Global Canine Oral Chewable Tablet Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

2.93 Billion

2024

2032

USD

1.32 Billion

USD

2.93 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 2.93 Billion | |

|

|

|

|

Canine Oral Chewable Tablet Market Size

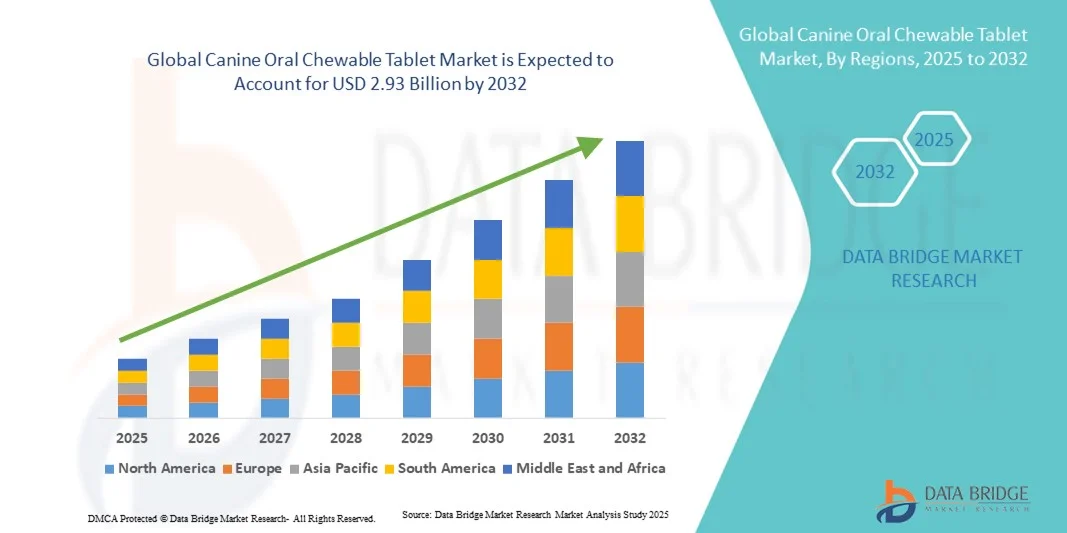

- The global canine oral chewable tablet market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 2.93 billion by 2032, at a CAGR of 10.49% during the forecast period

- The market growth is largely fueled by increasing pet ownership, rising awareness of canine health, and the demand for convenient, palatable, and effective treatments for various canine health issues

- Furthermore, innovations in pharmaceutical formulations and the introduction of multi-functional chewable tablets for dogs are driving adoption. Rising consumer preference for easy-to-administer and integrated health solutions for their pets is establishing chewable tablets as the preferred dosage form, thereby significantly boosting the industry's growth

Canine Oral Chewable Tablet Market Analysis

- Canine oral chewable tablets, offering palatable, easy-to-administer medication for dogs, are increasingly vital components of modern pet healthcare due to their convenience, accurate dosing, and ability to target specific health conditions in both household pets and working dogs

- The escalating demand for canine oral chewable tablets is primarily fueled by rising pet ownership, growing awareness of canine health and wellness, and a preference for convenient, stress-free medication administration

- North America dominated the canine oral chewable tablet market with the largest revenue share of 39.8% in 2024, characterized by high pet ownership, strong veterinary infrastructure, and a presence of leading pharmaceutical companies, with the U.S. experiencing substantial growth driven by innovations in both botanically and chemically synthesized chewable formulations

- Asia-Pacific is expected to be the fastest-growing region in the canine oral chewable tablet market during the forecast period due to increasing pet adoption, rising disposable incomes, and growing awareness of preventive healthcare for dogs

- The vitamins and minerals segment dominated the market with a share of 42.9% in 2024, driven by rising consumer demand for preventive healthcare solutions, easy-to-administer dosage forms, and integrated nutritional benefits in canine diets

Report Scope and Canine Oral Chewable Tablet Market Segmentation

|

Attributes |

Canine Oral Chewable Tablet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Canine Oral Chewable Tablet Market Trends

