Global Cannabis Gummies Market

Market Size in USD Billion

CAGR :

%

USD

13.30 Billion

USD

108.49 Billion

2021

2029

USD

13.30 Billion

USD

108.49 Billion

2021

2029

| 2022 –2029 | |

| USD 13.30 Billion | |

| USD 108.49 Billion | |

|

|

|

|

Market Analysis and Size

The industry's interest in CBD-based products has skyrocketed as a result of the general public's efforts to legalise marijuana for medicinal and recreational purposes. As a result of their non-psychotropic effects, CBD gummies have gained popularity among consumers. The growing range of medicinal applications for CBD gummies, such as neurological disorders, psychiatric disorders, and cancer therapeutics, is a key driver of the CBD gummies market's evolution.

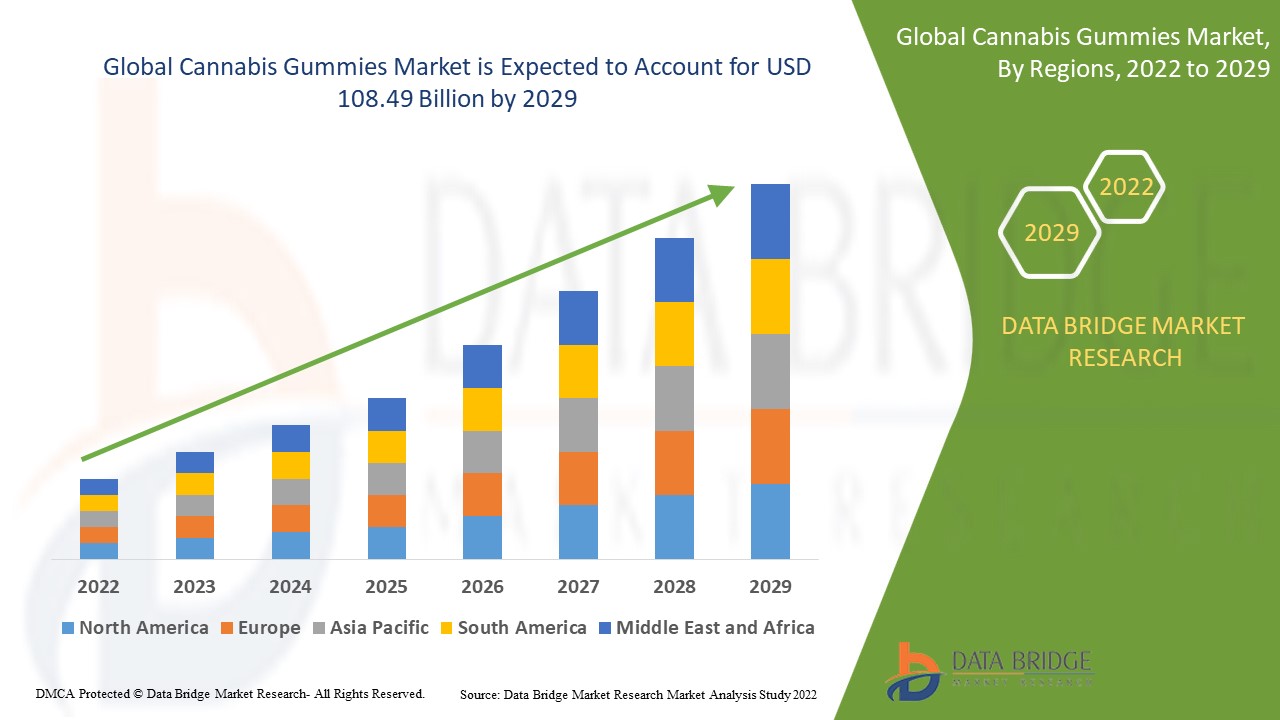

Data Bridge Market Research analyses that the Cannabis gummies market which was valued at USD 13.3 billion in 2021 and is expected to reach the value of USD 108.49 billion by 2029, at a CAGR of 30.00% during the forecast period of 2022-2029.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Concentration (High, Low Concentration), Distribution Channel (Online and Offline), Type (Solid Edible, Topical Edible, Inhalation and Liquid Edible), Preparation (Cannabidiol and Tetrahydrocannabinol), Application (Cancer, Epilepsy, Arthritis, Multiple Sclerosis, Alzheimer, Anorexia and Nausea) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Global, Brazil, Argentina, Rest of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

