Global Car T Therapy Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

6.66 Billion

2024

2032

USD

2.44 Billion

USD

6.66 Billion

2024

2032

| 2025 –2032 | |

| USD 2.44 Billion | |

| USD 6.66 Billion | |

|

|

|

|

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Size

- The global chimeric antigen receptor (CAR)-T cell therapy market size was valued at USD 2.44 billion in 2023 and is projected to reach USD 5.97 billion by 2031, at a CAGR of 15.3% during the forecast period.

- This growth is driven by factors such as increasing prevalence of cancer, advancements in immunotherapy, and growing approvals of CAR-T cell therapies by regulatory agencies

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Analysis

- CAR-T cell therapy is a revolutionary cancer treatment that modifies a patient’s T-cells to target and destroy cancer cells. It has shown high efficacy in treating certain types of leukemia, lymphoma, and multiple myeloma

- The demand for CAR-T cell therapy is rising due to increasing incidences of hematologic malignancies and promising outcomes in clinical trials

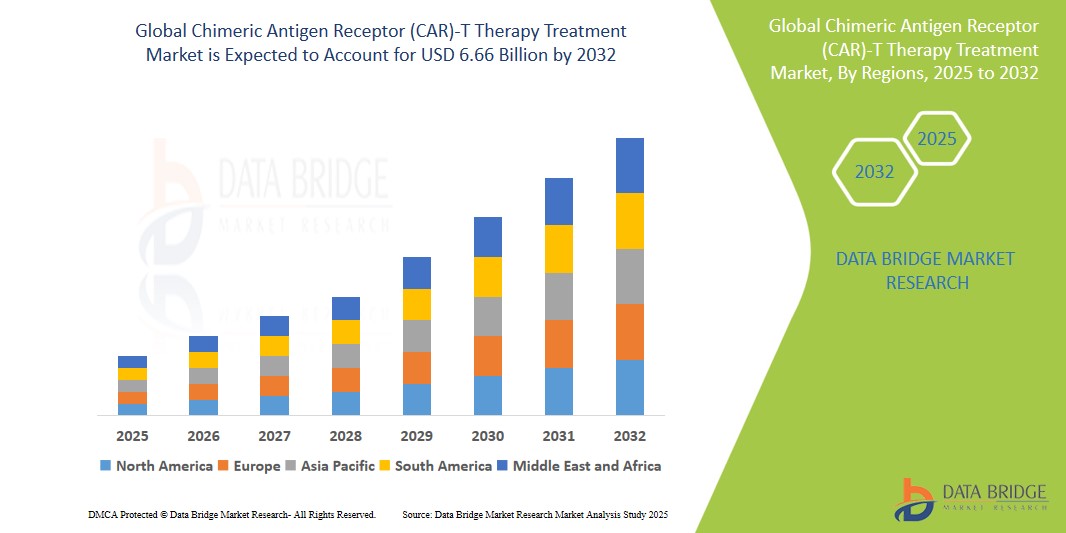

- North America is expected to dominate the CAR-T cell therapy market owing to strong R&D activities, high healthcare expenditure, and early adoption of advanced therapies

- Asia-Pacific is expected to be the fastest growing region in the CAR-T cell therapy market during the forecast period due to expanding biotechnology sectors and increasing cancer burden.

- Acute lymphocytic leukemia segment is expected to dominate the market with a market share of 30% due to high treatment responsiveness and ongoing clinical development. As one of the first approved indications for CAR-T therapy, it continues to drive market growth

Report Scope and Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Segmentation

|

Attributes |

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Trends

“Next-Generation CAR-T Therapies and Off-the-Shelf (Allogeneic) Solutions”

- A major trend in the CAR-T cell therapy landscape is the emergence of next-generation CAR-T therapies and the development of off-the-shelf (allogeneic) CAR-T solutions that aim to overcome the limitations of traditional autologous CAR-T products

- These innovations aim to improve manufacturing efficiency, reduce treatment costs, and ensure faster patient access by eliminating the need to harvest and modify a patient’s own T cells

- For instance, allogeneic CAR-T therapies such as those under development by Allogene Therapeutics and Precision BioSciences utilize gene editing technologies to produce universal CAR-T cells from healthy donors, offering the potential for scalable and readily available treatments

