Global Carcinoembryonic Antigen Cea Market

Market Size in USD Million

CAGR :

%

USD

1,855.41 Million

USD

2,912.90 Million

2021

2029

USD

1,855.41 Million

USD

2,912.90 Million

2021

2029

| 2022 –2029 | |

| USD 1,855.41 Million | |

| USD 2,912.90 Million | |

|

|

|

|

Carcinoembryonic Antigen (CEA) Market????? Analysis and Size

Carcinoembryonic antigen sensitivity is low in patients with early colon cancer. The carcinoembryonic antigen (CEA) test is particularly useful for rectum and large intestine cancers. Carcinoembryonic antigen is one of the most widely used tumour markers in the world. However, it is most important in colorectal cancer.

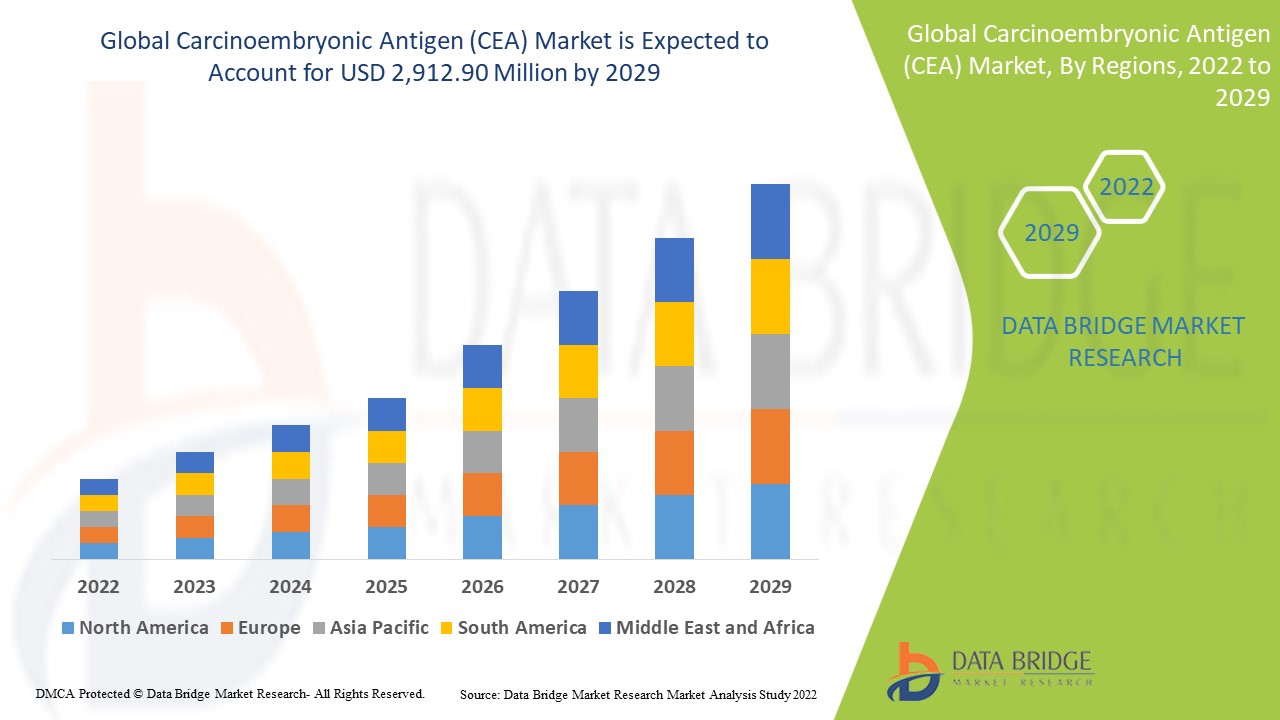

Data Bridge Market Research analyses that the carcinoembryonic antigen (CEA) market which was USD 1,855.41 million in 2021, is expected to reach USD 2,912.90 million by 2029, at a CAGR of 5.80% during the forecast period 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Carcinoembryonic Antigen (CEA) Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Test type (Molecular Tests, Serology Tests), Product Types (CD66a, CD66b, CD66c, CD66d, CD66e, CD66f), Gender (Male, Female), Application (Gastrointestinal Cancer, Colorectal Cancer, Pancreatic Cancer, Breast Cancer, Lung Cancer, Thyroid Cancer, Ovarian Cancer, Others), End-User (Hospitals, Diagnostic Centers, Cancer Centers, Research, Academic Institutes) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Quest Diagnostics Incorporated (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Genway Biotech, LLC. (U.S.), Abbott (U.S.), Mayo Foundation for Medical Education and Research (MFMER) (U.S.), Lee BioSolutions (U.S.), RayBiotech Life, Inc (U.S.), Correlogic Systems, Inc. (Hong Kong), Boster Biological Technology (U.S.), Omega Diagnostics Group PLC (U.K.), Creative Diagnostics (U.S.), Cigna (U.S.), Merck KGaA (Germany), Prospec-Tany Technogene Ltd (Israel), Laboratory Corporation of America Holdings (U.S.) |

