Global Cam Software Market

Market Size in USD Billion

CAGR :

%

USD

3.92 Billion

USD

7.95 Billion

2025

2033

USD

3.92 Billion

USD

7.95 Billion

2025

2033

| 2026 –2033 | |

| USD 3.92 Billion | |

| USD 7.95 Billion | |

|

|

|

|

What is the Global CAM Software Market Size and Growth Rate?

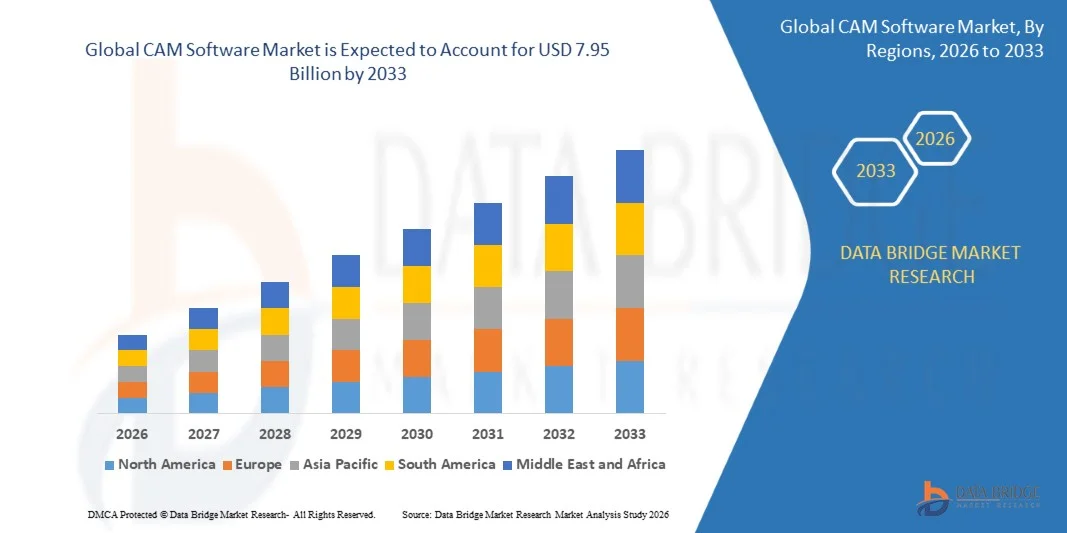

- The global CAM Software market size was valued at USD 3.92 billion in 2025 and is expected to reach USD 7.95 billion by 2033, at a CAGR of 9.25% during the forecast period

- CAM Software provides advanced computer-aided manufacturing solutions for machining, milling, turning, and additive manufacturing, helping manufacturers improve efficiency, precision, and productivity

- Growing adoption of automation, Industry 4.0 initiatives, and digital manufacturing solutions has significantly driven demand for CAM Software globally

What are the Major Takeaways of CAM Software Market?

- Rising need for operational efficiency, reduced production costs, and higher accuracy in manufacturing processes is boosting CAM Software adoption across aerospace, automotive, medical, and industrial sectors

- Technological advancements such as 3D modeling, simulation, cloud-based platforms, and integration with CAD software are enhancing product capabilities and appeal

- Increasing focus on smart factories, digital twin implementation, and precision engineering continues to drive growth, positioning CAM Software as a critical tool in modern manufacturing workflows

- North America dominated the CAM Software market with a 36.8% revenue share in 2025, supported by widespread adoption of advanced manufacturing technologies, Industry 4.0 practices, and digitalized production workflows across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.98% from 2026 to 2033, fueled by rising industrialization, growing manufacturing output, and increasing adoption of advanced CAM solutions in China, India, Japan, and Southeast Asia

- The On-Premises segment dominated the market with a revenue share of 55.4% in 2025, driven by the preference of large enterprises for secure, internally managed software solutions with high customization and control

Report Scope and CAM Software Market Segmentation

|

Attributes |

CAM Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the CAM Software Market?

