Global Camouflage Fabrics Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

3.70 Billion

2024

2032

USD

2.50 Billion

USD

3.70 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 3.70 Billion | |

|

|

|

|

Camouflage Fabrics Market Size

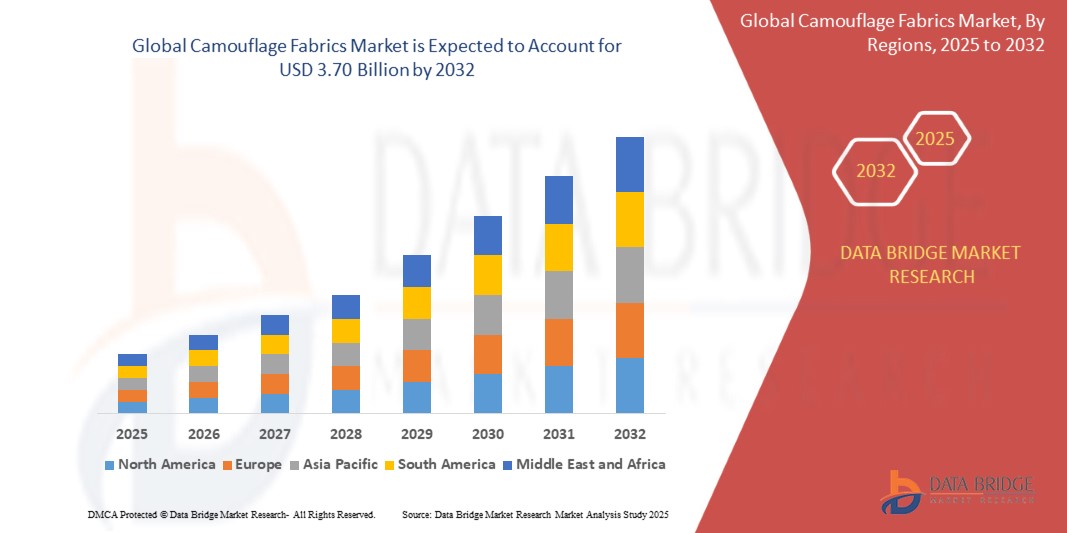

- The global camouflage fabrics market size was valued at USD 2.50 billion in 2024 and is expected to reach USD 3.70 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by the rising demand from the defense and military sector, increasing investments in tactical gear development, and growing popularity of camouflage apparel in outdoor recreational and fashion segments

- Expanding procurement contracts by governments and defense agencies across various regions are further accelerating the demand for technologically advanced camouflage textiles

Camouflage Fabrics Market Analysis

- Increasing geopolitical tensions and defense modernization programs are boosting the demand for advanced camouflage materials used in uniforms, equipment covers, and protective gear

- The growing trend of outdoor activities such as hunting, hiking, and wildlife photography is supporting the use of camouflage fabrics in consumer-grade clothing and accessories

- North America dominated the camouflage fabrics market with the largest revenue share of 39.6% in 2024, driven by robust defense spending, the popularity of outdoor recreational activities, and the strong presence of tactical apparel manufacturers

- Asia-Pacific region is expected to witness the highest growth rate in the global camouflage fabrics market, driven by expanding textile manufacturing capacity, growing defense budgets, and increasing consumer demand for camouflage apparel in recreational and tactical markets across countries such as China, India, and Japan

- The polyester segment dominated the market with the largest market revenue share of 57.8% in 2024, driven by its affordability, lightweight nature, and wide use in mass-produced military and outdoor gear. Polyester-based camouflage fabrics are also highly durable, offering resistance to moisture and wrinkles, which makes them a preferred choice for combat uniforms and field equipment. Their compatibility with various printing technologies enables high-definition camouflage patterns across diverse operational environments

Report Scope and Camouflage Fabrics Market Segmentation

|

Attributes |

Camouflage Fabrics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Camouflage Fabrics Market Trends

