Global Car Carrier Market

Market Size in USD Billion

CAGR :

%

USD

51.28 Billion

USD

91.45 Billion

2024

2032

USD

51.28 Billion

USD

91.45 Billion

2024

2032

| 2025 –2032 | |

| USD 51.28 Billion | |

| USD 91.45 Billion | |

|

|

|

|

Car Carrier Market Size

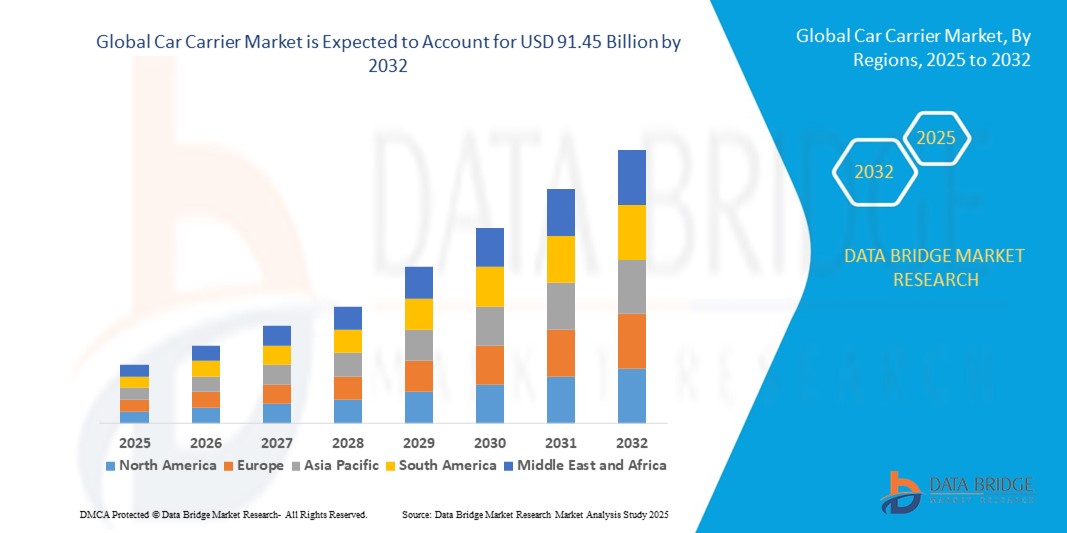

- The global car carrier market size was valued at USD 51.28 billion in 2024 and is expected to reach USD 91.45 billion by 2032, at a CAGR of 7.5% during the forecast period

- The market growth is largely fuelled by increasing vehicle production worldwide, rising demand for efficient and safe transportation of automobiles, and expansion in global automotive trade

- In addition, advancements in carrier design and the growth of e-commerce and automotive aftermarket sectors are further supporting market expansion

Car Carrier Market Analysis

- The increasing production of electric vehicles and the need for specialized carriers to transport these cars safely are driving innovation and demand within the car carrier market

- Growth in international trade and the surge in automotive exports from manufacturing hubs such as Asia-Pacific and Europe are contributing to a higher demand for both rail and road car carriers

- North America dominated the car carrier market with the largest revenue share of 37.8% in 2024, driven by the region’s established automotive manufacturing base and high demand for efficient vehicle transportation solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global car carrier market, driven by increasing vehicle production, expanding export activities, and significant investments in logistics and transportation infrastructure. Emerging economies such as China, India, and Japan are fueling demand for modern car carriers, supported by technological advancements and rising urbanization

- The RoRo-type segment dominated the market with the largest market revenue share in 2024, driven by its efficiency in loading and unloading vehicles without the need for cranes or additional handling equipment. RoRo carriers are widely used for international automotive trade due to their time-saving capabilities and ability to transport large volumes of vehicles securely. The segment also benefits from increasing global exports of both conventional and electric vehicles, supporting sustained demand.