|

Market Opportunities |

|

Market Definition

Carcinoembryonic antigen (CEA) is found in embryonic endodermal epithelial cells. Carcinoembryonic antigen is a glycoprotein found in the fluids of the foetus and embryo, as well as the gastrointestinal tract. Carcinoembryonic antigen is also found in colorectal mucosal cells, gastrointestinal cells, and in trace amounts in the blood. The test is also to manage and diagnose cancers such as breast cancer, colorectal or colon cancer, gastrointestinal cancer, liver cancer, ovarian cancer, lung cancer, and others.

Global Carcinoembryonic Antigen (CEA) Market Dynamics

Drivers

- Rising awareness to bolster the growth

Increasing awareness about preclinical testing for disease detection, but carcinoembryonic antigen is the most cost-effective valuation, which continues to drive market demand for testing. Furthermore, consumers' rising disposable income, combined with rising life expectancy, will eventually result in market growth. Favourable government policies relating to cancer awareness and control implemented by organisations such as the National Cancer Institute and (CPCRN) are boost market growth.

- Technological developments

Proteomics-related technological advancements, such as protein bioinformatics, mass spectroscopy, protein labelling, imaging, and array-based approaches, are drive market growth. The development of new biomarkers and immunological techniques such as radioimmunoassay that can be used in conjunction with carcinoembryonic antigen (CEA) for the detection of various types of cancers will also drive market growth. For instance, the development of tumour markers that can be used in conjunction with CEA to detect colorectal cancer. Government initiatives to introduce new diagnostic tools/technologies are drive market growth. Furthermore, rising demand for minimally invasive diagnostic procedures to avoid various post-procedural side effects drives the growth of this market.

- Increasing number of cancer cases

According to the World Health Organization, cancer is one of the leading causes of death worldwide. It is expected to cause 10 million deaths by 2020. Cancer is responsible for approximately one in every six deaths worldwide. Cancer kills approximately 70% of people in low- and middle-income countries; the most common types of cancer are breast (2.26 million cases in 2020), lung (2.21 million cases in 2020), and colon and rectum cancers (1.93 million cases in 2020). The number of cancer cases diagnosed each year in the world has increased dramatically due to increased life expectancy, resulting in millions of people being diagnosed in their lifetime, driving the market's growth.

Opportunities

- Rise in the number of hospitals in the developing economies

Cancer has become the leading cause of death in many parts of the world due to rapid growth in the number of cancer patients and cancer incidences in both developed and developing countries. According to the WHO, nearly 10 million deaths occur each year as a result of cancer, with 1.93 million cases of colon and rectum cancer in 2020. Healthcare services are improving and focusing on earlier disease detection and treatment. Population growth and increased life expectancy are the primary factors driving the overall increase in incidence. Furthermore, rising public awareness of cancer has increased the number of patients who undergo screening.

- Increasing prevalence of unhealthy lifestyles

The increasing prevalence of unhealthy lifestyles such as irregular dietary habits and exposure to carcinogenic elements all contribute to its large share. Furthermore, increased alcohol consumption and sedentary lifestyle may contribute to the growth of colorectal cancer over the next seven years.

Restraints/Challenges

- Risk of infection will restrain the growth

Dearth of awareness about the carcinoembryonic antigen test, risk of infections by carcinoembryonic antigen testing and failure to detect cancer at the initial stage will obstruct the market's growth rate.

This carcinoembryonic antigen (CEA) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the carcinoembryonic antigen (CEA) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Carcinoembryonic Antigen (CEA) Market

COVID-19 has created new opportunities in the carcinoembryonic antigen (CEA) market. For instance, COVID-19 has forced us to concentrate on biotechnologically modified products in order to achieve better results. During the outbreak, many biopharmaceutical companies developed biotechnologically modified vaccines and diagnostic kits to treat SARS-CoV-2. Furthermore, biotechnological equipment has aided in various stages of the pandemic's combat; the COVID-19 pandemic has made us realise that biotechnological solutions provide a better healthcare system, positively affecting the Carcinoembryonic antigen (CEA) market.

Global Carcinoembryonic Antigen (CEA) Market Scope

The carcinoembryonic antigen (CEA) market is segmented on the basis of test type, product types, gender, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market.

