Global Cardiac Biomarker Assays Market

Market Size in USD Million

CAGR :

%

USD

501.63 Million

USD

1,296.36 Million

2025

2033

USD

501.63 Million

USD

1,296.36 Million

2025

2033

| 2026 –2033 | |

| USD 501.63 Million | |

| USD 1,296.36 Million | |

|

|

|

|

Cardiac Biomarker Assays Market Size

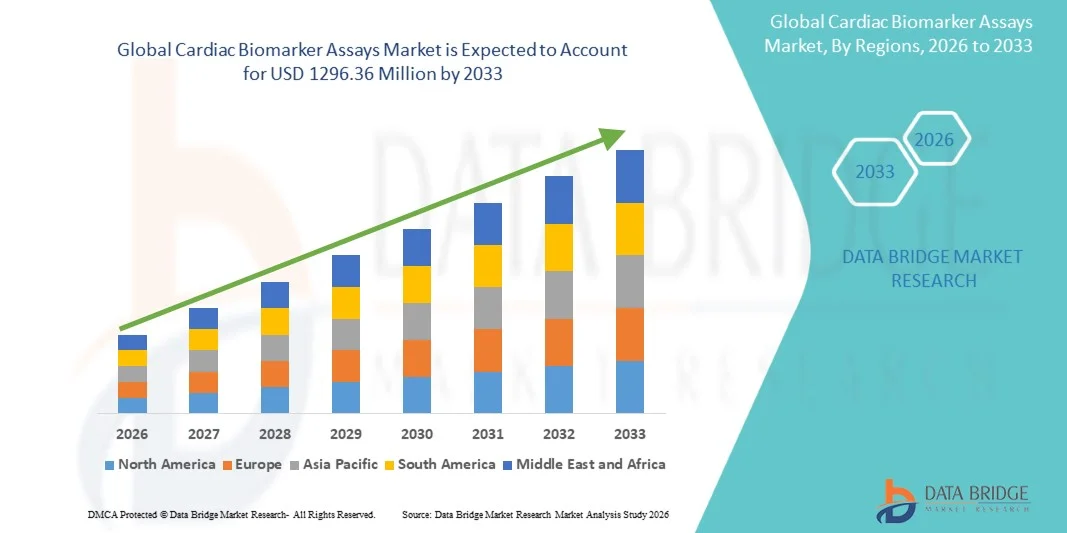

- The global cardiac biomarker assays market size was valued at USD 501.63 million in 2025 and is expected to reach USD 1296.36 million by 2033, at a CAGR of 12.60% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases and the growing emphasis on early diagnosis and preventive healthcare, driving widespread adoption of cardiac biomarker assays across hospitals and diagnostic laboratories. Continuous advancements in high-sensitivity assays and automation technologies are enhancing test accuracy and efficiency, further expanding their clinical applications in cardiac care

- Furthermore, rising healthcare expenditure, supportive government initiatives for cardiovascular screening, and the integration of point-of-care testing solutions are establishing cardiac biomarker assays as essential diagnostic tools for timely and precise cardiac evaluation. These factors are accelerating market adoption, thereby significantly boosting the industry’s growth

Cardiac Biomarker Assays Market Analysis

- Cardiac biomarker assays, designed to detect and quantify specific proteins released during cardiac injury, play a critical role in the early diagnosis and management of conditions such as myocardial infarction, heart failure, and acute coronary syndrome. Their rapid and reliable results enable clinicians to make informed treatment decisions and improve patient outcomes across both emergency and clinical settings

- The growing demand for cardiac biomarker assays is primarily driven by the rising incidence of heart-related disorders, technological innovation in diagnostic platforms, and the increasing preference for high-sensitivity and automated testing systems in healthcare facilities

- North America dominated the cardiac biomarker assays market with a share of 47.8% in 2025 due to the high prevalence of cardiovascular diseases and well-established healthcare infrastructure

