Global Car Accessories Market

Market Size in USD Billion

CAGR :

%

USD

470.07 Billion

USD

766.35 Billion

2024

2032

USD

470.07 Billion

USD

766.35 Billion

2024

2032

| 2025 –2032 | |

| USD 470.07 Billion | |

| USD 766.35 Billion | |

|

|

|

|

Car Accessories Market Size

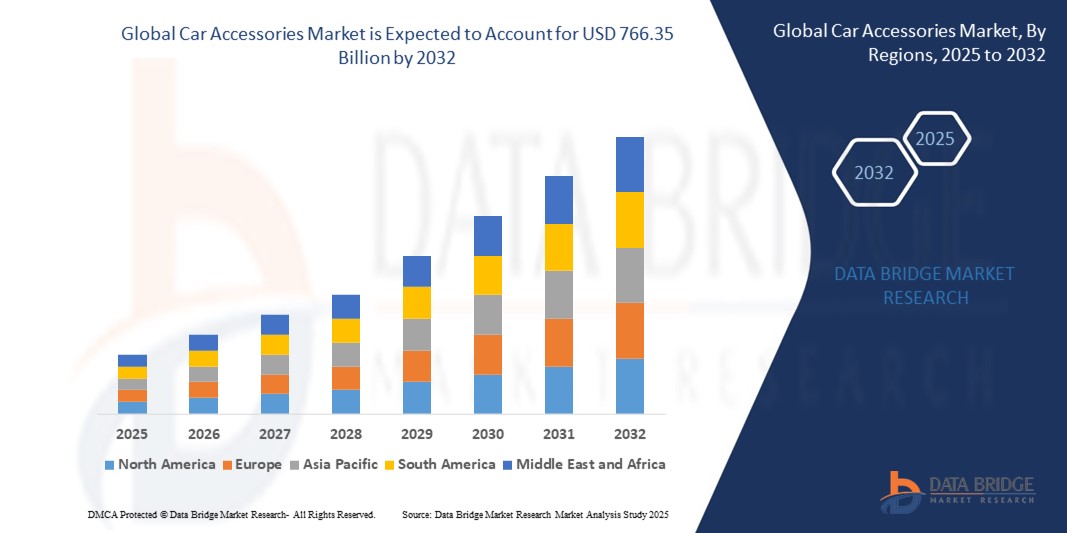

- The global car accessories market size was valued at USD 470.07 billion in 2024 and is expected to reach USD 766.35 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is primarily driven by increasing consumer demand for vehicle customization, enhanced driving comfort, and advanced safety features, coupled with rising vehicle ownership globally

- Growing awareness of vehicle aesthetics, safety, and performance enhancements is boosting the demand for car accessories across OEM and aftermarket channels

Car Accessories Market Analysis

- The car accessories market is experiencing robust growth due to rising consumer interest in personalization, safety, and comfort features that enhance vehicle functionality and appearance

- Demand is increasing across various vehicle segments, including sedans, SUVs, and pickup trucks, encouraging manufacturers to innovate with high-quality, durable, and technologically advanced accessories

- Asia-Pacific dominates the car accessories market with the largest revenue share of 38.9% in 2024, driven by high vehicle production, rising disposable incomes, and growing consumer preference for vehicle customization in countries such as China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period, fueled by increasing demand for advanced safety and performance accessories, a strong aftermarket presence, and growing adoption of electric and luxury vehicles

- The interior accessories segment dominated the largest market revenue share of 58.25% in 2024, driven by consumer demand for enhanced in-car comfort and aesthetics. Products such as seat covers, floor mats, and infotainment systems are highly sought after for their ability to personalize vehicle interiors and improve the driving experience

Report Scope and Car Accessories Market Segmentation

|

Attributes |

Car Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Car Accessories Market Trends

Increasing Integration of Smart Technologies and Connectivity

- The global car accessories market is experiencing a significant trend toward the integration of smart technologies and connectivity features in accessories

- Advanced technologies, such as AI-powered infotainment systems, IoT-enabled devices, and smartphone-integrated accessories, are enhancing user experience by offering seamless connectivity, real-time data, and personalized features

- For instance, companies are developing accessories such as AI-driven dash cams with real-time hazard detection and GPS navigation systems with voice recognition, improving both safety and convenience

- Smart accessories, such as wireless charging pads and Bluetooth-enabled audio systems, are gaining popularity, particularly among tech-savvy consumers in regions such as Asia-Pacific and North America