- These advancements are poised to transform cancer immunotherapy, reducing time-to-treatment, enhancing accessibility, and supporting the expansion of CAR-T therapy across broader indications and patient populations

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Dynamics

Driver

“Rising Cancer Incidence and High Efficacy of CAR-T in Hematologic Malignancies”

- The growing global burden of cancer—especially hematologic malignancies like leukemia, lymphoma, and multiple myeloma—is a key factor driving the demand for CAR-T cell therapy

- CAR-T therapies offer high efficacy, with several FDA-approved products demonstrating strong remission rates in patients who have not responded to conventional treatments

- For instance, According to the International Agency for Research on Cancer (IARC) in 2022, approximately 20 million new cancer cases were diagnosed globally, with blood cancers accounting for a significant proportion of these cases. The increasing prevalence of treatment-resistant cancers is propelling the need for advanced therapeutic options like CAR-T.

- With continuous advancements in CAR design, target antigen selection, and therapy delivery, the effectiveness and safety of CAR-T therapy continue to improve, driving market growth

Opportunity

“Expanding Indications into Solid Tumors and Earlier Treatment Lines”

- One of the most promising opportunities lies in expanding CAR-T cell therapy beyond hematologic malignancies into solid tumors, which constitute the majority of global cancer cases

- Innovations in tumor microenvironment modulation, dual-targeting CARs, and armored CAR-Ts are enabling CAR-T cells to better infiltrate and persist in solid tumors

- Furthermore, regulatory agencies and researchers are exploring the use of CAR-T therapy in earlier lines of treatment, potentially increasing patient eligibility and outcomes

- For instance, In March 2024, researchers at the National Cancer Institute (NCI) began Phase I trials for CAR-T therapies targeting HER2-positive breast cancer and EGFR-positive glioblastoma, marking a shift toward solid tumor applications

- These developments could significantly expand the commercial scope of CAR-T therapies and position them as a first-line or second-line option in a broader range of cancers

Restraint/Challenge

“High Treatment Costs and Complex Manufacturing Processes”

- One of the biggest challenges limiting widespread adoption of CAR-T therapy is its high cost and complex, individualized manufacturing process, which involves extracting, engineering, and reinfusing a patient’s own T cells

- Treatment costs often exceed hundreds of thousands of dollars per patient, creating significant financial barriers for patients and payers, and limiting access in low- and middle-income countries

- For instance, In October 2024, a study published in Health Affairs estimated the average total cost of CAR-T therapy (including hospitalization and supportive care) in the U.S. at over USD 500,000 per patient, making affordability a major concern for healthcare systems

- Consequently, such limitations can result in disparities in the quality of care and access to advanced surgical procedures, ultimately hindering the overall growth of the market.

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Scope

The market is segmented on the basis types, target antigen and therapeutic application.

|

Segmentation |

Sub-Segmentation |

|

By Types |

|

|

By Target Antigen |

|

|

By Therapeutic Application |

|

In 2025, the acute lymphocytic leukemia (ALL) segment is projected to dominate the market with the largest share in the therapeutic application segment

The acute lymphocytic leukemia (ALL) segment is expected to lead the CAR-T cell therapy market in 2025, accounting for the largest market share of approximately 30%. This dominance is attributed to the early approval and clinical success of CAR-T therapies such as Kymriah and Tecartus for treating relapsed or refractory ALL. With its high response rates and life-saving potential, CAR-T therapy is becoming the standard of care for patients unresponsive to conventional treatments. The increasing incidence of ALL, especially in pediatric populations, along with continued clinical advancements, is expected to further reinforce the segment’s leading position.

The CD19 target antigen segment is expected to dominate the market with the largest share in the target antigen segment

The CD19 target antigen segment is projected to hold the largest market share of 48.6% in 2025 within the CAR-T cell therapy market. CD19 has been the most widely targeted antigen due to its high expression in B-cell malignancies such as acute lymphocytic leukemia, non-Hodgkin lymphoma, and chronic lymphocytic leukemia. Multiple FDA-approved CAR-T therapies, including Kymriah, Yescarta, and Breyanzi, are CD19-specific, demonstrating significant clinical efficacy. As ongoing trials explore CD19 in combination therapies and new indications, this segment is expected to maintain its dominant position throughout the forecast period.

