Global Capacitive Voltage Transformer Market

Market Size in USD Billion

CAGR :

%

USD

29.98 Billion

USD

66.93 Billion

2024

2032

USD

29.98 Billion

USD

66.93 Billion

2024

2032

| 2025 –2032 | |

| USD 29.98 Billion | |

| USD 66.93 Billion | |

|

|

|

|

Capacitive Voltage Transformer Market Size

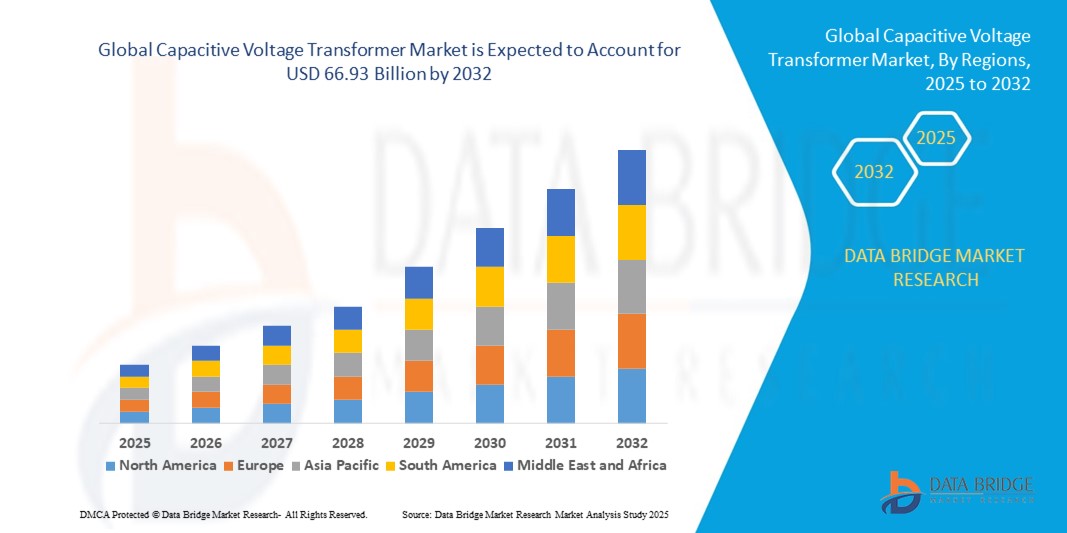

- The global capacitive voltage transformer market size was valued at USD 29.98 billion in 2024 and is expected to reach USD 66.93 billion by 2032, at a CAGR of 10.56% during the forecast period

- The market growth is largely fuelled by the increasing demand for reliable electricity transmission, modernization of aging grid infrastructure, and rising integration of renewable energy sources into power systems

- Growing investments in high-voltage transmission projects and digital substation development are expected to further strengthen market growth over the coming years

Capacitive Voltage Transformer Market Analysis

- The capacitive voltage transformer market is witnessing robust growth due to its critical role in high-voltage transmission networks for voltage measurement, grid protection, and signal transmission

- Growing adoption of smart grid technologies and advancements in digital substations are driving demand for CVTs with improved accuracy, reliability, and compatibility with intelligent electronic devices (IEDs)

- North America dominated the capacitive voltage transformer market with the largest revenue share of 38.74% in 2024, driven by large-scale grid modernization initiatives, rising electricity demand, and strong adoption of renewable energy. The region’s well-established infrastructure and focus on smart grid deployment have created a favorable environment for CVTs, particularly in high-voltage transmission projects

- Asia-Pacific region is expected to witness the highest growth rate in the global capacitive voltage transformer market, driven by expanding industrialization, massive renewable energy projects, and government-led initiatives to strengthen power reliability across emerging economies

- The Oil-Paper segment held the largest market revenue share in 2024, owing to its widespread use in high-voltage applications and proven long-term reliability. Oil-paper insulation offers superior dielectric properties and durability, making it the preferred choice in large substations and transmission networks

Report Scope and Capacitive Voltage Transformer Market Segmentation

|

Attributes |

Capacitive Voltage Transformer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Capacitive Voltage Transformer Market Trends