“Rising Adoption of Advanced, Cloud-Connected, and AI-Integrated CAM Solutions”

- The CAM Software market is witnessing a major trend toward integration of AI, machine learning, cloud computing, and simulation-driven design. These trends allow engineers and manufacturers to optimize tool paths, improve precision, reduce material waste, and accelerate product development cycles

- For instance, companies such as Autodesk, Dassault Systèmes, and Siemens are introducing AI-powered CAM solutions capable of real-time toolpath optimization, predictive maintenance, and process automation to enhance productivity

- The increasing complexity of components in aerospace, automotive, and industrial machinery is driving demand for advanced CAM systems that support multi-axis machining, additive manufacturing, and hybrid production processes

- Manufacturers are adopting cloud-based CAM platforms enabling collaboration across locations, faster deployment, and integration with CAD, PLM, and ERP systems

- Continuous R&D in high-speed machining algorithms, simulation accuracy, and automated toolpath generation is accelerating innovation across the CAM Software landscape

- As smart factories and Industry 4.0 adoption grow, CAM Software solutions are expected to remain central to digital manufacturing transformation globally

What are the Key Drivers of CAM Software Market?

- Rising demand for precision engineering, reduced production costs, and faster time-to-market is driving adoption of CAM Software globally

- In 2025, leading players such as ANSYS, Altair, and Autodesk enhanced their AI-integrated CAM offerings to support automated toolpath optimization, cloud collaboration, and real-time process monitoring

- Growth in aerospace, automotive, industrial machinery, and consumer electronics sectors fuels the need for advanced CAM platforms capable of multi-axis and hybrid manufacturing

- Technological advancements such as AI-assisted machining, generative design, and digital twins enhance product quality, operational efficiency, and predictive capabilities

- Increasing integration of CAM Software into smart manufacturing workflows, Industry 4.0, and additive manufacturing accelerates global adoption

- With ongoing investments in simulation accuracy, cloud-based deployment, and process automation, the CAM Software market is expected to maintain a strong growth trajectory

Which Factor is Challenging the Growth of the CAM Software Market?

- High costs of advanced CAM solutions, including software licensing, training, and hardware requirements, limit affordability, especially for SMEs

- In 2024–2025, fluctuations in demand for skilled CAM operators and integration challenges with legacy systems impacted adoption rates

- Complexity in software implementation, interoperability with diverse CAD/PLM systems, and IT infrastructure requirements increase deployment barriers

- Limited awareness in emerging regions about the benefits of AI-enabled, cloud-integrated CAM solutions restricts large-scale adoption

- Competition from traditional CNC programming, open-source software, and basic CAD/CAM tools creates pricing pressure and affects market penetration

- To overcome these challenges, companies are focusing on subscription-based licensing, modular CAM solutions, training programs, and cloud deployment, providing affordable, scalable, and flexible CAM platforms

How is the CAM Software Market Segmented?

The market is segmented on the basis of deployment type, industry vertical, CAM application, license type, and number of CNC machines.

• By Deployment Type

On the basis of deployment type, the CAM Software market is segmented into On-Premises, Cloud, and Hybrid. The On-Premises segment dominated the market with a revenue share of 55.4% in 2025, driven by the preference of large enterprises for secure, internally managed software solutions with high customization and control. On-premises CAM software offers enhanced data privacy, integration with internal IT infrastructure, and support for complex production workflows, making it highly preferred in automotive, aerospace, and industrial machinery sectors.

The Cloud segment is projected to grow at the fastest CAGR between 2026 and 2033, fueled by small and medium enterprises seeking scalable, subscription-based solutions with remote accessibility, seamless updates, and reduced IT maintenance costs. Cloud adoption is further accelerated by increasing digital transformation and IoT integration in manufacturing environments.

• By Industry Vertical

Based on industry vertical, the market is segmented into Automotive, Aerospace & Defense, Healthcare, Consumer Electronics, and Industrial Machinery. The Automotive segment dominated the market with a revenue share of 38.7% in 2025, driven by the growing complexity of automotive components and demand for precision manufacturing. CAM software enables high-efficiency machining, product customization, and integration with CAD systems, supporting both OEMs and suppliers.

