Global Car Dashboard Market

Market Size in USD Million

CAGR :

%

USD

629.45 Million

USD

881.52 Million

2024

2032

USD

629.45 Million

USD

881.52 Million

2024

2032

| 2025 –2032 | |

| USD 629.45 Million | |

| USD 881.52 Million | |

|

|

|

|

Car Dashboard Market Size

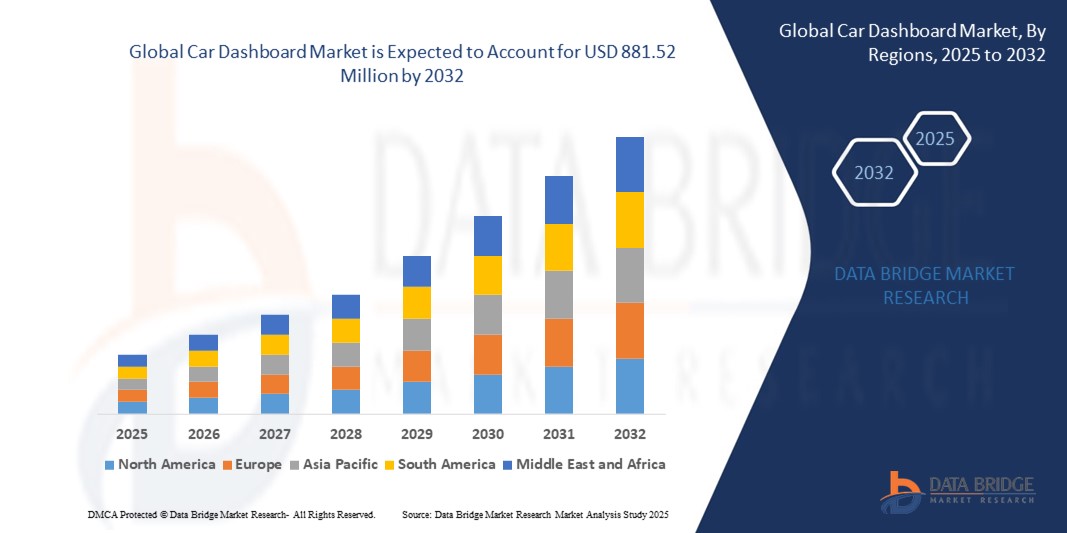

- The global car dashboard market size was valued at USD 629.45 million in 2024 and is expected to reach USD 881.52 million by 2032, at a CAGR of 4.3% during the forecast period

- The market growth is largely fueled by the increasing integration of advanced infotainment systems, digital instrument clusters, and connected technologies, which are transforming dashboards into multifunctional control hubs in modern vehicles

- Furthermore, rising consumer demand for personalized, user-friendly, and safety-enhancing cockpit solutions is establishing digital dashboards as a key differentiator in both passenger and electric vehicles. These converging factors are accelerating the uptake of advanced dashboard systems, thereby significantly boosting the industry’s growth

Car Dashboard Market Analysis

- Car dashboards serve as the central interface for drivers, integrating speedometers, infotainment, navigation, head-up displays, and advanced driver-assistance features into a unified control panel. With the shift toward digital and LCD dashboards, vehicles are increasingly offering immersive, customizable, and connected driving experiences for users across different segments

- The escalating demand for advanced dashboards is primarily fueled by the surge in connected vehicle adoption, rising electrification trends, and growing consumer preference for enhanced safety, convenience, and in-vehicle entertainment systems

- Asia-Pacific dominated the car dashboard market in 2024, due to the rising production of passenger vehicles, strong consumer demand for SUVs and sedans, and rapid adoption of digital dashboards across emerging economies

- North America is expected to be the fastest growing region in the car dashboard market during the forecast period due to high adoption of connected vehicles, strong demand for SUVs and pickup trucks, and rapid penetration of LCD dashboards

- Conventional dashboard segment dominated the market with a market share of 61.9% in 2024, due to its widespread presence in mid-range and economy vehicles and its proven reliability. Automakers continue to favor conventional dashboards due to their lower production cost, ease of integration, and long-standing acceptance among drivers. Many consumers in developing regions still prefer traditional dashboard layouts for their simplicity, durability, and cost-effectiveness, which keeps demand strong across various vehicle categories