Canopy Growth Corporation (Canada), The Cronos Group (Canada), Tilray. (US), Hexo (Canada), CannTrust (Canada), Aurora Cannabis Inc. (Canada), GW Pharmaceuticals plc. (UK), VIVO Cannabis Inc. (Canada), Alkaline88, LLC. (US), NewAge Inc. (US), Cannara. (Canada), Dixie Brands (US), KANNAWAY LLC. (US), The Supreme Cannabis Company, Inc (Canada), CANNABIS Aphria (Canada), CURA CS, LLC. (US), KAZMIRA (US), Curaleaf (US) and CannazALL (US) |

|

Opportunities |

|

Market Definition

CBD gummies are edible candies that contain non-psychoactive cannabidiol oil derived from the marijuana plant. These gummies are widely available in a variety of shapes, flavors, colours, and cannabidiol concentrations. CBD gummies are easily ingestible and aid in relieving chronic pain, reducing anxiety and depression, reducing stress, the treatment of insomnia and other ailments.

Cannabis Gummies Market Dynamics

Drivers

- Rising legalization of cannabis for medicinal and recreational purposes

The increasing legalization of cannabis for a variety of medical and recreational purposes, particularly across borders, is increasing demand for CBD gummies. Furthermore, rising consumer awareness of the numerous benefits of CBD gummies in treating inflammation, relieving pain, improving sleep quality, and stress management is propelling market growth.

- The rising prevalence of neurological and psychiatric disorders among population

The rising prevalence of several respiratory ailments caused by cannabis smoking has shifted consumer preference for CBD-infused edibles, such as CBD gummies. Furthermore, the non-psychotropic features of CBD gummies, which reduce the risk of drug-induced sensations among consumers, are boosting the adoption of CBD gummies due to the increased prevalence of various neurological and mental illnesses. Furthermore, the emergence of gluten-free, vegan, sugar-free, and organic CBD gummies, typically made from non-GMO hemp plants, catalyzes market growth.

Opportunity

One of the major contributors to the growth of the CBD gummies market is the healthcare sector. CBD gummies can help us control our bodies' inflammatory responses. CBD products, such as gummies, are gaining popularity as an alternative to traditional analgesics like ibuprofen, aspirin, and others. CBD has been discovered to have powerful anti-anxiety and anti-depressant properties. Furthermore, it has been shown to increase neurogenesis (brain cell growth) in key areas of the brain associated with anxiety and depression. All of these factors will play a significant role in driving market growth in the coming years.

Restraints

Most CBD products are not FDA-approved because their strengths and purity can vary between brands and even within the same brand, potentially resulting in less-than-desired positive outcomes. As a result, their use is restricted in a number of countries. Furthermore, the availability of substitutes such as CBD dark chocolates, salad dressings, and protein supplements is a significant impediment to effective adoption, limiting growth prospects.

This cannabis gummies market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the cannabis gummies market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Cannabis Gummies Market

COVID-19, like any other market, had a negative impact on the cannabis market. Consumers were discouraged from visiting brick-and-mortar stores as a result of the lockdown. However, many cannabis companies began to rely heavily on social media and e-commerce platforms to market to consumers during the year. The Alberta government designated cannabis retail shops, producers, manufacturers, distributors, and warehouses as essential services on March 30, 2020. As a result, throughout the COVID-19 pandemic, cannabis businesses and services continued to serve Albertans.

Recent Development

- Canopy Growth, one of the world's largest cannabis companies, announced in June 2021 that it had completed the acquisition of The Supreme Cannabis Company and had acquired 100 percent of Supreme's issued and outstanding common shares.

- STADA Arzneimittel AG, one of Germany's largest pharmaceutical firms, will enter the medical cannabis space in March 2021 with an agreement with Canadian firm MediPharm Labs for the launch of two flower products, with six more to follow

- TCV Sciences, Inc. announced the release of PLUSCBDTM calm and sleep gummies in May 2021, two flavorful gummies that support healthy stress responses and sleep cycles for people returning to their normal routines.

- Pfizer Inc. and GSK merged their respective consumer healthcare businesses in 2019 to form GSK Consumer Healthcare, a global consumer healthcare joint venture.