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Regional Analysis

“North America Holds the Largest Share in the Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market”

- North America dominates the CAR-T cell therapy market, supported by strong clinical research infrastructure, early adoption of innovative immunotherapies, and a robust regulatory framework facilitating advanced cell therapy approvals.

- The United States leads the region with a high concentration of approved CAR-T therapies, including Kymriah, Yescarta, and Breyanzi, which are widely accessible across specialized cancer treatment centers.

- Favorable reimbursement policies, increasing cancer incidence, and government-backed initiatives to promote precision oncology contribute significantly to market expansion.

- In addition, the presence of leading biotechnology companies, ongoing clinical trials for new indications, and investments in cell therapy manufacturing facilities strengthen the region's leadership in the global CAR-T therapy landscape.

“Asia-Pacific is Projected to Register the Highest CAGR in the Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the CAR-T cell therapy market, fueled by expanding healthcare infrastructure, rising cancer prevalence, and growing investments in biotechnology innovation

- Countries like China, Japan, South Korea, and India are emerging as key markets due to increasing adoption of personalized cancer treatment and government support for clinical research and cell therapy development

- China, in particular, is rapidly advancing in the CAR-T space, with a large number of clinical trials and domestic biotech firms launching competitive therapies targeting CD19, CD22, and BCMA antigens

- Japan’s regulatory body has adopted fast-track approval pathways for regenerative and advanced therapies, helping accelerate access to CAR-T treatments

- India is witnessing growing demand for CAR-T therapy, supported by academic collaborations and initiatives to localize manufacturing and reduce treatment costs. This regional momentum is expected to significantly contribute to global market growth over the forecast period

Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Autolus Therapeutics (U.K.)

- CARsgen Therapeutics Holdings Limited (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Sorrento Therapeutics, Inc. (U.S.)

- bluebird bio, Inc. (U.S.)

- Eureka Therapeutics Inc. (U.S.)

- Avacta Group plc (U.K.)

- Cibus Inc. (France)

- Celyad Oncology SA (Belgium)

- Fortress Biotech, Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Novartis AG (Switzerland)

- Alaunos Therapeutics, Inc. (U.S.)

- Poseida Therapeutics, Inc. (U.S.)

Latest Developments in Global Chimeric Antigen Receptor (CAR)-T Therapy Treatment Market

- In December 2023, Max Healthcare successfully introduced CAR-T cell therapy in the Delhi-NCR area, marking a significant advancement in cancer treatment options. This innovative therapy, developed in partnership with ImmunoACT, is specifically designed to combat lymphomas and leukemias, offering new hope for patients battling these challenging conditions

- In December 2022, CARsgen Therapeutics Co., Ltd. partnered with the Shanghai Cancer Institute to develop new technology that significantly enhances the antitumor effectiveness of T cells. Their research team discovered that CAR T cells engineered to overexpress Runx3 exhibited sustained antitumor activity and improved tumor control compared to traditional chimeric antigen receptor T-cell therapies

- In November 2022, Caribou Biosciences, Inc. announced that its allogeneic anti-CD19 CAR-T cell therapy, CB-010, received Regenerative Medicine Advanced Therapy (RMAT) designation from the U.S. Food and Drug Administration (FDA) for relapsed or refractory large B cell lymphoma (LBCL), as well as fast track designation for relapsed or refractory B cell non-Hodgkin lymphoma

- In June 2022, The University of Ottawa showcased promising results from the Canadian-Led Immunotherapies in Cancer-01 (CLIC-01) clinical trial, which focused on one of the first Canadian-developed CAR-T cell therapies for cancer. This therapy features a unique manufacturing process that may lead to more affordable and equitable treatment options

- In November 2021, The California Institute for Regenerative Medicine's governing board approved a grant of USD 4.1 million to support the advancement of innovative chimeric antigen receptor T-cell therapy being developed by scientists at the University of California San Diego School of Medicine, aiding their efforts to transition this promising cancer treatment from the laboratory to clinical practice

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.1.1 PREVALENCE OF B-CELL ACUTE LYMPHOBLASTIC LEUKEMIA (ALL)