- Asia-Pacific is expected to be the fastest growing region in the cardiac biomarker assays market during the forecast period due to rising urbanization, growing healthcare awareness, and government initiatives promoting early cardiac screening

- Troponin segment dominated the market with a market share of 54.7% in 2025 due to its status as the gold standard for detecting cardiac injury and myocardial infarction. Troponin assays offer high specificity and sensitivity, enabling early and accurate diagnosis, which is critical for effective patient management. Hospitals and diagnostic centers heavily invest in troponin-based assay systems due to their reliability, fast turnaround times, and integration with automated laboratory workflows. Continuous innovations in assay formats, including high-sensitivity troponin tests, further strengthen its market leadership

Report Scope and Cardiac Biomarker Assays Market Segmentation

|

Attributes |

Cardiac Biomarker Assays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cardiac Biomarker Assays Market Trends

“Growing Use of High-Sensitivity Biomarker Assays”

- The cardiac biomarker assays market is experiencing robust growth due to the adoption of high-sensitivity assays capable of detecting minute concentrations of cardiac proteins with exceptional accuracy. These advanced assays are transforming cardiovascular diagnostics by enabling earlier disease detection, faster clinical decision-making, and improved patient prognosis in both acute and chronic conditions

- For instance, Abbott Laboratories and Roche Diagnostics have commercialized high-sensitivity troponin assays that allow emergency departments to diagnose myocardial infarction within minutes. Abbott’s ARCHITECT High Sensitive Troponin-I assay and Roche’s Elecsys Troponin T Gen 5 are utilized globally for precise detection of cardiac injury at extremely low thresholds, significantly improving diagnostic efficiency

- High-sensitivity assays provide greater clinical value by allowing continuous monitoring of cardiac proteins such as troponins, natriuretic peptides, and creatine kinase-MB. Their enhanced analytical performance aids early risk assessment and supports personalized treatment strategies for patients with suspected heart conditions

- In addition, hospitals and diagnostics laboratories are increasingly integrating automated analyzer platforms with high-throughput capabilities. These platforms reduce turnaround times, improve reproducibility, and enhance workflow efficiency in cardiac testing environments, making them essential in acute care settings

- The incorporation of advanced technologies such as chemiluminescent immunoassays and multiplex testing is further strengthening diagnostic accuracy and expanding the range of detectable biomarkers. Innovations in assay design and reagent stability also support the miniaturization and portability of cardiovascular testing devices

- The widespread adoption of high-sensitivity biomarker assays is redefining cardiac diagnostics by combining clinical precision, timeliness, and analytical reliability. As healthcare systems continue to focus on preventive cardiology and efficient patient triage, these assays are set to play a central role in future diagnostic standards for cardiovascular diseases

Cardiac Biomarker Assays Market Dynamics

Driver

“Increasing Prevalence of Cardiovascular Diseases”

- The rising global burden of cardiovascular diseases (CVDs) such as myocardial infarction, heart failure, and coronary artery disease is a major driver for the cardiac biomarker assays market. The growing incidence of lifestyle-related risk factors including obesity, diabetes, and hypertension demands efficient diagnostic tools for accurate, timely cardiac evaluation

- For instance, Siemens Healthineers and Beckman Coulter have developed advanced cardiac biomarker platforms that assist clinicians in early diagnosis and post-treatment monitoring. Siemens’ Atellica and Beckman Coulter’s Access hsTnI systems are being adopted by hospitals and diagnostic centers across several regions to manage the growing volume of cardiac patients effectively

- Rapid urbanization and an aging population are exacerbating cardiovascular health risks, increasing the volume of emergency cardiac testing. Hospitals and laboratories are thus investing in automated biomarker analyzers capable of handling high testing throughput while maintaining accuracy and reliability

- In addition, preventive screening programs and government initiatives promoting heart health awareness are expanding the use of cardiac biomarker assays in routine diagnostic protocols. This is fostering early intervention and improved patient management in high-risk populations