- This trend is driven by the growing demand for connected vehicles, with over 65% of new vehicles equipped with AI-driven infotainment systems in 2023, according to industry reports

- These advancements are making car accessories more appealing to both individual consumers and fleet operators, enhancing vehicle functionality and user engagement

Car Accessories Market Dynamics

Driver

Rising Demand for Vehicle Personalization and Advanced Safety Features

- The increasing consumer preference for vehicle personalization is a major driver of the global car accessories market, with consumers seeking to enhance aesthetics, comfort, and functionality through accessories such as custom seat covers, alloy wheels, and LED lighting

- Safety and security accessories, such as dash cams, parking sensors, and anti-theft devices, are in high demand due to growing awareness of vehicle safety and government regulations mandating advanced safety features in regions such as Europe and Asia-Pacific

- The proliferation of e-commerce platforms, particularly in Asia-Pacific, which dominates the market, has made accessories more accessible, driving sales through online stores and specialty retailers

- The rise of electric vehicles (EVs) is fueling demand for EV-compatible accessories, such as fast-charging cables and lightweight aerodynamic enhancements, especially in North America, the fastest-growing region

- Automakers are increasingly offering factory-fitted accessories, such as infotainment systems and ambient lighting, as standard or optional features to meet consumer expectations and enhance vehicle value

Restraint/Challenge

High Costs of Premium Accessories and Counterfeit Products

- The high initial costs of premium accessories, such as advanced infotainment systems, performance parts, and smart security devices, can deter adoption, particularly in price-sensitive markets such as parts of Asia-Pacific and Latin America

- The complexity and cost of integrating advanced accessories into existing vehicles pose challenges, especially for older vehicle models or budget-conscious consumers

- The prevalence of counterfeit and low-quality accessories in the aftermarket, particularly through online distribution channels, undermines consumer trust and brand reputation, posing a significant challenge to market growth

- Data security concerns related to connected accessories, such as GPS trackers and smart infotainment systems, raise privacy issues, with fragmented regulations across regions complicating compliance for manufacturers and retailers

- These factors can limit market expansion, particularly in regions with high cost sensitivity or stringent regulatory environments

Car Accessories market Scope

The market is segmented on the basis of product type, vehicle type, market material, distribution channel, and application.

- By Product Type

On the basis of product type, the global car accessories market is segmented into interior accessories, exterior accessories, comfort and convenience accessories, safety and security accessories, and performance accessories. The interior accessories segment dominated the largest market revenue share of 58.25% in 2024, driven by consumer demand for enhanced in-car comfort and aesthetics. Products such as seat covers, floor mats, and infotainment systems are highly sought after for their ability to personalize vehicle interiors and improve the driving experience. Their ease of installation and wide variety of design options make them a preferred choice for individual vehicle owners seeking customization.

The exterior accessories segment is expected to register the fastest growth rate from 2025 to 2032, propelled by rising consumer interest in vehicle personalization and functional enhancements. Exterior accessories, including alloy wheels, body kits, and LED lighting, cater to both aesthetic appeal and practical benefits such as improved aerodynamics and visibility. The growing popularity of SUVs and electric vehicles (EVs) further drives demand for lightweight, EV-compatible exterior designs that enhance range and style.

- By Vehicle Type

On the basis of vehicle type, the global car accessories market is categorized into sedan, SUV, hatchback, MPV, and pickup truck. The SUV segment accounted for the highest revenue share in 2024, fueled by the global surge in SUV and crossover sales, particularly in urban and emerging markets. SUVs require specialized accessories such as roof racks, running boards, and protective cladding, which cater to both lifestyle needs and vehicle protection. The versatility and popularity of SUVs make them a key driver of accessory demand across regions.

The electric vehicle (EV) segment, while not explicitly listed, is anticipated to grow at the fastest CAGR from 2025 to 2032, as the adoption of EVs accelerates globally. The increasing need for EV-specific accessories, such as charging cables, battery management systems, and aerodynamic enhancements, supports this growth. The shift toward sustainable and connected vehicles further amplifies demand for accessories tailored to EVs and hybrid models.

- By Market Material

On the basis of market material, the global car accessories market is segmented into plastic, metal, leather, fabric, and rubber. The plastic segment held the largest revenue share in 2024, accounting for approximately 50.23% of the market, due to its cost-effectiveness, durability, and versatility in manufacturing a wide range of accessories, from dashboard covers to exterior trims. Plastic’s lightweight properties also align with the growing demand for EV-compatible accessories that minimize range penalties.

