Global Can Packaging Market

Market Size in USD Billion

CAGR :

%

USD

58.83 Billion

USD

93.76 Billion

2025

2033

USD

58.83 Billion

USD

93.76 Billion

2025

2033

| 2026 –2033 | |

| USD 58.83 Billion | |

| USD 93.76 Billion | |

|

|

|

|

Can Packaging Market Size

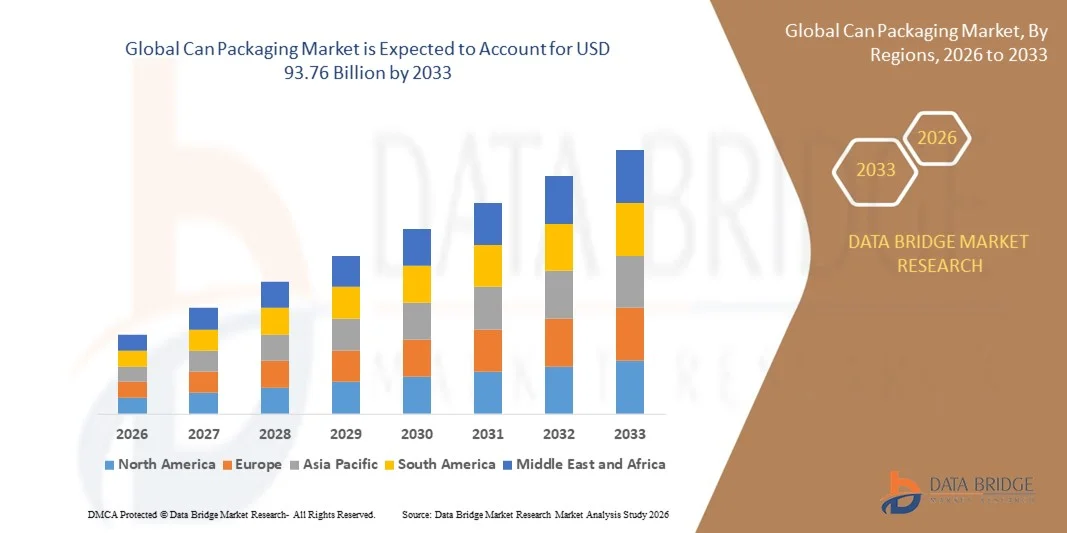

- The global can packaging market size was valued at USD 58.83 billion in 2025 and is expected to reach USD 93.76 billion by 2033, at a CAGR of 6.00% during the forecast period

- The market growth is largely fuelled by the rising demand for convenient and sustainable packaging solutions across food and beverage, personal care, and industrial sectors

- Increasing consumer preference for ready-to-eat and on-the-go products is driving the adoption of cans due to their portability, durability, and longer shelf life

Can Packaging Market Analysis

- Growing emphasis on sustainability and recyclability is encouraging manufacturers to adopt aluminum and steel cans, which are highly recyclable and reduce environmental impact

- Rising consumption of beverages, processed foods, and aerosol products globally is increasing demand for can packaging, making it a preferred choice for product protection, preservation, and branding

- North America dominated the can packaging market with the largest revenue share in 2025, driven by increasing demand for sustainable packaging solutions, growing consumption of ready-to-drink beverages and processed foods, and heightened consumer awareness of eco-friendly products

- Asia-Pacific region is expected to witness the highest growth rate in the global can packaging market, driven by rising population, growing middle-class consumers, expanding food and beverage industry, and increasing adoption of modern packaging solutions

- The aluminium segment held the largest market revenue share in 2025, driven by its lightweight, corrosion-resistant properties and superior recyclability. Aluminium cans offer enhanced product protection, longer shelf-life, and cost-effective transportation, making them a preferred choice across food and beverage applications

Report Scope and Can Packaging Market Segmentation

|

Attributes |

Can Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Lcoa Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Can Packaging Market Trends

