Global Car Batteries Market

Market Size in USD Million

CAGR :

%

USD

636.93 Million

USD

1,170.21 Million

2024

2032

USD

636.93 Million

USD

1,170.21 Million

2024

2032

| 2025 –2032 | |

| USD 636.93 Million | |

| USD 1,170.21 Million | |

|

|

|

|

Car Batteries Market Size

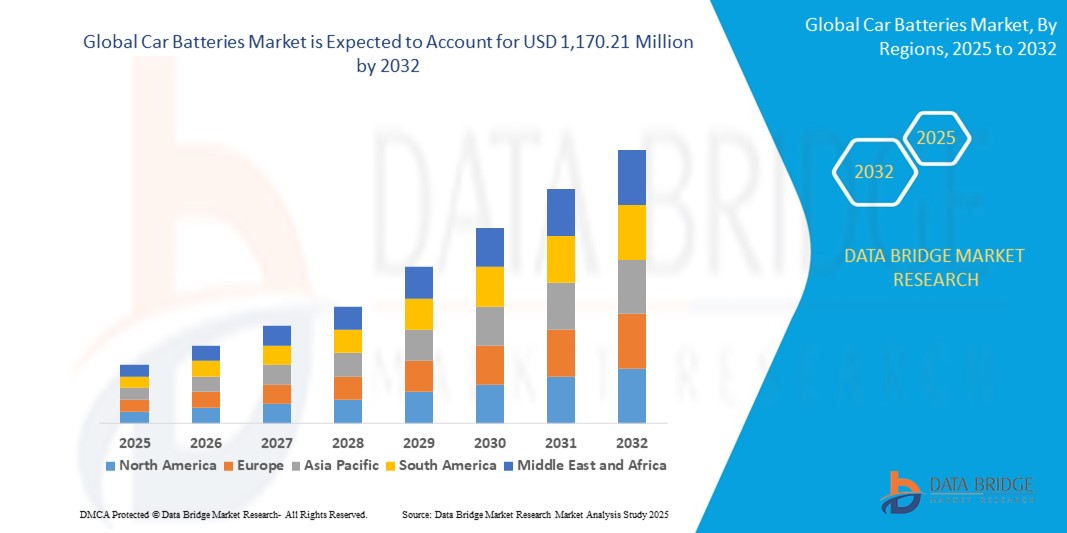

- The global car batteries market size was valued at USD 636.93 million in 2024 and is expected to reach USD 1,170.21 million by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is driven by the rising adoption of electric vehicles (EVs), increasing demand for advanced battery technologies, and the need for reliable power sources for vehicle start, lighting, and ignition systems

- Growing consumer awareness of energy efficiency, environmental concerns, and advancements in battery performance are further propelling demand across OEM and aftermarket channels

Car Batteries Market Analysis

- The car batteries market is experiencing robust growth due to the global shift toward electric mobility and the increasing integration of advanced electronics in vehicles

- Demand is rising across both passenger and commercial vehicle segments, encouraging manufacturers to innovate with high-performance, long-lasting, and eco-friendly battery solutions

- North America dominated the car batteries market with the largest revenue share of 39.2% in 2024, driven by a well-established automotive industry, high EV adoption, and stringent regulations promoting sustainable energy solutions

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing vehicle production, and rising demand for EVs in countries such as China, Japan, India, and South Korea

- The lithium-ion segment held the largest market revenue share of 55% in 2024, driven by its high energy density, longer lifespan, and increasing adoption in electric vehicles. Lithium-ion batteries are preferred for their lightweight design and efficiency, making them ideal for EVs and hybrid vehicles

Report Scope and Car Batteries Market Segmentation

|

Attributes |

Car Batteries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Car Batteries Market Trends

Increasing Adoption of Advanced Battery Technologies

- The global car batteries market is experiencing a significant trend toward the adoption of advanced battery technologies, particularly lithium-ion and emerging sodium-ion batteries

- These technologies offer higher energy density, longer lifespan, and faster charging capabilities compared to traditional lead-acid batteries

