Global Candida Auris Infection Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

1.81 Billion

2025

2033

USD

1.27 Billion

USD

1.81 Billion

2025

2033

| 2026 –2033 | |

| USD 1.27 Billion | |

| USD 1.81 Billion | |

|

|

|

|

Candida Auris Infection Market Size

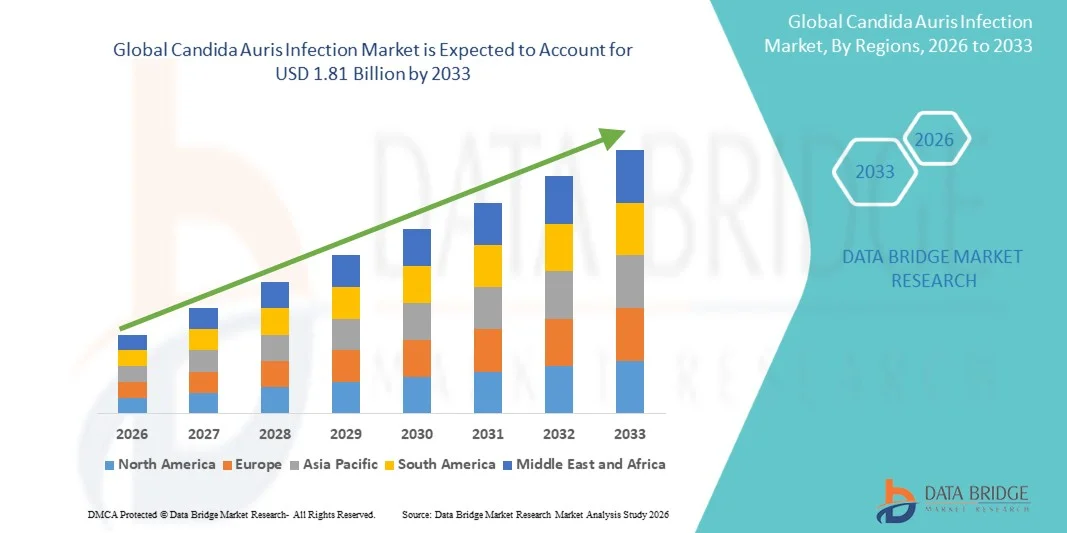

- The global candida auris infection market size was valued at USD 1.27 billion in 2025 and is expected to reach USD 1.81 billion by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the increasing prevalence of Candida auris infections, rising hospitalizations, and the growing awareness of multidrug-resistant fungal infections among healthcare professionals, leading to an increased demand for effective diagnostic and therapeutic solutions in both clinical and hospital settings

- Furthermore, the escalating need for rapid detection, early intervention, and specialized antifungal therapies is driving the adoption of advanced Candida Auris Infection treatment solutions, thereby significantly boosting the industry's growth

Candida Auris Infection Market Analysis

- Candida Auris infections, a multidrug-resistant fungal pathogen, pose significant challenges in clinical and hospital settings due to their rapid transmission, high mortality rate, and limited treatment options. The increasing prevalence of hospital-acquired infections and rising awareness among healthcare providers are driving the growth of the Candida Auris Infection market

- Furthermore, the growing demand for rapid diagnostics, effective antifungal therapies, and specialized infection management protocols is accelerating the adoption of Candida Auris Infection treatment solutions, thereby significantly boosting the industry's growth

- North America dominated the candida auris infection market with the largest revenue share of approximately 38.5% in 2025, supported by advanced healthcare infrastructure, high awareness of drug-resistant infections, robust infection surveillance programs, and the widespread availability of specialized antifungal therapies. The U.S. experienced substantial growth due to early diagnosis, hospital infection control initiatives, and increasing research funding for multidrug-resistant fungal pathogens

- Asia-Pacific is expected to be the fastest-growing region in the candida auris infection market during the forecast period, driven by rising healthcare expenditure, increasing hospitalizations, enhanced access to diagnostic technologies, and growing awareness about early detection and management of Candida Auris infections across countries such as India, China, and Japan

- The antifungal drugs segment dominated the largest market revenue share of 72.5% in 2025, driven by the global increase in fungal infections, the multidrug-resistant nature of Candida Auris, and the critical need for timely treatment

