Global Canned Wine Market

Market Size in USD Billion

CAGR :

%

USD

12.18 Billion

USD

21.24 Billion

2024

2032

USD

12.18 Billion

USD

21.24 Billion

2024

2032

| 2025 –2032 | |

| USD 12.18 Billion | |

| USD 21.24 Billion | |

|

|

|

|

Canned Wine Market Size

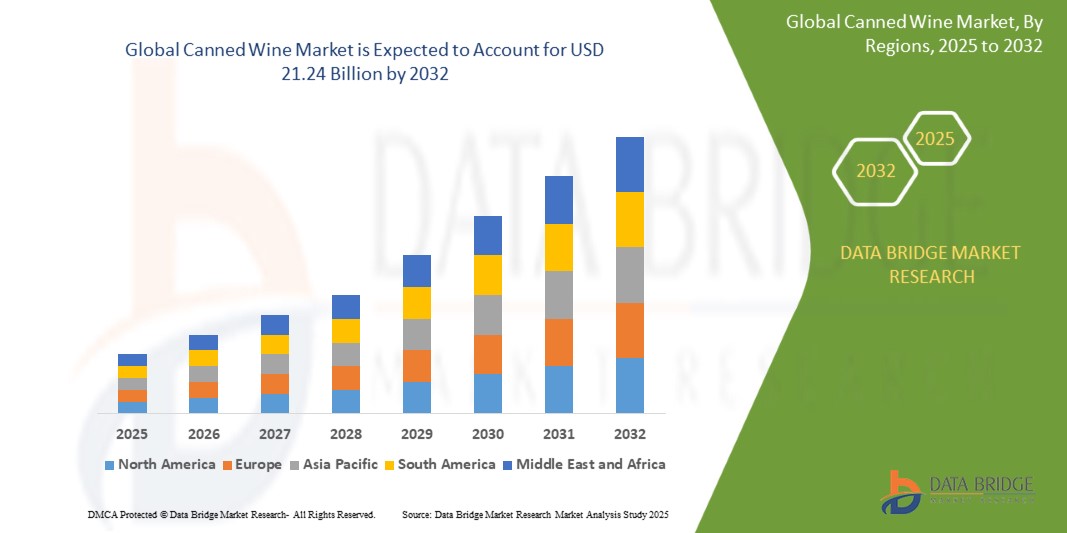

- The global canned wine market was valued at USD 12.18 billion in 2024 and is expected to reach USD 21.24 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.20%, primarily driven by convenience and portability

- This growth is driven by factors such as ease of storage and handling and portability for active lifestyles

Canned Wine Market Analysis

- Canned wine refers to wine that is packaged in aluminium cans, offering a convenient and portable alternative to traditional glass bottles. It has gained popularity for its ease of use, sustainability, and wide range of available wine varieties, including still, sparkling, and rosé

- The growth of the canned wine market is primarily driven by the increasing demand for convenient, portable, and single-serving wine options. A growing awareness of the sustainability benefits of aluminum cans over glass bottles is also contributing to the market's expansion. A 2023 survey found that 35% of consumers preferred canned wine for its portability and convenience, especially for outdoor activities

- Furthermore, the market is being reshaped by a shift toward healthier and more environmentally-conscious consumption. As consumers demand cleaner, sustainable products, many canned wine brands are focusing on organic, low-sugar, and low-alcohol options to cater to health-conscious individuals

- For instance, prominent brands such as Barefoot and Bota Box have expanded their product lines to include cans, offering various options that appeal to consumers seeking both quality and convenience. This expansion is a direct response to the growing trend of more casual, eco-friendly wine consumption

- The canned wine market is poised for continued growth, driven by increasing consumer preference for portable and eco-friendly beverage options, along with the expanding popularity of wine among younger generations. The market is also benefiting from the rising trend of sustainable packaging, and with innovations in wine preservation and packaging technology, further market growth is expected in the coming years

Report Scope and Canned Wine Market Segmentation

|

Attributes |

Canned Wine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Canned Wine Market Trends

“Increasing Demand for Sustainable and Eco-Friendly Packaging”

