Global Canoe And Kayak Rental Service Market

Market Size in USD Million

CAGR :

%

USD

427.91 Million

USD

613.21 Million

2024

2032

USD

427.91 Million

USD

613.21 Million

2024

2032

| 2025 –2032 | |

| USD 427.91 Million | |

| USD 613.21 Million | |

|

|

|

|

Canoe and Kayak Rental Service Market Size

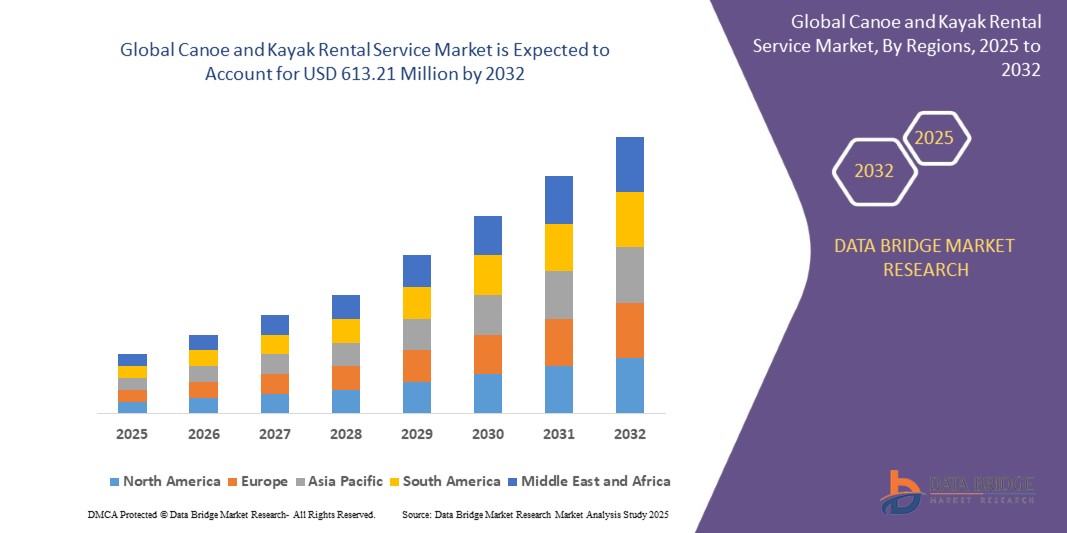

- The global canoe and kayak rental service market size was valued at USD 427.91 million in 2024 and is expected to reach USD 613.21 million by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the rising popularity of outdoor recreational activities, adventure tourism, and eco-friendly travel experiences, leading to increased adoption of canoe and kayak rentals across both domestic and international tourist destinations

- Furthermore, growing consumer demand for flexible, convenient, and self-service rental options is establishing automated kiosks and mobile app-based rentals as the preferred method for accessing watercraft. These converging factors are accelerating the adoption of canoe and kayak rental services, thereby significantly boosting the industry's growth

Canoe and Kayak Rental Service Market Analysis

- Canoe and kayak rental services provide users with access to watercraft for recreational, fitness, and adventure purposes, typically on an hourly, daily, or seasonal basis. Rentals can be self-guided, guided, or offered for groups, catering to both casual paddlers and enthusiasts

- The escalating demand for these rentals is primarily fueled by increasing outdoor leisure participation, rising tourism, and the convenience of digital booking platforms. Enhanced safety features, professionally managed rental services, and expanding availability at scenic lakes, rivers, and coastal areas further contribute to the market’s growth

- Europe dominated canoe and kayak rental service market with a share of 33.9% in 2024, due to the popularity of outdoor recreational activities, adventure tourism, and a well-established network of water sports destinations

- Asia-Pacific is expected to be the fastest growing region in the canoe and kayak rental service market during the forecast period due to increasing urbanization, rising disposable incomes, and growing interest in adventure tourism in countries such as China, Japan, and India

- Daily rentals segment dominated the market with a market share of 32.9% in 2024, due to the convenience they offer for tourists and locals seeking full-day water experiences. Daily rentals provide flexibility for planning sightseeing, guided tours, or recreational paddling without the commitment of longer-term rentals. The segment also benefits from peak seasonal tourism and outdoor activity trends, as many water bodies have regulations or limits that favor shorter rental periods

Report Scope and Canoe and Kayak Rental Service Market Segmentation

|

Attributes |

Canoe and Kayak Rental Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Canoe and Kayak Rental Service Market Trends