Report Scope and Candida Auris Infection Market Segmentation

|

Attributes |

Candida Auris Infection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Candida Auris Infection Market Trends

“Rising Incidence and Increasing Awareness Among Healthcare Providers”

- A significant and accelerating trend in the global candida auris infection market is the growing recognition of Candida Auris as a multidrug-resistant pathogen, prompting hospitals and clinics to adopt stricter infection-control protocols

- For instance, in July 2023, the U.S. Centers for Disease Control and Prevention (CDC) issued an updated clinical alert highlighting a rapid rise in Candida Auris cases across multiple states, urging hospitals to strengthen surveillance, screening, and isolation procedures

- Increasing awareness among healthcare professionals about early detection, rapid diagnostics, and appropriate antifungal therapy is driving improvements in patient outcomes

- Furthermore, the focus on antimicrobial stewardship programs and hospital hygiene monitoring is enhancing clinical decision-making, reducing the spread of infections, and supporting better treatment strategies

- The trend towards implementing advanced laboratory testing and molecular diagnostics is allowing for more precise identification of Candida Auris, enabling clinicians to optimize treatment regimens and reduce the risk of outbreaks

- With healthcare institutions emphasizing infection prevention, reporting standards, and surveillance systems, the market is witnessing growing adoption of innovative diagnostic tools and treatment protocols

Candida Auris Infection Market Dynamics

Driver

“Increasing Prevalence of Multidrug-Resistant Infections and Rising Hospitalization Rates”

- The rising incidence of Candida Auris infections across healthcare settings is a major factor driving market growth. Infected patients often require prolonged hospitalization and intensive care, increasing demand for effective antifungal therapies

- For instance, in March 2024, CDC reported a significant increase in Candida Auris cases in U.S. healthcare facilities, prompting hospitals to update treatment and containment strategies

- Growing awareness among clinicians regarding the severe complications associated with Candida Auris, including bloodstream infections and high mortality rates, is boosting adoption of targeted treatments

- Healthcare investments in infection control, antimicrobial surveillance, and specialized treatment protocols are further supporting market expansion

- The emergence of combination therapies, alongside supportive care approaches such as fluid replacement and monitoring, is strengthening the market presence and providing more treatment options for patients.

Restraint/Challenge

“Challenges in Diagnosis, High Treatment Costs, and Limited Availability of Antifungal Options”

- The difficulty in timely and accurate diagnosis of Candida Auris infections poses a significant restraint to market growth. Conventional methods may fail to detect the pathogen promptly, leading to delayed treatment and increased complications

- For instance, in June 2023, several hospitals reported misidentification of Candida Auris as other Candida species, resulting in treatment delays and highlighting the need for better diagnostic infrastructure

- The high cost of advanced antifungal medications and supportive care, particularly echinocandins and newer formulations, can limit accessibility for certain healthcare facilities and patients in developing regions

- In addition, the limited availability of standardized treatment guidelines in many regions and the need for specialized monitoring increase operational challenges for hospitals and clinics

- Overcoming these barriers through enhanced diagnostic technologies, clinical training, and government initiatives to improve access to antifungal therapies is vital for sustained market growth

Candida Auris Infection Market Scope

The market is segmented on the basis of treatment, diagnosis, dosage, route of administration, symptoms, end-users, and distribution channel.

• By Treatment

On the basis of treatment, the Candida Auris Infection market is segmented into antifungal drugs and others. The antifungal drugs segment dominated the largest market revenue share of 72.5% in 2025, driven by the global increase in fungal infections, the multidrug-resistant nature of Candida Auris, and the critical need for timely treatment. Azoles, echinocandins, and polyenes are commonly used, and their widespread availability across hospitals and clinics contributes to strong adoption. Rising awareness among healthcare providers and improved diagnostic capabilities have enhanced prescription rates for antifungal drugs. Hospitals increasingly prioritize treatment protocols using antifungals to reduce mortality and morbidity associated with Candida Auris infections. Established pharmaceutical players are actively promoting evidence-based guidelines for antifungal therapy. Moreover, government initiatives for fungal infection surveillance are encouraging proper antifungal usage. Regional variations exist, but the demand is highest in North America and Europe due to higher hospital-acquired infection rates. The segment’s growth is supported by continuous research into novel antifungal formulations and combination therapies. Educational programs for healthcare professionals also increase adoption rates. The segment is expected to maintain a CAGR of 9.8% from 2026 to 2033, reflecting its continued dominance.

