Global Cancer Registry Software Market

Market Size in USD Billion

CAGR :

%

USD

83.61 Billion

USD

183.31 Billion

2024

2032

USD

83.61 Billion

USD

183.31 Billion

2024

2032

| 2025 –2032 | |

| USD 83.61 Billion | |

| USD 183.31 Billion | |

|

|

|

|

Cancer Registry Software Market Size

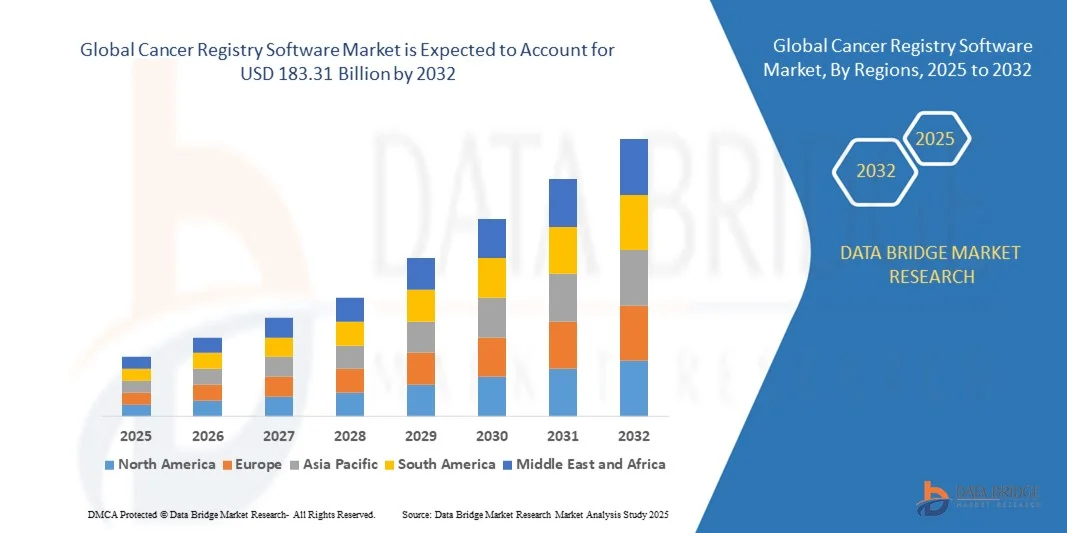

- The global cancer registry software market size was valued at USD 83.61 billion in 2024 and is expected to reach USD 183.31 billion by 2032, at a CAGR of 10.31% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of cancer worldwide, which is driving demand for effective data management and tracking systems

- Rising government initiatives and funding programs supporting cancer surveillance and population health monitoring are further boosting the adoption of cancer registry software

Cancer Registry Software Market Analysis

- The market is witnessing steady expansion as healthcare systems increasingly prioritize cancer surveillance, early detection, and research

- Growing emphasis on personalized medicine and the need for reliable datasets for clinical trials are driving adoption among hospitals, research centers, and public health agencies

- North America dominated the cancer registry software market with the largest revenue share of 38.7% in 2024, driven by growing investments in healthcare IT infrastructure, government initiatives for cancer tracking, and increasing adoption of digital health solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global cancer registry software market, driven by rapid technological advancements, government support for cancer surveillance programs, and growing investments in healthcare IT infrastructure

- The cross-disciplinary segment held the largest market revenue share in 2024, driven by its ability to integrate across multiple oncology fields and provide comprehensive data for population health management. These solutions enable interoperability and streamline workflows for diverse stakeholders.

Report Scope and Cancer Registry Software Market Segmentation

|

Attributes |

Cancer Registry Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cancer Registry Software Market Trends

Integration of Artificial Intelligence and Cloud-Based Platforms in Cancer Registry Software

The increasing integration of artificial intelligence (AI) and cloud-based platforms is revolutionizing cancer registry software by enabling real-time data processing, predictive analytics, and scalable storage solutions. These advancements allow healthcare providers to track cancer cases more efficiently and support population-based cancer surveillance, ultimately improving treatment outcomes and policy-making

The growing demand for cloud-enabled cancer registry systems in hospitals and research centers is accelerating adoption, particularly in regions with limited IT infrastructure. Cloud solutions enhance accessibility, reduce operational costs, and allow seamless collaboration across multiple stakeholders, including clinicians, researchers, and policymakers

AI-driven features such as natural language processing (NLP) and machine learning algorithms are making registry systems smarter by automating data abstraction and reducing manual errors. This significantly improves data quality, speeds up cancer case reporting, and strengthens clinical decision-making

For instance, in 2023, several U.S.-based cancer institutes deployed AI-powered registry platforms to streamline oncology data collection, leading to faster reporting of patient outcomes and improved participation in clinical trials. These initiatives are helping optimize treatment protocols and boost cancer research

