Global Car Finance Market

Market Size in USD Billion

CAGR :

%

USD

2,340.17 Billion

USD

3,277.35 Billion

2024

2032

USD

2,340.17 Billion

USD

3,277.35 Billion

2024

2032

| 2025 –2032 | |

| USD 2,340.17 Billion | |

| USD 3,277.35 Billion | |

|

|

|

|

Car Finance Market Size

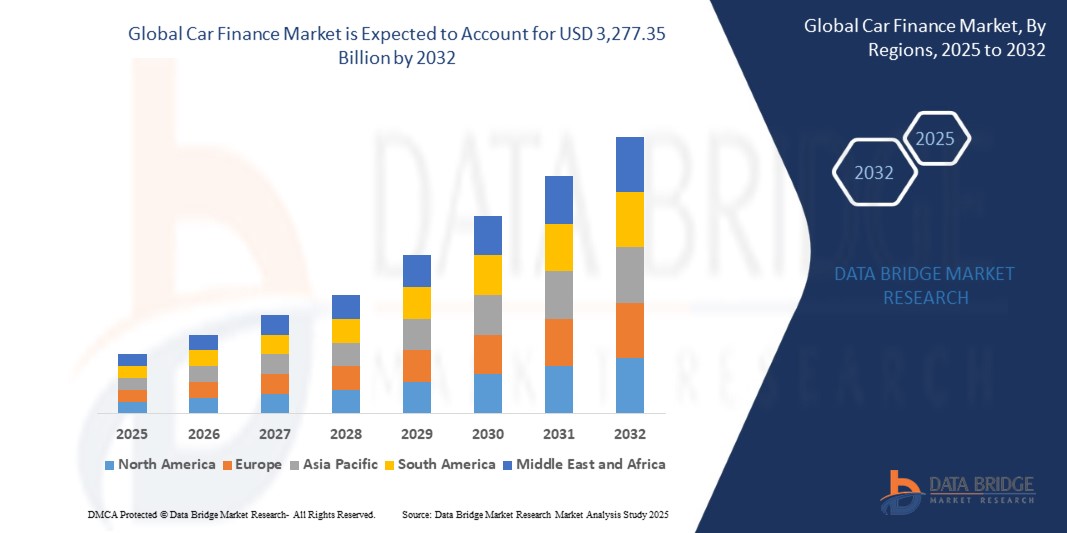

- The global car finance market size was valued at USD 2,340.17 billion in 2024 and is expected to reach USD 3,277.35 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely fuelled by the increasing demand for passenger and commercial vehicles, coupled with the rising adoption of digital lending platforms and easy financing options

- Growing disposable incomes, urbanization, and the expansion of ride-hailing and car rental businesses are further boosting the demand for flexible auto financing solutions

Car Finance Market Analysis

- The car finance market is witnessing significant transformation with the integration of advanced technologies such as AI-driven credit assessment, blockchain-based loan processing, and mobile-first financing platforms

- Shifts in consumer preferences toward electric vehicles (EVs) and hybrid cars are encouraging lenders to introduce tailored financing schemes, further reshaping market dynamics

- Asia-Pacific dominated the car finance market with the largest revenue share of 36.7% in 2024, driven by rising vehicle sales, growing middle-class population, and increasing adoption of structured financing solutions for personal and commercial vehicles

- North America region is expected to witness the highest growth rate in the global car finance market, driven by high consumer spending power, technological advancements in digital lending, and the growing trend of vehicle leasing. Strong automotive sales and increased demand for convenient, tech-enabled financing solutions are fueling the region’s rapid market growth

- The indirect financing segment held the largest market revenue share in 2024, driven by the dominance of dealer-arranged financing options that simplify loan approvals and offer convenience for car buyers. Indirect financing channels continue to attract consumers by providing flexible structures and quicker disbursals through dealer networks

Report Scope and Car Finance Market Segmentation

|

Attributes |

Car Finance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Car Finance Market Trends

Rise Of Digital And Online Financing Platforms

- The rapid adoption of digital platforms is revolutionizing the car finance industry, offering consumers faster loan approvals, simplified application processes, and enhanced transparency. Online platforms provide real-time loan comparisons, making it easier for buyers to secure competitive interest rates. This convenience is driving consumer preference, especially among younger demographics

- The widespread use of smartphones and internet banking is enabling customers to complete end-to-end car financing processes remotely. Digital platforms are particularly effective in markets where physical bank visits are time-consuming, helping streamline accessibility and saving valuable time for consumers

- Affordability and customization options available through digital platforms are attracting customers with diverse credit profiles, enabling flexible repayment terms and personalized finance plans. This is leading to greater market penetration among first-time buyers and middle-income groups

