Global Carboxy Methyl Cellulose Market

Market Size in USD Billion

CAGR :

%

USD

2.63 Billion

USD

3.97 Billion

2024

2032

USD

2.63 Billion

USD

3.97 Billion

2024

2032

| 2025 –2032 | |

| USD 2.63 Billion | |

| USD 3.97 Billion | |

|

|

|

|

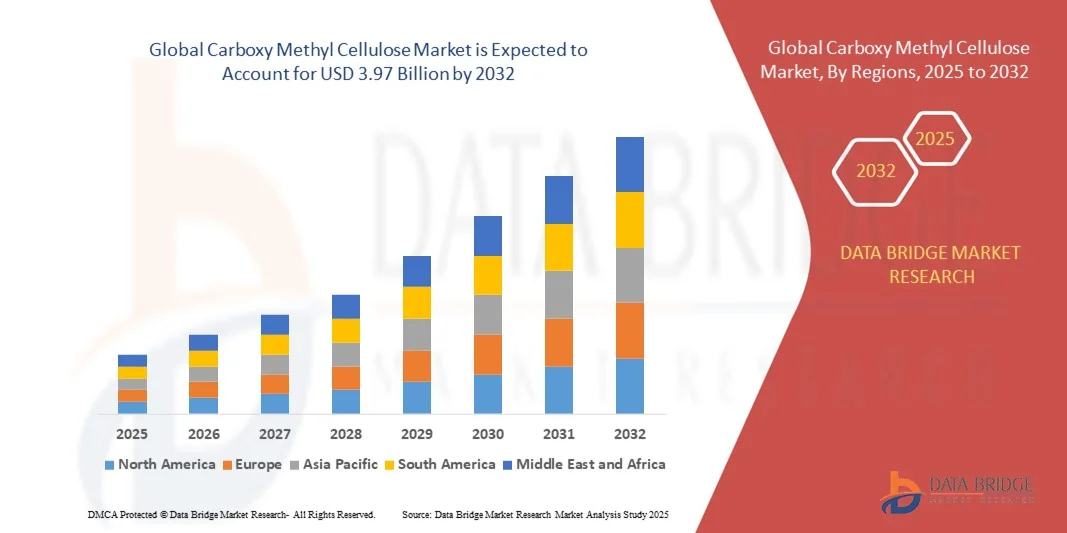

What is the Global Carboxy Methyl Cellulose Market Size and Growth Rate?

- The global carboxy methyl cellulose market size was valued at USD 2.63 billion in 2024 and is expected to reach USD 3.97 billion by 2032, at a CAGR of 5.30% during the forecast period

- Rise in application of carboxy methyl cellulose for pharmaceutical applications is the root cause fuelling up the carboxy methyl cellulose market growth rate. Rising industrialization coupled with growth in the level of oil drilling projects will also directly and positively impact the growth rate of the carboxy methyl cellulose market

- Growth and expansion of various end user verticals especially in the emerging economies coupled with surge in the preferences for fat-free and gluten-free products by the population will further carve the way for the growth of the carboxy methyl cellulose market. Overall rise in the global population will also foster the carboxy methyl cellulose market growth rate

What are the Major Takeaways of Carboxy Methyl Cellulose Market?

- Availability of substitute products such as microcrystalline cellulose, carrageenan, ethyl cellulose will pose a major challenge to the growth of the carboxy methyl cellulose market

- Fluctuations in the prices of raw materials will dampen the carboxy methyl cellulose market growth rate. Also, emergence of green and organic substitutes will further derail the carboxy methyl cellulose market growth rate

- Asia-Pacific dominated the carboxy methyl cellulose (CMC) market with the largest revenue share of 41.2% in 2024, driven by robust demand across food & beverage, pharmaceutical, and oil & gas industries. The region’s rapidly expanding industrial base, rising population, and growing consumption of processed food and personal care products are fueling market growth

- The North America Carboxy Methyl Cellulose market is projected to grow at the fastest CAGR of 13.4% during the forecast period of 2025 to 2032, driven by increasing demand across the pharmaceutical, oil & gas, and food processing sectors

- The High Purity 99.5% and Above segment dominated the market with the largest revenue share of 47.8% in 2024, owing to its widespread application in pharmaceuticals, food & beverages, and personal care industries

Report Scope and Carboxy Methyl Cellulose Market Segmentation

|

Attributes |

Carboxy Methyl Cellulose Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Carboxy Methyl Cellulose Market?

