Global Canola Lecithin Market

Market Size in USD Million

CAGR :

%

USD

313.26 Million

USD

422.17 Million

2024

2032

USD

313.26 Million

USD

422.17 Million

2024

2032

| 2025 –2032 | |

| USD 313.26 Million | |

| USD 422.17 Million | |

|

|

|

|

Canola Lecithin Market Size

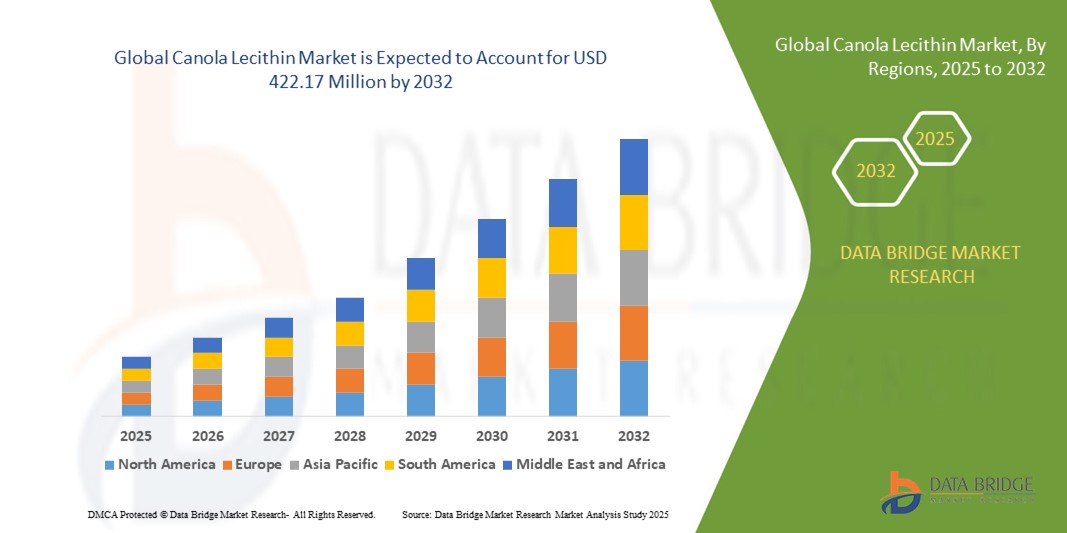

- The global canola lecithin market size was valued at USD 313.26 million in 2024 and is expected to reach USD 422.17 million by 2032, at a CAGR of 3.8% during the forecast period

- The market growth is largely fueled by increasing demand for natural emulsifiers and functional ingredients in the food and beverage, pharmaceutical, and nutraceutical industries, driving widespread adoption of canola lecithin globally

- Furthermore, rising consumer preference for clean-label, non-GM, and plant-based ingredients is establishing canola lecithin as a preferred choice for manufacturers seeking natural, sustainable, and versatile solutions. These converging factors are accelerating product adoption, thereby significantly boosting the industry's growth

Canola Lecithin Market Analysis

- Canola lecithin is a natural phospholipid derived from canola oil, widely used as an emulsifier, stabilizer, and texturizer in food, pharmaceutical, and industrial applications. Its functional properties, such as enhancing shelf life, texture, and nutrient absorption, make it highly valued across multiple sectors

- The escalating demand for canola lecithin is primarily fueled by the growing processed food and functional food markets, increasing pharmaceutical and nutraceutical production, and the shift toward plant-based and clean-label ingredients among health-conscious consumers

- Asia-Pacific dominated the canola lecithin market with a share of 35.5% in 2024, due to increasing demand from the food and beverage sector, expanding pharmaceutical and nutraceutical manufacturing, and growing industrial applications across the region

- North America is expected to be the fastest growing region in the canola lecithin market during the forecast period due to rising demand for plant-based emulsifiers, functional foods, and nutraceuticals

- Non-genetically modified canola segment dominated the market with a market share of 63% in 2024, due to increasing consumer preference for natural and clean-label products. Health-conscious consumers and food manufacturers prioritize non-GM lecithin due to its perception as safer and more environmentally sustainable, enhancing its adoption in organic and natural food formulations. The segment’s growth is further supported by regulatory incentives in several regions favoring non-GM ingredients. Non-GM canola lecithin also finds strong demand in pharmaceuticals and nutraceuticals where clean-label and non-GM certifications are valued

Report Scope and Canola Lecithin Market Segmentation

|

Attributes |

Canola Lecithin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Canola Lecithin Market Trends

Growing Preference for Clean-Label and Plant-Based Ingredients

- The global canola lecithin market is expanding rapidly as consumers demand clean-label, non-GMO, and allergen-free ingredients. Canola lecithin is gaining attention as a sustainable, plant-based alternative to traditional soy lecithin, especially in health-focused product formulations

