Global Car Wash Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.22 Billion

2024

2032

USD

1.58 Billion

USD

2.22 Billion

2024

2032

| 2025 –2032 | |

| USD 1.58 Billion | |

| USD 2.22 Billion | |

|

|

|

|

Car Wash Systems Market Size

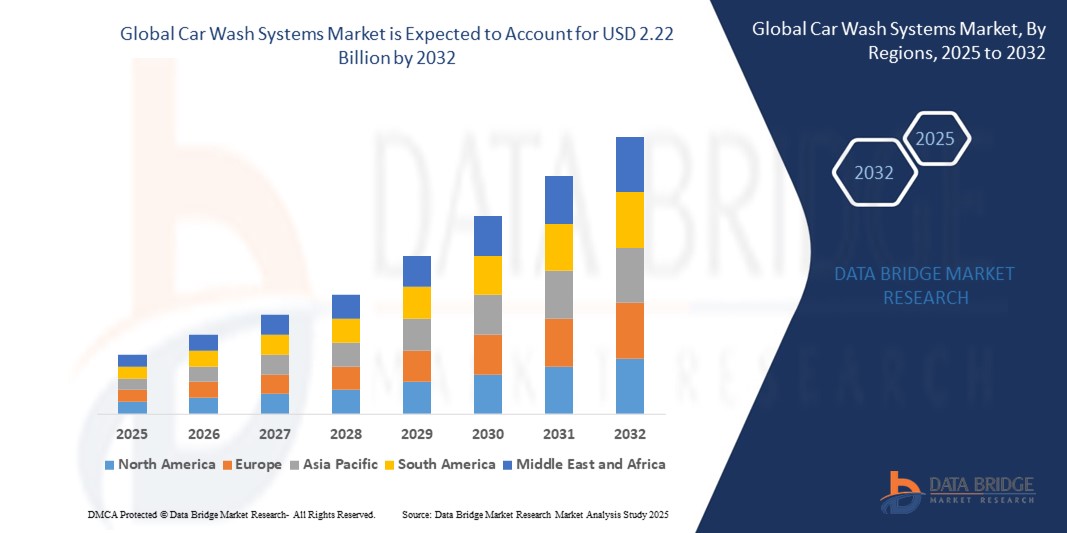

- The global car wash systems market size was valued at USD 1.58 billion in 2024 and is expected to reach USD 2.22 billion by 2032, at a CAGR of 4.35% during the forecast period

- The market growth is largely fueled by the increasing demand for automated, time-efficient, and water-saving vehicle cleaning solutions, driven by rising car ownership, urbanization, and consumer preference for professional car care services across both developed and emerging economies

- Furthermore, advancements in car wash technologies—such as touchless systems, water recycling units, and IoT-enabled automation—are enhancing operational efficiency, customer experience, and environmental compliance, thereby accelerating the adoption of modern car wash systems and propelling market expansion

Car Wash Systems Market Analysis

- Car wash systems are automated or semi-automated setups designed to clean the exterior and interior of vehicles using advanced mechanical and chemical processes. These systems include in-bay automatics, conveyor tunnel systems, and self-service models, often equipped with water recycling, high-pressure jets, and contactless technology to ensure efficient and eco-friendly operations

- The growing adoption of car wash systems is primarily driven by shifting consumer behavior toward convenience-focused services, rising environmental awareness, and the expansion of commercial car wash chains offering fast, consistent, and digitally integrated wash experiences

- North America dominated the car wash systems market with a share of 50.5% in 2024, due to a strong culture of vehicle ownership, high frequency of car wash usage, and widespread availability of automated facilities

- Asia-Pacific is expected to be the fastest growing region in the car wash systems market during the forecast period due to rapid urbanization, increasing vehicle sales, and evolving consumer lifestyles

- Automatic in–bay system segment dominated the market with a market share of 41.8% in 2024, due to its compact footprint and high compatibility with space-constrained locations such as gas stations and convenience stores. Its fully automated operation reduces labor costs and enables high vehicle throughput, making it a preferred solution among urban and suburban operators seeking operational efficiency. Consumers are also drawn to the convenience and quick turnaround time of in-bay systems, contributing to its wide-scale adoption

Report Scope and Car Wash Systems Market Segmentation

|

Attributes |

Car Wash Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Car Wash Systems Market Trends

“Expansion of Mobile Car Wash Services”

- The car wash systems market is rapidly growing as mobile and on-demand car wash services become more popular, providing convenience to urban consumers who seek quick, location-flexible vehicle cleaning