- For instance, in 2023, several banks and fintech firms in India reported a significant rise in car loan applications via mobile apps, as digital onboarding and instant credit verification accelerated approvals. This trend reduced paperwork and processing delays, boosting customer satisfaction

- While digital platforms are transforming car finance by improving convenience and reach, their success depends on secure data handling, continuous tech innovation, and financial literacy. Lenders must focus on user-friendly design and strong cybersecurity to capitalize on this digital shift

Car Finance Market Dynamics

Driver

Growing Demand For Vehicle Ownership Supported By Flexible Financing Options

- Rising vehicle demand, supported by increasing disposable incomes and urbanization, is fueling the need for accessible financing. Car finance has become a vital enabler for middle-class consumers aspiring to own vehicles without large upfront costs

- Consumers are increasingly aware of the benefits of structured financing, such as low down payments and flexible repayment schedules. These options redce financial stress and make vehicle ownership more achievable, boosting car sales globally

- Government initiatives and supportive banking policies are also enhancing credit availability. From low-interest loan schemes to subsidies for electric vehicle financing, public-sector support is driving market adoption

- For instance, in 2022, the U.S. automotive finance sector saw rising adoption of zero-interest loan programs, encouraging buyers to upgrade vehicles without immediate financial strain

- While strong consumer demand and institutional support are driving growth, further improvements in digital accessibility, financial literacy, and inclusive lending practices are essential to sustain long-term market expansion

Restraint/Challenge

High Interest Rates And Credit Accessibility Barriers For Low-Income Groups

- Elevated interest rates and strict eligibility criteria often make vehicle financing expensive and inaccessible for low-income groups or individuals with poor credit histories. This remains a critical barrier in emerging and developed markets alike

- In many regions, lack of credit history or financial literacy restricts access to affordable car loans. This limits market penetration among potential buyers who rely on informal lending or cash purchases. The situation is especially challenging in developing economies where financial institutions lack robust credit evaluation systems, making it harder for underserved populations to secure loans despite rising vehicle demand

- Market growth is further hindered by regional disparities in banking infrastructure and credit availability. Rural and semi-urban consumers frequently face longer approval times, hidden charges, and limited loan product options

- For instance, in 2023, surveys across Africa and Southeast Asia indicated that nearly 60% of first-time car buyers struggled to access formal financing due to high interest rates and collateral requirements. Many consumers turned to informal credit channels, often facing unfavorable repayment terms that increase financial risks. This reliance on unregulated alternatives highlights the urgent need for inclusive financing models and fintech-driven credit scoring solutions to bridge the accessibility gap

- While the car finance market continues to evolve, overcoming affordability and accessibility challenges is essential. Stakeholders must develop inclusive lending models, digital credit assessment tools, and risk-sharing mechanisms to unlock full market potential

Car Finance Market Scope

The market is segmented on the basis of financing type, car type, provider, application, and purpose.

• By Financing Type

On the basis of financing type, the car finance market is segmented into direct financing and indirect financing. The indirect financing segment held the largest market revenue share in 2024, driven by the dominance of dealer-arranged financing options that simplify loan approvals and offer convenience for car buyers. Indirect financing channels continue to attract consumers by providing flexible structures and quicker disbursals through dealer networks.

The direct financing segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing adoption of digital banking platforms and online loan applications. Direct financing allows buyers to negotiate better interest rates and terms directly with lenders, improving transparency and affordability.

• By Car Type

On the basis of car type, the market is segmented into new cars and used cars. The new car segment accounted for the largest share in 2024, fueled by rising consumer preference for advanced vehicles with improved safety and technology features. Strong financing support from banks and OEMs further drives this demand.

The used car segment is expected to witness the fastest growth rate from 2025 to 2032, driven by affordability, growing acceptance of certified pre-owned vehicles, and digital marketplaces that ease financing access.

• By Provider

On the basis of provider, the market is segmented into OEMs, banks, credit unions, financial institutions, and others. The banks segment led the market in 2024, backed by their extensive customer base, competitive loan offerings, and strong financial infrastructure.

The OEMs segment is expected to witness the fastest growth rate from 2025 to 2032, supported by in-house financing schemes, bundled offers, and brand-driven loyalty programs that attract younger consumers.

• By Application

On the basis of application, the car finance market is segmented into personal and commercial. The personal segment dominated the market in 2024, as individual consumers increasingly relied on flexible financing options to purchase new and used vehicles.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising fleet expansion activities, logistics demand, and mobility-as-a-service providers seeking bulk financing solutions.

• By Purpose

On the basis of purpose, the market is segmented into loans and lease. The loans segment contributed the largest revenue share in 2024, supported by long-standing consumer familiarity, ownership benefits, and wider availability across financial institutions.

The lease segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rising appeal of flexible ownership models, lower upfront costs, and increasing demand among younger, urban consumers.