“Integration of Smart and Adaptive Camouflage Technologies”

- Increasing interest in dynamic camouflage fabrics that adjust to environmental changes such as light, temperature, and terrain is influencing military procurement strategies globally

- Defense forces are demanding multi-spectral and infrared-resistant textiles to provide concealment against modern surveillance equipment, including drones and thermal imaging systems

- Advancements in textile engineering are allowing the development of color-shifting and pattern-altering fabrics that enhance stealth in multiple operational settings

- Outdoor and tactical apparel brands are beginning to explore smart camouflage applications for hunting, surveillance, and wilderness gear, though at a niche scale

- For instance, in 2023, the U.S. Army collaborated with MIT on developing adaptive camouflage uniforms that react to changing surroundings, offering real-time concealment in various field conditions

Camouflage Fabrics Market Dynamics

Driver

“Increasing Global Military Expenditure and Tactical Gear Modernization”

- Growing geopolitical tensions and border security concerns are prompting countries to increase defense budgets, which include investments in advanced combat uniforms and gear

- Armed forces require fabric solutions suitable for multiple terrains such as forests, deserts, snowfields, and urban zones, creating demand for versatile camouflage products

- Camouflage fabrics are critical for ensuring stealth and safety in combat scenarios, driving government contracts and innovation partnerships with textile companies

- Digitized patterns and materials compatible with night-vision and thermal suppression technologies are being prioritized by military buyers for future-readiness

- For instance, in 2022, the Indian Army introduced new digital camouflage uniforms designed in collaboration with textile manufacturers to enhance durability and terrain adaptability

Restraint/Challenge

“High Cost of Advanced Camouflage Fabric Development and Limited Commercial Adoption”

- Developing smart and adaptive camouflage fabrics involves high R&D and production costs, limiting accessibility for non-military sectors such as fashion and recreational wear

- Integration of features such as infrared resistance and thermal suppression requires specialized materials and technologies, raising overall fabric costs

- Commercial outdoor brands face challenges in balancing performance with affordability, especially when targeting price-sensitive consumers

- Comfort, breathability, and maintenance complexity often limit the practicality of high-tech fabrics in everyday or non-combat applications

- For instance, in 2024, multiple North American hunting gear brands avoided adopting smart camouflage materials due to elevated costs and limited consumer demand, favoring traditional printed designs instead

Camouflage Fabrics Market Scope

The market is segmented on the basis of type, application, covering, end use, and distribution channel.

• By Type

On the basis of type, the camouflage fabrics market is segmented into polyester and nylon. The polyester segment dominated the market with the largest market revenue share of 57.8% in 2024, driven by its affordability, lightweight nature, and wide use in mass-produced military and outdoor gear. Polyester-based camouflage fabrics are also highly durable, offering resistance to moisture and wrinkles, which makes them a preferred choice for combat uniforms and field equipment. Their compatibility with various printing technologies enables high-definition camouflage patterns across diverse operational environments.

The nylon segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its superior strength and abrasion resistance. Nylon-based fabrics are favored in tactical applications requiring heavy-duty performance, such as backpacks and gear covers. Their high tensile strength, smooth finish, and water-repellent properties are contributing to increasing adoption across both military and commercial sectors.

• By Application

On the basis of application, the camouflage fabrics market is segmented into knapsacks, clothing, and others. The clothing segment held the largest market revenue share in 2024, driven by its critical use in military uniforms, outdoor sportswear, and fashion apparel. Camouflage clothing is essential for concealment in combat and hunting, while also gaining popularity as a style element in streetwear.

The knapsacks segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing demand for camouflage-patterned backpacks among outdoor enthusiasts, photographers, and tactical users. These fabrics provide durability, lightweight construction, and water resistance, which are key features for rugged and field-ready gear.

