Global Cannabis Packaging Market

Market Size in USD Billion

CAGR :

%

USD

50.05 Billion

USD

33.95 Billion

2025

2033

USD

50.05 Billion

USD

33.95 Billion

2025

2033

| 2026 –2033 | |

| USD 50.05 Billion | |

| USD 33.95 Billion | |

|

|

|

|

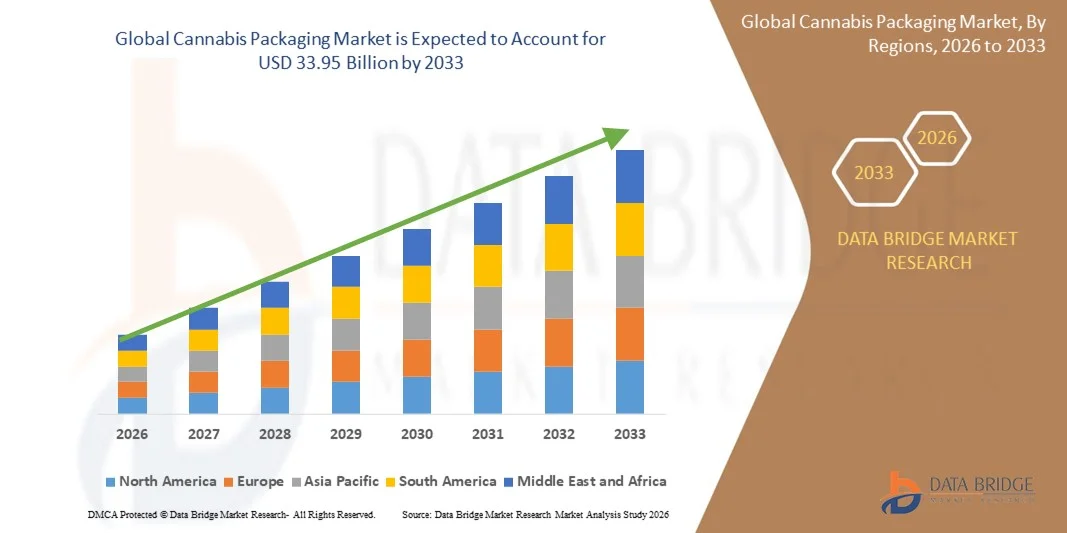

What is the Global Cannabis Packaging Market Size and Growth Rate?

- The global cannabis packaging market size was valued at USD 50.05 billion in 2025 and is expected to reach USD 33.95 billion by 2033, at a CAGR of 7.10% during the forecast period

- The cannabis packaging market is rising in demand owing to rapidly increasing use of cannabis for both medicinal and recreational purposes. Also, the legitimizing the use of cannabis by various governments of countries particularly in North America is also highly impacting the growth of the cannabis packaging

- The increasing demand for medical and recreational cannabis products for consumption along with the introduction of new active packaging solutions for cannabis are anticipated to flourish the growth of the market owing to the above mentioned reasons and is also is projected to grow substantially during the forecast period

What are the Major Takeaways of Cannabis Packaging Market?

- the rapid increase in the medical cannabis packaging industry due to increasing proliferation of cannabis in the medical industry, which has, in turn, created a huge demand for protective packaging which is also expected to push the growth of cannabis packaging market in the above mentioned forecast period

- The major factor which actively drives the demand of cannabis packaging market is the growth of customized cannabis packaging solutions to maintain the brand positioning as well as the growing need for quality compliant packaging has given importance amongst cannabis manufacturers

- North America dominated the cannabis packaging market with the largest revenue share of 42.5% in 2025, driven by the legalization of cannabis across several states, growing recreational and medicinal usage, and the presence of established cannabis product manufacturers

- The Asia-Pacific region is projected to witness the fastest growth rate of 9.54% during 2026–2033, driven by the gradual legalization of medicinal cannabis, expanding consumer awareness, and growing participation of international players in emerging markets

- The rigid packaging segment dominated the market with the largest revenue share of 46.7% in 2025, owing to its superior product protection, durability, and compliance with stringent regulatory standards

Report Scope and Cannabis Packaging Market Segmentation

|

Attributes |

Cannabis Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cannabis Packaging Market?