- For instance, Cargill launched Purisoya canola lecithin, promoting it as a non-GMO, allergen-free emulsifier for bakery and confectionery applications. This move aligns with consumer preference for plant-based ingredients while offering manufacturers reliable functionality and performance benefits

- The trend toward plant-based food alternatives is directly accelerating demand for canola lecithin. Its neutral flavor, allergen-free profile, and ability to efficiently emulsify enhance applications across vegan chocolates, dairy substitutes, nutritional beverages, and fortified food products

- In addition, growing consumer scrutiny of ingredient labels drives manufacturers to reformulate with natural emulsifiers. Canola lecithin is being positioned favorably as it avoids concerns with allergens, enhancing brand transparency and consumer trust in packaged foods

- Clean-label innovation pipelines in food and nutraceuticals are strongly influencing this trend. Manufacturers are actively replacing chemical emulsifiers with canola lecithin to meet stricter regulatory requirements and appeal to health-driven consumer segments across developed and emerging markets

- The rising global focus on wellness and dietary transparency is changing product development strategies. Canola lecithin’s perceived natural origin and sustainable sourcing are reinforcing its role in the clean-label movement, making it vital for long-term growth trajectories

Canola Lecithin Market Dynamics

Driver

Rising Demand from Food, Pharmaceutical, and Nutraceutical Industries

- Demand for canola lecithin is growing in diverse industries because of its functional properties such as emulsification, stabilization, and dispersion. It plays a critical role in improving product texture, solubility, and bioavailability of active ingredients across sectors

- For instance, Archer Daniels Midland (ADM) expanded its lecithin production facilities to address increasing demand from food and pharmaceutical companies. This investment highlights the role of canola lecithin in supporting clean-label and differentiated product development opportunities globally

- The food industry is significantly driving volume adoption, as canola lecithin ensures smooth texture in bakery, confectionery, and dairy substitutes. Its capacity to provide consistent performance without allergenic concerns enhances its position as a preferred emulsifier

- In addition, nutraceutical companies are adopting canola lecithin due to its capacity to aid bioavailability of nutrients. Its integration into dietary supplements enhances absorption of fat-soluble vitamins and nutrients, strengthening consumer health outcomes and industry growth

- The pharmaceutical sector is increasingly investing in lecithin-based delivery systems. Canola lecithin’s ability to act as a stabilizer in drug formulations reflects its expanding role in high-value applications beyond traditional food processing environments

Restraint/Challenge

Price Volatility of Raw Canola and Supply Chain Constraints

- The growth of the canola lecithin market faces difficulties due to raw material price volatility linked with unpredictable weather and geopolitical disruptions. Supply instability leads to cost fluctuations that directly affect profit margins of manufacturers

- For instance, canola production in Canada, one of the largest producers, witnessed price surges due to drought conditions in recent years. Such supply-side challenges disrupted ingredient costs and created instability for global lecithin processors and food companies

- Trade restrictions and export bottlenecks further constrain steady raw material availability. In markets dependent on imports, supply fluctuations create major challenges for manufacturers in maintaining consistent production and stable pricing models

- In addition, transportation and storage costs are rising due to increased energy prices and complex logistics. These escalating overhead expenses add pressure to operating margins and make canola lecithin less competitive relative to alternative emulsifiers

- Uncertainties in establishing steady sourcing networks continue to affect the long-term planning of manufacturers. Overcoming these issues requires strategic supply diversification, long-term contracts with canola growers, and investment in resilient logistics infrastructure

Canola Lecithin Market Scope

The market is segmented on the basis of source and application.

- By Source

On the basis of source, the canola lecithin market is segmented into genetically modified (GM) canola and non-genetically modified (non-GM) canola. The non-GM canola segment dominated the largest market revenue share of 63% in 2024, driven by increasing consumer preference for natural and clean-label products. Health-conscious consumers and food manufacturers prioritize non-GM lecithin due to its perception as safer and more environmentally sustainable, enhancing its adoption in organic and natural food formulations. The segment’s growth is further supported by regulatory incentives in several regions favoring non-GM ingredients. Non-GM canola lecithin also finds strong demand in pharmaceuticals and nutraceuticals where clean-label and non-GM certifications are valued.

The genetically modified (GM) canola segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its higher yield, cost-effectiveness, and consistent quality. GM canola lecithin provides manufacturers with a reliable supply for large-scale food and industrial applications, particularly where price sensitivity is a key factor. Technological advances in GM crop cultivation and growing acceptance in emerging markets are further boosting this segment’s adoption. Its scalability and ability to meet the rising global demand for lecithin in processed foods and industrial applications contribute to its projected rapid growth.