The Healthcare segment is expected to grow at the fastest CAGR during 2026–2033, fueled by rising adoption of CAM solutions for prosthetics, dental implants, surgical instruments, and medical devices. Continuous innovation in software algorithms, multi-axis machining, and biocompatible material handling is enhancing adoption in healthcare manufacturing globally.

• By CAM Application

On the basis of CAM application, the market is segmented into 2-Axis Milling, 3-Axis Milling, 4-Axis Milling, 5-Axis Milling, Multi-Axis Milling, Turning, and Drilling. The 3-Axis Milling segment dominated the market with a revenue share of 36.2% in 2025, driven by its widespread use in automotive, aerospace, and consumer electronics for standard machining tasks. It offers precision, ease of use, and cost efficiency for flat and contoured surfaces.

Multi-Axis Milling is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for complex geometries, advanced aerospace components, and high-precision molds. Continuous software enhancements for toolpath optimization, collision detection, and adaptive machining are driving growth globally.

• By License Type

On the basis of license type, the CAM Software market is segmented into Perpetual and Subscription. The Perpetual license segment dominated with a revenue share of 60.1% in 2025, as established manufacturers prefer one-time investments for long-term usage with full control and customization options.

The Subscription license segment is expected to grow at the fastest CAGR during 2026–2033, driven by small and medium enterprises and startups seeking flexible, cost-effective, cloud-based solutions with automatic updates and technical support. Subscription models also promote adoption of integrated CAM-CAD-PLM ecosystems in modern smart factories.

• By Number of CNC Machines

On the basis of number of CNC machines, the market is segmented into 1–10, 11–50, 51–100, 101–500, and 500+. The 11–50 CNC machines segment dominated the market with a revenue share of 42.5% in 2025, supported by small and medium manufacturing units adopting CAM software for operational efficiency and production flexibility.

The 101–500 CNC machines segment is projected to grow at the fastest CAGR between 2026 and 2033, driven by large-scale industrial enterprises expanding their manufacturing capacity and automation, requiring CAM software for toolpath optimization, multi-axis machining, and real-time monitoring across multiple machines.

Which Region Holds the Largest Share of the CAM Software Market?

- North America dominated the CAM Software market with a 36.8% revenue share in 2025, supported by widespread adoption of advanced manufacturing technologies, Industry 4.0 practices, and digitalized production workflows across the U.S. and Canada. Well-established industrial infrastructure, high technology adoption, and demand for precision engineering contribute to regional leadership

- Leading players are leveraging cloud-connected CAM platforms, AI-based toolpath optimization, and simulation-driven manufacturing to meet the growing need for efficiency and accuracy. Government initiatives supporting smart manufacturing, workforce upskilling, and advanced engineering adoption further strengthen regional dominance

- High urbanization, industrial automation, and rising investment in aerospace, automotive, and electronics sectors are boosting CAM Software adoption in North American manufacturing facilities

U.S. CAM Software Market Insight

The U.S. is the largest contributor to North America’s market, driven by high adoption of AI-enabled, multi-axis, and cloud-integrated CAM solutions. Manufacturers increasingly prefer software that enhances production efficiency, reduces material waste, and supports complex product designs. Companies are investing in training programs, simulation-based design, and integration with CAD/PLM systems while expanding deployment across aerospace, automotive, and industrial machinery sectors. Advanced manufacturing, digital twin adoption, and smart factory initiatives underpin strong growth in the U.S.

Canada CAM Software Market Insight

Canada contributes steadily, supported by the growth of automotive, aerospace, and electronics manufacturing. Adoption is driven by demand for high-precision machining, IoT-connected systems, and cloud-enabled CAM platforms. Collaborations between software providers and industrial firms are expanding capabilities, including predictive maintenance, toolpath automation, and hybrid manufacturing support. Increasing investment in workforce digital skills and smart factory infrastructure continues to drive market growth.

