Global Capacitor Bank Controllers Substation Automation Market

Market Size in USD Billion

CAGR :

%

USD

3.30 Billion

USD

6.57 Billion

2024

2032

USD

3.30 Billion

USD

6.57 Billion

2024

2032

| 2025 –2032 | |

| USD 3.30 Billion | |

| USD 6.57 Billion | |

|

|

|

|

Capacitor Bank Controllers Substation Automation Market Size

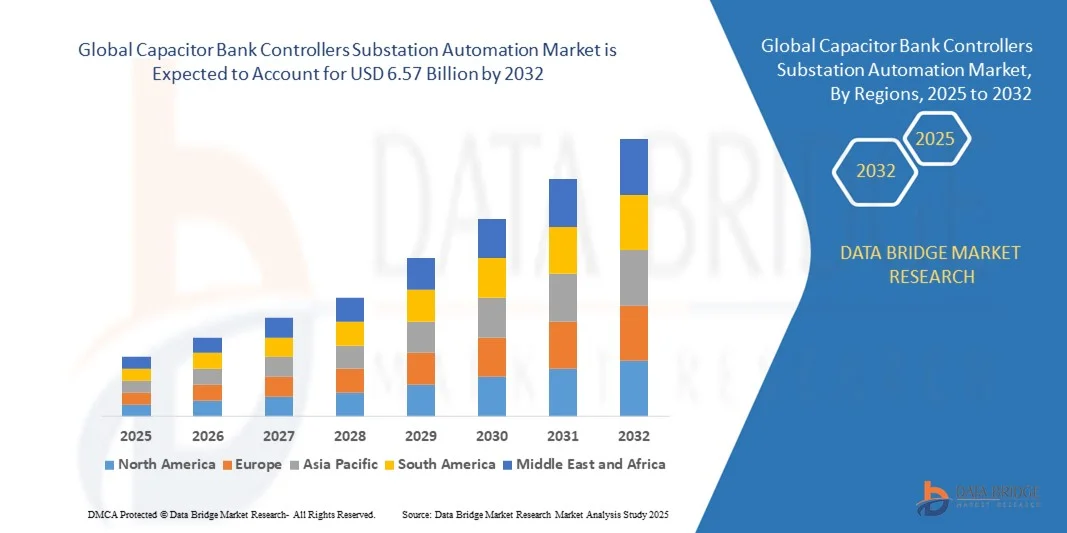

- The global capacitor bank controllers substation automation market size was valued at USD 3.3 billion in 2024 and is expected to reach USD 6.57 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by the increasing modernization of power grids and the adoption of digital substation technologies, leading to enhanced monitoring, control, and optimization of capacitor banks across transmission and distribution networks

- Furthermore, rising demand for reliable reactive power management, real-time monitoring, and automated switching solutions is establishing capacitor bank controllers as essential components of substation automation systems. These converging factors are accelerating the adoption of advanced capacitor bank control solutions, thereby significantly boosting the industry’s growth

Capacitor Bank Controllers Substation Automation Market Analysis

- Capacitor bank controllers, enabling automated control and optimization of reactive power in substations, are increasingly critical for improving grid stability, minimizing power losses, and enhancing operational efficiency in both utility and industrial settings

- The escalating demand for capacitor bank controllers is primarily driven by the growing deployment of smart grids, integration of renewable energy sources, and the need for predictive maintenance and real-time diagnostics to ensure reliable and efficient power distribution

- North America dominated the capacitor bank controllers substation automation market with a share of 39.5% in 2024, due to growing investments in smart grid modernization and the need for reliable power quality management

- Asia-Pacific is expected to be the fastest growing region in the capacitor bank controllers substation automation market during the forecast period due to rapid urbanization, industrialization, and increasing investments in power infrastructure in countries such as China, Japan, and India

- Ethernet segment dominated the market with a market share of 48.8% in 2024, due to its high-speed data transfer, reliability, and widespread deployment in substation networks. Ethernet provides seamless connectivity between controllers, IEDs, and SCADA systems, enabling efficient monitoring and control of capacitor banks. Utilities also prefer Ethernet for its compatibility with standard network protocols, scalability for future upgrades, and ease of integration with digital substation technologies

Report Scope and Capacitor Bank Controllers Substation Automation Market Segmentation

|

Attributes |

Capacitor Bank Controllers Substation Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Capacitor Bank Controllers Substation Automation Market Trends