The “others” treatment segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, fueled by increasing clinical trials of alternative therapies, supportive care options, and new drug development targeting multidrug-resistant strains. Hospitals and clinics are exploring adjunctive treatments and investigational therapies. The growing need for personalized treatment regimens for immunocompromised patients accelerates adoption. Technological advances in drug delivery systems further facilitate treatment options beyond conventional antifungal drugs. Awareness campaigns about emerging therapies are encouraging experimentation with non-standard interventions. Adoption is highest in tertiary care centers managing severe infections. Regulatory approvals for newer therapies in emerging markets are driving adoption. Expansion of hospital pharmacies’ portfolios to include adjunctive treatments contributes to growth. Increased research funding for alternative therapeutics and combination therapy approaches stimulates the segment’s uptake. The segment is projected to gain prominence particularly in regions with rising multidrug-resistant Candida Auris prevalence.

• By Diagnosis

On the basis of diagnosis, the market is segmented into blood tests, laboratory tests, and others. The blood tests segment dominated with 65.4% market revenue share in 2025, owing to its ability to rapidly detect bloodstream infections caused by Candida Auris. Blood cultures, combined with molecular identification, provide timely and accurate detection critical for effective treatment. Clinical guidelines recommend blood testing as the primary diagnostic tool in suspected infections. Hospitals and clinics rely heavily on automated blood culture systems to streamline detection. The availability of advanced blood test kits enhances efficiency and reliability. Training programs for laboratory personnel contribute to widespread adoption. Integration of blood testing with hospital infection control protocols further strengthens demand. Rapid diagnostic assays are also promoting blood test usage. Blood test results are increasingly integrated into electronic health records for clinical decision-making. The segment’s robust performance is reflected in its CAGR of 8.7% from 2026 to 2033.

The laboratory tests segment is expected to witness the fastest CAGR of 12.2% from 2026 to 2033, driven by advancements in molecular diagnostics, PCR-based testing, and next-generation sequencing. Increased investment in hospital laboratories for early and accurate pathogen identification supports growth. High-throughput labs are adopting molecular kits to reduce turnaround time. Laboratory tests are particularly critical in tertiary hospitals and research centers. Government and private sector funding for infectious disease surveillance boosts uptake. Clinical trials requiring precise pathogen detection further encourage laboratory test usage. Hospitals in regions with rising antifungal resistance are prioritizing molecular diagnostics. Continuous innovation in testing technologies reduces false negatives, increasing reliability. Adoption is further encouraged by accreditation requirements and quality assurance standards in healthcare facilities.

- By Dosage

On the basis of dosage, the market is segmented into Tablet, Injection, and Others. The Tablet segment dominated the market with a significant revenue share of 58.3% in 2025, driven by its ease of administration, patient compliance, and suitability for both hospital and outpatient settings. Tablets provide a convenient route for systemic antifungal therapy, particularly for stable patients who do not require intensive care. Clinical guidelines often recommend oral tablets as first-line therapy in mild to moderate Candida Auris infections. The availability of a wide range of tablet formulations, including extended-release and combination therapies, enhances adoption. Integration with hospital pharmacy protocols and outpatient management plans further strengthens demand. Tablets are increasingly preferred in regions with well-established supply chains, reflecting reliability and cost-effectiveness. The segment is expected to witness a steady CAGR of 9.1% from 2026 to 2033, fueled by ongoing innovation in oral antifungal formulations and improved patient adherence programs.

The Injection segment is projected to experience a robust CAGR of 11.4% during the forecast period, supported by the need for rapid and intensive therapy in severe or systemic Candida Auris infections. Intravenous antifungal injections enable high bioavailability and fast therapeutic action, making them critical in intensive care units and for immunocompromised patients. Hospitals are increasingly investing in IV antifungal stock and infusion protocols to manage outbreaks effectively. The adoption of combination therapy regimens in clinical settings further propels the injection segment. Training programs for healthcare professionals on IV antifungal administration and monitoring also contribute to growth. This segment is particularly important in tertiary hospitals, outbreak-prone regions, and for patients requiring emergency interventions.