Report Scope and Car Dashboard Market Segmentation

|

Attributes |

Car Dashboard Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Car Dashboard Market Trends

Growing Adoption of Digital and LCD Dashboards

- The automotive industry is rapidly shifting toward digital and LCD dashboard systems that provide enhanced display resolution, customization, real-time information access, and integration with smart connectivity solutions, elevating the driving experience and vehicle functionality

- For instance, leading automakers such as Tesla, BMW, and Mercedes-Benz are equipping their latest models with fully digital instrument clusters and touchscreen interfaces, featuring intuitive layouts, heads-up displays, and direct smartphone linkage

- Expansion of infotainment features and vehicle connectivity is fueling demand for dashboards that seamlessly integrate navigation, entertainment, climate controls, and vehicle diagnostics, promoting safer and more interactive user interactions

- Rising consumer expectations for convenience and aesthetics drive manufacturers to introduce dashboards with more vibrant graphics, adaptive layouts, and voice command functionalities

- Growth in autonomous vehicle programs and electric car platforms further promotes advanced dashboard technologies capable of supporting complex driver assistance, battery monitoring, and AI-powered user interfaces

- Increasing adoption of modular and upgradable dashboard systems allows automakers and aftermarket providers to respond quickly to changing consumer preferences and emerging tech innovations

Car Dashboard Market Dynamics

Driver

Adoption of Advanced Driving Assistance Systems

- Growing integration of advanced driving assistance systems (ADAS), including adaptive cruise control, lane-keeping, collision avoidance, and parking support, is a major force driving demand for smart, multifunctional dashboards in passenger vehicles

- For instance, dashboard manufacturers such as Visteon, Continental, and Panasonic supply OEMs with high-performance displays that visualize ADAS data—such as proximity warnings, camera feeds, and sensor overlays—helping drivers make safer, more informed decisions

- Enhanced sensor connectivity, real-time feedback, and AI-driven analytics improve dashboard utility across various driving scenarios, increasing relevance in both premium and mass-market vehicles

- Complex integration requirements and rapid technological advances in vehicle electronics encourage collaborative development between automakers, Tier 1 suppliers, and technology partners

- Dashboard systems increasingly play a critical role in supporting autonomous and semi-autonomous driving modes by providing clear status updates and actionable data to drivers

Restraint/Challenge

High Cost Associated with Car Dashboard Replacement

- The cost of replacing modern digital dashboards, especially those with large LCD screens and complex electronics, represents a significant challenge for both consumers and service providers, often leading to high out-of-pocket expenses

- For instance, owners of luxury vehicles or high-end electric cars face premium charges for dashboard repairs or replacement due to the specialized parts, labor, and calibration required for advanced display systems

- Limited aftermarket availability and dependency on proprietary components can extend repair timelines and elevate replacement costs, especially outside warranties or manufacturer service networks

- Technological complexity and integration with other vehicle systems (infotainment, sensors, controls) heighten diagnostic and installation demands, further increasing service expenses

- Price-sensitive markets and older vehicles may experience reduced adoption or postponed upgrades due to unaffordable dashboard replacement costs. Environmental concerns and electronic waste from dashboard replacements encourage manufacturers to improve repairability, modular design, and recycling initiatives

Car Dashboard Market Scope

The market is segmented on the basis of type, vehicle type, and sales channel.

- By Type

On the basis of type, the car dashboard market is segmented into LCD dashboard and conventional dashboard. The conventional dashboard segment dominated the largest market revenue share of 61.9% in 2024, attributed to its widespread presence in mid-range and economy vehicles and its proven reliability. Automakers continue to favor conventional dashboards due to their lower production cost, ease of integration, and long-standing acceptance among drivers. Many consumers in developing regions still prefer traditional dashboard layouts for their simplicity, durability, and cost-effectiveness, which keeps demand strong across various vehicle categories.