While AI and cloud-based innovations are accelerating adoption, their success depends on data privacy, interoperability, and user training. Vendors must focus on compliance with healthcare regulations such as HIPAA and GDPR, as well as offer user-friendly systems to fully capitalize on this growing demand

Cancer Registry Software Market Dynamics

Driver

Rising Cancer Incidence and Increasing Emphasis on Population Health Management

The surge in global cancer incidence is compelling governments and healthcare providers to prioritize cancer registry software as a core component of health infrastructure. Accurate registries enable better planning of resources, screening programs, and treatment pathways, driving significant investment in advanced solutions

Hospitals and research centers are increasingly aware of the importance of robust cancer data collection, including its role in clinical trials, patient outcomes, and national cancer control programs. This awareness is fueling the adoption of registry systems, even among small and mid-sized facilities

Public health agencies and international organizations are strengthening cancer surveillance frameworks by providing funding, technical support, and standardized reporting guidelines. These measures are enhancing registry adoption at both local and national levels

For instance, in 2022, the European Union expanded its cancer surveillance initiatives by integrating centralized registry systems across member countries, boosting demand for advanced software platforms

While demand and institutional support are accelerating adoption, ensuring interoperability across diverse healthcare systems and maintaining high data accuracy remain ongoing challenges that must be addresse

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- The high costs associated with implementing advanced cancer registry software, including licensing, integration, and training expenses, limit adoption among small and resource-constrained healthcare providers. This cost barrier often delays deployment in developing regions

- Many hospitals and research centers struggle with data privacy and security concerns, especially when adopting cloud-based solutions. The risk of sensitive patient data breaches and the complexity of compliance with regulations such as HIPAA in the U.S. or GDPR in Europe pose significant hurdles

- Technical and infrastructural challenges further limit adoption in rural and underdeveloped regions, where healthcare IT systems are still evolving. This reduces the availability of accurate cancer data and affects the global cancer surveillance ecosystem

- For instance, in 2023, oncology associations in Sub-Saharan Africa reported that over 60% of cancer treatment centers lacked access to reliable registry systems due to high costs, inadequate infrastructure, and limited cybersecurity measures

- While cancer registry software continues to evolve, addressing affordability, interoperability, and data security challenges is critical. Vendors must focus on offering cost-effective, scalable, and compliant solutions to bridge existing gaps and enable widespread adoption globally

Cancer Registry Software Market Scope

The market is segmented on the basis of software, type, deployment model, database type, functionality, and end user.

- By Software

On the basis of software, the cancer registry software market is segmented into cross-disciplinary and specific. The cross-disciplinary segment held the largest market revenue share in 2024, driven by its ability to integrate across multiple oncology fields and provide comprehensive data for population health management. These solutions enable interoperability and streamline workflows for diverse stakeholders.

The specific segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising demand for tailored registry systems that address niche cancer types and specialized research needs. Their precision-driven design makes them highly valuable for institutions focusing on targeted therapies and clinical trials.

- By Type

On the basis of type, thecancer registry software market is segmented into standalone and integrated. The integrated segment accounted for the largest share in 2024 due to its seamless compatibility with electronic health records (EHRs) and hospital IT systems, enabling automated data collection and compliance reporting.

The standalone segment is expected to witness the fastest growth rate from 2025 to 2032, supported by small and mid-sized healthcare facilities seeking cost-effective, flexible, and independent registry solutions without complex integration requirements.

- By Deployment Model

On the basis of deployment model, the cancer registry software market is segmented into on-premise and cloud-based. The on-premise segment held the largest share in 2024 owing to high adoption among large hospitals and government agencies prioritizing strict data security and regulatory compliance.

The cloud-based segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its scalability, reduced infrastructure costs, and ability to provide remote access, making it attractive for research centers and multi-location healthcare providers.

- By Database Type

On the basis of database type, the cancer registry software market is segmented into commercial and public. The commercial segment dominated the market in 2024 due to its robust data analytics capabilities, extensive reporting features, and value-added services for pharmaceutical and biotech companies.

The public segment is expected to witness the fastest growth rate from 2025 to 2032, supported by government-led cancer surveillance programs and rising investments in national healthcare databases for population-wide monitoring.

- By Functionality

On the basis of functionality, the cancer registry software market is segmented into cancer reporting to meet state and federal regulations, patient care management, medical research and clinical studies, and product outcome evaluation. The cancer reporting segment captured the largest share in 2024, reflecting the increasing regulatory emphasis on standardized cancer case submissions and compliance tracking.

The patient care management is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for precision oncology, personalized treatment planning, and clinical trial participation.

- By End User

On the basis of end user, the cancer registry software market is segmented into government organizations and third-party administrators, hospitals and medical practices, private payers, pharmaceutical, biotechnology and medical device companies, research centres, and others. Hospitals and medical practices led the market in 2024 due to the rising need for real-time cancer data integration with patient care pathways.

Pharmaceutical is expected to witness the fastest growth rate from 2025 to 2032, as they increasingly leverage registry data for drug development, outcome tracking, and post-market surveillance.