Rising Demand for Sustainable and Child-Resistant Cannabis Packaging Solutions

- The cannabis packaging market is undergoing a major transformation driven by the increasing emphasis on sustainability, product safety, and regulatory compliance. With the global legalization of cannabis for medical and recreational use, brands are shifting toward eco-friendly and compliant packaging that ensures both environmental protection and consumer safety

- For instance, Sana Packaging Inc. and Dymapak have developed packaging made from hemp-based bioplastics, ocean-reclaimed plastics, and recyclable materials to reduce carbon footprint and promote circular economy principles within the cannabis supply chain

- The adoption of child-resistant, tamper-evident, and odor-proof packaging is gaining traction due to stringent government regulations in countries such as the U.S., Canada, and Germany. These innovations enhance safety and align with compliance standards such as ASTM and ISO certifications

- Manufacturers are integrating smart labeling, QR codes, and blockchain-based tracking systems to improve product transparency and enable consumers to verify product authenticity, source, and potency. This digital integration also aids in regulatory reporting and anti-counterfeiting efforts

- The growing consumer preference for minimalist, biodegradable, and reusable packaging is prompting companies to explore plant-based polymers, paper composites, and lightweight packaging formats. Elevate Packaging, for instance, offers compostable pouches and labeling solutions tailored to cannabis brands emphasizing environmental responsibility

- As environmental awareness and compliance demands intensify, the shift toward sustainable, child-safe, and smart cannabis packaging will remain a defining trend influencing product design, branding, and manufacturing strategies across the global cannabis industry

What are the Key Drivers of Cannabis Packaging Market?

- The global legalization and commercialization of cannabis for medical and recreational applications serve as the primary growth drivers for the cannabis packaging market. Expanding consumer bases in North America and Europe are creating massive demand for compliant and innovative packaging solutions

- For instance, in 2025, Berlin Packaging reported rising demand for premium glass jars and child-resistant closures across the U.S. and Canada, driven by increasing product diversification in edibles, oils, and concentrates

- The growing emphasis on brand differentiation and consumer safety is pushing companies to invest in visually appealing, compliant, and functional packaging formats that meet strict labeling and protection standards

- Rising environmental concerns and government restrictions on single-use plastics are fueling the adoption of biodegradable, recyclable, and compostable materials in cannabis packaging. Manufacturers are also expanding R&D capabilities to balance sustainability with cost efficiency and product performance

- Technological integration through smart packaging features such as NFC tags, scannable QR codes, and tamper-proof seals is enabling better product tracking and customer engagement. These innovations enhance brand transparency and consumer trust, particularly in the premium cannabis segment

- As cannabis legalization spreads globally and consumer awareness increases, the demand for safe, sustainable, and smart packaging will continue to strengthen. Continuous innovation in design and materials will play a pivotal role in shaping the market’s long-term growth trajectory

Which Factor is Challenging the Growth of the Cannabis Packaging Market?

- High production costs and complex regulatory compliance requirements pose significant challenges in the cannabis packaging market. The need for specialized materials and certifications for child-resistant, odor-proof, and tamper-evident packaging drives up manufacturing expenses

- For instance, smaller cannabis brands in the U.S. and Canada have reported difficulty in meeting packaging compliance standards set by the U.S. Food and Drug Administration (FDA) and Health Canada, leading to higher operational costs and limited scalability

- Fluctuations in raw material prices—especially for eco-friendly bioplastics and glass—further strain profitability. The cost of developing sustainable and compliant packaging often surpasses that of conventional alternatives, creating barriers for startups and small-scale producers

- Frequent regulatory updates across regions require continuous packaging redesigns, labeling revisions, and certification renewals. This adds financial and logistical burdens for both manufacturers and distributors

- The lack of standardized global packaging regulations for cannabis also leads to inconsistencies in compliance strategies, particularly for companies operating across multiple jurisdictions

- To overcome these challenges, market players are focusing on modular packaging solutions, strategic partnerships with compliance consultants, and investment in automated production lines. Over time, advances in material science and standardization efforts are expected to ease compliance costs and improve accessibility for emerging cannabis brands

How is the Cannabis Packaging Market Segmented?

The market is segmented on the basis of type, packaging type, and application.

- By Type

On the basis of type, the cannabis packaging market is segmented into rigid, semi-rigid, and flexible packaging. The rigid packaging segment dominated the market with the largest revenue share of 46.7% in 2025, owing to its superior product protection, durability, and compliance with stringent regulatory standards. Rigid packaging formats such as glass jars, metal tins, and hard plastic containers are widely used for storing cannabis flowers, edibles, and concentrates, as they offer enhanced child resistance, odor control, and extended shelf life. Moreover, their premium appearance supports branding and consumer trust in high-value cannabis products.

The flexible packaging segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing demand for lightweight, cost-efficient, and eco-friendly options such as pouches and sachets. Increasing consumer preference for portability and convenience, combined with advancements in biodegradable and recyclable films, is propelling flexible packaging adoption among cannabis producers targeting sustainable and economical solutions.