Adoption Of Digital Substations And Smart Grid Integration

- The increasing shift toward digital substations is transforming the capacitive voltage transformer (CVT) landscape by enabling real-time monitoring, communication, and control of high-voltage networks. Integration with smart grid platforms allows utilities to achieve higher efficiency, better fault detection, and enhanced power system stability. This trend is particularly vital for handling complex grid operations and renewable energy inputs

- The growing demand for advanced grid monitoring tools is driving the adoption of CVTs with digital sensors and communication modules. These devices provide accurate data to intelligent electronic devices (IEDs) and SCADA systems, ensuring faster decision-making in both routine and emergency situations. The adoption is further supported by government-backed modernization programs for aging power infrastructure

- The rise of smart grids and renewable-heavy networks is encouraging utilities to invest in CVTs that deliver improved accuracy and long-term reliability. Their ability to support high-voltage transmission with reduced losses makes them an essential component of next-generation energy infrastructure

- For instance, in 2023, several utilities in Europe deployed CVTs with integrated digital monitoring systems to improve high-voltage grid efficiency and reduce operational downtime. This upgrade supported renewable integration while enhancing transmission reliability and asset management

- While digital CVTs are accelerating modernization and strengthening power networks, their long-term adoption depends on affordability, interoperability, and local manufacturing support. Manufacturers must continue innovating scalable, cost-efficient designs to maximize penetration across developing markets

Capacitive Voltage Transformer Market Dynamics

Driver

Rising Demand For High-Voltage Transmission And Grid Modernization

- The rapid expansion of high-voltage transmission projects is pushing governments and utilities to deploy CVTs as critical components for grid safety, measurement, and communication. With rising electricity consumption in urban and industrial hubs, long-distance power transfer has become essential, making CVTs indispensable for operational stability and efficiency. Their use ensures accurate monitoring, improved reliability, and reduced downtime in power delivery

- Growing emphasis on grid modernization and energy security is boosting CVT adoption across both developed and developing economies. Utilities are increasingly investing in reliable monitoring systems to prevent outages, minimize transmission losses, and improve resilience against sudden power surges or faults. The integration of renewable energy sources is also intensifying demand for CVTs that can stabilize and balance fluctuating power flows

- Public sector investments, along with regulatory frameworks promoting modernization of substations, are creating significant growth opportunities. National grid operators are prioritizing advanced voltage monitoring systems to meet sustainability goals and ensure compliance with international standards. Subsidized infrastructure projects in developing economies are accelerating CVT installations, particularly in regions undergoing rapid electrification and cross-border grid expansion

- For instance, in 2022, China initiated multiple ultra-high-voltage transmission projects to balance regional power supply, significantly increasing demand for CVTs to ensure operational reliability and real-time voltage monitoring. These large-scale projects highlight how advanced CVTs are central to long-distance power transfer and effective renewable integration. The initiatives also reflect a growing global shift toward stronger, more interconnected electricity networks

- While modernization initiatives and rising energy demand are driving market expansion, ensuring cost efficiency and accessibility remains a key priority for utilities. Large-scale projects require significant capital investment, and delays in supply or installation can affect timelines. Manufacturers must focus on modular, scalable solutions and local partnerships to meet rising demand while reducing financial burdens on utilities

Restraint/Challenge

High Installation Costs And Maintenance Complexities

- The high upfront cost of installing advanced CVTs limits their adoption among utilities operating under constrained budgets, particularly in developing regions. Unlike conventional transformers, CVTs designed for ultra-high-voltage applications involve more complex engineering, rigorous testing, and higher deployment expenses. These factors make adoption difficult for smaller utilities and rural operators with limited financial resources

- Maintenance complexities, including the need for highly skilled technicians and specialized tools, further hinder accessibility and long-term usage. In many countries, there is a shortage of trained personnel capable of handling installation, calibration, and technical servicing of CVTs. This increases reliance on international expertise, raising operational costs and often leading to prolonged downtime during equipment servicing

- Market penetration is also restricted by logistical barriers, as transporting and installing CVTs across remote high-voltage transmission corridors requires heavy infrastructure and advanced equipment. Developing economies face further constraints due to limited local manufacturing capabilities and dependence on costly imports. These issues collectively delay deployment, increase project costs, and restrict widespread adoption

- For instance, in 2023, utilities in parts of Sub-Saharan Africa reported delays in grid upgrade projects due to the high costs of CVTs and lack of local expertise for installation and maintenance. This hampered modernization timelines and prevented the region from fully realizing its renewable energy integration goals. Similar challenges are common across several emerging markets where funding gaps are significant

- While CVTs are critical for ensuring high-voltage stability, overcoming cost and technical barriers is crucial for market growth. Manufacturers and policymakers must focus on localized production facilities, modular product designs, and mobile training programs to address workforce shortages. Such steps will help accelerate adoption, reduce operational risks, and create long-term sustainability for power infrastructure development

Capacitive Voltage Transformer Market Scope

The market is segmented on the basis of insulation type, voltage range, application, accuracy class, and phases.

