Global Cancer Spit Test Device Market

Market Size in USD Million

CAGR :

%

USD

606.26 Million

USD

1,271.50 Million

2024

2032

USD

606.26 Million

USD

1,271.50 Million

2024

2032

| 2025 –2032 | |

| USD 606.26 Million | |

| USD 1,271.50 Million | |

|

|

|

|

Cancer Spit Test Device Market Size

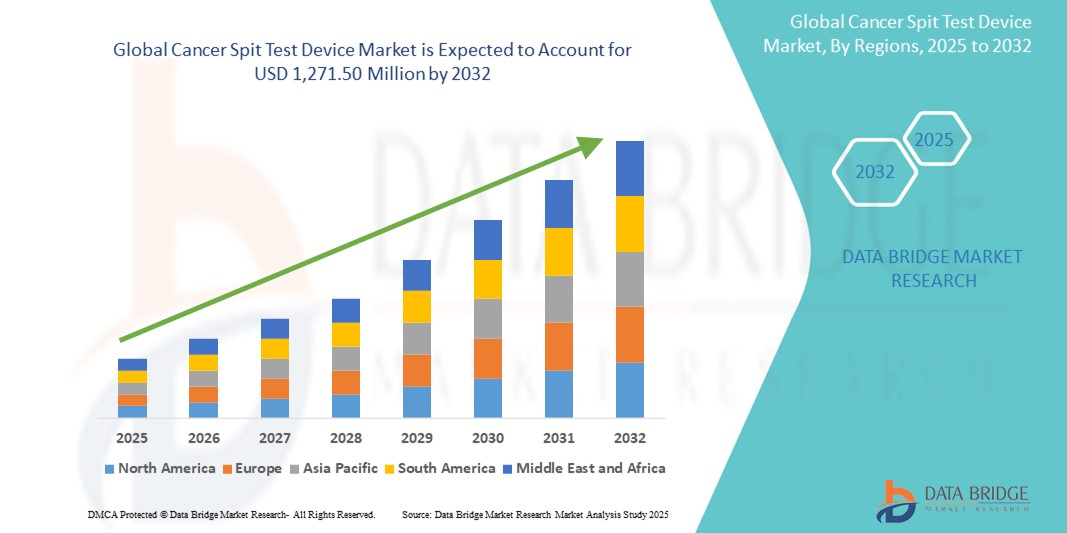

- The global cancer spit test device market size was valued at USD 606.26 million in 2024 and is expected to reach USD 1,271.50 million by 2032, at a CAGR of 9.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress in non-invasive diagnostic technologies, particularly in the field of salivary diagnostics. Advancements in molecular biology, point-of-care testing, and biosensor technologies are enhancing the sensitivity and accuracy of cancer spit test devices, enabling earlier detection and monitoring of various cancers, including oral, lung, breast, and pancreatic cancers. This progress is significantly driving digital transformation in diagnostic approaches across both clinical and home healthcare settings

- Furthermore, rising consumer and clinical demand for non-invasive, user-friendly, and rapid testing solutions is positioning cancer spit test devices as a modern alternative to traditional diagnostic methods such as biopsies and blood tests. These converging factors are accelerating the adoption of cancer spit test device solutions, thereby significantly boosting the industry's growth. Key advantages such as minimal discomfort, ease of sample collection, and the ability to conduct repeated testing are fueling their uptake across hospitals, diagnostic centers, and even direct-to-consumer platforms

Cancer Spit Test Device Market Analysis

- Cancer spit test devices, offering non-invasive and rapid diagnostic capabilities, are increasingly vital components of early cancer detection systems in both clinical and home-based settings due to their enhanced convenience, ease of use, and compatibility with mobile health platforms

- The escalating demand for cancer spit test devices is primarily fueled by rising global cancer incidence, growing emphasis on early detection, and increasing consumer preference for painless, saliva-based screening methods