- By Packaging Type

On the basis of packaging type, the cannabis packaging market is categorized into glass, metal, plastic, and cardboard containers. The plastic segment dominated the market with the largest revenue share of 39.2% in 2025, primarily due to its versatility, low cost, and suitability for a wide range of cannabis products including oils, pre-rolls, and edibles. Plastic containers offer excellent moisture resistance, durability, and customization flexibility, making them highly preferred for both medical and recreational applications. Moreover, manufacturers are increasingly incorporating recyclable and bio-based plastics to align with environmental regulations and consumer expectations.

The glass segment is anticipated to register the fastest growth from 2026 to 2033, driven by rising demand for premium and sustainable packaging solutions. Glass jars and vials are favored for their chemical stability, odor retention, and reusability, particularly in the medical cannabis sector. The growing shift toward eco-conscious packaging and premium branding is further supporting glass container adoption across the global cannabis packaging landscape.

- By Application

On the basis of application, the cannabis packaging market is segmented into medical use, recreational use, and others. The medical use segment dominated the market with the largest revenue share of 52.4% in 2025, supported by the expanding legalization of medical cannabis and increasing prescription-based consumption for chronic pain, anxiety, and neurological disorders. Strict regulatory requirements in medical cannabis packaging—such as child resistance, tamper evidence, and accurate labeling—are encouraging pharmaceutical-grade packaging innovations. In addition, the rising acceptance of cannabis-based treatments in regions such as North America and Europe continues to drive demand.

The recreational use segment is expected to grow at the fastest rate from 2026 to 2033, fueled by the rapid legalization of adult-use cannabis in several countries and evolving consumer preferences for convenient, visually appealing packaging. Brands are focusing on lifestyle-oriented designs, resealable formats, and sustainable materials to cater to a broad consumer base, further strengthening the segment’s market expansion.

Which Region Holds the Largest Share of the Cannabis Packaging Market?

- North America dominated the cannabis packaging market with the largest revenue share of 42.5% in 2025, driven by the legalization of cannabis across several states, growing recreational and medicinal usage, and the presence of established cannabis product manufacturers

- The region’s advanced regulatory framework, focus on child-resistant and sustainable packaging, and rising investments in branding and product differentiation have accelerated market adoption

- Furthermore, continuous innovations in biodegradable packaging materials, premium product presentation, and consumer safety standards are strengthening North America’s leadership in the global cannabis packaging market

U.S. Cannabis Packaging Market Insight

The U.S. held the largest share in the North America Cannabis Packaging market in 2025, supported by the rapid expansion of legal cannabis consumption, both medicinal and recreational. The country’s strong network of dispensaries, retailers, and e-commerce channels is driving high packaging demand. Growing emphasis on sustainable, odor-proof, and tamper-evident solutions is shaping product innovation. Leading U.S. packaging firms are focusing on eco-friendly designs and branding aesthetics to comply with stringent state regulations, boosting market growth further.

Canada Cannabis Packaging Market Insight

Canada remains a major contributor within North America due to its nationwide legalization of cannabis and the presence of numerous licensed producers. The market benefits from increasing sales of pre-rolls, edibles, and CBD products, which demand diverse packaging formats. Canadian companies are investing in recyclable, child-resistant, and compliant packaging solutions that align with government policies. The country’s advanced production infrastructure and focus on sustainability and product differentiation are fostering steady growth and innovation across the market.

Asia-Pacific Cannabis Packaging Market Insight

The Asia-Pacific region is projected to witness the fastest growth rate of 9.54% during 2026–2033, driven by the gradual legalization of medicinal cannabis, expanding consumer awareness, and growing participation of international players in emerging markets. Increasing acceptance of CBD-based products, coupled with investments in hemp cultivation and eco-friendly packaging, is accelerating market expansion. The region’s cost-effective manufacturing, rising disposable incomes, and supportive government initiatives are positioning Asia-Pacific as a promising cannabis packaging hub.

China Cannabis Packaging Market Insight

China is emerging as a key market player within Asia-Pacific, supported by its strong packaging manufacturing base, large-scale export capacity, and growing focus on biodegradable materials. Although cannabis remains largely regulated, rising hemp production for industrial and CBD purposes is driving packaging demand. Local companies are investing in custom design, branding, and sustainable production technologies, strengthening China’s position as a major global supplier of cannabis packaging materials.

India Cannabis Packaging Market Insight

India is experiencing increasing interest in the hemp-based and Ayurvedic cannabis product segment, creating new growth opportunities for packaging manufacturers. Government initiatives promoting industrial hemp cultivation and the ‘Make in India’ campaign are encouraging local production. The rising adoption of eco-friendly, affordable, and compliant packaging solutions by startups and health supplement brands is fostering market development. India’s growing young population and expanding retail infrastructure further enhance its long-term potential in the regional cannabis packaging market.

