Global Cannabidiol Cbd Gummies Market

Market Size in USD Billion

CAGR :

%

USD

6.74 Billion

USD

50.25 Billion

2025

2033

USD

6.74 Billion

USD

50.25 Billion

2025

2033

| 2026 –2033 | |

| USD 6.74 Billion | |

| USD 50.25 Billion | |

|

|

|

|

Cannabidiol (CBD) Gummies Market Size

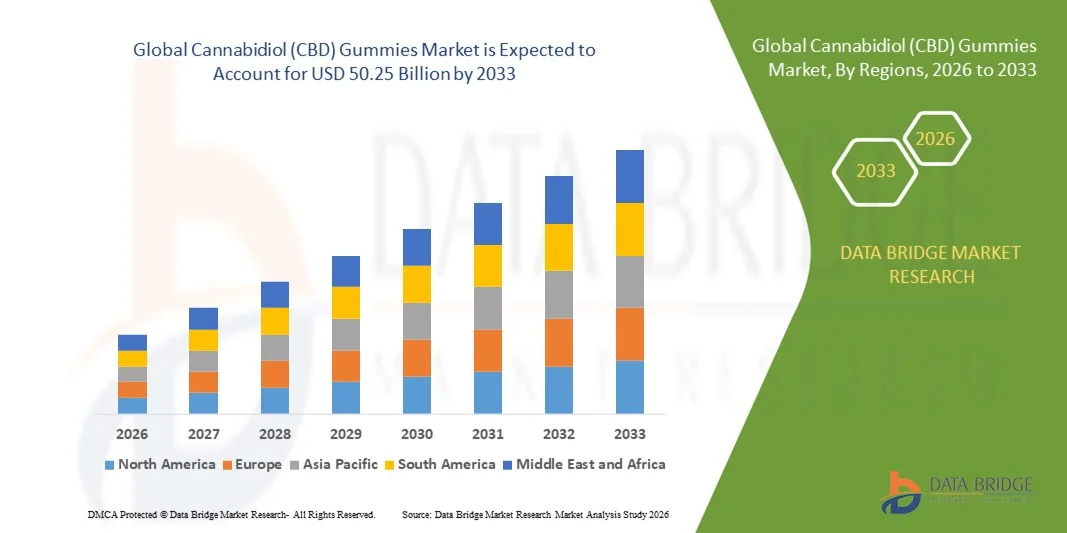

- The global cannabidiol (CBD) gummies market size was valued at USD 6.74 billion in 2025 and is expected to reach USD 50.25 billion by 2033, at a CAGR of 28.53% during the forecast period

- The market growth is largely fueled by the increasing consumer inclination toward natural wellness products and the therapeutic benefits of cannabidiol (CBD), such as stress reduction, pain relief, and sleep improvement, which are driving the demand for CBD-infused edibles across global markets

- Furthermore, the rising availability of legal and regulated hemp-derived products, combined with growing product innovation in flavors, concentrations, and vegan formulations, is strengthening consumer confidence and accelerating market expansion for CBD gummies worldwide

Cannabidiol (CBD) Gummies Market Analysis

- CBD gummies, formulated with cannabidiol extracted from hemp, have emerged as one of the most popular formats in the CBD edibles category due to their convenience, precise dosing, and pleasant taste, appealing to both new and experienced users seeking wellness benefits without psychoactive effects

- The escalating demand for CBD gummies is primarily driven by growing consumer awareness of plant-based therapeutics, expanding legalization across major regions such as North America and Europe, and continuous product development focused on high-quality, THC-free, and functional formulations tailored to specific wellness needs

- North America dominated the cannabidiol (CBD) gummies market with a share of 47.3% in 2025, due to high consumer awareness of CBD’s therapeutic benefits and a well-established legalization framework across the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the cannabidiol (CBD) gummies market during the forecast period due to gradual regulatory easing and growing consumer interest in functional wellness products

- Low/Concentrated segment dominated the market with a market share of 89.3% in 2025, due to its popularity among beginners and wellness-oriented users seeking mild, daily benefits without strong effects. The growing trend of microdosing for general wellness, stress management, and preventive care supports segment expansion. These products are also gaining traction in mainstream retail outlets and among younger consumers experimenting with CBD-infused supplements for relaxation and mood balance