Test Type

- Molecular Tests

- Serology Tests

Product Types

- CD66a

- CD66b

- CD66c

- CD66d

- CD66e

- CD66f

Gender

- Male

- Female

Application

- Gastrointestinal Cancer

- Colon Cancer

- Pancreatic Cancer

- Rectal Cancer

- Liver Cancer

- Stomach Cancer

- Esophageal Cancer

- Gallbladder Cancer

- Anal Cancer

- Colorectal Cancer

- Pancreatic Cancer

- Breast Cancer

- Lung Cancer

- Thyroid Cancer

- Ovarian Cancer

- Others

End-User

- Hospitals

- Diagnostic Centers

- Cancer Centers

- Research

- Academic Institutes

Carcinoembryonic Antigen (CEA) Market Regional Analysis/Insights

The carcinoembryonic antigen (CEA) market is analysed and market size insights and trends are provided by country, test type, product types, gender, application and end user as referenced above.

The countries covered in the carcinoembryonic antigen (CEA) market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the carcinoembryonic antigen (CEA) market due to the high incidence rates of cancer, presence of sophisticated healthcare infrastructure, and high patient awareness levels in the region.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 owing to the growing awareness in patients, high incidence rates of cancer and existence of advanced healthcare framework in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The carcinoembryonic antigen (CEA) market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for carcinoembryonic antigen (CEA) market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the carcinoembryonic antigen (CEA) market. The data is available for historic period 2010-2020.

Competitive Landscape and Carcinoembryonic Antigen (CEA) Market Share Analysis

The carcinoembryonic antigen (CEA) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to carcinoembryonic antigen (CEA) market.

Some of the major players operating in the carcinoembryonic antigen (CEA) market are:

- Quest Diagnostics Incorporated (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Genway Biotech, LLC. (U.S.)

- Abbott (U.S.)

- Mayo Foundation for Medical Education and Research (MFMER) (U.S.)

- Lee BioSolutions (U.S.)

- RayBiotech Life, Inc (U.S.)

- Correlogic Systems, Inc. (Hong Kong)

- Boster Biological Technology (U.S.)

- Omega Diagnostics Group PLC (U.K.)

- Creative Diagnostics (U.S.)

- Cigna (U.S.)

- Merck KGaA (Germany)

- Prospec-Tany Technogene Ltd (Israel)

- Laboratory Corporation of America Holdings (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY TEST TYPE