Rising Demand for Sustainable and Eco-Friendly CMC Solutions

- A significant and accelerating trend in the global carboxy methyl cellulose (CMC) market is the growing emphasis on sustainability and environmentally friendly production processes. Manufacturers are increasingly focusing on developing bio-based CMC derived from renewable cellulose sources to meet regulatory standards and consumer demand for greener materials

- For instance, Nouryon (Netherlands) has introduced sustainable CMC grades designed for reduced environmental impact and enhanced biodegradability, catering to industries such as food, pharmaceuticals, and personal care

- The demand for low-carbon manufacturing technologies, waste reduction, and closed-loop processing is driving CMC producers to optimize their supply chains and adopt cleaner chemical conversion methods. In addition, regulatory pressure in regions such as Europe and North America is accelerating the adoption of eco-certified cellulose ethers

- Several manufacturers are investing in energy-efficient production and recycling of process byproducts to minimize waste and improve yield, further aligning with corporate sustainability goals. For instance, Ashland (U.S.) has expanded its portfolio of sustainable cellulose-based products for food and pharmaceutical use

- This trend toward eco-efficient and bio-derived CMC is expected to strengthen the market position of companies prioritizing sustainability while meeting the growing consumer and industrial preference for natural, safe, and biodegradable materials

What are the Key Drivers of Carboxy Methyl Cellulose Market?

- The rising demand across food & beverage, pharmaceutical, and oil & gas industries is a primary driver of market growth. CMC’s excellent properties such as water solubility, thickening, stabilization, and film-forming ability—make it essential in diverse applications ranging from food additives to drilling fluids

- For instance, in January 2024, DuPont (U.S.) introduced a new line of high-purity CMC for drug formulations, improving tablet binding and stability. Similarly, CP Kelco (U.S.) expanded its biopolymer portfolio for plant-based and clean-label food applications

- The expanding pharmaceutical sector in emerging economies, coupled with the growth of processed food and beverage industries, continues to drive consumption. CMC is widely used as a stabilizer in sauces, ice creams, and beverages, and as a disintegrant in pharmaceutical tablets

- In the oil & gas industry, CMC plays a crucial role as a viscosity modifier and fluid-loss control agent in drilling operations, particularly with the global rise in shale gas and offshore exploration

- In addition, technological advancements in CMC manufacturing—such as improved etherification processes and sustainable raw material sourcing—are supporting increased production efficiency and product quality

Which Factor is Challenging the Growth of the Carboxy Methyl Cellulose Market?

- One of the primary challenges hindering market growth is the fluctuation in raw material prices, particularly wood pulp and cotton linter, which are major cellulose sources. These cost variations affect production economics and overall product pricing

- For instance, global pulp price volatility in 2023–2024 significantly impacted major producers such as NIPPON PAPER INDUSTRIES CO., LTD. (Japan) and Lamberti S.p.A. (Italy), prompting cost optimization strategies

- Another major challenge is competition from alternative polymers such as hydroxyethyl cellulose (HEC), xanthan gum, and guar gum, which offer similar functional properties at potentially lower costs

- In addition, the stringent regulatory requirements for food and pharmaceutical grades of CMC in regions such as the U.S. and the European Union can delay product approvals and increase compliance costs

- Overcoming these challenges through innovation in low-cost production, vertical integration of cellulose sourcing, and expanded application diversification will be essential for maintaining market competitiveness and ensuring stable growth in the coming years

How is the Carboxy Methyl Cellulose Market Segmented?

The market is segmented on the basis of grade, property, and application.

- By Grade

On the basis of grade, the carboxy methyl cellulose (CMC) market is segmented into High Purity 99.5% and Above, Technical Grade Purity 90–99.5%, and Industrial Grade Purity 50–90%. The High Purity 99.5% and Above segment dominated the market with the largest revenue share of 47.8% in 2024, owing to its widespread application in pharmaceuticals, food & beverages, and personal care industries. This grade is preferred for its superior quality, consistency, and compliance with international safety standards.

The Technical Grade (90–99.5%) segment is projected to register the fastest CAGR from 2025 to 2032, driven by rising demand across paints, adhesives, and textile industries, where purity requirements are moderate but performance reliability is critical. Increasing investments in refining technologies and the expansion of end-user applications are expected to further strengthen the growth of both high-purity and technical-grade CMC in the coming years.

- By Property

On the basis of property, the carboxy methyl cellulose market is segmented into Thickening Agent, Stabilizer, Binder, Anti-repository Agent, Lubricator, Emulsifier, and Excipient. The Thickening Agent segment dominated the market with a market share of 42.3% in 2024, primarily due to its extensive use in food, beverages, paints, and cosmetics to enhance viscosity and texture. Its ability to maintain product consistency under varying temperature and pH conditions makes it indispensable across multiple industries.

