Global Caprylyl Glycol Market

Market Size in USD Billion

CAGR :

%

USD

2.46 Billion

USD

4.26 Billion

2024

2032

USD

2.46 Billion

USD

4.26 Billion

2024

2032

| 2025 –2032 | |

| USD 2.46 Billion | |

| USD 4.26 Billion | |

|

|

|

|

Caprylyl Glycol Market Size

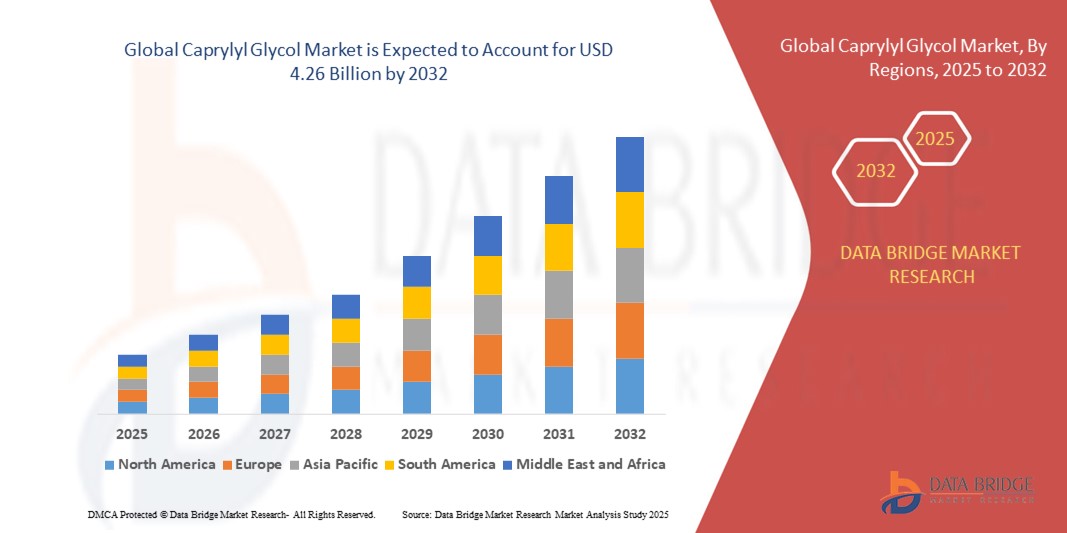

- The global caprylyl glycol market size was valued at USD 2.46 billion in 2024 and is expected to reach USD 4.26 billion by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is largely fuelled by the rising demand for multifunctional cosmetic ingredients that offer both moisturizing and antimicrobial properties, especially in skincare and personal care products

- Increasing consumer awareness about natural and safe preservatives in cosmetic formulations is driving manufacturers to incorporate caprylyl glycol, further accelerating market expansion

Caprylyl Glycol Market Analysis

- The global caprylyl glycol market is witnessing significant growth due to its widespread application as a preservative and skin-conditioning agent in cosmetics and personal care products

- Rising trends in clean beauty and natural ingredient formulations are encouraging manufacturers to adopt caprylyl glycol as an effective alternative to traditional preservatives

- North America dominated the global caprylyl glycol market with the largest revenue share of 39.5% in 2024, driven by the high demand for personal care products and increasing consumer preference for multifunctional cosmetic ingredients

- Asia-Pacific region is expected to witness the highest growth rate in the global caprylyl glycol market, driven by expanding personal care and cosmetics industries, growing consumer awareness about ingredient safety, and supportive government initiatives promoting manufacturing and innovation

- The cosmetic grade segment dominated the market with the largest revenue share in 2024, driven by its extensive use in personal care and beauty products due to its multifunctional properties as a preservative and skin conditioning agent. Cosmetic grade caprylyl glycol is preferred for its safety profile and compatibility with a wide range of formulations, making it a staple ingredient in skincare and haircare products

Report Scope and Caprylyl Glycol Market Segmentation

|

Attributes |

Caprylyl Glycol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Natural and Multifunctional Cosmetic Ingredients |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Caprylyl Glycol Market Trends