Asia-Pacific CAM Software Market Insight

Asia-Pacific is projected to register the fastest CAGR of 10.98% from 2026 to 2033, fueled by rising industrialization, growing manufacturing output, and increasing adoption of advanced CAM solutions in China, India, Japan, and Southeast Asia. Expanding industrial parks, automation initiatives, and government programs supporting digital manufacturing are accelerating market growth. Cloud-based CAM platforms, AI-assisted machining, and multi-axis systems are gaining popularity, supported by local R&D and awareness campaigns.

China CAM Software Market Insight

China leads the Asia-Pacific market, supported by rapid industrial modernization, government investment in smart manufacturing, and demand for precision and efficiency in automotive, aerospace, and electronics production. Companies are adopting CAM solutions integrated with CAD, PLM, and IoT systems to optimize production, reduce costs, and improve quality. Broad availability through software vendors, training centers, and industrial consultancies supports market expansion.

India CAM Software Market Insight

India is emerging as a key contributor, fueled by industrial growth, government initiatives for advanced manufacturing, and rising adoption of digital production technologies. CAM Software solutions integrated with cloud platforms, AI-driven toolpath optimization, and simulation capabilities are in demand. Companies are innovating with affordable, scalable, and localized CAM platforms for SMEs and large industrial players. Increasing urbanization, industrial investment, and skill development programs are expected to sustain long-term growth.

Europe CAM Software Market Insight

Europe holds a significant share, led by demand for precision engineering, aerospace, and automotive production in Germany, the U.K., France, and Italy. Manufacturers increasingly adopt AI- and simulation-enabled CAM Software to enhance productivity and reduce material wastage. Growth is supported by Industry 4.0 adoption, government initiatives for advanced manufacturing, and sustainability-focused production practices.

Germany CAM Software Market Insight

Germany leads Europe, driven by high demand for smart manufacturing, advanced automotive engineering, and aerospace production. CAM Software solutions integrated with simulation, additive manufacturing, and multi-axis machining support efficient production. Investments in R&D, industrial automation, and workforce upskilling strengthen adoption, while a strong industrial base ensures accessibility across sectors.

U.K. CAM Software Market Insight

The U.K. market is expanding steadily, supported by aerospace, automotive, and electronics sectors. Adoption is facilitated through specialist industrial software vendors and cloud-based deployment. Manufacturers increasingly prefer AI-integrated CAM Software for toolpath optimization, process automation, and digital twin implementation. Rising industrial automation, government initiatives, and skill development programs continue to drive market growth.

Which are the Top Companies in CAM Software Market?

The CAM software industry is primarily led by well-established companies, including:

- ANSYS, Inc. (U.S.)

- Altair Engineering Inc. (U.S.)

- Autodesk, Inc. (U.S.)

- Bentley Systems, Incorporated (U.S.)

- Dassault Systèmes (France)

- ESI Group (France)

- Siemens (Germany)

- BETA CAE Systems (France)

- COMSOL (Sweden)

- PTC (U.S.)

- Hexagon AB (Sweden)

- Symscape (U.S.)

What are the Recent Developments in Global CAM Software Market?

- In April 2025, Siemens Digital Industries Software acquired DownStream Technologies, enhancing its PCB manufacturing CAM portfolio with CAM350 to better serve small and medium-sized electronics producers, strengthening its position in the CAM market

- In March 2025, Mastercam expanded its operations by acquiring Barefoot CNC, CAD/CAM Solutions, CamTech Engineering Services, and CIMCO probing technology, marking a total of eight acquisitions in 2025, and significantly broadening its market presence

- In February 2025, Mastercam appointed Russ Bukowski as interim president and acquired FASTech Inc., improving service coverage across the U.S. Midwest and reinforcing its regional support capabilities

- In April 2024, ESI Group and FAW-Volkswagen (FAW-VW) TE signed a Memorandum of Understanding to advance intelligent simulation technology in China’s automotive sector, establishing a localized material database and enhancing collaboration for automotive innovation and research

- In February 2024, Hexagon AB partnered with Augment Technologies in Western Australia to optimize ore yield and operational efficiency for mining operations, integrating block model data, AI, and 3D movement tracking, delivering substantial operational value to mines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.