- The combination of demographic shifts, lifestyle changes, and increasing healthcare investment is continually driving demand for specialized cardiac biomarker testing. This sustained emphasis on early and accurate diagnosis establishes biomarker assays as one of the most essential components in cardiovascular disease management globally

Restraint/Challenge

“High Assay Cost and Regulatory Barriers”

- High assay costs and complex regulatory frameworks pose significant challenges to the growth of the cardiac biomarker assays market. The production of high-sensitivity diagnostic reagents requires sophisticated technology, advanced raw materials, and strict quality control, which collectively increase manufacturing and end-user expenses

- For instance, Roche Diagnostics and Abbott Laboratories face elevated cost pressures related to developing and maintaining compliance for their high-sensitivity troponin products under regulatory frameworks such as the U.S. FDA and the European Union’s In Vitro Diagnostic Regulation (IVDR). These rigorous approval processes lengthen product development timelines and elevate operational costs

- The expensive nature of test reagents and instrumentation can limit adoption, particularly in resource-constrained healthcare systems or smaller diagnostic laboratories. Cost concerns are amplified by reimbursement challenges, as many healthcare policies fail to fully cover advanced assay procedures despite their clinical advantages

- In addition, differences in biomarker standardization, lack of unified assay cut-off values, and varying interpretation guidelines across regions affect data consistency and hinder clinical adoption. These factors create uncertainty for healthcare providers and slow down broader implementation

- Addressing these challenges through international harmonization of assay standards, cost-effective production innovations, and support for reimbursement inclusion will be vital to promote affordability, accessibility, and regulatory alignment in the cardiac biomarker assays market globally

Cardiac Biomarker Assays Market Scope

The market is segmented on the basis of indication, biomarker, and end-user.

- By Indication

On the basis of indication, the cardiac biomarker assays market is segmented into myocardial infarction, congestive heart failure, and acute coronary syndrome. The myocardial infarction segment dominated the market with the largest revenue share in 2025, driven by the critical role of early detection in preventing severe cardiac complications and reducing mortality. Myocardial infarction assays, particularly troponin-based tests, are widely preferred by clinicians for their high sensitivity and specificity, enabling rapid diagnosis and timely intervention. The segment benefits from increasing prevalence of cardiovascular diseases globally, higher hospital admissions for cardiac emergencies, and growing awareness among healthcare providers regarding the importance of accurate diagnostics. The adoption of automated and high-throughput testing systems in hospitals further reinforces its market dominance.

The acute coronary syndrome segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising incidences of unstable angina and acute cardiac events. Early ACS detection through biomarker assays enables personalized treatment strategies and prevents long-term cardiac damage. The segment is supported by technological advancements in point-of-care devices and rapid diagnostic kits, which allow for immediate assessment in emergency and outpatient settings. Rising awareness campaigns and guideline recommendations for ACS testing from cardiology associations also accelerate market adoption.

- By Biomarker

On the basis of biomarker, the cardiac biomarker assays market is segmented into troponin, BNP, and myoglobin. The troponin segment dominated the market with the largest revenue share of 54.7% in 2025, driven by its status as the gold standard for detecting cardiac injury and myocardial infarction. Troponin assays offer high specificity and sensitivity, enabling early and accurate diagnosis, which is critical for effective patient management. Hospitals and diagnostic centers heavily invest in troponin-based assay systems due to their reliability, fast turnaround times, and integration with automated laboratory workflows. Continuous innovations in assay formats, including high-sensitivity troponin tests, further strengthen its market leadership.

The BNP segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing prevalence of congestive heart failure and the need for early risk stratification. BNP assays help monitor cardiac stress levels and treatment response, supporting proactive clinical decision-making. The growth is further fueled by adoption of point-of-care testing solutions and automated immunoassay platforms in specialty clinics and outpatient cardiac centers. Rising awareness of preventive cardiology and recommendations from cardiac societies also encourage wider BNP assay utilization.

