Global Carboxylates Market

Market Size in USD Billion

CAGR :

%

USD

14.32 Billion

USD

22.49 Billion

2024

2032

USD

14.32 Billion

USD

22.49 Billion

2024

2032

| 2025 –2032 | |

| USD 14.32 Billion | |

| USD 22.49 Billion | |

|

|

|

|

Carboxylates Market Size

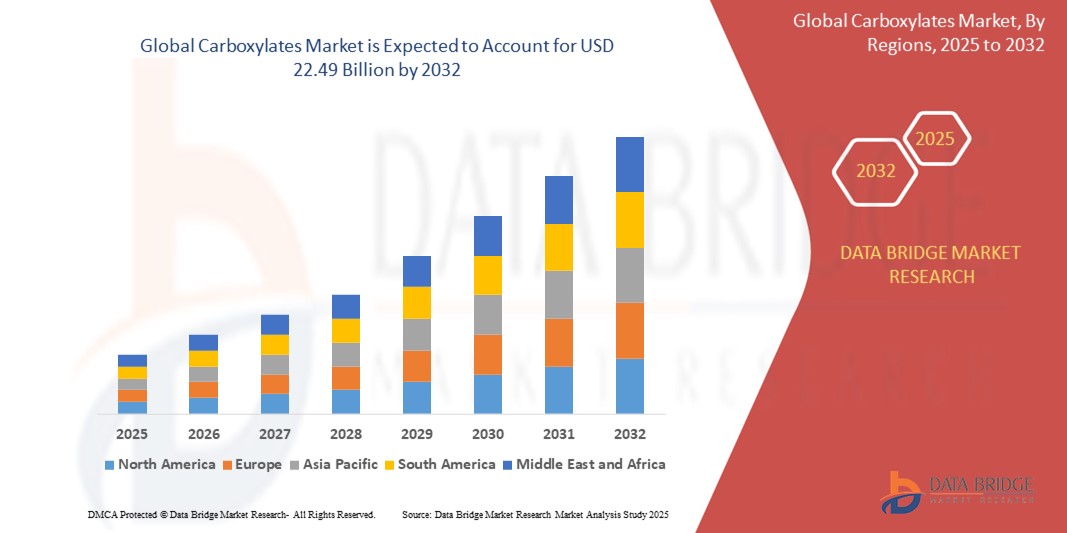

- The global carboxylates market size was valued at USD 14.32 billion in 2024 and is expected to reach USD 22.49 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is primarily driven by increasing demand for carboxylates in food preservation, animal feed additives, and personal care products, coupled with advancements in production technologies

- Rising consumer awareness of sustainable and bio-based chemicals, along with the growing application of carboxylates in lubricants and consumer goods, is further propelling market expansion

Carboxylates Market Analysis

- Carboxylates, organic compounds derived from carboxylic acids, are widely used across industries for their antimicrobial, preservative, and functional properties in applications such as food processing, cosmetics, and industrial lubricants

- The market is fueled by growing demand for natural preservatives in the food and beverage sector, increasing use of carboxylates in animal nutrition to enhance feed efficiency, and their rising adoption in eco-friendly personal care formulations

- North America dominated the carboxylates market with the largest revenue share of 42.5% in 2024, driven by advanced manufacturing capabilities, high demand in the food and beverage industry, and a strong presence of key market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid industrialization, increasing demand for packaged foods, and rising disposable incomes in countries such as China and India

- The acetic segment dominated the largest market revenue share of 38.5% in 2024, driven by its extensive use as a preservative and flavor enhancer in the food and beverage industry, as well as its critical role in producing vinyl acetate monomer for adhesives and coatings

Report Scope and Carboxylates Market Segmentation

|

Attributes |

Carboxylates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carboxylates Market Trends

“Increasing Demand for Natural and Bio-Based Products”

- The global carboxylates market is experiencing a notable trend toward the adoption of natural and bio-based carboxylates, driven by consumer preference for sustainable and eco-friendly products

- Advanced biotechnological processes, such as renewable fermentation, enable the production of bio-based carboxylates such as citric acid and lactic acid, reducing reliance on petroleum-based feedstocks

- These bio-based solutions provide enhanced environmental benefits, appealing to industries aiming to meet sustainability goals and regulatory requirements

- For instance, companies are developing bio-based acetic and citric acids for use in food preservation and cosmetics, offering safer and greener alternatives to synthetic counterparts

- This trend enhances the appeal of carboxylates across various applications, making them more attractive to environmentally conscious consumers and industries