Adoption of Digital Substations and Smart Grids

- The capacitor bank controllers substation automation market is evolving rapidly with the growing adoption of digital substations and smart grid infrastructure. Utilities and grid operators are migrating from legacy manual and analog systems to integrated, intelligent automation solutions capable of optimizing grid reliability, efficiency, and power quality in real time

- For instance, Siemens AG and Schneider Electric SE have launched advanced digital substation platforms incorporating smart capacitor bank controllers, enabling remote monitoring, adaptive control, and predictive maintenance functions via secure digital communication protocols. This transition is reshaping traditional grid management and accelerating the deployment of self-healing and adaptive networks

- Digital capacitor bank controllers are now critical for modern grid applications, providing precise control over reactive power compensation, voltage regulation, and load balancing across distributed energy resources. Their integration facilitates dynamic adjustment of capacitor banks based on real-time electrical parameters, improving overall grid stability and efficiency

- Smart grid initiatives are advancing the use of IEC 61850 communication, cloud-based supervisory control and data acquisition (SCADA), and IoT-enabled sensor networks that deliver high-resolution, low-latency data for centralized and decentralized grid management. The shift to interoperable, software-upgradable systems supports decarbonization and distributed energy resource integration

- In addition, rapid urbanization, proliferation of renewables, and electric vehicle infrastructure expansion are driving the need for flexible, scalable substation automation. Capacitor bank controllers play an essential role in harmonics management, voltage support, and loss reduction, aligning with evolving regulatory targets and utility performance objectives

- As digital transformation across energy networks accelerates, the adoption of intelligent capacitor bank controllers and automated substation solutions is expected to drive next-generation grid modernization. These trends signify a move toward future-ready, resilient power infrastructure supporting the demands of emerging energy markets

Capacitor Bank Controllers Substation Automation Market Dynamics

Driver

Rising Demand for Real-Time Reactive Power Management

- Increasing demand for real-time reactive power management is a key factor fueling the market for capacitor bank controllers in substation automation. Modern power systems require high-speed, precise control of reactive power flow to maintain voltage stability, optimize load profiles, and reduce transmission losses in increasingly complex grid environments

- For instance, ABB Ltd. has developed intelligent capacitor bank controllers integrated with centralized substation automation systems, enabling utilities to execute fast, adaptive power factor correction and improve voltage profiles under dynamic load conditions. This real-time operational capability supports reliable grid performance even as renewable penetration grows

- Reactive power management is essential for optimizing energy transfer, improving network efficiency, and minimizing outage risk during load fluctuations and fault events. Automated capacitor bank controllers allow grid operators to adjust compensation settings instantly in response to variable generation, demand spikes, or contingency events

- In addition, the distributed nature of modern energy sources and growing electrification of end-use sectors such as transportation and storage intensifies the need for decentralized reactive power control. Smart capacitor bank controllers facilitate coordination across multiple substations, supporting flexible, robust grid operation in future energy scenarios

- The adoption of advanced reactive power management systems aligns with regulatory mandates and corporate sustainability goals aimed at enhancing energy reliability, reducing emissions, and supporting grid decarbonization objectives. Continued technological advancement and investment in intelligent control systems will remain central to powering smart grid evolution

Restraint/Challenge

High Initial Investment and System Integration Complexity

- The high initial investment required for digital substation upgrades and smart capacitor bank controller deployment presents a significant challenge to market expansion, especially for smaller utilities and developing regions. Advanced hardware, software licensing, and cyber-secure communication infrastructures contribute to elevated capital costs for new installations and retrofits

- For instance, GE Grid Solutions and Eaton Corporation have highlighted the substantial upfront costs and integration complexity involved in migrating from legacy analog systems to fully automated digital platforms. These projects often entail comprehensive system reengineering, multi-vendor compatibility testing, and specialized workforce training

- Integration complexity arises from the need to connect diverse hardware modules, ensure real-time interoperability, and adapt legacy SCADA and protection schemes to new digital communication standards such as IEC 61850. Customized migration strategies and prolonged commissioning timelines can disrupt ongoing grid operations and inflate project budgets

- In addition, cybersecurity concerns and regulatory compliance requirements further increase cost and complexity, as operators must safeguard sensitive grid data and maintain resilient network architectures

- Mitigating these challenges will require collaborative deployment models, modular upgrade pathways, and widespread standardization of hardware and communication. As technology costs decline and proven deployment frameworks emerge, market access and adoption of capacitor bank controllers for substation automation are expected to broaden globally

Capacitor Bank Controllers Substation Automation Market Scope

The market is segmented on the basis of module and communication channel.