7.1.2 PREVALENCE OF B-CELL NON-HODGKIN LYMPHOMA (NHL)

7.1.3 PREVALENCE OF FOLLICULAR LYMPHOMA

7.1.4 PREVALENCE OF MANTLE CELL LYMPHOMA (MCL)

7.1.5 PREVALENCE OF MULTIPLE MYELOMA

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR XX

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDICTION

11.3 PHARMACOLOGICAL CLASS OF THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.1 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, BY TARGET INDICATION

15.1 OVERVIEW

15.2 B-CELL ACUTE LYMPHOBLASTIC LEUKEMIA (ALL)

15.3 B-CELL NON-HODGKIN LYMPHOMA (NHL)

15.4 FOLLICULAR LYMPHOMA

15.5 MANTLE CELL LYMPHOMA (MCL)

15.6 MULTIPLE MYELOMA

15.7 OTHERS

16 GLOBAL

16.1 OVERVIEW

16.2 AUTOLOGOUS CAR-T CELLS

16.3 ALLOGENEIC CAR-T CELLS

17 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, BY TARGET ANTIGEN

17.1 OVERVIEW

17.2 CD19

17.2.1 TISAGENLECLEUCEL

17.2.1.1. MARKET VALUE (USD MN)

17.2.1.2. MARKET VOLUME (SU)

17.2.1.3. AVERAGE SELLING PRICE (USD)

17.2.2 AXIXABTAGENE CILOLEUCEL

17.2.2.1. MARKET VALUE (USD MN)

17.2.2.2. MARKET VOLUME (SU)

17.2.2.3. AVERAGE SELLING PRICE (USD)

17.2.3 BREXUCABTAGENE AUTOLLEUCEL

17.2.3.1. MARKET VALUE (USD MN)

17.2.3.2. MARKET VOLUME (SU)

17.2.3.3. AVERAGE SELLING PRICE (USD)

17.2.4 LISOCABTAGENE MARALEUCEL

17.2.4.1. MARKET VALUE (USD MN)

17.2.4.2. MARKET VOLUME (SU)

17.2.4.3. AVERAGE SELLING PRICE (USD)

17.2.5 OTHERS

17.3 BCMA

17.3.1 IDECABTAGENE VICLEUCEL

17.3.1.1. MARKET VALUE (USD MN)

17.3.1.2. MARKET VOLUME (SU)

17.3.1.3. AVERAGE SELLING PRICE (USD)

17.3.2 CILTACABTAGENE AUTOLEUCEL

17.3.2.1. MARKET VALUE (USD MN)

17.3.2.2. MARKET VOLUME (SU)

17.3.2.3. AVERAGE SELLING PRICE (USD)

17.3.3 OTHERS

17.4 OTHERS

18 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, BY AGE GROUP

18.1 OVERVIEW

18.2 CHILDREN (0-15)

18.3 ADULTS (16- 64)

18.4 SENIORS (65 AND ABOVE)

19 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, BY GENDER

19.1 OVERVIEW

19.2 MALE

19.3 FEMALE

20 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, BY END USER

20.1 OVERVIEW

20.2 HOSPITAL

20.2.1 PRIVATE

20.2.2 PUBLIC

20.3 SPECIALTY CLINICS

20.4 RESEARCH INSTITUTES

20.5 CANCER INSTITUTES

20.6 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

20.7 OTHERS

21 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 DIRECT SALE

21.3 RETAIL SALES

21.4 OTHERS

22 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, BY GEOGRAPHY

GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 U.K.

23.2.3 ITALY

23.2.4 FRANCE

23.2.5 SPAIN

23.2.6 RUSSIA

23.2.7 SWITZERLAND

23.2.8 TURKEY

23.2.9 BELGIUM

23.2.10 NETHERLANDS

23.2.11 DENMARK

23.2.12 SWEDEN

23.2.13 POLAND

23.2.14 NORWAY

23.2.15 FINLAND

23.2.16 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 SINGAPORE

23.3.6 THAILAND

23.3.7 INDONESIA

23.3.8 MALAYSIA

23.3.9 PHILIPPINES

23.3.10 AUSTRALIA

23.3.11 NEW ZEALAND

23.3.12 VIETNAM

23.3.13 TAIWAN

23.3.14 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 EGYPT

23.5.3 BAHRAIN

23.5.4 UNITED ARAB EMIRATES

23.5.5 KUWAIT

23.5.6 OMAN

23.5.7 QATAR

23.5.8 SAUDI ARABIA

23.5.9 REST OF MIDDLE EAST AND AFRICA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL CHIMERIC ANTIGEN RECEPTOR (CAR)-T THERAPY TREATMENT MARKET, COMPANY PROFILE