Enhanced Convenience Through Palatable and Multi-Functional Formulations

- A significant and accelerating trend in the global canine oral chewable tablet market is the increasing development of palatable, easy-to-administer tablets that combine multiple active ingredients, improving compliance and overall canine health management

- For Instance, Elanco’s Credelio Quattro combines flea, tick, and heartworm preventive treatment in a single monthly chewable tablet, improving convenience for pet owners

- Multi-functional chewables enable features such as joint support, gastrointestinal health, and vitamin supplementation simultaneously, reducing the need for multiple medications. Instance, some Nutramax chewables combine joint health support with vitamins to enhance canine wellness

- The integration of flavor enhancements and natural ingredients ensures higher acceptance by dogs, promoting better adherence to prescribed treatments and preventive regimens

- This trend towards more palatable, multi-functional, and convenient chewable formulations is fundamentally reshaping owner expectations for canine healthcare. Instance, companies such as Bayer and Zoetis are developing chewables with improved palatability and combined health benefits

- The demand for chewable tablets offering multi-functional health benefits is growing rapidly across both household pets and working dogs, as consumers increasingly prioritize convenience and holistic canine wellness

Canine Oral Chewable Tablet Market Dynamics

Driver

Growing Need Due to Rising Pet Ownership and Preventive Healthcare Awareness

- The increasing prevalence of pet ownership and rising awareness of preventive canine healthcare are significant drivers for the heightened demand for chewable tablets

- For Instance, in March 2024, Zoetis launched an initiative promoting preventive oral care and multi-functional chewables, aimed at improving pet wellness

- As pet owners become more aware of potential health risks, chewable tablets offer combined benefits such as vitamins, minerals, and disease prevention, providing a compelling alternative to single-ingredient medications

- Furthermore, the growing popularity of integrated veterinary care and home-based preventive solutions is making chewables an essential component of modern pet health management

- The convenience of easy-to-administer, palatable tablets and the ability to manage multi-condition health needs in a single dosage form are key factors propelling adoption across both household and working dog populations

Restraint/Challenge

Palatability Issues and Regulatory Compliance Hurdle

- Concerns surrounding flavor acceptance and ingredient sensitivity pose a significant challenge to broader market penetration, as some dogs may reject tablets due to taste or adverse reactions

- For Instance, reports of canine refusal or mild gastrointestinal upset from certain chewable formulations have made some pet owners hesitant to adopt specific products

- Addressing these issues through flavor optimization, natural ingredients, and veterinary guidance is crucial for building owner trust. Companies such as Nutramax and Virbac emphasize palatability and safety in marketing to reassure potential buyers

- In addition, regulatory compliance related to veterinary pharmaceuticals, including labeling, dosage accuracy, and safety testing, can be a barrier for new product launches, particularly in highly regulated regions

- While formulation improvements are ongoing, palatability challenges and strict regulatory requirements can hinder widespread adoption, especially among new entrants or price-sensitive markets

- Overcoming these challenges through enhanced product development, consumer education, and adherence to regulatory standards will be vital for sustained market growth

Canine Oral Chewable Tablet Market Scope

The market is segmented on the basis of composition type, drug type, applications, mode of purchase, and distribution channel.

- By Composition Type

On the basis of composition type, the canine oral chewable tablet market is segmented into botanically synthesized and chemically synthesized. The chemically synthesized segment dominated the market with the largest revenue share in 2024, driven by its established efficacy, wide availability, and consistent quality. Chemically synthesized tablets are often preferred by veterinarians due to standardized dosages and predictable therapeutic outcomes. Pet owners also favor these tablets for managing specific health conditions, such as infectious diseases or gastrointestinal disorders. Furthermore, well-established pharmaceutical companies dominate this segment, providing extensive product portfolios that enhance trust and adoption. The segment also benefits from research and development investments that continually improve bioavailability and palatability.