- North America dominated the cancer spit test device market with the largest revenue share of 41.8% in 2024, attributed to strong healthcare infrastructure, high awareness of preventive cancer screening, and the presence of key diagnostic technology developers. The U.S. is witnessing substantial growth in the adoption of saliva-based cancer diagnostics due to innovations from both established medical device companies and biotech startups

- Asia-Pacific is expected to be the fastest growing region in the cancer spit test device market during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing government initiatives to promote affordable cancer screening in countries like China, India, and Japan

- The saliva collection kits segment dominated the cancer spit test device market with the largest revenue share of 38.4% in 2024, driven by growing use in non-invasive diagnostics and at-home testing

Report Scope and Cancer Spit Test Device Market Segmentation

|

Attributes |

Cancer Spit Test Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cancer Spit Test Device Market Trends

“Rising Preference for At-Home Testing and Non-Invasive Cancer Diagnostics”

- A significant and accelerating trend in the global cancer spit test device market is the growing preference for at-home testing and non-invasive cancer screening methods. Consumers and healthcare providers alike are increasingly turning to saliva-based testing due to its ease of use, cost-effectiveness, and the ability to detect cancer biomarkers without the need for blood draws or biopsies

- For instance, companies such as DNA Genotek and PeriRx have introduced advanced saliva collection kits designed for home use that ensure sample integrity and diagnostic accuracy. These innovations empower users to collect samples conveniently and send them to labs for analysis—minimizing the need for in-person clinic visits and accelerating early detection

- Saliva-based diagnostics are gaining strong traction in screening for oral, breast, lung, and pancreatic cancers. Their application in population-wide screening campaigns is also expanding, particularly in areas with limited access to advanced medical facilities. The minimal requirement for technical training in sample collection makes these devices particularly suitable for remote and underserved regions

- Furthermore, partnerships between diagnostics companies and telemedicine platforms are helping integrate spit test devices into broader virtual care ecosystems. This seamless collaboration supports timely diagnosis, faster clinical decision-making, and improved patient compliance—all of which are critical in the early stages of cancer management

- This trend toward simplified, accessible, and efficient diagnostic tools is fundamentally reshaping how cancer screening is approached globally. As consumer awareness grows and healthcare systems increasingly prioritize preventive care, the demand for cancer spit test devices is expected to surge across both developed and emerging markets

Cancer Spit Test Device Market Dynamics

Driver

“Growing Need for Early, Non-Invasive Cancer Diagnostics”

- The increasing global burden of cancer and the demand for early-stage, non-invasive diagnostic solutions are key drivers of the cancer spit test device market. Saliva-based testing offers a painless, quick, and cost-effective alternative to traditional biopsy or blood-based methods

- For instance, in October 2023, the University of California, Los Angeles (UCLA) researchers developed a saliva-based test capable of detecting early-stage oral and throat cancers with over 90% accuracy. Such innovations are expected to significantly boost market demand by offering accessible cancer screening tools

- Furthermore, growing awareness among patients and healthcare providers about the benefits of liquid biopsy and non-invasive diagnostics is driving increased adoption in both clinical and research settings. Saliva tests are also being integrated into cancer screening programs in schools, workplaces, and remote areas, widening their application scope

- Saliva-based diagnostics eliminate the need for specialized collection equipment or facilities, making them ideal for decentralized and point-of-care testing environments. Their ease of use, minimal training requirements, and fast turnaround times make them a preferred option for both developed and emerging markets

Restraint/Challenge

“Lack of Standardization and Sensitivity Concerns”

- Despite the promise of saliva-based diagnostics, a significant challenge lies in the lack of standardization in collection, processing, and interpretation protocols. Variability in saliva composition due to hydration levels, diet, or time of collection may affect test accuracy and consistency

- For instance, while certain devices can detect specific biomarkers with high sensitivity, they may fall short when applied to rare or complex cancer types, limiting the broad applicability of some solutions

- Regulatory hurdles and the need for extensive clinical validation before gaining FDA or CE approval can also delay market entry for innovative startups. Moreover, healthcare providers may be hesitant to switch from established diagnostic practices due to unfamiliarity or perceived risks of false negatives

- Overcoming these challenges will require collaboration between diagnostic developers, regulatory agencies, and healthcare institutions to create unified guidelines, improve test performance, and foster trust among clinicians and patients. Advancements in biomarker discovery, AI-based analysis, and portable lab-on-chip platforms are expected to address some of these concerns in the coming years

Cancer Spit Test Device Market Scope

The market is segmented on the basis of product type, site of collection, application, age group, method of collection, end user, and distribution channel.

