Global Car Dvr Market

Market Size in USD Billion

CAGR :

%

USD

3.33 Billion

USD

5.05 Billion

2025

2033

USD

3.33 Billion

USD

5.05 Billion

2025

2033

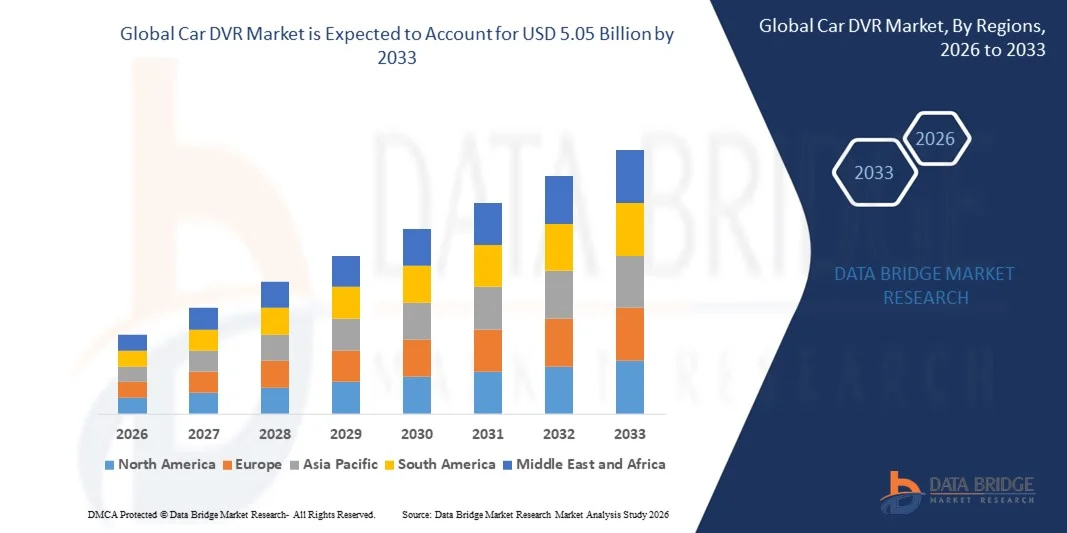

| 2026 –2033 | |

| USD 3.33 Billion | |

| USD 5.05 Billion | |

|

|

|

|

Car DVR Market Size

- The global car DVR market size was valued at USD 3.33 billion in 2025 and is expected to reach USD 5.05 billion by 2033, at a CAGR of 5.32% during the forecast period

- The market growth is largely driven by rising concerns over road safety, increasing vehicle ownership, and the growing need for reliable accident evidence and insurance claim support. In parallel, technological advancements in camera sensors, AI-based analytics, and cloud connectivity are enhancing the functionality of car DVR systems, accelerating their adoption across passenger and commercial vehicles

- Furthermore, increasing awareness among consumers and fleet operators regarding driver monitoring, theft prevention, and legal protection is positioning car DVRs as an essential in-vehicle safety solution. These combined factors are significantly strengthening demand and supporting sustained growth of the car DVR market

Car DVR Market Analysis

- Car DVRs, also known as dash cameras, are in-vehicle video recording systems designed to continuously capture road conditions, driving behavior, and surrounding events through front, rear, or multi-channel camera setups. These systems support features such as real-time recording, GPS tracking, night vision, and cloud-based data access, improving safety, accountability, and transparency for drivers and fleet operators

- The rising adoption of car DVRs is primarily fueled by increasing traffic congestion, higher accident rates, and growing emphasis on evidence-based insurance and legal processes. In addition, expanding integration of DVR systems with connected vehicle platforms and advanced driver assistance technologies is further reinforcing their importance within the evolving automotive ecosystem

- Europe dominated the car DVR market with a share of 31.96% in 2025, due to strong road safety regulations, rising adoption of in-vehicle safety technologies, and increasing awareness regarding accident documentation and insurance claims

- Asia-Pacific is expected to be the fastest growing region in the car DVR market during the forecast period due to rapid urbanization, rising vehicle sales, and increasing road safety concerns

- Passenger cars segment dominated the market with a market share of 63.61% in 2025, due to high global vehicle ownership and increasing consumer adoption of in-vehicle safety electronics. Rising concerns over road accidents, theft prevention, and insurance documentation encourage passenger car owners to install dash cameras. The availability of compact, user-friendly DVR systems and strong aftermarket penetration further supports dominance in this segment. Growing awareness of personal safety and legal protection continues to drive adoption across urban and semi-urban regions

Report Scope and Car DVR Market Segmentation

|

Attributes |

Car DVR Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Car DVR Market Trends