- Lithium-ion batteries are increasingly used in electric vehicles (EVs) due to their lightweight design and ability to support extended driving ranges

- For instance, companies such as CATL and BYD are developing high-performance lithium-ion batteries, such as LFP (lithium iron phosphate) and NMC (nickel manganese cobalt), to enhance EV efficiency and safety

- Sodium-ion batteries are gaining attention for their cost-effectiveness and reduced reliance on critical minerals such as lithium, making them a sustainable alternative for future market growth

- These advancements are driving the transition toward electrification, appealing to both manufacturers and consumers seeking efficient and eco-friendly solutions

Car Batteries Market Dynamics

Driver

Surge in Electric Vehicle Adoption and Government Incentives

- The rising demand for electric vehicles (EVs), driven by consumer preference for sustainable transportation and stringent emission regulations, is a key driver for the global car batteries market

- Government incentives, such as tax credits and subsidies in regions such as North America and Europe, are accelerating EV adoption, boosting demand for lithium-ion and other advanced batteries

- The proliferation of charging infrastructure and advancements in 5G technology enable faster data processing for battery management systems, enhancing performance and user experience

- Automakers are increasingly integrating high-capacity batteries as standard features in EVs to meet consumer expectations for longer ranges and improved vehicle performance

- The growing popularity of hybrid and plug-in hybrid electric vehicles (PHEVs) further fuels demand for batteries that support electric propulsion alongside internal combustion engines

Restraint/Challenge

High Production Costs and Supply Chain Constraints

- The high cost of producing advanced batteries, particularly lithium-ion, due to expensive raw materials such as lithium, cobalt, and nickel, poses a significant barrier to widespread adoption, especially in cost-sensitive markets

- Supply chain disruptions and limited availability of critical minerals can lead to price volatility, impacting manufacturing costs and market growth

- In addition, concerns over battery recycling and disposal present environmental and regulatory challenges, as improper handling can lead to ecological harm

- The complexity of integrating advanced batteries into existing vehicle designs, particularly for retrofitting internal combustion engine (ICE) vehicles, adds to implementation costs

- These factors may slow market expansion in emerging economies, where affordability and infrastructure limitations remain significant hurdles

Car Batteries market Scope

The market is segmented on the basis of battery type, engine type, functions, sales channel, and vehicle type.

- By Battery Type

On the basis of battery type, the global car batteries market is segmented into lithium-ion, lead-acid, nickel, and sodium-ion batteries. The lithium-ion segment held the largest market revenue share of 55% in 2024, driven by its high energy density, longer lifespan, and increasing adoption in electric vehicles. Lithium-ion batteries are preferred for their lightweight design and efficiency, making them ideal for EVs and hybrid vehicles. Their dominance is further supported by advancements in battery technology and declining production costs.

The sodium-ion segment is anticipated to grow at the fastest CAGR from 2025 to 2032, as manufacturers explore cost-effective and sustainable alternatives to lithium-ion batteries. Sodium-ion batteries offer advantages in terms of raw material availability and environmental impact, making them appealing for large-scale EV production and stationary energy storage applications.

- By Engine Type

On the basis of engine type, the global car batteries market is segmented into internal combustion engine (ICE) and electric vehicles (EVs). The ICE segment accounted for the largest revenue share in 2024, driven by the widespread use of lead-acid batteries in conventional vehicles for starting, lighting, and ignition functions. The established automotive market in North America, coupled with high demand for passenger and commercial vehicles, supports the dominance of this segment.

The EV segment is projected to grow at the fastest rate from 2025 to 2032, propelled by global efforts to reduce carbon emissions and the rapid expansion of EV infrastructure. Government incentives, stringent emission regulations, and increasing consumer preference for sustainable mobility are driving demand for advanced batteries, particularly lithium-ion and emerging sodium-ion technologies, in the Asia-Pacific region.

- By Functions

On the basis of functions, the global car batteries market is segmented into electric propulsion, start, lighting, and ignition (SLI). The SLI segment dominated the market in 2024, attributed to the widespread use of lead-acid batteries in ICE vehicles for starting engines and powering lighting and ignition systems. The reliability and cost-effectiveness of lead-acid batteries ensure their continued demand in conventional vehicles, particularly in North America.