Increasing Outdoor Recreation Popularity

- The surge in demand for outdoor recreation is significantly shaping the canoe and kayak rental market, driven by consumers seeking nature-based tourism and active leisure experiences. Rising wellness-focused lifestyles are creating opportunities for sustainable growth in this sector

- For instance, REI Co-op has expanded its rental programs across multiple U.S. cities, offering inclusive kayak packages for beginners and families. Similarly, outfitters in British Columbia report growing demand for rentals from eco-tourists exploring regional waterways

- Growing influence of social media platforms is amplifying customer interest in water-based adventures. Adventure travel bloggers and influencers increasingly highlight kayaking experiences, generating aspirational demand and contributing to higher seasonal rental bookings among younger traveler demographics

- Operators are diversifying service offerings by combining kayak rentals with additional tourism services such as guided wildlife tours, fishing trips, and overnight camping. This service bundling allows companies to maximize revenue while enhancing customer experience value

- Sustainability trends are shaping the sector as operators integrate eco-friendly rental fleets, adopt digital booking platforms, and partner with conservation initiatives. These practices align with consumer demand for responsible travel choices and bolster brand positioning effectively

- Urban waterfront projects and municipal tourism investments are opening new rental opportunities. Expansions in public docks, riverside trails, and community recreation facilities allow businesses to broaden consumer access and establish rental hubs in high-traffic areas

Canoe and Kayak Rental Service Market Dynamics

Driver

Increasing Accessibility and Infrastructure

- Tourism authorities and governments are actively investing in waterfront infrastructure including public slips, ramps, and breakwaters. This investment supports market growth by enabling rental operators to offer convenient, well-maintained access points across popular recreational waterways

- For instance, Parks Canada has significantly upgraded infrastructure at several national park lakes, boosting accessibility for canoe and kayak rental businesses. Likewise, state-level programs in the U.S. have enhanced dock access facilities, fueling additional market growth

- Digital transformation is driving adoption of rental services as mobile reservation apps, online scheduling systems, and digital payments streamline engagement. Consumer convenience and operational efficiency make digital integration a strategic growth driver for operators worldwide

- The rise of regional and domestic tourism is creating fresh opportunities as consumers prefer cost-effective, close-to-home outdoor adventures. Canoeing and kayaking are increasingly marketed as family-friendly activities combining fitness, bonding, and affordability for households

- Sustainability and low-emission travel drivers are positioning canoeing and kayaking as attractive alternatives to motorized water sports. Environmental trends boost appeal among eco-conscious consumers, reinforcing their role as integral offerings within low-impact tourism portfolios globally

Restraint/Challenge

High Maintenance and Operational Costs

- High maintenance costs remain a pressing challenge as rental operators must frequently service and replace canoes, kayaks, and safety equipment. Constant exposure to water and weather accelerates wear, adding financial burden to operational budgets

- For instance, small-scale operators in Europe consistently report profitability challenges due to equipment damage, seasonal repairs, and recurring storage expenses. These costs create barriers despite steady demand and rising interest in local outdoor adventure rentals

- Insurance obligations and regulatory compliance costs place additional strain on businesses. Firms must invest in liability coverage, staff safety training, and equipment certification processes, raising expense levels and reducing profit margins over time

- The strongly seasonal nature of demand restricts consistent cash flow. Rentals often peak only during summer months or holiday seasons, making it difficult for small operators to sustain year-round stability without diversification options

- Competition from personal equipment ownership and peer-to-peer app-based rental services is intensifying. Consumers increasingly purchase entry-level inflatable kayaks or transact through sharing platforms, creating pressure for traditional rental operators to differentiate and retain customers

Canoe and Kayak Rental Service Market Scope

The market is segmented on the basis of watercraft type, rental duration, target market, distribution channel, and service type.

• By Watercraft Type

On the basis of watercraft type, the Canoe and Kayak Rental Service market is segmented into canoes and kayaks. The kayak segment dominated the largest market revenue share in 2024, owing to its versatile use in both calm lakes and rapid rivers. Kayaks appeal to a broad range of users—from beginners to advanced paddlers—due to their stability, maneuverability, and availability in single or tandem options. The segment also benefits from the growing popularity of adventure tourism and water sports activities, which drive higher rental demand. In addition, kayaks are often preferred for eco-friendly and fitness-oriented recreational activities, enhancing their market traction. Their compatibility with guided tours and self-guided rentals further strengthens their adoption.

The canoe segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising interest in family-oriented and group water activities. Canoes are often perceived as more stable and spacious, making them suitable for beginners, children, and leisurely exploration. Growing rental options at tourist destinations and resorts, combined with customizable rentals for larger groups, contribute to the segment’s increasing popularity. Canoes’ appeal for scenic and relaxed paddling experiences also supports strong demand growth in both domestic and international markets.