- By Product Type

On the basis of product type, the cancer spit test device market is segmented into saliva collection kits, fluid specific devices, oral swab, bar-code labels, saliva cryostorage box, and others. The saliva collection kits segment dominated the market with the largest revenue share of 38.4% in 2024, driven by growing use in non-invasive diagnostics and at-home testing.

The oral swab segment is projected to witness the fastest CAGR of 21.1% from 2025 to 2032, due to ease of use in pediatric and geriatric populations.

- By Site of Collection

On the basis of site of collection, the cancer spit test device market is segmented into sub-mandibular/sub-lingual gland, parotid gland, and minor salivary gland. The parotid gland segment accounted for the highest share of 47.5% in 2024, owing to high saliva volume and sample quality.

The minor salivary gland segment is anticipated to grow at the fastest CAGR of 19.3% over the forecast period.

- By Application

On the basis of applications, the cancer spit test device market is segmented into liver-lung cancer, breast cancer, colon and rectal cancer, prostate cancer, pancreatic cancer, oral cancer, thyroid cancer, endometrial cancer, kidney cancer, leukemia, melanoma, non-Hodgkin lymphoma, and others. Oral cancer accounted for the largest market share of 26.2% in 2024, as saliva-based diagnostics are especially effective in oral cavity malignancies.

Breast cancer segment is expected to grow with highest CAGR of 18.7% during the forecast period, respectively, due to increasing precision diagnostics.

- By Age Group

On the basis of age group, the cancer spit test device market is segmented into adult and pediatric. The adult segment held the dominant market share of 83.5% in 2024, attributed to higher disease prevalence and screening rates.

The pediatric segment is anticipated to expand at a CAGR of 16.2%, as demand rises for child-friendly diagnostic methods.

- By Method of Collection

On the basis of method of collection, the cancer spit test device market is segmented passive drool, oral swab, and others.

The passive drool segment led the market with a share of 41.9% in 2024, due to widespread clinical and research use.

The oral swab segment is expected to grow at the fastest CAGR of 22.5%, driven by user-friendliness and lower operational costs.

- By End User

On the basis of end users, the cancer spit test device market is segmented into hospitals, diagnostic laboratories, oncology specialty clinics, cancer research institutes, and others. Diagnostic laboratories held the largest share at 36.7% in 2024, owing to their critical role in early and confirmatory cancer testing.

Oncology specialty clinics are forecasted to grow at a fastest CAGR of 20.4%, fueled by the increasing adoption of targeted therapies.

- By Distribution Channel

On the basis of distribution channels, the cancer spit test device market is segmented into direct tenders, retail sales, and others. Direct tenders dominated the segment with 52.3% share in 2024, driven by institutional procurement.

Retail sales are expected to grow with fastest CAGR of 19.6%, supported by DTC (direct-to-consumer) trends and e-commerce availability.

Cancer Spit Test Device Market Regional Analysis

- North America dominated the cancer spit test device market with the largest revenue share of 41.8% in 2024, driven by growing demand for non-invasive diagnostic methods, advanced healthcare infrastructure, and increasing awareness of early cancer detection

- Hospitals and diagnostic labs in North America are adopting saliva-based testing for cancer screening at a faster pace, supported by research funding and favorable regulatory environments

- The region is expected to maintain its dominance through the forecast period, with an estimated CAGR of 17.2% from 2025 to 2032

U.S. Cancer Spit Test Device Market Insight

The U.S. cancer spit test device market captured the largest revenue share of 71.0% within North America in 2024, owing to early adoption of advanced diagnostics, high cancer incidence rates, and strong presence of key players. The U.S. market is projected to expand at a CAGR of 16.9% from 2025 to 2032, supported by at-home saliva kits, mobile app integration, and AI-enhanced testing tools.