Rising Integration of AI and Connected Vehicle Technologies

- A key trend in the car DVR market is the growing integration of artificial intelligence and connected vehicle technologies, driven by the increasing demand for smarter safety, monitoring, and data-driven driving solutions. Modern car DVR systems are evolving beyond basic video recording to include AI-powered features such as driver behavior analysis, collision detection, and real-time alerts, strengthening their role within connected automotive ecosystems

- For instance, Garmin has integrated advanced connectivity and driver-assistance features into its Dash Cam X series, enabling seamless synchronization with mobile applications and cloud-based platforms. These solutions enhance real-time access to video footage and driving data, supporting improved safety awareness and user convenience

- The adoption of AI-enabled dash cameras is increasing among fleet operators as these systems help analyze driving patterns, reduce accidents, and improve operational efficiency. Companies such as BlackVue are offering cloud-connected DVR systems that enable live view, remote notifications, and fleet monitoring through centralized dashboards

- Car DVRs are increasingly being integrated with broader vehicle telematics and infotainment systems, supporting real-time data sharing and smarter decision-making. This integration is strengthening the position of DVR systems as essential components of connected vehicles rather than standalone accessories

- The market is also witnessing rising compatibility between car DVRs and advanced driver assistance systems, allowing recorded video data to support lane monitoring, collision analysis, and parking surveillance. This trend is reinforcing the shift toward intelligent, connected, and safety-focused in-vehicle camera solutions

- Overall, the rising incorporation of AI, cloud connectivity, and vehicle intelligence is reshaping the car DVR market and supporting its transition toward advanced mobility and connected transportation ecosystems

Car DVR Market Dynamics

Driver

Growing Demand for Road Safety and Accident Evidence

- The increasing focus on road safety and the need for reliable accident evidence is a major driver of growth in the car DVR market. Rising traffic congestion and accident rates have heightened demand for video-based documentation to support insurance claims, legal proceedings, and driver accountability

- For instance, insurance providers across Europe and Asia increasingly accept dash camera footage as supporting evidence during accident investigations, encouraging vehicle owners to install DVR systems. This acceptance has strengthened consumer confidence in using dash cameras as protective and preventive safety tools

- Fleet operators and ride-hailing platforms are also driving demand for car DVRs to monitor driver behavior and reduce liability risks. Companies such as Uber encourage the use of in-car recording systems to improve safety transparency for both drivers and passengers

- Governments and road safety organizations are promoting the use of in-vehicle monitoring technologies to enhance accountability and deter reckless driving. This has increased adoption of DVR systems among commercial vehicles, taxis, and logistics fleets

- The growing emphasis on evidence-based insurance processing and dispute resolution continues to support the widespread deployment of car DVR systems. As safety awareness increases globally, the demand for reliable, continuous video recording solutions remains a strong growth catalyst for the market

Restraint/Challenge

Data Privacy and Regulatory Compliance Concerns

- The car DVR market faces challenges related to data privacy, surveillance regulations, and compliance with regional data protection laws. Continuous video recording raises concerns around unauthorized data collection, storage, and misuse of personal and public information

- For instance, strict data protection frameworks such as the General Data Protection Regulation in Europe impose limitations on how video footage can be recorded, stored, and shared. These regulations require manufacturers and users to implement privacy safeguards, increasing compliance complexity

- In some countries, the legality of dash camera usage remains unclear or restricted, creating uncertainty for consumers and slowing adoption. Manufacturers must adapt product designs to include privacy modes, encryption, and controlled data access to meet varying regulatory requirements

- The challenge is further intensified by the growing use of cloud-connected DVR systems, where data storage and transmission must comply with regional cybersecurity and privacy standards. Ensuring secure data handling increases development and operational costs for vendors

- These regulatory and privacy-related challenges continue to influence purchasing decisions and market penetration. Addressing compliance requirements while maintaining functionality and user convenience remains a critical hurdle for sustained growth in the car DVR market

Car DVR Market Scope

The market is segmented on the basis of product type, vehicle type, sales channel, technology level, and video quality.

- By Product Type

On the basis of product type, the Car DVR market is segmented into single-channel, dual-channel, 360° surround-view systems, triple-channel or cabin-view, and rear-view-only dash cameras. The dual-channel segment dominated the largest market revenue share in 2025, driven by rising consumer focus on comprehensive incident recording and enhanced road safety. Dual-channel DVRs provide simultaneous front and rear coverage, supporting better evidence during accidents, insurance claims, and traffic disputes. Their growing adoption is also supported by improving affordability, better night vision capabilities, and compatibility with advanced driver monitoring features. Increasing awareness among private vehicle owners and fleet operators further strengthens demand for this segment.

The 360° surround-view systems segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising demand for premium safety and parking assistance solutions. These systems offer full vehicle coverage, minimizing blind spots and supporting advanced situational awareness. Growth is driven by increasing integration in high-end passenger cars and luxury SUVs, along with technological advancements in multi-camera stitching and real-time video processing.

