Global Carbon Dioxide Removal Cdr Market

Market Size in USD Billion

CAGR :

%

USD

1.01 Billion

USD

1.79 Billion

2024

2032

USD

1.01 Billion

USD

1.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1.01 Billion | |

| USD 1.79 Billion | |

|

|

|

|

Carbon Dioxide Removal (CDR) Market Size

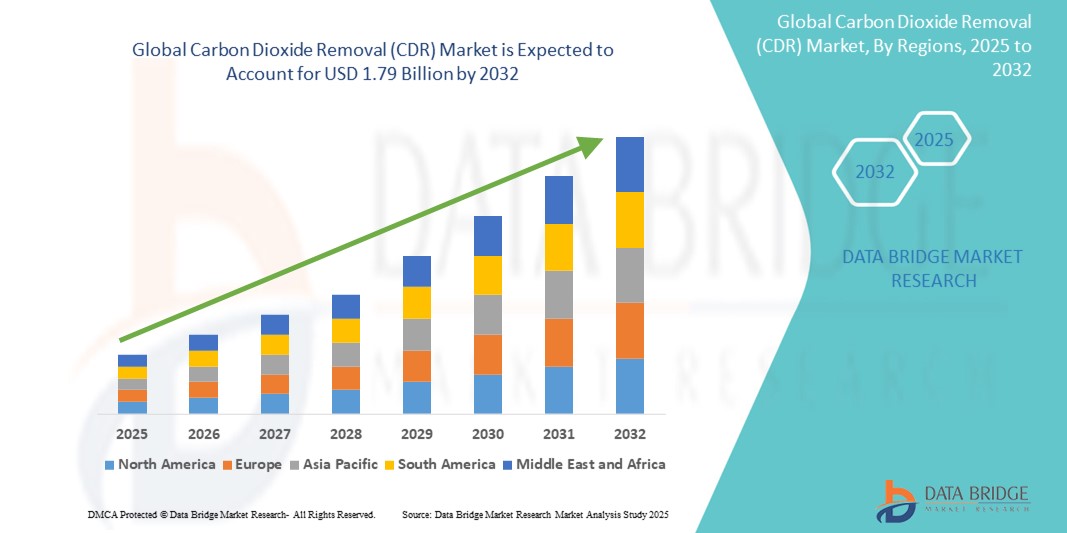

- The global carbon dioxide removal (CDR) market size was valued at USD 1.01 billion in 2024 and is expected to reach USD 1.79 billion by 2032, at a CAGR of 7.4% during the forecast period

- The market growth is largely fuelled by the rising need to offset industrial emissions, growing investments in negative emissions technologies, and increasing global climate change mitigation commitments

- In addition, supportive government policies, carbon pricing mechanisms, and advancements in direct air capture and bioenergy with carbon capture and storage (BECCS) are significantly contributing to the market’s expansion

Carbon Dioxide Removal (CDR) Market Analysis

- The carbon dioxide removal market is experiencing steady growth as industries seek sustainable solutions to meet environmental targets and reduce atmospheric emissions

- The adoption of innovative carbon capture technologies is expanding across sectors including power generation, manufacturing, and agriculture

- North America dominated the carbon dioxide removal (CDR) market with the largest revenue share in 2024, supported by strong regulatory frameworks, technological advancements, and investments in large-scale pilot projects across the U.S. and Canada

- Asia-Pacific region is expected to witness the highest growth rate in the global carbon dioxide removal (CDR) market, driven by increasing investments in clean energy technologies, strong government decarbonization targets, and expanding industrial infrastructure across countries such as China, Japan, and India

- The direct air capture segment held the largest market revenue share in 2024, owing to rising investments in engineered carbon removal and its potential to remove emissions at scale. DAC is increasingly being adopted by corporations and governments aiming for precise carbon accounting, with deployments supported by favorable policies and funding in North America and Europe. Its integration into carbon credit programs further strengthens its commercial viability

Report Scope and Carbon Dioxide Removal (CDR) Market Segmentation

|

Attributes |

Carbon Dioxide Removal (CDR) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbon Dioxide Removal (CDR) Market Trends

“Growing Adoption of Direct Air Capture Technologies”

- The carbon dioxide removal (CDR) market is witnessing a significant trend in the growing adoption of direct air capture (DAC) technologies. These systems extract carbon dioxide directly from ambient air, offering a scalable and measurable approach to reducing atmospheric CO₂ levels. Companies are increasingly investing in DAC due to its potential to meet net-zero targets and regulatory compliance.