Rise of Sustainable and Innovative Can Packaging

- The increasing adoption of sustainable can packaging is transforming the packaging landscape by offering eco-friendly, recyclable, and lightweight alternatives to traditional packaging. This shift allows manufacturers to meet regulatory requirements and consumer demand for environmentally responsible products, improving brand image and reducing environmental impact. In addition, innovations in material science and coating technologies are enhancing durability and food safety, making cans a preferred choice for premium and functional products

- The rising preference for ready-to-drink beverages, processed foods, and aerosol products is accelerating the demand for cans due to their convenience, portability, and ability to preserve freshness and quality. These factors are particularly relevant in urban and on-the-go consumption scenarios. Furthermore, cans provide barrier protection against light, oxygen, and contaminants, extending shelf-life and reducing product waste, which appeals to both consumers and manufacturers

- Advancements in can design, printing, and coatings are enhancing product appeal, shelf-life, and functionality, making cans an attractive choice for manufacturers across food, beverage, and personal care segments. Improved aesthetics and usability support stronger consumer engagement and repeat purchases. Manufacturers are increasingly using high-resolution labeling, custom shapes, and interactive packaging features to boost brand differentiation and attract younger, tech-savvy consumers

- For instance, in 2023, several beverage companies in North America and Europe reported increased sales of energy drinks and craft beers packaged in aluminum cans, highlighting the potential for market growth and product differentiation. The adoption of lightweight and eco-friendly cans also allowed these companies to reduce transportation costs and carbon emissions, supporting sustainability commitments

- While can packaging adoption is growing, its impact depends on material cost, manufacturing efficiency, and regulatory compliance. Stakeholders must focus on innovation, sustainable sourcing, and supply chain optimization to fully capitalize on market opportunities. In addition, investments in recycling infrastructure, circular economy initiatives, and strategic partnerships with material suppliers are critical for long-term market sustainability

Can Packaging Market Dynamics

Driver

Rising Demand For Sustainable Packaging Solutions

- Growing environmental awareness among consumers and governments is pushing manufacturers to adopt recyclable and lightweight can packaging. This trend is encouraging investment in eco-friendly materials and promoting circular economy initiatives across industries. Companies are also leveraging eco-labeling and sustainability certifications to strengthen brand credibility and consumer trust

- Food and beverage manufacturers are increasingly shifting from plastic and glass to aluminum and steel cans due to superior recyclability, product protection, and ease of transport. This enhances operational efficiency and reduces carbon footprint. Moreover, the adoption of lightweight cans helps reduce shipping costs, storage space, and overall environmental impact, which aligns with corporate ESG goals

- Regulatory frameworks and incentives promoting sustainable packaging solutions are further strengthening adoption. Companies compliant with eco-labels and sustainability certifications benefit from increased consumer trust and competitive advantage. Governments in Europe, North America, and Asia-Pacific are providing tax benefits and subsidies for manufacturers using recycled materials, which is boosting market expansion

- For instance, in 2022, several multinational beverage brands in Europe introduced fully recyclable aluminum cans for soft drinks and beers, which received strong market acceptance and contributed to higher revenue growth. These initiatives also enabled companies to meet evolving environmental regulations and sustainability targets, increasing investor confidence

- While sustainability is driving the market, continuous innovation in lightweighting, coatings, and material efficiency is essential to meet consumer expectations and regulatory standards, ensuring long-term growth. In addition, manufacturers must invest in automation and advanced production technologies to maintain cost-effectiveness while enhancing product quality

Restraint/Challenge

High Production Costs And Supply Chain Constraints

- The production of high-quality aluminum and steel cans involves significant capital investment, energy consumption, and raw material costs, limiting adoption among small and medium manufacturers. Price sensitivity can restrict market penetration in developing regions. The volatility of aluminum and steel prices also affects profit margins, making cost management a key challenge for producers