The LCD dashboard segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising consumer preference for advanced infotainment and digital driving interfaces. LCD dashboards offer customizable displays, integration with navigation and driver-assistance systems, and enhanced aesthetics, aligning with the growing trend of connected and smart vehicles. Luxury and premium car manufacturers are aggressively adopting LCD dashboards to deliver a modernized and interactive driving experience, while declining component costs are expected to accelerate penetration into mid-range vehicle categories.

- By Vehicle Type

On the basis of vehicle type, the car dashboard market is segmented into SUV, hatchback, convertible, sedan, MPV, coupe, and others. The SUV segment dominated the market in 2024, supported by the global surge in SUV sales and consumer preference for spacious, versatile vehicles. SUVs typically feature advanced dashboard configurations to accommodate larger display screens and integrated infotainment, appealing to families and tech-savvy buyers. The strong presence of SUVs across both developed and emerging markets continues to strengthen their position in dashboard adoption.

The fastest-growing segment from 2025 to 2032 is expected to be the sedan category, benefiting from increasing electrification trends and premiumization in this vehicle class. Sedans are often equipped with advanced digital dashboards to enhance driver assistance, safety, and luxury appeal, making them particularly attractive in urban markets. Growth is further supported by rising demand for electric sedans, where dashboards act as central hubs for energy monitoring, connectivity, and real-time driving data.

- By Sales Channel

On the basis of sales channel, the car dashboard market is segmented into OEM and aftermarket. The OEM segment dominated the market revenue share in 2024, as automakers increasingly integrate advanced dashboards during production to meet consumer demand for connected features. OEM-installed dashboards ensure seamless compatibility with vehicle systems, offering a high level of reliability and warranty coverage. The growing competition among automakers to differentiate vehicles based on technology and infotainment capabilities further reinforces the dominance of OEM distribution.

The aftermarket segment is anticipated to record the fastest growth rate from 2025 to 2032, fueled by the rising consumer demand for dashboard upgrades in older vehicles. Drivers are increasingly turning to aftermarket solutions to add LCD panels, navigation systems, and advanced infotainment features without purchasing a new car. The availability of cost-effective and customizable dashboard kits, along with a strong DIY installation trend, is expected to further accelerate growth in this segment.

Car Dashboard Market Regional Analysis

- Asia-Pacific dominated the car dashboard market with the largest revenue share in 2024, driven by the rising production of passenger vehicles, strong consumer demand for SUVs and sedans, and rapid adoption of digital dashboards across emerging economies

- The region’s competitive automotive manufacturing base, growing investments in connected vehicle technologies, and supportive government policies for smart mobility are fueling market expansion

- Increasing electrification of vehicles, availability of low-cost skilled labor, and large-scale automotive exports from China, Japan, and South Korea are further strengthening dashboard adoption in both LCD and conventional formats

China Car Dashboard Market Insight

China held the largest share in the Asia-Pacific car dashboard market in 2024, owing to its dominant position in global automotive manufacturing and strong domestic demand for passenger vehicles. The government’s push toward smart and electric vehicles, combined with the rapid integration of digital instrument clusters, is driving dashboard innovation. The presence of leading automakers and advanced supply chains continues to make China a key hub for dashboard production and adoption.

India Car Dashboard Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by increasing vehicle sales, rising consumer preference for connected infotainment systems, and expanding investments by global OEMs. The government’s “Make in India” initiative and rapid urbanization are fueling demand for both LCD and conventional dashboards. Growth is further supported by the country’s booming mid-range passenger car segment, where dashboards are evolving into multifunctional digital control centers.

Europe Car Dashboard Market Insight

The Europe car dashboard market is expanding steadily, supported by strong demand for premium vehicles, early adoption of digital clusters, and stringent safety regulations requiring advanced display features. The region’s focus on electric mobility, smart infotainment, and sustainability in automotive design is fostering dashboard innovation. Increasing collaborations between automakers and technology providers are accelerating the development of customizable and connected dashboard solutions.

