by the growing demand for thermal and fire-resistant insulation solutions across industrial and commercial projects.

The Fire Protection segment is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent fire safety regulations and increasing industrial safety standards, making calcium silicate a preferred material for high-temperature and fireproof applications.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into Pharmaceutical, Industrial, Construction, Food, and Others. The Construction segment held the largest market revenue share in 2024 driven by large-scale adoption in commercial and residential buildings for thermal insulation and fire protection.

The Industrial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing use of calcium silicate in power plants, refineries, and manufacturing units where high-temperature resistance and durability are critical.

Calcium Silicate Market Regional Analysis

North America dominated the calcium silicate market with the largest revenue share in 2024, driven by the increasing adoption of energy-efficient and fire-resistant insulation solutions across industrial, construction, and power generation sectors

Consumers in the region highly value the thermal stability, fire retardancy, and lightweight properties of calcium silicate, which enhance safety and reduce energy consumption in buildings and industrial facilities

This widespread adoption is further supported by stringent regulatory standards, high awareness of sustainable construction materials, and the growing preference for long-lasting, low-maintenance insulation solutions

U.S. Calcium Silicate Market Insight

The U.S. calcium silicate market captured the largest revenue share in 2024 within North America, fueled by the rising demand for thermal and fire-resistant insulation in industrial plants, power generation facilities, and commercial buildings. Manufacturers are increasingly adopting high-quality calcium silicate products to meet safety regulations and improve energy efficiency. In addition, government initiatives promoting sustainable construction materials and the modernization of industrial infrastructure are further propelling market growth.

Europe Calcium Silicate Market Insight

The Europe calcium silicate market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent fire safety regulations and the growing need for energy-efficient insulation solutions. The increase in urbanization, coupled with the demand for sustainable building materials, is fostering the adoption of calcium silicate. European consumers and industries are also drawn to the durability and low-maintenance benefits of these products. The region is experiencing significant growth across industrial, construction, and power generation applications.

U.K. Calcium Silicate Market Insight

The U.K. calcium silicate market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing focus on fire-safe construction and energy-efficient building solutions. Rising concerns regarding industrial safety and the adoption of stringent building codes are encouraging manufacturers and contractors to choose high-performance calcium silicate products. The U.K.’s growing infrastructure development and modernization of industrial facilities are also expected to continue stimulating market growth.

Germany Calcium Silicate Market Insight

The Germany calcium silicate market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of fire protection, energy efficiency, and sustainable insulation solutions. Germany’s advanced industrial and construction sectors, combined with regulatory support for fire-safe and energy-efficient buildings, promote the adoption of calcium silicate. The integration of these materials in both new construction and renovation projects is becoming increasingly prevalent, with a strong focus on safety, durability, and compliance with local standards.

Asia-Pacific Calcium Silicate Market Insight

The Asia-Pacific calcium silicate market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, industrial expansion, and rising energy efficiency standards in countries such as China, Japan, and India. The region's growing inclination towards fire-safe, durable, and sustainable insulation materials, supported by government initiatives and infrastructure development, is driving market adoption. Furthermore, as APAC emerges as a manufacturing hub for high-quality calcium silicate, affordability and accessibility are expanding to a wider industrial and construction consumer base.

Japan Calcium Silicate Market Insight

The Japan calcium silicate market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on industrial safety, energy efficiency, and fire-resistant construction materials. Japanese industries and building developers are increasingly adopting calcium silicate insulation to meet stringent safety regulations and improve operational efficiency. In addition, Japan’s aging industrial infrastructure and growing emphasis on modernization are fueling demand for reliable, long-lasting insulation solutions in both industrial and construction sectors.

China Calcium Silicate Market Insight

The China calcium silicate market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding industrial facilities, and growing adoption of energy-efficient and fire-resistant building materials. China stands as one of the largest markets for insulation materials, and calcium silicate is becoming increasingly popular across industrial, construction, and power generation applications. Government initiatives promoting sustainable construction practices, coupled with strong domestic manufacturing capabilities, are key factors propelling the market in China.

Calcium Silicate Market Share

The Calcium Silicate industry is primarily led by well-established companies, including:

- Promat International NV (Belgium)

- Skamol (Denmark)

- American Elements (U.S.)

- Weifang Hongyuan Chemical Co., Ltd. (China)

- Johns Manville (U.S.)

- Spectrum Chemical Manufacturing Corp. (U.S.)

- Associated Ceramics and Technology, Inc. (U.S.)

- Mil-Spec Industries Corporation (U.S.)

- ZIRCAR Ceramics, Inc. (U.S.)

- Pyrotek (Australia)

- Isolite Insulating Products Co., Ltd. (Japan)

- A&A Material Corporation (U.S.)

- NICHIAS Corporation (Japan)

- WELLPOOL CO., LTD. (Japan)

- Ramco Industries Limited (India)

- XIANGYUAN (China)

- Zhejiang Hailong New Building Materials Co., Ltd. (China)

- SANLE GROUP CO., LTD. (China)

- Shandong Lutai Building Material Science And Technology Group Co., Ltd. (China)

- ProChem, Inc. (U.S.)

- Materion Corporation (U.S.)

- Anglitemp Ltd. (U.K.)

- 2K Technologies (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Calcium Silicate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Calcium Silicate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Calcium Silicate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.