Increasing Preference for Multifunctional Cosmetic Ingredients

- The rising demand for multifunctional cosmetic ingredients is reshaping the caprylyl glycol market by promoting products that offer both preservative and moisturizing benefits. This dual functionality reduces the need for multiple additives in formulations, streamlining product development and appealing to consumer preferences for simplified skincare routines

- Growing consumer inclination toward clean-label and natural-based cosmetics is driving the adoption of caprylyl glycol as a safer and effective alternative to traditional preservatives. Its antimicrobial properties coupled with skin-conditioning effects position it as a favored choice among formulators

- The expansion of the personal care sector in emerging markets is fueling demand for caprylyl glycol, as manufacturers seek ingredients that improve product efficacy and shelf life while meeting regulatory standards. Increased product launches featuring caprylyl glycol highlight its rising prominence

- For example, in 2023, several leading skincare brands introduced new moisturizing creams and serums incorporating caprylyl glycol, which received positive consumer feedback for enhancing skin hydration and product freshness

- While the market is growing rapidly, continued innovation in formulation techniques and sourcing sustainable raw materials will be key to maintaining momentum and meeting evolving consumer expectations

Caprylyl Glycol Market Dynamics

Driver

Increasing Demand for Natural and Effective Preservatives in Cosmetics

• Rising consumer awareness about the adverse effects of synthetic preservatives is encouraging cosmetic manufacturers to seek natural and multifunctional ingredients such as caprylyl glycol. This shift is driving investments in research and product development focused on safe and efficient preservatives

• The booming skincare and personal care industry globally, especially in Asia-Pacific and Latin America, is propelling demand for caprylyl glycol, as consumers look for products that combine safety with performance. Regulatory encouragement for cleaner formulations is further supporting this trend.

• Growth in e-commerce and direct-to-consumer sales channels has enabled faster product innovation cycles, increasing market penetration of caprylyl glycol-containing formulations. Online platforms allow brands to quickly gather consumer feedback and adjust formulations accordingly, enhancing customer satisfaction and loyalty

• For instance, in 2022, a leading European cosmetic manufacturer expanded its portfolio of natural preservatives by integrating caprylyl glycol into several product lines, resulting in increased market share and consumer trust. The company’s strategic move not only enhanced product safety but also aligned with sustainability goals, appealing to eco-conscious consumers

• Despite strong demand, manufacturers must focus on optimizing cost-effectiveness and scalability to fully capitalize on market potential. The relatively high production costs compared to synthetic alternatives can be a barrier for widespread adoption, especially in price-sensitive markets. Investments in advanced manufacturing technologies and supply chain improvements are crucial to reduce costs while maintaining quality.

Restraint/Challenge

High Production Costs and Regulatory Complexities

• The relatively high cost of caprylyl glycol compared to conventional preservatives limits its adoption, particularly among small and medium-sized cosmetic manufacturers operating with tight margins. This cost sensitivity makes it challenging for many companies to switch from cheaper synthetic alternatives despite growing consumer demand for safer ingredients. As a result, price competitiveness and economies of scale remain critical factors for wider market penetration, especially in developing regions where budget constraints are more pronounced

• Stringent regulatory requirements across different regions regarding ingredient safety, labeling, and usage concentration can complicate product development and market entry, delaying commercialization. Navigating the complex regulatory landscape requires significant investment in compliance testing and documentation, which can be time-consuming and costly for manufacturers. Differences in regulations between markets such as the EU, U.S., and Asia-Pacific also create barriers for global product launches, necessitating tailored formulations and marketing strategies for each region

• Variability in raw material supply and quality issues pose challenges for consistent large-scale production, affecting formulation stability and efficacy. Inconsistent quality can lead to batch-to-batch variations, impacting the performance and safety of cosmetic products, which in turn can harm brand reputation and consumer trust. Ensuring reliable sourcing of high-purity caprylyl glycol requires stringent supplier qualification processes and robust quality control measures, which add complexity and cost to the supply chain

• For example, in 2023, several emerging market manufacturers reported supply chain disruptions impacting the availability of high-purity caprylyl glycol, causing delays in new product launches. These disruptions were often linked to raw material shortages, logistical bottlenecks, and geopolitical tensions affecting trade routes. The resulting production delays not only impacted revenue but also led to missed market opportunities and increased pressure to find alternative preservatives or suppliers

