Global Cannabidiol Cbd Testing Market

Market Size in USD Billion

CAGR :

%

USD

50.85 Billion

USD

74.00 Billion

2024

2032

USD

50.85 Billion

USD

74.00 Billion

2024

2032

| 2025 –2032 | |

| USD 50.85 Billion | |

| USD 74.00 Billion | |

|

|

|

|

Cannabidiol (CBD) Testing Market Size

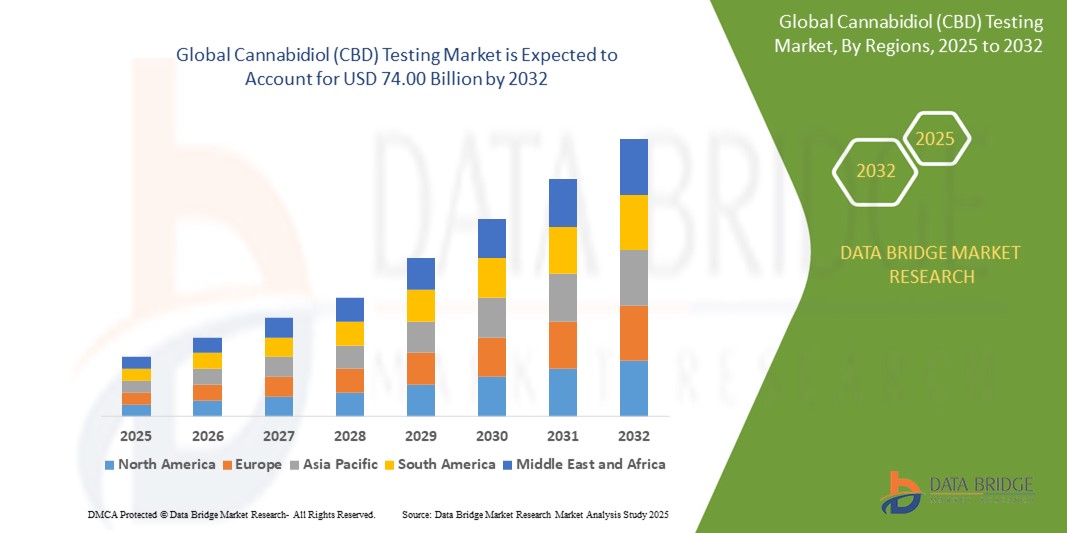

- The global cannabidiol (CBD) testing market size was valued at USD 50.85 billion in 2024 and is expected to reach USD 74.00 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the increasing legalization of cannabis across various countries, rising demand for CBD-based products, and stringent regulatory requirements ensuring product quality and safety

- Advancements in testing technologies, such as high-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS), are further contributing to market expansion by enabling precise cannabinoid profiling and contamination detection

Cannabidiol (CBD) Testing Market Analysis

- The growing popularity of CBD in food, beverage, pharmaceutical, and cosmetic industries is driving the need for reliable and accurate testing solutions

- Market participants are focusing on advanced chromatographic techniques and expanding testing lab capacities to meet compliance standards and growing commercial demand

- North America dominated the cannabidiol (CBD) testing market with the largest revenue share of 41.56% in 2024, driven by favorable regulatory developments, the increasing legalization of cannabis for medical and recreational use, and the growing need for product standardization

- Asia-Pacific region is expected to witness the highest growth rate in the global cannabidiol (CBD) testing market, driven by expanding legalization of cannabis-based products, increasing awareness regarding product safety, and rising investments in testing infrastructure across countries such as China, Japan, and Australia

- The analytical instruments segment accounted for the largest revenue share in 2024, driven by growing demand for accurate and high-throughput testing in regulated environments. Instruments such as HPLC, GC-MS, and spectroscopy systems are increasingly used for precise CBD content quantification and contaminant detection. As regulatory standards tighten across various countries, testing labs are investing heavily in sophisticated analytical equipment to ensure compliance and product safety

Report Scope and Cannabidiol (CBD) Testing Market Segmentation

|

Attributes |

Cannabidiol (CBD) Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Accredited Testing Laboratories • Increasing Adoption of CBD In Wellness and Personal Care Products |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cannabidiol (CBD) Testing Market Trends

“Integration of Advanced Chromatography Techniques for High-Precision Testing”

- The growing sophistication of CBD products is prompting laboratories to adopt advanced chromatographic methods such as High-Performance Liquid Chromatography (HPLC) and Gas Chromatography–Mass Spectrometry (GC-MS) for precise analysis

- These techniques help identify not only cannabidiol content but also trace amounts of THC, terpenes, residual solvents, and heavy metals to ensure consumer safety and legal compliance

- Increased demand from pharmaceutical companies for clinical-grade testing is accelerating the shift toward validated and reproducible testing protocols

- As competition intensifies, brands are leveraging third-party lab certifications to strengthen product credibility and differentiate in a saturated market

- Adoption of automation and data-integrated chromatography systems is also improving testing throughput and reducing turnaround times

- For instance, Eurofins Scientific has expanded its CBD testing capabilities in the U.S. using LC-MS and GC-MS technologies to provide full-spectrum analysis for edible, topical, and oil-based CBD products.

