Global Canola Meal Market

Market Size in USD Billion

CAGR :

%

USD

9.20 Billion

USD

12.89 Billion

2024

2032

USD

9.20 Billion

USD

12.89 Billion

2024

2032

| 2025 –2032 | |

| USD 9.20 Billion | |

| USD 12.89 Billion | |

|

|

|

|

Canola Meal Market Size

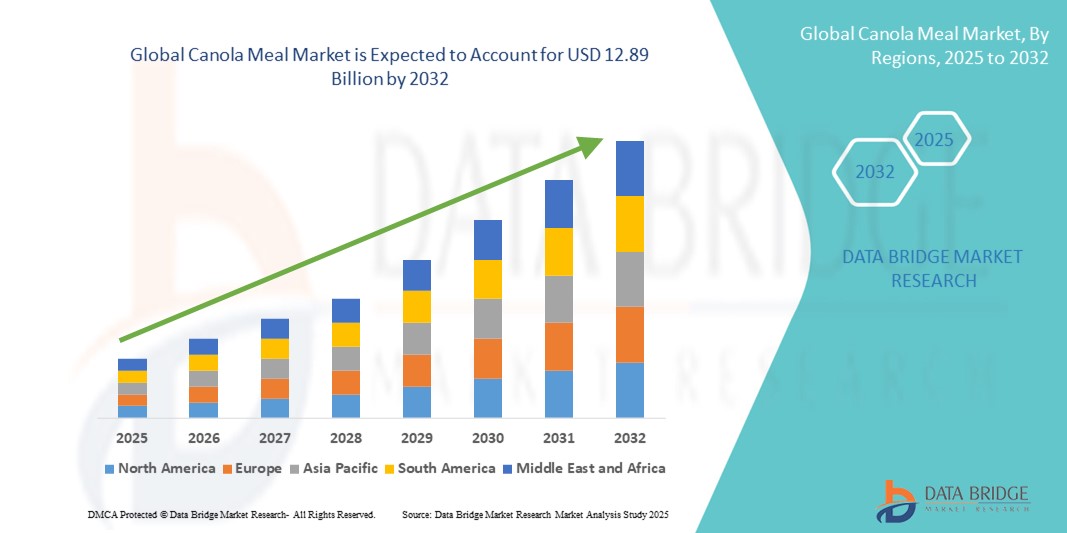

- The global canola meal market size was valued at USD 9.20 billion in 2024 and is expected to reach USD 12.89 billion by 2032, at a CAGR of 4.3% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-protein livestock feed, expansion of aquaculture activities, and growing adoption of plant-based protein sources across feed and food industries

- Rising soybean meal prices and fluctuating global supply chains are prompting feed manufacturers to diversify protein sources, thereby boosting the uptake of canola meal as a cost-efficient alternative

Canola Meal Market Analysis

- Rising emphasis on sustainable and cost-effective animal nutrition is driving the substitution of traditional protein meals with canola meal in livestock and poultry diets

- Expansion of aquaculture production, especially in Asia-Pacific and North America, is boosting demand for canola meal as a suitable plant-based protein alternative in fish feed formulations

- Europe dominated the global canola meal market with the largest revenue share of 38.25% in 2024, driven by high rapeseed production, strong feed manufacturing capacity, and growing emphasis on sustainable and non-GMO animal nutrition

- Asia-Pacific region is expected to witness the highest growth rate in the global canola meal market, driven by surging demand for animal protein, rapid industrialization of livestock production, and growing adoption of cost-effective, sustainable feed ingredients

- The poultry segment accounted for the largest market revenue share in 2024, driven by the high protein content and amino acid profile of canola meal, which supports growth and productivity in poultry farming. Its affordability compared to soybean meal makes it a preferred choice among poultry feed producers seeking cost-effective and nutritious feed options

Report Scope and Canola Meal Market Segmentation

|

Attributes |

Canola Meal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion in Aquaculture Feed Applications |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Canola Meal Market Trends

Integration of Functional Ingredients to Enhance Gut Health and Growth Efficiency

- The global canola meal market is experiencing strong demand growth due to its positioning as a sustainable, high-protein alternative to soybean meal in animal nutrition. With favorable amino acid profiles and cost competitiveness, canola meal is being increasingly incorporated into feed formulations for cattle, poultry, swine, and aquaculture

- The rising cost of traditional protein sources and concerns over genetically modified organisms (GMOs) in soymeal have boosted the appeal of non-GMO and expeller-pressed canola meal, particularly in North America and Europe. This shift is also aligned with consumer interest in clean-label livestock and dairy production

- Feed manufacturers are focusing on improved processing technologies such as cold pressing and enzymatic treatment to reduce anti-nutritional factors and improve digestibility. These advances are expanding the inclusion rate of canola meal in feed, making it suitable for younger animals and sensitive species