- By Module

On the basis of module, the Capacitor Bank Controllers Substation Automation market is segmented into SCADA, IEDs, and Communication Network. The SCADA segment dominated the market with the largest revenue share of 46.1% in 2024, driven by its ability to provide centralized monitoring and real-time control of substation operations. SCADA systems enable utilities to optimize capacitor bank performance, reduce power losses, and enhance grid stability. The demand is further supported by increasing investments in grid modernization and the need for predictive maintenance, ensuring uninterrupted power quality. Utilities also prefer SCADA for its compatibility with existing infrastructure and its capacity to integrate with multiple automation devices, providing both operational efficiency and cost-effectiveness.

The IEDs segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in modern substations requiring localized control and advanced protection features. Intelligent Electronic Devices provide real-time monitoring, fault detection, and automated switching of capacitor banks, improving operational reliability. Their modular architecture allows for easy upgrades, and they are increasingly integrated with communication networks for remote diagnostics and control. The combination of enhanced functionality, flexibility, and scalability positions IEDs as a key growth driver in substation automation.

- By Communication Channel

On the basis of communication channel, the market is segmented into Ethernet, Power Line Communication, Copper Wire Communication, and Optical Fiber Communication. The Ethernet segment held the largest market revenue share of 48.8% in 2024, driven by its high-speed data transfer, reliability, and widespread deployment in substation networks. Ethernet provides seamless connectivity between controllers, IEDs, and SCADA systems, enabling efficient monitoring and control of capacitor banks. Utilities also prefer Ethernet for its compatibility with standard network protocols, scalability for future upgrades, and ease of integration with digital substation technologies.

The Optical Fiber Communication segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the need for high-bandwidth, long-distance, and interference-resistant communication in modern substations. Optical fiber enables precise and real-time transmission of operational data, supporting advanced automation, fault diagnostics, and grid stability. Its immunity to electromagnetic interference and capability to handle large volumes of data make it ideal for smart grid applications. Increasing investments in digital substations and the expansion of smart grid infrastructure are expected to further drive the adoption of optical fiber communication.

Capacitor Bank Controllers Substation Automation Market Regional Analysis

- North America dominated the capacitor bank controllers substation automation market with the largest revenue share of 39.5% in 2024, driven by growing investments in smart grid modernization and the need for reliable power quality management

- Utilities and industrial operators in the region increasingly prioritize real-time monitoring, fault detection, and automated capacitor bank control to enhance grid stability and operational efficiency

- The widespread adoption is further supported by advanced infrastructure, high technology penetration, and regulatory incentives for digital substation deployment, establishing capacitor bank controllers as a preferred solution across transmission and distribution networks

U.S. Capacitor Bank Controllers Substation Automation Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by rapid modernization of power grids and rising demand for automated substation solutions. Utilities are increasingly deploying SCADA-integrated capacitor bank controllers to reduce power losses and improve voltage stability. The focus on predictive maintenance, real-time diagnostics, and remote control capabilities further drives market adoption. In addition, government initiatives promoting smart grid and renewable integration are supporting investments in digital substation technologies.

Europe Capacitor Bank Controllers Substation Automation Market Insight

The Europe market is projected to grow at a notable CAGR throughout the forecast period, driven by stringent regulations on energy efficiency and power quality standards. The region’s increasing integration of renewable energy sources necessitates reliable capacitor bank management to maintain grid stability. Utilities in countries such as Germany, France, and Italy are adopting advanced monitoring and automation solutions to optimize performance. Moreover, investments in smart grid initiatives and digital substations are accelerating the uptake of capacitor bank controllers across residential, commercial, and industrial segments.

U.K. Capacitor Bank Controllers Substation Automation Market Insight

The U.K. market is anticipated to grow steadily during the forecast period, supported by the country’s transition toward smart grids and enhanced energy management. Utilities are deploying automated capacitor bank controllers to improve voltage regulation, reduce reactive power losses, and ensure efficient load distribution. In addition, initiatives to integrate renewable energy and smart metering solutions are promoting the adoption of digital substation technologies. The country’s strong focus on sustainability and technological innovation continues to drive market expansion.

Germany Capacitor Bank Controllers Substation Automation Market Insight

The Germany market is expected to expand at a significant CAGR, driven by rising investments in grid automation and the demand for efficient power distribution. The country’s advanced electrical infrastructure and emphasis on renewable energy integration create a strong need for real-time capacitor bank monitoring and control. Utilities are increasingly adopting SCADA-integrated solutions and intelligent electronic devices (IEDs) to enhance grid reliability and operational efficiency. The integration of digital communication networks and predictive analytics further supports market growth.

