Global Captive Portal Market

Market Size in USD Million

CAGR :

%

USD

990.00 Million

USD

2,755.43 Million

2024

2032

USD

990.00 Million

USD

2,755.43 Million

2024

2032

| 2025 –2032 | |

| USD 990.00 Million | |

| USD 2,755.43 Million | |

|

|

|

|

Captive Portal Market Size

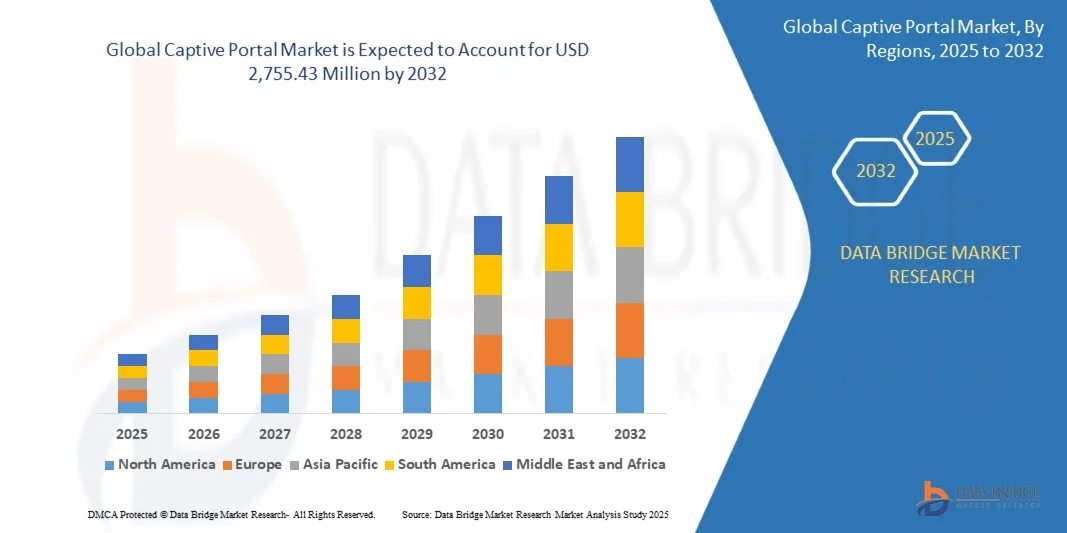

- The global captive portal market size was valued at USD 990.00 million in 2024 and is expected to reach USD 2,755.43 million by 2032, at a CAGR of 13.65% during the forecast period

- The market growth is largely fuelled by the increasing adoption of Wi-Fi networks in public spaces, rising demand for secure user authentication, and growing need for personalized digital experiences

Captive Portal Market Analysis

- The market is witnessing significant growth due to the widespread deployment of public and enterprise Wi-Fi networks, which require secure access management and user engagement solutions

- Increasing focus on customer analytics, targeted advertising, and improved network security is driving investment in advanced captive portal solutions

- North America dominated the captive portal market with the largest revenue share of 40.50% in 2024, driven by the growing demand for secure public Wi-Fi networks, advanced user engagement, and enterprise network monitoring

- Asia-Pacific region is expected to witness the highest growth rate in the global captive portal market, driven by rising internet penetration, expanding smart city initiatives, and increasing demand for secure and managed network access across hospitality, retail, and corporate sectors

- The solution segment held the largest market revenue share in 2024 driven by the increasing adoption of secure authentication systems and network management tools. Captive portal solutions often provide seamless user access, analytics, and integration with backend IT systems, making them a popular choice for enterprises and public venues

Report Scope and Captive Portal Market Segmentation

|

Attributes |

Captive Portal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Captive Portal Market Trends

“Rise of Cloud-Based and Personalized Captive Portal Solutions”

- The growing adoption of cloud-based captive portal solutions is transforming the network access management landscape by enabling real-time user authentication and monitoring. These platforms allow immediate control of connected devices, especially in public Wi-Fi hotspots and enterprise networks, resulting in improved user experience and reduced security risks