Global Cannabis Gummies Market Scope

The cannabis gummies market is segmented on the basis of concentration, distribution channel, type, preparation and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Concentration

- High

- Low

Type

- Solid Edible

- Topical Edible

- Inhalation

- Liquid Edible

Preparation

- Cannabidiol

- Tetrahydrocannabinol

Application

- Cancer

- Epilepsy

- Arthritis

- Multiple Sclerosis

- Alzheimer

- Anorexia

- Nausea

Distribution channel

- Online

- Offline

Cannabis Gummies Market Regional Analysis/Insights

The cannabis gummies market is analysed and market size insights and trends are provided by country, source, products, consumer, packaging, and sales channel as referenced above.

The countries covered in the cannabis gummies market report are U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Global, Brazil, Argentina, Rest of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa.

The North American region, which has experienced significant year-on-year growth, is expected to drive the global CBD gummies market. The rising demand for recreational and medicinal marijuana and products for heart health, stamina, and bone health is a major driver of the CBD gummies market's expansion. Additionally, products aimed specifically at children are driving innovation, particularly those addressing immune and gut health, which are expected to gain traction in the coming years. The North American market may also see increased demand for vegan/plant-based products in various fruit flavours, which may contribute to the region's market development.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Cannabis Gummies Market Share Analysis

The cannabis gummies market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to cannabis gummies market.

Some of the major players operating in the cannabis gummies market are:

- Canopy Growth Corporation (Canada)

- The Cronos Group (Canada)

- Tilray. (US)

- Hexo (Canada)

- CannTrust (Canada)

- Aurora Cannabis Inc. (Canada)

- GW Pharmaceuticals plc. (UK)

- VIVO Cannabis Inc. (Canada)

- Alkaline88, LLC. (US)

- NewAge Inc. (US)

- Cannara. (Canada)

- Dixie Brands (US)

- KANNAWAY LLC. (US)

- The Supreme Cannabis Company, Inc (Canada)

- CANNABIS Aphria (Canada)

- CURA CS, LLC. (US)

- KAZMIRA (US)

- Curaleaf (US)

- CannazALL (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CANNABIS GUMMIES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CANNABIS GUMMIES MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CANNABIS GUMMIES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TTELEVISION ADVERTISEMENT

5.4.4.2. OONLINE ADVERTISEMENT

5.4.4.3. IIN-STORE ADVERTISEMENT

5.4.4.4. OOUTDOOR ADVERTISEMENT

5.5 PRIVATE LABEL VS BRAND ANALYSIS

5.6 PROMOTIONAL ACTIVITIES

5.7 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.8 NEW PRODUCT LAUNCH STRATEGY

5.8.1 NUMBER OF NEW PRODUCT LAUNCH

5.8.1.1. LINE EXTENSTION

5.8.1.2. NEW PACKAGING

5.8.1.3. RE-LAUNCHED

5.8.1.4. NEW FORMULATION

5.9 CONSUMER LEVEL TRENDS

5.1 MEETING CONSUMER REQUIREMENT

6 REGULATORY FRAMEWORK AND GOVERNMENT INITIATIVES

7 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON SUPPLY CHAIN

7.3 IMPACT ON SHIPMENT

7.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL CANNABIS GUMMIES MARKET, BY GUMMY FORM, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 GUMMY BEARS

11.3 GUMMY RINGS

11.4 GUMMY WORMS

11.5 OTHERS

12 GLOBAL CANNABIS GUMMIES MARKET, BY CBD TYPE, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 FULL-SPECTRUM CBD

12.3 CBD ISOLATE

12.4 BROAD-SPECTRUM CBD

13 GLOBAL CANNABIS GUMMIES MARKET, BY CONCENTRATION, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 HIGH CONCENTRATION