Report Scope and Cannabidiol (CBD) Gummies Market Segmentation

|

Attributes |

Cannabidiol (CBD) Gummies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cannabidiol (CBD) Gummies Market Trends

Rising Demand for Functional and Wellness-Oriented CBD Gummies

- The growing demand for CBD gummies is mainly driven by increasing consumer interest in wellness and functional food products that promote relaxation, stress relief, and better sleep quality. Consumers are increasingly viewing CBD-infused gummies as a convenient and enjoyable method to incorporate plant-based wellness into their daily routines

- For instance, Charlotte’s Web Holdings, Inc. expanded its product range in 2024 with gummies targeting specific health needs such as calm, sleep, and recovery, combining CBD with functional ingredients including melatonin and turmeric. This exemplifies how brands are aligning product development with consumer health trends to enhance market visibility

- The fusion of CBD with vitamins, adaptogens, and natural flavors is helping brands cater to broader health-conscious audiences. Gummies infused with added ingredients such as vitamin B12, ashwagandha, or collagen appeal to consumers seeking comprehensive wellness benefits beyond traditional CBD effects. This expansion of functional formulations is contributing to a diversified product mix

- Growing awareness of mental wellness and self-care practices has also contributed to the strong uptake of CBD gummies. Consumers perceive these products as tools for managing everyday stress and improving mood balance, particularly among millennials and urban professionals who favor natural wellness alternatives

- The increasing presence of CBD gummies in mainstream retail channels such as pharmacies, health stores, and online marketplaces demonstrates widening market acceptance. Clear labeling, improved flavor profiles, and education initiatives are helping reduce skepticism about hemp-derived products and foster sustained demand growth

- Overall, the shift toward functional, wellness-oriented, and easy-to-consume CBD gummies is redefining product positioning in the nutraceutical and dietary supplement landscape. This convergence of health benefits, convenience, and regulatory progress continues to strengthen the market outlook globally

Cannabidiol (CBD) Gummies Market Dynamics

Driver

Expanding Legalization and Acceptance of Hemp-Derived CBD Products

- The progressive legalization of hemp cultivation and CBD product sales in major markets, particularly across North America and parts of Europe, is significantly driving CBD gummy demand. Consumers increasingly associate hemp-derived products with natural therapeutic benefits such as stress reduction and sleep improvement, contributing to expanding retail penetration

- For instance, HempFusion Wellness Inc. launched its CBD Gummies Plus range in the United States after the passage of the 2018 Farm Bill, which legalized hemp-derived CBD under federal law. This regulatory change enabled companies to commercialize CBD products in mainstream outlets such as supermarkets and pharmacies, amplifying consumer accessibility

- The growing normalization of CBD in health and wellness sectors has improved consumer confidence and spurred investment from established nutraceutical and F&B manufacturers. These partnerships are introducing standardized formulations, improved taste profiles, and transparent labeling, all of which are promoting market maturity

- In addition, the medical potential of CBD for anxiety, pain management, and sleep has encouraged regulatory bodies to relax restrictions and promote research-driven applications. Countries such as Canada and Germany have witnessed significant market expansion following revised hemp regulations

- Broadened legalization has encouraged innovative product developments and increased consumer trials, translating to higher repeat purchases. As regulatory clarity improves across new markets in Asia-Pacific and Latin America, the global CBD gummies segment is expected to witness accelerated adoption, reinforcing its economic sustainability

Restraint/Challenge

Regulatory Uncertainty and Lack of Standardized Product Guidelines

- Despite expanding legalization, the CBD gummies market continues to face regulatory inconsistencies across regions, creating uncertainty for manufacturers and retailers. Varying limits on THC concentration, labeling requirements, and advertising restrictions hinder cross-border trade and product standardization

- For instance, in 2024, the U.S. Food and Drug Administration (FDA) reiterated its stance that CBD cannot be marketed as a dietary supplement, prompting several companies such as CV Sciences Inc. and Green Roads to adjust labeling strategies to remain compliant. This lack of unified regulatory direction slows innovation and complicates consumer education