- Supply chain challenges, including fluctuations in raw material availability and transportation costs, can lead to production delays and increased operational expenses. These factors impact the timely supply of cans to manufacturers across global markets. In addition, disruptions in global logistics networks and energy shortages can exacerbate these constraints, particularly in emerging economies

- Technical challenges in coating, printing, and sealing cans to meet quality and safety standards can further restrict adoption, particularly for niche or specialty products. Manufacturers may face difficulties ensuring product integrity and shelf-life consistency. This necessitates investments in R&D, employee training, and quality assurance programs to mitigate risks and maintain brand reputation

- For instance, in 2023, several food and beverage producers in Asia-Pacific reported production delays due to aluminum shortages and coating line maintenance, affecting revenue and product launches. Some companies had to renegotiate supply contracts or temporarily shift production to other facilities, highlighting the importance of resilient supply chains

- While advancements in manufacturing and material science are improving efficiency, addressing cost, supply, and technical challenges remains critical. Market players must focus on process optimization, quality control, and resilient supply chains to sustain growth. In addition, collaborative initiatives with suppliers, recycling partners, and logistics providers are essential to ensure uninterrupted production and meet growing global demand

Can Packaging Market Scope

The global can packaging market is segmented on the basis of material and application.

- By Material

On the basis of material, the market is segmented into aluminium, steel, and others. The aluminium segment held the largest market revenue share in 2025, driven by its lightweight, corrosion-resistant properties and superior recyclability. Aluminium cans offer enhanced product protection, longer shelf-life, and cost-effective transportation, making them a preferred choice across food and beverage applications.

The steel segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its durability, high strength, and suitability for premium or specialty products. Steel cans are increasingly adopted in processed foods, aerosols, and healthcare packaging where robustness and product integrity are critical, supporting long-term adoption by manufacturers.

- By Application

On the basis of application, the market is segmented into food, beverage, healthcare, personal care, and others. The beverage segment held the largest revenue share in 2025 due to the rising consumption of ready-to-drink beverages, craft beers, and energy drinks packaged in cans. Cans provide convenience, portability, and preservation of product quality, driving widespread use in the beverage industry.

The food segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for processed, ready-to-eat, and packaged food products. Cans ensure longer shelf-life, maintain product safety, and offer design flexibility, making them a preferred solution for food manufacturers globally.

Can Packaging Market Regional Analysis

- North America dominated the can packaging market with the largest revenue share in 2025, driven by increasing demand for sustainable packaging solutions, growing consumption of ready-to-drink beverages and processed foods, and heightened consumer awareness of eco-friendly products

- Manufacturers and consumers in the region highly value the recyclability, durability, and convenience offered by aluminum and steel cans, supporting a shift from glass and plastic packaging

- This widespread adoption is further fueled by high disposable incomes, well-developed supply chains, and technological advancements in can manufacturing, establishing cans as a preferred choice for food, beverage, and personal care products

U.S. Can Packaging Market Insight

The U.S. can packaging market captured the largest revenue share in 2025 within North America, driven by the rising consumption of soft drinks, energy drinks, and canned foods. The adoption of lightweight, recyclable aluminum and steel cans is accelerating due to consumer demand for sustainable packaging. The growing trend of on-the-go consumption, coupled with innovation in can coatings and printing technologies, is further driving market expansion. Moreover, the presence of major beverage and food manufacturers focusing on eco-friendly packaging solutions is significantly contributing to growth.

Europe Can Packaging Market Insight

The Europe can packaging market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations, government incentives promoting recyclable packaging, and increasing consumer preference for sustainable products. Urbanization, modernization of production facilities, and a strong beverage sector are fostering adoption. The market is witnessing growth across food, beverage, and personal care applications, with cans increasingly used in both retail and e-commerce channels.

U.K. Can Packaging Market Insight

The U.K. can packaging market is expected to grow rapidly from 2026 to 2033, fueled by rising awareness of environmental sustainability and increased demand for ready-to-drink beverages and packaged foods. Consumer preference for recyclable and lightweight packaging, coupled with robust retail and e-commerce infrastructure, is driving market growth. The shift from traditional glass and plastic containers to aluminum and steel cans is prominent, particularly in the beverage and processed food segments.