The botanically synthesized segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising consumer preference for natural and holistic treatments for pets. Botanically synthesized chewables often contain herbal extracts and plant-based compounds, appealing to pet owners seeking chemical-free alternatives. This segment is also benefiting from increased awareness of pet wellness trends and preventive healthcare. Companies are investing in R&D to enhance the efficacy, safety, and flavor profiles of botanical formulations, further driving adoption. The market growth is reinforced by marketing strategies emphasizing sustainability, natural ingredients, and reduced side effects.

- By Drug Type

On the basis of drug type, the canine oral chewable tablet market is segmented into analgesics, anti-infective, anti-ulcers, vitamins and minerals, and others. The vitamins and minerals segment dominated the market in 2024 with a market share of 42.9%, driven by strong demand for preventive healthcare solutions in dogs. Pet owners are increasingly seeking chewable tablets that supplement their pets’ diet with essential nutrients, enhancing overall health. The segment’s popularity is reinforced by multi-functional tablets that combine vitamins with minerals or joint health ingredients. Veterinary professionals often recommend vitamins and minerals for puppies, senior dogs, or dogs recovering from illness, contributing to sustained demand. In addition, the wide range of formulations, flavors, and dosage forms enhances compliance and palatability, which is critical for consumer adoption. Continuous innovation in delivery systems, such as chewables with improved taste and digestibility, is further strengthening market dominance.

The anti-infective segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing prevalence of canine infectious diseases and rising awareness of timely treatment. Anti-infective chewables are essential for preventing and treating conditions such as parasitic, bacterial, and viral infections. Growing veterinary recommendations for prophylactic and post-infection treatments are driving adoption. Companies are developing convenient chewable formulations to improve adherence and minimize stress during administration. The increasing incidence of pet travel and adoption also contributes to higher demand for anti-infective tablets. Continuous innovation in combination therapies, such as anti-infective tablets with immune-boosting ingredients, is accelerating segment growth.

- By Applications

On the basis of applications, the canine oral chewable tablet market is segmented into gastrointestinal diseases and infectious diseases. The gastrointestinal diseases segment dominated the market in 2024, driven by the high prevalence of digestive issues in domestic dogs. Pet owners are increasingly aware of the importance of digestive health and seek chewables to manage conditions such as gastritis, diarrhea, and upset stomachs. Veterinary recommendations and preventive care practices enhance adoption, particularly among young and senior dogs. Multi-functional chewables combining digestive enzymes and probiotics are widely preferred for their efficacy and palatability. The segment’s dominance is also supported by increasing education and awareness campaigns by veterinary clinics and online pet care platforms.

The infectious diseases segment is expected to witness the fastest growth from 2025 to 2032 due to rising cases of parasitic and bacterial infections in dogs worldwide. Chewable tablets for infectious diseases are becoming essential in routine veterinary practice and preventive care. The segment growth is bolstered by formulations that simplify dosing and improve compliance, particularly in multi-dog households. Increasing pet adoption in emerging regions and awareness of disease prevention contribute to rising demand. Manufacturers are also focusing on research to create combination tablets targeting multiple infectious agents, enhancing convenience for pet owners. Regulatory approvals and veterinary endorsements further accelerate growth in this segment.

- By Mode of Purchase

On the basis of mode of purchase, the canine oral chewable tablet market is segmented into prescription and over-the-counter (OTC). The prescription segment dominated the market in 2024, driven by the need for veterinarian-supervised administration for specific medications. Prescription chewables ensure proper dosage, treatment efficacy, and safety for conditions such as infections or gastrointestinal disorders. Veterinary guidance also builds consumer trust and drives repeat purchases. The segment benefits from strong distribution through clinics, pharmacies, and veterinary hospitals, providing convenience and accessibility. Multi-functional prescription chewables are particularly popular for combining preventive and therapeutic benefits in one dosage form.

The over-the-counter segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising consumer preference for convenient, non-prescription solutions such as vitamins, minerals, and general wellness tablets. OTC chewables are widely available through online stores, veterinary pharmacies, and retail outlets, increasing accessibility for pet owners. Marketing campaigns emphasizing ease of use and preventive health benefits drive adoption. Growth is also supported by the increasing awareness of canine wellness trends and DIY preventive care. Innovations in flavor, form, and packaging further encourage OTC purchase behavior.