- Direct air capture is gaining traction as a preferred method for achieving negative emissions, especially in regions with ambitious climate commitments such as the U.S. and Europe

- Startups and major corporations alike are launching commercial DAC facilities, such as Climeworks in Switzerland and Carbon Engineering in Canada

- The decreasing cost of DAC technology, combined with technological improvements in sorbent materials, is making these systems more economically viable

- Partnerships between energy companies and tech innovators are accelerating DAC deployment—for example, Occidental’s collaboration with Carbon Engineering

- Governments are supporting DAC through funding and tax credits, further boosting its global market penetration

Carbon Dioxide Removal (CDR) Market Dynamics

Driver

“Rising Net-Zero Emissions Commitments Across Nations and Corporations”

- Countries and global corporations are increasingly committing to net-zero emissions, driving demand for carbon dioxide removal (CDR) technologies to offset residual emissions from hard-to-abate sectors such as aviation, cement, and steel

- Global agreements such as the Paris Agreement have accelerated the push for CDR adoption, supported by enhanced national policies and funding, including legally binding carbon neutrality targets across Europe and parts of Asia

- Government investments are boosting the market, with the U.S. Department of Energy funding large-scale Direct Air Capture Hubs to fast-track the deployment of innovative CDR solutions

- Private corporations such as Microsoft and Stripe are leading by instance, pledging millions toward CDR procurement to meet their sustainability goals and stimulate technological advancements

- The development of carbon credit marketplaces and offset programs is incentivizing broader adoption of CDR by providing financial returns, supporting commercialization of technologies such as BECCS and ocean-based carbon removal

Restraint/Challenge

“High Operational Costs and Technological Limitations”

- The carbon dioxide removal market faces a major hurdle in the form of high implementation and operational costs, particularly with technologies such as direct air capture and carbon mineralization that are energy-intensive and require significant upfront investment

- These cost challenges are especially difficult for developing regions, where limited financial resources and infrastructure make it harder to scale or adopt CDR technologies at commercial levels

- Most CDR solutions are still in pilot or early-stage development, raising concerns about their long-term scalability, effectiveness, and the ability to deploy them on a mass scale to meet global targets

- Infrastructure limitations such as secure CO₂ transport systems and permanent storage facilities require regulatory frameworks and financial support, which are still lacking in many regions

- Uncertainty in carbon credit verification and accounting, along with environmental concerns related to afforestation land use and marine ecosystems, further hampers confidence and investment in the CDR market

Carbon Dioxide Removal (CDR) Market Scope

The market is segmented on the basis of technology, application, and end-user industry.

- By Technology

On the basis of technology, the carbon dioxide removal (CDR) market is segmented into direct air capture (DAC), bioenergy with carbon capture and storage (BECCS), enhanced weathering, and afforestation and reforestation. The direct air capture segment held the largest market revenue share in 2024, owing to rising investments in engineered carbon removal and its potential to remove emissions at scale. DAC is increasingly being adopted by corporations and governments aiming for precise carbon accounting, with deployments supported by favorable policies and funding in North America and Europe. Its integration into carbon credit programs further strengthens its commercial viability.

The afforestation and reforestation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and ecological benefits. These nature-based solutions are gaining traction among environmental organizations and sustainability-focused corporations due to their simplicity, lower technological barriers, and positive public perception. They are also supported by voluntary carbon markets and reforestation-focused climate initiatives.

- By Application

On the basis of application, the carbon dioxide removal market is segmented into industrial applications, energy sector, transportation sector, agriculture and land use, and others. The industrial applications segment accounted for the largest market share in 2024, attributed to the rising demand for emission mitigation in heavy industries such as cement and steel manufacturing. Many industrial players are implementing CDR technologies to meet compliance targets and offset unavoidable emissions through both in-house systems and third-party providers.

The energy sector segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the decarbonization goals of fossil-based energy producers and utilities. Energy firms are deploying BECCS and DAC solutions at power plants to reduce net emissions while maintaining operational continuity. Policy incentives and pilot programs in the U.S. and U.K. further encourage this application’s rapid growth.

- By End-User Industry

On the basis of end-user industry, the carbon dioxide removal market is segmented into oil and gas, power generation, manufacturing, agriculture, and others. The power generation segment dominated the market in 2024 due to early investments in carbon capture infrastructure and the urgent need to decarbonize energy systems. Power producers are increasingly integrating CDR into their sustainability strategies to align with global climate targets and benefit from supportive regulatory frameworks.

The agriculture segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the integration of CDR practices such as biochar application and soil carbon sequestration. Farmers and agri-tech companies are leveraging these approaches not only to remove CO₂ but also to enhance soil fertility and crop yields, with growing support from climate-smart agriculture programs and carbon credit schemes.