The electric propulsion segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising popularity of EVs and the need for high-performance batteries to support electric drivetrains. This segment’s growth is particularly strong in Asia-Pacific, where EV adoption is accelerating due to government policies and investments in charging infrastructure.

- By Sales Channel

On the basis of sales channel, the global car batteries market is segmented into original equipment manufacturer (OEM) and aftermarket channels. The OEM segment held the largest revenue share in 2024, driven by the integration of batteries in new vehicle production, particularly in North America, where major automakers prioritize high-quality, reliable battery systems. Partnerships between battery manufacturers and OEMs ensure seamless integration and compliance with vehicle specifications.

The aftermarket segment is anticipated to grow at the fastest CAGR from 2025 to 2032, as the increasing vehicle parc and aging vehicle fleets drive demand for battery replacements. The Asia-Pacific region’s rapid growth in vehicle ownership, coupled with the rising popularity of EVs, fuels the aftermarket demand for advanced battery technologies.

- By Vehicle Type

On the basis of vehicle type, the global car batteries market is segmented into passenger vehicles, commercial vehicles, and electric vehicles. The passenger vehicle segment accounted for the highest revenue share in 2024, supported by high vehicle ownership rates and the growing adoption of EVs in North America. The demand for reliable and efficient batteries in passenger vehicles is driven by consumer preferences for advanced features and sustainable mobility.

The electric vehicle segment is expected to grow at the fastest rate from 2025 to 2032, fueled by the global shift toward electrification and supportive policies in Asia-Pacific. The increasing production of EVs, coupled with advancements in battery technologies such as lithium-ion and sodium-ion, drives the rapid growth of this segment.

Car Batteries Market Regional Analysis

- North America dominated the car batteries market with the largest revenue share of 39.2% in 2024, driven by a well-established automotive industry, high EV adoption, and stringent regulations promoting sustainable energy solutions

- Consumers prioritize batteries for their reliability, high energy density, and ability to support advanced vehicle functions, particularly in regions with diverse climatic conditions and growing EV adoption

- Growth is supported by advancements in battery technology, such as lithium-ion and sodium-ion chemistries, alongside rising adoption in both OEM and aftermarket segments

U.S. Car Batteries Market Insight

The U.S. car batteries market captured the largest revenue share of 81% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of electric vehicle benefits, including reduced emissions and fuel savings. The trend towards vehicle electrification and supportive government policies promoting sustainable transportation further boost market expansion. Automakers’ increasing integration of advanced batteries in factory-installed EVs complements aftermarket sales, creating a diverse product ecosystem.

Europe Car Batteries Market Insight

The European car batteries market is expected to witness significant growth, supported by stringent emission regulations and a strong emphasis on vehicle electrification. Consumers seek batteries that offer high energy density and long lifespan for improved driving range and sustainability. The growth is prominent in both new vehicle installations and aftermarket upgrades, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban mobility demands.

U.K. Car Batteries Market Insight

The U.K. market for car batteries is expected to witness rapid growth, driven by demand for efficient and eco-friendly power solutions in urban and suburban settings. Increased interest in electric vehicles and growing awareness of battery performance benefits encourage adoption. Evolving regulations aimed at reducing carbon emissions influence consumer choices, balancing battery performance with compliance to safety and environmental standards.

Germany Car Batteries Market Insight

Germany is expected to witness rapid growth in the car batteries market, attributed to its advanced automotive manufacturing sector and high consumer focus on energy efficiency and vehicle performance. German consumers prefer technologically advanced batteries, such as lithium-ion and sodium-ion that enhance EV range and contribute to lower fuel consumption in hybrid vehicles. The integration of these batteries in premium vehicles and aftermarket options supports sustained market growth.

Asia-Pacific Car Batteries Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of electric vehicle benefits, including heat rejection and reduced emissions, is boosting demand. Government initiatives promoting energy efficiency and vehicle electrification further encourage the adoption of advanced car batteries.