Car Finance Market Regional Analysis

- Asia-Pacific dominated the car finance market with the largest revenue share of 36.7% in 2024, driven by rising vehicle sales, growing middle-class population, and increasing adoption of structured financing solutions for personal and commercial vehicles.

- Consumers in the region highly value flexible loan and lease options, competitive interest rates, and accessible digital finance platforms that simplify vehicle acquisition.

- This widespread adoption is further supported by rapid urbanization, improving financial literacy, and government initiatives promoting vehicle ownership, establishing car finance as a preferred solution across the region.

China Car Finance Market Insight

The China car finance market captured the largest revenue share in Asia-Pacific in 2024, fueled by the country’s expanding middle class, rapid urbanization, and rising vehicle ownership. Consumers are increasingly opting for loans and leasing programs to acquire both new and used vehicles. Strong partnerships between banks, OEMs, and fintech platforms enhance accessibility and affordability. In addition, government incentives for digital financing adoption are significantly contributing to the market’s growth.

Japan Car Finance Market Insight

The Japan car finance market is expected to witness the fastest growth rate from 2025 to 2032 due to high vehicle ownership, technological advancements in digital finance platforms, and the increasing preference for flexible loan and lease programs. Leasing and financing solutions are becoming a popular choice for both personal and commercial vehicle acquisitions. In addition, Japan’s aging population and focus on convenience in automotive services are driving demand for accessible and user-friendly car finance options.

North America Car Finance Market Insight

The North America car finance market is expected to witness the fastest growth rate from 2025 to 2032, driven by the high adoption of personal and commercial vehicle loans and leases, growing preference for digital finance solutions, and strong automotive sales. Consumers highly value flexible loan tenures, competitive interest rates, and convenient online application processes. The widespread use of credit and strong financial infrastructure further supports market growth, making car finance a key enabler for vehicle ownership in the region.

U.S. Car Finance Market Insight

The U.S. car finance market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the widespread availability of auto loans, leasing programs, and digital finance platforms. Consumers increasingly prefer financing options for both new and used vehicles, while banks, credit unions, and OEMs offer tailored packages. Growing awareness of credit benefits, coupled with easy access to online applications and mobile platforms, significantly boosts adoption. In addition, consumer demand for electric vehicles and hybrid cars is driving specialized financing products, contributing to overall market expansion.

Europe Car Finance Market Insight

The Europe car finance market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing vehicle sales, government incentives for low-emission vehicles, and the rising popularity of flexible loan and lease options. Consumers are showing a preference for digital finance solutions that simplify vehicle acquisition. The region’s well-established banking and financial institutions further support the penetration of car finance, particularly for new and used cars in both personal and commercial segments.

U.K. Car Finance Market Insight

The U.K. car finance market is expected to witness the fastest growth rate from 2025 to 2032, fueled by high vehicle ownership rates, the growing adoption of personal and commercial loans, and increasing consumer awareness of structured finance options. Flexible repayment plans, competitive interest rates, and accessible online platforms enhance adoption. In addition, incentives for electric vehicles and government-backed schemes supporting digital financing are contributing to market growth.

Germany Car Finance Market Insight

The Germany car finance market is expected to witness the fastest growth rate from 2025 to 2032, driven by a strong automotive industry, rising demand for new and used vehicles, and increasing consumer preference for loans and leasing programs. Financing options from banks, OEMs, and credit institutions provide convenience and flexibility. Furthermore, Germany’s advanced digital banking infrastructure, growing adoption of online platforms, and government policies promoting sustainable mobility enhance the growth of the car finance market.

Car Finance Market Share

The Car Finance industry is primarily led by well-established companies, including:

- Toyota Financial Services (Japan)

- Ford Motor Credit Company (U.S.)

- Ally Financial Inc.(U.S.)

- Volkswagen Financial Services (Germany)

- BMW Financial Services (Germany)

- General Motors Financial Company, Inc.(U.S.)

- Honda Financial Services (Japan)

- Mercedes-Benz Financial Services (Germany)

- Hyundai Capital America (U.S.)

Latest Developments in Global Car Finance Market

- In December 2023, Toyota Financial Services launched a new digital car finance platform aimed at streamlining the financing process. The platform allows customers to apply for loans, manage accounts, and access personalized financial services online. This development enhances customer convenience, reduces processing time, and strengthens Toyota’s competitive position in the car finance market by promoting digital adoption

- In October 2023, Ford Motor Credit Company entered a strategic partnership with a leading fintech firm to expand its digital lending capabilities. The collaboration focuses on offering innovative car finance solutions, improving loan processing efficiency, and providing tailored financing options. This initiative is expected to attract tech-savvy customers, increase market penetration, and reinforce Ford’s presence in the evolving automotive finance sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.