• By Rental Duration

On the basis of rental duration, the market is segmented into hourly rentals, daily rentals, weekly rentals, and seasonal rentals. Daily rentals dominated the largest market revenue share of 32.9% in 2024, driven by the convenience they offer for tourists and locals seeking full-day water experiences. Daily rentals provide flexibility for planning sightseeing, guided tours, or recreational paddling without the commitment of longer-term rentals. The segment also benefits from peak seasonal tourism and outdoor activity trends, as many water bodies have regulations or limits that favor shorter rental periods.

Hourly rentals are expected to witness the fastest CAGR from 2025 to 2032, supported by the growing demand for short, spontaneous experiences among local residents and adventure seekers. Hourly rentals allow users to enjoy water activities without long-term commitments, making them ideal for casual visitors, last-minute bookings, and flexible itineraries. The rise of urban adventure hubs and easy online booking options also facilitate the segment’s rapid adoption.

• By Target Market

On the basis of target market, the market is segmented into tourists, local residents, adventure seekers, and schools & groups. The tourist segment dominated the largest market revenue share in 2024, driven by the popularity of recreational water activities at vacation destinations. Tourists often seek guided experiences, scenic paddling routes, and convenient rental options, fueling higher revenue contributions. This segment also benefits from growing awareness of eco-tourism and outdoor activities, with many tour operators bundling watercraft rentals with accommodations and other experiences.

The adventure seekers segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by an increasing inclination toward outdoor sports, white-water kayaking, and exploration of challenging water routes. Adventure seekers typically demand specialized watercraft, professional guidance, and extended rental durations, boosting market adoption. Social media exposure and experiential tourism trends further amplify interest, encouraging rental providers to cater to this high-growth segment.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into online retail, supermarkets/hypermarkets, specialty stores, convenience stores, and others. The online retail segment dominated the largest market revenue share in 2024, driven by the convenience of digital bookings, real-time availability checks, and integrated payment options. Online platforms also allow operators to reach a wider customer base, offer package deals, and gather valuable user feedback to improve services. The ease of comparing prices, selecting watercraft type, and choosing rental durations enhances the attractiveness of online channels.

The specialty stores segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increased consumer interest in high-quality, tailored watercraft rentals. Specialty stores often provide expert guidance, premium equipment, and personalized rental services, appealing to enthusiasts and frequent renters. Growing investments in experiential retail and curated adventure packages also support the segment’s expansion.

• By Service Type

On the basis of service type, the market is segmented into self-guided rentals, guided rentals, and group rentals. Guided rentals dominated the largest market revenue share in 2024, driven by the demand for professional assistance, safety, and curated experiences. Guided services attract tourists, beginners, and adventure seekers seeking structured trips, expert navigation, and enhanced safety measures. The growing popularity of educational tours, eco-tours, and themed paddling experiences also supports the segment’s dominance.

Self-guided rentals are expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for independent and flexible paddling experiences. This segment appeals to experienced users who prefer exploring at their own pace and selecting custom routes. Integration of GPS-based apps, mobile booking, and on-demand services further contributes to the segment’s rapid adoption across recreational and fitness-focused consumers.

Canoe and Kayak Rental Service Market Regional Analysis

- Europe dominated the canoe and kayak rental service market with the largest revenue share of 33.9% in 2024, driven by the popularity of outdoor recreational activities, adventure tourism, and a well-established network of water sports destinations

- Consumers in the region highly value the convenience, variety of watercraft options, and professionally managed rental services offered by local operators

- This widespread adoption is further supported by high disposable incomes, a strong tourism infrastructure, and the growing preference for eco-friendly and experiential leisure activities, establishing canoe and kayak rentals as a favored solution for both tourists and local enthusiasts

Germany Canoe and Kayak Rental Market Insight

The Germany market captured the largest revenue share in 2024 within Europe, fueled by increasing interest in adventure tourism and outdoor sports. German consumers are prioritizing recreational and fitness-oriented activities, driving higher adoption of canoe and kayak rentals. The presence of well-maintained rivers, lakes, and national parks, combined with a preference for guided and self-guided experiences, further boosts the market. In addition, Germany’s strong focus on sustainability encourages the use of non-motorized watercraft for eco-conscious leisure activities.