• By Route of Administration

On the basis of route of administration, the Candida Auris Infection market is segmented into oral, intravenous, and others. The intravenous segment dominated with 61.7% market revenue share in 2025, driven by its essential role in treating critically ill, hospitalized patients requiring rapid onset of therapeutic effect. IV administration ensures maximum bioavailability, which is crucial for bloodstream and invasive Candida Auris infections commonly encountered in ICUs. Hospitals follow strict IV dosing guidelines to prevent complications and ensure effective management of multidrug-resistant fungal strains. The dominance of IV therapy is further supported by its integration into standardized infection control protocols for high-severity cases. Adoption is highest in emergency departments, critical care units, and surgical wards where timely intervention is essential. The segment benefits from strong institutional preference for parenteral antifungals and robust procurement infrastructure in hospital pharmacies. Rising hospitalization rates, increasing fungal morbidity, and the need for immediate clinical intervention strengthen this segment’s leadership. Continuous clinical validation and safety data for IV antifungals further reinforce its dominance. The segment will continue to be a mainstay due to its indispensable role in acute settings.

The oral segment is expected to witness the fastest CAGR of 13.8% from 2026 to 2033, supported by its growing acceptance in outpatient care and long-term treatment plans. Oral medications offer convenience, reduced hospital dependency, and improved adherence, making them a preferred option for stable patients transitioning from IV therapy. Pharmaceutical advancements are leading to more potent oral antifungal formulations with enhanced pharmacokinetics. The rise of telemedicine and home-care models further supports the use of oral antifungals. Retail and online pharmacies contribute significantly to distribution expansion. Increased screening of at-risk populations results in early diagnosis, enabling the use of oral therapy before disease progression. Cost-effectiveness and ease of access encourage broader adoption among low-severity cases. The oral segment benefits from growing healthcare awareness and preventive treatment trends, making it a key driver in outpatient settings. This shift aligns with global healthcare strategies aimed at reducing hospital load.

• By Symptoms

On the basis of symptoms, the Candida Auris Infection market is segmented into fever, chills, sepsis, and others. The fever segment dominated with 55.2% market revenue share in 2025, as fever is the most frequent early clinical indicator prompting diagnostic evaluation and laboratory testing. Healthcare professionals often rely on persistent fever as a primary early sign of invasive fungal infection, especially in immunocompromised patients. Fever-driven diagnostic workflows significantly contribute to early case detection and faster intervention. Hospitals and clinics frequently classify patients with unknown febrile illness for fungal screening, elevating the diagnostic volume linked to this symptom. The segment benefits from strong clinical awareness and standardized fever-based triage protocols. Increasing incidences of drug-resistant fungal infections heighten the importance of fever monitoring. The dominance is also reinforced by high prevalence across all age groups and risk categories. Fever often initiates treatment decisions, making it a cornerstone in diagnostic pathways. Continuous training of healthcare staff on identifying fungal infection symptoms boosts early detection. The segment reflects the central role of fever in fungal epidemiology and patient management.

The sepsis segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, driven by rising ICU admissions and increasing cases of bloodstream Candida Auris infections, which frequently progress to severe systemic inflammatory responses. Sepsis is a critical medical emergency requiring immediate antifungal therapy and intensive care support. The growing burden of multidrug-resistant Candida Auris strains increases the likelihood of sepsis in vulnerable patients. Hospitals are reporting more cases of fungal sepsis, particularly in immunocompromised, elderly, and post-surgical patients. The segment gains traction from advancements in sepsis diagnostic tools and biomarker-based screening. Increasing awareness of fungal sepsis among clinicians drives early identification. Adoption of sepsis management protocols incorporating rapid antifungal treatment further supports growth. The rise in invasive medical procedures and catheter-related infections also contributes to more sepsis cases. As global healthcare systems enhance critical care infrastructure, fungal sepsis detection and treatment capacity expands, accelerating segment growth through the forecast period.