The leather segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by consumer preference for premium, luxurious interior accessories. Leather seat covers, steering wheel wraps, and interior trims appeal to high-end vehicle owners and those seeking to enhance the aesthetic and tactile quality of their vehicle interiors. The rise of vegan and synthetic leather alternatives further supports this segment’s growth, catering to environmentally conscious consumers.

- By Distribution Channel

On the basis of distribution channel, the global car accessories market is segmented into online stores, brick-and-mortar stores, OEM sales, aftermarket sales, and specialty retailers. The OEM sales segment dominated the market in 2024, with a 76.25% revenue share, due to the trust in factory-approved accessories and their integration with vehicle warranties. OEMs leverage connected-car technologies to offer subscription-based accessory features, ensuring seamless compatibility and brand consistency.

The online stores segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the convenience of e-commerce platforms and the availability of AI-driven fitment tools. Online retail offers a broader product selection, competitive pricing, and global reach, enabling smaller brands to compete with established players. The rise of digital marketplaces and increasing consumer trust in online purchasing further accelerate this segment’s growth.

- By Application

On the basis of application, the global car accessories market is segmented into comfort, convenience, safety, security, performance, and styling. The comfort segment held the largest revenue share in 2024, driven by the demand for accessories such as ergonomic seat covers, ambient lighting, and advanced infotainment systems that enhance the in-car experience. The focus on long-term vehicle ownership and consumer preference for luxurious driving experiences fuel this segment’s dominance.

The safety segment is projected to grow at the fastest CAGR from 2025 to 2032, propelled by increasing regulatory requirements and consumer awareness of vehicle safety. Accessories such as advanced driver-assistance systems (ADAS), dash cams, and GPS trackers are critical for improving road safety and reducing crash rates. The integration of smart technologies, such as real-time hazard detection and biometric authentication, further drives demand for safety-focused accessories.

Car Accessories Market Regional Analysis

- Asia-Pacific dominates the car accessories market with the largest revenue share of 38.9% in 2024, driven by high vehicle production, rising disposable incomes, and growing consumer preference for vehicle customization in countries such as China, India, and Japan

- The demand for interior and exterior accessories, such as seat covers, alloy wheels, and body kits, is fueled by a growing middle class and increasing vehicle ownership

- Safety and security accessories, such as dash cams and GPS systems, are gaining traction due to heightened awareness of road safety and government initiatives promoting energy efficiency.

Japan Car Accessories Market Insight

Japan’s car accessories market is thriving, driven by consumer demand for technologically advanced products that enhance comfort, safety, and styling. Comfort and convenience accessories, such as touchscreen infotainment systems and ambient lighting, are popular, alongside safety accessories such as advanced driver-assistance systems (ADAS). The presence of major automotive manufacturers and a strong OEM market accelerate the integration of high-quality accessories. Aftermarket customization is also growing, supported by a tech-savvy consumer base.

China Car Accessories Market Insight

China holds the largest share of the Asia-Pacific car accessories market, propelled by rapid urbanization, increasing vehicle ownership, and a focus on vehicle aesthetics and functionality. Interior accessories, such as premium seat covers and air purifiers, and exterior accessories, such as spoilers and window films, are in high demand. The market is supported by strong domestic manufacturing capabilities, competitive pricing, and a growing e-commerce sector. Rising consumer awareness of safety and eco-friendly materials further drives adoption of advanced accessories.

U.S. Car Accessories Market Insight

The U.S. car accessories market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer interest in vehicle personalization. Products such as safety and security accessories, including dash cams and GPS trackers, and comfort accessories, such as ergonomic seat covers, are highly sought after. The trend toward eco-friendly materials, such as sustainable fabrics and vegan leather, aligns with environmental awareness. A well-established e-commerce infrastructure and increasing OEM integration of advanced accessories further propel market growth.

North America Car Accessories Market Insight

North America is the fastest-growing region in the global car accessories market, driven by high vehicle ownership rates and a strong consumer preference for personalization. The demand for interior accessories, such as seat covers and infotainment systems, and exterior accessories, such as alloy wheels and body kits, is fueled by a culture of vehicle customization. The region benefits from technological advancements, including smart and connected accessories, and a robust e-commerce ecosystem that enhances accessibility. The U.S. dominates the North American market, supported by a mature automotive industry and increasing adoption of safety and performance accessories.