- By End-User

On the basis of end-user, the cardiac biomarker assays market is segmented into hospitals and specialty clinics. The hospital segment dominated the market with the largest revenue share in 2025, due to the high volume of cardiac patients, comprehensive diagnostic infrastructure, and capacity for rapid biomarker testing. Hospitals are equipped with advanced laboratory systems, automated analyzers, and skilled personnel to perform large-scale cardiac biomarker assays efficiently. Government healthcare initiatives, insurance coverage, and increasing public awareness of early cardiovascular disease detection further strengthen the segment’s market position.

The specialty clinics segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the rising number of outpatient cardiac care centers and preventive cardiology-focused diagnostic facilities. Specialty clinics offer convenient, fast, and targeted cardiac biomarker testing for patients, often supported by portable point-of-care analyzers. Integration with telemedicine and remote monitoring platforms enhances accessibility, particularly in urban and semi-urban regions. The adoption of advanced assay kits and rapid testing devices further accelerates growth in this segment.

Cardiac Biomarker Assays Market Regional Analysis

- North America dominated the cardiac biomarker assays market with the largest revenue share of 47.8% in 2025, driven by the high prevalence of cardiovascular diseases and well-established healthcare infrastructure

- The region’s advanced diagnostic capabilities, increasing healthcare expenditure, and early adoption of innovative assay technologies continue to boost market growth

- Favorable reimbursement policies and strong presence of leading diagnostic companies further support the market’s dominance. The growing awareness regarding early cardiac diagnosis and preventive healthcare practices positions North America as a key contributor to global revenue

U.S. Cardiac Biomarker Assays Market Insight

The U.S. cardiac biomarker assays market captured the largest revenue share within North America in 2025, attributed to the high demand for advanced cardiac testing and the rapid adoption of high-sensitivity troponin assays. Rising incidences of myocardial infarction and heart failure, coupled with a strong network of clinical laboratories and hospitals, are driving market expansion. Continuous product launches by key diagnostic players and the integration of point-of-care testing solutions further accelerate the adoption of cardiac biomarker assays across the country.

Europe Cardiac Biomarker Assays Market Insight

The Europe cardiac biomarker assays market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by the increasing burden of cardiovascular diseases and government support for diagnostic innovation. European healthcare systems are focusing on precision diagnostics and early disease detection, promoting widespread adoption of biomarker assays. The region is also witnessing an upsurge in collaborations between research institutions and diagnostic firms aimed at developing high-sensitivity and multiplexed assay platforms.

U.K. Cardiac Biomarker Assays Market Insight

The U.K. cardiac biomarker assays market is expected to expand at a significant CAGR during the forecast period, driven by growing awareness of preventive cardiology and the country’s focus on healthcare digitalization. The rising number of cardiac care centers and diagnostic laboratories, combined with favorable health policies, is enhancing market penetration. Moreover, increased government investments in clinical diagnostics and biomarker research are fostering the development of advanced cardiac testing solutions across hospitals and clinics.

Germany Cardiac Biomarker Assays Market Insight

The Germany cardiac biomarker assays market is anticipated to witness robust growth during the forecast period, supported by a strong healthcare infrastructure and the country’s emphasis on diagnostic precision. Germany’s continuous investment in laboratory automation and advanced immunoassay systems boosts the demand for cardiac biomarker testing. The country’s aging population and rising cardiovascular disease rates are further propelling market adoption, particularly in hospital and specialized diagnostic settings.

Asia-Pacific Cardiac Biomarker Assays Market Insight

The Asia-Pacific cardiac biomarker assays market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rising urbanization, growing healthcare awareness, and government initiatives promoting early cardiac screening. Expanding healthcare infrastructure in countries such as China, Japan, and India, along with increasing affordability of diagnostic assays, is fueling regional growth. The availability of locally manufactured assay kits and the rising prevalence of cardiovascular disorders strengthen the region’s position as the fastest-growing market globally.