- For instance, major companies such as WashTec, Daifuku, Tommy Car Wash Systems, and technology-driven startups such as Spiffy and Mister Car Wash are introducing app-based and mobile van services, leveraging eco-friendly techniques and advanced water-saving equipment to reach time-sensitive customers at homes and offices

- The increasing adoption of automated and touchless car wash solutions is a key trend, as consumers prefer safe, fast, and damage-free cleaning enabled by high-pressure jets, advanced sensors, and specialty detergents

- Environmental regulations and sustainability consciousness are prompting car wash operators to invest in water recycling systems, eco-friendly chemicals, and energy-efficient machinery to minimize resource consumption and compliance risks

- Urbanization and apartment living trends, which restrict personal car washing spaces, are fueling the shift towards professional, mobile, and subscription-based car wash services across many markets

- Advances in artificial intelligence, IoT integration, and digital payment systems are further enhancing the efficiency, customization, and ease of use of modern car wash services, attracting a wider customer base

Car Wash Systems Market Dynamics

Driver

“Increasing Vehicle Ownership”

- Growing vehicle ownership worldwide, fueled by rising disposable incomes, auto financing options, and urban migration, is a major driver for the car wash systems industry

- For instance, manufacturers such as Maersk Container Industry (in refrigerated sectors) and traditional players such as Belanger, Otto Christ, and MK Seiko are adapting to serve new car buyers, fleet operators, and rideshare companies who need regular, professional cleaning for maintenance and resale value

- Expanding urban populations result in more private vehicles on the road, increasing the volume and frequency of car cleaning needs for both individual and commercial fleets

- Car owners are increasingly aware of the benefits of regular washes—including aesthetics, longevity, and easier maintenance—which boosts service utilization rates

- The rising trend of small businesses, such as delivery and ride-hailing operations, further increases the frequency of vehicle usage and the necessity for advanced washing systems. Global proliferation of electric and hybrid vehicles brings new demand for wash systems compatible with sensitive technology and unique design structures

Restraint/Challenge

“Operational and Maintenance Costs”

- High operational and maintenance costs—including utilities, labor, chemicals, and waste management—pose a significant challenge for owners and operators of car wash systems

- For instance, automated car wash owners using advanced systems from brands such as Washworld and PECO face ongoing expenses such as USD 2,000– USD 5,000 per month for electricity and water, USD 1,000– USD 3,000 for equipment upkeep, plus additional costs for labor, insurance, and rent

- Substantial up-front investments in new equipment, AI-powered systems, site construction, and compliance with environmental regulations limit the entry of new players, especially in emerging and cost-sensitive markets

- Regular technical maintenance is required to keep automated and touchless systems operating effectively, and any downtime can significantly impact revenue and customer satisfaction

- Rising costs for eco-friendly supplies, required system upgrades, and staff training further compress margins, especially when coupled with aggressive price competition and frequent promotions in the sector

Car Wash Systems Market Scope

The market is segmented on the basis of system type, vehicle type, sales channel, process, and location.

- By System Type

On the basis of system type, the car wash systems market is segmented into automatic in–bay system, conveyor tunnel system, gantry car washes, and self-service car wash. The automatic in-bay system segment dominated the largest market revenue share of 41.8% in 2024, owing to its compact footprint and high compatibility with space-constrained locations such as gas stations and convenience stores. Its fully automated operation reduces labor costs and enables high vehicle throughput, making it a preferred solution among urban and suburban operators seeking operational efficiency. Consumers are also drawn to the convenience and quick turnaround time of in-bay systems, contributing to its wide-scale adoption.

The conveyor tunnel system segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-capacity wash solutions in busy urban centers and fleet operations. These systems enable continuous vehicle processing, making them ideal for high-traffic car wash businesses. The ability to integrate multiple wash stages and upsell services such as waxing or underbody cleaning enhances profitability and customer satisfaction, thus accelerating market demand.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into compact cars, premium cars, luxury cars, light commercial vehicles, and heavy commercial vehicles. The compact cars segment accounted for the largest market revenue share in 2024, attributed to their high ownership volumes and frequent usage in urban regions where car wash facilities are readily available. The segment benefits from routine service patterns among individual users and ride-sharing operators, driving consistent demand across geographies.