Cannabidiol (CBD) Testing Market Dynamics

Driver

“Growing Regulatory Support and Legalization of CBD Products”

- Global regulatory shifts supporting medical and recreational cannabis use have catalyzed the demand for safety-focused CBD testing services

- In countries such as Canada, the U.S., and parts of the EU, testing is legally required for product potency, purity, and contaminant levels before retail distribution

- Government agencies are actively funding research into cannabinoid safety, fostering innovation in lab testing protocols and infrastructure

- Legal clarity is encouraging small and mid-sized labs to enter the CBD testing space, driving availability and affordability of certified analysis

- Increased consumer awareness around health risks from mislabeled or contaminated CBD products is also pushing manufacturers to opt for comprehensive third-party testing

- For instance, California’s Department of Cannabis Control requires all CBD products sold within the state to pass stringent lab testing for residual solvents, microbial impurities, and potency — a mandate that has led to a boom in licensed testing facilities.

Restraint/Challenge

“Lack of Standardization in Testing Protocols across Regions”

- Despite global growth, no universal standard exists for CBD testing, resulting in fragmented compliance frameworks across North America, Europe, and Asia-Pacific

- Labs in different regions use varying reference standards, extraction methods, and analytical instruments, often leading to inconsistent test results for the same product

- Manufacturers aiming for international expansion must retest their products according to each region’s local guidelines, increasing time and cost burdens

- Disparities in THC threshold limits (e.g., 0.3% in the U.S. vs. 0.2% in the EU) create compliance challenges, especially for full-spectrum CBD oils

- The absence of globally recognized accreditation for cannabis testing labs further complicates consumer trust and cross-border product standardization

- For instance, a U.S.-based CBD company exporting to Germany had to reformulate its entire product line after German authorities rejected their original batch for exceeding local THC content, despite being compliant in the U.S.

Cannabidiol (CBD) Testing Market Scope

The market is segmented on the basis of product and software, testing procedures, and end-user.

• By Product and Software

On the basis of product and software, the cannabidiol (CBD) testing market is segmented into analytical instruments, consumables, and software. The analytical instruments segment accounted for the largest revenue share in 2024, driven by growing demand for accurate and high-throughput testing in regulated environments. Instruments such as HPLC, GC-MS, and spectroscopy systems are increasingly used for precise CBD content quantification and contaminant detection. As regulatory standards tighten across various countries, testing labs are investing heavily in sophisticated analytical equipment to ensure compliance and product safety.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising need for automation, data management, and regulatory traceability. Integrated laboratory information management systems (LIMS) streamline workflow, reporting, and compliance, especially in multi-location testing labs and research facilities.

• By Testing Procedures

On the basis of testing procedures, the market is segmented into residual solvent screening, terpene profiling, potency testing, genetic testing, pesticide screening, heavy metal testing, and microbial analysis. Potency testing dominated the market in 2024 with the largest share, driven by the requirement to accurately label CBD concentration in consumer products. Regulatory authorities across North America and Europe mandate precise potency testing to protect public health and ensure truthful product claims.

Microbial analysis is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising concerns around contamination in edibles and topicals. Pathogen detection—including E. coli and Salmonella—is critical in maintaining consumer safety and quality assurance. An instance of this was seen in California, where microbial contamination prompted the recall of several CBD-infused consumables in 2023.

• By End-User

On the basis of end-user, the CBD testing market is segmented into laboratories, cannabis cultivators, research institutes, drug manufacturers, and dispensaries. The laboratories segment held the largest revenue share in 2024, driven by the increasing number of third-party testing facilities that cater to cannabis brands and cultivators seeking regulatory certification and product validation. These labs are central to maintaining trust in the CBD supply chain.

Drug manufacturers is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding R&D investments in cannabidiol-based pharmaceuticals. With rising interest in CBD as a therapeutic agent for anxiety, epilepsy, and pain management, manufacturers are implementing rigorous testing protocols to meet FDA and EMA standards.

Cannabidiol (CBD) Testing Market Regional Analysis

• North America dominated the cannabidiol (CBD) testing market with the largest revenue share of 41.56% in 2024, driven by favorable regulatory developments, the increasing legalization of cannabis for medical and recreational use, and the growing need for product standardization

• Consumers and businesses across the region place high importance on product safety, efficacy, and transparency, which has increased the demand for advanced testing procedures

• The widespread adoption of third-party lab testing, government compliance standards, and a well-established network of laboratories further support North America's leadership in the market

U.S. Cannabidiol (CBD) Testing Market Insight

The U.S. CBD testing market accounted for the majority of North America's share in 2024, fueled by the rising consumption of CBD products and a stringent regulatory framework led by agencies such as the FDA. As cannabis-derived wellness and therapeutic products proliferate across the market, manufacturers are compelled to ensure compliance with purity, potency, and safety standards. The increasing demand for lab-tested CBD oils, tinctures, and edibles, especially among health-conscious consumers, is driving growth. The expansion of independent testing laboratories and the implementation of state-specific quality mandates have also contributed significantly to market expansion in the U.S.