- By Vehicle Type

On the basis of vehicle type, the Car DVR market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment held the largest market revenue share of 63.61%in 2025, driven by high global vehicle ownership and increasing consumer adoption of in-vehicle safety electronics. Rising concerns over road accidents, theft prevention, and insurance documentation encourage passenger car owners to install dash cameras. The availability of compact, user-friendly DVR systems and strong aftermarket penetration further supports dominance in this segment. Growing awareness of personal safety and legal protection continues to drive adoption across urban and semi-urban regions.

The light commercial vehicles segment is expected to grow at the fastest rate during the forecast period due to expanding logistics, e-commerce, and last-mile delivery operations. Fleet operators increasingly deploy DVR systems to monitor driver behavior, optimize routes, and reduce liability risks. Regulatory emphasis on fleet safety and operational transparency also contributes to accelerated growth in this segment.

- By Sales Channel

On the basis of sales channel, the Car DVR market is segmented into aftermarket and OEM-installed. The aftermarket segment dominated the market in 2025, driven by flexibility in product selection, price competitiveness, and widespread availability across online and offline retail channels. Consumers prefer aftermarket installations due to the ability to upgrade existing vehicles without purchasing new models. Rapid innovation, frequent product launches, and easy installation further strengthen aftermarket demand. High adoption across emerging economies also supports the segment’s leading position.

The OEM-installed segment is projected to witness the fastest growth from 2026 to 2033, supported by increasing integration of DVR systems as standard or optional safety features in new vehicles. Automakers are incorporating factory-fitted DVRs to enhance vehicle safety packages and brand differentiation. Growing collaboration between OEMs and technology providers is further accelerating this segment’s expansion.

- By Technology Level

On the basis of technology level, the Car DVR market is segmented into basic DVR, advanced DVR with ADAS, and smart connected DVR. The basic DVR segment accounted for the largest market share in 2025 due to its cost-effectiveness and widespread use among price-sensitive consumers. These systems fulfill core recording needs, supporting accident documentation and basic security applications. High adoption in developing markets and among first-time users continues to drive revenue for this segment. Simplicity, reliability, and low maintenance requirements further support sustained demand.

The smart connected DVR segment is expected to register the fastest growth during the forecast period, driven by rising adoption of AI-enabled analytics, cloud storage, and real-time connectivity. These systems support features such as live streaming, remote access, driver behavior analysis, and predictive safety alerts. Increasing digitalization of vehicles and demand for intelligent mobility solutions are key contributors to rapid growth.

- By Video Quality

On the basis of video quality, the Car DVR market is segmented into SD or HD up to 720p, Full HD 1080p, and 4K and above. The Full HD 1080p segment dominated the market revenue share in 2025, driven by its optimal balance between video clarity, storage efficiency, and affordability. Consumers favor 1080p resolution for its ability to capture clear license plate details and road conditions without excessive data consumption. Broad compatibility with existing storage solutions and displays further supports its widespread adoption.

The 4K and above segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising demand for ultra-high-definition recording and enhanced image accuracy. Advancements in sensor technology and declining costs of high-capacity storage enable greater adoption of 4K DVR systems. Increasing preference for premium safety and surveillance solutions continues to accelerate growth in this segment.

Car DVR Market Regional Analysis

- Europe dominated the car DVR market with the largest revenue share of 31.96% in 2025, driven by strong road safety regulations, rising adoption of in-vehicle safety technologies, and increasing awareness regarding accident documentation and insurance claims

- Consumers across Europe emphasize vehicle safety, legal evidence, and driver accountability, leading to higher installation rates of dash cameras in both private and commercial vehicles

- The region’s dominance is further supported by strict traffic monitoring norms, widespread use of advanced driver assistance systems, and growing integration of DVRs in connected and premium vehicles, establishing Europe as a mature and regulation-driven market

Germany Car DVR Market Insight

The Germany car DVR market held the largest share within Europe in 2025, driven by the country’s strong automotive ecosystem and high consumer preference for technologically advanced vehicle solutions. German consumers prioritize precision, reliability, and data security, encouraging adoption of high-quality DVR systems. Increasing use of dash cameras in commercial fleets and logistics operations to improve driver behavior monitoring and operational efficiency is further supporting growth. Regulatory clarity around controlled DVR usage is also aiding wider acceptance.

U.K. Car DVR Market Insight

The U.K. car DVR market is anticipated to grow at a notable CAGR during the forecast period, supported by rising insurance-related applications and increasing awareness of road safety. Dash cameras are widely adopted by private car owners and taxi operators for accident evidence and dispute resolution. The strong presence of online retail channels and growing demand for easy-to-install aftermarket DVR systems further stimulate market expansion.