The light commercial vehicles segment is expected to register the fastest CAGR from 2025 to 2032, propelled by the expanding last-mile delivery ecosystem and fleet management services. LCVs require regular cleaning to maintain brand image and operational hygiene, especially for businesses operating in e-commerce, logistics, and rental services. The rising preference for automated, efficient, and time-saving wash solutions among commercial fleet operators is accelerating adoption in this segment.

- By Sales Channel

On the basis of sales channel, the car wash systems market is segmented into original equipment manufacturer (OEM) and aftermarket. The OEM segment held the largest market revenue share in 2024, driven by strong partnerships between car wash technology providers and infrastructure developers. OEMs offer integrated solutions with advanced features, ensuring optimized installation and system performance for end-users such as fuel stations and dealerships.

The aftermarket segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for upgrades, retrofitting, and replacement of aging systems. Independent car wash operators and service stations are actively investing in newer technologies to stay competitive, enhance customer experience, and comply with evolving environmental and water usage regulations, thereby driving aftermarket sales.

- By Process

On the basis of process, the market is segmented into cloth friction car washing and touch-less car washing. The cloth friction segment held the dominant revenue share in 2024, as it offers deep cleaning capabilities and is widely compatible with various vehicle types. Operators often prefer cloth-based systems due to their cost-effectiveness, speed, and ability to clean stubborn dirt efficiently.

The touch-less car washing segment is forecasted to experience the fastest CAGR from 2025 to 2032, driven by growing consumer preference for paint-safe, contactless cleaning methods. With increasing awareness of automotive surface care—especially among owners of premium and luxury vehicles—touch-less systems are gaining traction for their reduced risk of scratches and superior use of high-pressure water and detergents.

- By Location

On the basis of location, the car wash systems market is segmented into gas station, airport, hotels, resort, highway, malls, service station, car plants, and others. The gas station segment led the market with the highest revenue share in 2024, supported by the integration of car wash services as a value-added offering that enhances customer retention and boosts fuel station margins. These locations benefit from steady footfall and convenient drive-in access, making them ideal sites for automated wash installations.

The service station segment is expected to expand at the fastest rate from 2025 to 2032, owing to growing customer preference for bundled maintenance and cleaning services in a single visit. As consumer expectations rise for comprehensive vehicle care solutions, service centers are increasingly investing in modern, efficient car wash systems to meet demand and create a competitive edge in after-sales services.

Car Wash Systems Market Regional Analysis

- North America dominated the car wash systems market with the largest revenue share of 50.5% in 2024, driven by a strong culture of vehicle ownership, high frequency of car wash usage, and widespread availability of automated facilities

- The region benefits from a mature infrastructure, a well-established aftermarket ecosystem, and a growing preference for convenience-driven services such as subscription-based and contactless car washes

- Increasing environmental regulations are also encouraging the adoption of water-efficient and eco-friendly systems, making technologically advanced car wash installations more attractive to operators across the U.S. and Canada

U.S. Car Wash Systems Market Insight

The U.S. car wash systems market captured the largest revenue share in 2024 within North America, driven by the rising demand for time-efficient, automated cleaning solutions. High rates of car ownership, coupled with consumers' preference for convenience and quality, have fueled the expansion of express and tunnel wash models. The proliferation of retail fuel stations integrating car wash services and the increasing popularity of monthly membership programs are accelerating the industry's growth. In addition, regulatory focus on water conservation has spurred investment in systems that support water recycling and reduced runoff.

Europe Car Wash Systems Market Insight

The Europe car wash systems market is projected to expand at a significant CAGR during the forecast period, driven by growing awareness of sustainable vehicle maintenance and a shift toward eco-conscious washing practices. The increasing number of automated wash installations in urban areas and along major transport routes supports consistent consumer access. Furthermore, stringent environmental policies are prompting businesses to adopt water-efficient and low-emission systems. Growing adoption of touchless and sensor-based technologies is also reshaping the car wash landscape across both Western and Central Europe.

U.K. Car Wash Systems Market Insight

The U.K. car wash systems market is anticipated to grow at a notable CAGR, supported by a rising demand for professional vehicle care and an evolving preference for contactless wash services. Factors such as limited water availability and government incentives for eco-friendly solutions are leading operators to invest in water-saving, automated systems. The expansion of mobile-enabled wash services and self-service kiosks is also driving innovation, as consumers increasingly prioritize convenience, hygiene, and technological integration in their service experiences.