- By Application

On the basis of application, the canola lecithin market is segmented into food and beverage, pharmaceuticals, and industrial. The food and beverage segment dominated the largest market revenue share in 2024, driven by the extensive use of lecithin as an emulsifier, stabilizer, and texture enhancer in baked goods, confectionery, dairy, and functional foods. Rising consumer demand for convenience foods and clean-label ingredients further fuels its adoption in this segment. Food and beverage manufacturers increasingly incorporate canola lecithin to improve shelf life, consistency, and product quality while complying with health-focused ingredient trends. The segment benefits from growing innovation in functional and fortified foods, boosting its continued dominance in the market.

The pharmaceuticals segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing use of canola lecithin as a natural excipient, carrier, and emulsifying agent in drug formulations, nutraceuticals, and dietary supplements. Its biocompatibility and regulatory acceptance make it a preferred choice for pharmaceutical applications, particularly in oral and topical products. Rising demand for plant-based and non-toxic excipients in emerging pharmaceutical markets is further accelerating growth. In addition, ongoing research and development efforts to enhance bioavailability and delivery efficiency are expanding the segment’s potential.

Canola Lecithin Market Regional Analysis

- Asia-Pacific dominated the canola lecithin market with the largest revenue share of 35.5% in 2024, driven by increasing demand from the food and beverage sector, expanding pharmaceutical and nutraceutical manufacturing, and growing industrial applications across the region

- The region’s cost-effective raw material availability, rising investments in processing facilities, and growing exports of lecithin-based products are accelerating market expansion

- The availability of skilled labor, favorable government initiatives supporting agriculture and food processing, and rapid industrialization across developing economies are contributing to increased consumption of canola lecithin in multiple applications

China Canola Lecithin Market Insight

China held the largest share in the Asia-Pacific canola lecithin market in 2024, owing to its strong agricultural base, leading food processing industry, and expanding pharmaceutical and nutraceutical manufacturing. Government support for domestic oilseed cultivation and investments in high-quality lecithin extraction facilities are major growth drivers. Rising consumer preference for functional foods and clean-label ingredients further fuels demand, along with strong export potential to regional and international markets.

India Canola Lecithin Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by increasing demand for functional and fortified foods, expanding pharmaceutical and nutraceutical production, and rising investments in lecithin processing infrastructure. Initiatives to promote domestic oilseed cultivation and self-sufficiency in food ingredients are boosting market adoption. The growing bakery, confectionery, and processed food industries are also contributing to robust market expansion.

Europe Canola Lecithin Market Insight

The Europe canola lecithin market is expanding steadily, supported by high demand for clean-label ingredients, regulatory compliance requirements, and growing use in food, pharmaceuticals, and industrial applications. The region emphasizes product quality, traceability, and sustainability, particularly in functional foods and nutraceuticals. Increasing R&D efforts to develop specialized lecithin formulations for bakery, confectionery, and pharmaceutical applications are further enhancing market growth.

Germany Canola Lecithin Market Insight

Germany’s canola lecithin market is driven by strong food processing and pharmaceutical industries, growing adoption of clean-label ingredients, and well-established manufacturing infrastructure. The country benefits from advanced R&D in functional food formulations and nutraceuticals, supporting high-value applications. Demand is particularly strong for high-purity lecithin in bakery, confectionery, and pharmaceutical formulations, as well as for industrial uses in emulsification and stabilization.

U.K. Canola Lecithin Market Insight

The U.K. market is supported by a mature food and beverage industry, increasing emphasis on clean-label and plant-based ingredients, and growing investments in nutraceutical and pharmaceutical sectors. Rising consumer awareness regarding natural additives, coupled with innovation in functional foods and supplements, is fueling demand. Collaboration between academic research and industry for high-quality lecithin applications continues to enhance market potential.

North America Canola Lecithin Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for plant-based emulsifiers, functional foods, and nutraceuticals. A strong focus on health-conscious products, advancements in food processing technologies, and growing use of lecithin in pharmaceuticals and industrial applications are boosting demand. In addition, rising reshoring of food ingredient production and increased investments in sustainable supply chains are supporting market expansion.

U.S. Canola Lecithin Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its extensive food and beverage industry, high consumer awareness of functional and natural ingredients, and strong nutraceutical and pharmaceutical sectors. Government regulations supporting clean-label and plant-based ingredients, along with a well-established distribution network, are further driving market growth. Demand is particularly strong for bakery, confectionery, and supplement applications, solidifying the U.S.’s leading position in the region.

Canola Lecithin Market Share

The canola lecithin industry is primarily led by well-established companies, including:

- Cargill Incorporated (U.S.)

- Bunge Limited (U.S.)

- Lipoid GmbH (Germany)

- Lecico GmbH (Germany)

- Austrade Inc. (Canada)

- Bioriginal Food & Science Corp. (Canada)

- Soya International (Netherlands)

- Parchem Fine & Specialty Chemicals (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Canola Lecithin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Canola Lecithin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Canola Lecithin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.