Germany Car Dashboard Market Insight

Germany’s car dashboard market is driven by its leadership in premium and luxury vehicle manufacturing, where LCD dashboards and fully digital clusters are standard features. Strong R&D capabilities, integration of cutting-edge automotive electronics, and partnerships with global technology firms are fueling growth. German automakers’ emphasis on driver-assistance integration and seamless infotainment systems keeps the country at the forefront of dashboard innovation.

U.K. Car Dashboard Market Insight

The U.K. market is supported by its well-established automotive design and engineering expertise, growing adoption of connected vehicle technologies, and rising consumer preference for luxury sedans and SUVs. Post-Brexit shifts toward localized manufacturing and greater emphasis on in-vehicle infotainment are supporting demand. With strong innovation in EVs and smart mobility solutions, the U.K. continues to be a notable market for advanced dashboard systems.

North America Car Dashboard Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, fueled by high adoption of connected vehicles, strong demand for SUVs and pickup trucks, and rapid penetration of LCD dashboards. Rising consumer interest in advanced infotainment, seamless smartphone integration, and safety features is accelerating dashboard upgrades. The presence of leading automakers, strong aftermarket demand, and growing EV production are further supporting market growth.

U.S. Car Dashboard Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its strong automotive industry, high consumer spending on premium vehicles, and fast-growing EV market. Automakers are increasingly equipping vehicles with digital clusters, AR-based head-up displays, and advanced infotainment features to enhance customer appeal. Robust R&D, a mature aftermarket network, and rising partnerships with tech companies strengthen the U.S.’s leading role in dashboard adoption.

Car Dashboard Market Share

The car dashboard industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Denso Corporation (Japan)

- Valeo SA (France)

- Magna International Inc. (Canada)

- Robert Bosch GmbH (Germany)

- Calsonic Kansei Corporation (Japan)

- Yazaki Corporation (Japan)

- Faurecia SA (France)

- Hyundai Mobis Co., Ltd. (South Korea)

- Toyoda Gosei Co., Ltd. (Japan)

Latest Developments in Global Car Dashboard Market

- In January 2025, BMW Group introduced the BMW Panoramic iDrive, featuring a windshield-wide head-up display that will enter series production in late 2025. This innovation marks a major step toward immersive and safety-focused driving experiences, as it integrates navigation, vehicle data, and infotainment across the driver’s line of sight. The move underscores the industry shift toward larger, seamless displays, setting new benchmarks in luxury vehicles and pushing the demand for advanced digital dashboards

- In January 2025, Samsung Display unveiled bendable OLED dash panels and Real Black head-up displays equipped with under-panel cameras. These breakthroughs highlight the growing adoption of flexible, high-contrast displays designed to improve visibility and aesthetics in next-generation vehicles. By combining OLED technology with hidden sensors, Samsung is driving innovation in premium dashboards and supporting the expansion of futuristic, customizable cockpit solutions

- In January 2025, AUO showcased the Smart Cockpit 2025, featuring Micro LED dashboards and transparent roof-mounted display panels. This development signals a major advancement in immersive in-car experiences, offering sharper visuals, enhanced energy efficiency, and innovative integration of transparent displays. The introduction of Micro LED technology positions AUO as a key enabler of next-generation dashboards, contributing to the evolution of fully digital and interactive cockpits

- In October 2024, Hyundai Mobis partnered with Zeiss to develop holographic head-up displays and also unveiled rollable dash screens tailored for EV interiors. This collaboration represents a leap in AR-based dashboard solutions, enabling 3D navigation and dynamic content projection while optimizing space in electric vehicles. The initiative strengthens Hyundai Mobis’s competitive edge in the rapidly growing EV cockpit market and demonstrates how AR and flexible displays are reshaping driver engagement

- In January 2020, automotive systems maker Denso partnered with chipmaker Qualcomm to co-develop next-generation integrated cockpit systems. Leveraging Qualcomm’s expertise in semiconductors and communication technologies alongside Denso’s strengths in in-vehicle safety, quality, and HMI systems, this partnership accelerated the shift toward smart, connected dashboards. It laid the foundation for integrating smartphone-grade performance into vehicle cockpits, fueling the long-term adoption of intelligent dashboard ecosystems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.