Carbon Dioxide Removal (CDR) Market Regional Analysis

- North America dominated the carbon dioxide removal (CDR) market with the largest revenue share in 2024, supported by strong regulatory frameworks, technological advancements, and investments in large-scale pilot projects across the U.S. and Canada

- The region’s leadership is further driven by active government support and public-private partnerships that are accelerating the commercialization of CDR technologies such as direct air capture and bioenergy with carbon capture and storage

- Favorable climate policies, carbon offset markets, and significant funding from climate-conscious investors have established North America as a key region for early-stage deployment and scale-up of carbon dioxide removal solutions

U.S. Carbon Dioxide Removal (CDR) Market Insight

The U.S. carbon dioxide removal market accounted for the largest share in North America in 2024, bolstered by federal incentives and private sector investment in innovative carbon removal startups. Major tech companies and oil giants are also backing CDR technologies to meet their carbon neutrality goals. With the launch of large-scale DAC facilities and carbon credit schemes, the U.S. is driving innovation and scalability in the global market. Moreover, policy frameworks such as the Inflation Reduction Act are providing critical tax credits for carbon capture initiatives, ensuring continued market momentum.

Europe Carbon Dioxide Removal (CDR) Market Insight

The Europe carbon dioxide removal market is expected to witness the fastest growth rate from 2025 to 2032, supported by the European Union’s climate goals and its push for net-zero emissions. Public and private investments are being funneled into afforestation, enhanced weathering, and BECCS projects. Countries such as Germany, Norway, and the U.K. are taking the lead in R&D and cross-border carbon storage collaborations. The region’s strong environmental consciousness and established carbon pricing systems are also creating fertile ground for CDR technology adoption across industries.

Germany Carbon Dioxide Removal (CDR) Market Insight

The Germany is expected to be a prominent player in the European carbon dioxide removal market, driven by its focus on sustainable industrial practices and innovation in carbon-neutral technologies. The country is investing in pilot-scale DAC plants and exploring nature-based solutions such as afforestation to meet its climate objectives. Collaboration between research institutes and industrial stakeholders is accelerating the deployment of advanced CDR systems. Germany’s commitment to phasing out fossil fuels and its support for climate tech startups further strengthen its role in shaping the European CDR landscape.

U.K. Carbon Dioxide Removal (CDR) Market Insight

The U.K. carbon dioxide removal market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong government commitments toward achieving net-zero emissions and a supportive policy environment. The U.K. is investing in large-scale BECCS and DAC initiatives, including partnerships with major energy and industrial players. With well-developed carbon pricing mechanisms and funding for innovation, the country is creating a favorable ecosystem for carbon removal technologies. In addition, pilot programs tied to the U.K.’s Net Zero Innovation Portfolio are accelerating the commercialization of scalable CDR solutions.

Asia-Pacific Carbon Dioxide Removal (CDR) Market Insight

The Asia-Pacific carbon dioxide removal market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising industrial emissions, increasing environmental awareness, and government-backed decarbonization programs in countries such as China, India, and Japan. The region is witnessing a surge in research and demonstration projects for BECCS and afforestation. China’s clean energy transition plans and South Korea’s green hydrogen roadmap are also supporting CDR integration. In addition, regional manufacturing strengths and cost competitiveness are enabling greater production and deployment of CDR technologies at scale.

China Carbon Dioxide Removal (CDR) Market Insight

The China is expected to lead the Asia-Pacific carbon dioxide removal market in terms of revenue share, owing to its aggressive carbon neutrality goals and large-scale afforestation efforts. The Chinese government is actively promoting the integration of carbon capture technologies within industrial hubs and coal power plants. In addition, domestic startups and academic institutions are advancing direct air capture solutions and enhanced mineralization processes. With growing investment in sustainable infrastructure and smart city initiatives, China is well-positioned to scale up CDR adoption across various sectors.

Japan Carbon Dioxide Removal (CDR) Market Insight

The Japan is emerging as a key player in the Asia-Pacific carbon dioxide removal market, supported by its long-term decarbonization targets and technological expertise. The country is exploring a mix of engineered and nature-based CDR methods, including DAC, BECCS, and afforestation. Leading corporations and academic institutions are collaborating to pilot advanced carbon removal systems. Japan’s focus on clean energy integration and smart city development is also enabling the deployment of CDR technologies within urban infrastructure and industrial processes.

Carbon Dioxide Removal (CDR) Market Share

The Carbon Dioxide Removal (CDR) industry is primarily led by well-established companies, including:

- Carbon Engineering Ltd (Canada)

- Climeworks AG (Switzerland)

- Global Thermostat LLC (U.S.)

- Carbon Clean Solutions Limited (U.K.)

- Blue Planet (U.S.)

- CarbonCure Technologies Inc (Canada)

- Project Vesta (U.S.)

- Solidia Technologies (U.S.)

- KlimaDAO (U.S.)

- Verdox (U.S.)

- Plan A (Germany)

- Skytree (Netherlands)

- Swiss Direct Air Capture AG – DAC (Switzerland)

- Running Tide Technologies (U.S.)

- CO2OL ENERGIE GmbH (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.