- By Distribution Channel

On the basis of distribution channel, the canine oral chewable tablet market is segmented into veterinary clinics, veterinary pharmacies, online veterinary stores, and others. The veterinary clinics segment dominated the market in 2024, driven by direct recommendation from veterinarians and reliable availability of prescription chewables. Clinics offer professional guidance, ensuring proper dosage and treatment adherence, which builds trust among pet owners. The segment is also supported by in-clinic promotions, subscription programs, and bundled offers for preventive care packages. Multi-functional tablets combining vitamins, minerals, and therapeutic ingredients are often sold through clinics due to higher value and prescription requirements. Veterinary clinics also serve as primary education hubs for owners on canine health management, further reinforcing dominance.

The online veterinary stores segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing e-commerce penetration, convenience, and subscription-based services for regular medication and wellness supplements. Online platforms offer a wide range of chewable tablets, enabling consumers to compare products, read reviews, and make informed purchases. Growth is also driven by increasing adoption of mobile apps and digital veterinary consultations, which allow remote prescriptions and delivery. Manufacturers are partnering with online stores to launch promotional campaigns, bundle offers, and auto-refill subscriptions, boosting sales. The convenience of doorstep delivery and growing trust in online veterinary services accelerate adoption in this channel.

Canine Oral Chewable Tablet Market Regional Analysis

- North America dominated the canine oral chewable tablet market with the largest revenue share of 39.8% in 2024, characterized by high pet ownership, strong veterinary infrastructure, and a presence of leading pharmaceutical companies, with the U.S. experiencing substantial growth driven by innovations in both botanically and chemically synthesized chewable formulations

- Consumers in the region highly value the convenience, palatability, and multi-functional health benefits offered by chewable tablets, such as combined vitamins, minerals, and disease prevention in a single dosage form

- This widespread adoption is further supported by the presence of leading veterinary pharmaceutical companies, technologically advanced veterinary clinics, and strong pet wellness trends, establishing chewable tablets as a preferred solution for both household pets and working dogs

U.S. Canine Oral Chewable Tablet Market Insight

The U.S. canine oral chewable tablet market captured the largest revenue share of 82% in 2024 within North America, fueled by the high prevalence of pet ownership and strong veterinary healthcare infrastructure. Consumers are increasingly prioritizing convenient, palatable, and multi-functional tablets that combine vitamins, minerals, and preventive treatments. The growing preference for DIY preventive pet healthcare, combined with robust demand for combination chewables for joint, gastrointestinal, and infectious disease management, further propels the market. Moreover, the increasing integration of veterinary recommendations, e-commerce platforms, and subscription-based delivery services is significantly contributing to market expansion.

Europe Canine Oral Chewable Tablet Market Insight

The Europe canine oral chewable tablet market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of preventive pet healthcare and stringent veterinary regulations. The rise in pet adoption, coupled with growing demand for multi-functional chewable tablets, is fostering market growth. European consumers are also drawn to convenience, palatability, and veterinarian-approved formulations. The region is experiencing significant growth across household pets, working dogs, and multi-pet households, with chewables being incorporated into both regular preventive care and therapeutic regimens.

U.K. Canine Oral Chewable Tablet Market Insight

The U.K. canine oral chewable tablet market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising pet ownership and a desire for convenient, preventive, and holistic health solutions. In addition, concerns regarding common canine health issues such as gastrointestinal disorders and infections are encouraging pet owners to adopt chewable tablets. The U.K.’s embrace of veterinary guidance, combined with a robust e-commerce and retail infrastructure, is expected to continue stimulating market growth.

Germany Canine Oral Chewable Tablet Market Insight

The Germany canine oral chewable tablet market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of canine health and rising demand for multi-functional, high-quality chewable tablets. Germany’s well-developed veterinary infrastructure, combined with emphasis on innovation, safety, and natural ingredients, promotes the adoption of chewables, particularly for preventive and therapeutic applications. The integration of chewables into routine veterinary recommendations is also becoming increasingly prevalent, with a strong preference for safe, palatable, and effective solutions aligning with local consumer expectations.