Europe Cannabis Packaging Market Insight

The Europe cannabis packaging market is growing steadily, fueled by expanding medical cannabis programs across countries such as Germany, Italy, and the U.K. Strict EU packaging standards emphasizing sustainability, safety, and transparency are encouraging innovation. Increasing investments in recyclable and child-resistant packaging materials, along with the shift toward premium CBD wellness products, are propelling market growth. The region’s regulatory alignment and commitment to green manufacturing continue to drive consistent expansion.

Germany Cannabis Packaging Market Insight

Germany leads the European market due to its robust medical cannabis framework and rapidly expanding pharmaceutical sector. Strong government support for regulated cannabis imports and the introduction of eco-conscious packaging solutions have boosted local production. Manufacturers are prioritizing compliance, recyclability, and product protection, aligning with EU sustainability directives. Germany’s focus on medical-grade cannabis products and growing investment in domestic cultivation strengthen its leadership within Europe.

U.K. Cannabis Packaging Market Insight

The U.K. market is supported by increasing awareness of CBD health products, evolving consumer preferences, and steady legalization progress. Rising e-commerce distribution and the shift toward compact, branded, and sustainable packaging are driving growth. Post-Brexit regulatory flexibility allows domestic producers to innovate with biodegradable materials and premium packaging designs. The U.K.’s growing network of health and wellness retailers continues to accelerate adoption of compliant cannabis packaging solutions.

Latin America Cannabis Packaging Market Insight

The Latin America market is witnessing growing demand due to the legalization of medical cannabis in countries such as Mexico, Brazil, and Colombia. Expanding cultivation and export activities, especially for CBD oils and extracts, are increasing packaging requirements. Local companies are focusing on cost-effective, eco-friendly, and regulatory-compliant packaging formats to meet global standards. With expanding regional regulations and investment inflows, Latin America is emerging as an attractive destination for cannabis packaging manufacturers.

Middle East & Africa Cannabis Packaging Market Insight

The Middle East & Africa region is in the early stages of cannabis packaging adoption, with South Africa and Israel being the most progressive markets. Israel’s leadership in medical cannabis research and export is spurring packaging innovation, while South Africa’s legalization of cannabis for private use has opened new business opportunities. Growing interest in hemp-based consumer goods and rising awareness of sustainable materials are such asly to support gradual market development over the next decade.

Which are the Top Companies in Cannabis Packaging Market?

The cannabis packaging industry is primarily led by well-established companies, including:

- J.L. Clark (U.S.)

- Elevate Packaging (U.S.)

- The BoxMaker (U.S.)

- Kush Supply Co, Inc. (U.S.)

- Berlin Packaging (U.S.)

- Cannabis Creative Group (U.S.)

- Dixie Brands (U.S.)

- Cannaline (U.S.)

- MMC Depot (U.S.)

- Origin Pharma Packaging (U.K.)

- Global Printing (U.S.)

- Shatter Labels (U.S.)

- N2 Packaging Systems (U.S.)

- Calyx Containers (U.S.)

- Dymapak (U.S.)

- Pollen Gear (U.S.)

- Cannasupplies, a division of PharmaSystems Inc. (Canada)

- Sana Packaging Inc. (U.S.)

- Kaya Cannabis (U.S.)

- Maple Leaf Green World Inc. (Canada)

What are the Recent Developments in Global Cannabis Packaging Market?

- In February 2025, Berry Global reported a 2% organic volume growth and announced a renewed focus on consumer packaging to cater to the rising demand for cannabis-related products. This strategic shift highlights the company’s commitment to expanding its footprint in the cannabis packaging sector and addressing evolving market needs

- In January 2025, Tilray recorded USD 211 million in Q2 revenue, with USD 66 million generated from cannabis sales and a 36% increase in its beverage segment. This performance underscores the company’s strong diversification strategy and growing influence in the global cannabis and wellness markets

- In January 2025, Packaging Strategies reported USD 30 billion in merger and acquisition transactions, including a significant Amcor-Berry mega-merger expected to reshape the cannabis packaging supply landscape. This consolidation signals a future shift in supplier leverage, competition, and innovation within the packaging industry

- In January 2024, Israel-based compostable packaging manufacturer Tipa partnered with Wyld to develop compostable packaging solutions for cannabis-based edible products. The 608 home-compostable laminate designed by Tipa will be used for pouches and wraps for edible gummies, reflecting a growing industry focus on eco-friendly and sustainable packaging

- In November 2023, Amcor Plc collaborated with CRATIV Packaging to launch the Crativ PCR50, a cannabis container made from 50% post-consumer recycled (PCR) polypropylene. Designed as a child-resistant container for edible, vape, pre-roll, and flower products, this innovation demonstrates Amcor’s dedication to sustainability and safety in the expanding CBD, hemp, and cannabis packaging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cannabis Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cannabis Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cannabis Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.