Germany Car Wash Systems Market Insight

The Germany car wash systems market is expected to grow steadily over the forecast period, fueled by a strong automotive culture, high car ownership rates, and rising consumer preference for efficient and environmentally responsible services. Germany's regulatory environment encourages the use of water recycling and chemical-free processes, pushing adoption of advanced gantry and conveyor tunnel systems. The presence of key European manufacturers and innovation hubs further strengthens the market, as operators adopt smart monitoring and automation to optimize performance and sustainability.

Asia-Pacific Car Wash Systems Market Insight

The Asia-Pacific car wash systems market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, increasing vehicle sales, and evolving consumer lifestyles across countries such as China, Japan, and India. Rising demand for automated and quick vehicle care services, especially in densely populated cities, is accelerating adoption. Government-led smart city initiatives and infrastructure expansion are also facilitating the growth of fixed-site and mobile car wash systems, while the growing number of service stations and mall-based facilities is broadening access.

Japan Car Wash Systems Market Insight

The Japan car wash systems market is gaining momentum due to a high standard of living, dense urban infrastructure, and cultural emphasis on cleanliness and vehicle care. Consumers in Japan increasingly seek automated, space-efficient, and touchless wash solutions that align with limited land availability and environmental values. Technological innovation in compact in-bay systems and energy-efficient operations is helping operators meet evolving expectations for speed, quality, and sustainability, especially in residential complexes and commercial hubs.

China Car Wash Systems Market Insight

The China car wash systems market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by a rapidly growing middle class, increasing disposable income, and the surge in private vehicle ownership. The booming automotive aftermarket and digitalization of services—including app-based car wash booking and cashless payments—are accelerating consumer adoption. China’s push for smart cities, along with the presence of several domestic equipment manufacturers, is driving large-scale deployment of automated, AI-enabled, and water-recycling car wash solutions across urban and semi-urban areas.

Car Wash Systems Market Share

The car wash systems industry is primarily led by well-established companies, including:

- Motor City Wash Works (U.S.)

- Daifuku Co., Ltd. (Japan)

- ISTOBAL (Spain)

- Christ Wash Systems (Germany)

- National Carwash Solutions, Inc. (U.S.)

- PECO Car Wash Systems (U.S.)

- Oasis Car Wash Systems (U.S.)

- Degama S.R.L. (Italy)

- Tommy's Express (U.S.)

- Qingdao Risense Mechatronics Co., Ltd. (China)

Latest Developments in Global Car Wash Systems Market

- In June 2024, OPW Vehicle Wash Solutions, a division of Dover, expanded its market presence with the launch of two new product add-ons and an online store. The integration of Washnetics Tunnel Wash Components with Belanger tunnel systems and the addition of the OneShot Presoak from the Turtle Wax Pro lineup are expected to enhance operational efficiency and elevate the customer wash experience, reinforcing OPW’s position in the automated car wash solutions market

- In May 2024, Car Wash Company, the largest car wash chain in Europe, completed the acquisition of its key competitor, QuickWash, in a strategic consolidation move aimed at strengthening its leadership in the European market. By absorbing QuickWash’s customer base and operational infrastructure, Car Wash Company significantly expands its market coverage, enhances brand visibility, and gains economies of scale. This acquisition intensifies its competitive advantage and also reshapes the regional landscape by reducing market fragmentation and setting the stage for further innovation and service expansion

- In March 2024, WashTec, a global leader in car wash technology, entered a strategic partnership with AutoNation, one of the largest automotive retailers in the U.S. This collaboration involves integrating WashTec’s state-of-the-art automated systems across AutoNation's dealership locations, thereby enhancing post-sale vehicle care services. The partnership marks a significant step in bridging the gap between automotive retail and advanced car wash automation, creating new growth opportunities in the dealership service market while boosting customer satisfaction and operational streamlining

- In January 2024, Suds 'N' Suds, a leading player in the car wash industry, launched its Express Wash service in five major metropolitan areas, targeting the surging demand for high-speed, high-efficiency car cleaning solutions. This move expands the company’s footprint in densely populated urban centers and also positions it to capitalize on evolving consumer preferences for convenience-driven, quick-turnaround services. The launch is expected to set a new benchmark in service speed and reliability, intensifying competition in the express car wash segment

- In December 2023, Magnolia Wash Holdings announced its rebranding to Whistle Express Car Wash, consolidating over 100 locations from multiple local and regional operators. This strategic move aims to strengthen brand recognition, streamline operations, and deliver a consistent and improved customer experience across nine states, thereby boosting competitiveness in the growing regional car wash market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.