Global Carbon Black Market

Market Size in USD Billion

CAGR :

%

USD

1,145.71 Billion

USD

1,845.47 Billion

2024

2032

USD

1,145.71 Billion

USD

1,845.47 Billion

2024

2032

| 2025 –2032 | |

| USD 1,145.71 Billion | |

| USD 1,845.47 Billion | |

|

|

|

|

Carbon Black Market Size

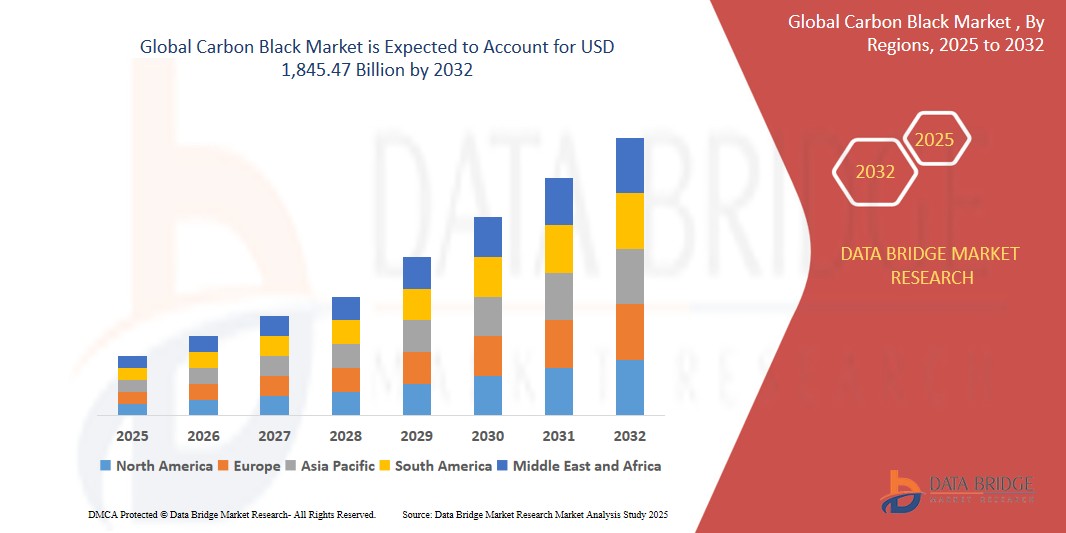

- The global Carbon Black market was valued at USD 1,145.71 billion in 2024 and is expected to reach USD 1,845.47 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.14%, primarily driven by the growing consumer awareness regarding health and wellness

- This growth is driven by factors such as busy lifestyles and a growing aging population are fuelling demand for products that enhance health and prevent disease

Carbon Black Market Analysis

- Carbon black is a fine black powder composed primarily of elemental carbon, produced through the incomplete combustion or thermal decomposition of hydrocarbons. It is widely used as a reinforcing filler in tires and other rubber products, as well as a black pigment in inks, coatings, and plastics. The majority of carbon black is produced via the furnace black process, which enables large-scale and cost-effective production. Other types—such as thermal black, acetylene black, lamp black, and channel black—serve niche applications in specialty products requiring high purity, conductivity, or tint strength.

- The carbon black market is experiencing robust growth driven by expanding tire manufacturing, rising demand for automotive and industrial rubber goods, and growing use in plastics and coatings. The global automotive sector, particularly in emerging economies, continues to propel the demand for durable and high-performance tires, thereby increasing carbon black consumption. Additionally, the push for lightweight and aesthetically enhanced plastic components in automotive and consumer goods is creating opportunities in the masterbatch and plastic coloring segments. Moreover, as conductive carbon black variants find increasing adoption in batteries and electronics, particularly in EVs and energy storage applications, the market is witnessing diversification beyond conventional sectors.

- Asia Pacific leads the global carbon black market in terms of volume and revenue, driven by rapid industrialization, extensive tire manufacturing capacity, and strong demand from the construction and automotive industries in China and India. North America and Europe follow, with a growing emphasis on sustainable production practices and demand for high-performance carbon black grades in specialty applications. Meanwhile, regions like Latin America and the Middle East & Africa are emerging as potential growth hubs due to rising vehicle ownership and expanding infrastructure projects.