• By Covering

On the basis of covering, the camouflage fabrics market is segmented into cladded, non-cladded, and others. The cladded segment dominated the market in 2024 due to its enhanced protection and performance capabilities in extreme environments. Cladded fabrics offer multi-layer construction that includes coatings or laminates, enhancing their resistance to weather, UV exposure, and infrared detection.

The non-cladded segment is expected to witness the fastest growth rate from 2025 to 2032 owing to its cost-effectiveness and widespread use in applications where basic camouflage functionality is sufficient, such as in recreational or fashion uses.

• By End Use

On the basis of end use, the camouflage fabrics market is segmented into military, gaming, photography, hunting, and others. The military segment accounted for the largest revenue share in 2024, fueled by defense modernization programs and increased procurement of combat uniforms and tactical gear. High-performance fabrics that provide concealment, comfort, and durability are essential to defense operations.

The hunting segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising popularity of outdoor sports and wildlife tourism. Camouflage gear enhances stealth and safety, making it a must-have for both professional and recreational hunters.

• By Distribution Channel

On the basis of distribution channel, the camouflage fabrics market is segmented into direct sales, brick and mortar stores, online retailers, supermarkets, and others. The direct sales segment led the market in 2024, primarily due to government and institutional procurement contracts for military and tactical purposes. These bulk purchases often involve long-term supply agreements with certified fabric manufacturers.

The online retailers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing preference for digital shopping among consumers. Outdoor enthusiasts and fashion-conscious buyers are turning to e-commerce platforms to access a variety of camouflage products, supported by ease of comparison, product reviews, and home delivery services.

Camouflage Fabrics Market Regional Analysis

- North America dominated the camouflage fabrics market with the largest revenue share of 39.6% in 2024, driven by robust defense spending, the popularity of outdoor recreational activities, and the strong presence of tactical apparel manufacturers

- Consumers and institutions across the region rely on advanced camouflage fabrics for applications ranging from military gear to hunting and sportswear. The use of innovative technologies such as IR suppression and weather-resistant coatings enhances fabric functionality across extreme environments

- This dominance is further reinforced by a well-established textile infrastructure, favorable government procurement policies, and increasing demand for both commercial and defense-grade camouflage materials in the U.S. and Canada

U.S. Camouflage Fabrics Market Insight

The U.S. camouflage fabrics market captured the largest revenue share in North America in 2024, supported by large-scale military procurement programs, a highly active outdoor sports culture, and the presence of major textile technology players. Demand is high for both advanced multi-spectral fabrics for defense and stylish camouflage patterns for hunting, hiking, and everyday fashion. The integration of smart textiles into tactical clothing is also gaining ground across defense and private sectors.

Asia-Pacific Camouflage Fabrics Market Insight

The Asia-Pacific camouflage fabrics market is expected to witness the fastest growth rate from 2025 to 2032, supported by defense modernization, rapid textile industrialization, and rising demand for camouflage gear across commercial applications. Countries such as China, India, and South Korea are increasingly adopting high-performance camouflage materials for military use, while outdoor lifestyle trends continue to boost sales of patterned clothing and accessories.

China Camouflage Fabrics Market Insight

The China camouflage fabrics market accounted for a significant revenue share in Asia-Pacific in 2024, driven by its leading textile production capacity and growing domestic demand for both defense and outdoor products. The country’s emphasis on strengthening its military forces and expanding smart city infrastructure supports procurement of advanced camouflage materials. Meanwhile, the fashion and outdoor industries are adopting camouflage prints across bags, jackets, and performance wear.

Japan Camouflage Fabrics Market Insight

The Japan camouflage fabrics market is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in textile technology, increasing defense readiness, and a rising interest in outdoor recreation. Japan's emphasis on innovation and precision manufacturing supports the development of lightweight, durable, and multifunctional camouflage fabrics suited for diverse environmental conditions. The growing popularity of camping, airsoft, and hunting activities is also boosting demand for commercial-grade camouflage apparel and gear. In addition, collaborations between the government and local textile firms to enhance military uniform capabilities are strengthening market prospects.