- The absence of clear quality standards has resulted in uneven product quality and potency discrepancies among manufacturers. Without consistent testing and certification requirements, consumers may face difficulty distinguishing between reliable and low-quality brands, affecting market credibility

- In addition, restrictions on health claims and advertising of CBD edibles have limited brand outreach potential, particularly through traditional and digital platforms. Companies are required to navigate complex approval processes and constantly update compliance strategies to avoid regulatory penalties

- The establishment of harmonized global standards for production, labeling, and dosage safety will be crucial to overcome these challenges. Achieving such regulatory consistency will enhance consumer trust, ensure fair competition, and facilitate sustainable growth in the CBD gummies industry globally

Cannabidiol (CBD) Gummies Market Scope

The market is segmented on the basis of type, concentration, packaging type, and distribution channel.

- By Type

On the basis of type, the Cannabidiol (CBD) Gummies market is segmented into CBD isolate gummies, broad-spectrum CBD gummies, and full-spectrum CBD gummies. The full-spectrum CBD gummies segment dominated the market with the largest revenue share in 2025, driven by rising consumer preference for products offering the “entourage effect,” where multiple cannabinoids work synergistically to enhance therapeutic benefits. These gummies retain trace amounts of THC along with other cannabinoids, appealing to consumers seeking holistic wellness solutions for anxiety, pain, and sleep regulation. The increasing awareness of natural alternatives to pharmaceuticals and wide availability across wellness and retail stores further boost the segment’s dominance.

The broad-spectrum CBD gummies segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing demand for THC-free products that still offer multiple cannabinoid benefits. Consumers preferring non-psychoactive options, especially in regions with strict THC regulations, are driving this segment’s expansion. The segment benefits from rising product innovation in flavors and formulations, appealing to health-conscious consumers seeking balance between efficacy and compliance. Growing brand penetration in e-commerce platforms and partnerships with wellness influencers are also enhancing visibility and adoption.

- By Concentration

On the basis of concentration, the CBD gummies market is divided into high and low/concentrated segments. The low/concentrated segment held the largest market share of 89.3% in 2025, driven by its popularity among beginners and wellness-oriented users seeking mild, daily benefits without strong effects. The growing trend of microdosing for general wellness, stress management, and preventive care supports segment expansion. These products are also gaining traction in mainstream retail outlets and among younger consumers experimenting with CBD-infused supplements for relaxation and mood balance.

The high concentrated segment is anticipated to grow at the fastest rate from 2026 to 2033, attributed to growing demand from consumers with chronic pain, stress, and insomnia who seek potent and longer-lasting effects. These gummies are often preferred by regular users familiar with CBD dosing and willing to pay premium prices for therapeutic strength. The segment also benefits from an increasing number of medically guided wellness programs recommending higher CBD doses for targeted relief.

- By Packaging Type

On the basis of packaging type, the market is segmented into pouches, bottles, jars, and tins. The bottles segment dominated the market with the largest revenue share in 2025, driven by its durability, resealability, and ability to preserve product freshness over time. Bottled CBD gummies are favored by premium brands emphasizing safety, labeling accuracy, and child-resistant packaging, aligning with regulatory requirements. Their transparent design also enhances consumer trust through visible quality assurance, further strengthening their market position.

The pouches segment is projected to witness the fastest growth rate from 2026 to 2033, supported by rising demand for lightweight, portable, and eco-friendly packaging options. Pouch packaging allows flexible sizing, cost-effective distribution, and reduced environmental footprint, aligning with sustainability goals of CBD brands. The growing trend toward travel-friendly wellness products and increasing adoption by direct-to-consumer brands have accelerated the shift toward pouch-based packaging in the global CBD gummies market.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based retailing and online retailing. The store-based retailing segment accounted for the largest revenue share in 2025, driven by consumers’ preference for purchasing wellness products from trusted pharmacies, specialty stores, and supermarkets. Physical retail presence helps brands build credibility, offer in-person consultations, and ensure product authenticity, which is crucial in the regulated CBD market. The segment’s growth is reinforced by partnerships between CBD brands and established retail chains across North America and Europe.