Report Scope and Car Carrier Market Segmentation

|

Attributes |

Car Carrier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Electric Vehicle (EV) Carriers |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Car Carrier Market Trends

Integration of Telematics and IoT in Car Carrier Operations

- The adoption of telematics and Internet of Things (IoT) solutions is transforming the car carrier industry by enabling real-time tracking of vehicle location, load status, and transit conditions. This enhanced visibility allows operators to optimize routes, reduce delays, and improve overall fleet efficiency

- The growing demand for data-driven logistics management is accelerating the integration of connected sensors, onboard diagnostics, and fleet monitoring software in car carriers. These tools help reduce operational costs while ensuring timely deliveries for both domestic and international shipments

- The ability to collect and analyze operational data is also enabling predictive maintenance, reducing breakdowns and downtime. Carriers benefit from extended asset lifespan and improved service reliability, strengthening customer trust

- For instance, in 2024, several leading European logistics firms deployed IoT-enabled car carriers that provided live updates on vehicle temperature and vibration levels during transit, ensuring the safe transport of high-value electric and luxury vehicles

- While telematics and IoT are enhancing operational efficiency, their effectiveness depends on continued investment in digital infrastructure, operator training, and data security. Manufacturers and service providers must develop cost-effective, user-friendly platforms to maximize adoption across the industry

Car Carrier Market Dynamics

Driver

Rising Global Vehicle Production and Expanding Automotive Trade

• The steady increase in global vehicle production is driving the need for efficient transportation solutions, with car carriers playing a central role in moving vehicles from manufacturing plants to dealerships and export destinations. This demand is further boosted by the rise in electric vehicle production, which requires specialized handling and equipment to ensure safe and damage-free transit. As automakers expand production capacities, logistics providers are adapting fleets to accommodate these evolving needs, enhancing service offerings

• The growth of automotive exports, particularly from Asia-Pacific and Europe, is expanding the need for both maritime and land-based car carrier services. Manufacturers and logistics providers are investing in larger fleets and advanced carrier technologies to meet rising trade volumes while ensuring compliance with international shipping standards. This expansion supports a more connected global automotive supply chain, enabling faster delivery and improved customer satisfaction

• Government investments in port and road infrastructure are also supporting market growth by enabling faster and more reliable vehicle transport. These developments are particularly notable in emerging economies where automotive production is expanding rapidly, facilitating smoother logistics and reducing bottlenecks. Enhanced infrastructure improves operational efficiency, lowers transportation costs, and encourages foreign direct investment in automotive manufacturing hubs

• For instance, in 2023, Japan reported a surge in car exports to North America, leading to increased utilization of roll-on/roll-off (RoRo) vessels and specialized land carriers. This surge necessitated fleet upgrades and route optimizations to handle higher shipment volumes without compromising delivery timelines. It also highlighted the importance of collaboration between port authorities and logistics firms to streamline operations

• While global vehicle production and trade are fueling market expansion, the industry must also address challenges related to fuel efficiency, emissions regulations, and port congestion to sustain growth. Regulatory pressure is driving the adoption of greener transportation methods and innovation in carrier design to reduce carbon footprints. In addition, resolving congestion issues is critical for maintaining timely deliveries and minimizing operational disruptions

Restraint/Challenge

High Operational Costs and Volatility in Fuel Prices

• The car carrier industry faces significant cost pressures from fluctuating fuel prices, which directly impact transportation expenses. Fuel costs can represent a large share of operating budgets, particularly for long-haul shipments, making carriers vulnerable to global oil market volatility. This unpredictability complicates budgeting and pricing strategies, often squeezing profit margins in an already competitive market

• Maintenance of specialized carriers, including RoRo vessels and multi-level land transporters, adds to operational costs. These expenses cover regular inspections, repairs, and upgrades to meet safety and environmental standards. For smaller logistics operators, these costs can limit fleet expansion or modernization, restricting their ability to compete with larger firms offering more efficient services

• Fuel price volatility also makes long-term contract pricing challenging, leading to uncertainties in revenue projections and financial planning for service providers. Contracts often include fuel surcharges or variable pricing clauses to offset risk, but sudden price spikes can still disrupt cash flow. This volatility encourages carriers to seek alternative fuel sources and improve fuel efficiency to stabilize operating costs

• For instance, in 2022, a spike in global oil prices increased average shipping costs for automotive logistics companies by more than 20%, forcing some operators to pass on the costs to customers or reduce fleet utilization. This scenario led to tighter capacity in the market and increased shipping rates, impacting supply chains and delaying deliveries. It also prompted many carriers to accelerate investment in fuel-efficient technologies and alternative propulsion systems