• Addressing cost and regulatory hurdles through technological innovation, strategic partnerships, and enhanced supply chain management will be essential to unlock long-term growth opportunities in the global caprylyl glycol market. Advances in green chemistry and sustainable production methods may reduce manufacturing costs and environmental impact, making caprylyl glycol more attractive to producers and consumers alike. Collaborative efforts between ingredient suppliers, manufacturers, and regulatory bodies can streamline compliance and improve market access, fostering a more resilient and dynamic industry landscape.

Caprylyl Glycol Market Scope

The market is segmented on the basis of grade, product, distribution channel, end user, and application.

- By Grade

On the basis of grade, the caprylyl glycol market is segmented into cosmetic grade and industrial grade. The cosmetic grade segment dominated the market with the largest revenue share in 2024, driven by its extensive use in personal care and beauty products due to its multifunctional properties as a preservative and skin conditioning agent. Cosmetic grade caprylyl glycol is preferred for its safety profile and compatibility with a wide range of formulations, making it a staple ingredient in skincare and haircare products.

The industrial grade segment is expected to witness fastest growth rate from 2025 to 2032, fueled by its increasing application in various industrial formulations such as disinfectants, lubricants, and specialty chemicals. The rising demand for industrial grade caprylyl glycol is supported by its antimicrobial properties and efficacy in enhancing product stability in harsher environments.

- By Product

On the basis of product, the market is segmented into natural and synthetic. The natural segment dominated the market in 2024, owing to increasing consumer awareness and preference for naturally derived ingredients in cosmetics and personal care products. Natural caprylyl glycol is favored for its eco-friendly profile and compatibility with organic certification standards, boosting its adoption across skincare and haircare industries.

The synthetic segment is expected to witness fastest growth rate from 2025 to 2032, due to cost-effectiveness, consistent quality, and scalability offered by synthetic production methods. Synthetic caprylyl glycol is widely used in industrial applications where higher volumes and stringent purity levels are required.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online retailers, specialty stores, drugstores and pharmacies, and hypermarkets and supermarkets. Online retailers accounted for the largest market share in 2024, driven by the convenience of purchase, wider product variety, and increasing e-commerce penetration worldwide.

Specialty stores is expected to witness fastest growth rate from 2025 to 2032, supported by the rising number of health and beauty-focused retail outlets and growing consumer demand for premium and niche formulations containing caprylyl glycol.

- By End User

On the basis of end user, the market is segmented into men, women, and children. The women segment dominated the market with the highest revenue share in 2024, attributed to the greater consumption of skincare and haircare products among women, which frequently contain caprylyl glycol as a preservative and moisturizing agent.

The children segment is expected to witness fastest growth rate from 2025 to 2032, driven by increasing awareness among parents regarding the use of gentle and safe ingredients in baby care and pediatric skin formulations.

- By Application

On the basis of application, the market is segmented into hair care products, skin care products, wet wipes, toiletries, and others. The skin care products segment held the largest market revenue share in 2024, fueled by the growing use of caprylyl glycol in creams, lotions, and serums for its antimicrobial and moisturizing properties.

The wet wipes segment is expected to witness fastest growth rate from 2025 to 2032, supported by the increasing use of caprylyl glycol as a preservative in disposable wipes for personal hygiene and cosmetic removal, driven by rising hygiene awareness and convenience trends worldwide.

Caprylyl Glycol Market Regional Analysis

• North America dominated the global caprylyl glycol market with the largest revenue share of 39.5% in 2024, driven by the high demand for personal care products and increasing consumer preference for multifunctional cosmetic ingredients.

• The region benefits from advanced manufacturing capabilities, stringent product quality standards, and widespread adoption of natural and synthetic preservatives in skincare, haircare, and hygiene products.

• Rising awareness about product safety, coupled with strong distribution networks and growth in e-commerce platforms, supports market expansion across both cosmetic and industrial applications in North America.