Asia-Pacific Canine Oral Chewable Tablet Market Insight

The Asia-Pacific canine oral chewable tablet market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing pet adoption, rising disposable incomes, and growing awareness of preventive canine healthcare in countries such as China, Japan, and India. The region’s growing inclination towards convenient, palatable, and multi-functional chewable tablets is driving adoption. Furthermore, as APAC emerges as a manufacturing hub for veterinary pharmaceuticals, the affordability and accessibility of chewable tablets are expanding to a wider consumer base.

Japan Canine Oral Chewable Tablet Market Insight

The Japan canine oral chewable tablet market is gaining momentum due to the country’s high pet ownership, increasing awareness of preventive healthcare, and demand for convenience. The Japanese market places a significant emphasis on safety, palatability, and multi-functional formulations, and the adoption of chewable tablets is driven by the rising number of household pets and working dogs. Integration with veterinary guidance and home-based preventive care is fueling growth. Moreover, Japan’s aging population is such asly to spur demand for easy-to-administer, effective, and safe chewable tablets in both residential and therapeutic applications.

India Canine Oral Chewable Tablet Market Insight

The India canine oral chewable tablet market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid pet adoption, increasing awareness of preventive healthcare, and growing disposable incomes. India stands as one of the largest emerging markets for pet wellness products, and chewable tablets are becoming increasingly popular for household pets, working dogs, and multi-pet households. Government initiatives promoting veterinary health, the push towards preventive care, and the availability of affordable chewable tablet options, alongside strong domestic manufacturers, are key factors propelling the market in India.

Canine Oral Chewable Tablet Market Share

The Canine Oral Chewable Tablet industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- Merck Animal Health (U.S.)

- Virbac (U.S.)

- Elanco (U.S.)

- PRN (U.S.)

- Innomalous Technologies Private Limited (India)

- Pet Tech Labs (U.S.)

- AdvaCare Pharma (China)

- Dechra Pharmaceuticals Limited (U.K.)

- Cronus Pharma Specialties India Ltd. (India)

- Cuckoos Pharma (India)

- PGPET. (India)

- Ayoddhya Medimpex (India)

- Infocom Network Private Limited. (India)

- SmartPak Equine LLC (U.S.)

- Dogseechew (India)

- PetMeds (U.S.)

- Giant Eagle Pet Rx (U.S.)

What are the Recent Developments in Global Canine Oral Chewable Tablet Market?

- In July 2025, Boehringer Ingelheim launched Vetmedin 1.5 mg/ml oral solution in Great Britain, offering a new treatment option for dogs with asymptomatic heart disease or congestive heart failure (CHF). This oral solution complements the existing chewable tablet version, providing a more precise and accessible way to manage heart disease in dogs, particularly smaller breeds and those who struggle with tablets

- In April 2025, Felixvet launched Carprofen Soft Chewable Tablets, now available through animal health distributors. This addition aims to enhance treatment options for canine osteoarthritis and pain management

- In October 2024, the U.S. Food and Drug Administration (FDA) approved Elanco Animal Health’s Credelio Quattro, a single monthly chewable tablet for dogs aged eight weeks or older. This tablet offers protection against six parasitic infections, including fleas, ticks, heartworms, roundworms, hookworms, and tapeworms. Elanco plans to launch the product in the first quarter of 2025

- In April 2024, Forte Healthcare announced the launch of Ficoxil, a flavoured chewable tablet for pain in dogs, containing firocoxib as its active ingredient. Available in two strengths as packs of 30, Ficoxil aims to provide an effective and palatable option for managing pain in canine patients

- In June 2023, Zoetis Inc. announced that the FDA approved Apoquel Chewable (oclacitinib chewable tablet) for controlling pruritus associated with allergic dermatitis and atopic dermatitis in dogs at least 12 months of age

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.