Europe Cancer Spit Test Device Market Insight

The Europe cancer spit test device market is projected to expand at a substantial CAGR throughout the forecast period, fueled by robust healthcare systems, growing focus on personalized medicine, and stringent diagnostic guidelines. The European market is anticipated with increasing use of salivary biomarkers in cancer screening programs and clinical trials.

U.K. Cancer Spit Test Device Market Insight

The U.K. cancer spit test device market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rapid digital health adoption, rising cancer awareness, and NHS-backed screening initiatives.

Germany Cancer Spit Test Device Market Insight

The Germany cancer spit test device market is expected to expand at a considerable CAGR during the forecast period, propelled by early cancer detection strategies and government-funded digital health innovations.

Asia-Pacific Cancer Spit Test Device Market Insight

The Asia-Pacific cancer spit test device market is projected to grow at the fastest CAGR of 12.3% from 2025 to 2032, driven by rising cancer incidence, expanding diagnostic infrastructure, and cost-effective saliva-based tests in countries like China, India, and Japan.

Japan Cancer Spit Test Device Market Insight

The Japan cancer spit test device market captured a revenue share of 27.6% in the Asia-Pacific market in 2024, supported by its aging population and early adoption of non-invasive diagnostic technologies. The market is expected to grow, with strong growth in precision diagnostics for oral, gastric, and pancreatic cancers.

China Cancer Spit Test Device Market Insight

The China cancer spit test device market accounted for the largest revenue share of 41.3% in the Asia-Pacific Cancer Spit Test Device market in 2024, owing to large-scale public health campaigns, rising healthcare spending, and strong domestic manufacturing capabilities. The market is anticipated to grow from 2025 to 2032, driven by increasing adoption in hospitals, cancer centers, and home settings.

Cancer Spit Test Device Market Share

The cancer spit test device industry is primarily led by well-established companies, including:

- DNA Genotek (Canada)

- Salimetrics, LLC (U.S.)

- PeriRx (U.S.)

- Color Health, Inc. (U.S.)

- SARSTEDT AG. Co. KG (Germany)

- Miraclean Technology Co., Ltd. (Taiwan)

- Agilent Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- QIAGEN (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- BD U.S.)

- Biocartis (Belgium)

- BIOMÉRIEUX (France)

- Siemens Healthineers AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Oasis Diagnostics Corporation (U.S.)

Latest Developments in Global Cancer Spit Test Device Market

- In April 2025, researchers from The Institute of Cancer Research (ICR) and The Royal Marsden NHS Foundation Trust in the U.K. announced the results of a major clinical trial demonstrating that a new at-home saliva-based genetic test significantly outperforms the traditional PSA blood test in detecting aggressive prostate cancers. The test, based on a polygenic risk score using 130 genetic variants, was shown to improve early cancer detection while reducing false positives. This advancement is expected to save the NHS over £500 million annually by enabling earlier and more accurate diagnoses

- In May 2024, Israeli biotech company Salignostics partnered with Sheba Medical Center to develop the first rapid saliva-based diagnostic test for early detection of oral cavity cancer. The collaboration focuses on leveraging molecular biomarkers in saliva to identify early-stage tumors, enabling quicker and less invasive screening procedures. This development underscores the expanding applications of saliva diagnostics across multiple cancer types

- In February 2024, a team of biomedical engineers developed a low-cost saliva biosensor capable of detecting breast cancer biomarkers such as HER2 and CA 15‑3 in under 5 seconds. Designed for use in low-resource settings, this portable diagnostic tool supports early-stage detection without the need for blood draws or laboratory processing, making it particularly promising for widespread population screening.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.