- By Process, Furnace Black dominates the carbon black market due to its cost efficiency, scalability, and suitability for a wide range of applications, including tire rubber, belts, hoses, and molded goods. Thermal Black is gaining traction for specialty rubber applications where high resilience is needed, while Acetylene Black is witnessing growth in high-purity applications such as lithium-ion batteries and conductive polymers. Lamp Black and Channel Black, though limited in commercial scale, remain relevant for pigments, coatings, and artistic uses due to their superior dispersion and tinting properties.

Report Scope and Carbon Black Market Segmentation

|

Attributes |

Carbon Black Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific (APAC)

South America

Middle East and Africa (MEA)

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Carbon Black Market Trend

“Shift Toward Sustainable Carbon Black and Circular Economy Integration”

• A key trend shaping the carbon black market is the increasing shift toward sustainable production practices, driven by tightening environmental regulations, carbon neutrality goals, and rising consumer awareness. Traditional carbon black manufacturing is carbon-intensive, prompting industry players to seek lower-emission technologies and circular economy models.

• Sustainable carbon black (also referred to as recovered carbon black or rCB), derived from end-of-life tires and rubber products through pyrolysis, is gaining significant attention as a viable, eco-friendly alternative to virgin carbon black. This transition aligns with the global push toward zero waste and closed-loop manufacturing systems.

• Automotive OEMs and tire manufacturers are increasingly collaborating with rCB producers to incorporate recycled content into their products without compromising performance, enabling compliance with sustainability targets and extended producer responsibility (EPR) mandates.

- For instance, major tire companies such as Michelin and Continental have partnered with recyclers like Enviro and Pyrolyx to develop commercial-scale rCB production, aiming to reduce the environmental footprint of tire manufacturing and secure raw material supply amidst rising regulatory pressure.

• Additionally, research initiatives focused on reducing greenhouse gas emissions during furnace black production—such as through alternative feedstocks or process optimization—are gaining traction among leading carbon black producers.

Carbon Black Market Dynamics

Driver

“Rising Demand from Automotive and Industrial Rubber Sectors”

• The primary driver of the carbon black market is the growing consumption in the automotive and industrial rubber sectors, particularly for tire production. Carbon black enhances key mechanical properties such as abrasion resistance, tensile strength, and longevity, making it essential for passenger and commercial vehicle tires.

• As global vehicle production continues to rebound and expand—especially in high-growth regions like Asia-Pacific—demand for carbon black is correspondingly rising. Additionally, industrial rubber applications such as belts, hoses, gaskets, and vibration dampening systems rely heavily on carbon black for reinforcement.

• Urbanization, infrastructure expansion, and increased freight movement in developing economies further support robust demand from construction and manufacturing equipment sectors.

Opportunity

“Expanding Applications in Plastics, Coatings, and Electronics”

• A promising opportunity in the carbon black market lies in its growing use in non-rubber applications such as plastics, paints & coatings, and conductive materials. In the plastics industry, carbon black serves as a black pigment and UV stabilizer for products like pipes, containers, and packaging films.

• In coatings, it provides color intensity, conductivity, and protection against environmental degradation. Additionally, specialty grades like acetylene black are witnessing rising adoption in lithium-ion batteries, cables, and electronics due to their high purity and conductivity.

• The increasing demand for conductive and antistatic materials in consumer electronics, EV batteries, and 5G infrastructure is opening up high-value avenues for carbon black producers to diversify their product portfolios.

Restraint/Challenge

“Environmental Regulations and Health Concerns”

• One of the major challenges in the carbon black market is the stringent environmental regulations governing its production and usage. The manufacturing process emits significant quantities of CO₂ and other particulate pollutants, leading to regulatory scrutiny—especially in regions like the EU and North America.