- By Insulation Type

On the basis of insulation type, the capacitive voltage transformer market is segmented into Oil-Paper, Dry-Type, Cast Resin, and Others. The Oil-Paper segment held the largest market revenue share in 2024, owing to its widespread use in high-voltage applications and proven long-term reliability. Oil-paper insulation offers superior dielectric properties and durability, making it the preferred choice in large substations and transmission networks.

The Dry-Type segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for safer, eco-friendly alternatives with minimal maintenance needs. Dry-type CVTs are particularly suitable for indoor installations and urban substations, where fire safety and compact design are key considerations.

- By Voltage Range

On the basis of voltage range, the market is segmented into Up to 33 kV, 33 kV to 66 kV, 66 kV to 132 kV, 132 kV to 220 kV, and Above 220 kV. The 132 kV to 220 kV segment dominated the market in 2024, driven by extensive use in regional transmission networks and large-scale substations. This range is widely adopted due to its balance between cost-effectiveness and suitability for long-distance transmission.

The Above 220 kV segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing investments in ultra-high-voltage (UHV) projects and cross-border transmission lines. Growing renewable energy integration and long-haul power transfer needs are expected to fuel demand in this range.

- By Application

On the basis of application, the capacitive voltage transformer market is segmented into Substations, Power Plants, Industrial Installations, Distribution Networks, and Others. The Substations segment held the largest market share in 2024, as CVTs are indispensable in voltage measurement, protection, and communication in high-voltage substations. Rising global investments in modernizing substation infrastructure further supported this dominance.

The Industrial Installations segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for efficient power monitoring in heavy industries such as steel, cement, and petrochemicals. These industries are adopting CVTs for accurate power quality monitoring and reliable voltage control.

- By Accuracy Class

On the basis of accuracy class, the market is segmented into 0.1, 0.2, 0.5, 1.0, and 3.0. The 0.2 accuracy class held the largest revenue share in 2024, owing to its wide adoption in protection and metering applications where high accuracy is essential for billing and system monitoring. Utilities prefer this class for its balance between cost and performance in large-scale transmission systems.

The 0.1 accuracy class is expected to witness the fastest growth rate from 2025 to 2032, as demand for highly precise measurement rises with the expansion of digital substations and smart grid networks. Growing reliance on advanced monitoring systems and intelligent electronic devices (IEDs) is expected to drive adoption in this category.

- By Phases

On the basis of phases, the market is segmented into Single-Phase and Three-Phase. The Single-Phase segment accounted for the largest market share in 2024, primarily due to its widespread deployment in conventional high-voltage transmission and measurement systems. Single-phase CVTs are cost-effective and well-suited for voltage measurement and relay protection functions.

The Three-Phase segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing adoption in modern substations and smart grid applications. Three-phase CVTs offer greater efficiency and compact designs, making them ideal for space-constrained installations and advanced monitoring systems.

Capacitive Voltage Transformer Market Regional Analysis

- North America dominated the capacitive voltage transformer market with the largest revenue share of 38.74% in 2024, driven by large-scale grid modernization initiatives, rising electricity demand, and strong adoption of renewable energy. The region’s well-established infrastructure and focus on smart grid deployment have created a favorable environment for CVTs, particularly in high-voltage transmission projects

- Utilities across the region are prioritizing the replacement of aging grid assets with advanced monitoring solutions, further accelerating CVT adoption. This dominance is reinforced by high investment capacity, regulatory support for sustainable energy transition, and the growing need for real-time grid protection and stability

U.S. Capacitive Voltage Transformer Market Insight

The U.S. capacitive voltage transformer market captured the largest revenue share in 2024 within North America, fueled by extensive modernization of power transmission networks and rising integration of solar and wind energy. The adoption of smart substations and digital monitoring systems is driving demand for CVTs across utilities and industrial installations. Federal and state-level programs focusing on grid resilience and decarbonization are expected to further propel market growth.