- The high demand for personalized and secure network access in commercial and hospitality sectors is accelerating the deployment of AI-driven and automated captive portal systems. These solutions are particularly effective where multiple users require differentiated access and monitoring, helping reduce unauthorized usage and ensure compliance with policies. The trend is further supported by businesses seeking enhanced customer engagement and analytics

- The affordability and ease of deployment of modern captive portal platforms are making them attractive for small and medium-sized enterprises, leading to improved network management. Organizations benefit from faster onboarding, centralized administration, and lower IT support requirements, which ultimately enhances operational efficiency

- For instance, in 2023, several hotel chains in Southeast Asia reported increased guest satisfaction and reduced network abuse after implementing intelligent captive portal systems developed by regional technology providers. These portals enabled personalized login experiences, improved security, and enhanced analytics for marketing purposes

- While captive portals are accelerating secure and efficient network access, their impact depends on continued innovation, integration with backend systems, and user education. Providers must focus on AI integration, customizable interfaces, and multi-platform support to fully capitalize on growing demand

Captive Portal Market Dynamics

Driver

“Increasing Demand for Secure Network Access and Enhanced User Engagement”

- The rise in public Wi-Fi usage and connected devices is pushing organizations to adopt captive portal solutions that ensure secure authentication, compliance, and differentiated access. This leads to reduced unauthorized usage and improved network monitoring, encouraging investment in advanced portals. In addition, enterprises are leveraging captive portals to enhance operational efficiency by managing multiple devices across large venues, providing better control and oversight

- Businesses are increasingly aware of the operational benefits associated with captive portals, including real-time analytics, targeted promotions, and customer engagement. This awareness is driving higher adoption across hospitality, retail, and corporate sectors. In addition, captive portals enable organizations to collect valuable user data, enhance marketing strategies, and optimize network performance while improving overall customer satisfaction

- Government regulations and industry standards promoting secure public networks are fostering investments in captive portal technologies. From compliance with data privacy regulations to cybersecurity frameworks, supportive policies are enabling faster deployment of advanced portals. In addition, regulatory encouragement ensures standardized implementation across public and private venues, increasing trust in captive portal solutions

- For instance, in 2022, several European airports implemented AI-driven captive portals to manage passenger connectivity, boosting adoption among enterprises and public venues seeking secure and monitored access. These implementations also helped streamline network operations, reduce IT overhead, and deliver personalized digital experiences to users, enhancing overall service quality

- While secure network access and regulatory support are driving the market, challenges such as integration complexity, data privacy concerns, and network scalability must be addressed for sustained adoption. In addition, organizations must ensure interoperability with existing IT systems, provide user training, and continuously monitor cybersecurity risks to maintain trust and reliability

Restraint/Challenge

“High Implementation Costs and Limited Technical Expertise”

- The high price of advanced captive portal systems, including AI-based authentication and analytics platforms, limits accessibility for small enterprises and organizations with limited IT budgets. Capital-intensive investments remain a significant barrier to widespread deployment. In addition, ongoing maintenance, software updates, and licensing costs add to the total cost of ownership, discouraging small-scale adoption

- Many organizations lack trained personnel capable of implementing, configuring, and maintaining sophisticated captive portal solutions. The absence of technical expertise and supporting infrastructure further reduces adoption, particularly in developing regions. In addition, the shortage of skilled IT professionals can lead to misconfigurations, network downtime, and suboptimal performance, reducing the perceived value of the technology

- Integration challenges with existing network infrastructure, backend databases, and CRM systems can hinder seamless deployment and performance. Variability in network conditions and device compatibility may increase operational complexity and costs. In addition, legacy system constraints and limited vendor support can slow rollout timelines and affect scalability across multiple sites

- For instance, in 2023, several SMEs in Sub-Saharan Africa reported delays in deploying captive portal solutions due to insufficient technical support, fragmented IT infrastructure, and high installation costs. These delays also impacted customer experience, network reliability, and the ability to leverage advanced analytics for business decisions

- While captive portal technologies continue to advance, addressing cost, technical expertise, and integration challenges is crucial. Market stakeholders must focus on scalable solutions, training programs, and simplified deployment to expand adoption and ensure sustainable growth. In addition, collaboration with managed service providers and local IT partners can help overcome skill gaps and accelerate implementation