- One prominent trend in the global canned wine market is the increasing demand for sustainable and eco-friendly packaging

- This trend is driven by growing consumer awareness about the environmental impact of packaging materials, with consumers preferring products that use recyclable and reduced-waste materials, such as aluminum cans over glass bottles

- For instance, brands such as Bota Box and Barefoot have expanded their product offerings in recyclable aluminum cans, catering to consumers looking for eco-conscious, portable wine options

- The shift towards sustainable sourcing and production practices is expected to gain momentum, with companies focusing on reducing carbon footprints, utilizing recyclable materials, and adopting eco-friendly manufacturing processes to meet evolving consumer expectations

- As competition increases, manufacturers will continue to innovate in packaging technologies, sustainability efforts, and transparency. The rising demand for canned wine in environmentally-conscious markets, combined with increasing adoption of eco-friendly packaging by major wine producers, will further propel the market's growth, solidifying canned wine's place as an eco-friendly alternative for wine lovers

Canned Wine Market Dynamics

Driver

“Social Media Influence and Trends”

- The increasing influence of social media is a key driver of growth in the canned wine market. As digital platforms continue to shape consumer preferences, the demand for aesthetically appealing, convenient, and shareable beverage options has surged, positioning canned wine as a trendy and accessible choice for modern wine drinkers

- This impact is particularly evident on platforms such as Instagram, TikTok, and Pinterest, where visually engaging packaging, lifestyle-driven marketing, and influencer collaborations play a crucial role in brand visibility

- With social media emphasizing convenience and on-the-go lifestyles, the preference for canned wine over traditional bottled options has grown. The ability to showcase canned wine as a stylish and hassle-free alternative for casual gatherings, festivals, and outdoor activities has fueled its popularity among millennials and Gen Z

- Brands and retailers are increasingly using influencer partnerships, targeted ads, and viral marketing campaigns to promote canned wine as a fun, innovative, and eco-friendly choice

- The expanding use of digital engagement strategies further drives demand for canned wine, as consumers seek products that align with their social and environmental values while fitting seamlessly into their lifestyle

For instance,

- House Wine and Underwood Wine have successfully leveraged Instagram and TikTok marketing campaigns to attract younger audiences, positioning their canned wine offerings as the perfect fit for outdoor adventures and social gatherings

- BABE Wine, backed by influencer-driven marketing, has gained significant traction by promoting its canned wine as a stylish and convenient alternative for modern consumers

- With the continuous rise of social media marketing, increasing engagement with digital-native consumers, and growing emphasis on visually appealing, sustainable beverage options, the canned wine market is expected to expand further

Opportunity

“Partnerships with Events, Festivals, and the Travel Industry”

- The increasing collaboration between canned wine brands and the events, festivals, and travel industries presents a significant opportunity for market growth. As consumers seek convenient and portable beverage options, the demand for canned wine at large gatherings, entertainment venues, and travel destinations is rising

- Canned wine is gaining traction due to its lightweight packaging, durability, and easy-to-carry format, making it an ideal choice for music festivals, sports events, beach parties, and airline services

- The ability to offer pre-portioned servings also aligns with the growing preference for on-the-go, single-serve alcohol options among travelers and event attendees

For instance,

- BABE Wine and House Wine have secured partnerships with major music festivals, positioning their canned wines as the preferred choice for outdoor events

- Underwood Wine has collaborated with airlines and hotels to introduce canned wine as a travel-friendly beverage, catering to consumers who want a premium yet portable wine experience

- As demand for experiential and outdoor social drinking occasions continues to grow, investments in strategic partnerships with event organizers, airlines, and hospitality brands will expand market reach. These collaborations will drive brand visibility and consumer adoption, further solidifying canned wine’s position as the go-to choice for social, travel, and entertainment experiences

Restraint/Challenge

“Limited Shelf Life and Preservation Issues”

- The limited shelf life and preservation challenges of canned wine present a significant hurdle for market growth. Unlike traditional glass bottles, canned wine is more susceptible to oxidation and flavor degradation over time, impacting its overall taste and quality