The Stabilizer segment is expected to exhibit the fastest CAGR from 2025 to 2032, driven by increasing utilization in pharmaceutical formulations, dairy products, and sauces, where stability and shelf-life are crucial. In addition, ongoing innovations in multifunctional CMC formulations combining thickening and stabilizing properties are broadening its application spectrum, thereby accelerating overall market growth during the forecast period.

- By Application

On the basis of application, the carboxy methyl cellulose market is segmented into Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Oil and Gas, Paints and Adhesives, Paper Industry, Detergents, and Others. The Food and Beverages segment accounted for the largest revenue share of 39.6% in 2024, owing to the increasing use of CMC as a thickener, stabilizer, and emulsifier in processed foods, dairy products, and bakery items. Rising demand for ready-to-eat and clean-label food products continues to propel this segment.

The Pharmaceuticals segment is projected to record the fastest CAGR from 2025 to 2032, fueled by the growing use of CMC in drug formulations as a binder, excipient, and controlled-release agent. In addition, expanding applications in cosmetics and oil & gas industries, coupled with increased global consumption of personal care and industrial products, are expected to drive consistent demand across multiple CMC end-use segments.

Which Region Holds the Largest Share of the Carboxy Methyl Cellulose Market?

- Asia-Pacific dominated the carboxy methyl cellulose (CMC) market with the largest revenue share of 41.2% in 2024, driven by robust demand across food & beverage, pharmaceutical, and oil & gas industries. The region’s rapidly expanding industrial base, rising population, and growing consumption of processed food and personal care products are fueling market growth

- China, India, and Japan are leading producers and consumers of CMC, benefiting from abundant raw material availability and cost-effective manufacturing. In addition, the expansion of local chemical industries and government initiatives supporting biopolymer and cellulose-based production are bolstering regional dominance

- Favorable economic growth, strong export potential, and increasing applications of CMC in construction and oilfield operations are reinforcing Asia-Pacific’s leadership, positioning it as the largest global hub for Carboxy Methyl Cellulose manufacturing and consumption

China Carboxy Methyl Cellulose Market Insight

The China carboxy methyl cellulose market accounted for the largest revenue share of 57% in 2024 within the Asia-Pacific region, supported by the country’s large-scale production capacity and rapidly growing end-use industries. Rising demand for pharmaceuticals, processed foods, and cosmetics, along with government initiatives promoting bio-based chemicals, is driving substantial market growth. The presence of leading domestic manufacturers such as QINGDAO SINOCMC CHEMICAL CO., LTD. and WEIFANG LUDE CHEMICAL CO., LTD. ensures steady supply and competitive pricing. In addition, the growing export of CMC from China to Europe and North America highlights its dominance as a key global supplier of high-quality and technical-grade CMC.

India Carboxy Methyl Cellulose Market Insight

The India carboxy methyl cellulose market is expanding rapidly due to strong demand from the food processing, pharmaceutical, and detergent industries. The country benefits from low-cost cellulose sources, favorable government policies supporting chemical manufacturing, and a thriving FMCG sector. Increasing usage of CMC as a stabilizer and thickener in packaged foods and pharmaceuticals is driving adoption. Moreover, the growth of domestic producers such as Amar Cellulose Industries and Patel Industries is enhancing local availability. As India continues to modernize its industrial base, the country is emerging as a key exporter of low- and medium-grade CMC to neighboring Asian and African markets.

Japan Carboxy Methyl Cellulose Market Insight

The Japan carboxy methyl cellulose market is witnessing steady growth driven by its technological innovation and focus on high-purity CMC for food and pharmaceutical use. The country’s leading players, such as DKS Co. Ltd. and Daicel Corporation, emphasize advanced R&D and sustainability, producing premium-grade CMC for specialized applications. Demand in Japan is primarily supported by its aging population, rising consumption of convenience foods, and increased adoption of eco-friendly materials. The market is also benefiting from collaborations between chemical manufacturers and research institutions aimed at developing biodegradable and functional cellulose derivatives.

Which Region is the Fastest Growing Region in the Carboxy Methyl Cellulose Market?

The North America carboxy methyl cellulose market is projected to grow at the fastest CAGR of 13.4% during the forecast period of 2025 to 2032, driven by increasing demand across the pharmaceutical, oil & gas, and food processing sectors. Rising consumer preference for natural stabilizers and thickeners, coupled with strong investment in sustainable chemical production, is fueling growth. The adoption of advanced manufacturing technologies and expansion of research activities in bio-based polymers further enhance the region’s market potential.