Europe Camouflage Fabrics Market Insight

The Europe camouflage fabrics market is expected to witness the fastest growth rate from 2025 to 2032, supported by sustained military expenditures, strong textile innovation, and growing demand for camouflage patterns in fashion and utility clothing. The region’s focus on eco-friendly manufacturing and sustainable synthetic fibers is shaping product development in camouflage applications across countries such as Germany, France, and the U.K.

Germany Camouflage Fabrics Market Insight

The Germany camouflage fabrics market is expected to witness the fastest growth rate from 2025 to 2032, supported by advancements in textile technology and rising applications in defense, law enforcement, and outdoor recreation. Germany's defense procurement emphasizes innovation and sustainability, fostering demand for recyclable, high-durability camouflage fabrics. Tactical gear and hunting accessories are key growth areas in the commercial segment.

U.K. Camouflage Fabrics Market Insight

The U.K. camouflage fabrics market is expected to witness the fastest growth rate from 2025 to 2032, driven by ongoing military uniform upgrades and the popularity of camouflage designs in commercial fashion and utility gear. British defense forces are working with textile producers to enhance camouflage performance under modern surveillance technologies, while the outdoor and adventure market continues to adopt these fabrics for jackets, backpacks, and gear covers.

Camouflage Fabrics Market Share

The Camouflage Fabrics industry is primarily led by well-established companies, including:

- Ghillie Suit Warehouse (U.S.)

- Arcturus Gear (U.S.)

- Tactical Concealment LLC (U.S.)

- TrueTimber (U.S.)

- Predator Camo (U.S.)

- HUNTWORTH GEAR (U.S.)

- NATURAL GEAR (U.S.)

- Camo Fasteners (U.S.)

- First Lite (U.S.)

- VEIL CAMO (U.S.)

- Prois Hunting (U.S.)

- DayOne Camouflage (U.S.)

- Gildan Activewear SRL (Canada)

- Cortman Textiles (U.S.)

- Crye Precision LLC (U.S.)

- DuPont (U.S.)

- IBENA Textilwerke GmbH (Germany)

- MANIFATTURA LANDI SRL (Italy)

- Milliken & Company (U.S.)

- Koch Industries, Inc. (U.S.)

Latest Developments in Global Camouflage Fabrics Market

- In October 2023, in a landmark development for military camouflage, Zimmer unveiled significant advancements in camouflage printing technologies. This collaboration introduced innovative printing techniques specifically designed for military applications, enhancing the effectiveness of concealment strategies for defense forces globally. The advancements promise to revolutionize how military uniforms and equipment blend into their surroundings, thereby increasing operational efficiency and safety for troops in the field

- In October 2023, Nature inFocus, a prominent Indian production house, announced the launch of Project Tiger, a new documentary film dedicated to highlighting the country's flagship conservation program. This initiative aims to raise awareness about the critical importance of tiger conservation in India, showcasing the efforts made to protect these magnificent creatures and their habitats. The documentary is expected to inspire action and promote wildlife conservation efforts across the nation

- In March 2023, in a significant advancement towards modernization, the Indian Army successfully procured Integrated Mobile Camouflage Systems from an innovative startup. This cutting-edge technology enhances the army's concealment capabilities on the battlefield, reflecting a strategic commitment to adopting advanced technologies. By utilizing these systems, the military aims to improve its operational effectiveness and adaptability in diverse combat environments, ensuring better protection for personnel and assets

- In April 2022, in a strategic move to expand its market presence, Sherwin-Williams Company acquired the European industrial coatings business of Sika AG. This acquisition enables Sherwin-Williams to enhance its product offerings and strengthen its competitive position in the European market. By integrating Sika’s innovative technologies and expertise, the company aims to provide advanced coating solutions, catering to diverse customer needs in various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Camouflage Fabrics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Camouflage Fabrics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Camouflage Fabrics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.