Cancer Registry Software Market Regional Analysis

- North America dominated the cancer registry software market with the largest revenue share of 38.7% in 2024, driven by growing investments in healthcare IT infrastructure, government initiatives for cancer tracking, and increasing adoption of digital health solutions

- Healthcare providers in the region highly value the ability of cancer registry software to streamline patient data management, support regulatory compliance, and improve clinical research efficiency

- This widespread adoption is further supported by advanced hospital networks, high healthcare spending, and a focus on data-driven patient care, establishing cancer registry software as an essential tool for hospitals, research centers, and public health organizations

U.S. Cancer Registry Software Market Insight

The U.S. cancer registry software market captured the largest revenue share in 2024 within North America, fueled by widespread implementation of electronic health records (EHR) and government programs aimed at cancer surveillance. Providers are increasingly prioritizing efficient patient tracking, clinical study support, and regulatory reporting. The growing integration of software with cloud platforms, analytics tools, and AI-enabled solutions further propels market growth. In addition, initiatives such as the National Cancer Institute (NCI) programs are significantly contributing to the market's expansion.

Europe Cancer Registry Software Market Insight

The Europe cancer registry software market i is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent healthcare regulations, rising cancer incidence, and the need for standardized data reporting across countries. Increasing adoption in hospitals, research institutes, and national cancer registries is fostering market growth. European healthcare providers also appreciate the software’s capabilities in enhancing patient outcomes, enabling research, and supporting clinical decision-making.

U.K. Cancer Registry Software Market Insight

The U.K. cancer registry software market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the government’s National Health Service (NHS) initiatives and programs focused on cancer surveillance and reporting. The rising trend toward digitization of patient records and data interoperability is encouraging adoption. The U.K.’s strong IT infrastructure and increasing use of cloud-based healthcare solutions are further supporting market growth.

Germany Cancer Registry Software Market Insight

The Germany cancer registry software market is anticipated to expand at a considerable CAGR, driven by rising cancer prevalence, government mandates for cancer reporting, and growing research activities. Germany’s advanced healthcare infrastructure and focus on precision medicine promote software adoption in hospitals and research centers. Integration with national healthcare databases and compliance with EU regulations further enhances market penetration.

Asia-Pacific Cancer Registry Software Market Insight

The Asia-Pacific cancer registry software market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing investments in healthcare IT, rising cancer incidence, and the adoption of digital health initiatives in countries such as China, Japan, and India. The region’s expanding healthcare infrastructure, government programs, and growing awareness of data-driven cancer management are accelerating adoption. In addition, the availability of cost-effective software solutions is widening access across hospitals and research institutions.

Japan Cancer Registry Software Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to rapid digitalization of healthcare systems, an aging population, and strong government support for cancer surveillance programs. Hospitals and research centers are increasingly adopting software to enhance patient tracking, clinical studies, and regulatory compliance. Integration with national health databases and electronic medical records is driving growth.

China Cancer Registry Software Market Insight

The China cancer registry software market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to government initiatives promoting cancer data collection, rapid digitization of hospitals, and high adoption of healthcare IT solutions. Increasing cancer incidence, strong domestic software providers, and focus on large-scale epidemiological studies are key factors propelling the market. Affordable and scalable software solutions are also expanding adoption in hospitals, research institutes, and public health programs.

Cancer Registry Software Market Share

The Cancer Registry Software industry is primarily led by well-established companies, including:

- Centres for Disease Control and Prevention (CDC) (U.S.)

- Elekta AB (publ) (Sweden)

- IBM (U.S.)

- Netdox Health Pvt. Ltd. (India)

- C-Net Solutions (U.S.)

- Ordinal Data, Inc. (U.S.)

- himagine solutions (India)

- McKesson Corporation (U.S.)

- Conduent, Inc. (U.S.)

- National Council on Radiation Protection and Measurements (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- NeuralFrame, Inc. (U.S.)

Latest Developments in Global Cancer Registry Software Market

- In May 2024, Elekta AB, acquisition, acquired Philips Healthcare's Pinnacle Treatment Planning System (TPS) patent portfolio to strengthen its Elekta ONE software. This move is designed to enhance cancer treatment planning, improve monitoring of patient care, and streamline workflows, ultimately supporting more precise and efficient oncology services in the market

- In March 2024, Elekta AB, strategic partnership, partnered with Merck & Co., Inc. to develop a digital platform for monitoring patients with advanced renal cell carcinoma (RCC). The initiative aims to improve kidney cancer care by leveraging digital solutions, enabling better patient tracking, timely interventions, and enhanced clinical outcomes, thereby positively impacting oncology management

- In November 2023, ONCO, Inc., strategic partnership, collaborated with Oncora Medical to develop advanced cancer registry, reporting, and analytics software. The collaboration focuses on automating data processes, supporting personalized patient care, and empowering cancer centers with actionable insights, driving efficiency and improved decision-making in the cancer care market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.