Captive Portal Market Scope

The captive portal market is segmented on the basis of component, deployment mode, application, and end-use

• By Component

On the basis of component, the captive portal market is segmented into solution and services. The solution segment held the largest market revenue share in 2024 driven by the increasing adoption of secure authentication systems and network management tools. Captive portal solutions often provide seamless user access, analytics, and integration with backend IT systems, making them a popular choice for enterprises and public venues.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for managed services, installation, and maintenance support. Services offerings are particularly preferred by organizations lacking in-house IT expertise, as they provide technical assistance, continuous monitoring, and optimized performance for captive portal deployments.

• By Deployment Mode

On the basis of deployment mode, the captive portal market is segmented into cloud and on-premises. The cloud segment held the largest revenue share in 2024 owing to its ease of deployment, scalability, and remote management capabilities. Cloud-based captive portals enable enterprises to efficiently manage multiple locations, reduce IT infrastructure costs, and ensure real-time analytics and updates.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, driven by organizations requiring enhanced data security, compliance with regulations, and control over network infrastructure. On-premises deployments are particularly popular in sectors with sensitive information and strict regulatory requirements, providing full control over captive portal operations.

• By Application

On the basis of application, the captive portal market is segmented into Wi-Fi management, content filtering, device management, and bandwidth management. The Wi-Fi management segment held the largest market revenue share in 2024 due to the growing need to authenticate users, manage access, and monitor network usage efficiently. Wi-Fi management portals enhance user experience and provide businesses with insights for operational improvements.

The device management segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising number of connected devices and BYOD policies in enterprises. Device management solutions allow administrators to monitor, control, and secure devices accessing the network, ensuring better security and optimized performance.

• By End-use

On the basis of end-use, the captive portal market is segmented into hospitality, retail, healthcare, education, transportation, public venues, and corporate/enterprise offices. The hospitality segment held the largest market revenue share in 2024 owing to the increasing demand for guest Wi-Fi access, customer engagement, and personalized experiences. Captive portals in hotels and resorts enable businesses to collect data, offer promotions, and enhance guest satisfaction.

The corporate/enterprise offices segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for secure network access, BYOD support, and employee monitoring. Enterprises are increasingly adopting captive portal solutions to ensure compliance, enhance network security, and improve workforce productivity.

Captive Portal Market Regional Analysis

- North America dominated the captive portal market with the largest revenue share of 40.50% in 2024, driven by the growing demand for secure public Wi-Fi networks, advanced user engagement, and enterprise network monitoring

- The adoption of connected devices and increasing investment in smart city initiatives are further boosting market growth, while strong IT infrastructure and regulatory support create favorable conditions for captive portal deployment

- In addition, North American organizations are increasingly prioritizing data privacy and network security, encouraging widespread adoption across commercial and public venues

U.S. Captive Portal Market Insight

The U.S. captive portal market captured the largest revenue share in 2024 within North America, fueled by the rising adoption of cloud-based solutions and AI-enabled analytics platforms. Organizations are increasingly implementing captive portals to ensure secure authentication, monitor network usage, and deliver personalized user experiences. The expansion of Wi-Fi networks in hospitality, retail, and transportation sectors, along with government support for cybersecurity compliance, is further propelling the market. In addition, ongoing investments in IoT and smart city initiatives are enhancing opportunities for advanced captive portal solutions.

Europe Captive Portal Market Insight

The Europe captive portal market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent data privacy regulations, rising adoption of cloud-based network management solutions, and the growing need for secure guest Wi-Fi in commercial establishments. Organizations across retail, education, and public venues are increasingly leveraging captive portals to monitor network usage and deliver targeted services. In addition, European enterprises are prioritizing seamless user authentication and analytics, further supporting market expansion across key countries such as Germany, France, and the U.K.

U.K. Captive Portal Market Insight

The U.K. captive portal market is expected to witness significant growth from 2025 to 2032, driven by increasing deployment of secure public Wi-Fi networks and demand for enhanced user engagement. Enterprises are implementing captive portals to ensure compliance with GDPR, provide personalized marketing, and monitor bandwidth utilization. In addition, the country’s advanced IT infrastructure, strong digital economy, and high adoption of connected devices are expected to stimulate market growth across hospitality, retail, and corporate sectors, creating a favorable environment for innovative solutions.