The online retailing segment is projected to record the fastest growth from 2026 to 2033, propelled by the convenience of doorstep delivery, broad product variety, and educational marketing. Increasing digital literacy and social media influence have encouraged consumers to explore online wellness solutions. E-commerce platforms also enable subscription-based sales models and access to niche or specialized CBD formulations unavailable in physical stores, driving rapid expansion in this channel.

Cannabidiol (CBD) Gummies Market Regional Analysis

- North America dominated the cannabidiol (CBD) gummies market with the largest revenue share of 47.3% in 2025, driven by high consumer awareness of CBD’s therapeutic benefits and a well-established legalization framework across the U.S. and Canada

- The region’s strong retail infrastructure, coupled with the availability of premium, lab-tested CBD products, supports significant market penetration

- Increasing acceptance of CBD for wellness applications such as stress relief, pain management, and sleep improvement further fuels market growth, with major brands emphasizing quality assurance and transparency in formulations

U.S. Cannabidiol (CBD) Gummies Market Insight

The U.S. CBD gummies market captured the largest revenue share in 2025 within North America, supported by expanding legalization of hemp-derived CBD and growing public interest in natural wellness alternatives. Consumers are increasingly choosing CBD gummies for their convenience, dosage consistency, and discreet consumption format. A surge in product innovation across flavor, potency, and vegan-friendly formulations, combined with the presence of leading players such as Charlotte’s Web and Medterra, is reinforcing the country’s dominance. The expanding e-commerce distribution network further enhances market accessibility across states.

Europe Cannabidiol (CBD) Gummies Market Insight

The Europe CBD gummies market is projected to register a robust CAGR during the forecast period, driven by favorable regulatory developments and the rising trend toward plant-based wellness supplements. Consumers are becoming more health-conscious, and the adoption of CBD gummies for anxiety, sleep improvement, and general well-being is increasing. The region’s growing number of CBD-infused product launches and the presence of established nutraceutical brands are accelerating growth. Continuous expansion of retail and online distribution networks is also supporting product availability and awareness across major European economies.

U.K. Cannabidiol (CBD) Gummies Market Insight

The U.K. CBD gummies market is anticipated to grow at a significant CAGR during the forecast period, fueled by the country’s progressive stance on CBD regulation and increasing preference for edible wellness products. Consumers are turning to CBD gummies as a daily supplement for managing stress, inflammation, and mood. The U.K.’s strong retail presence, combined with rising product listings on health and wellness platforms, is expanding accessibility. Leading domestic and European brands are investing in new flavors and low-dose variants to attract new consumers and strengthen brand loyalty.

Germany Cannabidiol (CBD) Gummies Market Insight

The Germany CBD gummies market is expected to expand steadily during the forecast period, supported by growing consumer acceptance of natural therapies and a favorable legal framework for hemp-based products. German consumers show strong trust in certified and pharmaceutical-grade formulations, prompting companies to focus on product safety and compliance with EU standards. The increasing integration of CBD products into pharmacy and wellness retail channels is further driving market expansion. Rising demand from middle-aged consumers seeking non-prescription wellness solutions reinforces Germany’s role as a key European market.

Asia-Pacific Cannabidiol (CBD) Gummies Market Insight

The Asia-Pacific CBD gummies market is projected to grow at the fastest CAGR from 2026 to 2033, propelled by gradual regulatory easing and growing consumer interest in functional wellness products. Countries such as Japan, China, and Australia are witnessing rising awareness of CBD’s therapeutic potential for stress management and sleep regulation. Increasing digital marketing campaigns and cross-border e-commerce channels are enhancing product visibility. The expanding middle class and growing health-conscious population are fostering strong regional demand for CBD-infused gummies.

Japan Cannabidiol (CBD) Gummies Market Insight

The Japan CBD gummies market is gaining momentum due to rising acceptance of hemp-based wellness products and growing consumer focus on natural health supplements. Regulatory approvals for CBD imports have encouraged domestic players to launch high-quality, THC-free products targeting relaxation and mental wellness. The popularity of CBD gummies is expanding among urban professionals seeking stress relief and better sleep quality. The emphasis on clean-label ingredients and minimalist packaging is also contributing to rapid market traction across Japan.