• Additionally, occupational health concerns related to prolonged carbon black exposure have raised questions about worker safety and product handling. Regulatory bodies such as the EPA and REACH have set limits on emissions and workplace exposure, increasing compliance costs for producers.

• While sustainable carbon black and process innovations offer long-term solutions, high investment costs, technology scalability issues, and uncertain regulatory pathways can delay widespread adoption, especially among small-to-medium-scale manufacturers.

Carbon Black Market Market Scope

The market is segmented on the basis process, grade and application.

|

Segmentation |

Sub-Segmentation |

|

By Process |

|

|

By Grade |

|

|

By Application |

|

Carbon Black Market Regional Analysis

“Asia-Pacific to Dominate the Carbon Black Market by Revenue”

• Asia-Pacific (APAC) is expected to lead the global carbon black market in terms of revenue, driven by rapid industrialization, robust automotive production, and a thriving manufacturing base across countries like China, India, Japan, and South Korea. China, in particular, accounts for a significant share of global carbon black consumption due to its extensive tire and rubber goods manufacturing capacity.

• The region's growing middle-class population and urbanization trends are fueling demand for automobiles, consumer electronics, plastics, and construction materials—all of which utilize carbon black in various forms. Additionally, low-cost production environments, access to abundant feedstock, and expanding infrastructure projects further reinforce APAC’s dominance in the global market.

• Leading global carbon black manufacturers have established or expanded production capacities in Asia-Pacific to cater to the growing demand, while local players continue to scale operations through process innovation and vertical integration.

“North America to Register the Highest CAGR in the Carbon Black Market”

• North America is projected to witness the highest CAGR in the carbon black market during the forecast period, supported by technological advancements, growing demand for specialty carbon black, and a shift toward sustainable materials. The U.S. and Canada are investing significantly in recovered carbon black (rCB) initiatives to meet environmental goals and circular economy standards.

• The rising demand for high-performance tires, coatings, and conductive plastics—especially in automotive, aerospace, and electronics sectors—is driving market growth. Furthermore, increased adoption of electric vehicles and energy storage systems is elevating the use of specialty grades such as acetylene black in batteries and conductive components.

• The region’s regulatory push for low-emission manufacturing processes, along with strong R&D ecosystems and partnerships between manufacturers and recyclers, is accelerating innovation and the commercialization of eco-friendly carbon black alternatives.

Carbon Black Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Asahi Carbon Co Ltd (Japan)

- Birla Carbon (India)

- Black Bear Carbon BV (Netherlands)

- Cabot Corporation (U.S.)

- Carbon Clean Tech AG (Germany)

- China Synthetic Rubber Corporation (Taiwan)

- Continental Carbon Company (U.S.)

- Jinneng Science and Technology Company Limited (China)

- Longxing Chemical Stock Co Ltd (China)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Monolith Materials Inc (U.S.)

- Nippon Steel & Sumikin Chemical Co Ltd (Japan)

- OCI Company Ltd (South Korea)

- Omsk Carbon Group (Russia)

- Orion Engineered Carbons SA (Luxembourg)

- Phillips Carbon Black Limited (India)

- Qingzhou Boao Carbon Black Co Ltd (China)

- Shandong Huadong Rubber Materials Co Ltd (China)

- Shandong Lion King Carbon Black Co Ltd (China)

- Sid Richardson Carbon and Energy Co Ltd (U.S.)

- Tokai Carbon Co Ltd (Japan)

Latest Developments in Global Carbon Black Market

- In April 2025, Aditya Birla Group announced the expansion of its specialty carbon black production facilities to cater to increasing demand in sectors such as automotive and electronics. This initiative aligns with their goal of strengthening their position in the global market.

- In April 2025, Cabot Corporation continued its investments in recovered carbon black (rCB) technologies. Their commitment to sustainability is evident as they aim to minimize environmental impacts while fulfilling the growing need for eco-friendly materials.

- In April 2025, Orion Engineered Carbons disclosed plans to enhance its production capacities in Europe and North America. They are also exploring the use of carbon black in innovative applications, including electric vehicle (EV) components and renewable energy solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carbon Black Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carbon Black Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carbon Black Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.