U.S. Caprylyl Glycol Market Insight

The U.S. caprylyl glycol market held the largest revenue share within North America in 2024, propelled by the rising demand for clean-label and preservative-enhanced cosmetic formulations. Consumers are increasingly seeking products with effective yet gentle ingredients, bolstering the use of caprylyl glycol in skincare, haircare, and baby care items. Strong research and development activities, combined with the presence of key manufacturers and suppliers, further drive market growth.

Europe Caprylyl Glycol Market Insight

The Europe caprylyl glycol market is expected to witness fastest growth rate from 2025 to 2032, owing to the growing demand for natural and sustainable ingredients in personal care and cosmetic formulations. The region’s regulatory framework emphasizing ingredient safety and eco-friendly formulations encourages the adoption of caprylyl glycol as a preservative booster and skin-conditioning agent. Increasing consumer inclination toward premium beauty products and rising industrial applications contribute to the market’s growth.

U.K. Caprylyl Glycol Market Insight

The U.K. caprylyl glycol market is expected to witness fastest growth rate from 2025 to 2032, driven by the country’s increasing focus on personal care innovation and rising demand for natural cosmetic ingredients. Consumers and manufacturers alike are prioritizing ingredient transparency and safety, fueling the integration of caprylyl glycol in skincare, haircare, and wet wipe products. The expansion of online retail and specialty stores further enhances product accessibility across the U.K. market.

Germany Caprylyl Glycol Market Insight

The Germany caprylyl glycol market is expected to witness fastest growth rate from 2025 to 2032, supported by the country’s emphasis on sustainability, product efficacy, and stringent regulations governing cosmetics and industrial chemicals. Germany’s well-established cosmetic industry and rising consumer awareness about ingredient benefits promote the usage of caprylyl glycol in various applications. Moreover, demand for multifunctional preservatives aligns with the preferences of both manufacturers and end users.

Asia-Pacific Caprylyl Glycol Market Insight

The Asia-Pacific caprylyl glycol market is expected to witness fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and expanding personal care and hygiene industries in countries such as China, Japan, and India. Increasing adoption of cosmetic and industrial products containing multifunctional preservatives, along with government initiatives supporting manufacturing and innovation, propels the market in the region.

Japan Caprylyl Glycol Market Insight

The Japan caprylyl glycol market is expected to witness fastest growth rate from 2025 to 2032, influenced by the country’s advanced cosmetic industry and consumer preference for high-quality, multifunctional ingredients. Japan’s aging population and demand for gentle, effective skin and hair care solutions foster increased usage of caprylyl glycol in personal care formulations. In addition, innovation in wet wipes and toiletries sectors supports market expansion.

China Caprylyl Glycol Market Insight

China accounted for the largest revenue share in the Asia-Pacific caprylyl glycol market in 2024, driven by a burgeoning middle class, rapid industrialization, and rising consumption of personal care and hygiene products. The country’s strong domestic manufacturing base, favorable regulatory environment, and increasing exports of cosmetics and toiletries containing caprylyl glycol are key factors fueling market growth. The push towards innovation and clean-label formulations further enhances product demand across China.

Caprylyl Glycol Market Share

The Caprylyl Glycol industry is primarily led by well-established companies, including:

- Ashland (U.S.)

- BASF SE (Germany)

- Symrise (Germany)

- Inolex, Inc. (U.S.)

- Lonza (Switzerland)

- Evonik Industries AG (Germany)

- Dow (U.S.)

- CLARIANT (Switzerland)

- Lotioncrafter (U.S.)

- Thor Personal Care (U.K.)

Latest Developments in Global Caprylyl Glycol Market

- In April 2022, Symrise introduced a plant-derived version of caprylyl glycol called 1,2-octanediol. This development marks a shift from traditional petrochemical production to a more sustainable, bio-based approach. The ingredient serves as a moisturizing and antimicrobial agent widely used in personal care products. By offering a natural alternative, Symrise aims to meet growing consumer demand for eco-friendly formulations. This innovation is expected to positively impact the personal care market by promoting cleaner, greener ingredient options and supporting sustainability trends

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Caprylyl Glycol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Caprylyl Glycol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Caprylyl Glycol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.