13.2.1 HIGH CONCENTRATION, BY CBD CONTENT PER GUMMY

13.2.1.1. 101-250MG

13.2.1.2. 250-500- MG

13.2.1.3. >500 MG

13.2.1.4. OTHERSS

13.3 LOW CONCENTRATION

13.3.1 LOW CONCENTRATION, BY CBD CONTENT PER GUMMY

13.3.1.1. 10 MG

13.3.1.2. 20 MG

13.3.1.3. 25 MG

13.3.1.4. 50 MG

13.3.1.5. 51 TO 100 MG

14 GLOBAL CANNABIS GUMMIES MARKET, BY FLAVOR, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 TANGERINE

14.3 STRAWBERRY

14.4 BLUEBERRY

14.5 CHERRY

14.6 RASPBERRY

14.7 BLACKBERRY

14.8 BANANA

14.9 CRANBERRY

14.1 WATERMELON

14.11 ORANGE

14.12 PINEAPPLE

14.13 APPLE

14.14 LIME

14.15 BLACKCURRENT

14.16 MANGO

14.17 SOUR

14.18 OTHERS

15 GLOBAL CANNABIS GUMMIES MARKET, BY NATURE, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 ORGANIC

15.3 CONVENTIONAL

16 GLOBAL CANNABIS GUMMIES MARKET, BY USAGE TYPE, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 RECREATIONAL

16.3 MEDICINAL

16.3.1 MEDICINAL, BY TYPE

16.3.1.1. CANCER

16.3.1.2. EPILEPSY

16.3.1.3. ARTHRITIS

16.3.1.4. MULTIPLE SCLEROSIS

16.3.1.5. ALZHEIMER

16.3.1.6. ANOREXIA

16.3.1.7. NAUSEA

16.3.1.8. DIABETES

16.3.1.9. DEPRESSION

16.3.1.10. ANXIETY

16.3.1.11. OTHERS

17 GLOBAL CANNABIS GUMMIES MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 JAR / BOTTLES

17.2.1 GLASS JAR

17.2.2 PLASTIC JARS

17.3 POUCHES

17.4 OTHERS

18 GLOBAL CANNABIS GUMMIES MARKET, BY PACKAGING SIZE, 2022-2031 (USD MILLION)

18.1 OVERVIEW

18.2 LESS THAN 100 GRAMS

18.3 101-200 GRAMS

18.4 201-300 GRAMS

18.5 301-400 GRAMS

18.6 401-500 GRAMS

18.7 MORE THAN 500 GRAMS

19 GLOBAL CANNABIS GUMMIES MARKET, BY END USER, 2022-2031 (USD MILLION)

19.1 OVERVIEW

19.2 ADULTS

19.2.1 MEN

19.2.2 WOMEN

19.3 KIDS

20 GLOBAL CANNABIS GUMMIES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

20.1 OVERVIEW

20.2 STORE BASED RETAILERS

20.2.1 HYPERMARKETS / SUPERMARKETS

20.2.2 GROCERY STORES

20.2.3 CONVENIENCE STORES

20.2.4 SPECIALTY STORES

20.2.5 OTHERS

20.3 NON-STORE RETAILERS

20.3.1 COMPANY OWNED WEBSITES

20.3.2 E-COMMERCE WEBSITES

21 GLOBAL CANNABIS GUMMIES MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 MERGERS & ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT & APPROVALS

21.7 EXPANSIONS & PARTNERSHIP

21.8 REGULATORY CHANGES

22 GLOBAL CANNABIS GUMMIES MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

22.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

22.2 NORTH AMERICA

22.2.1 U.S.

22.2.2 CANADA

22.2.3 MEXICO

22.3 EUROPE

22.3.1 GERMANY

22.3.2 U.K.

22.3.3 ITALY

22.3.4 FRANCE

22.3.5 SPAIN

22.3.6 SWITZERLAND

22.3.7 NETHERLANDS

22.3.8 BELGIUM

22.3.9 RUSSIA

22.3.10 DENMARK

22.3.11 SWEDEN

22.3.12 POLAND

22.3.13 TURKEY

22.3.14 NORWAY

22.3.15 FINLAND

22.3.16 REST OF EUROPE

22.4 ASIA-PACIFIC

22.4.1 JAPAN

22.4.2 CHINA

22.4.3 SOUTH KOREA

22.4.4 INDIA

22.4.5 AUSTRALIA

22.4.6 SINGAPORE

22.4.7 THAILAND

22.4.8 INDONESIA

22.4.9 MALAYSIA

22.4.10 PHILIPPINES

22.4.11 NEW ZEALAND

22.4.12 VIETNAM

22.4.13 TAIWAN

22.4.14 REST OF ASIA-PACIFIC

22.5 SOUTH AMERICA

22.5.1 BRAZIL

22.5.2 ARGENTINA

22.5.3 REST OF SOUTH AMERICA

22.6 MIDDLE EAST AND AFRICA

22.6.1 SOUTH AFRICA

22.6.2 UAE

22.6.3 SAUDI ARABIA

22.6.4 OMAN

22.6.5 QATAR

22.6.6 KUWAIT

22.6.7 ISRAEL

22.6.8 BAHRAIN

22.6.9 EGYPT

22.6.10 REST OF MIDDLE EAST AND AFRICA

23 GLOBAL CANNABIS GUMMIES MARKET, SWOT & DBMR ANALYSIS

24 GLOBAL CANNABIS GUMMIES MARKET, COMPANY PROFILE

24.1 CV SCIENCES, INC.

24.1.1 COMPANY OVERVIEW

24.1.2 GEOGRAPHICAL PRESENCE

24.1.3 PRODUCTION CAPACITY OVERVIEW

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 DIXIE BRANDS, INC.