U.S. Carboxy Methyl Cellulose Market Insight

The U.S. carboxy methyl cellulose market captured the largest revenue share of 82% in 2024 within North America, propelled by increasing applications in pharmaceutical formulations, food products, and industrial fluids. Companies such as DuPont and Ashland are leading innovation in sustainable and high-purity CMC production. Growing consumer preference for clean-label ingredients, the expansion of oilfield drilling operations, and advancements in controlled-release drug formulations are key growth drivers. Furthermore, the rising adoption of bio-based and eco-friendly cellulose derivatives supports continued market expansion in the U.S.

Canada Carboxy Methyl Cellulose Market Insight

The Canada carboxy methyl cellulose market is expected to register a notable CAGR during 2025–2032, driven by increasing use of CMC in food, personal care, and industrial applications. The growing focus on sustainable product development, along with the expansion of local food processing and pharmaceutical industries, is supporting demand. In addition, the presence of well-regulated chemical manufacturing frameworks and strong research collaboration between academia and industry are promoting innovation. Canada’s increasing import of specialty-grade CMC from U.S. and Asian producers further contributes to its steady market growth trajectory.

Which are the Top Companies in Carboxy Methyl Cellulose Market?

The carboxy methyl cellulose industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Ashland (U.S.)

- Nouryon (Netherlands)

- CP Kelco U.S., Inc. (U.S.)

- DuPont (U.S.)

- USK KIMYA CORP (Turkey)

- DKS Co. Ltd. (Japan)

- NIPPON PAPER INDUSTRIES CO., LTD. (Japan)

- Daicel Corporation (Japan)

- Lamberti S.p.A. (Italy)

- Amar Cellulose Industries (India)

- Patel Industries (India)

- QINGDAO SINOCMC CHEMICAL CO., LTD. (China)

- Cellulose Solutions Private Limited (India)

- Trishul Industries (India)

- Chongqing Lihong Fine Chemicals Co., Ltd. (China)

- Nilkanth Organics (India)

- K.A. Malle Pharmaceuticals (India)

- Changshu Wealthy Science and Technology Co., Ltd. (China)

- WEIFANG LUDE CHEMICAL CO., LTD. (China)

What are the Recent Developments in Global Carboxy Methyl Cellulose Market?

- In March 2025, Nippon Paper Industries held a ceremony marking the completion of its new Li-ion-battery-grade Carboxy Methyl Cellulose (CMC) plant in Hungary, adding 24 kt/y of dedicated production capacity. This strategic expansion strengthens the company’s foothold in the European CMC market, supporting the growing demand for battery materials used in electric vehicles (EVs). This move reinforces Nippon Paper’s commitment to advancing sustainable and high-performance cellulose derivatives for the global energy transition

- In November 2024, Tate & Lyle finalized its EUR 1.4 billion acquisition of CP Kelco, enhancing its position in the specialty ingredients and biopolymers market. The merger creates a stronger, synergized platform that broadens Tate & Lyle’s global reach and innovation capabilities in nature-based ingredients, including Carboxy Methyl Cellulose. This acquisition significantly boosts Tate & Lyle’s portfolio diversification and strengthens its competitiveness in the global CMC sector

- In June 2024, INOX Air Tate & Lyle announced its plan to acquire the entire issued share capital of CP Kelco U.S., CP Kelco China, and CP Kelco ApS, along with their subsidiaries, from J.M. Huber Corporation for an implied total consideration of USD 1.8 billion on a cash-free, debt-free basis. As CP Kelco is a leading producer of pectin, specialty gums, and Carboxy Methyl Cellulose, this acquisition will expand Tate & Lyle’s production footprint and strengthen its presence in the bio-based polymer industry. This transaction marks a major consolidation step, aligning both companies toward sustainable ingredient innovation and growth

- In February 2023, Nippon Paper Industries Co., Ltd. established a manufacturing and sales subsidiary in Hungary for its SUNROSE MAC Carboxy Methyl Cellulose product, which is utilized in lithium-ion battery anodes for electric vehicles. The new subsidiary aims to enhance the company’s rapidly expanding supply chain in Europe, ensuring timely and efficient distribution. This initiative highlights Nippon Paper’s proactive approach to supporting the European EV ecosystem and securing its leadership in the specialty CMC segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carboxy Methyl Cellulose Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carboxy Methyl Cellulose Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carboxy Methyl Cellulose Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.