U.K. Canoe and Kayak Rental Market Insight

The U.K. market is projected to grow at a substantial CAGR during the forecast period, driven by rising domestic and international tourism and the popularity of water-based recreational activities. Consumers are drawn to the convenience, safety, and accessibility of rental services, especially at popular lakes, rivers, and coastal regions. Online booking platforms, coupled with organized tours and events, are fostering growth across both urban and rural regions.

North America Canoe and Kayak Rental Market Insight

The North America market is expected to grow at a noteworthy CAGR, fueled by the increasing demand for outdoor and adventure experiences in countries such as the U.S. and Canada. Consumers are seeking unique recreational activities that combine fitness, leisure, and family-oriented experiences. The expansion of national parks, adventure hubs, and guided tour services, along with convenient booking options, is supporting market growth.

U.S. Canoe and Kayak Rental Market Insight

The U.S. market accounted for the largest revenue share within North America in 2024, driven by a growing preference for water sports, adventure tourism, and weekend recreational activities. Consumers are increasingly adopting rentals for short-term experiences such as hourly and daily options. The integration of online booking platforms, mobile applications, and social media promotions is further contributing to market expansion.

Asia-Pacific Canoe and Kayak Rental Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing interest in adventure tourism in countries such as China, Japan, and India. The development of water sports facilities, coupled with government initiatives promoting outdoor recreation and tourism, is encouraging adoption. Affordability, easy access to rental services, and increasing awareness of health and fitness benefits are further fueling market growth.

Japan Canoe and Kayak Rental Market Insight

The Japan market is gaining momentum due to the country’s strong adventure tourism culture, scenic waterways, and high demand for recreational activities. Japanese consumers value safe, professionally managed rentals and self-guided experiences. The integration of technology for reservations, safety tracking, and guided tours is enhancing the adoption of canoe and kayak rentals.

China Canoe and Kayak Rental Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, growing domestic tourism, and rising interest in outdoor leisure activities. The development of lakeside resorts, eco-tourism destinations, and adventure hubs is increasing the availability of rental services. Government support for recreational infrastructure and the emergence of local operators offering guided and self-guided experiences are key factors driving the market.

Canoe and Kayak Rental Service Market Share

The canoe and kayak rental service industry is primarily led by well-established companies, including:

- American Canoe Association (U.S.)

- Jackson Kayak (U.S.)

- Johnson Outdoors Inc., (U.S.)

- Wilderness Systems (U.S.)

- Perception Kayaks (U.S.)

- Hobie (U.S.)

- Pyranha Kayaks (U.K.)

- Dagger Kayaks (U.S.,)

- Tahe Outdoors (France)

- Newell Brands (U.S.)

Latest Developments in Global Canoe and Kayak Rental Service Market

- In August 2025, the Bay County government partnered with Rent.Fun to install its first self-service kayak rental kiosk at Lake Powell. The kiosk is equipped with multiple kayaks, paddles, and life vests, allowing residents and tourists to rent watercraft through the Rent.Fun app. The kiosk operates autonomously, enabling users to access and return kayaks without staff assistance. This initiative aims to enhance recreational infrastructure, promote outdoor tourism, and provide convenient access to water-based activities throughout the day

- In 2025, Ottawa County issued a request for proposals to deploy self-service kayak rental kiosks at multiple locations across the county. These kiosks are intended to expand public access to kayaking, promote eco-friendly recreation, and provide innovative solutions for outdoor activities. The initiative focuses on enhancing user convenience, safety, and operational efficiency while supporting local tourism and recreational engagement

- In December 2024, Rent.Fun introduced a self-service kayak rental kiosk at Fischer Park in New Braunfels. The kiosk features four kayaks, paddles, and life vests, which can be rented via the Rent.Fun app during daylight hours. The automated system is designed for easy access and secure returns, offering a convenient solution for outdoor enthusiasts while encouraging participation in recreational paddling activities

- In May 2024, Clinton Lake Marina launched a self-service kayak and paddleboard rental kiosk featuring 12 compartments for watercraft and safety equipment. Customers can unlock the equipment using a mobile app, providing 24/7 access even outside regular operating hours. The marina’s new system is designed to streamline rentals, reduce wait times, and encourage greater participation in water sports, supporting both casual users and adventure enthusiasts

- In May 2023, the Havelock City government teamed up with Rent.Fun, a self-service equipment rental company, to introduce a self-service rental kiosk at Slocum Creek Park. Rent.Fun has installed a kiosk equipped with four kayaks, paddles, and life vests. Customers can rent these kayaks through the Rent.Fun app on a self-service basis. The kiosk operates on solar power and is designed to automatically lock and unlock the kayaks as they are rented and returned

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.