Europe Capacitive Voltage Transformer Market Insight

The Europe capacitive voltage transformer market is expected to witness the fastest growth rate from 2025 to 2032, driven by ambitious renewable energy targets, cross-border interconnections, and growing urban electricity demand. Countries such as Germany, France, and the U.K. are leading the adoption of CVTs as part of their smart grid and digital substation initiatives. The European Union’s stringent regulatory frameworks for grid efficiency and carbon reduction further strengthen CVT adoption across the region.

Germany Capacitive Voltage Transformer Market Insight

The Germany capacitive voltage transformer market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s ongoing energy transition and focus on renewable power integration. High penetration of solar and wind power has created strong demand for CVTs to stabilize transmission and ensure voltage accuracy. Germany’s well-developed infrastructure, coupled with its innovation-driven energy sector, positions it as one of the fastest-growing CVT markets in Europe

U.K. Capacitive Voltage Transformer Market Insight

The U.K. capacitive voltage transformer market is expected to witness the fastest growth rate from 2025 to 2032, supported by heavy investments in offshore wind power, grid digitalization, and substation upgrades. Increasing concerns over energy security and grid stability are encouraging utilities to deploy advanced CVTs with higher accuracy. The U.K.’s regulatory push toward decarbonization and smart energy solutions will further boost long-term demand.

Asia-Pacific Capacitive Voltage Transformer Market Insight

The Asia-Pacific capacitive voltage transformer market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising electricity demand, and significant investments in transmission infrastructure. China and India remain the largest contributors, supported by large-scale renewable energy projects, ultra-high-voltage transmission development, and government-backed electrification initiatives. APAC’s role as a hub for power equipment manufacturing also strengthens the affordability and accessibility of CVTs across the region.

China Capacitive Voltage Transformer Market Insight

The China capacitive voltage transformer market accounted for the largest share in Asia-Pacific in 2024, driven by aggressive expansion of UHV transmission projects and massive renewable integration efforts. China’s strong domestic manufacturing base ensures cost-effective availability of CVTs, while its ambitious carbon neutrality targets drive continuous investment in modern grid infrastructure.

Japan Capacitive Voltage Transformer Market Insight

The Japan capacitive voltage transformer market is expected to witness the fastest growth rate from 2025 to 2032, driven by the modernization of aging infrastructure and increasing adoption of digital substations. With a strong emphasis on grid resilience, renewable energy integration, and disaster management, Japan is adopting high-accuracy CVTs for secure and efficient transmission. The country’s tech-driven utilities are also exploring CVTs with enhanced digital monitoring features.

Capacitive Voltage Transformer Market Share

The Capacitive Voltage Transformer industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Siemens (Germany)

- General Electric (U.S.)

- Schneider Electric (France)

- Eaton (Ireland)

- Mitsubishi Electric (Japan)

- Toshiba (Japan)

- Fuji Electric (Japan)

- Hitachi (Japan)

- ITRON (U.S.)

- SEL (U.S.)

- Elastimold (U.S.)

- Prysmian Group (Italy)

- NKT Cables (Denmark)

- LS Cable & System (South Korea)

Latest Developments in Global Capacitive Voltage Transformer Market

- In February 2024, Hitachi Energy announced a €30 million investment to expand and modernize its transformer facility in Bad Honnef, Germany. The project, scheduled for completion in 2026, is expected to create up to 100 new jobs while boosting the company’s global production capacity. This development is aimed at meeting the rising demand for transformers across Europe’s energy transition, thereby strengthening Hitachi Energy’s market position and supporting regional grid modernization initiatives

- In September 2024, TESCO launched the KCTS-8000X Current Transformer Testing System, engineered to deliver traceable accuracy down to a 1% rating factor. Capable of testing primaries up to 8000 amperes, the system provides utilities with enhanced precision, efficiency, and reliability in transformer testing. This advancement not only sets a new benchmark in transformer validation but also helps utilities ensure compliance in metering systems, positively impacting operational performance in the global transformer market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Capacitive Voltage Transformer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Capacitive Voltage Transformer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Capacitive Voltage Transformer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.