• While efficiency improvements and alternative fuel technologies can help mitigate these challenges, widespread adoption requires substantial investment and industry collaboration to reduce dependency on conventional fuels. Developing infrastructure for electric or hydrogen-powered carriers, alongside regulatory incentives, will be critical in enabling a sustainable transition. Until then, managing operational costs amid fuel price swings remains a significant hurdle for market players

Car Carrier Market Scope

The market is segmented on the basis of type, capacity, propulsion, end user, and application

- By Type

On the basis of type, the car carrier market is segmented into trailer-type, container-type, and RoRo-type. The RoRo-type segment dominated the market with the largest market revenue share in 2024, driven by its efficiency in loading and unloading vehicles without the need for cranes or additional handling equipment. RoRo carriers are widely used for international automotive trade due to their time-saving capabilities and ability to transport large volumes of vehicles securely. The segment also benefits from increasing global exports of both conventional and electric vehicles, supporting sustained demand.

The trailer-type segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for domestic and regional vehicle transport. Trailer-type carriers offer flexibility, cost efficiency, and adaptability to various load sizes, making them highly suitable for short-haul and intercity deliveries. Their growing adoption among logistics companies and automotive dealerships further contributes to market expansion.

- By Capacity

On the basis of capacity, the car carrier market is segmented into less than 2,000 units, 2,000–3,000 units, 3,000–4,000 units, and more than 4,000 units. The 3,000–4,000 units segment held the largest market revenue share in 2024, supported by its optimal balance between load capacity and operational efficiency. This capacity range is preferred by many global shipping companies for maintaining cost-effective routes while maximizing load volumes.

The more than 4,000 units segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for high-capacity transport solutions in major automotive exporting nations. Increasing investments in mega RoRo vessels capable of carrying large volumes of vehicles in a single trip are boosting this segment’s growth prospects.

- By Propulsion

On the basis of propulsion, the car carrier market is segmented into diesel-powered, LNG-powered, hybrid-powered, and electric-powered. The diesel-powered segment dominated the market in 2024 due to its long-standing use, global availability of fuel, and high-power output suitable for long-haul shipping. Diesel propulsion remains a cost-effective option for many operators, particularly in regions lacking alternative fuel infrastructure.

The LNG-powered segment is expected to witness the fastest growth rate from 2025 to 2032, driven by stricter emissions regulations and increasing adoption of cleaner fuels in maritime transport. LNG carriers offer reduced greenhouse gas emissions and compliance with IMO environmental standards, making them an attractive choice for sustainable operations.

- By End User

On the basis of end user, the car carrier market is segmented into automotive sales service shop 4S, terminals, and others. The terminals segment held the largest market revenue share in 2024, supported by the high volume of vehicles transported through port terminals for both imports and exports. These facilities serve as critical nodes in global automotive logistics, ensuring smooth vehicle handling and transfer.

The automotive sales service shop 4S segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing dealership networks and the need for timely deliveries of new vehicles to showrooms. Efficient carrier services help maintain inventory turnover and support customer satisfaction in this segment.

- By Application

On the basis of application, the car carrier market is segmented into short-haul, long-haul, coastal, and intermodal. The long-haul segment dominated the market in 2024, fueled by the expansion of international automotive trade routes and demand for cost-effective transportation over long distances. Long-haul carriers are essential for linking manufacturing hubs with distant markets.

The intermodal segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing integration of road, rail, and maritime logistics networks. Intermodal solutions offer flexibility, reduced transit times, and better utilization of infrastructure, making them highly attractive for modern supply chains.

Car Carrier Market Regional Analysis

• North America dominated the car carrier market with the largest revenue share of 37.8% in 2024, driven by the region’s established automotive manufacturing base and high demand for efficient vehicle transportation solutions.

• The presence of extensive port infrastructure, advanced logistics networks, and growing vehicle exports supports the widespread use of specialized car carriers. This, combined with technological advancements in carrier design, enhances operational efficiency and safety, reinforcing North America’s leading position.

U.S. Car Carrier Market Insight

The U.S. car carrier market captured the largest revenue share in 2024 within North America, fueled by strong domestic vehicle production and growing automotive exports. Increasing demand for both domestic distribution and international shipping is driving investments in modernized fleets and advanced carrier technologies. The rise of electric vehicle manufacturing and increasing trade with Canada and Mexico further strengthen the market. In addition, infrastructure upgrades and regulatory support promote seamless vehicle logistics across the country.