Asia-Pacific Capacitor Bank Controllers Substation Automation Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025–2032, fueled by rapid urbanization, industrialization, and increasing investments in power infrastructure in countries such as China, Japan, and India. Governments in the region are promoting digital substations and smart grid initiatives to improve energy efficiency and grid stability. The adoption of advanced capacitor bank controllers is rising in response to growing electricity demand, reactive power management requirements, and the modernization of aging grid systems.

Japan Capacitor Bank Controllers Substation Automation Market Insight

The Japan market is witnessing steady growth due to the country’s focus on smart grid technology, renewable energy integration, and advanced substation automation. Utilities prioritize real-time monitoring and predictive maintenance of capacitor banks to maintain stable voltage levels and reduce energy losses. The deployment of SCADA and IED-based solutions enhances operational efficiency, while the emphasis on automation and reliability drives continued adoption across the industrial and utility sectors.

China Capacitor Bank Controllers Substation Automation Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, industrial growth, and the expansion of smart grid infrastructure. Utilities are increasingly implementing automated capacitor bank controllers to optimize reactive power management and improve power quality. Government support for digital substations, combined with rising demand for reliable electricity supply in industrial and urban areas, continues to propel market growth. The presence of strong domestic manufacturers also facilitates widespread adoption of advanced substation automation solutions.

Capacitor Bank Controllers Substation Automation Market Share

The capacitor bank controllers substation automation industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Cisco, Inc. (U.S.)

- Crompton Greaves Consumer Electricals Limited (India)

- Eaton Corporation (U.S.)

- General Electric (U.S.)

- LARSEN & TOUBRO LIMITED (India)

- Schneider Electric (France)

- Siemens (Germany)

- Trilliant Holdings Inc. (U.S.)

- VENSON ELECTRIC PVT. LTD. (India)

- Ingeteam (Spain)

- Grid Solutions (U.S.)

- Schweitzer Engineering Laboratories, Inc. (U.S.)

- Alstom (France)

- Itron Inc. (U.S.)

- Adesto Technologies Corporation (U.S.)

- Encore Networks (U.S.)

- Power System Engineering, Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- TOSHIBA CORPORATION (Japan)

Latest Developments in Global Capacitor Bank Controllers Substation Automation Market

- In September 2024, ABB launched its next-generation capacitor bank controller featuring advanced AI-driven algorithms for predictive maintenance and optimized switching strategies. This innovation is expected to significantly strengthen ABB’s position in the global capacitor bank controllers substation automation market by enabling utilities to improve grid reliability, reduce operational downtime, and optimize reactive power management. The seamless integration with ABB Ability digital platforms also allows remote monitoring and diagnostics, enhancing operational efficiency and driving the adoption of intelligent substation solutions worldwide

- In July 2024, Siemens Energy partnered with National Grid ESO to deploy advanced reactive power compensation systems across the UK transmission network. This collaboration is poised to bolster Siemens Energy’s market presence in Europe by demonstrating its expertise in dynamic VAR support and grid stability solutions. The implementation of these technologies will facilitate the integration of renewable energy sources, address voltage fluctuations, and encourage utilities to adopt more sophisticated substation automation systems, thereby accelerating market growth in the region

- In May 2024, General Electric introduced its Grid Solutions advanced capacitor bank control system equipped with enhanced cybersecurity features and edge computing capabilities. This launch strengthens GE’s market position by addressing the growing demand for secure and intelligent substation automation solutions. By enabling real-time reactive power optimization while maintaining robust protection protocols for critical infrastructure, the system supports utilities in enhancing operational efficiency and resilience, which is likely to drive adoption across North America, Europe, and Asia-Pacific

- In March 2024, Schneider Electric acquired Aveva's power system automation division, enhancing its portfolio of substation automation solutions, including capacitor bank controllers. This strategic acquisition is expected to expand Schneider Electric’s market share by combining Aveva’s advanced software capabilities with Schneider’s existing hardware solutions. The strengthened portfolio allows for more integrated grid management and improved industrial automation, positioning the company to capture higher adoption rates in both established and emerging markets

- In January 2024, Eaton Corporation announced a USD 150 million investment to expand its power management manufacturing facilities in Mexico and India, including production capacity for intelligent capacitor bank controllers. This investment is set to support Eaton’s growth in the Latin America and Asia-Pacific markets by meeting the rising demand for advanced substation automation solutions. By enhancing production capabilities and targeting fast-growing regions, Eaton is well-positioned to capitalize on the increasing adoption of smart grid technologies and automated reactive power management systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.