North America Car DVR Market Insight

The North America car DVR market is experiencing consistent growth due to increasing vehicle ownership, rising insurance fraud concerns, and growing adoption of connected car technologies. Consumers value DVR systems for personal security, theft prevention, and legal documentation. Strong aftermarket sales, combined with rising OEM integration in newer vehicle models, continue to drive demand across the U.S. and Canada.

U.S. Car DVR Market Insight

The U.S. car DVR market accounts for the largest revenue share within North America, driven by widespread adoption of advanced automotive electronics and high awareness of insurance and liability protection. Fleet operators, ride-hailing services, and commercial vehicle owners increasingly rely on DVR systems for driver monitoring and operational transparency. Integration with cloud platforms and mobile applications is further accelerating market growth.

Asia-Pacific Car DVR Market Insight

The Asia-Pacific car DVR market is projected to grow at the fastest CAGR during the forecast period, supported by rapid urbanization, rising vehicle sales, and increasing road safety concerns. Growing disposable incomes and expanding adoption of smart and connected vehicles are boosting demand for DVR systems. The region also benefits from strong manufacturing capabilities, improving affordability and accessibility of car DVR products.

China Car DVR Market Insight

China accounted for the largest revenue share in the Asia-Pacific car DVR market in 2025, driven by high vehicle ownership, rapid technological adoption, and expanding smart mobility initiatives. Dash cameras are widely used for traffic monitoring, insurance documentation, and personal safety. Strong domestic manufacturers and competitive pricing further support widespread adoption across passenger and commercial vehicles.

Japan Car DVR Market Insight

The Japan car DVR market is growing steadily, supported by the country’s emphasis on road safety, advanced automotive technology, and high penetration of connected vehicles. Consumers favor compact, high-resolution DVR systems with advanced features such as night vision and AI-based alerts. The aging population and focus on safer driving practices are further encouraging adoption across residential and commercial vehicle segments.

Car DVR Market Share

The car DVR industry is primarily led by well-established companies, including:

- Vantrue Technology Co., Ltd. (China)

- Panasonic Holdings Corporation (Japan)

- Rexing Inc. (U.S.)

- Thinkware Corporation (South Korea)

- Koninklijke Philips N.V. (Netherlands)

- Auto-vox Technology Co., Ltd. (China)

- Garmin Ltd. (U.S.)

- DOD Tech Co., Ltd. (Taiwan)

- Xiaomi Corporation – 70mai (China)

- Cobra Electronics Corporation (U.S.)

- Fine Digital Inc. (South Korea)

- Nextbase Limited (U.K.)

- Transcend Information, Inc. (Taiwan)

- ABEO Technology Co., Ltd. (South Korea)

- Samsung Electronics Co., Ltd. (South Korea)

- Steelmate Co., Ltd. (China)

- PAPAGO Inc. (Taiwan)

- VIOFO Ltd. (China)

- Cansonic Inc. (China)

- Pittasoft Co., Ltd. (South Korea)

- Qrontech Co., Ltd. (South Korea)

Latest Developments in Global Car DVR Market

- In September 2025, Standard Fleet secured USD 13 million in Series A funding, strengthening its position in the connected fleet and car DVR ecosystem by accelerating the expansion of mixed-fleet connectivity solutions. The funding supports the rollout of an upgraded digital-key platform integrated with real-time video monitoring, enhancing demand for advanced DVR systems in fleet management, improving driver accountability, and increasing adoption of video-enabled telematics across commercial vehicles

- In December 2024, BlackVue, a brand of Pittasoft, launched the DR590X PLUS series, reinforcing competition in the mid-range car DVR segment through upgraded full HD recording and enhanced connectivity features. The introduction of Sony STARVIS CMOS sensors, built-in Wi-Fi, and native parking mode strengthens consumer demand for high-reliability dash cameras, while impact and motion detection features improve value for personal safety, insurance evidence, and vehicle surveillance use cases

- In December 2024, Honda and Nissan signed a memorandum of understanding to merge operations, potentially creating a top-three global automaker with a strong focus on electric vehicles and integrated camera-based safety systems. This strategic move is expected to accelerate OEM-level integration of advanced car DVR and camera suites, boosting long-term demand for factory-installed video recording and driver monitoring technologies

- In September 2024, Garmin unveiled the Dash Cam X series, expanding its automotive product portfolio with enhanced integration features tailored for connected vehicle applications. The launch supports market growth by improving compatibility with in-vehicle systems, increasing adoption among tech-savvy consumers, and reinforcing the trend toward smarter, app-connected DVR solutions

- In January 2024, ECARX announced a strategic partnership with FAW to introduce the first Hongqi model featuring AutoGPT with DeepSeek-R1 integration, signaling a shift toward AI-driven in-car intelligence. This development indirectly strengthens the car DVR market by promoting deeper integration of video, AI, and cloud analytics within vehicle ecosystems, paving the way for smarter, data-centric camera and monitoring solutions in next-generation vehicles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.