• By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The hospital segment dominated with 78.4% market revenue share in 2025, owing to the high concentration of Candida Auris cases in inpatient settings. Hospitals—especially intensive care units—are hotspots for outbreaks due to invasive procedures, weakened immunity among patients, and prolonged hospital stays. Strict infection control measures, surveillance systems, and mandatory screening protocols reinforce hospital-centered diagnosis and treatment. Hospitals remain the primary users of advanced antifungal therapies, including IV formulations, due to availability of skilled healthcare professionals. Large procurement capacities of hospital pharmacies also strengthen the segment. Rising incidence of hospital-acquired fungal infections, particularly among ventilated and catheterized patients, further contributes to the segment’s dominance. The integration of antimicrobial stewardship programs ensures optimized treatment. Increasing global reporting requirements for Candida Auris infections also drives hospital-based testing. The segment is supported by continuous upgrades in hospital diagnostic infrastructure.

The clinic segment is expected to witness the fastest CAGR of 11.7% from 2026 to 2033, driven by rising outpatient visits for suspected fungal infections and preventive screenings. Clinics are increasingly adopting rapid diagnostic methods to detect fungal pathogens early. Growth in community health centers and specialty infectious disease clinics supports broader access to care. Outpatient management of mild infections is becoming more common, supported by expanding oral antifungal availability. Clinics also play an important role in follow-up care after hospital discharge. Increasing patient preference for cost-effective consultations supports clinic expansion. Awareness campaigns by healthcare organizations lead to more early-stage patient presentations. Telemedicine integration enhances clinic accessibility. As fungal infections become more prevalent globally, primary care settings play a bigger role in diagnosis and treatment, boosting this segment’s growth.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated with 68.5% market revenue share in 2025, driven by centralized procurement of antifungal drugs and immediate availability for inpatient treatment. Hospitals rely on in-house pharmacies to maintain continuous stock of IV and critical antifungal formulations essential for treating severe Candida Auris cases. Institutional purchasing power ensures better pricing and consistent supply. Hospital pharmacies are integrated with infectious disease departments for coordinated treatment plans. The presence of clinical pharmacists ensures proper dosing and medication stewardship. Rising hospitalization rates for fungal infections further support demand. ICU and emergency departments heavily depend on immediate pharmaceutical access. Additionally, infection control policies prioritize hospital pharmacy dispensing for regulated antifungal use. The segment benefits from strict oversight and superior storage infrastructure, which are vital for sensitive antifungal medications.

The online pharmacy segment is expected to witness the fastest CAGR of 14.1% from 2026 to 2033, driven by rising patient demand for convenient access to antifungal medications and increasing digital adoption in healthcare. Online platforms provide wider availability of oral antifungal drugs, supporting outpatient management. Growth in e-commerce adoption accelerates purchase behavior, especially among patients managing long-term fungal conditions. Online pharmacies offer doorstep delivery, competitive pricing, and better accessibility for remote regions. Regulatory improvements and digital prescription models enhance trust and compliance. Increased awareness of fungal infections leads patients to seek timely treatment, often facilitated through online channels. The shift toward home-based care encourages online medication procurement. Expanding telemedicine services direct patients to digital pharmacies for follow-up therapy. As digital healthcare ecosystems strengthen globally, online pharmacies become a major distribution channel for non-critical antifungal treatments.

Candida Auris Infection Market Regional Analysis

- North America dominated the candida auris infection market with the largest revenue share of approximately 38.5% in 2025

- Supported by advanced healthcare infrastructure, high awareness of drug-resistant infections, robust infection surveillance programs, and the widespread availability of specialized antifungal therapies

- The region’s strong focus on infection prevention, rapid diagnostic testing, and outbreak management continues to support market expansion

U.S. Candida Auris Infection Market Insight

The U.S. candida auris infection market captured the largest revenue share within North America in 2025, driven by early adoption of advanced diagnostic tools, aggressive hospital infection-control initiatives, and growing research funding targeting multidrug-resistant fungal pathogens. Increasing implementation of mandatory reporting guidelines, coupled with investments in rapid PCR-based and molecular diagnostics, is significantly accelerating the demand for Candida auris treatment solutions across hospitals and long-term care facilities.