Japan Car Batteries Market Insight

Japan’s car batteries market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced batteries that enhance driving range and safety. The presence of major automotive manufacturers and the integration of advanced batteries in OEM vehicles accelerate market penetration. Rising interest in aftermarket EV upgrades also contributes to growth.

China Car Batteries Market Insight

China holds the largest share of the Asia-Pacific car batteries market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for electric and hybrid vehicle solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced batteries such as lithium-ion and sodium-ion. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Car Batteries Market Share

The car batteries industry is primarily led by well-established companies, including:

- Johnson Controls (U.S.)

- GS Yuasa International Ltd. (Japan)

- Exide Technologies (U.S.)

- East Penn Manufacturing Company (U.S.)

- Camel Group Co., Ltd (China)

- Fengfan (Yangzhou) Co., Ltd.(China)

- FIAMM Energy Technology S.p.A. (Italy)

- ENERSYS (U.S.)

- Robert Bosch GmbH (Germany)

- MK Battery (U.S.)

- Amara Raja Group (India)

- Hitachi, Ltd. (Japan)

- SANYO Electric Co., Ltd. (Japan)

- Okaya Power Private Limited (India)

- Luminous India (India)

- Huawei Technologies Co., Ltd. (China)

- Chaowel Power Holdings Limited (China)

What are the Recent Developments in Global Car Batteries Market?

- In March 2025, the International Energy Agency (IEA) reported that the battery industry has entered a new phase, marked by annual global battery demand surpassing 1 terawatt-hour (TWh). A key milestone was also reached as the average price of battery packs for battery electric vehicles (BEVs) dropped below USD 100 per kilowatt-hour—a threshold long considered essential for cost parity with conventional vehicles. This price decline is attributed to a sharp drop in lithium prices (down over 85% from their 2022 peak) and rapid advancements in manufacturing capacity and technology, which are reshaping the global battery supply chain

- In December 2024, a report by Technavio highlighted the growing adoption of software and sensor-based intelligent Battery Management Systems (BMS) in the global EV battery market. This trend is driven by the increasing demand for advanced features in electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs)—such as GPS, real-time displays, and modern powertrain systems—that consume substantial power. To ensure longer battery life and reduce charging frequency, manufacturers are investing in high-end BMS solutions that optimize battery performance and safety. The report underscores the critical role of intelligent BMS in supporting the next wave of EV innovation

- In April 2024, Hyundai Motor Company and Kia Corporation signed a Memorandum of Understanding (MoU) with Exide Energy Solutions Ltd., a leading Indian battery manufacturer, to localize EV battery production in India. The collaboration focuses on developing lithium-iron-phosphate (LFP) cells for future Hyundai and Kia electric vehicles. This strategic move aims to enhance cost competitiveness and support India’s carbon neutrality goals by leveraging domestically produced batteries. The partnership marks a significant step in expanding Hyundai and Kia’s footprint in India’s rapidly growing EV market

- In January 2024, JSW Group, a leading Indian conglomerate, entered a pivotal joint venture with SAIC Motor, acquiring a significant stake in MG Motor India. The collaboration, formalized under JSW MG Motor India Pvt. Ltd., aims to localize EV production, expand MG’s electric vehicle portfolio, and scale up manufacturing to meet India’s surging EV demand. The venture will focus on lithium-ion battery technology, extensive supply chain integration, and launching new energy vehicles (NEVs) every 3–6 months. This strategic move positions JSW MG Motor to lead India’s transition to smart and sustainable mobility

- In October 2023, Toyota Motor Corporation announced a major investment of USD 1.3 billion to establish a battery manufacturing plant in Liberty, North Carolina. The facility, part of Toyota Battery Manufacturing North Carolina (TBMNC), is expected to begin production in 2025 and will have the capacity to produce lithium-ion batteries for up to 800,000 vehicles annually. This strategic move underscores Toyota’s commitment to securing its EV battery supply chain in the U.S. and supporting its broader electrification goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Car Batteries Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Car Batteries Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Car Batteries Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.