16.1 OVERVIEW

16.2 MOLECULAR TESTS

16.2.1 RADIOIMMUNOASSAY

16.2.2 IMMUNOHISTOCHEMISTRY

16.2.3 ELECTROCHEMILUMINESCENCE IMMUNOASSAY

16.2.4 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

16.2.5 OTHERS

16.3 SEROLOGY TESTS

16.3.1 BLOOD TEST

16.3.2 ABDOMINAL WALL (PERITONEAL FLUID)

16.3.3 SPINAL CORD (CEREBROSPINAL FLUID OR CSF)

16.3.4 CHEST (PLEURAL FLUID)

16.3.5 OTHERS

16.4 OTHERS

17 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY PRODUCT TYPE

17.1 OVERVIEW

17.2 CD66A

17.3 CD66B

17.4 CD66C

17.5 CD66D

17.6 CD66E

17.7 CD66F

18 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY KIT/PACK SIZE

18.1 OVERVIEW

18.2 100 TEST

18.3 200 TEST

18.4 OTHERS

19 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY GENDER

19.1 OVERVIEW

19.2 MALE

19.2.1 GASTROINTESTINAL CANCER

19.2.2 COLORECTAL CANCER

19.2.3 PANCREATIC CANCER

19.2.4 LUNG CANCER

19.2.5 THYROID CANCER

19.2.6 OTHERS

19.3 FEMALE

19.3.1 GASTROINTESTINAL CANCER

19.3.2 COLORECTAL CANCER

19.3.3 PANCREATIC CANCER

19.3.4 BREAST CANCER

19.3.5 LUNG CANCER

19.3.6 THYROID CANCER

19.3.7 OVARIAN CANCER

19.3.8 OTHERS

20 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY AGE GROUP

20.1 OVERVIEW

20.2 ADULT

20.2.1 MOLECULAR TESTS

20.2.2 SEROLOGY TEST

20.3 GERIATRIC

20.3.1 MOLECULAR TESTS

20.3.2 SEROLOGY TEST

21 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY APPLICATION

21.1 OVERVIEW

21.2 DIAGNOSTICS

21.2.1 GASTROINTESTINAL CANCER

21.2.2 COLORECTAL CANCER

21.2.3 PANCREATIC CANCER

21.2.4 BREAST CANCER

21.2.5 LUNG CANCER

21.2.6 THYROID CANCER

21.2.7 OVARIAN CANCER

21.3 RESEARCH

21.4 OTHERS

22 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITAL

22.2.1 BY TYPE

22.2.1.1. PRIVATE

22.2.1.2. GOVERNMENT

22.2.2 BY TIER

22.2.2.1. TIER 1

22.2.2.2. TIER 2

22.2.2.3. TIER 3

22.3 SPECIALTY CLINICS

22.4 DIAGNOSTIC CENTERS

22.5 RESEARCH AND ACADEMIC INSTITUTES

22.6 OTHERS

23 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDER

23.3 REATIL SALES

23.4 OTHERS

24 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: EUROPE

24.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

24.5 COMPANY SHARE ANALYSIS: SOUTH AMERICA

24.6 MERGERS & ACQUISITIONS

24.7 NEW PRODUCT DEVELOPMENT & APPROVALS

24.8 EXPANSIONS

24.9 REGULATORY CHANGES

24.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, BY GEOGRAPHY

GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 EUROPE

25.2.1 GERMANY

25.2.2 FRANCE

25.2.3 U.K.

25.2.4 HUNGARY

25.2.5 LITHUANIA

25.2.6 AUSTRIA

25.2.7 IRELAND

25.2.8 NORWAY

25.2.9 POLAND

25.2.10 ITALY

25.2.11 SPAIN

25.2.12 RUSSIA

25.2.13 TURKEY

25.2.14 NETHERLANDS

25.2.15 SWITZERLAND

25.2.16 REST OF EUROPE

25.3 ASIA-PACIFIC

25.3.1 JAPAN

25.3.2 CHINA

25.3.3 SOUTH KOREA

25.3.4 INDIA

25.3.5 AUSTRALIA

25.3.6 SINGAPORE

25.3.7 THAILAND

25.3.8 MALAYSIA

25.3.9 INDONESIA

25.3.10 PHILIPPINES

25.3.11 VIETNAM

25.3.12 REST OF ASIA-PACIFIC

25.4 SOUTH AMERICA

25.4.1 BRAZIL

25.4.2 ARGENTINA

25.4.3 PERU

25.4.4 REST OF SOUTH AMERICA

25.5 MIDDLE EAST AND AFRICA

25.5.1 SOUTH AFRICA

25.5.2 GLOBAL

25.5.3 UAE

25.5.4 EGYPT

25.5.5 KUWAIT

25.5.6 ISRAEL

25.5.7 REST OF MIDDLE EAST AND AFRICA

25.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

26 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL CARCINOEMBRYONIC ANTIGEN (CEA) MARKET, COMPANY PROFILE

27.1 QUEST DIAGNOSTICS INCORPORATED.

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 F. HOFFMANN-LA ROCHE LTD

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 WELDON BIOTECH, INC.

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 BIOGENEX

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 ABBOTT

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 THERMO FISHER SCIENTIFIC INC.

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 MEDIX BIOCHEMICA USA INC.

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 BOSTER BIOLOGICAL TECHNOLOGY

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 OMEGA DIAGNOSTICS LTD.

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 MERCK KGAA

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 CREATIVE DIAGNOSTICS

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 LABORATORY CORPORATION OF AMERICA HOLDINGS

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 AVIVA SYSTEMS BIOLOGY CORPORATION

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 ABCAM LIMITED.

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 ADVACARE PHARMA

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 GETEIN BIOTECH, INC.

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 ATLAS LINK TECHNOLOGY CO. LTD.

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 COSMIC SCIENTIFIC TECHNOLOGIES

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 BIOPANDA REAGENTS LTD,

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 RAYBIOTECH, INC.

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 PROSPEC-TANY TECHNOGENE LTD.

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 BTNX INC.

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 WONDFO

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 ELABSCIENCE BIONOVATION INC.

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 CTK BIOTECH, INC.

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 HIPRO BIOTECHNOLOGY CO.,LTD.

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

27.27 QUADRATECH DIAGNOSTICS LTD

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPMENTS

27.28 XIAMEN BIOTIME BIOTECHNOLOGY CO., LTD..

27.28.1 COMPANY OVERVIEW

27.28.2 REVENUE ANALYSIS

27.28.3 GEOGRAPHIC PRESENCE

27.28.4 PRODUCT PORTFOLIO

27.28.5 RECENT DEVELOPMENTS

27.29 TULIP DIAGNOSTIC (P) LTD.

27.29.1 COMPANY OVERVIEW

27.29.2 REVENUE ANALYSIS

27.29.3 GEOGRAPHIC PRESENCE

27.29.4 PRODUCT PORTFOLIO

27.29.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.