- For instance, in 2023, a Canadian aquafeed producer launched a trout feed containing 30 percent canola meal, supported by trial results indicating stable growth performance and reduced feed cost per kilogram of gain. The innovation marked a breakthrough in canola meal use beyond terrestrial livestock

- As global protein demand rises, canola meal's low environmental footprint, regional availability, and enhanced processing potential will drive its long-term role in sustainable feed strategies

Canola Meal Market Dynamics

Driver

Increased Focus on Animal Productivity and Disease Prevention Post African Swine Fever Outbreak

• Expanding global demand for meat, milk, and eggs is increasing the need for high-quality, sustainable protein sources in animal feed. Canola meal offers an environmentally friendly alternative to conventional proteins, supporting both intensive and pasture-based farming models

• Feed producers are seeking to reduce their reliance on soybean meal due to geopolitical trade tensions and environmental concerns tied to deforestation. Canola meal, particularly when locally sourced, serves as a reliable protein input with lower carbon emissions

• Governments in key producing regions such as Canada and the European Union are promoting oilseed cultivation and value-added processing through subsidies and infrastructure development, further enhancing supply availability for the feed sector

• For instance, in 2022, the Canadian government announced a multimillion-dollar investment in canola crushing capacity, which is expected to double domestic meal availability and strengthen export capabilities in the feed market

• With livestock production growing rapidly in Asia and Africa, canola meal is poised to gain further ground as a strategic feed component—especially where import dependence and sustainability are key decision factors

Restraint/Challenge

Volatile Raw Material Prices and Regulatory Barriers for Additive Approvals

• Despite its nutritional benefits, canola meal contains higher fiber and certain anti-nutritional compounds such as glucosinolates, which can limit its digestibility in monogastric animals such as poultry and swine. This restricts its usage compared to soymeal, especially in high-performance feed formulations

• In price-sensitive markets, the cost of canola meal can become less competitive when soymeal prices fall due to global surplus or favorable trade policies. This reduces feed millers’ incentive to reformulate diets with canola meal, especially when long-term supply contracts exist for soymeal

• The limited awareness among small and mid-sized farmers regarding the optimal use and processing requirements of canola meal often leads to underutilization, further slowing market growth in emerging regions

• For example, in 2023, poultry feed manufacturers in parts of Southeast Asia reported reluctance to switch from soymeal to canola meal, citing concerns over performance variability and limited access to feed-grade quality meal

• Bridging the knowledge gap through farmer education, refining processing technologies, and building resilient pricing strategies will be key to ensuring canola meal’s competitiveness in the global protein feed market

Canola Meal Market Scope

The market is segmented on the basis of animal type, grade, end user, and application.

- By Animal Type

On the basis of animal type, the canola meal market is segmented into aquatic animals, poultry, and ruminants. The poultry segment accounted for the largest market revenue share in 2024, driven by the high protein content and amino acid profile of canola meal, which supports growth and productivity in poultry farming. Its affordability compared to soybean meal makes it a preferred choice among poultry feed producers seeking cost-effective and nutritious feed options.

The aquatic animals segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increased use of plant-based protein sources in aquaculture to replace fishmeal. Canola meal’s digestibility and balanced nutrient composition are promoting its adoption in fish and shrimp feed formulations as the aquaculture industry expands globally.

- By Grade

On the basis of grade, the canola meal market is segmented into food grade, feed grade, and industrial grade. The feed grade segment dominated the market with the highest revenue share in 2024 due to the widespread use of canola meal in livestock and poultry diets across various regions. Its favorable cost-to-nutrient ratio and consistent availability make it a staple in feed formulations for commercial animal production systems.

The food grade segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for plant-based proteins in human nutrition. As food manufacturers seek sustainable protein ingredients for meat alternatives and bakery products, food-grade canola meal is gaining traction for its nutritional profile and functional properties.

- By End User

On the basis of end user, the canola meal market is segmented into poultry feed manufacturers, dairy feed manufacturers, and swine feed manufacturers. The poultry feed manufacturers segment held the largest share in 2024, driven by large-scale poultry operations in Asia-Pacific and North America utilizing canola meal as a key protein ingredient. Its compatibility with other feed components and affordability make it a standard component in broiler and layer rations.

The dairy feed manufacturers segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising awareness of the benefits of canola meal in improving milk yield and quality. Dairy farmers are increasingly incorporating it into ruminant diets for its favorable amino acid content and digestibility.

- By Application

On the basis of application, the canola meal market is segmented into feed, fertilizer, and food additive. The feed segment dominated the global market in 2024 with the highest revenue contribution, as canola meal remains a widely used protein-rich feed ingredient across poultry, swine, dairy, and aquaculture sectors. Its consistent supply and cost-effectiveness continue to support its strong presence in the animal nutrition industry.