Germany Can Packaging Market Insight

The Germany can packaging market is expected to witness significant growth from 2026 to 2033, driven by environmental regulations, technological advancements in can production, and a strong focus on sustainability. Increasing demand for functional, high-quality packaging in the food and beverage sector supports adoption. The integration of innovative printing, coating, and lightweighting technologies is enhancing can appeal, while manufacturers emphasize compliance with eco-labels and recycling standards.

Asia-Pacific Can Packaging Market Insight

The Asia-Pacific can packaging market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing consumption of packaged foods and beverages in countries such as China, India, and Japan. Government initiatives promoting sustainable packaging and digitalization of manufacturing processes are accelerating adoption. The region is also emerging as a manufacturing hub for aluminum and steel cans, improving affordability and accessibility to a broader consumer base.

Japan Can Packaging Market Insight

The Japan can packaging market is expected to witness strong growth from 2026 to 2033, owing to high consumer awareness of sustainability, increasing demand for ready-to-drink beverages, and technological advancements in can manufacturing. Adoption is supported by the country’s focus on lightweight and recyclable packaging, coupled with the rising trend of convenience foods and on-the-go consumption. The use of advanced coatings, printing, and sealing technologies is enhancing product appeal and shelf-life.

China Can Packaging Market Insight

The China can packaging market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding middle class, rapid urbanization, and high consumption of beverages and packaged foods. The push for sustainable packaging, combined with local manufacturing capabilities and affordable can options, is driving adoption. The market benefits from government initiatives supporting eco-friendly packaging and the growing trend of ready-to-drink beverages and processed foods, further propelling market growth.

Can Packaging Market Share

The Can Packaging industry is primarily led by well-established companies, including:

• Lcoa Corporation (U.S.)

• Amcor plc (U.K.)

• Ardagh Group S.A. (Luxembourg)

• BALL CORPORATION (U.S.)

• Crown (U.K.)

• BWAY Corporation (U.S.)

• COFCO (China)

• Greif (U.S.)

• Silgan Holdings Inc. (U.S.)

• TON YI INDUSTRIAL CORP (Taiwan)

• Can-Pack Romania (Romania)

• Tubex Aluminium Tubes (Germany)

• HUBER Packaging Group GmbH (Germany)

• Metal Packaging Europe (Belgium)

• Emballator Metal Group (Sweden)

• Anheuser-Busch Companies, LLC. (U.S.)

• DAIWA CAN COMPANY (Japan)

• Hildering Packaging BV (Netherlands)

• HOE CHONG TIN PTE LTD. (Singapore)

• Orora Packaging Australia Pty Ltd (Australia)

• Pirlo Holding GmbH (Germany)

• Sonoco Products Company (U.S.)

• Tata Steel (India)

• Tecnocap S.p.A. (Italy)

• Massilly Holding SAS (France)

Latest Developments in Global Can Packaging Market

- In October 2024, Arnest Packaging Solutions announced plans to build a new aluminium beverage can manufacturing plant in Uzbekistan. The $100 million facility is expected to commence operations in late 2025 with an annual production capacity of over 1.5 billion cans. Approximately 30% of the output will be allocated for export, enhancing Arnest’s international market presence. This development is set to strengthen the company’s production capabilities, improve supply chain efficiency, and support growing demand for aluminium beverage cans in both domestic and global markets

- In June 2024, Sonoco Products Company revealed its agreement to acquire Eviosys, a European metal packaging manufacturer, for $3.9 billion. This strategic acquisition is aimed at expanding Sonoco’s footprint in the global metal food can and aerosol packaging sectors. The deal is expected to create operational synergies, improve market reach in the U.S. and Europe, and reinforce the company’s leadership position in the metal packaging industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Can Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Can Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Can Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.