Europe Candida Auris Infection Market Insight

The Europe candida auris infection market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent infection-control regulations, rising incidence of hospital-acquired infections, and increased adoption of molecular testing systems in healthcare facilities. Growing awareness about emerging fungal threats and the expansion of specialized infectious-disease treatment centers are contributing to the region’s steady market growth.

U.K. Candida Auris Infection Market Insight

The U.K. candida auris infection market is anticipated to grow at a notable CAGR, supported by the National Health Service’s (NHS) emphasis on early detection, antimicrobial stewardship, and outbreak preparedness. Rising concerns regarding healthcare-associated infections and increasing deployment of high-sensitivity laboratory testing systems are further driving market adoption.

Germany Candida Auris Infection Market Insight

The Germany candida auris infection market is expected to expand at a considerable CAGR, fueled by strong hospital infrastructure, rapid adoption of automated diagnostic platforms, and increasing investment in biosafety and infection-control technologies. Germany’s emphasis on early detection and advanced laboratory capabilities strengthens the demand for both diagnostics and antifungal treatment solutions.

Asia-Pacific Candida Auris Infection Market Insight

The Asia-Pacific candida auris infection market is projected to grow at the fastest CAGR between 2026 and 2033, driven by rising healthcare expenditure, increasing hospitalization rates, and growing awareness of antimicrobial resistance. Expanding access to diagnostic technologies and government initiatives focused on infectious-disease surveillance are accelerating market growth across China, India, Japan, and Southeast Asia.

Japan Candida Auris Infection Market Insight

The Japan candida auris infection market is gaining momentum due to the country’s strong research ecosystem, high diagnostic accuracy standards, and rapid adoption of molecular testing. Increased focus on infection control in hospitals, along with Japan’s aging population requiring frequent healthcare interventions, continues to fuel demand for effective Candida auris treatment solutions.

China Candida Auris Infection Market Insight

The China candida auris infection market accounted for the largest share in the Asia-Pacific region in 2025, supported by rising hospital admissions, large patient population, and strong government initiatives promoting infection surveillance and laboratory modernization. Growing adoption of advanced diagnostic platforms and the expanding pharmaceutical manufacturing sector are significantly boosting market growth across the country.

Candida Auris Infection Market Share

The Candida Auris Infection industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Johnson & Johnson (U.S.)

- Roche Holding AG (Switzerland)

- GlaxoSmithKline plc (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Sanofi S.A. (France)

- AbbVie Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Bayer AG (Germany)

- Takeda Pharmaceutical Company Ltd. (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

Latest Developments in Global Candida Auris Infection Market

- In October 2024, researchers at Mount Sinai Brooklyn published enhanced screening protocols for C. auris, showing that expanded screening among patients from nursing-home backgrounds uncovered previously undiagnosed colonization cases. The study found that 2.4% of screened patients tested positive, including 8 cases that would have been missed under prior protocols — highlighting the value of stricter surveillance in preventing hospital outbreaks

- In April 2024, the Centers for Disease Control and Prevention (CDC) in the U.S. updated its public-health resources and confirmed that clinical cases of C. auris remain on the rise: 4,514 new cases were reported in 2023, underscoring ongoing spread and reinforcing the need for screening, infection-control measures, and careful antifungal use

- In March 2025, World Health Organization (WHO) issued its first-ever comprehensive report on tests and treatments for invasive fungal infections, underscoring the critical lack of antifungal drugs and diagnostics — and calling out fungi like C. auris as “critical-priority” pathogens needing urgent R&D and public-health focus

- In July 2025, researchers at Michigan State University (MSU) published a study revealing a novel mechanism by which C. auris remodels its cell wall to evade frontline antifungals (echinocandins), offering insight into resistance development and guiding future drug design strategies

- In September 2025, the European Centre for Disease Prevention and Control (ECDC) released a 2024 survey showing that C. auris continues to spread rapidly across European hospitals: from 2013–2023, EU/EEA countries reported over 4,012 colonisations or infections, with 1,346 new cases in 2023 alone. Several nations have moved beyond isolated outbreaks into a state of regional endemicity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.