China Cardiac Biomarker Assays Market Insight

China accounted for the largest revenue share in the Asia-Pacific market in 2025, attributed to its expanding healthcare sector, rapid technological adoption, and strong domestic production capabilities. The country’s government-led initiatives on healthcare reform and the development of smart diagnostic laboratories are accelerating the use of cardiac biomarker assays. The growing middle-class population and rising investments in cardiovascular research further enhance market demand across hospitals and diagnostic centers.

Japan Cardiac Biomarker Assays Market Insight

Japan’s cardiac biomarker assays market is experiencing steady growth, driven by an aging population, advanced healthcare technologies, and the strong presence of diagnostic device manufacturers. High demand for precise and rapid testing solutions for early detection of myocardial infarction and heart failure is fostering market adoption. Integration of biomarker assays into point-of-care systems and telemedicine platforms is also enhancing accessibility, positioning Japan as a technologically advanced and steadily growing market within the Asia-Pacific region.

Cardiac Biomarker Assays Market Share

The cardiac biomarker assays industry is primarily led by well-established companies, including:

- Abbott Laboratories (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Danaher Corporation (U.S.)

- Siemens AG (Germany)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Thermo Fisher Scientific, Inc. (U.S.)

- PerkinElmer Inc. (U.S.)

- bioMérieux, Inc. (France)

- Tosoh Corporation (Japan)

- Becton, Dickinson and Company (U.S.)

Latest Developments in Global Cardiac Biomarker Assays Market

- In September 2025, Roche Diagnostics launched its sixth-generation Elecsys Troponin T high-sensitivity (Gen 6) assay after receiving CE marking and completing validation across a global cohort of more than 13,000 participants. This product introduction significantly strengthens Roche’s cardiac biomarker portfolio, offering improved analytical precision and faster turnaround for acute myocardial infarction diagnosis. The launch reinforces Roche’s market leadership in high-sensitivity assays, expands its footprint across clinical laboratories, and enhances the global adoption of advanced troponin testing technologies

- In January 2025, bioMérieux completed the acquisition of SpinChip Diagnostics ASA, a Norwegian company specializing in point-of-care high-sensitivity immunoassay platforms for cardiac biomarkers such as hs-Troponin I and NT-proBNP. This strategic acquisition enables bioMérieux to penetrate the rapidly growing decentralized testing segment by integrating SpinChip’s portable diagnostic technology into its cardiac assay portfolio. The move accelerates bioMérieux’s presence in near-patient cardiac diagnostics and strengthens its competitive position against major global players in point-of-care testing

- In June 2024, Siemens Healthineers introduced the NT-proBNPII assay on its Atellica Solution platform, designed to deliver faster and more accurate diagnostics for heart failure. This launch enhances Siemens’ comprehensive cardiac testing ecosystem and supports healthcare providers with efficient, automated workflows. The innovation aligns with the company’s strategy to expand its assay menu and meet the growing demand for high-throughput cardiac biomarker testing, thereby reinforcing Siemens’ dominance in integrated clinical laboratory solutions

- In March 2024, Polymedco received U.S. FDA 510(k) clearance for its PATHFAST High-Sensitivity Cardiac Troponin I (hs-cTnI-II) assay, marking a pivotal milestone as the first hs-Troponin test cleared for point-of-care use in the U.S. This regulatory approval enables faster diagnosis of myocardial infarction in emergency settings, addressing the critical need for rapid decision-making in cardiac care. The approval positions Polymedco as a key emerging player in the cardiac biomarker assays landscape and intensifies competition in the point-of-care diagnostics segment

- In October 2023, Mindray in collaboration with its subsidiary HyTest launched new high-sensitivity Troponin I (hs-cTnI) and NT-proBNP assays aimed at early detection of acute coronary syndrome and heart failure. The expansion of Mindray’s cardiac biomarker portfolio enhances its global competitiveness, especially in emerging markets with rising cardiovascular disease burdens. This launch also supports Mindray’s strategy to deliver cost-effective, high-precision assays, accelerating the company’s growth in the clinical diagnostics and hospital laboratory sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.