Europe Cannabidiol (CBD) Testing Market Insight

The Europe CBD testing market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising demand for high-quality cannabis-based wellness products and a push toward harmonized EU regulations. Regulatory authorities in countries such as Germany and the Netherlands are emphasizing product testing to ensure consumer safety and authenticity. In addition, growing awareness among European consumers about the medicinal benefits of CBD is encouraging responsible sourcing and laboratory validation. Europe’s dynamic regulatory landscape and the presence of dedicated cannabis research institutions contribute to a robust testing infrastructure across the region.

U.K. Cannabidiol (CBD) Testing Market Insight

The U.K. CBD testing market is expected to witness the fastest growth rate from 2025 to 2032 is expected to witness the fastest growth rate from 2025 to 2032, driven by regulatory initiatives from the Food Standards Agency (FSA) and increasing consumer demand for safe, certified CBD products. Companies are required to submit novel food applications with detailed product testing data, accelerating investment in testing services. Moreover, the growing popularity of CBD-infused skincare and wellness products is amplifying the need for rigorous microbial, pesticide, and heavy metal screening to meet market expectations.

Germany Cannabidiol (CBD) Testing Market Insight

The Germany CBD testing market is expected to witness the fastest growth rate from 2025 to 2032, owing to the government’s proactive approach to medical cannabis and increasing investments in cannabis research and development. Germany’s pharmaceutical-grade quality expectations and controlled substance regulations mandate comprehensive testing procedures across the supply chain. Domestic producers and international suppliers alike must adhere to strict potency and contamination standards, encouraging partnerships with accredited laboratories. Germany’s centralized role in the European cannabis ecosystem further drives growth in analytical testing services.

Asia-Pacific Cannabidiol (CBD) Testing Market Insight

The Asia-Pacific CBD testing market is expected to witness the fastest growth rate from 2025 to 2032, driven by the gradual legalization of CBD products and the increasing interest in cannabis-derived pharmaceuticals across emerging economies such as China, India, and Thailand. Governments in the region are exploring the economic benefits of cannabis cultivation while enforcing strict quality control measures, thereby boosting the demand for reliable testing infrastructure. The rising number of research collaborations, combined with public health initiatives, is also enhancing testing capacity and promoting safe CBD consumption.

Japan Cannabidiol (CBD) Testing Market Insight

The Japan CBD testing market is expected to witness the fastest growth rate from 2025 to 2032, due to evolving regulations, rising health awareness, and the country’s reputation for stringent quality control standards. While cannabis remains heavily regulated, the demand for CBD-based cosmetics and wellness supplements is encouraging investment in compliant testing services. The Japanese consumer market emphasizes safety and product integrity, prompting retailers to partner with certified laboratories for terpene profiling and potency verification. These trends are expected to strengthen Japan’s position in the premium CBD segment.

China Cannabidiol (CBD) Testing Market Insight

The China CBD testing market captured the largest share in Asia-Pacific in 2024, supported by the country’s dominance in industrial hemp cultivation and growing exports of CBD-based products. Although domestic consumption is tightly regulated, the demand for tested, export-compliant CBD oils, cosmetics, and raw materials is significantly driving testing services. With major manufacturing hubs located in provinces such as Yunnan and Heilongjiang, the integration of advanced analytical instruments and standardized lab procedures is crucial for global market access.

Cannabidiol (CBD) Testing Market Share

The Cannabidiol (CBD) Testing industry is primarily led by well-established companies, including:

- CannaSafe (U.S.)

- Steep Hill, Inc (U.S.)

- Eirlab Research Group (Ireland)

- GOODBODY HEALTH INC. (U.S.)

- CW ANALYTICAL (U.S.)

- Pure Analytics (U.S.)

- ANRESCO (U.S.)

- SC Labs (India)

- Battelle Memorial Institute (U.S.)

- Aphria Inc (Canada)

- Medical Marijuana, Inc (U.S.)

- STENOCARE A/S (Denmark)

- Cannabis Science Inc (U.S.)

- Agilent Technologies, Inc. (U.S.)

Latest Developments in Global Cannabidiol (CBD) Testing Market

- In July 2020, Agilent Technologies recently unveiled pioneering solutions for the surging Global Cannabidiol (CBD) Testing Market, addressing challenges in potency and pesticide/mycotoxin assessments for cannabis and hemp. Launching the Agilent eMethods tool and two kits—Cannabis and Hemp Potency, and Cannabis Pesticide and Mycotoxin—the brand offers a swift setup with step-by-step instructions and consumables for comprehensive analysis. This innovative approach streamlines lab operations, aiding compliance with varying regulations. Monty Benefiel and Angelica Riemann, Agilent VPs, emphasized these solutions' role in establishing efficient testing procedures, enhancing productivity, and minimizing risks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cannabidiol Cbd Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cannabidiol Cbd Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cannabidiol Cbd Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.