Europe Car Accessories Market Insight

The Europe car accessories market is experiencing steady growth, driven by stringent safety regulations and consumer demand for comfort and styling enhancements. Interior accessories, such as premium floor mats and infotainment systems, dominate due to their role in improving driving experience. The adoption of eco-friendly materials, such as recyclable plastics and fabrics, is gaining traction, particularly in countries such as Germany and France. The aftermarket segment is expanding, supported by e-commerce platforms and a focus on vehicle aesthetics and functionality.

U.K. Car Accessories Market Insight

The U.K. market for car accessories is growing steadily, driven by consumer interest in comfort and convenience accessories, such as wireless charging pads and advanced navigation systems. Safety and security accessories, including parking sensors and alarms, are also in demand due to urban driving conditions and regulatory compliance. The popularity of vehicle customization among younger demographics and the rise of online retail channels contribute to market expansion, with a focus on stylish and sustainable products.

Germany Car Accessories Market Insight

Germany is a key player in the European car accessories market, driven by its advanced automotive industry and consumer preference for high-quality, performance-oriented products. Performance accessories, such as suspension upgrades and exhaust systems, and safety accessories, such as ADAS-compatible components, are popular. The market benefits from Germany’s focus on energy efficiency and technological innovation, with premium vehicles increasingly integrating advanced accessories. The aftermarket segment thrives due to strong demand for customization and eco-friendly materials.

Car Accessories Market Share

The car accessories industry is primarily led by well-established companies, including:

- Adient PLC (Ireland)

- Grupo Antolin (Spain)

- Panasonic Corporation (Japan)

- Faurecia (France)

- Lear Corporation (U.S.)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Harman International Industries Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Kenwood Corporation (Japan)

- Alpine (Japan)

- Yazaki Corporation (Japan)

- Tokai Rika (Japan)

- Bosch (Germany)

- Martinrea International (Canada)

- TS Tech (Japan)

- Aisin Seiki (Japan)

What are the Recent Developments in Global Car Accessories Market?

- In July 2024, Tesla launched a new aftermarket parts and accessories store, directly addressing the growing demand among Tesla owners for customization and vehicle-specific components. This initiative expands Tesla’s presence in the aftermarket sector, offering a curated selection of interior upgrades, exterior enhancements, and performance accessories tailored to models such as the Model 3, Model Y, Model S, and Model X. By providing official parts and design-focused options, Tesla aims to improve the ownership experience and support personalization while maintaining quality and compatibility standards

- In April 2024, Antolin and VIA optronics AG introduced their innovative Sunrise vehicle cockpit concept at the Embedded World exhibition in Nuremberg, Germany. This collaboration showcases a cutting-edge approach to automotive interiors, featuring seamless transitions between manual and autonomous driving modes. The Sunrise cockpit integrates sleek, minimalist design with smart surfaces, immersive ambient lighting, and advanced interactive displays across various interior components. It also emphasizes sustainable materials and enhanced safety to reduce driver distraction. This launch reflects the growing trend of merging digital technology with physical design to elevate the in-car user experience

- In February 2024, Thule Group, a leading manufacturer of roof racks and cargo carriers, launched the Thule Caprock, a modular roof platform engineered for off-road enthusiasts and adventure seekers. Designed to meet the rising demand for SUV and crossover accessories, the Caprock offers a rugged yet stylish solution for transporting bulky gear. Its versatile design includes integrated T-slots and multiple mounting options, allowing users to attach rooftop tents, light bars, and other overlanding essentials. Available in various sizes, the Caprock enhances vehicle utility while maintaining aerodynamic efficiency and durability for outdoor expeditions

- In January 2024, Viper, a leader in vehicle security systems, launched a new remote start and security system featuring full smartphone integration. This advanced system allows users to control vehicle functions—such as locking/unlocking doors, starting the engine, and opening the trunk—directly from their mobile devices via the Viper SmartStart app. It also includes real-time vehicle status updates, GPS tracking, and enhanced safety features such as Starter Kill and shock sensors. The launch reflects the growing demand for connected car technologies that improve both security and convenience for modern drivers

- In November 2023, Ford announced a strategic partnership with Stratasys to develop 3D-printed interior and exterior vehicle parts, leveraging Stratasys’ Infinite Build 3D printing technology. This collaboration aims to accelerate production timelines, reduce tooling costs, and enable greater customization for consumers. The system allows for the creation of large, lightweight components such as spoilers and center consoles, which can improve fuel efficiency and support low-volume manufacturing. Ford’s adoption of additive manufacturing reflects a broader industry shift toward flexible, digital production methods that enhance design agility and personalization in automotive engineering

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.