Europe Car Carrier Market Insight

The Europe car carrier market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increasing automotive exports and trade within the region. Growth in electric vehicle production and the need for eco-friendly carrier solutions are key factors. Enhanced port facilities, stringent safety standards, and investments in intermodal transport contribute to market expansion. The rising demand for efficient short- and long-haul vehicle transportation also supports growth across commercial and industrial sectors.

U.K. Car Carrier Market Insight

The U.K. car carrier market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing automotive trade and expanding dealership networks. The region benefits from a robust port infrastructure and well-established road transport systems that facilitate smooth vehicle movement. In addition, the growing demand for sustainable logistics solutions and the integration of digital fleet management tools are fueling market development.

Germany Car Carrier Market Insight

Germany holds a significant position in the European car carrier market, driven by its strong automotive manufacturing industry and export-oriented economy. The demand for technologically advanced and fuel-efficient carriers is rising, reflecting Germany’s focus on innovation and environmental sustainability. Investments in smart logistics and green transportation are expected to support market growth. In addition, the country’s central location in Europe makes it a key hub for vehicle distribution across the continent.

Asia-Pacific Car Carrier Market Insight

The Asia-Pacific car carrier market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising vehicle production, and expanding automotive exports from countries such as China, Japan, and India. Government initiatives to improve transport infrastructure and the growth of port facilities support increased carrier operations. Furthermore, the region’s emergence as a manufacturing hub enhances accessibility and affordability of car carrier services for domestic and international shipments.

Japan Car Carrier Market Insight

Japan’s car carrier market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s advanced automotive industry and high export volumes. The demand for specialized carriers that ensure the safe transport of luxury and electric vehicles is increasing. Integration of IoT and telematics in fleet management is enhancing operational efficiency. Moreover, the country’s emphasis on quality control and environmental standards is encouraging adoption of cleaner propulsion technologies in carriers.

China Car Carrier Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s booming vehicle manufacturing sector and growing automotive exports. The expansion of domestic dealership networks and improvements in logistics infrastructure further boost demand. China’s focus on developing green transportation solutions and smart port facilities also drives market growth. In addition, increasing consumer vehicle ownership and urbanization support steady demand for car carrier services.

Car Carrier Market Share

The car carrier industry is primarily led by well-established companies, including:

- Cottrell (U.S.)

- Landoll (U.S.)

- TEC Equipment Co (U.S.)

- Delavan (U.S.)

- Boydstun (U.S.)

- Appalachian Trailers (U.S.)

- Down Easter Coastal Metal Fab (U.S.)

- CIMC (China)

- Tom Nehl Truck Company (U.S.)

- Sun Country Trailers (U.S.)

- Schmitz Cargobull (Germany)

- Great Dane Trailers (U.S.)

- Krone (Germany)

- Hyundai Translead (U.S.)

- Koegel (Germany)

- Welton (U.S.)

- Miller Industries (U.S.)

- Kässbohrer (Germany)

- Dongfeng Trucks (China)

- MAN (Germany)

- Kentucky Trailers (U.S.)

- Delavan (U.S.)

Latest Developments in Global Car Carrier Market

- In December 2023, K Line, a major Japanese shipping company, announced an order for two battery hybrid RoRo (roll-on/roll-off) vessels specifically designed for car transport. These vessels will utilize both batteries and diesel engines, achieving a 20% reduction in CO2 emissions compared to conventional RoRo ships. The new vessels are expected to be delivered in 2025 and will operate primarily between Japan and North America, further solidifying K Line's commitment to environmentally friendly shipping practices

- In October 2023, UECC, a European short-sea shipping and logistics company, unveiled its newest vessel, the "Auto Eco", the first LNG-powered car carrier to operate in the Baltic Sea. This innovative ship features a dual-fuel engine that can run on either liquefied natural gas (LNG) or marine gas oil (MGO), significantly reducing its environmental footprint. The "Auto Eco" boasts a 47% reduction in CO2 emissions compared to conventional car carriers and sets a new standard for sustainable transportation in the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Car Carrier Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Car Carrier Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Car Carrier Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.