25.1 NOVARTIS AG

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 KITE PHARMA

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENTS

25.3 JUNO THERAPTICS

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENTS

25.4 BRISTOL MYERS SQUIBB

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENTS

25.5 LEGEND BIOTECH INC

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENTS

25.6 AMMGEN, INC

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENTS

25.7 SORRENTO THERAPUTICS, INC.

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENTS

25.8 GILEAD SCIENCE

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENTS

25.9 BLUE BIRD BIO, INC.

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPMENTS

25.1 IMMUN THERAPUTICS, INC

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENTS

25.11 BELLICUM PARMACEUTICALS, INC.

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENTS

25.12 PFIZER, INC.

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENTS

25.13 ELI LILLY AND COMPANY

25.13.1 COMPANY OVERVIEW

25.13.2 REVENUE ANALYSIS

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 PRODUCT PORTFOLIO

25.13.5 RECENT DEVELOPMENTS

25.14 JW THERAPEUTICS

25.14.1 COMPANY OVERVIEW

25.14.2 REVENUE ANALYSIS

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 PRODUCT PORTFOLIO

25.14.5 RECENT DEVELOPMENTS

25.15 FORTRESS BIOTECH, INC.

25.15.1 COMPANY OVERVIEW

25.15.2 REVENUE ANALYSIS

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 PRODUCT PORTFOLIO

25.15.5 RECENT DEVELOPMENTS

25.16 CARTESIAN THERAPEUTICS, INC.

25.16.1 COMPANY OVERVIEW

25.16.2 REVENUE ANALYSIS

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 PRODUCT PORTFOLIO

25.16.5 RECENT DEVELOPMENTS

25.17 CASI PHARMACEUTICALS

25.17.1 COMPANY OVERVIEW

25.17.2 REVENUE ANALYSIS

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 PRODUCT PORTFOLIO

25.17.5 RECENT DEVELOPMENTS

25.18 POSEIDA THERAPEUTICS, INC.

25.18.1 COMPANY OVERVIEW

25.18.2 REVENUE ANALYSIS

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 PRODUCT PORTFOLIO

25.18.5 RECENT DEVELOPMENTS

25.19 AUTOLUS THERAPEUTICS

25.19.1 COMPANY OVERVIEW

25.19.2 REVENUE ANALYSIS

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 PRODUCT PORTFOLIO

25.19.5 RECENT DEVELOPMENTS

25.2 EUREKA THERAPEUTICS

25.20.1 COMPANY OVERVIEW

25.20.2 REVENUE ANALYSIS

25.20.3 GEOGRAPHIC PRESENCE

25.20.4 PRODUCT PORTFOLIO

25.20.5 RECENT DEVELOPMENTS

25.21 AURORA BIOPHARMA

25.21.1 COMPANY OVERVIEW

25.21.2 REVENUE ANALYSIS

25.21.3 GEOGRAPHIC PRESENCE

25.21.4 PRODUCT PORTFOLIO

25.21.5 RECENT DEVELOPMENTS

25.22 IMMUNOACT

25.22.1 COMPANY OVERVIEW

25.22.2 REVENUE ANALYSIS

25.22.3 GEOGRAPHIC PRESENCE

25.22.4 PRODUCT PORTFOLIO

25.22.5 RECENT DEVELOPMENTS

25.23 FERRING PHARMACEUTICALS A/S

25.23.1 COMPANY OVERVIEW

25.23.2 REVENUE ANALYSIS

25.23.3 GEOGRAPHIC PRESENCE

25.23.4 PRODUCT PORTFOLIO

25.23.5 RECENT DEVELOPMENTS

25.24 JANSSEN BIOTECH, INC.

25.24.1 COMPANY OVERVIEW

25.24.2 REVENUE ANALYSIS

25.24.3 GEOGRAPHIC PRESENCE

25.24.4 PRODUCT PORTFOLIO

25.24.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

26 RELATED REPORTS

27 CONCLUSION

28 QUESTIONNAIRE

29 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.