- Data analytics and process optimization are being integrated to improve the efficiency of bio-based carboxylate production, further driving market growth

Carboxylates Market Dynamics

Driver

“Rising Demand for Food Preservation and Personal Care Products”

- Increasing consumer demand for processed foods, beverages, and natural cosmetics is a major driver for the global carboxylates market

- Carboxylates, such as acetic acid and citric acid, are widely used as preservatives and flavor enhancers in the food and beverage industry, extending shelf life and improving taste

- Government regulations in regions such as North America, promoting high standards for product safety and quality, are boosting the adoption of carboxylates in food and personal care applications

- The proliferation of green chemistry initiatives and advancements in production technologies, such as renewable fermentation, are enabling the expansion of carboxylate applications

- Manufacturers are increasingly incorporating carboxylates into consumer goods, such as detergents and soaps, to meet rising demand for sustainable and effective products

Restraint/Challenge

“High Production Costs and Supply Chain Vulnerabilities”

- The significant initial investment required for bio-based production facilities and advanced manufacturing processes can be a barrier, particularly for smaller companies in emerging markets

- Integrating sustainable production methods, such as fermentation, into existing supply chains can be complex and costly, limiting scalability

- Dependency on specific feedstocks, such as agricultural raw materials, creates vulnerabilities in the supply chain, potentially leading to shortages or price volatility

- Regulatory variations across countries regarding the use of carboxylates in food, cosmetics, and other applications complicate compliance for global manufacturers

- These factors may deter adoption in cost-sensitive markets and challenge market expansion, particularly in regions with limited infrastructure or stringent regulations

Carboxylates market Scope

The market is segmented on the basis of product and end-user.

- By Product

On the basis of product, the global carboxylates market is segmented into acetic, valeric, isovaleric, formic, propionic, butyric, isobutyric, citric, caproic, and stearic. The acetic segment dominated the largest market revenue share of 38.5% in 2024, driven by its extensive use as a preservative and flavor enhancer in the food and beverage industry, as well as its critical role in producing vinyl acetate monomer for adhesives and coatings. Its widespread industrial applications and high demand in chemical intermediates further solidify its dominance.

The citric segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032, fueled by increasing demand for natural preservatives and acidulants in beverages and processed foods. Its growing use in pharmaceuticals and cosmetics, owing to its antioxidant properties and mild acidity, also accelerates adoption.

- By End-User

On the basis of end-user, the global carboxylates market is segmented into food and beverages, animal feed, personal care and cosmetics, lubricants, and consumer goods. The food and beverages segment dominated the market with a revenue share of 45.2% in 2024, driven by the rising consumption of carboxylates such as acetic and citric acids as preservatives, flavor enhancers, and pH regulators in packaged and processed foods. The trend toward clean-label ingredients further boosts demand.

The personal care and cosmetics segment is anticipated to experience the fastest growth rate of 7.1% from 2025 to 2032. Increasing consumer awareness of beauty products, coupled with the extensive use of stearic and citric acids for emulsification, pH adjustment, and microbial prevention in cosmetics, drives this growth. Rising disposable incomes and demand for organic personal care products further propel the segment.

Carboxylates Market Regional Analysis

- North America dominated the carboxylates market with the largest revenue share of 42.5% in 2024, driven by advanced manufacturing capabilities, high demand in the food and beverage industry, and a strong presence of key market players

- Consumers prioritize carboxylates for their role in food safety, cosmetic formulations, and industrial applications, particularly in regions with stringent regulatory standards

- Growth is supported by advancements in bio-based carboxylate production and increasing adoption in food and beverage, animal feed, and cosmetic sectors

U.S. Carboxylates Market Insight

The U.S. carboxylates market captured the largest revenue share of 89.6% in 2024 within North America, fueled by strong demand in the food and beverage sector and growing awareness of sustainable chemical solutions. The trend toward natural preservatives and eco-friendly personal care products boosts market expansion. In addition, regulatory support for safe chemical applications and widespread use in animal feed complement both industrial and consumer-driven growth.

Europe Carboxylates Market Insight

The European carboxylates market is expected to witness significant growth, supported by regulatory emphasis on sustainable and safe chemical formulations. Consumers demand carboxylates that enhance product shelf life and safety in food and cosmetics. Growth is prominent in both industrial applications and consumer goods, with countries such as Germany and France showing strong adoption due to environmental concerns and advanced manufacturing capabilities.