Germany Captive Portal Market Insight

The Germany captive portal market is expected to witness rapid growth from 2025 to 2032, fueled by increasing awareness of network security, robust IT infrastructure, and the rising adoption of cloud-based network management solutions. Organizations are leveraging captive portals to enhance customer experiences, improve compliance, and optimize bandwidth usage. In addition, government regulations promoting secure public networks and the expansion of smart city initiatives are driving captive portal deployment across commercial, transportation, and public venues, strengthening overall market potential.

Asia-Pacific Captive Portal Market Insight

The Asia-Pacific captive portal market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising urbanization, growing adoption of Wi-Fi networks, and rapid digital transformation across countries such as China, Japan, India, and Australia. Enterprises and public venues are increasingly deploying captive portals for secure network access, user analytics, and bandwidth management. In addition, government initiatives supporting smart cities, technological advancements, and increased ICT infrastructure investments are expanding market opportunities and driving adoption across hospitality, education, and corporate sectors.

Japan Captive Portal Market Insight

The Japan captive portal market is expected to witness robust growth from 2025 to 2032, due to the country’s high adoption of connected devices, extensive public Wi-Fi deployment, and increasing focus on cybersecurity. Organizations are implementing captive portals to monitor network usage, enhance guest experience, and comply with local data privacy regulations. In addition, the aging population and the rise of smart buildings are encouraging investments in user-friendly and secure captive portal solutions across residential, commercial, and public sectors.

China Captive Portal Market Insight

The China captive portal market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, widespread adoption of mobile devices, and expanding commercial Wi-Fi networks. Captive portals are increasingly implemented for secure authentication, content filtering, and enhanced user engagement across retail, hospitality, and transportation sectors. In addition, the government’s push for smart city development and the growth of cloud-based services are creating strong opportunities for innovative captive portal deployments, driving market expansion across the region.

Captive Portal Market Share

The Captive Portal industry is primarily led by well-established companies, including:

- Cisco Systems (U.S.)

- Hewlett Packard Enterprise Development (U.S.)

- Extreme Networks (U.S.)

- Arista Networks (U.S.)

- Juniper Networks (U.S.)

- Purple (U.K.)

- Cloud4Wi (U.S.)

- IronWifi (U.S.)

- Netgear (U.S.)

- GlobalReach (U.S.)

- GoZone WiFi (U.S.)

- Adentro (U.S.)

- Spotipo (U.S.)

- Boingo (U.S.)

- Datavalet (Canada)

- ray.life (U.K.)

Latest Developments in Global Captive Portal Market

- In May 2024, Astound Business Solutions launched a new Wi-Fi networking solution, Wi-Fi Pro for Small Businesses, powered by eero, to deliver fast, secure, and scalable internet connectivity for businesses with up to 50 employees. The solution features eero’s mesh Wi-Fi technology and an integrated captive portal that allows branded guest Wi-Fi experiences, customizable splash pages, guest access controls, and bandwidth management. This development enhances network security, improves user engagement, and enables small businesses to efficiently manage and personalize guest networks, positively impacting the adoption of advanced Wi-Fi solutions in the small business segment

- In September 2023, Authentic introduced its "Captive in a Box" platform following a USD 5.5 million seed funding round led by Slow Ventures. The turnkey captive insurance solution is designed for vertical SaaS companies, franchises, and associations, handling legal, underwriting, reinsurance, and claims management logistics. This initiative simplifies captive insurance program deployment, reduces operational complexity, and encourages wider adoption of self-managed insurance solutions in niche markets

- In May 2023, Juniper Networks launched the Mist Access Assurance service, integrating cloud-native network access control (NAC) with AI-powered automation to enhance network security, streamline operations, and enable scalable management. Leveraging Mist AI, the service optimizes user connectivity, enforces network policies efficiently, and improves operational performance, driving increased adoption of AI-enabled network management solutions across enterprises

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.