- The interaction between wine acidity and the aluminum can lining can lead to subtle changes in flavor, making it crucial for brands to invest in advanced packaging technologies. In addition, canned wine lacks the aging potential of bottled wine, restricting its appeal to consumers who prefer wines that improve over time

- Unlike sealed glass bottles with cork or screw caps, canned wine must maintain strict storage conditions to prevent exposure to heat, light, and air, which can accelerate spoilage. Variations in temperature during distribution and retail display can also impact wine stability, leading to potential inconsistencies in quality

For instance,

- Some brands have introduced enhanced can linings and nitrogen-flushing techniques to extend shelf life and preserve wine freshness

- As consumer demand for canned wine continues to grow, these preservation challenges remain a critical factor influencing purchasing decisions and overall market adoption

Canned Wine Market Scope

The market is segmented on the basis of product type, color, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Color |

|

|

By Distribution Channel |

|

Canned Wine Market Regional Analysis

“North America is the Dominant Region in the Canned Wine Market”

- North America dominates the Canned Wine market, driven by the high consumer demand, a strong wine culture, and a growing preference for convenient alcoholic beverages. The region has witnessed a surge in canned wine adoption, particularly in the United States and Canada, where consumers seek single-serve, portable, and eco-friendly alternatives to traditional bottled wines

- The U.S. holds a significant share due to a well-established retail distribution network, increasing wine consumption, and the presence of major canned wine brands

- The rising number of outdoor and recreational activities, including camping, music festivals, sporting events, and beach outings, continues to drive the demand for canned wine. Consumers prefer lightweight and travel-friendly packaging, making canned wine an ideal choice for on-the-go drinking occasions

- In addition, the expansion of e-commerce and direct-to-consumer wine sales is further strengthening the market, allowing brands to reach a wider audience through online platforms and subscription-based wine services

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Canned Wine market, driven by changing consumer lifestyles, increasing disposable income, and growing social drinking culture

- Countries such as China, Japan, South Korea, and India are leading the market expansion, with younger consumers showing a strong preference for trendy, ready-to-drink alcoholic beverages. The rise of urban nightlife, casual dining, and Western-style social gatherings has significantly increased demand for canned wine across the region

- The introduction of innovative flavors and new product launches by leading wine companies is further accelerating market growth. Brands are customizing offerings to align with regional taste preferences and evolving drinking habits

- The rapid growth of digital marketing, influencer endorsements, and online alcohol delivery services is further fueling canned wine consumption, particularly among millennials and Gen Z consumers. As Asia Pacific continues to embrace premiumization and experiential drinking trends, the market presents lucrative opportunities for global and local wine brands looking to expand in the region

Canned Wine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- E. & J. Gallo Winery (U.S.)

- Constellation Brands, Inc. (U.S.)

- The Wine Group (U.S.)

- Treasury Wine Estates Ltd (Australia)

- Accolade Wines (Australia)

- Total Wine & More (U.S.)

- Grupo Peñaflor (Argentina)

- Rogue Ales & Spirits (U.S.)

- ASDA (U.K.)

- Bacardi Limited (Bermuda)

- Anheuser-Busch Companies LLC (U.S.)

- Brown‑Forman (U.S.)

- Diageo (U.K.)

- AG Barr (U.K.)

- Pernod Ricard (France)

- Manchester Drinks (U.K.)

Latest Developments in Global Canned Wine Market

- In November 2023, Canned Wine Co. announced the launch of two new product lines in the UK through Ocado, expanding its reach to a wider audience and showcasing the unique terroir and varietal characteristics of its wines. This move aligns with the growing demand for sustainable canned wine packaging, driving increased adoption of biopolymer coatings to enhance wine preservation, prevent aluminum interaction, and improve recyclability

- In February 2020, Sula Vineyards launched India’s first canned wine, paving the way for convenient and sustainable wine packaging. This move has increased the demand for biopolymer coatings in the packaging industry, as brands seek eco-friendly alternatives to traditional coatings. Biopolymer linings enhance wine preservation and recyclability, driving growth in the biopolymer coatings market as canned wine continues to gain popularity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Canned Wine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Canned Wine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Canned Wine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.