24.2.1 COMPANY OVERVIEW

24.2.2 GEOGRAPHICAL PRESENCE

24.2.3 PRODUCTION CAPACITY OVERVIEW

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 RELIVA WELLNESS (AURORA)

24.3.1 COMPANY OVERVIEW

24.3.2 GEOGRAPHICAL PRESENCE

24.3.3 PRODUCTION CAPACITY OVERVIEW

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 SUNDAY SCARIES

24.4.1 COMPANY OVERVIEW

24.4.2 GEOGRAPHICAL PRESENCE

24.4.3 PRODUCTION CAPACITY OVERVIEW

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 GREEN ROADS

24.5.1 COMPANY OVERVIEW

24.5.2 GEOGRAPHICAL PRESENCE

24.5.3 PRODUCTION CAPACITY OVERVIEW

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 MEDIX CBD

24.6.1 COMPANY OVERVIEW

24.6.2 GEOGRAPHICAL PRESENCE

24.6.3 PRODUCTION CAPACITY OVERVIEW

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 HEMP BOMBS

24.7.1 COMPANY OVERVIEW

24.7.2 GEOGRAPHICAL PRESENCE

24.7.3 PRODUCTION CAPACITY OVERVIEW

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 PUREKANA

24.8.1 COMPANY OVERVIEW

24.8.2 GEOGRAPHICAL PRESENCE

24.8.3 PRODUCTION CAPACITY OVERVIEW

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 DIAMOND WELLNESS HOLDINGS, INC.

24.9.1 COMPANY OVERVIEW

24.9.2 GEOGRAPHICAL PRESENCE

24.9.3 PRODUCTION CAPACITY OVERVIEW

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 PREMIUM JANE

24.10.1 COMPANY OVERVIEW

24.10.2 GEOGRAPHICAL PRESENCE

24.10.3 PRODUCTION CAPACITY OVERVIEW

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 CHARLOTTE'S WEB HOLDINGS INC

24.11.1 COMPANY OVERVIEW

24.11.2 GEOGRAPHICAL PRESENCE

24.11.3 PRODUCTION CAPACITY OVERVIEW

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 VERMA FARMS (ACQUIRED BY FE INTERNATIONAL)

24.12.1 COMPANY OVERVIEW

24.12.2 GEOGRAPHICAL PRESENCE

24.12.3 PRODUCTION CAPACITY OVERVIEW

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 HEMPZILLA CBD

24.13.1 COMPANY OVERVIEW

24.13.2 GEOGRAPHICAL PRESENCE

24.13.3 PRODUCTION CAPACITY OVERVIEW

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 ZENBEARS CBD

24.14.1 COMPANY OVERVIEW

24.14.2 GEOGRAPHICAL PRESENCE

24.14.3 PRODUCTION CAPACITY OVERVIEW

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 ENDOCA

24.15.1 COMPANY OVERVIEW

24.15.2 GEOGRAPHICAL PRESENCE

24.15.3 PRODUCTION CAPACITY OVERVIEW

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 CIBDOL

24.16.1 COMPANY OVERVIEW

24.16.2 GEOGRAPHICAL PRESENCE

24.16.3 PRODUCTION CAPACITY OVERVIEW

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 FLORA GROWTH CORP.

24.17.1 COMPANY OVERVIEW

24.17.2 GEOGRAPHICAL PRESENCE

24.17.3 PRODUCTION CAPACITY OVERVIEW

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 HEMPURA

24.18.1 COMPANY OVERVIEW

24.18.2 GEOGRAPHICAL PRESENCE

24.18.3 PRODUCTION CAPACITY OVERVIEW

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 CANNARAY

24.19.1 COMPANY OVERVIEW

24.19.2 GEOGRAPHICAL PRESENCE

24.19.3 PRODUCTION CAPACITY OVERVIEW

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 TAURIGA SCIENCES INC

24.20.1 COMPANY OVERVIEW

24.20.2 GEOGRAPHICAL PRESENCE

24.20.3 PRODUCTION CAPACITY OVERVIEW

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Global Cannabis Gummies Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cannabis Gummies Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cannabis Gummies Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.