China Cannabidiol (CBD) Gummies Market Insight

The China CBD gummies market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the country’s increasing focus on wellness trends and rapid digital retail expansion. Despite regulatory restrictions, consumer awareness and interest in CBD products continue to rise, primarily through cross-border e-commerce platforms. The presence of domestic manufacturers focusing on export-grade products and the growing popularity of CBD-infused supplements for relaxation and beauty are key drivers. As policy frameworks evolve, China is expected to emerge as one of the most influential markets in the Asia-Pacific region.

Cannabidiol (CBD) Gummies Market Share

The cannabidiol (CBD) gummies industry is primarily led by well-established companies, including:

- CV Sciences, Inc. (U.S.)

- CHARLOTTE'S WEB (U.S.)

- Verma Farms (U.S.)

- BAEYS (U.S.)

- Medterra CBD (U.S.)

- Balance CBD (U.S.)

- CBDfx (U.S.)

- CBD Pure (U.S.)

- PureKana (U.S.)

- Dixie Brands (U.S.)

- Premium Jane (U.S.)

- Diamond CBD (U.S.)

- Aurora Cannabis (Canada)

- CBD American Shaman (U.S.)

- Kushie Bites (U.S.)

- Sunday Scaries (U.S.)

- Medix CBD (U.S.)

- SaintyCo (China)

- Hemp Bombs (U.S.)

- Reliva CBD (U.S.)

Latest Developments in Global Cannabidiol (CBD) Gummies Market

- In February 2025, Charlotte’s Web Holdings announced the expansion of its wellness portfolio with the introduction of a new range of functional CBD gummies infused with adaptogens such as ashwagandha and L-theanine to enhance stress relief and cognitive balance. This launch reflects the growing consumer demand for multifunctional wellness products that combine CBD with botanical ingredients for synergistic effects. The development is expected to strengthen Charlotte’s Web’s leadership position in the premium CBD edibles category and appeal to a broader demographic seeking holistic health solutions

- In November 2024, CV Sciences announced that it had entered into a purchase agreement to acquire Extract Labs, Inc., a manufacturer and distributor of premium cannabinoid offerings including gummies, tinctures, and topicals. The acquisition, expected to be completed during the first quarter of 2025, will enable CV Sciences to expand its sales reach across B2B and B2C channels, leverage Extract Labs’ FDA-registered and GMP-certified facilities, and strengthen its presence in the premium cannabinoid market segment

- In July 2024, Medterra launched its next-generation fast-acting CBD gummies formulated with proprietary nano-emulsion technology to improve bioavailability and onset time. The new formulation enables quicker absorption of CBD, enhancing efficacy for users seeking immediate relief from stress and anxiety. This innovation is likely to drive market differentiation for Medterra and accelerate adoption among performance-oriented consumers, thereby boosting the company’s competitive edge in the global CBD gummies segment

- In March 2024, Green Roads introduced its “Sleep Tight Ultra” CBD gummy line featuring a higher concentration of CBD combined with melatonin and minor cannabinoids such as CBN to promote improved sleep quality. The launch caters to the rising consumer interest in sleep-support supplements as part of overall wellness routines. This product innovation underscores the company’s strategic focus on functional formulations and is expected to contribute to increased brand loyalty and growth within the wellness-driven CBD consumer base

- In October 2023, NextEvo Naturals launched its Extra Strength Daily Wellness CBD Gummies containing 20 mg of vegan, non-GMO, and THC-free cannabidiol in a Berry Mix flavor. Available in 60ct and 90ct packs, the product is designed for both home and travel use, reflecting the brand’s commitment to convenience and effectiveness. By expanding its product line and introducing clear functional labeling for ‘Calm’, ‘Recovery’, ‘Sleep’, and ‘Daily Wellness’, NextEvo aims to enhance consumer trust and stimulate demand in the growing CBD wellness category

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cannabidiol Cbd Gummies Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cannabidiol Cbd Gummies Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cannabidiol Cbd Gummies Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.