U.K. Carboxylates Market Insight

The U.K. market for carboxylates is anticipated to experience rapid growth, driven by demand for eco-friendly preservatives in food and beverage applications and innovative cosmetic formulations. Increasing consumer awareness of health and sustainability encourages adoption. Evolving regulations on chemical safety and environmental impact further shape consumer preferences, balancing efficacy with compliance.

Germany Carboxylates Market Insight

Germany is expected to witness rapid growth in the carboxylates market, attributed to its advanced chemical and manufacturing sectors and a strong focus on sustainability. German consumers favor carboxylates that enhance product performance while reducing environmental impact. The integration of carboxylates in premium personal care products and animal feed, alongside robust aftermarket demand, supports sustained market growth.

Asia-Pacific Carboxylates Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding industrial production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of food safety, personal care product quality, and sustainable lubricants boosts demand. Government initiatives promoting eco-friendly chemicals and industrial efficiency further encourage the adoption of advanced carboxylates.

Japan Carboxylates Market Insight

Japan’s carboxylates market is expected to grow rapidly due to strong consumer preference for high-quality, sustainable chemical solutions that enhance product safety and performance. The presence of major manufacturers and the integration of carboxylates in food, cosmetics, and animal feed accelerate market penetration. Rising interest in bio-based products and eco-conscious consumer goods also contributes to growth.

China Carboxylates Market Insight

China holds the largest share of the Asia-Pacific carboxylates market, propelled by rapid industrialization, growing consumer markets, and increasing demand for food preservatives and personal care formulations. The country’s expanding middle class and focus on sustainable manufacturing support the adoption of advanced carboxylates. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Carboxylates Market Share

The carboxylates industry is primarily led by well-established companies, including:

- Alcoa Corporation (U.S.)

- Thirumalai Chemicals Ltd. (India)

- Rio Tinto (Australia)

- RUSAL (Russia)

- Norsk Hydro A.S.A. (Norway)

- Emirates Global Aluminium PJSC (U.A.E)

- Aluminum Bahrain B.S.C. (Bahrain)

- Century Aluminum Company (U.S.)

- Vedanta Ltd. (India)

- China Aluminum Corporation (China)

- Merck KGaA (Germany)

- REDOX INDUSTRIES LIMITED (India)

- China Hongqiao (China)

- H.P. (Australia)

- East Hope Group (China)

- ACURO ORGANICS LIMITED (India)

- Emirates Global Aluminum (U.A.E.)

What are the Recent Developments in Global Carboxylates Market?

- In November 2024, BioVeritas launched operations to produce sustainable fuels and biochemicals, reinforcing its commitment to eco-friendly solutions. The company utilizes bacterial fermentation to convert biomass into caproic acid and volatile fatty acids, essential components in bio-based alternatives. This initiative underscores the growing emphasis on sustainability within the carboxylates market, offering innovative pathways for renewable chemical production

- In July 2024, KLK expanded its oleochemical processing capacity in China, significantly increasing production to meet the growing regional demand for sustainable oleochemicals. The expansion strengthens KLK’s global market position and enhances its ability to supply high-purity fatty acids and glycerin. The new facility, located in Zhangjiagang, boosts annual processing capacity to 500,000 tonnes, making it one of the most advanced oleochemical plants in China. This move aligns with industry trends toward eco-friendly solutions and reinforces KLK’s commitment to innovation

- In August 2024, Nalco Water and Danieli joined forces to advance industrial water treatment for the metal industry. This partnership merges Nalco’s chemical expertise with Danieli’s technological innovations, enabling metal producers to enhance production efficiency while minimizing environmental impact. A key aspect of this collaboration is the use of carboxylates as scale inhibitors in water treatment chemicals, improving system performance and sustainability

- In September 2022, Eastman Chemical Company acquired Taminco for USD 2.8 billion, reinforcing its presence in the specialty chemicals sector. Taminco, a leading producer of alkylamines and metal carboxylates, enhances Eastman’s portfolio, particularly in high-performance metal carboxylates for industrial and agricultural applications. This strategic move aligns with Eastman’s growth objectives, expanding its capabilities in niche markets such as food, feed, and agriculture

- In April 2022, Perstorp Holding AB announced plans to expand its carboxylic acid production capacity to 70,000 tons annually. The company is constructing a new production plant in Stenungsund, Sweden, which will significantly boost output and strengthen its position in the carboxylates market. This investment aligns with growing demand for non-phthalate plasticizers, engineered fluids, and food preservation solutions. The expansion reinforces Perstorp’s commitment to sustainable and high-performance chemical solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carboxylates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carboxylates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carboxylates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.