The fertilizer segment is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing use of canola meal as an organic fertilizer. Its nitrogen content and soil-enhancing properties are attracting attention from sustainable and organic farming practices aiming to reduce chemical fertilizer dependence.

Canola Meal Market Regional Analysis

• Europe dominated the global canola meal market with the largest revenue share of 38.25% in 2024, driven by high rapeseed production, strong feed manufacturing capacity, and growing emphasis on sustainable and non-GMO animal nutrition

• The region benefits from established processing infrastructure and widespread adoption of canola meal across poultry, swine, and dairy sectors. Demand is further bolstered by stringent environmental regulations, rising organic livestock production, and a shift away from soybean meal imports

• With strong integration between agricultural policy, feed innovation, and consumer preference for clean-label meat and dairy, Europe is expected to maintain its leadership position in the canola meal market throughout the forecast period

Germany Canola Meal Market Insight

The Germany canola meal market accounted for the largest revenue share within Europe in 2024, supported by the country’s leadership in rapeseed cultivation and efficient oilseed processing systems. German feed producers prioritize locally sourced, sustainable protein meals, aligning with the nation’s environmental and animal welfare standards. Demand is particularly high in the dairy and poultry industries, where consistent quality and traceability are critical. Moreover, government-backed sustainability programs and a strong focus on reducing carbon emissions are reinforcing the role of canola meal in the feed sector.

U.K. Canola Meal Market Insight

The U.K. canola meal market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for alternative protein feed sources amid shifting trade dynamics and climate-conscious agricultural practices. Post-Brexit strategies are prompting domestic livestock producers to reduce reliance on soy imports and embrace locally available protein options such as canola meal. The UK’s strong commitment to sustainable farming, combined with the growing popularity of traceable and responsibly sourced meat and dairy, supports further market expansion.

North America Canola Meal Market Insight

The North America canola meal market is expected to witness the fastest growth rate from 2025 to 2032, supported by its robust oilseed industry and established livestock feed demand. With Canada being a global leader in canola production and processing, the region enjoys a consistent supply of high-quality canola meal. Feed manufacturers across the United States and Canada are increasingly integrating canola meal to reduce feed costs, lower environmental impact, and meet rising demand for antibiotic-free and hormone-free livestock products.

U.S. Canola Meal Market Insight

The U.S. canola meal market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the expansion of dairy and poultry sectors and the need for affordable, high-protein feed alternatives. The presence of several canola processing plants near key livestock-producing areas has improved access and reduced logistics costs. In addition, industry efforts to improve digestibility and nutrient bioavailability are making canola meal more attractive for both ruminant and monogastric animal feeding programs.

Asia-Pacific Canola Meal Market Insight

The Asia-Pacific canola meal market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing protein demand, increasing feed cost pressures, and expanding commercial livestock farming. Countries such as China, Japan, South Korea, and India are relying on canola meal imports to diversify feed rations and ensure nutritional adequacy. The shift toward sustainable and efficient feed sources, especially in aquaculture and dairy production, is fueling demand for canola meal in the region.

China Canola Meal Market Insight

The China canola meal market captured the largest revenue share in Asia-Pacific in 2024, supported by massive feed demand across the swine, poultry, and aquaculture sectors. As the country intensifies efforts to reduce soybean meal imports and enhance food security, canola meal is gaining ground as a cost-effective, protein-rich alternative. China's strong trade ties with Canada and Australia, along with investments in domestic feed innovation, are propelling adoption across integrated farming operations and regional feed mills.

Japan Canola Meal Market Insight

The Japan canola meal market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s high dependence on imported protein feed and focus on efficient livestock production. Japanese feed manufacturers prefer high-quality, traceable ingredients, and canola meal fits well within these criteria, particularly in poultry and swine nutrition. As Japan continues to modernize its feed systems and pursue environmental sustainability, demand for imported canola meal—especially from Canada—is expected to remain strong.

Canola Meal Market Share

The Canola Meal industry is primarily led by well-established companies, including:

- Louis Dreyfus Company (Netherlands)

- MSM Milling (Australia)

- Sunrise Foods (India)

- Macquarie Oil Co. (Australia)

- Ibratas Trading Company (Jordan)

- LaBudde Group, Inc. (U.S.)

- Canex (Canada)

- Riverina (Australia)

- Sun Impex (India)

- Prestige Group (India)

- Mahesh Agro Food Industries (India)

- AGRIM (France)

Latest Developments in Global Canola Meal Market

- In July 2020, De Heus Animal Nutrition (Netherlands) and Golpasz (Poland) entered into a strategic agreement involving the sale and exchange of their respective feed production facilities in Poland. This development aims to optimize production capabilities, enhance regional efficiency, and strengthen their market positions within the Polish animal feed industry. By leveraging each other’s infrastructure, both companies are expected to reduce logistics costs and improve service to local livestock farmers. The move also supports long-term expansion strategies and reinforces competition in the Central and Eastern European feed market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.